Build loyalty

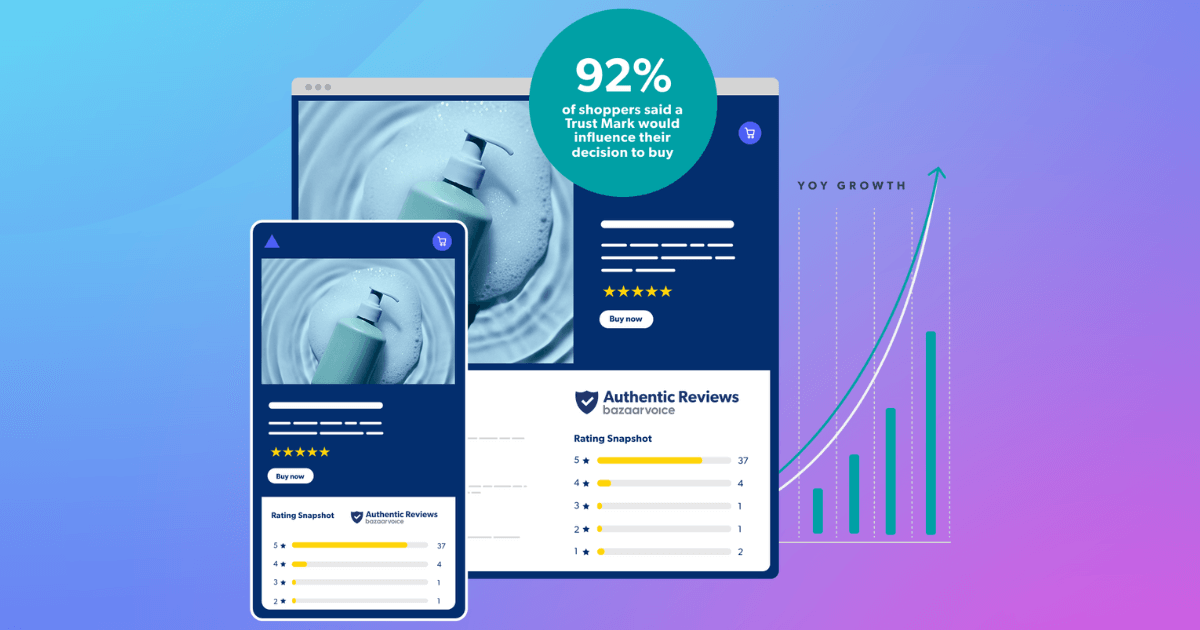

Authenticity

Actionable insights

Actionable insights

Actionable insights

Actionable insights

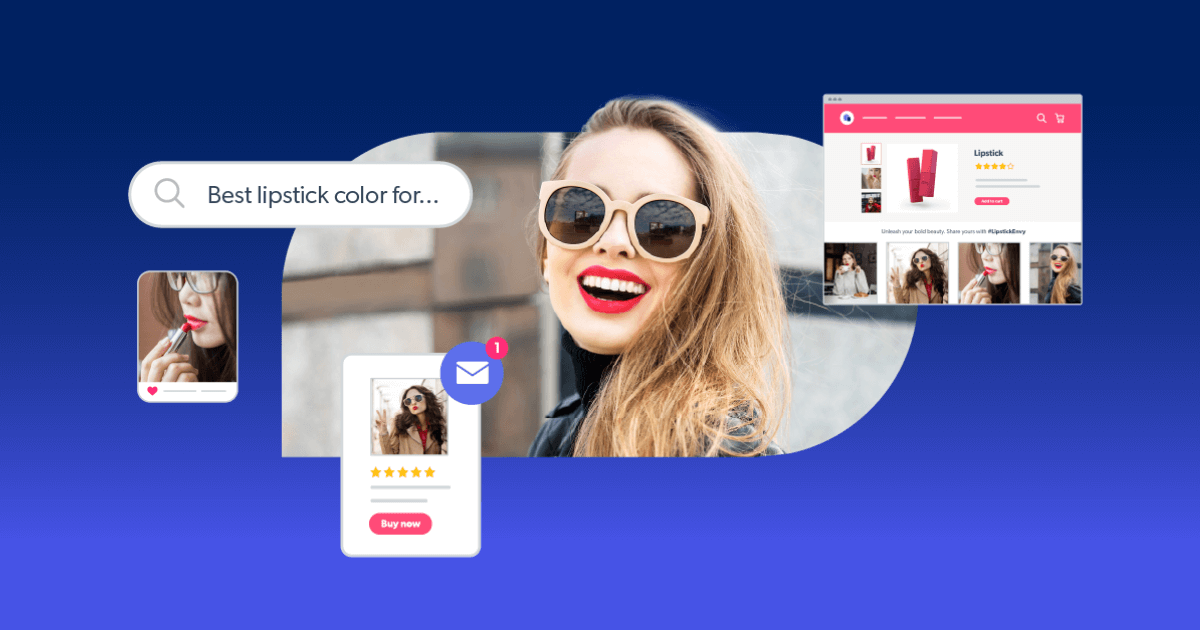

Social media

Amplify content

Actionable insights

Authenticity

Actionable insights

Acquire Content

Acquire Content