January 31, 2024

The e-commerce funnel is changing. Purchasing can happen anywhere, at any time, in an instant.

Here’s a thought experiment: In the past five years, how much has the landscape of e-commerce changed? With mass remote working, the widespread adoption of TikTok, and the increase in mobile shopping, the answer is a lot. So it’s only natural that the e-commerce funnel, once a reliable roadmap for customer journeys, has undergone a considerable (and interesting) shift.

Understanding and adapting to the new “state of the funnel” will allow you to create an interconnected, engaging journey that reflects the modern shopper’s behavior and rewards your bottom line.

Chapters:

- The e-commerce funnel as we knew it

- The collapse of the e-commerce funnel

- Breaking down silos with the correct content mix

- How to optimize the modern e-commerce funnel with UGC

- How Iconic London adapted to the collapse of the e-commerce funnel

- Embrace the new reality of e-commerce

The e-commerce funnel as we knew it

Picture a straight line that connects point A to point B. Now imagine that every person’s shopping journey follows that exact same shape — a neat, linear path from need to purchase. This is the essence of the traditional e-commerce funnel. It assumes that every shopper’s journey is predictable and follows a clear-cut path from consideration to purchase.

This is a neat model, yes. But if you try to make sense of it in light of the current landscape, the cracks begin to show — because the traditional e-commerce funnel doesn’t account for the dynamism and unpredictability of modern shopping behaviors. It’s a boxed-in approach, where the focus is primarily on guiding the consumer through a set sequence of stages.

This funnel operates under the belief that the consumer’s journey is a one-way street, leading straight to the checkout page. What the model fails to consider are the varied and often non-linear paths that consumers take in the digital age. It doesn’t leave room for the spontaneous, exploratory, and serendipitous nature of online shopping. It overlooks the fact that a consumer might jump stages, turn back a stage, or even convert immediately through in-feed check out, or one-click purchases, for example.

It’s comforting to believe that consumers will follow exactly the path you lay out. And it usually makes the lives of e-commerce brands easier. But alas, social media and other platforms have transformed how consumers discover, research, and engage with brands.

In a digital era where a consumer’s journey is anything but uniform, the traditional e-commerce funnel is increasingly out of touch with the realities of the online shopping experience. We might even go as far as to say that the funnel has collapsed.

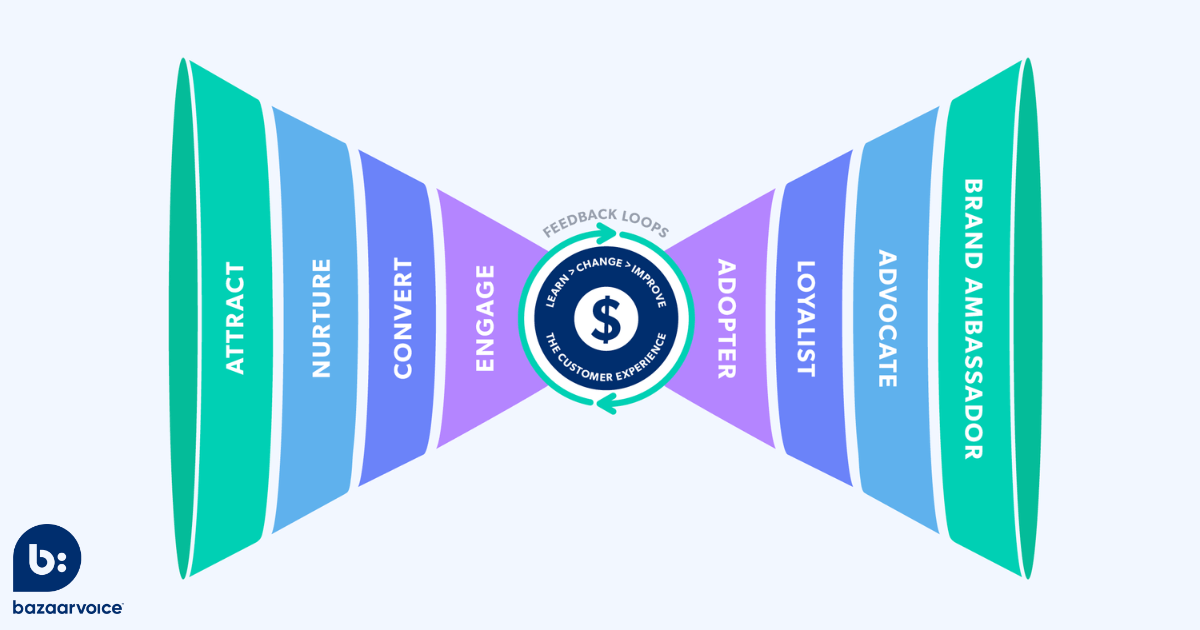

The collapse of the e-commerce funnel

This collapse isn’t as devastating as it sounds. But rather, it’s a natural progression of things. The rise of social commerce, mobile shopping, and e-commerce platforms has revolutionized the buyer’s journey, evolving (or devolving) the e-commerce funnel in the process.

The journey can start and end at any point, it’s characterized by speed, diversity, and a multitude of channels and touchpoints, making each person’s experience unique and dynamic. Someone might research a product in-store but buy it online, or use a retailer’s mobile app to compare prices while shopping in-store. A customer can move from discovery on social media to purchase without leaving the app or spending time in the consideration stage.

In this new era, search engines are the primary gateway to product pages, but other avenues like site searches, mobile apps, and social media searches are rapidly gaining traction. The traditional funnel, with its focus on a linear path that culminates in a purchase, doesn’t encapsulate the complexity and fluidity of these modern behaviors.

Also, the term “funnel” overlooks the fact that, for many consumers, the purchase is not the end but the beginning of an ongoing relationship with a brand. This change is evident in the way consumers interact with brands beyond the point of sale. Edelman’s 2023 Trust Barometer revealed that 79% of consumers engage with brands in ways that go beyond using their products, and about 78% find attributes that attract them and foster loyalty to a brand after they purchase.

In short, today’s buying behaviors are too dynamic for a linear mindset. For those who have been paying attention, the collapse of the e-commerce funnel isn’t a surprise — it’s an inevitability.

Social media, a new full-funnel experience

One of the main drivers of the traditional funnel collapse is social media. Channels like Instagram and TikTok have emerged as new search engines and storefronts, and almost single-handedly reshaped the e-commerce experience.

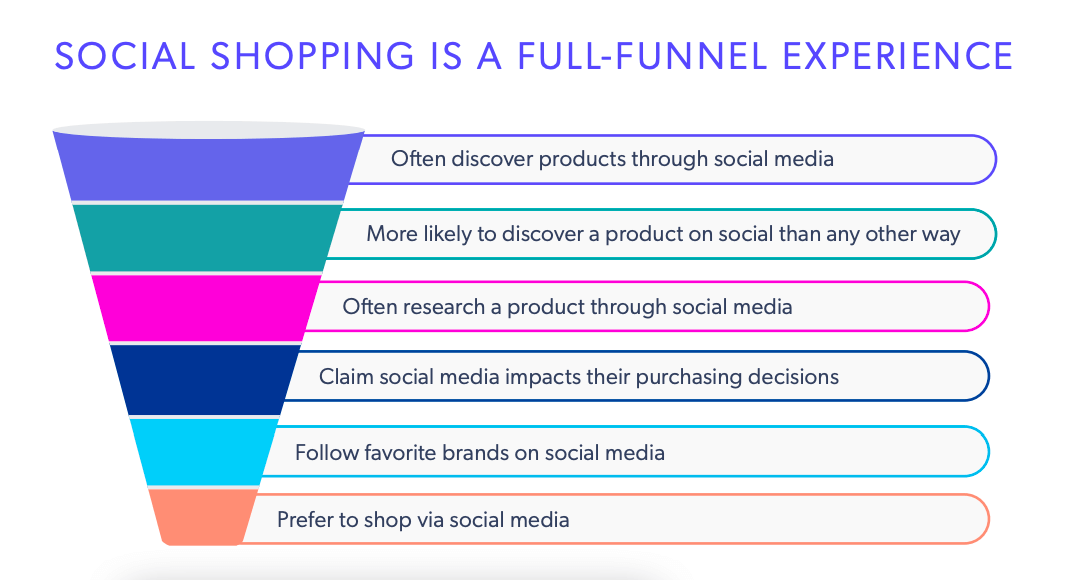

According to our 2023 Shopper Experience Index, over half of shoppers (58%) often stumble upon new products or services through social media, surpassing traditional channels in discovery. This shift isn’t just about accidental discovery — 50% of consumers actively research products on social platforms, and 42% acknowledge the significant impact of social media on their purchasing decisions.

Social media’s influence extends beyond the initial stages of the funnel. It also plays a role in promoting brand loyalty, with 46% of shoppers regularly following their favorite brands on these platforms. This engagement translates into tangible transactions — nearly a quarter (23%) of consumers have made between one and five purchases directly through social media platforms in the past year.

Unsurprisingly, the impact of social media on the e-commerce journey is very pronounced among younger demographics. 70% of people aged 18 to 24 are more likely to discover products through social media than any other means.

As it stands, social media isn’t just an extension of your marketing strategy, but an essential component of the modern e-commerce funnel. It’s a space where discovery, research, purchase, and loyalty come together to offer a seamless, uninterrupted, and integrated shopping experience. As consumer behaviors continue to evolve, the role of social media in the e-commerce funnel will only grow, making it an indispensable tool for you to connect with your audience in a meaningful and impactful way.

Breaking down silos with the correct content mix

Typically, teams that run top-of-the-funnel (awareness) and bottom-of-the-funnel (conversion) activities are different and tend to work in silos. But in the face of a collapsed funnel, brands can streamline costs and enhance the shopping experience with content that breaks down these barriers and integrates into each phase, from the awareness stage to consideration, conversion, and post-purchase loyalty.

When it comes to your content supply chain, a balanced mix of branded-, creator-, and user-generated content is essential to address full funnel needs. But 67% of brands and retailers plan to increase their spend on UGC in the coming year to meet rising consumer demands.

User-generated content (UGC) presents an economic means of driving high quality, high converting content for any phase of the buying journey. UGC is content produced by your customers (a.k.a. real people who use your products) and can take many forms, from written reviews to video testimonials, photos, and more.

There’s a real hunger for this type of content on the consumer side, as it makes customers more confident in their buying decisions — our Shopper Experience Index revealed that 55% of shoppers are unlikely to buy a product without UGC, and 62% are more likely to buy a product if they can view customer photos and videos.

Whether it’s an Instagram ad, an organic TikTok post, a homepage gallery, or a product page, UGC is the type of content that fits at every stage of the e-commerce funnel, and in every channel the modern consumer uses throughout their journey.

How to optimize the modern e-commerce funnel with UGC

There’s a lot to love about UGC, but one of its biggest selling points is versatility. Customer reviews, photos, and videos can be seamlessly woven into different stages of the e-commerce funnel to create a more engaging, trustworthy, and cohesive shopping experience — regardless of what the journey looks like for each individual consumer.

In the discovery phase, UGC is the magnet that attracts potential customers through relatable and authentic content. During consideration, it provides social proof, reassuring customers about their potential choices. At the point of purchase, UGC can tip the scales in favor of conversion. And in the post-purchase phase, it encourages brand loyalty and advocacy, turning your customers into long-term brand ambassadors.

Discovery: Building brand awareness

In the discovery phase, where the primary goal is to get eyes on your brand, UGC helps you spin a unique narrative that draws potential customers into your world. Thanks to its authentic nature, UGC gets through to audiences in a way that traditional content marketing can’t.

It provides a glimpse into the real-life experiences of existing customers, making your brand more approachable and trustworthy. These are the top ways you can leverage UGC at this point in the e-commerce game:

Social media showcases: Social media platforms are a fantastic source of high-quality visual UGC and one of the primary points of distribution for it (remember, consumers might very well begin and end their journey without even leaving a social media platform.) Pepper in discovery-focused UGC like customer photos, videos, and stories in your feeds that provide an overview of your products, highlight benefits, or introduce the ethos of your brand to newcomers. For example, a sports apparel brand might create a hashtag campaign encouraging customers to post their outfit photos and caption them with one healthy habit they try to adopt every day. That’s a ton of rich UGC the brand can then reshare to its own accounts.

Incorporate UGC in digital ads: 40% of shoppers say UGC makes them more likely to buy a product from an ad, so use that to your advantage. Incorporate UGC in digital advertising campaigns, whether it’s Google Shopping, TikTok, Facebook, or Instagram ads, to add a layer of authenticity and relatability to your marketing.

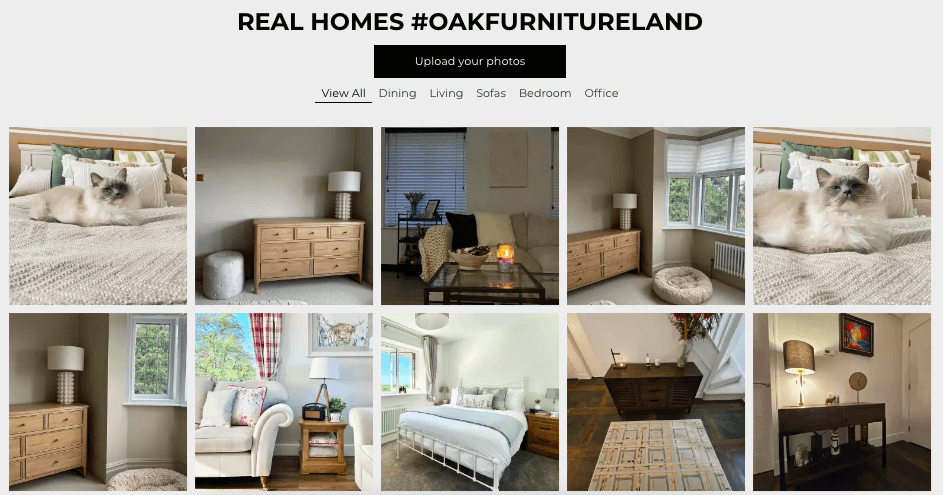

Interactive UGC galleries: Create interactive UGC galleries and display them on your homepage and landing pages, where website visitors can see how others are using the products. If you’re a home decor brand, you can have a gallery where customers upload pictures of their home interiors featuring your products, offering inspiration and real-life use cases to brand-new visitors.

Feature customer stories on your e-commerce site: Our 2022 Shopper Experience Index revealed that 74% of shoppers want to see consumer content on brands’ websites. Galleries are one way to do this, but you can go the extra mile and create a dedicated section on the website for customer stories or testimonials. This can be a powerful way to introduce new visitors to your brand through the lens of existing customers. For instance, a travel gear brand could feature stories from customers who have taken their products on adventures, complete with photos and quotes, on a special “Our Community” webpage.

Include UGC in welcome emails: Incorporate UGC in your emails to introduce new subscribers to the brand community. An example scenario of this strategy could be a fitness brand including customer success stories and workout photos in their welcome email, showcasing the impact of their products and programs.

Consideration: Engaging potential customers

UGC can further engage people who just found out about your brand. While some customers might skip this phase, others take time to evaluate their options, compare products, and decide if what you offer meets their needs and addresses their pain points.

Here’s how UGC can be used for funnel optimization in this context:

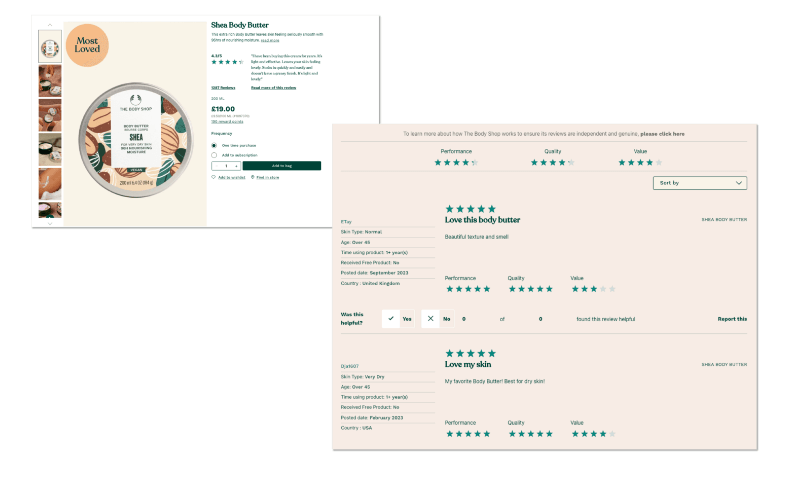

Showcasing real-life product use: Use UGC to show how real customers are using and benefiting from your products. This approach addresses any concerns or questions potential customers might have. For instance, a skincare brand can share before-and-after photos and testimonials from customers who have seen real results, providing tangible proof of product effectiveness.

@rhode @naomigenes✨ ♬ original sound – 🎄Speed Audios🎄

Hosting Q&A sessions with existing customers: Facilitate Q&A sessions or discussions between potential and existing customers. You can do this through social media platforms or on your product pages.

Incorporating UGC in product demos: Blend UGC with professional product demonstrations. This combination gives potential new customers a well-rounded view of the product in action — like a fitness equipment brand creating video content that combines professional demonstrations with clips of real people using the equipment at home.

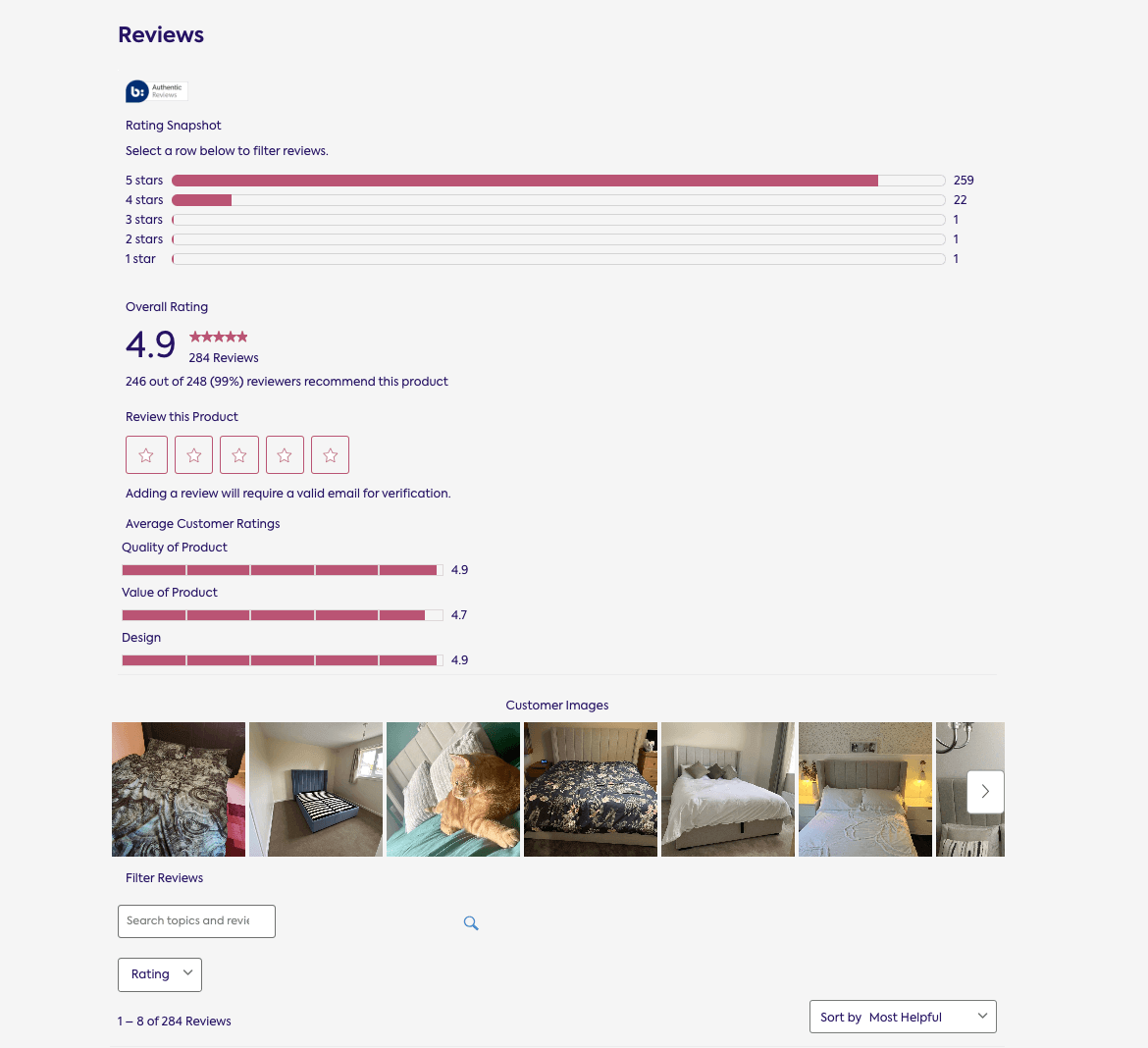

Highlighting customer reviews and ratings: 88% of shoppers consult ratings and reviews before making a purchase. Make good use of every review you have at your disposal by displaying them prominently on your website, making you a real contender in the minds of potential customers who are weighing their options.

Writing UGC-driven blog posts: Supercharge your SEO blog content with UGC. This includes customer success stories, tips, and how-to guides based on real user experiences. For example, an outdoor gear brand could publish a blog series featuring stories from customers about their adventures using the brand’s gear, providing both inspiration and practical insights.

Including UGC in email marketing: Add UGC to your email marketing campaigns and newsletters. This strategy can help personalize the user experience, make the content more relatable, and keep your brand top of mind during the consideration stage (like a gourmet food brand sending emails featuring customer-created recipes using their products, along with reviews and photos from these home chefs.)

Conversion: Encouraging purchase decisions

At the conversion stage, the focus shifts to turning consideration into action. This is where user-generated content becomes your ally in making potential customers become paying customers.

UGC, with its authentic and relatable nature, can play a significant role in alleviating last-minute jitters and reinforcing the decision to buy. Here’s how you can use UGC to encourage purchase decisions:

Product page optimization: Incorporate customer photos or videos directly on product pages to provide potential buyers with a real-life view of the product in use. If you’re an apparel brand, you might include a gallery of customer photos on each product page of your online store, showing how different people style their clothing.

Include UGC in abandoned cart emails: Use UGC in cart abandonment emails to remind customers of what they’re missing. Personal stories or images can reignite the interest that leads them to add items to their shopping cart (such as a home decor brand sending emails featuring photos of beautifully decorated rooms by customers using the items left in the cart, adding a personal touch to the reminder.)

Add customer testimonials to the checkout process: Display customer testimonials or reviews during the checkout process to reinforce the buyer’s decision and reduce cart abandonment rates.

Loyalty: Driving repeat business

You’re building trust with your customers — good job! But this is only the beginning of what can be a very beneficial symbiotic relationship. Now the goal is customer retention, turning a one-time buyer into a repeat customer, a brand advocate who not only comes back for more but also sings your praises to the world.

User-generated content provides a platform for customers to share their experiences and influence others to follow suit:

Create a community around UGC: Build an online community where customers can share their experiences, tips, and ideas related to your products. If you’re a home decor brand, you can create an online forum or a social media group where customers share home styling photos and tips using your products.

Reward UGC contributions: Implement a rewards system for customers who create UGC and incentivize them to keep feeding your marketing channels. This could be in the form of discounts, a loyalty program, or early access to new products.

Leverage UGC for product development: Use UGC as a source of customer feedback for product development. Engage with loyal customers to understand their needs and preferences for future products and ensure they never leave your side.

How Iconic London adapted to the collapse of the e-commerce funnel

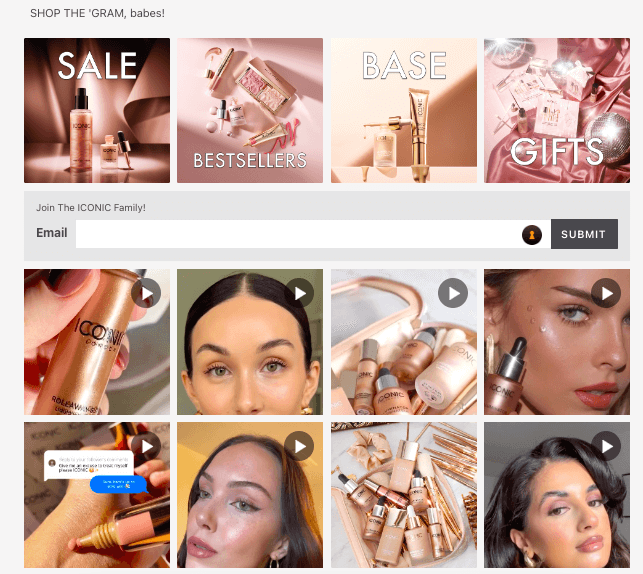

Iconic London, a digital-first beauty brand, is a masterclass in adapting to the new e-commerce landscape. Recognizing the shift in consumer shopping habits and the importance of a seamless digital experience, Iconic London partnered with Bazaarvoice to tap into user-generated content and bridge the gap between social media engagement and e-commerce growth.

The brand’s strategy was simple: Integrate UGC across digital channels to foster relationships with customers and drive conversions. Iconic London launched Like2Buy on Instagram and implemented Bazaarvoice Galleries on their product pages and homepage, creating a continuous shopping experience that resonated with their social media-savvy audience.

By sharing UGC on their e-commerce store, Iconic London strengthened the trust and connection with their customers. The product page galleries, featuring customer tags and content, not only celebrated their community but also provided an authentic representation of their products in use.

Iconic London’s adoption of Like2Buy on Instagram linked their social content to product pages. This strategy helped the brand win on two fronts. First, it compensated for revenue decline due to changes in the digital landscape. Second, it reinforced the brand’s commitment to a social-first approach, catering to customers who prefer shopping on social.

We know that our customers like shopping in a social environment. It’s the way the industry is going, but especially Iconic. So having Like2Buy allows us to maintain that social shopping experience a bit longer. It allows it to overflow into the website, onto the product page, and the homepage

Lizzie Newell, Head of Marketing, Social, and Campaigns at Iconic London

Over 12 months, Iconic London saw a 126% lift in conversion rates and an 11% increase in average order value. While the metrics alone were a victory, their approach also highlights the importance of authenticity, continuity, and customer engagement in driving e-commerce success today.

Embrace the new reality of e-commerce

To thrive in this new era, you have to adapt and embrace strategies that resonate with current consumer behaviors. Mastering the changing e-commerce funnel means balancing your marketing context mix with a healthy balance of brand and user-generated content.

And more importantly, getting that content in front of shoppers everywhere they are. Not just your PDPs but on social channels, paid media, video content, email campaigns, and in-store.

Learn more about how consumers are driving this shifting funnel and how brands and retailers are adapting in our Shopper Experience Index — a report of 7,000 global consumers and 465 brands and retailers that highlights the concerns of shoppers in the face of market shifts.