July 15, 2020

Originally published 4/1/2020

For a full 2020 lookback, check out our latest here.

With an overwhelming amount of information available about the impact of COVID-19, it can feel difficult to identify which information is relevant to your business and how it should shape your strategy moving forward.

With a network of over 6,200 brand and retailer sites as our client base, we have unique visibility into shopping activity. To combat some of the fatigue from combing through multiple information sources, we will be regularly compiling data from across our network to help you understand how this pandemic is influencing consumers.

We will be watching for patterns and changes in shopping behavior – increases and decreases in product page views, orders placed, reviews submitted, and more. We’ll be looking at the data globally and across more than 20 product categories and comparing it to the same time period in 2019, as well as earlier months in 2020. As new, significant trends emerge, you can expect us to provide updates here.

June 2020

Key takeaways

Shoppers are still spending time online

While some regions began reopening in early May, others held off until June, and some are waiting even longer. Even with slow roll reopenings happening globally, we’re still seeing significant online shopping activity.

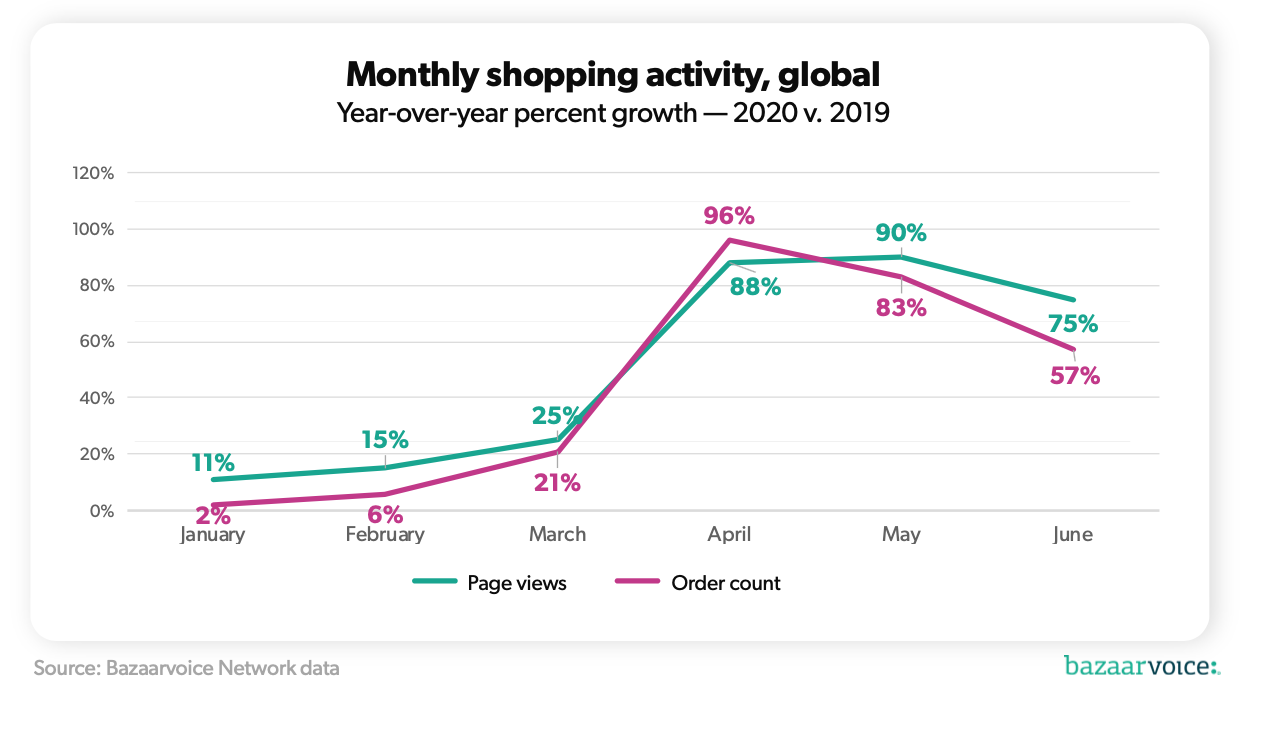

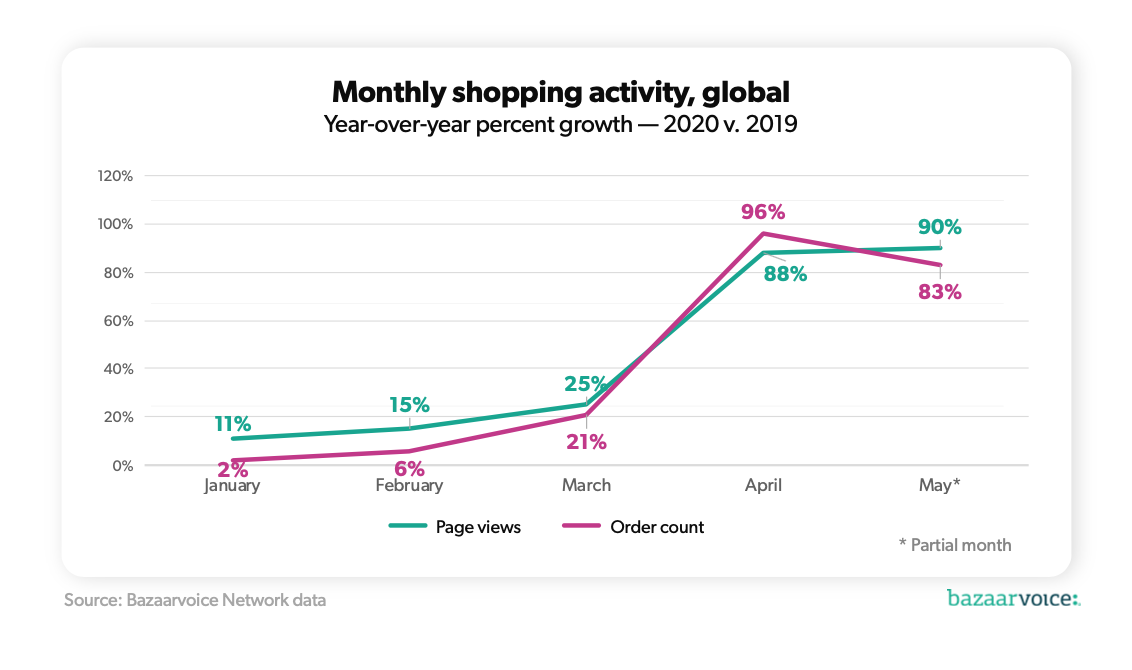

Page views are up 75% year-over-year and order count is up 57% for the same time period. While this growth is down from April and May, it’s still more significant than the growth we were seeing pre-pandemic. January saw 11% YOY growth for page views and 2% growth for order count, and February saw 15% YOY growth in page views and 6% growth in order count.

Shopping priorities have shifted

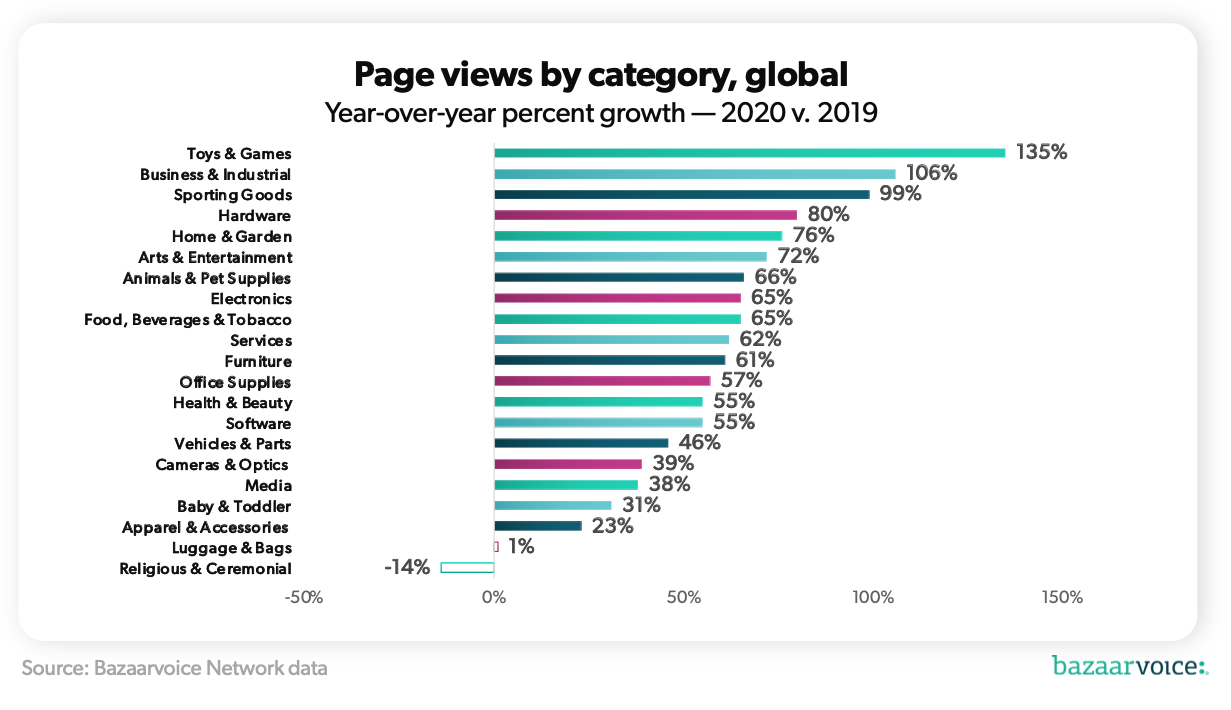

Early in the pandemic, shoppers were focused on buying masks, toys to keep little ones entertained at home, and stocking up on groceries. Currently, shoppers are focused on home and garden improvements. Business and Industrial and Toys and Games are still seeing growth, but not as significant as it was during the pandemic.

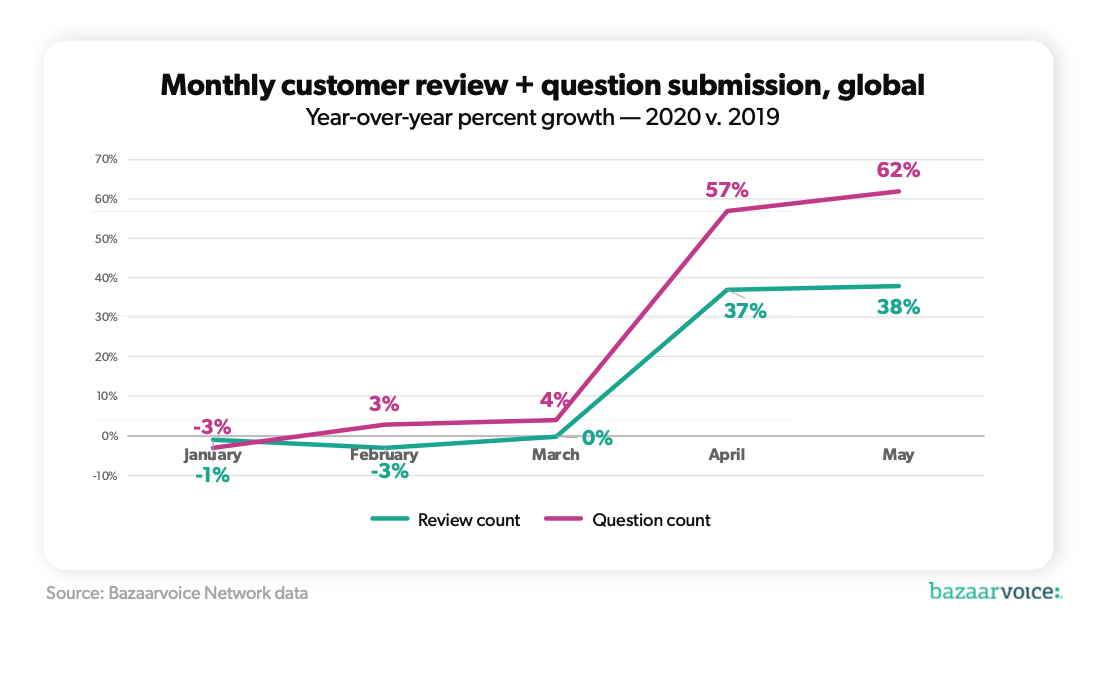

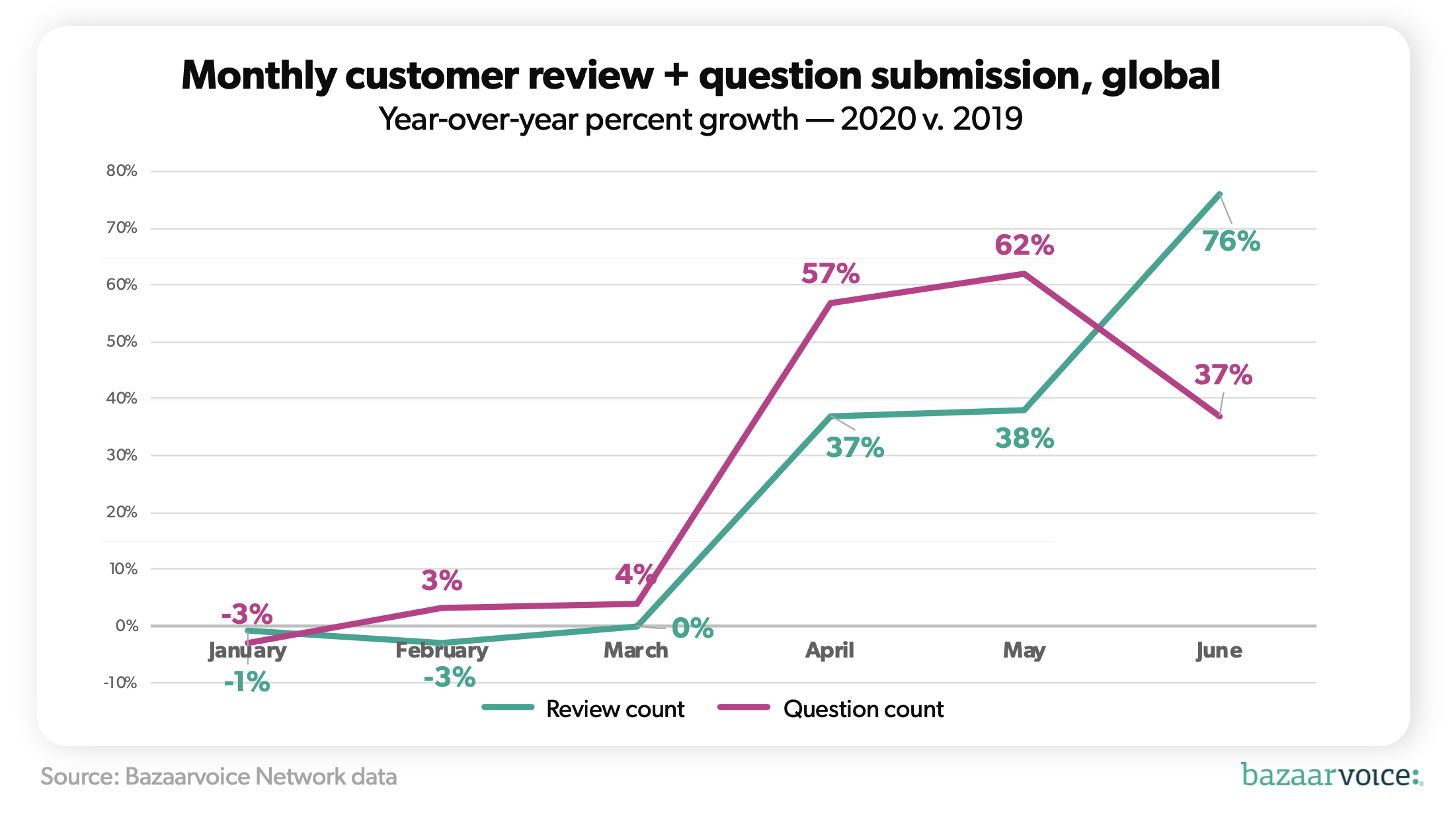

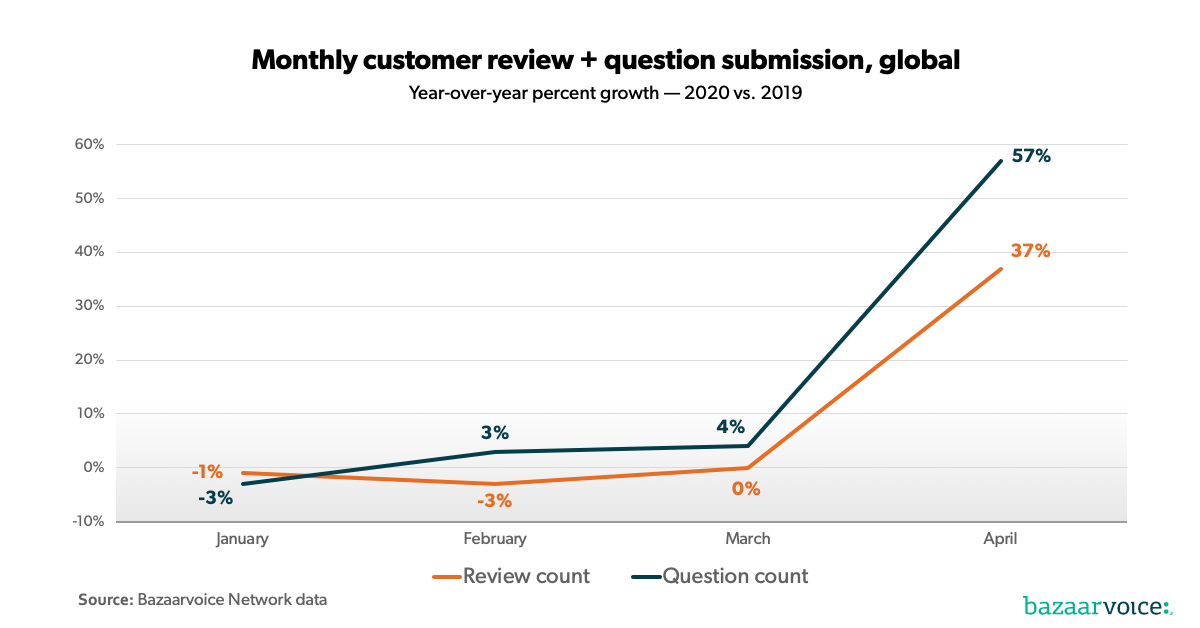

Review submission is picking up

Whether shoppers are finally receiving packages delayed in the mail due to COVID-19 or they’ve come to pay it forward as a consumer and leave a review for others, review count is up 76% year-over-year compared to 38% YOY in May. Question submission, however, dropped, from 62% YOY growth in May to 37% YOY growth in June.

Shoppers have also gotten more used to doing a lot of their shopping online, especially in categories where online shopping wasn’t as popular pre-COVID. For example, shoppers have finally settled into the norm of picking their produce digitally instead of in-person. Because of this, we’ve seen a surge in shoppers leaving reviews for Food, Beverage, and Tobacco, leading to a 176% increase in growth YOY.

And with working from home still largely the norm, shoppers are making sure they’re set up for the long haul. We’ve seen the largest increase in questions for Software, with 102% growth year over year.

Overall for June

- Page views are up 75% YOY

- Order count is up 57% YOY

- Submission of reviews is up 76%

- Submission of questions is up 37

Trending upwards in June:

- Toys and Games had one of the largest increases in page views (128%), as well as a 79% increase in order count.

- Food, Beverage, and Tobacco had the second highest increase in review submission (176%). Order count (56%) and page views (71%) are still increasing YOY.

- Arts and Entertainment saw the largest increase in review submission (193%). There was a 82% increase in page views and 81% increase in order count.

- Sporting Goods is seeing positive increases across all four metrics we’re tracking. Notably, page views (150%) and review submission (61%) are growing more YOY compared to May. Order count (122%) and question submission (46%) are both growing steadily as well.

- Animal and Pet Supplies experienced a 75% lift in page views, 23% increase in order count, and 15% increase in review submissions

- Business and Industrial (includes work safety gear and medical products) is back at top for page views (140%) and also saw a 128% increase in order count.

- Hardware had positive increases across page views (107%), order count (164%), and review submission (36%), and question submission (36%) as well.

- Software, once again, had the highest question submission growth at 102%. Page views and order count are both still trending upwards at 44% and 32%, respectively.

- Services (includes education, financial services, real estate, and travel) saw modest growth YOY in page views (19%) and questions (80%), but order count and review submission decreased by 1% and 35%, respectively.

- Health and Beauty is seeing growth across all four key metrics, including a 56% increase in page views, 44% increase in order count, 78% increase in review count, and 4% increase in question count.

- Apparel and Accessories has turned around from earlier in the pandemic. Page views and order counts are both up at 27% (up from 14% in May) and 23%.

- While page views aren’t faring well for Religious and Ceremonial, they saw a 31% increase in order count and 2% increase in question count

Trending downwards in June:

- Luggage and Bags is still the only category to see both a decrease in page views and order count.

- Luggage and Bags had a 11% decrease in page views and a 15% decrease in order count.

A look back at May 2020

Buying behavior slowed down, but is still tremendous

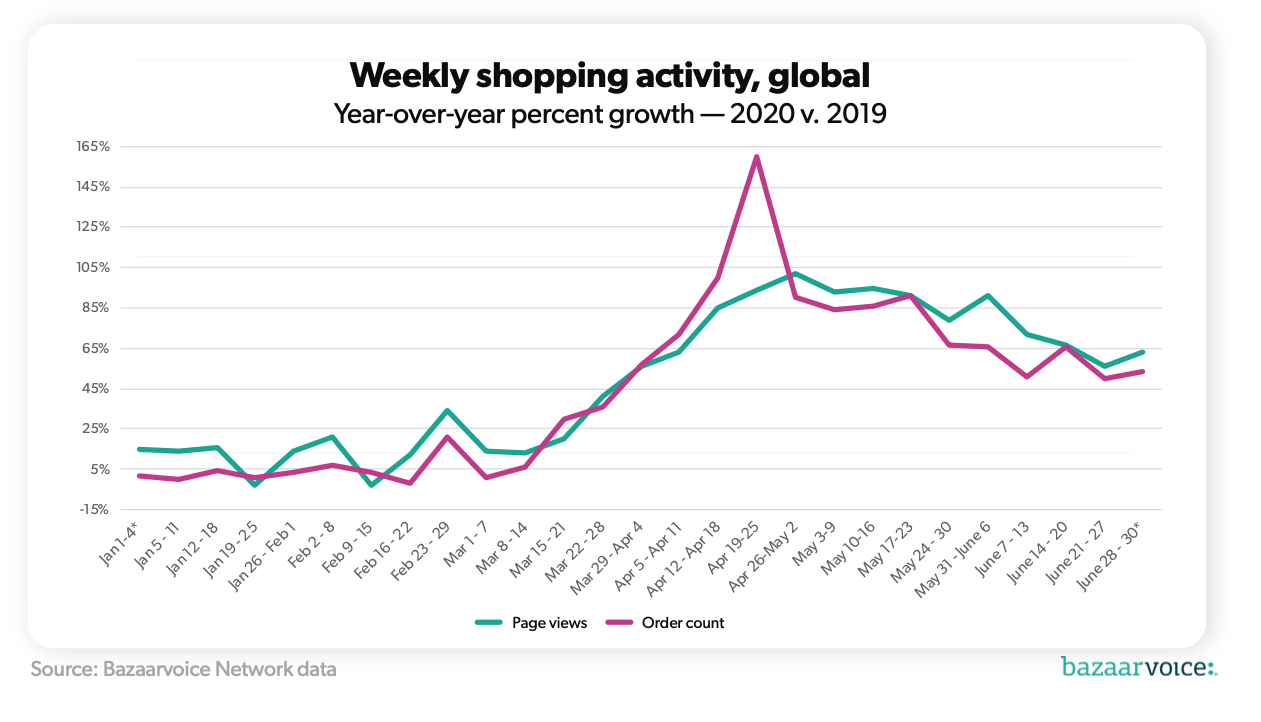

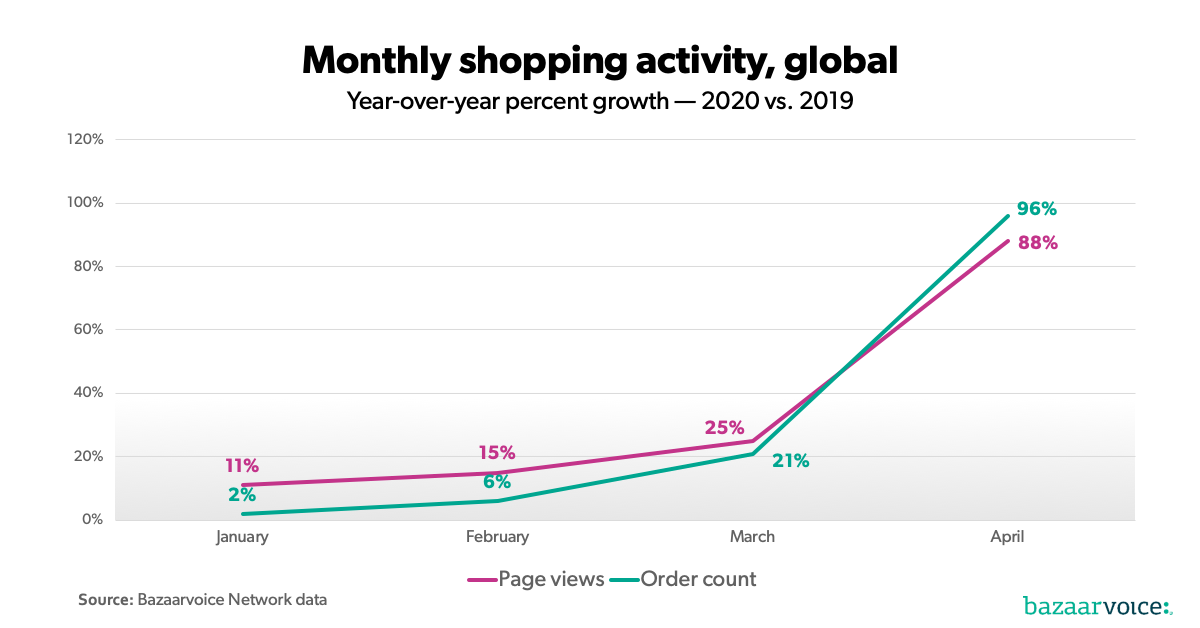

While May 2020 experienced a period of significant, sustained growth, buying behavior slowed down slightly compared to April 2020. May saw a YOY growth rate of 83% compared to May 2019, while April saw an order count increase of 96% year-over-year compared to April 2019. Based on the trends in the second half of May, it seems that April will serve as the growth peak.

Pre-crisis we typically saw shoppers browse more than they bought; however, in late March and continuing through much of April we saw buying outpace browsing. Order count began to surge on March 11th, the same day the World Health Organization declared COVID-19 a global pandemic and the US-Europe travel ban was announced. In May, shopper behavior returned to the pre-crisis pattern of browsing outpacing buying.

On top of browsing, shoppers are continuing to leave more reviews and ask more questions, benefitting future shoppers as they reach the buying decision phase of the shopper journey.

As the economy reopens, consumer needs are shifting

While many countries and towns are still in varying degrees of shelter-in-place or lockdown, some markets have begun to reopen. This has led to a shift in consumer buying behavior.

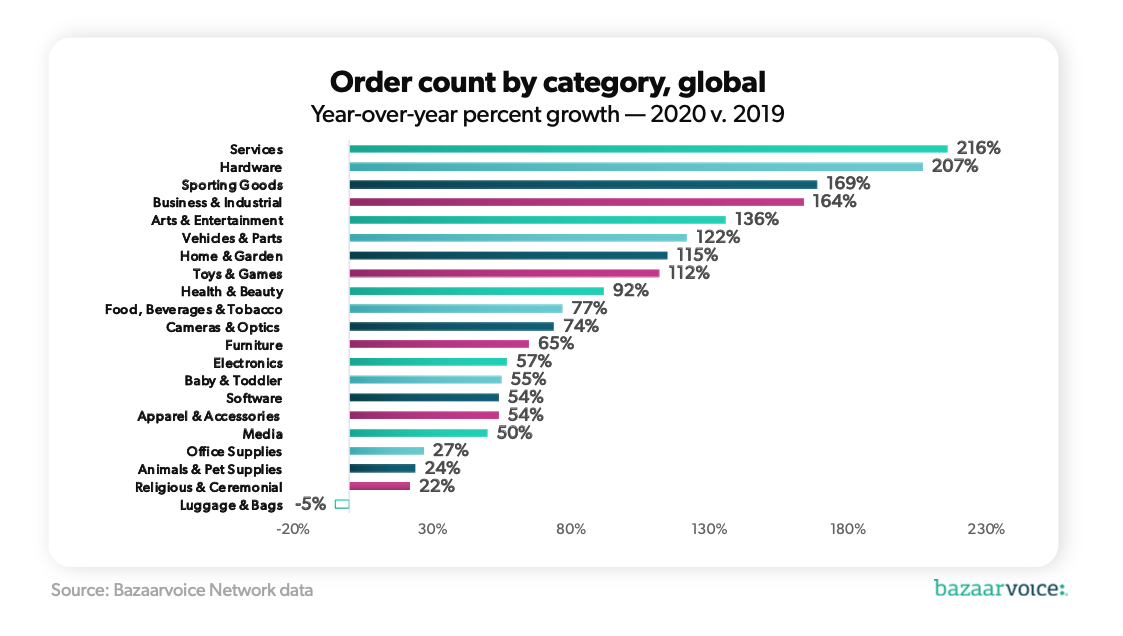

Many categories saw order count and page view year-over-year growth moderate between April and May. The Services category bucked the trend, growing faster in May than in April.

Services (which includes education, financial services, real estate, and travel) saw page view growth more than double, reaching 62% YOY in May, compared to 26% in April. While Service order count accelerated to 216% YOY in May, compared to 128% in April.

Now that many travel bans have lifted and economies are reopening, some of the services previously less utilized during lockdown are seeing greater need. For example – in the U.S., more housing listings are appearing online than in the previous month, and hotel bookings and air travel are both trending upwards.

Overall for May

- Page views are up 90% YOY

- Order count is up 83% YOY

- Submission of reviews is up 38%

- Submission of questions is up 62%

Trending upwards in May:

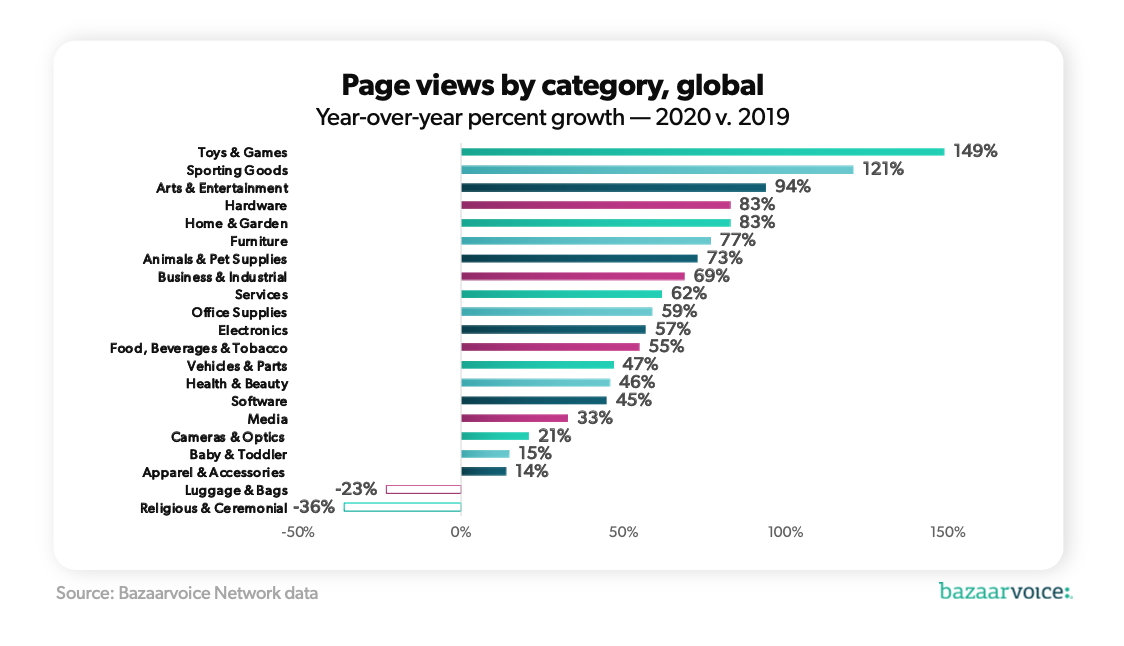

- Toys and Games had the largest increase in page views (149%), as well as a 122% increase in order count.

- Arts and Entertainment saw the largest increase in review submission (246%). There was a 94% increase in page views and 136% increase in order count. Question submission (15%) is also up.

- Sporting Goods is seeing positive increases across page views (121%), order count (169%), review submission (19%), and question submission (55%), which is up from April.

- Animal and Pet Supplies experienced a 73% lift in page views and 24% increase in order count.

- Business and Industrial (includes work safety gear and medical products) fell out of the top five categories for page views (69%) and also saw a 164% increase in order count.

- Hardware had the largest increase in order count (207%) and had positive increases across page views (83%), review submission (51% – up from April’s YOY growth), and question submission (55%) as well.

- Software had the highest question submission growth at 202%. Page views and order count are both still trending upwards at 45% and 54%, respectively.

- Services (includes education, financial services, real estate, and travel) is the only category to see page views (62%) and order count (216%) increase YOY from April. This category also saw the highest order count.

- Health and Beauty is still in the top ten for order count (92%).

- Apparel and Accessories has turned around from earlier in the pandemic. Page views and order counts are both up at 14% and 54%, which is higher order count growth than in April 2020.

- Food, Beverage, and Tobacco had the second highest increase in review submission (162%). Order count (77%) and page views (55%) are still increasing YOY.

- While page views aren’t faring well for Religious and Ceremonial, they saw a 100% increase year-over-year in question submissions. Order count was also up 22%.

Trending downwards in May:

- Luggage and Bags is still the only category to see both a decrease in page views and order count.

- Luggage and Bags had a 23% decrease in page views and a 5% decrease in order count. While still decreasing, May fared better than April.

A look back at April 2020

April outpaced March in growth year-over-year

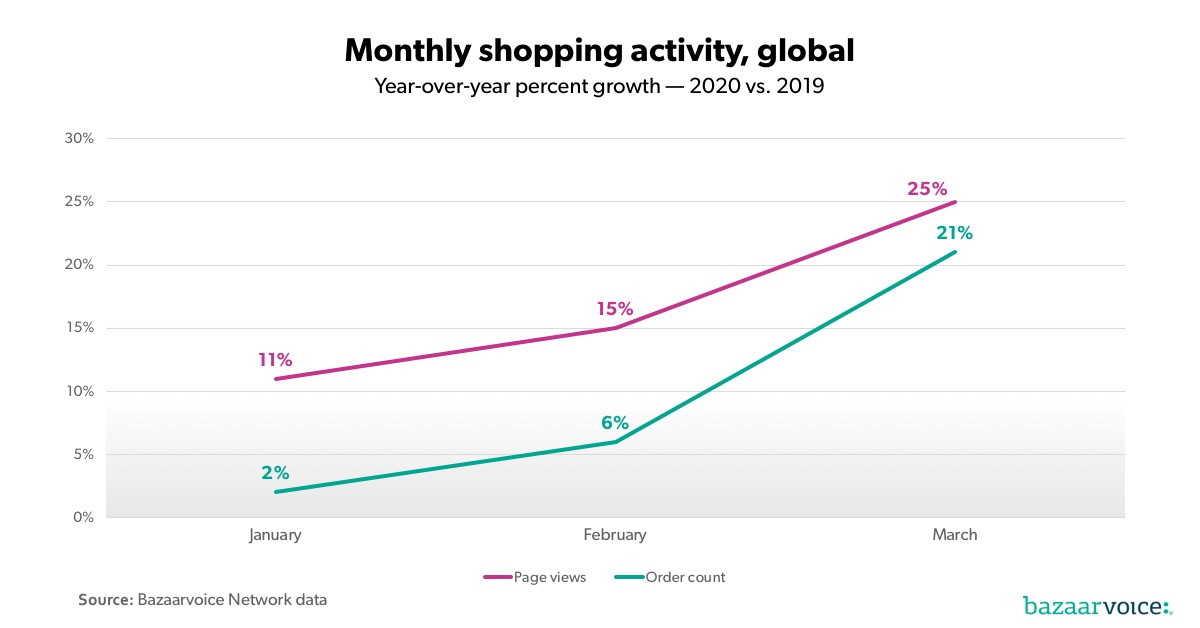

Based on the data, March 2020 growth was massive for e-commerce, but April 2020 grew even faster with every indicator we track (page views, order count, review submission, question submission) more than 3x the March 2020 numbers, and growth in each is growing more than 2.5x faster than it was pre-crisis.

March ended with a 25% YOY growth for page views, and April ended with an 88% increase. Page view growth has accelerated every week since the week beginning March 15.

Order count is also trending upward, with April 2020 year-over-year growth of 96%. For comparison – March closed with a 21% YOY increase in order count. While in March, browsing behavior (page views) was outpacing purchasing behavior (order count), this trend has reversed in April, with consumers buying more this month.

While the week of April 19-25th had the highest percentage of year-over-year growth for order count, order count slowed a little bit over the final week of April.his could potentially be because the end of the month may be a more challenging time for consumers financially, particularly with unemployment climbing.

Shoppers are leaving more reviews and asking more questions about products

When looking at the number of reviews submitted by consumers across our clients, March saw 0% growth year-over-year — that changed drastically in April with a 37% increase year-over-year. Many shoppers have made a larger percentage of purchases online than they have in the past, which could be triggering more post-interaction emails than usual. Spikes in review submission often occur after spikes in purchases. The delay accounts for shoppers receiving their items. To date, review submission has surpassed growth seen in this time frame last year. The partial week of April 26-30 saw the highest review submission YOY growth this year so far with a 64% increase.

Question submission saw even larger growth. In April, question submission was up 57% year-over-year, compared to just 4% YOY in March. The week of April 19-25th saw the highest YOY growth for question submissions with a 77% increase.

This influx of reviews and questions from shoppers helps other shoppers make informed purchases and buy with greater confidence. For brands, this influx supports conversion and provides additional customer insights at a time when shoppers needs are changing.

Brands should identify highlights and lowlights of their products from reviews, compile or update an existing list of frequently asked questions, and respond to customers as they reach out. Shoppers will remember the brands who made their quarantine easier.

April was all about entertainment, activity, and DIY

When COVID-19 was first declared a global pandemic, consumers rushed to buy non-perishable food items, face masks, and home office supplies. And our network data reflected that.

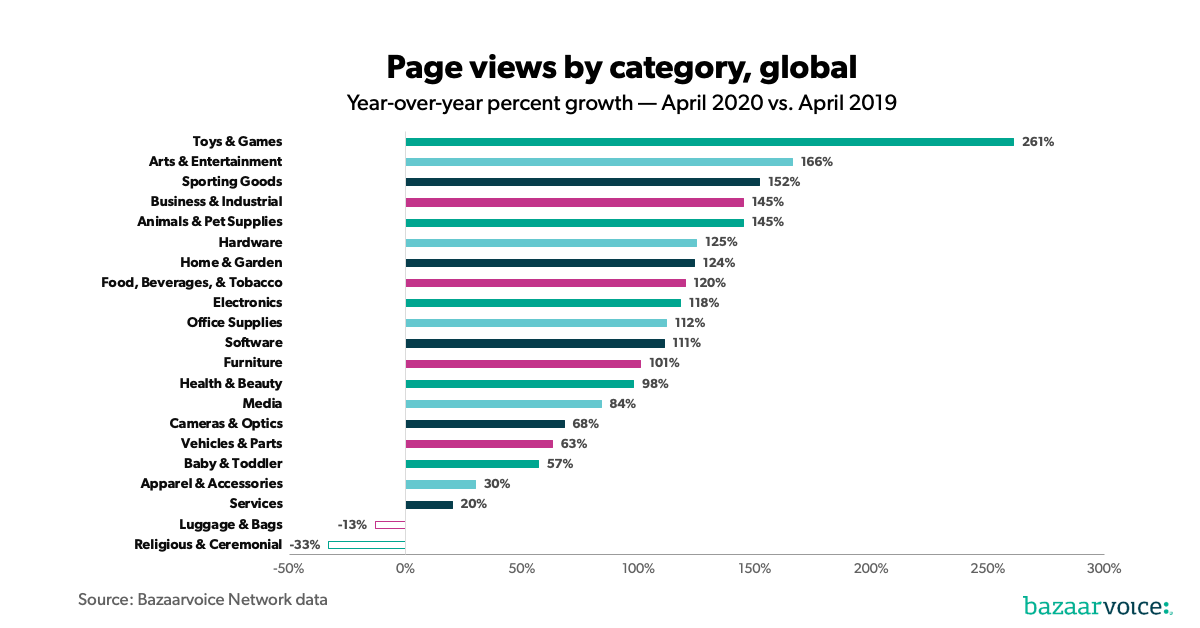

When we first looked at data towards the end of March, the top categories for page view growth were Business and Industrial, followed by Toys and Games, Food, Beverage, and Tobacco, Office Supplies, and Health and Beauty. Finishing the month of April, the top categories for page views were Toys and Games, Arts and Entertainment, Sporting Goods, Animals and Pet Supplies, and Business and Industrial.

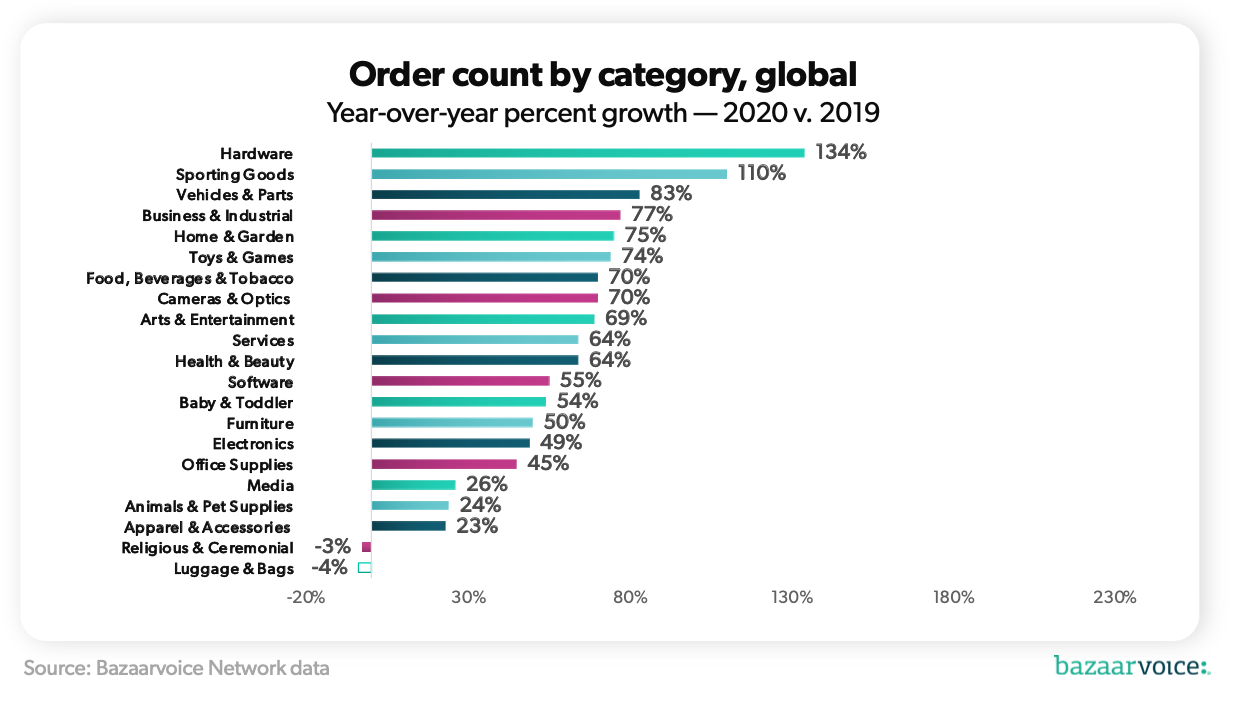

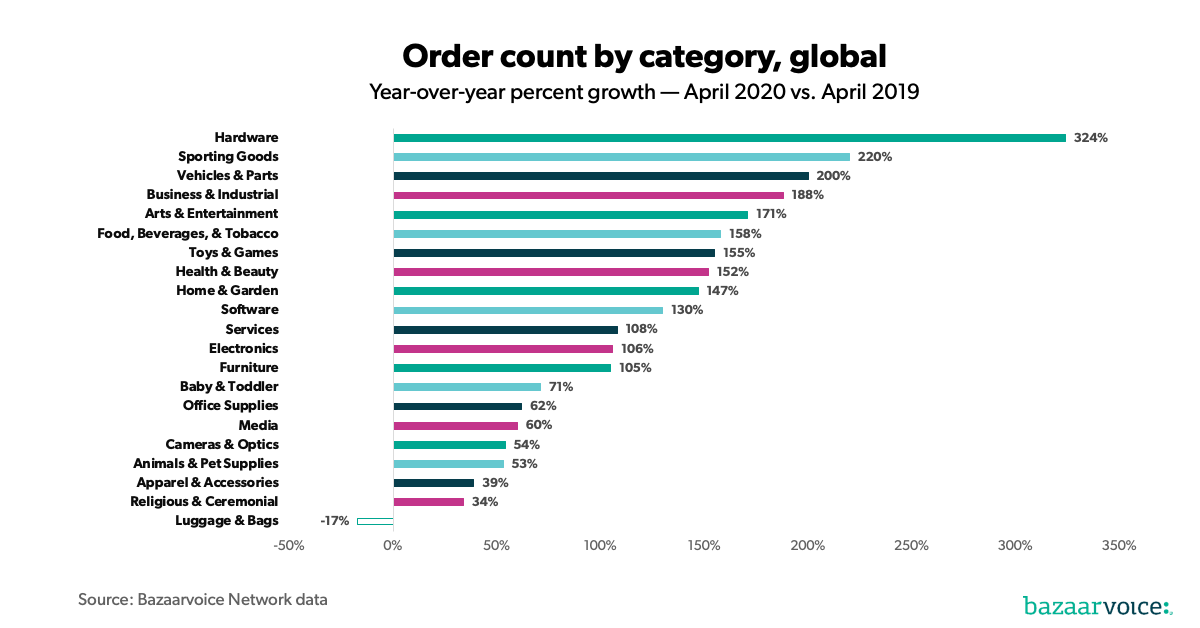

Looking at order count growth, March saw Food, Beverages, and Tobacco growing the most year-over-year, followed by Sporting Goods, Business and Industrial, Software, and Health and Beauty. For April, the top five categories were Hardware, Sporting Goods, Vehicles and Parts, Business and Industrial, and Arts and Entertainment.

Shoppers have adjusted to the new normal and are finding ways to keep occupied and productive during an uncertain time period. They took this month to build their home gyms, find new forms of entertainment, take extra care of their pets, and start DIY projects at home, including car repairs.

Overall for April:

- Page views are up 88%.

- Order count is up 96%.

- Submission of reviews is up 37%.

- Submission of questions is up 57%.

- 15 of the 21 categories we track are seeing growth across all four key indicators, and 19 out of 21 categories we track are seeing growth in both page views and orders

Trending upwards in April:

- Toys and Games had the largest increase in page views (261%), as well as a 155% increase in order count.

- Arts and Entertainment saw a 166% increase in page views and 171% increase in order count. Reviews (103%) and question submission (31%) are also up.

- Sporting Goods is seeing positive increases across page views (152%), order count (220%), review submission (22%), and question submission (49%).

- Animal and Pet Supplies experienced a 145% lift in page views and 53% increase in order count.

- Business and Industrial (includes work safety gear and medical products) is still in the top five for page views (145%) – and has been since we began tracking in March – and also saw a 188% increase in order count.

- Hardware had the largest increase in order count (324%) and had positive increases across page views (125%), review submission (17%), and question submission (41%) as well.

- Software had the second highest question submission growth at 221%. Page views and order count are both still trending upwards at 111% and 130%, respectively.

- Services (includes education, financial services, real estate, and travel) is still in the top categories for increase in order count, with a 108% increase.

- Health and Beauty is still in the top ten for order count (152%).

- Apparel and Accessories is seeing positive growth in order count for the second week in a row. Page views and order counts are both up at 30% and 39%, compared to 4% and -4%, respectively, at the end of March.

- Food, Beverage, and Tobacco had the highest increase in review submission (230%). Order count (158%) and page views (120%) are still increasing YOY.

- While page views aren’t faring well for Religious and Ceremonial, they saw a 600% increase in question submission year-over-year, which is the highest increase in question submission for the month. Order count was also up 34%

Trending downwards in April:

- Luggage and Bags is still the only category to see both a decrease in page views and order count.

- Luggage and Bags had a 13% decrease in page views and a 17% decrease in order count. While still decreasing, April is faring better than March.

A look back at March

Online shopping is on the rise, with browsing outpacing buying

Throughout the month of March, data from our network shows that customers started to prepare for the long haul of being home. Year-over-year, we saw page views and order counts increase 25% and 21%, respectively. Looking at order numbers for 2020 in itself, March orders are up from February. While order count in 2020 saw a 2% YOY increase in January and a 6% increase in February, it jumped to a 21% increase in March, when social distancing and shelter-in-place advisories started to become widely adopted.

In addition, the top ten days with the most orders on our network in 2020 happened in March. Order count began to surge on March 11th, the same day the World Health Organization declared COVID-19 a global pandemic and the US-Europe travel ban was announced.

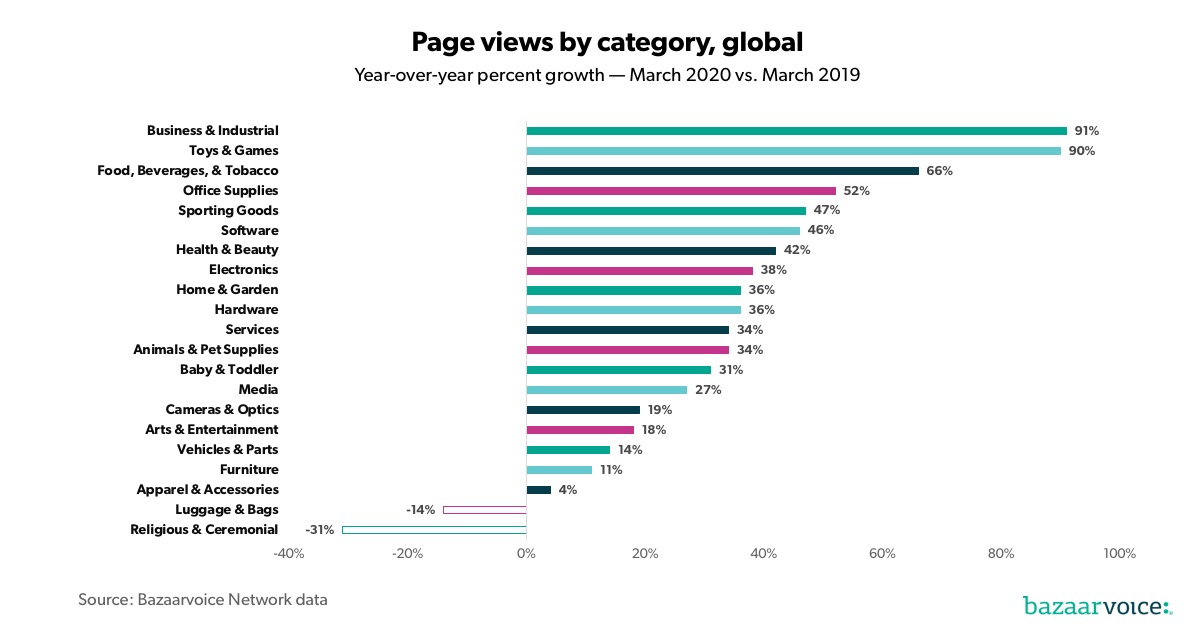

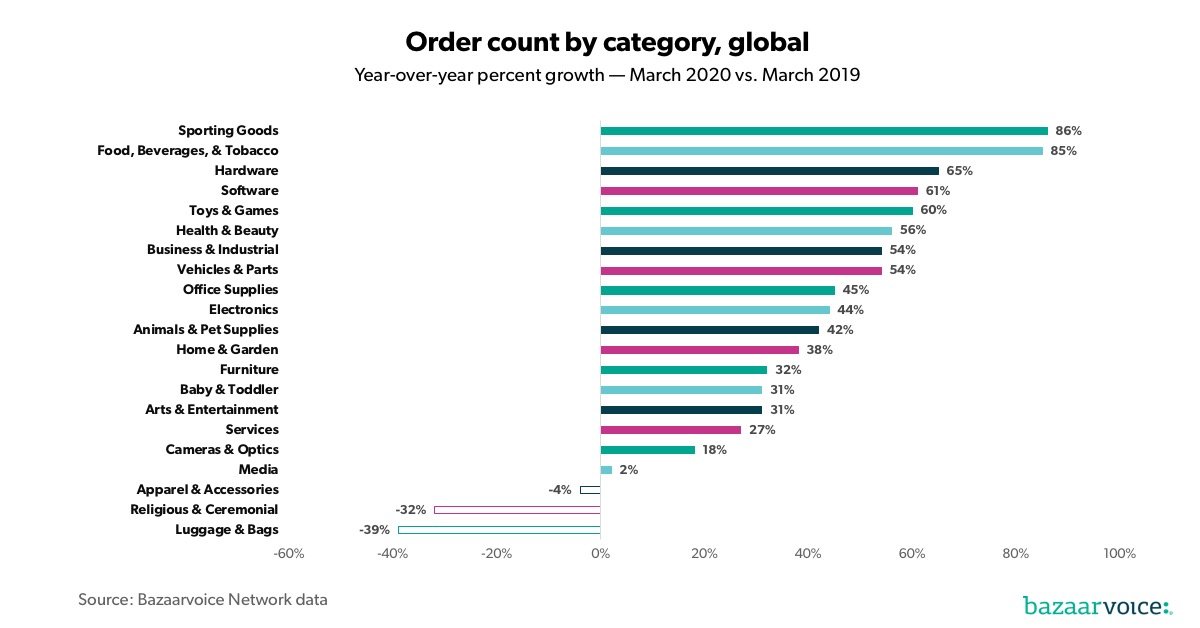

Essentials and entertainment are priority purchases

We saw year-over-year page view and order count increases across almost every product category. Food, Beverages, and Tobacco, Toys and Games, and Sporting Goods were the three categories that were in the top five for growth in both page views and order count. As consumers evaluated what they needed to live comfortably and entertain themselves and their children for the duration of stay-at-home orders, it’s not surprising these are the categories they’ve been drawn to. The growth in the Food, Beverages, and Tobacco category was especially noteworthy as more shoppers have turned to online grocery shopping, some for the first time. Similarly, categories like Business and Industrial (includes work safety gear and medical products), Office Supplies, and Software also saw high growth in March.

While consumer browsing activity is on par with last year for Apparel and Accessories products, buying behavior is down. Understandably, browsing and buying behavior for Luggage and Bags products are down as consumers are not leaving the house or traveling.

Read on for specific data points by category:

Overall

March closed out with a 25% increase YOY for page views and a 21% YOY increase for order count.

Trending upwards in March

- The Food, Beverages, and Tobacco, Toys and Games, and Sporting Goods categories were the only three categories that were in the top five for both page views and order count in March.

- Food, Beverages, and Tobacco saw a 66% increase in page views, an 85% increase in order count, and an 87% increase in review submissions.

- Toys and Games saw a 90% increase in page views and a 60% increase in order count.

- Sporting Goods saw a 47% increase in page views and an 86% increase in order count.

- The Business and Industrial category (includes work safety gear and medical products) had the highest growth in page views in March (91%).

- Software was in the top five categories for order count (61% increase) and had the highest growth of any category in the number of customer questions submitted last month (102% increase).

- Office Supplies saw a 90% increase YOY in review count and 13% increase in questions.

- Services (includes education, financial services, real estate, and travel) saw a 31% increase in review count during March.

- Electronics saw a 14% increase in questions.

Trending downwards in March

- Religious and Ceremonial and Luggage and Bags were the only two categories to see both a decrease in page views and order count.

- Religious and Ceremonial finished March with a 31% decrease in page views and a 32% decrease in order count.

- Luggage and Bags had a 14% decrease in page views and a 39% decrease in order count.

- Apparel and Accessories, while page views were up for March at 4%, the order count decreased by 4%.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

During this time, we want to be a resource for you. In addition to the shopping activity data from our network, we will be regularly providing information and resources to help brands and retailers be successful, in spite of the unique challenges today’s environment presents. View all of our COVID-19 resources here.