December 1, 2023

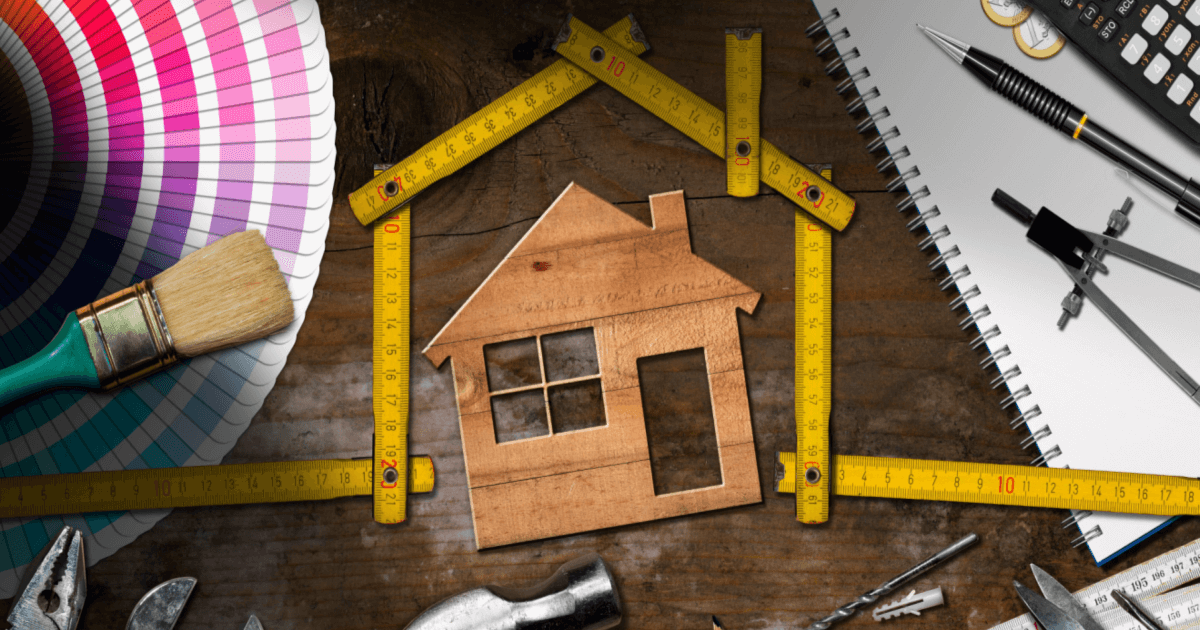

A research report looking into the DIY and home improvement industry trends brands need to lean into today and over the next five years

The DIY and home-improvement market keeps getting bigger. Between 2019 and 2021, spending on DIY projects grew 44% to $66 billion, according to the Joint Center for Housing Studies at Harvard University.

Almost 60% of homeowners remodeled or redecorated their homes in 2022, and 48% made home repairs, according to the 2023 U.S. Houzz and Home Study: Renovation Trends. More than half of homeowners planned projects in 2023.

All these home projects mean consumers are shopping for home building materials, home decor, tools, supplies, and more. Most consumers shop for what they need for their projects both online and in stores. They seek inspiration and information on social media and via user-generated content (UGC) posted by other DIY-ers — most shoppers always or sometimes read reviews before buying anything.

However, one thing to note about customer behavior and industry trends these days is that inflation is causing many to be slightly more budget-conscious with their DIY and home improvement projects. Our research shows that 55% of DIY consumers plan to re-purpose products that they already have to improve home decor.

Still, in the next year, 66% plan to make decorative changes in their homes, while 58% plan to make wear-and-tear repairs, our research shows. About 20% will take on structural, functional, or major renovations.

Home improvement trends: Now and next

Using our own research as well as third party insights, here’s a look at how DIY and home-improvement industry trends have evolved over the past few years, what’s on trend now, and what shopping habits you can expect in the near future.

Now: UGC entices consumers to shop for DIY products

Millennial DIYers often leverage social media platforms, like TikTok, YouTube, Instagram, and Pinterest, for home project ideas and inspiration. Influencers, including everyday consumers, reveal their latest projects and discuss the newest home trends. Retailers and brands need to make it easy for shoppers to connect the dots to purchase on social media.

Many consumers aren’t planners when it comes to DIY. 35% of DIYers do home projects when inspiration strikes, our research shows. But, they need help choosing the right items. That’s where UGC comes into play.

UGC is the most trusted form of content, according to 63% of DIY consumers. We’ve found that when DIY shoppers interact with UGC, you can see a 167% conversion lift and 250% RPV boost. Consumers are also more likely to buy items with written reviews and customer photos and videos.

Most shoppers expect UGC to be easy to find, whether they’re shopping online or in stores for home decor and DIY supplies. It helps them make informed decisions, so it’s important to feature UGC everywhere people shop.

About 2 in 3 consumers prefer shopping for DIY and home improvement products in-store (that number rises to 76% for consumers over 55). The main reasons they prefer visiting stores in person are to get advice from in-store sales reps and to get what they need more quickly.

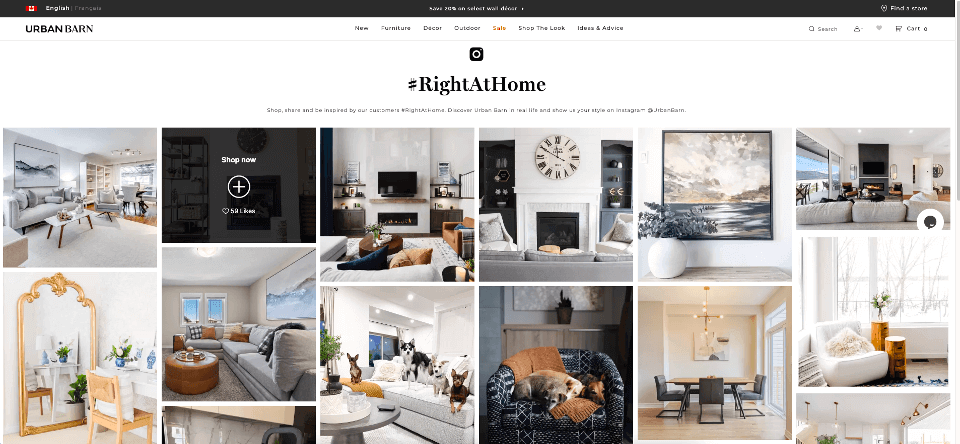

Vancouver-based furniture and decor company Urban Barn strives to offer shoppers consistent, unique experiences both online and in stores. The brand has found that even when shoppers visit stores, they research products on its website first. The company has been beefing up its UGC collection efforts by encouraging customers to post images on social media tagged #RightAtHome.

Urban Barn has seen a 59% conversion rate boost, a 29% increase in order value, and a whopping 270% lift in time on site since implementing its UGC strategy.

Next: DIY shoppers want multi-channel experiences

In the next few years, consumers will continue to seek convenience when shopping for home improvement items. DIY retailers should rise to the challenge and rethink their formats and services. Topps Tiles is a good example. The brand has opened smaller boutique-style storefronts to offer unique experiences.

Shoppers will embrace online shopping for home improvement purchases more often. Our research shows that consumers are motivated by the fact that more items are in stock online (41%), they can quickly get advice from customer reviews (36%), and they just enjoy shopping online more (34%).

The DIY brands that are winning offer a consistent, seamless shopper experience across digital, in-store, outdoor, and social media. For instance, Made.com, a British home goods e-commerce brand, has opened a few showrooms to provide this omnichannel experience.

Over three-quarters of shoppers research DIY and home improvement products online or on social media before buying them. And, more than 40% of 18- to 34-year-olds frequently purchase directly from social media. This highlights the importance of relevant, high-quality UGC in guiding online and in-store purchases.

Consumers tend to search for UGC on web browsers (45%), retail websites (40%), brand websites (39%), and social media (27%).

Over half of DIY consumers would be more likely to purchase DIY and home improvement products if more educational resources, like videos and reviews, were available. YouTube is the preferred platform for learning about DIY and home projects, followed by advice from friends and family.

With social media such an important source of inspiration, 31% of consumers also shop there for products for their DIY and home projects. This emphasizes the vital role social media marketing and UGC play in moving consumers through the purchase funnel.

Bedding and bath brand Parachute features UGC in its marketing mix to show how real customers are styling and using its products in their daily lives. This strategy has helped the brand increase click-through rates by 35% and lower cost-per-click rates by 60%.

By continuously collecting UGC, Parachute keeps a fresh slate of inspiring content flowing in all the time.

Future: DIYers want personalization and support to shop with confidence

DIY and home improvement retailers are considered places for consumers interested in tackling these projects to come together, find inspiration, and learn something new. This viewpoint is especially crucial for millennials and new homeowners, who feel that they lack the skills and confidence to complete these projects and need extra support.

For instance, 60% of millennials can’t put up shelves, and 39% say they can’t decorate. Educational marketing materials and in-store workshops will help engage and build trust among unconfident shoppers.

Home Depot has long recognized the value of engaging shoppers in this way. The retailer hosts virtual and in-store DIY workshops for all skill levels to help customers learn new skills and become handier at home.

45% of consumers expect a personalized experience from brands and retailers when shopping for DIY and home improvement products. So, investing in this area can help you maintain a competitive edge.

Consumers are also interested in tech-focused support. 45% of DIY shoppers have used some type of digital tool to plan their projects, while 25% have used “customized products on brand websites,” and 17% have used augmented reality or virtual reality to visualize furniture in their own space.

UGC is crucial for attracting DIY consumers now and in the future

There’s one standout and consistent trend when it comes to the home improvement industry, DIY and home improvement shoppers massively rely on what other consumers have to say before purchasing furniture, supplies, home decor, and other things to spruce up their homes.

Ensuring you have a process to collect and distribute UGC will continue to attract customers and build relationships with them for years to come. Learn more about Bazaarvoice’s solutions here.