January 16, 2023

This guide is for you if you want to know what customer lifetime value (CLV) is, how to calculate it, the benefits, and strategies to increase it. It’s not for you if you don’t care about retaining customers and providing outstanding shopping experiences.

Increasing your CLV will boost customer loyalty and retention, and lower your customer acquisition cost in the process. Read on to learn everything you need to know.

Chapters:

- What is customer lifetime value?

- How to calculate customer lifetime value

- The importance of measuring customer lifetime value

- Strategies to increase customer lifetime value

- Customer acquisition cost vs lifetime value

67% of businesses are prioritizing customer retention over acquisition this year, according to Segment’s 2022 Growth Report. While we often consider new customers the key to growth, lifelong customers are a more stable, profitable investment in a changing economy.

Customer lifetime value is a key metric to track when prioritizing customer retention because it provides a forward-looking overview of your customer relationships, efficiently allowing you to plan for future growth.

Increasing customer lifetime value ultimately builds stronger relationships, boosts profits, and reduces churn.

What is customer lifetime value?

Customer lifetime value is a metric that calculates how much the average customer will spend on your products or services throughout their lifetime. It’s a predictive model that gives you a look into the future, allowing you to make well-informed decisions regarding budgets, marketing efforts, and product development.

It also reveals how loyal your customers are — a crucial insight that directly relates to customer satisfaction.

How to calculate customer lifetime value

The basic formula for calculating customer lifetime value is average customer value (CLV) multiplied by average customer lifespan (ACL). You get your average customer value (ACL) by multiplying average order value (AOV) with average purchase frequency rate (APF). Thus, the basic formula for calculating customer lifetime value is:

AOV x APF x ACL = CLV

Average order value measures how much the average customer spends in a single transaction and is calculated by dividing the total amount of revenue by the number of transactions. The formula for AOV looks like this:

Total amount of revenue/Total number of transactions = AOV

Average purchase frequency rate calculates how many transactions a customer makes during a set period of time, which is calculated by dividing the total number of transactions by the total number of customers who made purchases during this time. The formula for APF is:

Total number of transactions/Total number of customers = APF

Average customer lifespan forecasts the length of time that customers will continue to purchase your product or service. It can be calculated two ways, depending on how much customer data your organization has. If your company charges customers on a subscription basis, you have access to detailed lifespan information because you know the length of every customer’s contract. In this case, you c

Sum of customers’ lifespans/Total number of customers = ACL

If your company uses a different payment model or doesn’t possess this data, you can still measure average customer lifespan. Start by figuring out your churn rate for a specific period of time with this formula:

(Number of customers at the beginning – Number of customers at the end)/Number of customers at the beginning = Churn rate

Then, use that figure to calculate ACL by dividing 1 by the churn rate. For example, if you had 100 customers at the beginning of the year and 90 at the end, your churn rate would be 0.1. This works out to an ACL of 10 months (1/churn rate).

The importance of measuring customer lifetime value

While metrics like Net Performer Score (NPS) and customer satisfaction surveys (CSAT) are helpful for analyzing customer relationships in the present, measuring customer lifetime value gives you a glimpse into the future. Which comes with its own nice set of benefits.

Gauge and improve brand loyalty

Customer lifetime value is a key indicator of brand loyalty. If CLV is high, that means customers are bringing a long-lasting relationship and a sustainable, continuous source of revenue to the table. They’re loyal. Measuring CLV helps you gauge loyalty among different audience segments and reframe your strategy, showing you where you might need to step up your game or shift focus.

For example, say you use age to divide your customer base into segments, and you find that:

- Segment A (26 to 35-year-olds) has a CLV of $10,000

- Segment B (36 to 45-year-olds) has a CLV of $2,000

Then you can dig into the specifics of why Segment A is more loyal and how (and if) you can replicate those results for Segment B. Maybe you’re not investing enough in marketing for Segment B. Perhaps there’s a bad product-market fit for Segment B, and you should focus on increasing customer lifetime value for Segment A, which has already proven to be profitable long term.

Inform budgeting decisions

Retaining satisfied, loyal customers requires a lower monetary investment than acquiring new ones, but new customers are still an essential component of growth. Measuring customer lifetime value allows you to find the right balance and inform your budgeting decisions (ultimately leading to an increase in revenue.)

Comparing CLV to your customer acquisition cost (CAC) allows you to determine where to invest more resources. On the one hand, if CLV is low and CAC is high, you should invest more into retention efforts to guarantee a steady profit from customers who’ll be loyal to you. It also doesn’t make sense to continue spending large chunks of your budget on acquisition if you’re having trouble retaining customers — it’s essentially a leaky bucket.

On the other hand, if CLV is high but CAC is low, it makes sense to invest more of your marketing budget toward acquiring new customers since current customers are satisfied. Getting the right balance means maintaining strong relationships with satisfied, loyal customers while steadily growing your customer base.

Gain customer insights that support marketing strategies

CLV is a surprising source of customer insights that can help streamline your marketing efforts, product launches, and promotional calendars. Since the metric is a good indicator of how often a customer buys a certain product and how much they’ll spend, it can inform pricing strategies and product launch schedules.

Say an e-commerce company that sells backpacks determines that its customer lifetime value for Model A is $4,000. (AOV = $100, APF = 2 years, ACL = 20 years).

Using this information, the company might plan a product launch for the new version of Model A every two years to get loyal customers excited about their new purchase and increase the probability of making a sale.

Apple successfully uses this strategy to launch new iPhone models. Research shows that the average iPhone user tends to replace their phone approximately every two and a half years, and until the recent yearly release schedule became popular, Apple launched a new model every two years.

To build up excitement, the company holds a press conference where it dives into every single detail of new product models, ensuring loyal customers line up outside stores on launch days and beat preorder records.

Predict and prevent customer churn

Measuring customer lifetime value helps predict churn because a high CLV indicates that it’s unlikely a customer will switch brands. However, a low CLV might be a warning sign that a customer won’t stay with you for long.

CLV is also a constantly changing metric, especially on an individual customer level. Tracking the numbers over time provides a good indication of how customer sentiments are changing. If you notice a customer’s CLV decreasing from one year to the next, it might be a sign that the customer is ready to churn because they’re either spending less per order or reducing their ordering frequency.

Catching this trend early allows you to reach out to the customer and launch a retention strategy, like offering promotional prices or a monthly discount on subscriptions.

Personalize customer service

According to Acquia’s 2022 CX Report, 58% of organizations surveyed say their number one priority over the next twelve months will be strengthening their customer service strategy to retain current customers. CLV is an important metric to base meaningful customer service decisions on — decisions that ultimately help your organization thrive.

A good way to personalize customer service using CLV is by extending promotions or incentives to existing customers with a high CLV. They bring a lot of value to the company, and you want to keep those relationships strong.

For example, a customer at an outdoor equipment company might contact support because their recently purchased product is defective. If a support representative sees their CLV showing consistent purchasing frequency and high order value, they can offer a special discount or promotion to persuade the customer to continue the relationship.

Strategies to increase customer lifetime value

Increasing the customer lifetime value comes down to creating an unparalleled customer experience, boosting satisfaction, and building loyalty.

Identify pain points and offer valuable solutions

A product or service that offers a solution to your customers’ pain points is crucial for increasing customer lifetime value because it turns wants into needs. But defining their pain points and building solutions that will work can be difficult without direct customer feedback.

Ratings and reviews are valuable tools for identifying the challenges your customers face and what they’re looking for in a solution. There’s a staggering amount of relevant information hidden within reviews, from key product features loved by customers to confusing operating instructions.

Say an online tax platform releases a new version of its software and notices CLV decreases over time. The platform then analyzes reviews of its update to find that the new interface is difficult to use, and customers have a hard time navigating it. These insights can then be used to fix the issue or offer users an educational guide to the new platform.

Case in point: children’s product manufacturer KidKraft used its collection of over 56,000 reviews to hone in on what customers liked and disliked about its products, and adjusted its marketing strategy to reflect that.

Even something as simple as picking out positive sentiments about certain product features within reviews and changing product display pages to include this information creates a more informative shopping experience for customers, allowing them to find solutions easily.

Add value to stand out from the competition

If two brands offer a comparable product, but one boasts 24/7 customer service and a strong loyalty program, which one do you think is more likely to increase customer lifetime value? The choice is easy because our shopping decisions are often based on how much value we get from a purchase. If we’re buying a product or a service that comes with a better customer experience, it sweetens the deal.

Amazon is a major example of an organization that adds value to stand out from its competitors — something that’s helped it dominate the e-commerce space. Customers choose Amazon because it offers time and cost savings to its shoppers through same-day delivery, instant checkouts, and free returns. In fact, a survey by eMarketer showed that quick commerce is the number one reason consumers shopped on Amazon.

But convenience isn’t the only added value that Amazon boasts — it also sells memberships and subscriptions for a variety of services, including Prime, Kindle, and Amazon Music. The same survey found that 65.7% of respondents shopped on Amazon because they were Prime subscribers, which gives them exclusive member discounts, access to multiple services, and free product trials.

There’s virtually no other e-commerce platform that offers such a wide range of products and services, making Amazon stand out from the competition.

Make the most out of the onboarding process

The onboarding process is your customers’ first real taste of your product or service. Make it easy, fast, and convenient to win them over and turn them into loyal, long-term customers.

Say your product is an AI-powered support operations platform that includes several integrations and tools. New customers (and their teams) will have multiple questions during the onboarding process, and their view of your brand will be a lot more positive if their access to answers and solutions is effortless and fast. Besides ensuring your customer service team is ready to handle their queries, create a stack of self-serve support options, including:

- How-to articles

- Video tutorials

- Community forums

- FAQs

- Guides

According to NICE, 81% of consumers surveyed want more self-service options. Many customers prefer automated solutions where they don’t need to contact anyone because it’s more convenient, especially for smaller issues and queries. Creating a streamlined onboarding process that promotes convenience and focuses on your customers’ needs will boost your retention rate, turning new customers into loyal brand advocates.

Personalize the customer journey

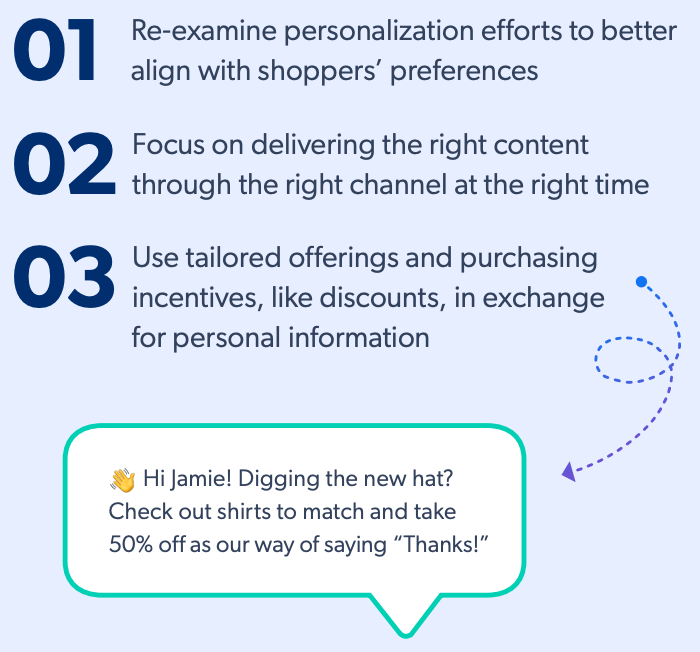

80% of customers are more likely to purchase a product or service if they receive a personalized experience, according to Freshdesk’s 2022 The Future of CX Report. Personalization makes customers feel valued and encourages them to become repeat customers, increasing customer lifetime value in the process.

Personalization methods like customer loyalty programs and tailored social commerce keep customers coming back, boosting repeat business relationships and brand loyalty.

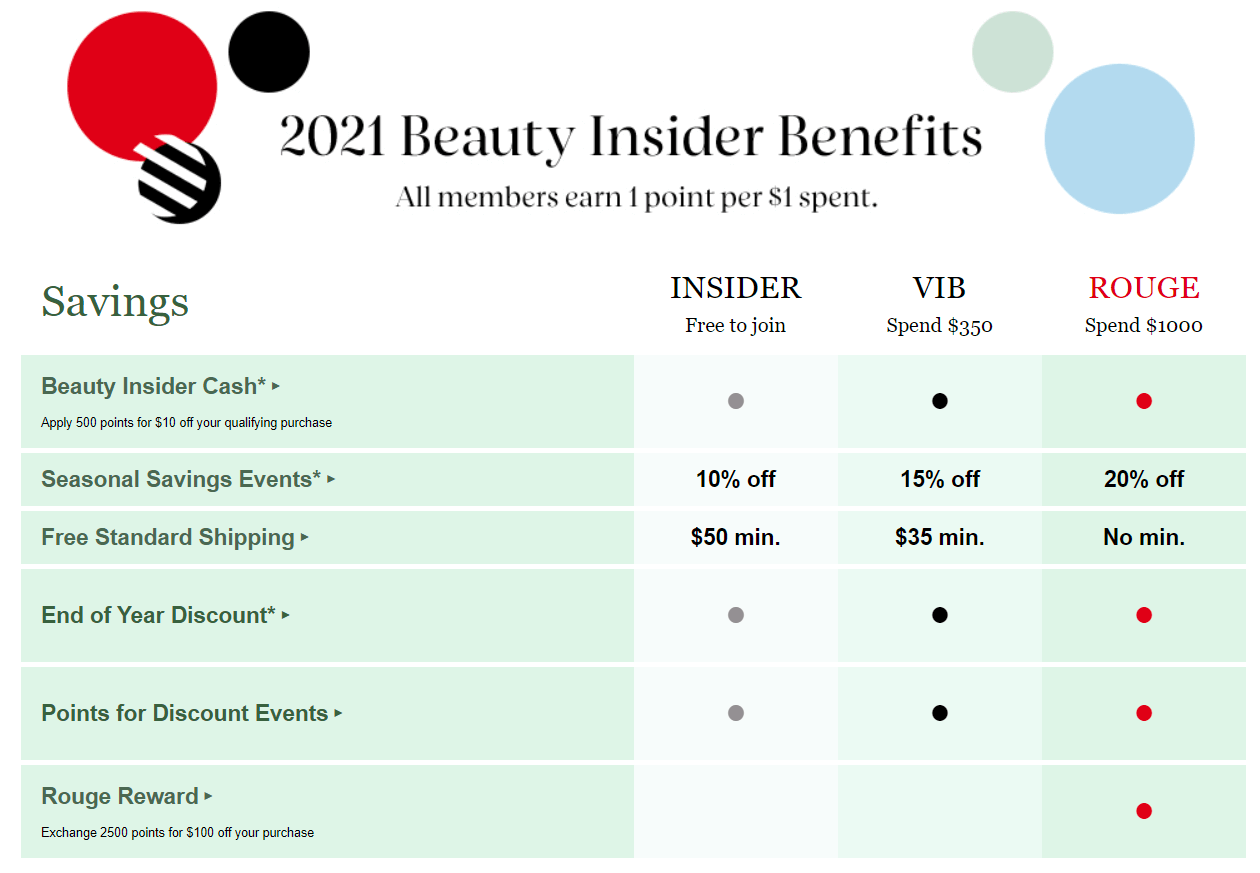

Sephora for example uses several loyalty and reward programs to encourage customers to return and buy more products. Shoppers collect points from every purchase to redeem for more products at a later time, but the beauty retailer takes it a step further by offering different tiers of rewards. Shoppers who spend over $1,000 a year at Sephora get exclusive gifts and perks, which encourage not only repeat purchases but also an increased number of purchases each year.

Social commerce is another way to personalize service for customers by tailoring social media ads for your following and turning social media platforms into personal shopping spaces. Adding shopping links to social media posts allows you to track your customers and gather valuable demographic data like location, age, and gender, as well as contact information like email addresses.

This data is the backbone of your marketing efforts and informs future personalized campaigns, ads, product recommendations, and more. Areas of opportunity include:

Engage and involve customers

Engaging customers through multiple channels, including social media and email marketing, keeps your brand center stage in their minds and ensures they keep coming back. But just being seen by customers isn’t enough — engagement comes from building excitement and adding value.

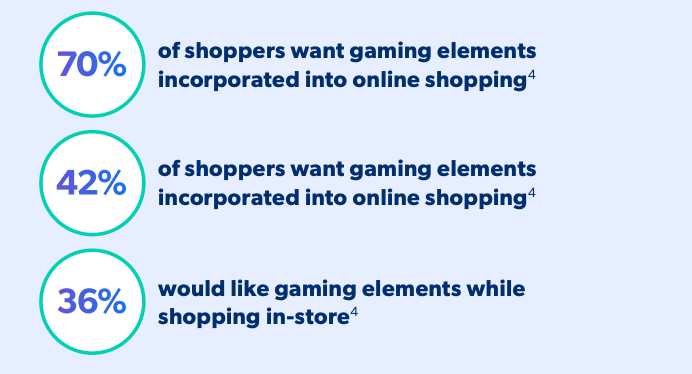

Gamification marketing is one way to keep customers excited about your products or services. It combines aspects of video games, like points, levels, and leaderboards, with traditional marketing campaigns. Imagine an online learning platform that advances users through levels with fun names, assigns points based on their usage, and creates leaderboards for the most advanced users.

This method fuels your customers’ sense of friendly competition and encourages them to continue their relationship with your brand.

User-generated content (UGC) is another way to engage customers by incorporating their ratings, reviews, and images into advertising, product pages, and social media. UGC is one of the most authentic forms of content because it’s made by customers, for customers — and authenticity is a big priority for brands and retailers, with 74% of consumers preferring to see customer-created content while shopping.

Seeing user-generated content will also encourage customers to create more of their own, which keeps them involved and advocating for your brand.

Upsell and cross-sell at the right time

According to Zendesk, 63% of consumers are, “open to product recommendations from service agents.” This creates a perfect opening for cross-selling and upselling your product or service — or does it? Cross-selling and upselling are two critical strategies for boosting CLV, but they need to be activated at the right time.

For example, trying to upsell a customer who is very unsatisfied with your service will do more harm than good. CLV can help map the customer life cycle, informing companies about the right time to upsell and cross-sell. Customers with a medium or high CLV will be more receptive to trying new products or services or purchasing upgrades and premium options.

Say you’ve been tracking a new customer’s lifetime value over a period of two years. They’ve tried your product, experienced all the features, and maybe even contacted customer care a few times. Throughout this time, their CLV remained steady or increased. Although the decision to upsell or cross-sell requires a deeper understanding of your customer’s pain points, using CLV to gauge how satisfied they currently are is a good indicator of a profitable opportunity.

Offer unparalleled customer care

Customer care is critical in terms of retaining lifelong customers. 54% of consumers would abandon a brand after just one bad experience. Conversely, according to HubSpot, 93% of consumers surveyed would consider becoming repeat customers if the brand provided outstanding customer support.

From quicker response times to omnichannel support, there’s multiple ways to improve your customer care. Conversational commerce experiences, which share customer information across different support channels, are a priority for over 70% of consumers. So, when a customer contacts your support center via email, they can easily transition to speaking to an agent through a messaging platform like WhatsApp without having to repeat their issue. This both speeds up resolution time and creates a personalized care environment for customers, which leads to higher satisfaction rates.

Another significant way to level up your customer service game is to transition to a proactive approach. Proactive customer service moves away from putting out fires to ensuring fires never start. Companies that offer proactive support contact customers when there’s an issue and de-escalate the problem by offering solutions before customers develop negative sentiments, boosting overall satisfaction and making customers feel valued.

Companies like Ikea go above and beyond to ensure customer satisfaction, creating buying guides, inspirational content, and a new augmented reality app that allows customers to digitally place furniture into their homes.

Beyond that, the company also provides post-purchase value-added services like spare parts delivery, furniture assembly, and a 365-day return policy. This well-rounded approach makes customers feel support throughout the entire purchase journey — from planning to purchasing to assembling.

Customer acquisition cost vs lifetime value

Customers, both new and old, are key drivers of your business’ growth and success. Measuring, analyzing, and increasing customer lifetime value leads to stronger relationships, increased revenue, and higher satisfaction scores from current customers.

But acquiring new customers is still an essential component of growth. Double down on your growth strategy by learning how to lower your customer acquisition cost.