December 2, 2021

Sucharita Kodali is the VP Principal Analyst for Forrester, and a well renowned e-commerce expert within the retail industry. Not to mention, the guest keynote speaker for the Bazaarvoice Retailer Summit 2021. As part of the event, we conducted a quick Q & A with Sucharita, for her perspective and insights around some of the most pressing questions that retailers face today. Here’s what she said.

If I see the comparison between the Old World and the New World, retailers are not growing as much as brands and marketplaces. So what is your advice for retailers to stay ahead?

One of the things that we’ve definitely seen over the last decade is just the growth of e-commerce and the erosion of traditional retail. We know that in the United States we have too many stores, and even in other parts of the world like Europe, there’s likely to be a shakeout in retail and physical retail as well.

And what that means for the remaining retailers, is there’s a couple of different things that they need to think about. One is, are there other services and other revenue opportunities that they can potentially pivot into? Are there other kinds of businesses? Certainly something we’ve seen with electronics is adding repair services to their businesses, in order to supplement erosion from the sale of physical goods.

The other piece is the incorporation of retailer media and monetizing the foot traffic that they get, and basically becoming advertising for other brands. That seems probably the most natural outgrowth of these changes, which is that people are still coming in order to discover products.

Very few brands have straight up recognised that as an advertising opportunity. And this is different to simply MDF funds or trade funds. This is really just straight up advertising. And it can be more than just brand advertising. It can also be non-endemic brand advertising from local merchants or brands, or other non physical goods.

Retail media is a huge revenue stream for retailers with many expanding their capabilities here very aggressively. Is there an anticipation of customer backlash and an impact to their experience with the retailer due to a saturation of on site ads? How can retailers balance this need for revenue successful media programmes with positive organic, relevant shopper experience for their shoppers?

Retailer media networks are one of the hottest topics in retail in the last year. These are basically new forms of advertising. We’ve seen some of the largest retailers in the world there, not just in North America, but Europe, Latin America, and Asia. They’ve all embraced this concept of retailer media networks. They’re also taking advantage of the fact that because of all of the privacy regulations around cookies, large technology companies will likely see some drop off. So some of these retailers will be able to pick up some of that.

So that’s all good and we absolutely see that happening. As far as what kind of a mess that could create for a retailer’s website? All I have to say is have you ever seen an Alibaba product detail page? That suggests that the human capability of being able to ingest lots of different stimuli is quite vast. I think that brands may have had a bias against what they perceive as something that’s so different and outside the realm of what is acceptable.

But what consumers have demonstrated over and over, is that they’ll have no problem with advertising. Go to any stadium, you look at any form of media, there’s so much advertising stimuli that’s around you. I really would find it difficult to believe that advertising on a retailer site is going to turn shoppers off. And if one does have a concern about that, that’s the value of AB testing — trying different approaches and different treatments from a creative standpoint to see if different approaches do in fact work or if they’re alienating.

Amazon really leapfrogged retail in the last decade with the promise of super fast delivery and easy returns. Many retailers are now offering that fast delivery option, but it hasn’t slowed down Amazon’s reign. What other strategies do you think retailers should be exploring to claw back their lost market share?

Well, certainly there’s the alternative revenue opportunities that we talked about. And that could be leaning into things like retail or media. But the main reason that companies have lost a lot of market share to companies like Amazon over the years, is due to the fact that they’re selling the same products as Amazon. But Amazon’s often winning on price. And it’s often taking a lot of the same merchandise and is able to be more competitive. Or its sellers are choosing to be more competitive, or there’s so much price discrepancy.

This is particularly an issue with global products that are distributed in different markets at different price points. You have something called retail arbitrage where people will straight up buy something from one seller in a lower cost market, and resell it in a higher cost market for a difference. The solution is to unify your global pricing so you don’t have those discrepancies. In the age of the internet, you cannot afford differences in pricing in that way. It’s not a strategy that works in 2021. Any company that chooses to have that differentiated pricing is probably not going to be around for long.

Those kinds of things are what we call e-control. It’s tightening up your distribution. We’ve seen lots of companies like Nike, Adidas, Birkenstock, limiting the number of distributors, unifying pricing, and differentiating packaging in different regions to make it more difficult to take something in one market and sell it in another. I’ve seen some sellers on Amazon will buy out other sellers. If they’ve identified that certain items are hot sellers, they’ll mark up the item, if they can sell it great. If they can’t sell it, they send it back to the original seller before the return window expires.

So there’s all kinds of stuff happening that just needs to be scrutinised. A lot of this comes down to tightening up your distribution and being very mindful of where your sales are coming from and shutting down anything that is suspect.

We’ve seen many new ideas and changes to how the traditional or old school retail stores are set up. What are some of the advancements or transitions, whether that be more openness, inclusion of QR codes, etc? Do you expect to be the new norm in retail locations?

So in terms of what do we expect to be different with physical stores, and how does the physical retail experience shift, is something where there’ll likely be several years of transition.

Right now, we have a tremendous amount of real estate. You can see it in companies like Sears where there isn’t a secondary use of that real estate. So you may end up with some of that real estate being used for things like e-commerce fulfilment or being appropriated by landlords for some other usage. Over time we’ve seen everything from charter schools to churches taking over some of the most distressed retail spaces that are out there. If it’s a retailer that’s not as challenged, and if the real estate is in an A-list location, what we’ll expect to see are likely just smaller stores. But more stores and more brands.

If I look at my local mall, in Charlotte, North Carolina, and we look at what are the stores that have opened recently, it’s companies like golden goose that have opened new stores, I mean, it’s a relatively hot new seller of footwear of streetwear. And they said it’s historically been more of a wholesale brand, but now they’re selling direct-to-consumer and having its own storefronts. Even in tier two markets like Charlotte now.

So I think the future is you’ll see new brands emerging, and some of those brands will take on real estate that they can afford. They won’t be taking on 10,000 square feet of real estate, but maybe a few 100 square feet. And in key select markets where there’s good foot traffic and a demographic that’s aligned with their brand.

We’re continuing to see retailers lean into private label, how are retailers driving awareness and loyalty to their private label brands, and how are consumers responding to the new to them private label brands?

Private label has been an area of investment for retailers for a long time now. And it’s certainly been the case with sectors like grocery, but even sectors like clothing. It makes a tonne of sense because it’s high margin. And especially if you have a high level item that people want, and they’re not necessarily there for a particular brand. They’re just there for a certain type of chip, or dress, private label can be really, really attractive.

We expect that private label will be even more important to these multi-category, multi-brand retailers in the future. This is a trend that we’ve been seeing with grocery in the past, but we expect it with all mass merchants in the future. In large because big brands will increasingly sell more direct-to-consumer and future consumers will know those brands.

So what the traditional retailers have to do is take the best parts of known brands, and then they’ll likely fill in the rest of their assortment with their own private label goods. I also expect that in order to win with private label, you’ll start to see better innovation with private label too. One of the things about Costco that is pretty famous is that they make a lot of money from private label in particular. Brands like Kirkland. And one of its requirements is those products have to be just a little bit better. Like a little bit more of a particular ingredient or the packaging needs to be a little bit more premium. And that’s one of the benefits — introducing quality into something like private label without necessarily incurring an enormous cost.

We’ve seen an expansion of retailer marketplaces. At one point does there become a dilution between great quantities of marketplaces that often carry the same brands or third party brands? And what lessons have we witnessed in effectively executing marketplace strategies?

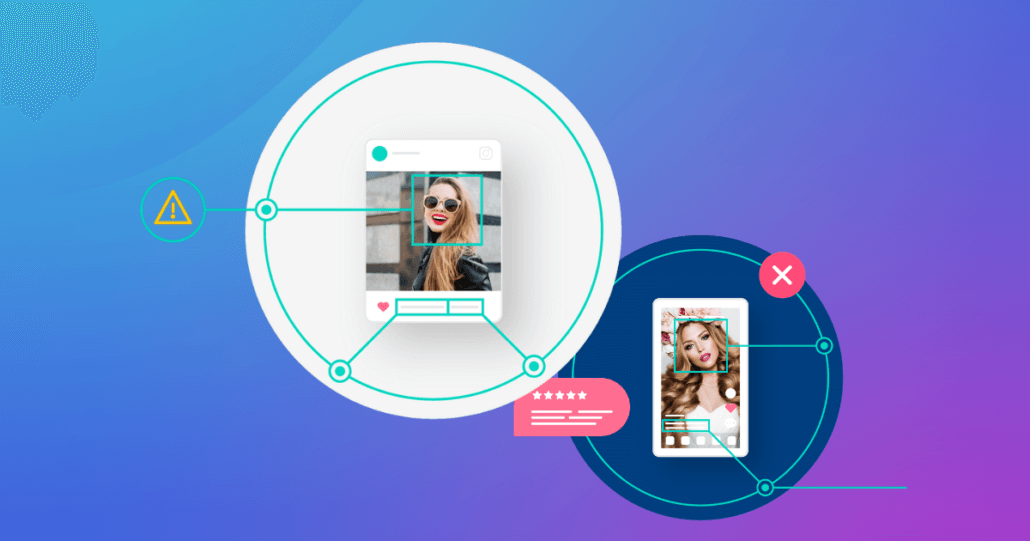

There’s probably a lot of cautionary tales that we’ve learned from marketplaces over the years. They’ve essentially been a wild west of product distribution. And the things that we think are most important to think about with the marketplace, particularly large marketplaces, is that they can serve a purpose. And they can serve a really, really important value, particularly for customer acquisition, and for awareness of a product.

In some cases, they can even serve the function of liquidation if you have too much of a particular item. So what I encourage everybody to do is to take stock of your portfolio. And if you want to engage with marketplaces, really understand where in the product life cycle a particular item is. Are you really early and you’re trying to get awareness? Because if so, maybe you can take the approach of Tufton Needle, when it started to sell on Amazon early in its days, and they used Amazon, primarily to get more ratings and reviews. If you’re a mature brand, and you have a lot of excess inventory, particularly of certain items, maybe you want to use those marketplaces to try to unload some of that excess inventory. Particularly if it’s perishable goods, and there’s less of a risk of that merchandise showing up in a secondary marketplace later on.

But if you’re at the peak of your business, and you’re already getting a significant amount of organic traffic, maybe it doesn’t make as much sense to showcase your products on marketplaces if you’re in a position to showcase your products directly on your own site. Maybe it makes sense to spend your marketing budget to drive people to your own site. And maybe it makes sense to manage some of the fulfilment in partnership with other partners. Secondary partners who are further down the list of accounts that can actually fulfil your goods so that you have a little bit of “having your cake and eating it too.”

I think that in the past, brands have been reluctant to invest in their own e-commerce sites because they’ve been hesitant to invest in fulfilment. But now with omni-channel approaches, with so much visibility around what products are in a given store, and that so many stores now have the ability to pick, pack and ship from stores that brands will be able to drive traffic to those products, they’ll be able to generate sales on those products. And that ends up being a win for local retailers and it ends up being a win win for the brand as well.