May 20, 2025

Australian consumer behavior in 2025 starts with intent, not impulse. They’re scrolling with purpose. Switching brands without hesitation. Swapping loyalty for logic.

What’s fueling it all? A combination of price sensitivity, digital fluency, and zero patience for gimmicks. The latest Bazaarvoice Shopper Preference Report reveals that Australians are responding to rising costs with clear intent: shopping smarter, questioning brand loyalty, and embracing digital platforms.

The report, conducted across six countries with insights from over 8,000 shoppers, shows Australia is among the most price-sensitive and digitally engaged markets surveyed. Aussie shoppers aren’t here to be dazzled. They’re here to be convinced.

If your brand isn’t offering value, proof, or a discount code, you’ll be scrolled past.

Cost-first mindset driving Australian shopping behavior

It’s all about the money, money, money

Pop music (and Jessie J) may have led us to believe that ‘it’s not about the price tag,’ but the reality is quite the opposite on the continent down under.

Whether at the supermarket or scrolling online, shoppers navigate every purchase with one filter in mind: what offers the best value?

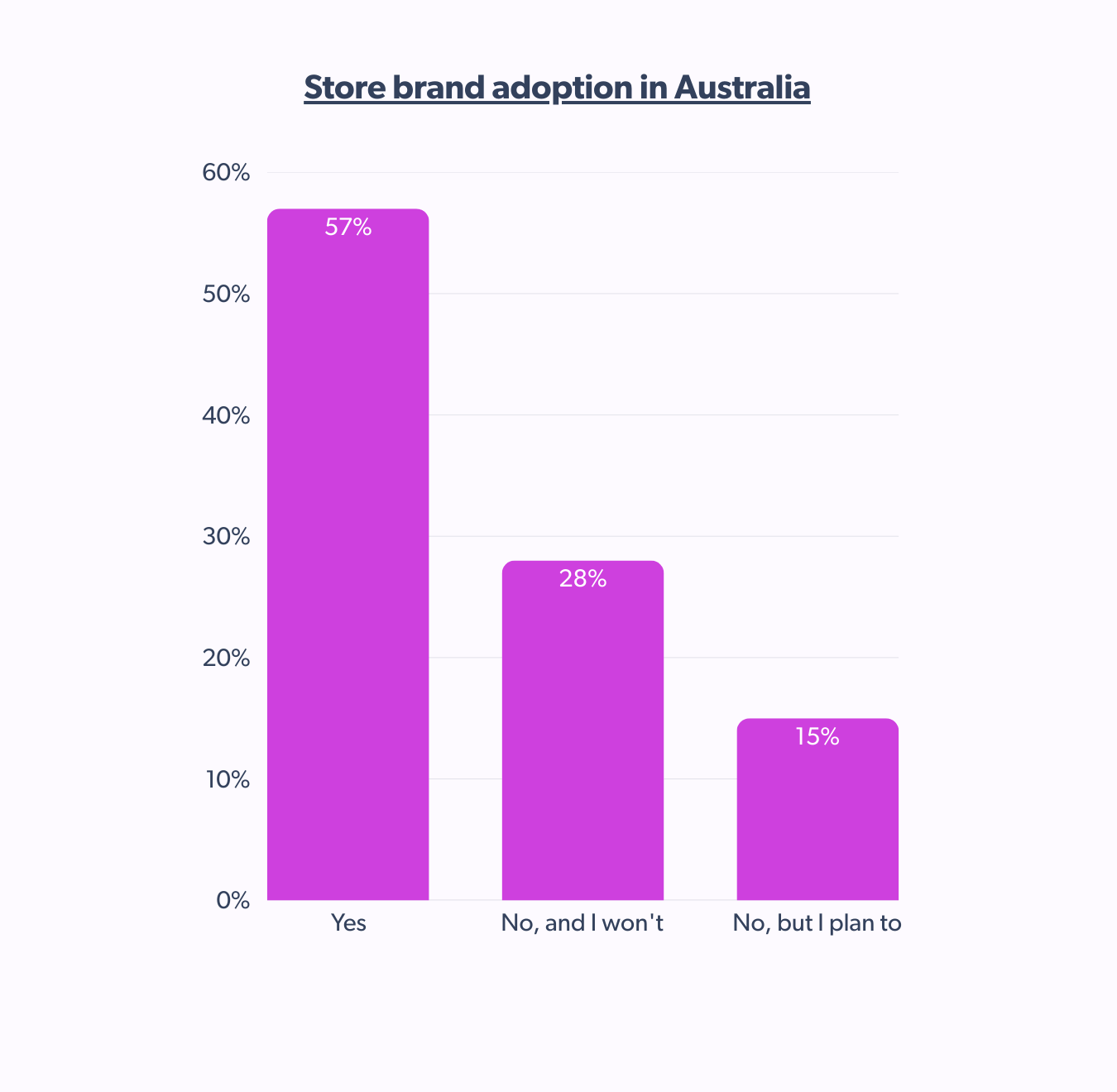

In 2025, Australian consumer behavior is defined by this approach. This focus on getting the best deal empowers consumers to redefine what, where, and how they shop. 57% of Australian shoppers have permanently switched to store-brand products, and another 15% say they plan to.

The preference for store brands isn’t simply a cost-cutting move. It reflects growing confidence in the quality of private-label products and a reevaluation of what makes something ‘worth paying more for.’

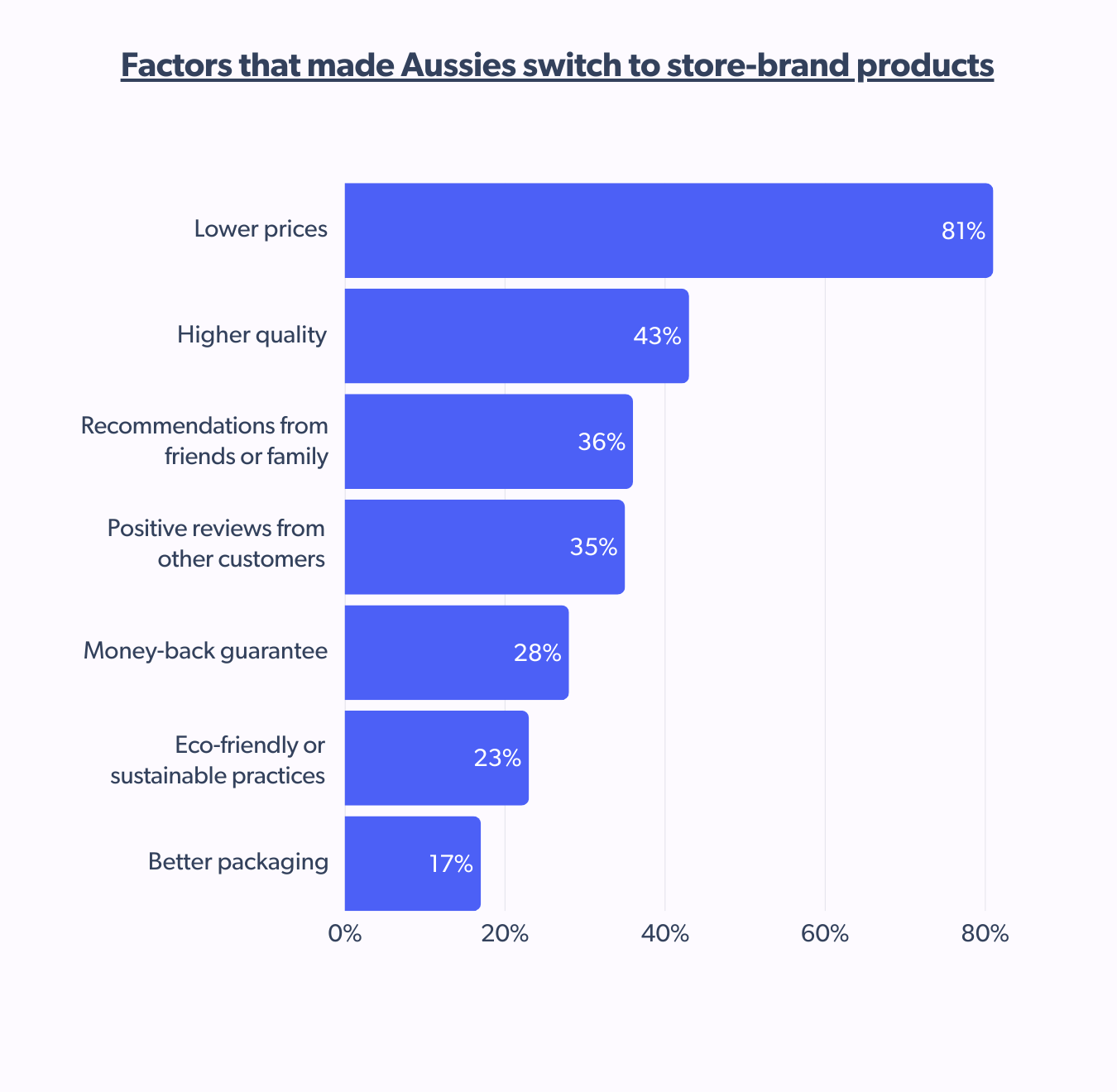

The primary reason for the switch to store brands — you guessed it — is price.

81% cite lower prices, making them the second most price-sensitive market surveyed, behind only Canada. Quality follows at 43%, indicating that while shoppers value product integrity, cost is the ultimate decision-maker.

Australian shoppers are open-minded but value-focused. Once the price threshold is met, trust signals like reviews and recommendations help close the gap.

For traditional brands, the value proposition must be revisited — because just being known isn’t enough anymore.

Chasing the best price

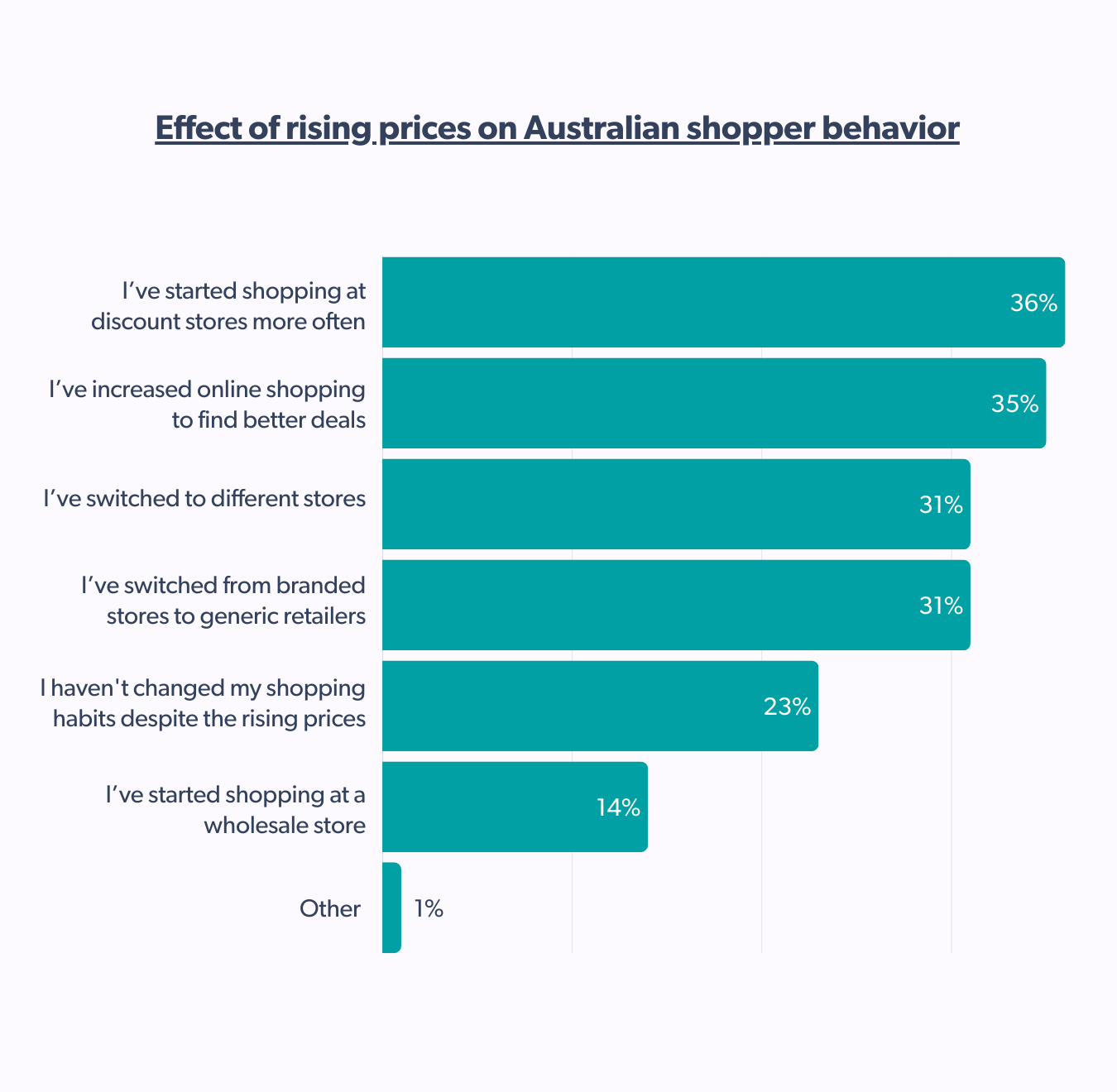

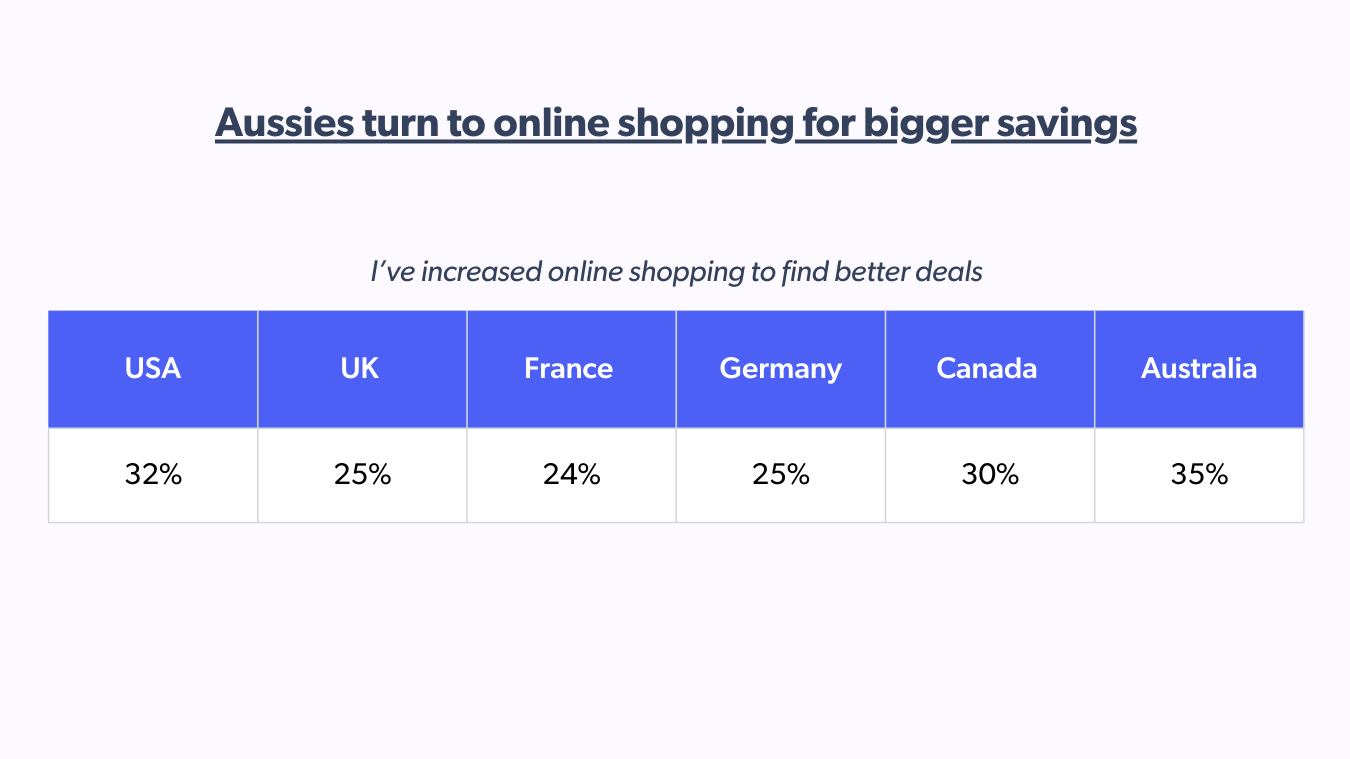

Beyond switching brands, Australian shoppers are also changing where they shop altogether. In response to rising prices, Australians are leading globally in seeking better deals online.

Discount stores are gaining traction with Aussie shoppers. But online deal-hunting is where they lead globally.

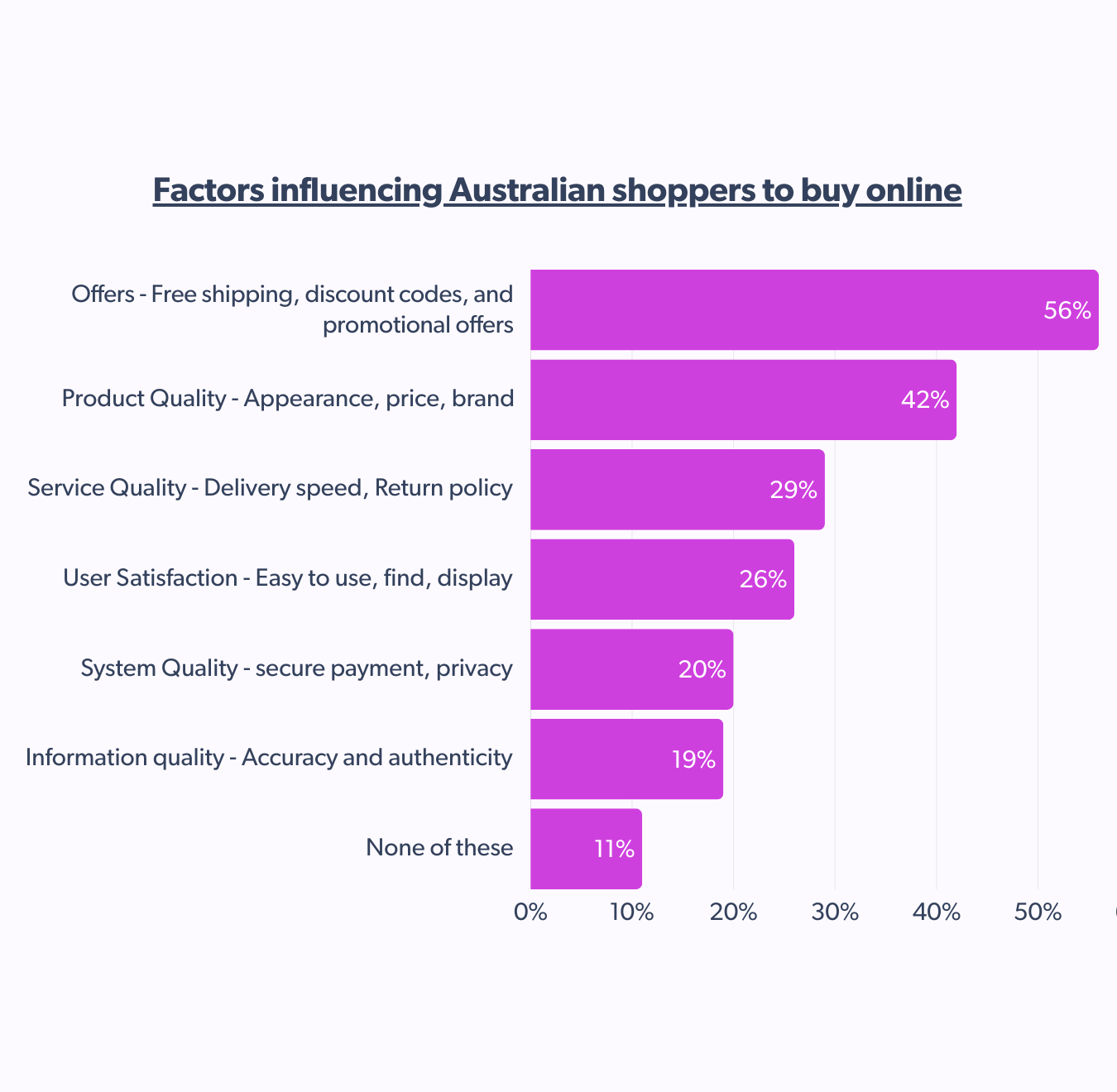

Even when shopping online, Australians are motivated by direct financial incentives: most shoppers say offers like free shipping, discount codes, or promos drive their purchase decisions.

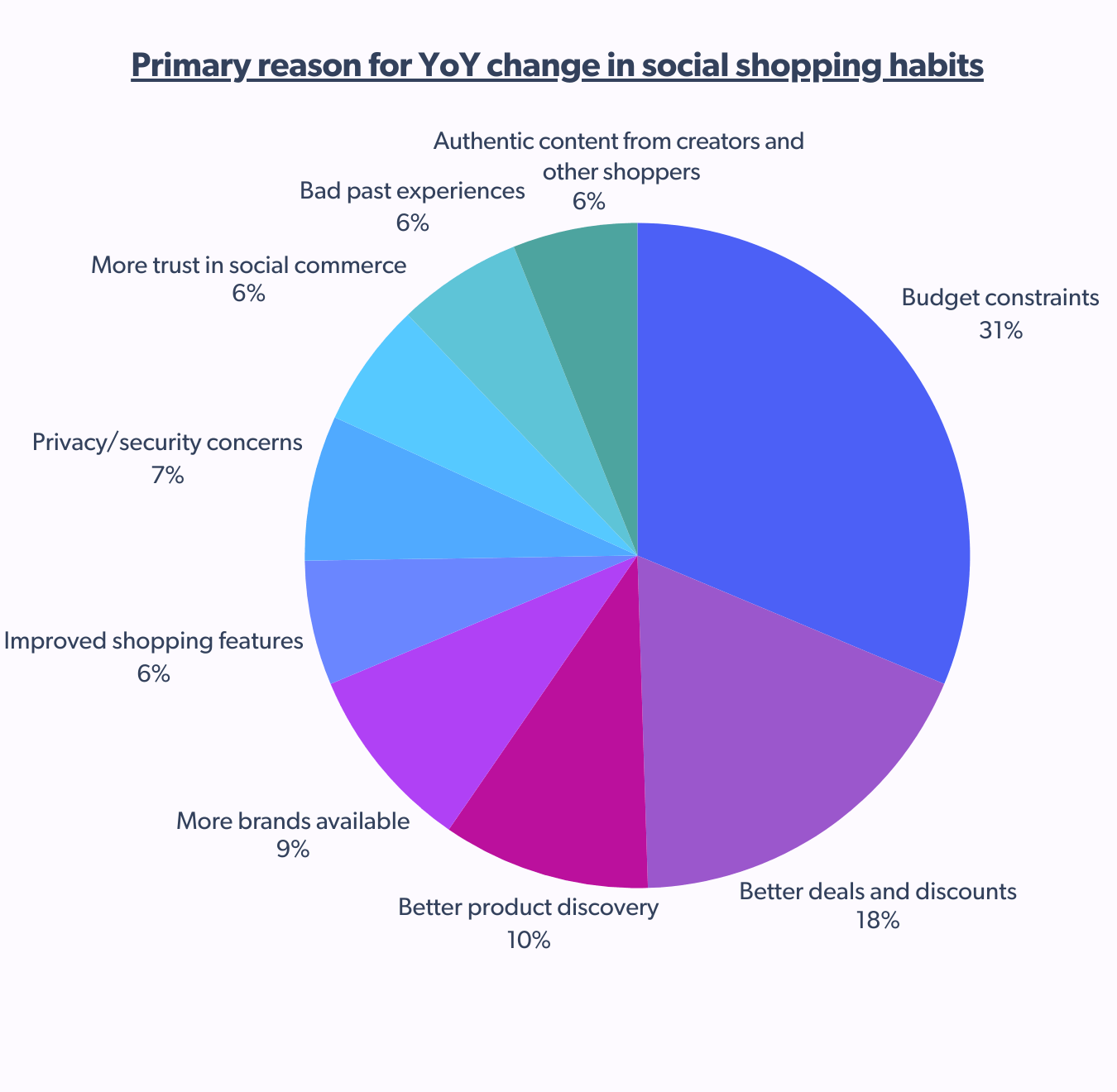

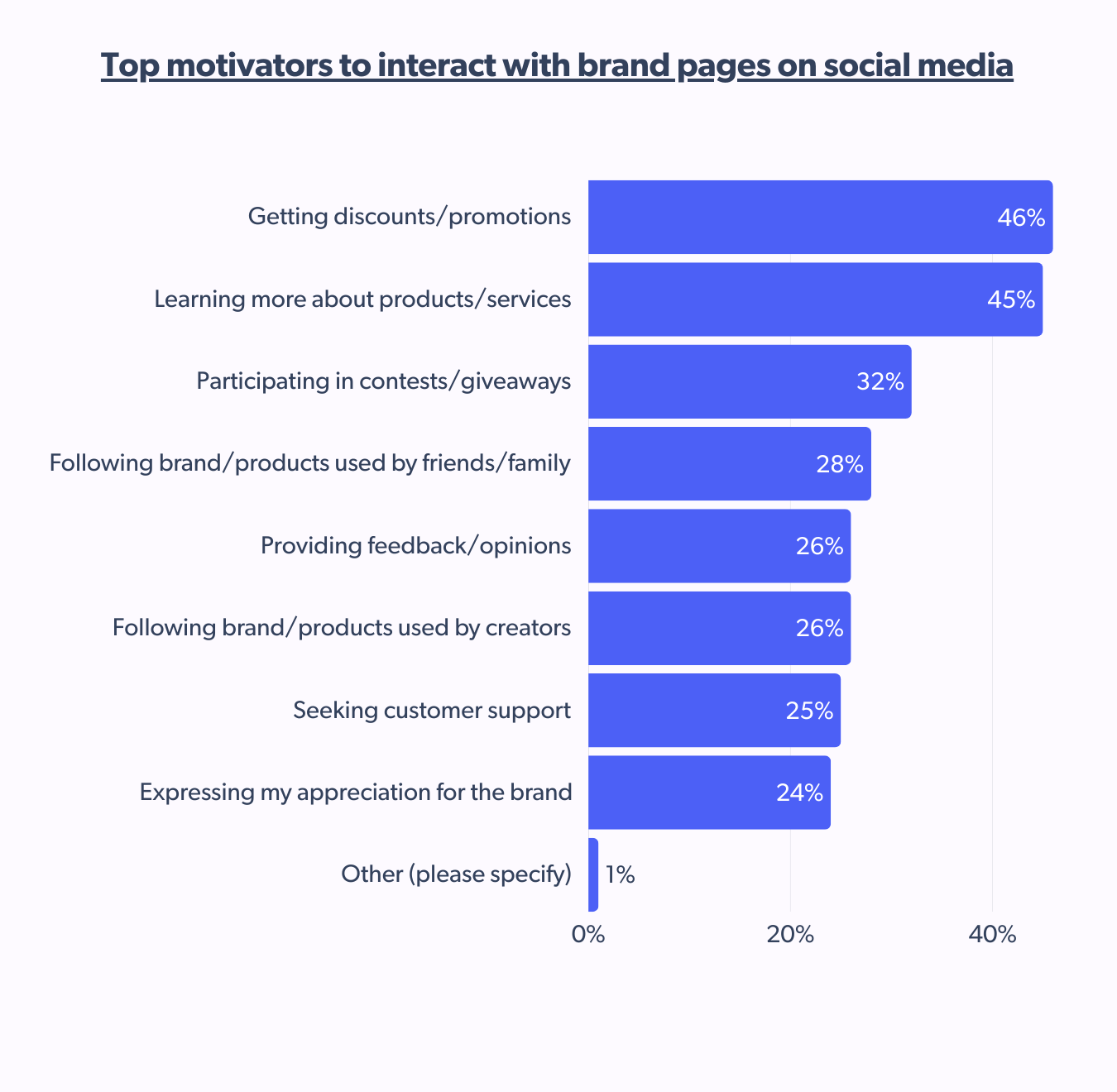

A look at social commerce shows that the value-first mindset extends even into how Australians interact with brands on platforms like Facebook, Instagram, or TikTok.

Price is the primary filter through which Australians evaluate every purchase. They’re pragmatic, digital-first when it suits them, and ready to adjust their habits for better outcomes. For brands, this means price competitiveness is no longer a lever. It’s a necessity.

“Trust, but verify” the Australian shopper’s mantra

Australian consumer behavior shows one clear pattern: trust isn’t given freely. It’s earned (through rigorous verification). They rely on a diverse mix of platforms, peer input, and visual validation to build trust before hitting ‘buy.’

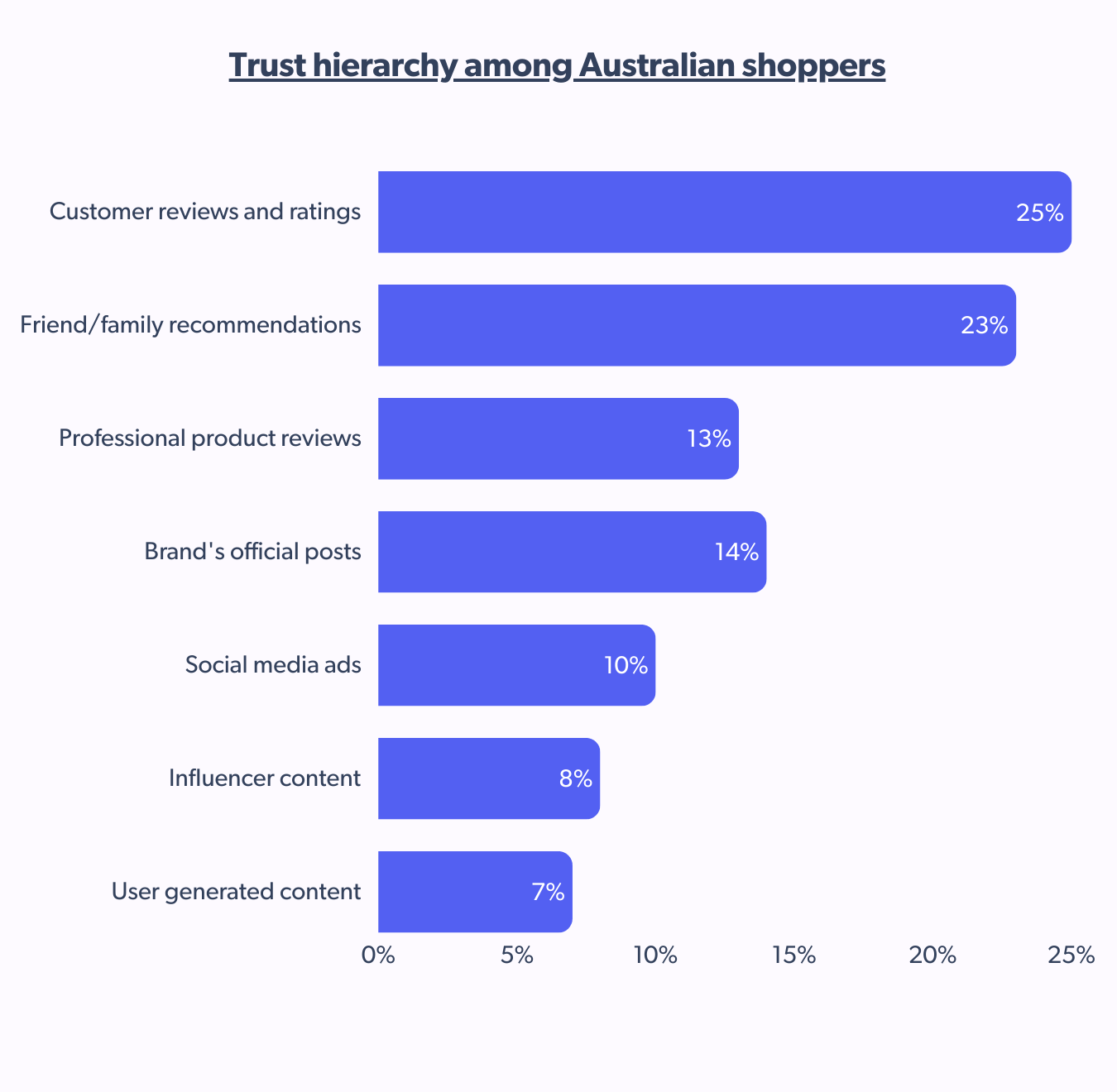

In this evolving landscape of e-commerce trends, trust doesn’t come from brands. It comes from people.

1 in 4 say straight from the source

Australians demonstrate a clear pattern: reviews and personal networks far outweigh branded content or paid promotions in the social commerce ecosystem.

This behavior reflects a nuanced online commerce trend: the shopper journey doesn’t begin and end on one channel.

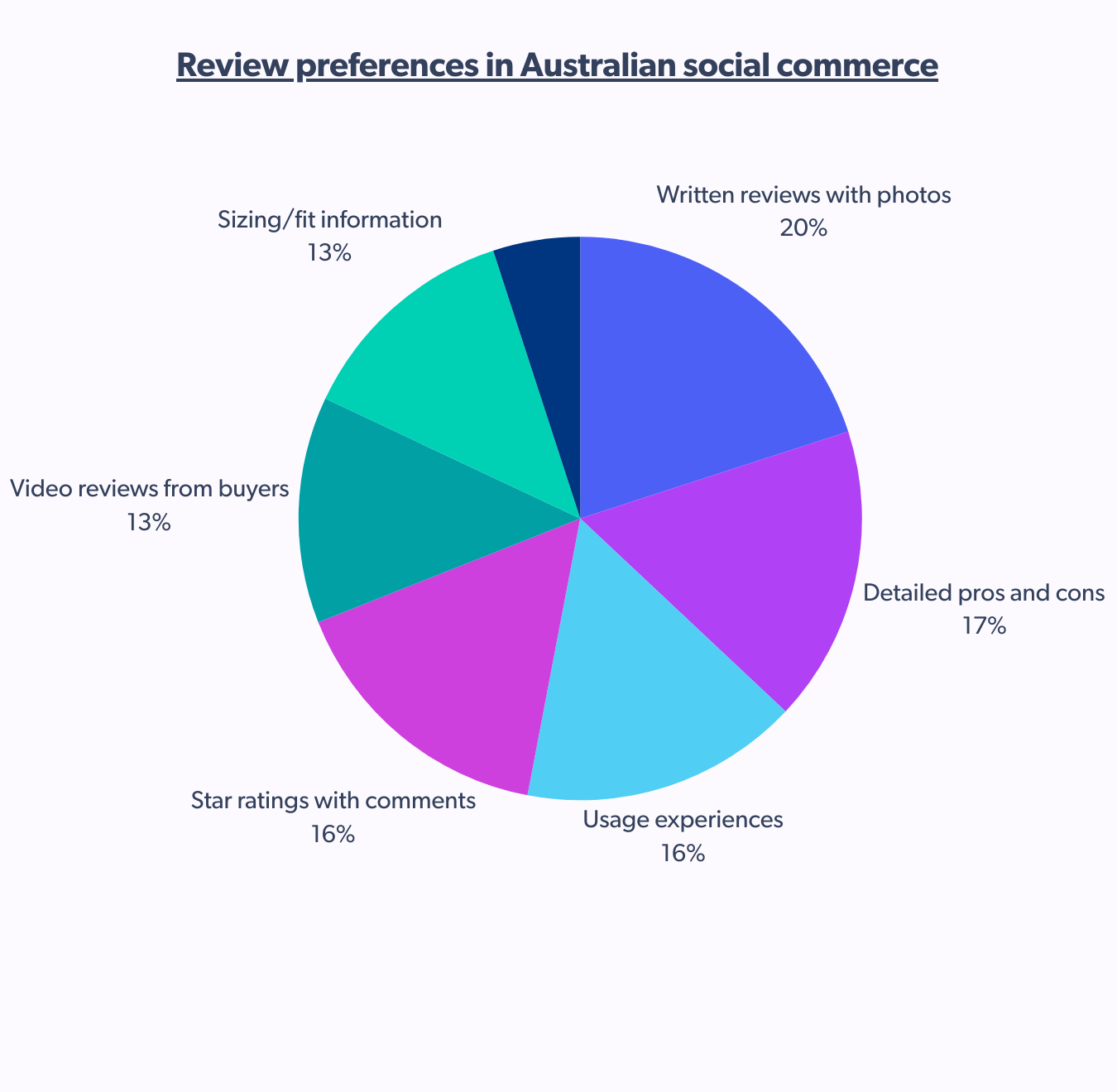

Photos > Star ratings

As the social commerce landscape evolves, so do the shoppers. Beyond written content, Australian shoppers want context and evidence.

While the Aussies’ preference (20%) is only slightly above the global average (19%), it signals something crucial: visual validation has become a cornerstone of online commerce trends, especially when evaluating the fit, quality, or usability of products.

This demand for photo-backed credibility becomes increasingly important in categories like apparel or personal care, where size and outcome vary. This shift in Australian consumer behavior necessitates focusing on visually showcasing products through customer feedback.

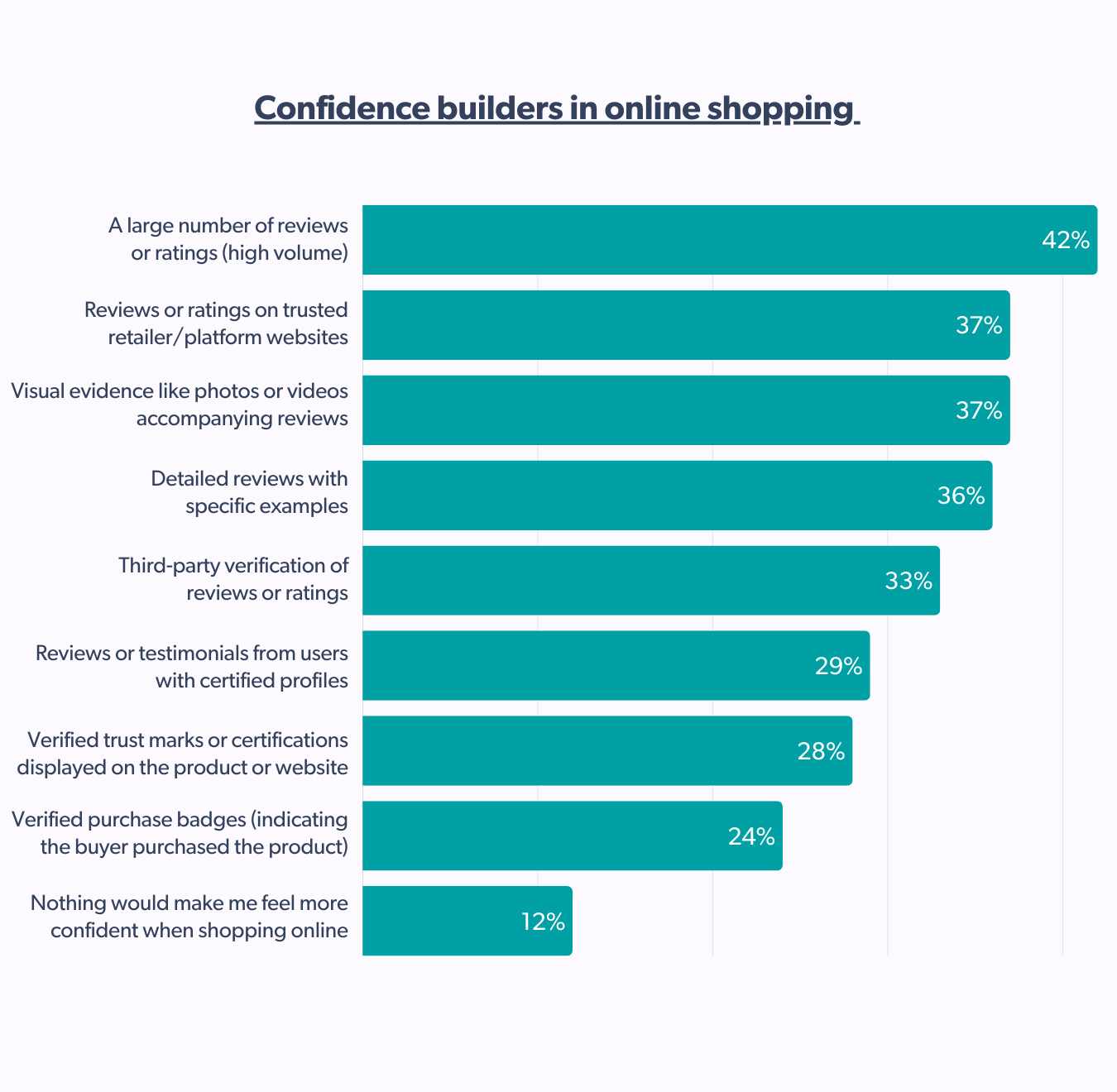

For 42%, confidence is crowdsourced

In the current landscape of online shopping trends, Australians seek volume, visuals, and specifics. “Seeing is believing” has become a fundamental principle in Australian consumer behavior that carries more weight than third-party verifications or trust seals.

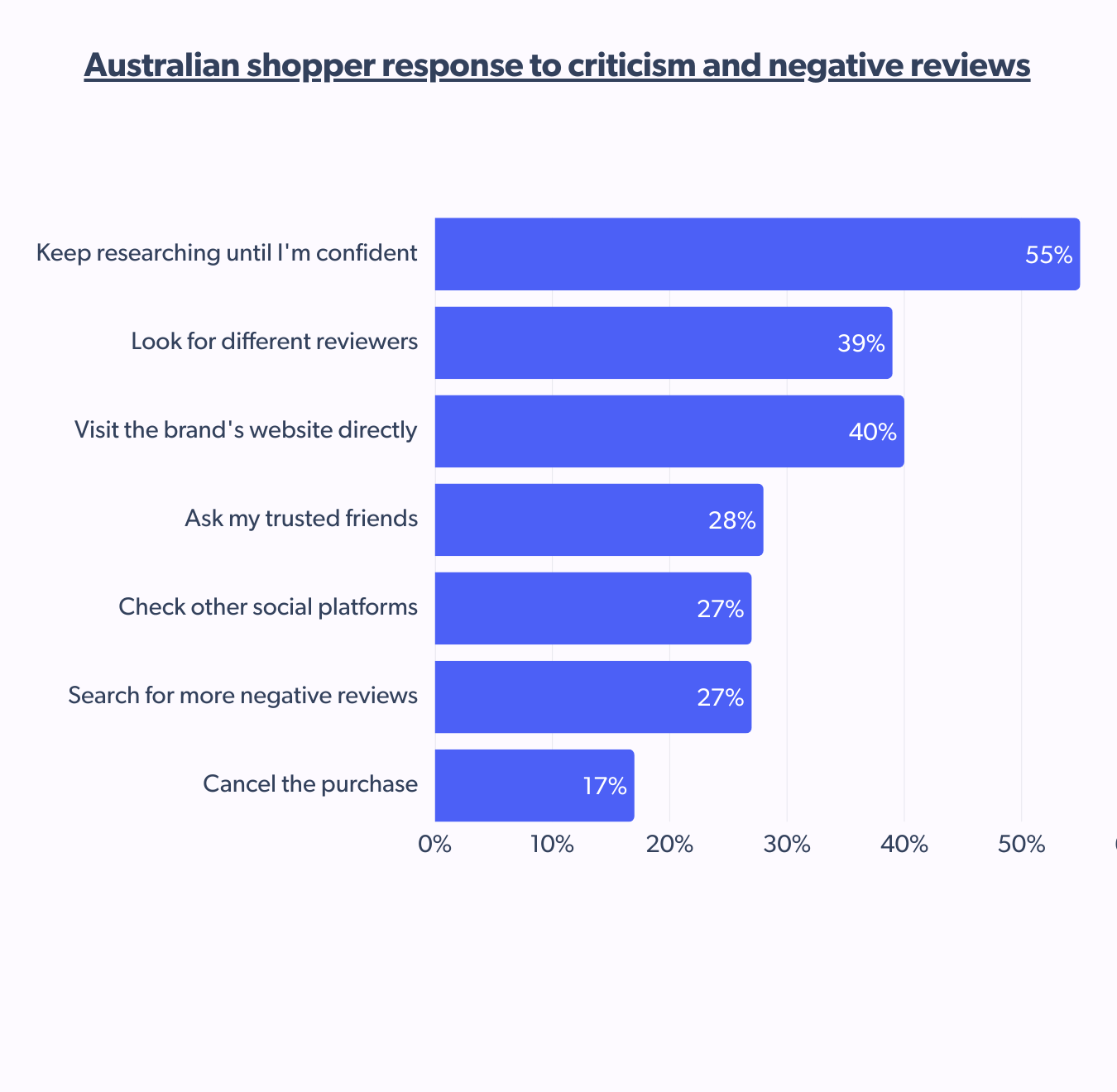

Negative reviews = Rerouted shopper journey

Reflecting broader e-commerce trends, Australians don’t immediately jump ship after encountering negative reviews. Most use criticism as a prompt to dig deeper — not walk away. Here’s how brands can best respond to such reviews.

This paints a clear picture of Australian consumer behavior: trust is conditional but stable. They’re willing to put in the effort as long as it is rewarded with transparency and trust. Australian shoppers are not impulsive. They’re intentional. They are cautious, methodical, and informed, representing a significant shift in online shopping trends.

This appetite for authenticity, credibility, and visual proof naturally extends to how Australians interact with content created by creators in the content creators and social commerce space.

Creator content takes a while to land in Oz

The Australian consumer doesn’t necessarily dismiss creators but approaches their content with questions like:

“Is this authentic?”

“What’s the complete picture?”

“What hidden details am I missing?”

This cautious mindset is fundamentally reshaping social commerce performance metrics in the Australian market. Trust consistently outweighs virality, and engagement rarely translates to immediate conversion.

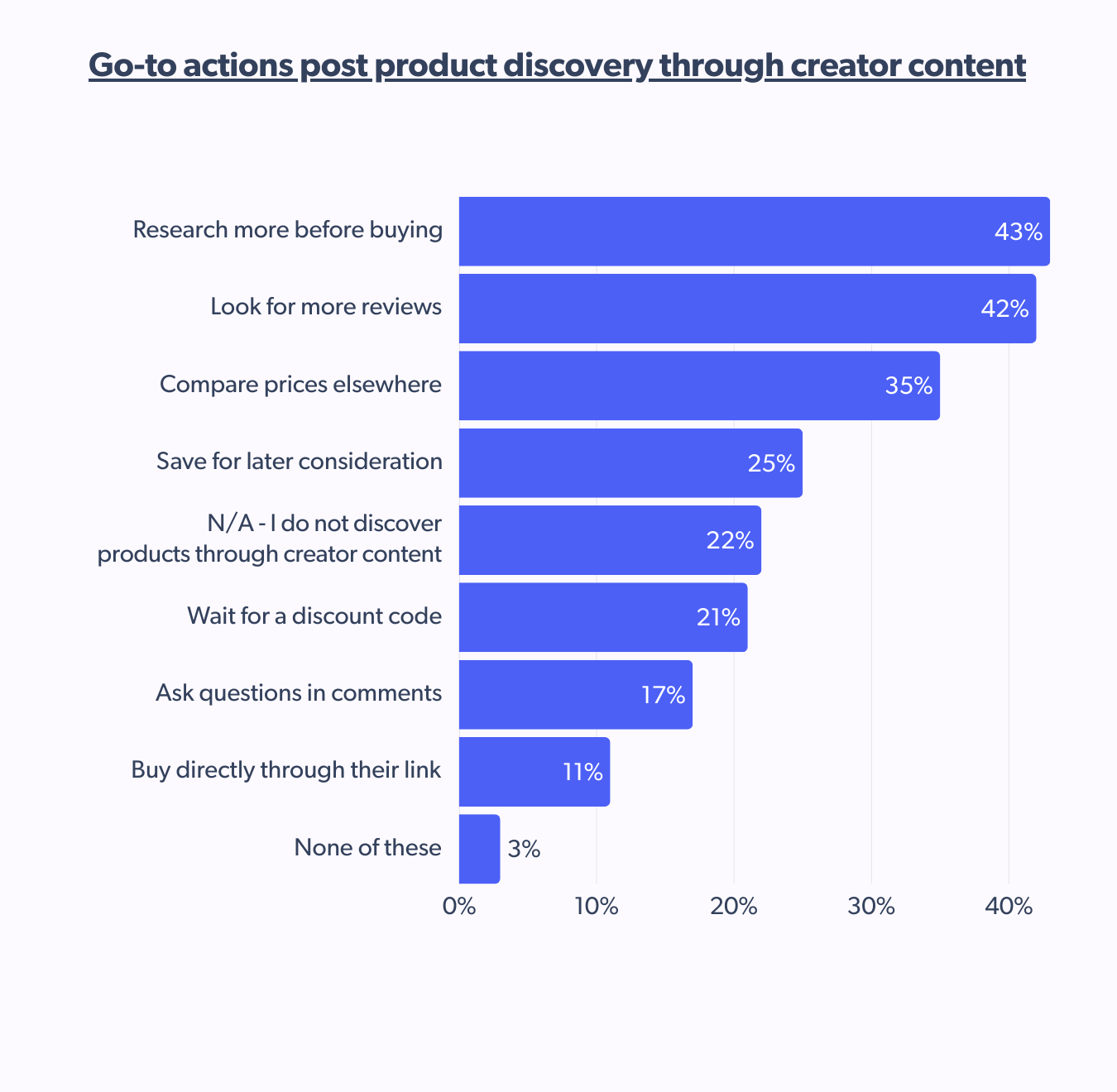

Scroll, research, think – and rarely purchase

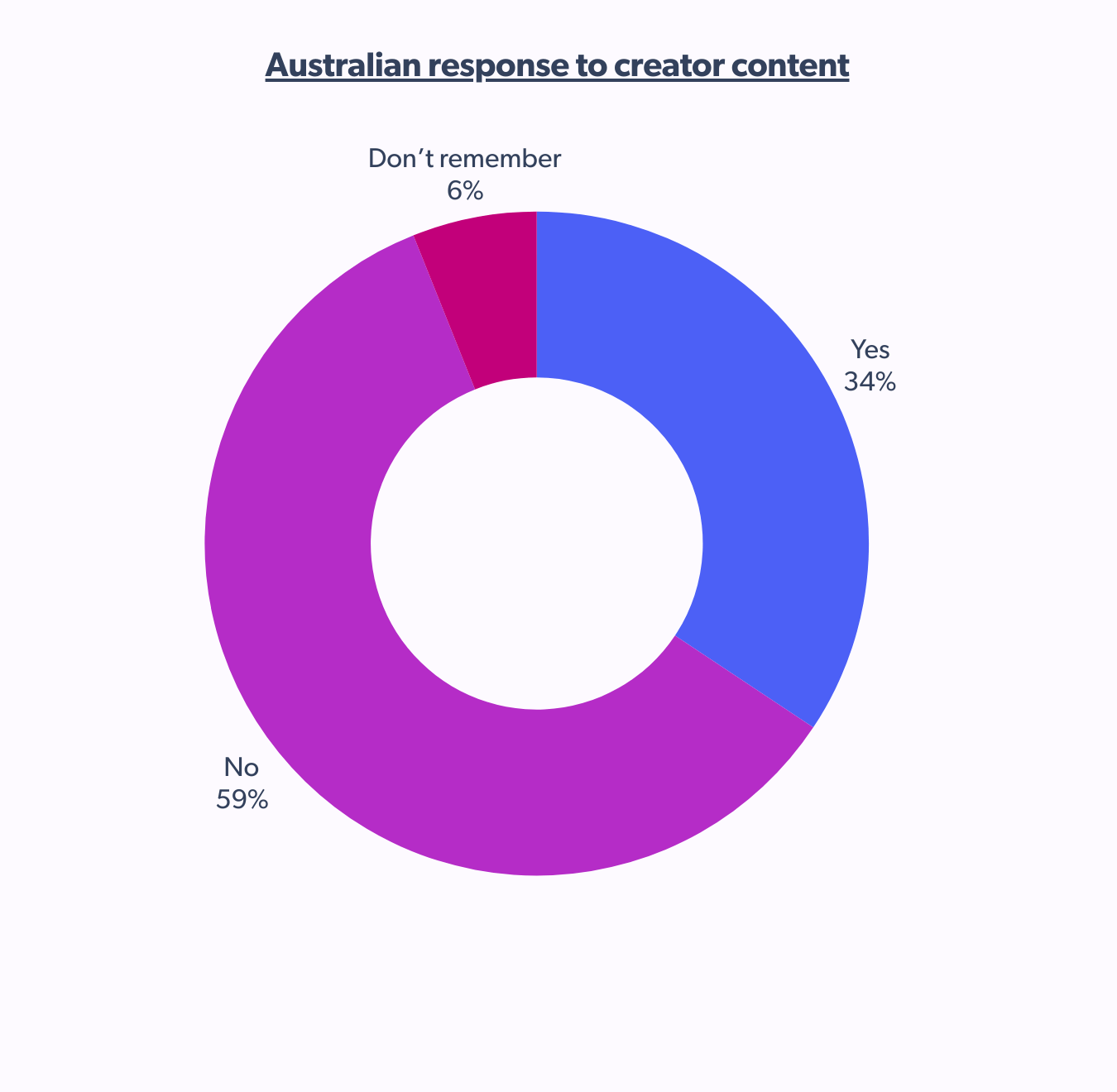

In the global landscape of online commerce trends, where influencer marketing is typically viewed as a powerful conversion driver, Australia showcases a different reality: consumers may engage with creator content, but few are persuaded by it immediately. At least 34% reported ever purchasing creator-recommended products.

In Australia, creator content primarily functions as a discovery trigger rather than a direct conversion tool.

Australians also demonstrate above-average hesitation, with many waiting for discount codes or saving products for later consideration — further reinforcing their value-conscious approach to online shopping trends.

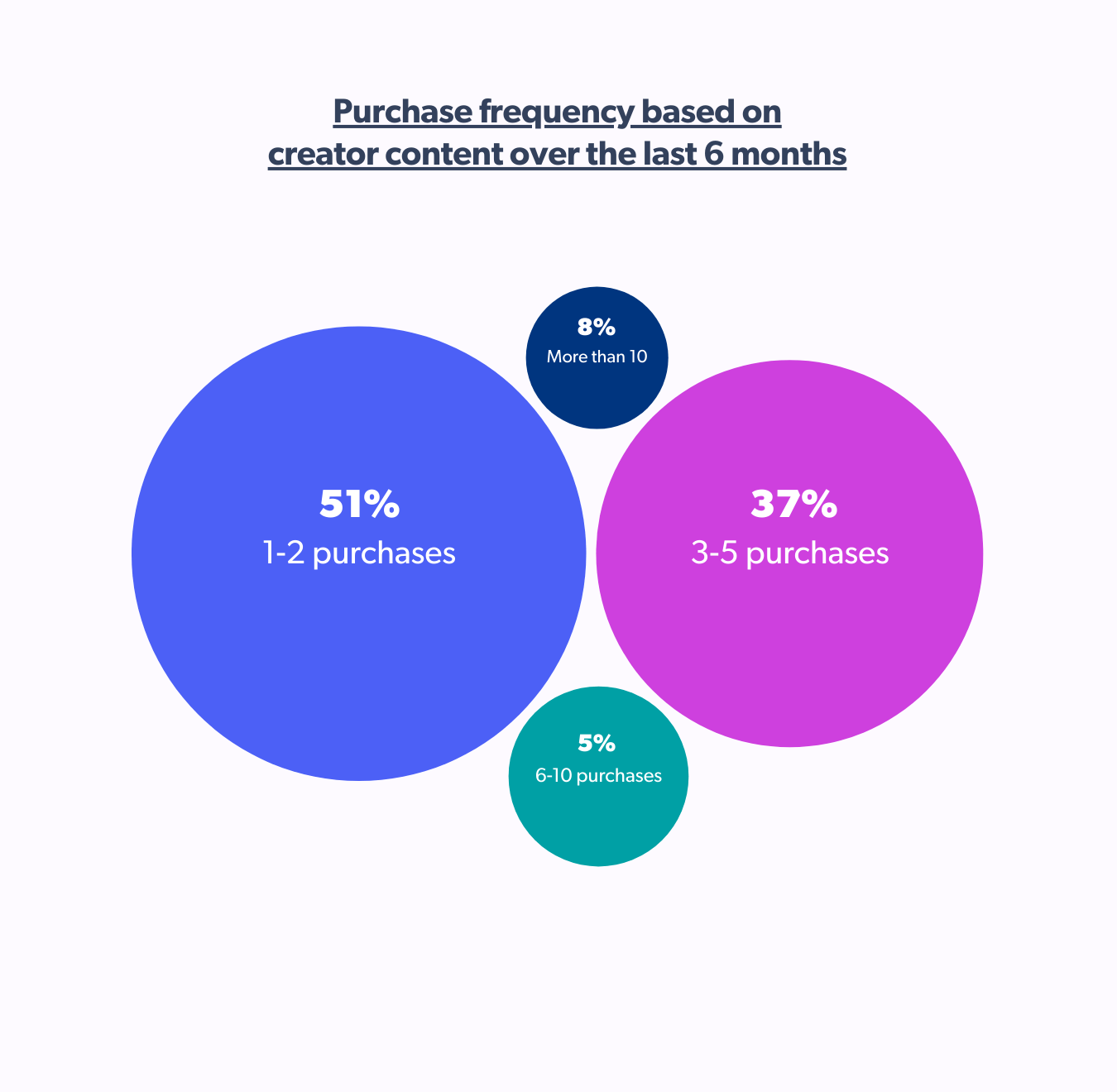

51% of shoppers make just 1-2 purchases from creators

Even among those who convert, the volume of creator-influenced purchases remains modest.

Australians don’t have an issue with creators; they just prefer to take their time evaluating recommendations. They focus more on credibility than on personalities.

Where influencers see the most success

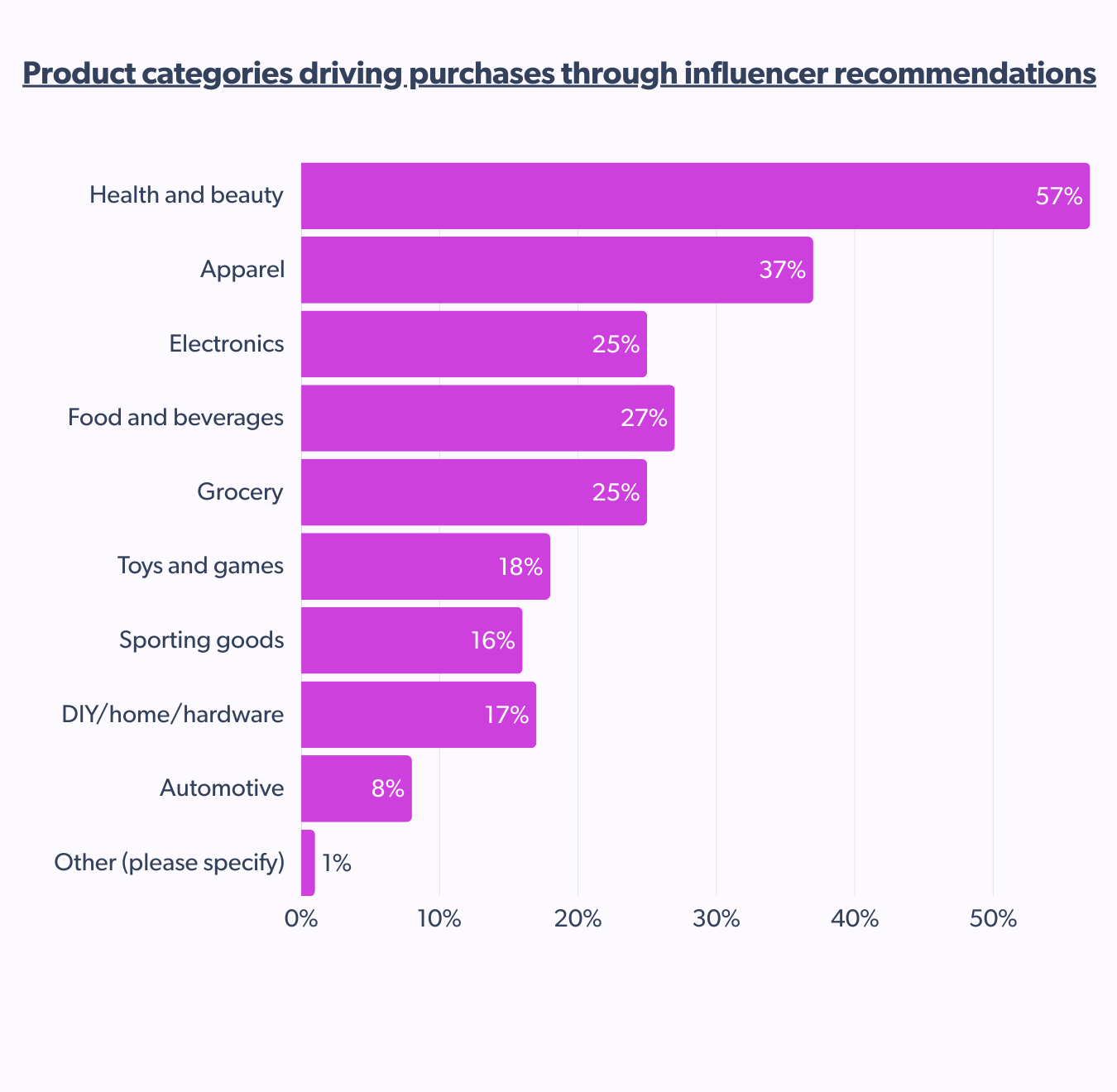

Creator content works best in categories that cluster in sectors where fit, function, and personal experience are most relevant.

As per the report, Australian shoppers respond most to creator content in categories where product demonstration or personal experience adds tangible value.

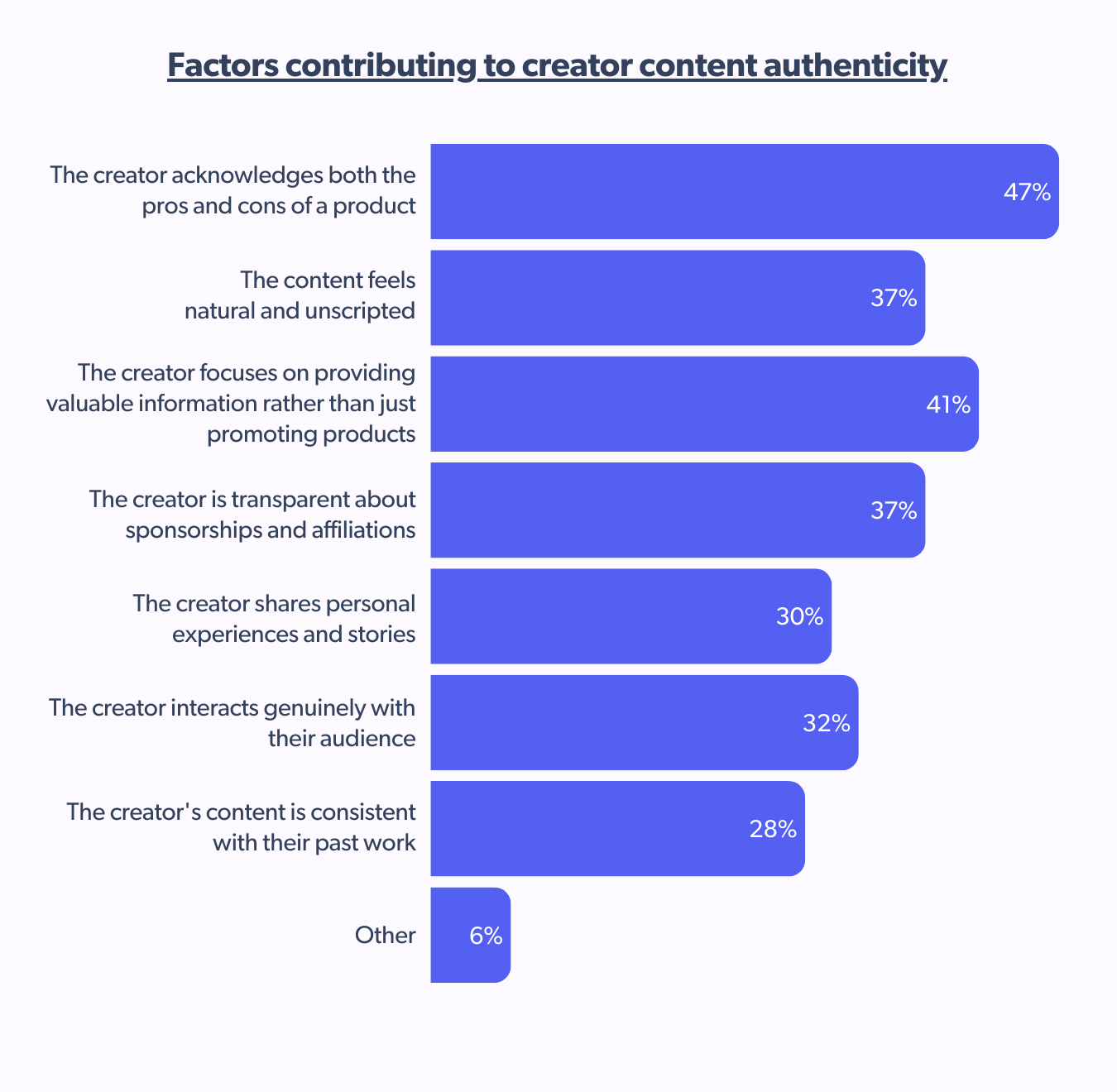

47% of shoppers demand full disclosure from creators

For shoppers down under, an effective influencer marketing campaign aligns with broader online shopping trends and interests and is not just a brand push.

Transparency trumps all

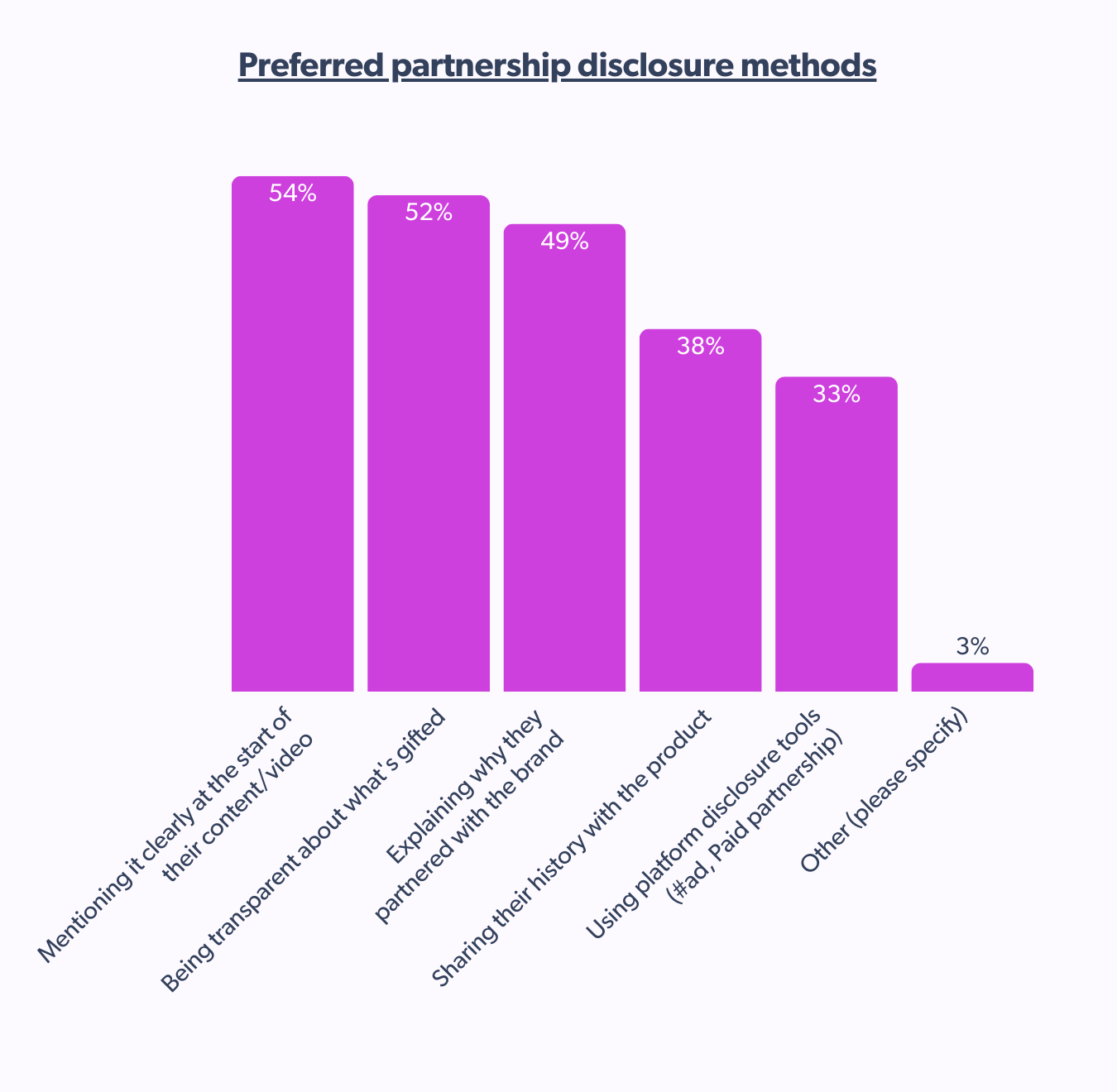

When asked about preferred methods for partnership disclosure, Australians were clear:

These expectations consistently exceed global averages — particularly regarding platform-native disclosure tools like #ad or “paid partnership” tags, which 33% of Australians prefer (versus 26% globally). This reflects evolving e-commerce trends where transparency directly impacts credibility.

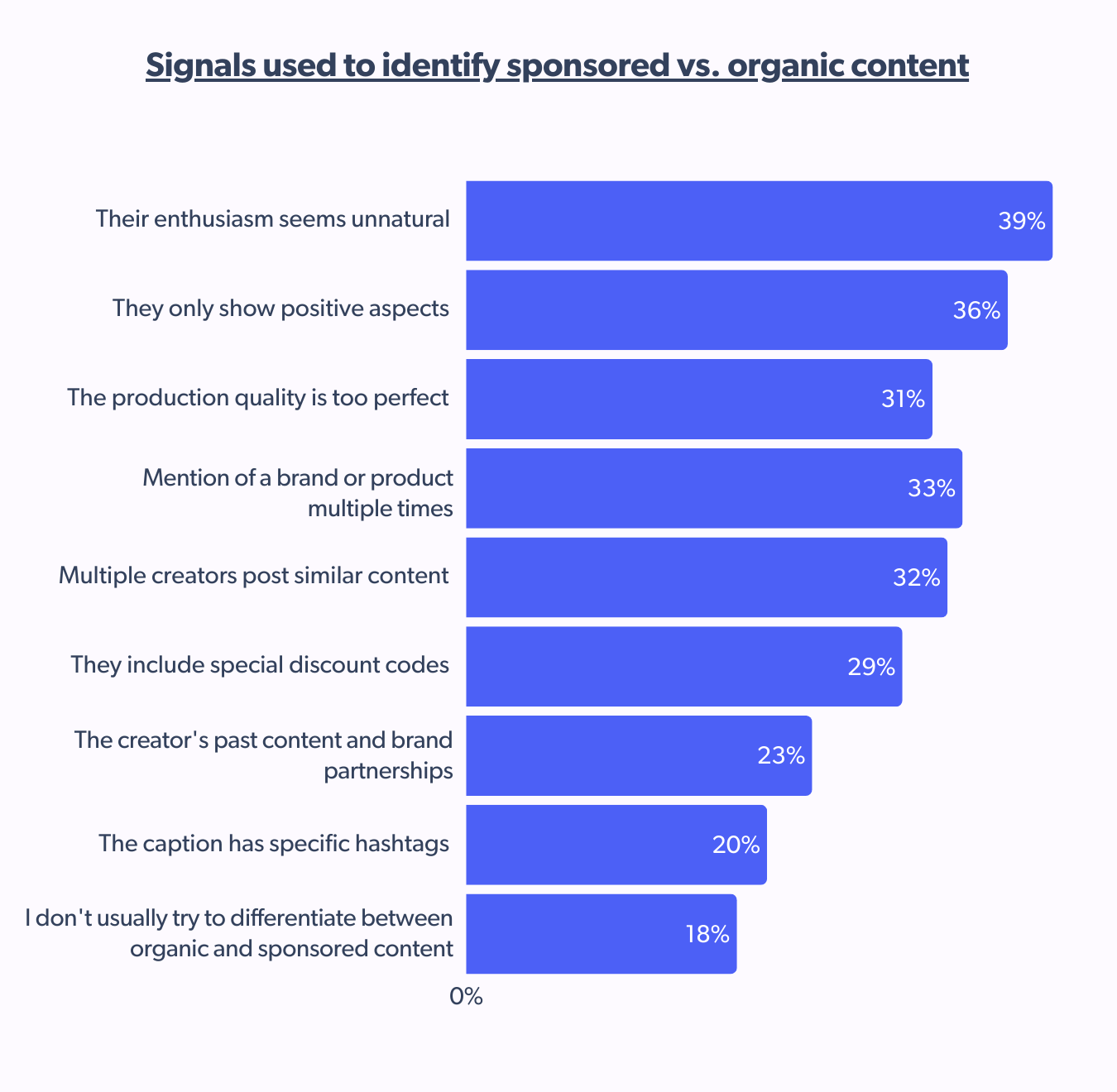

Fake enthusiasm? Oh naur!

When a creator’s enthusiasm feels forced, it becomes a red flag. This preference reflects a deeper cultural sensitivity to inauthenticity that’s reshaping social commerce in Australia.

Australians don’t expect every creator post to be organic, but they do expect it to feel genuine.

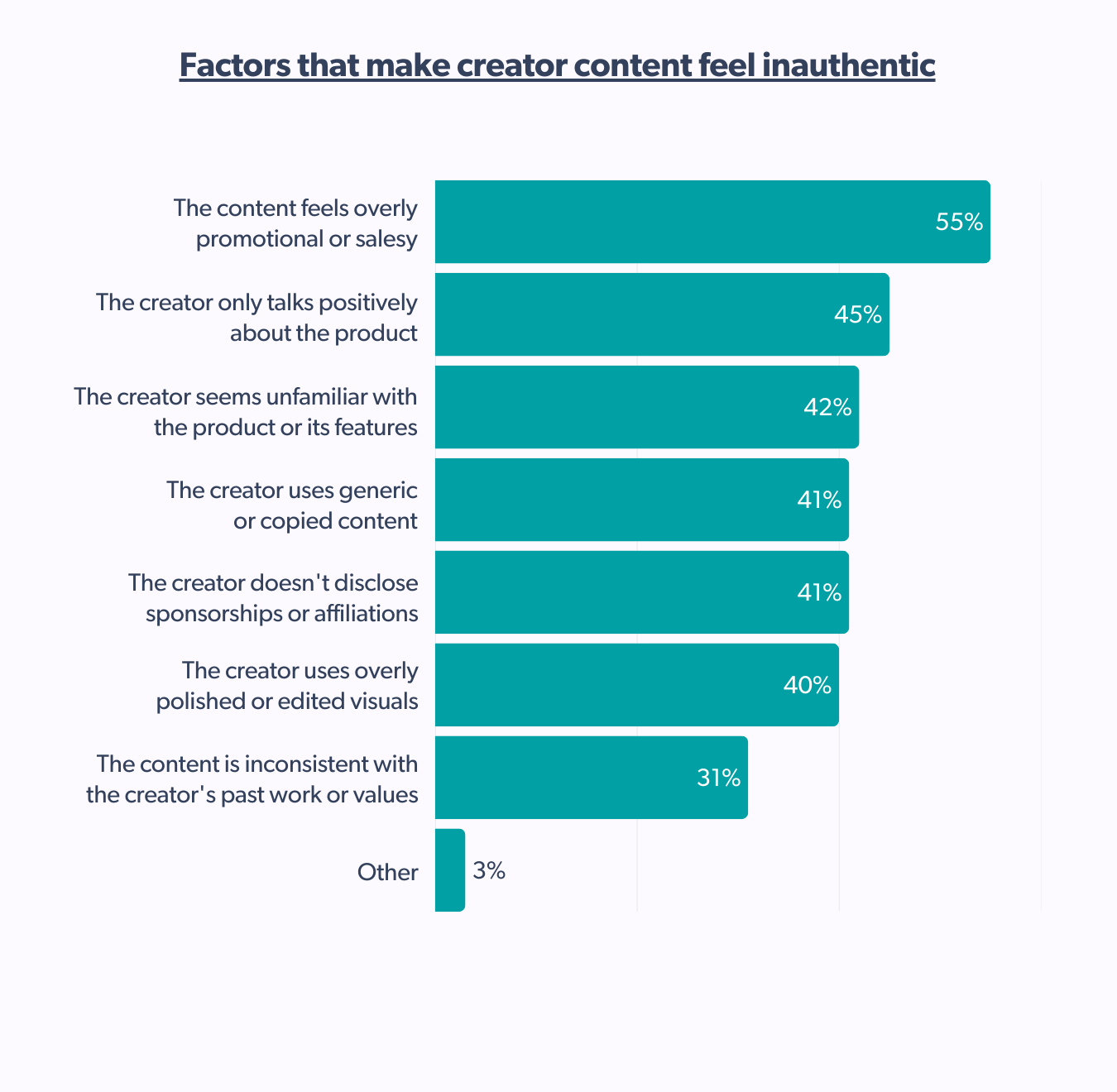

55% of Aussies flag super-salesy content as sponsored

For Australians, influence should be about helping them feel informed rather than sold to.

Compared to the global average, these shoppers show greater sensitivity to factors like sales language, disclosure, and product familiarity.

The rules for creator content in Australia are simple: Be clear. Be useful. Be real.

They engage when messages feel grounded, reviews seem earned, and creators appear genuinely aligned with products.

What roles do social media platforms play within the Australian market in the context of online shopping trends, and how do they affect shoppers?

Online shopping trends may vary, but value is the constant

The online shopping journey is fundamentally practical and purpose-driven for most Australians.

They approach social media with a transactional mindset, engaging when there’s tangible value on offer, with discounts and deals being their primary motivators.

Why follow brands on socials?

For brands, this means that social media should be more than a communication tool. An integrated strategy that builds a community and a loyal customer base and provides effective customer support is essential.

Discover online, buy offline

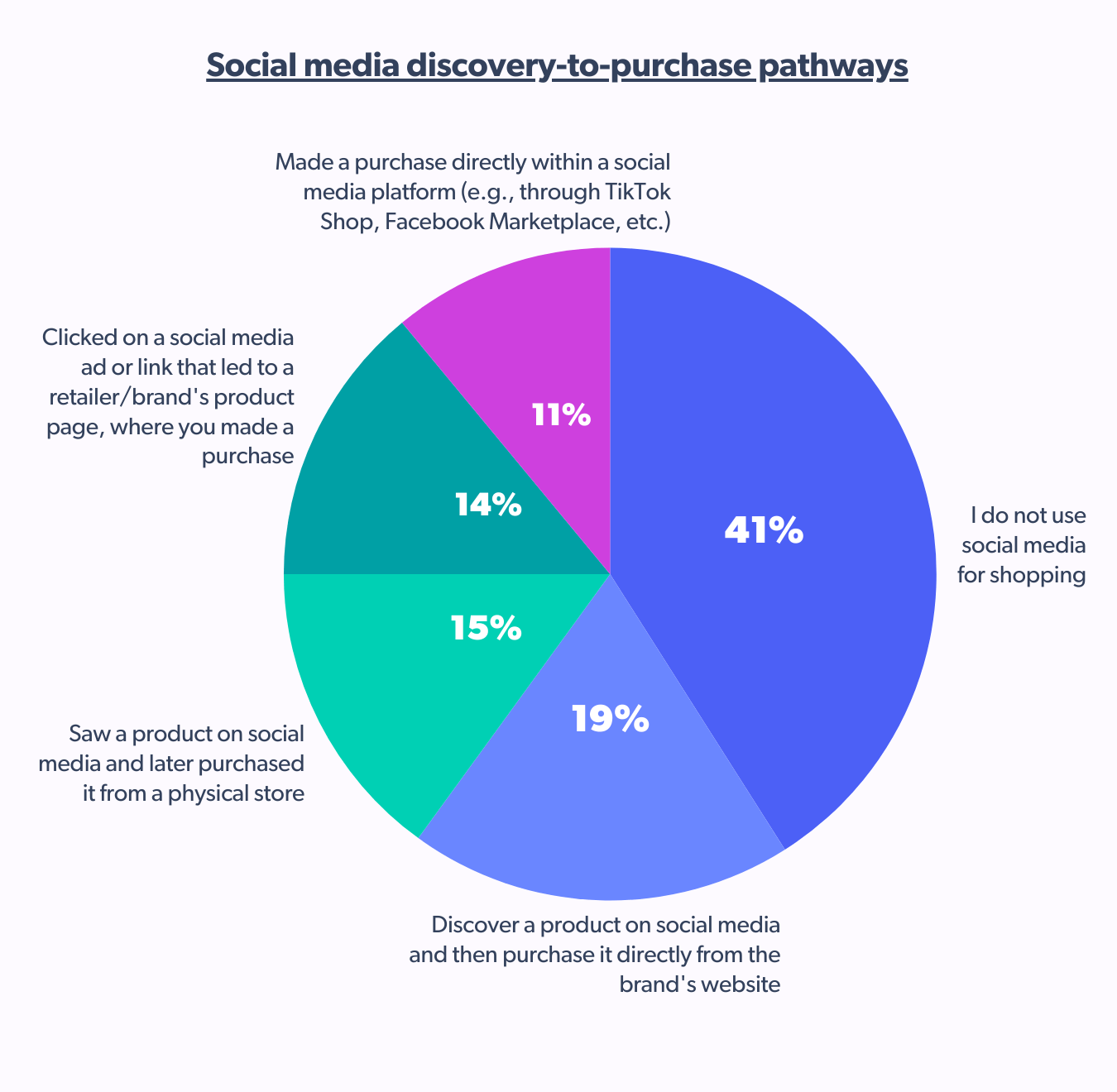

For Australians, social media serves as a top-of-funnel discovery and research tool, not necessarily a transactional platform. While the content on Instagram, TikTok, or Facebook may spark interest, most purchases happen elsewhere, either on brand websites or in-store.

Brands must optimize external channels and acknowledge the offline influence of social browsing.

How platforms dictate most purchases

Social commerce in Australia isn’t just about where consumers are active. It’s about what they’re shopping for and which platforms best serve each category.

There’s a distinct pattern here: visual-first, lifestyle-driven platforms dominate for trend-based categories, while review-heavy channels like YouTube win in higher-consideration segments like electronics.

While 36% of Australians say they don’t interact with brands on social at all, those who do show a clear preference for low-effort actions like liking posts (36%) over more engaged behaviors like commenting (25%) or messaging brands (12%). Still, when it comes to actual purchases, Facebook (57%) and Instagram (47%) lead the charge, proving that established, visual-first platforms are driving real action.

- Facebook: Remains a broad-use platform, not dominated by any category, but is consistently used across several. Purchases are spread across apparel (19%), electronics (16%), food & beverages (13%), and DIY/home/hardware (13%) suggesting a more utility-driven approach.

- Instagram: Performs strongest in visually-driven lifestyle categories, making it a key channel for beauty, fashion, and aspirational content. Australian shoppers on Instagram prefer health & beauty (25%) and apparel (24%), indicating that visually-led product storytelling leads to high conversions.

- TikTok: Mirrors Instagram in its category skew but leans even more heavily into trendy, visual-first items. The high traction in health & beauty (19%), followed by apparel (14%), reinforces TikTok’s role as a fast-moving, influence-heavy channel.

- YouTube: Where other platforms inspire quick wins, YouTube supports informed, higher-investment decisions. Electronics lead here at 14%, followed by health & beauty (12%) and apparel/food & beverages (10% each), proving the importance of visual storytelling in higher-consideration purchases.

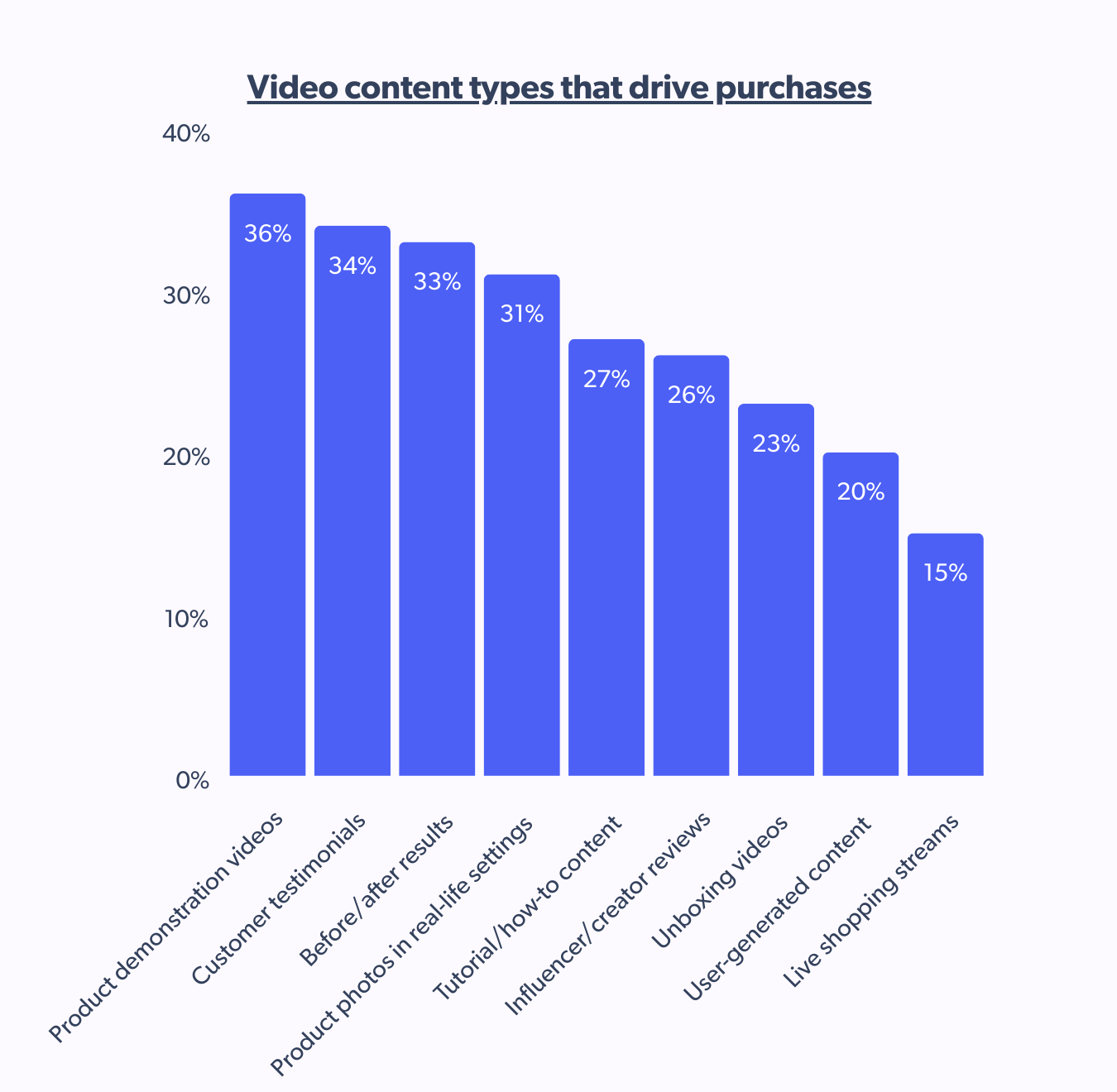

Why video content needs to prove its value

In the increasingly crowded social commerce landscape, video emerges as the breakthrough format, not just any video. For Aussies, content needs to do more than look good — show proof, offer clarity, and support confident buying decisions.

Aussies swayed by practicality in video content

Short-form video content is the dominant force shaping decisions for Australian shoppers. Reels and TikToks top the list for 50% of Aussie shoppers, making them the most influential content format. Reviews follow at 43%, with still images at 35% — proof that clear visuals and authentic validation drive decisions.

Even compared with global markets, Australia’s preference for short-form video was higher than the global average (46%). Brands and creators targeting this market should prioritize creating engaging and concise video content while also leveraging the power of customer reviews and testimonials.

From influencer content to platform preference and video strategy, Australian consumer behavior stays consistent: They are pragmatic, proof-seeking, and deliberate in engaging with social commerce. They are not driven by hype but by what feels helpful, trustworthy, and real.

The deliberate, digital, discerning shopper

Australian consumer behavior in 2025 is driven by clarity, not persuasion. They expect social platforms to deliver inspiration but demand proof before buying.

Ready to explore more insights? Discover how shoppers across the globe are shaping the future of commerce.

Explore the full Bazaarvoice Shopper Preference Report 2025 to unlock winning content and marketing strategies for the USA, UK, Germany, and other key markets — and connect with shoppers where it matters most.