May 16, 2025

As economic considerations shape spending habits, UK consumer behavior reflects a strategic shift. The modern UK shopper is increasingly becoming value-driven by turning to private-label products, dabbling in quality omnichannel experiences, and actively engaging with brands on social media in pursuit of better offers and exclusive discounts.

According to Bazaarvoice Shopper Preference Report 2025, affordability, reliance on authentic experiences, and a cautious yet growing interest in social commerce are key forces shaping UK consumer behavior.

Let’s explore the preferences of shoppers and how brands and retailers can adapt to these evolving expectations.

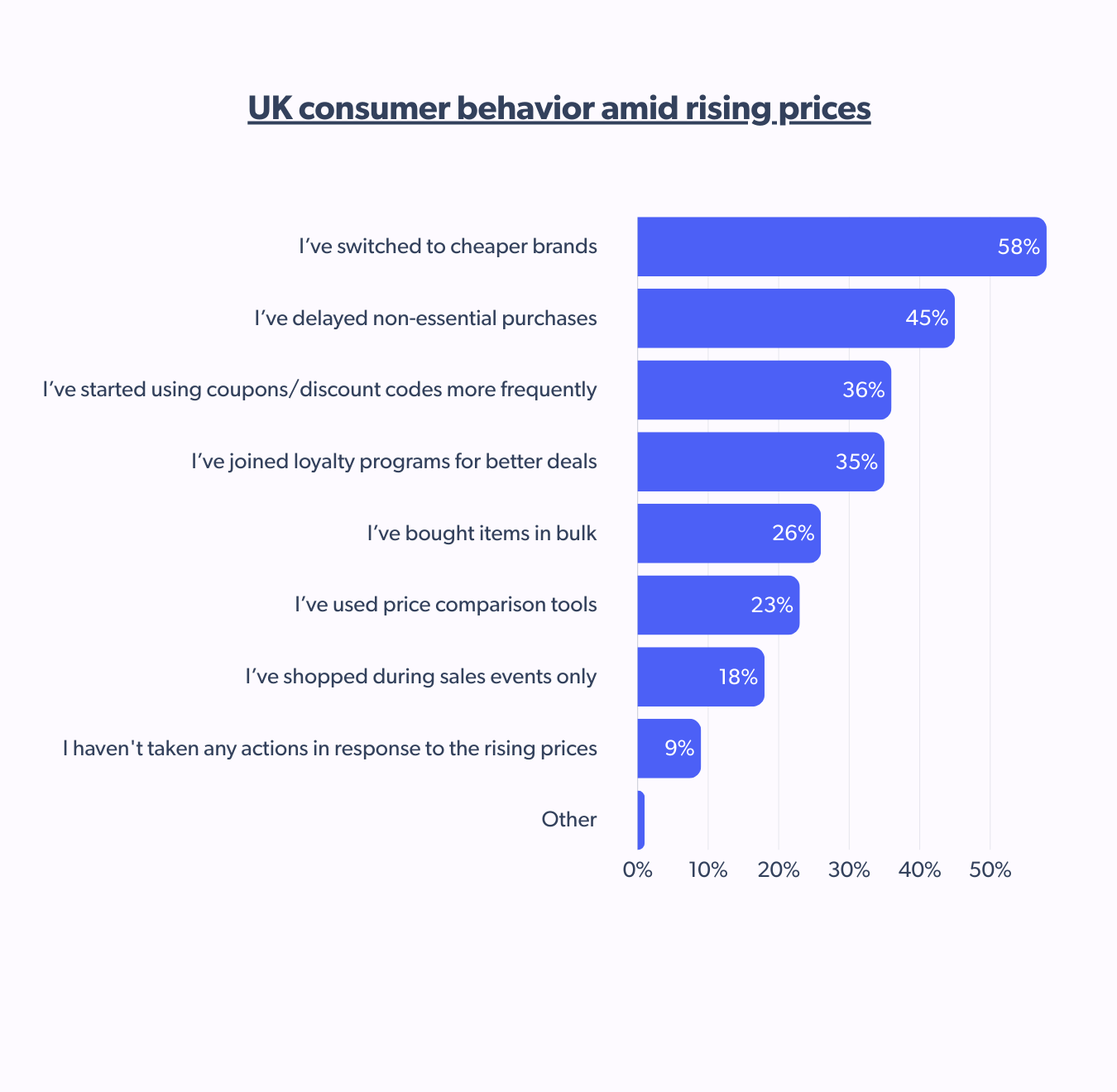

Affordability as the decisive force among UK shoppers

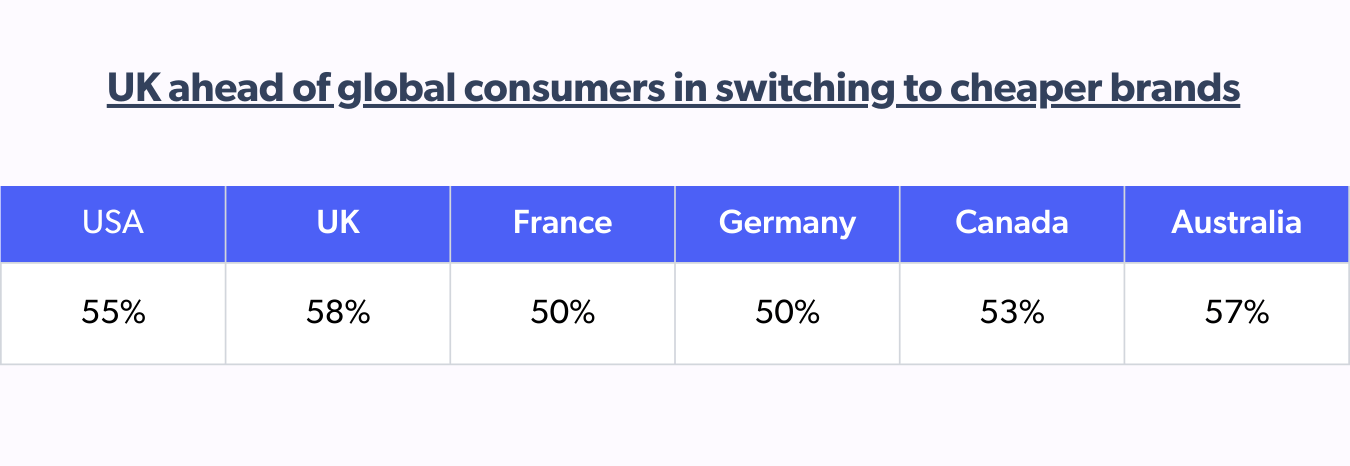

Affordability is front and center in UK consumer behavior. As prices rise, shoppers are prioritizing value more than ever. UK leads globally, with 58% of UK shoppers switching to cheaper brands and 45% delaying non-essential purchases in response to rising prices.

Rise of easy-on-the-pocket store brands

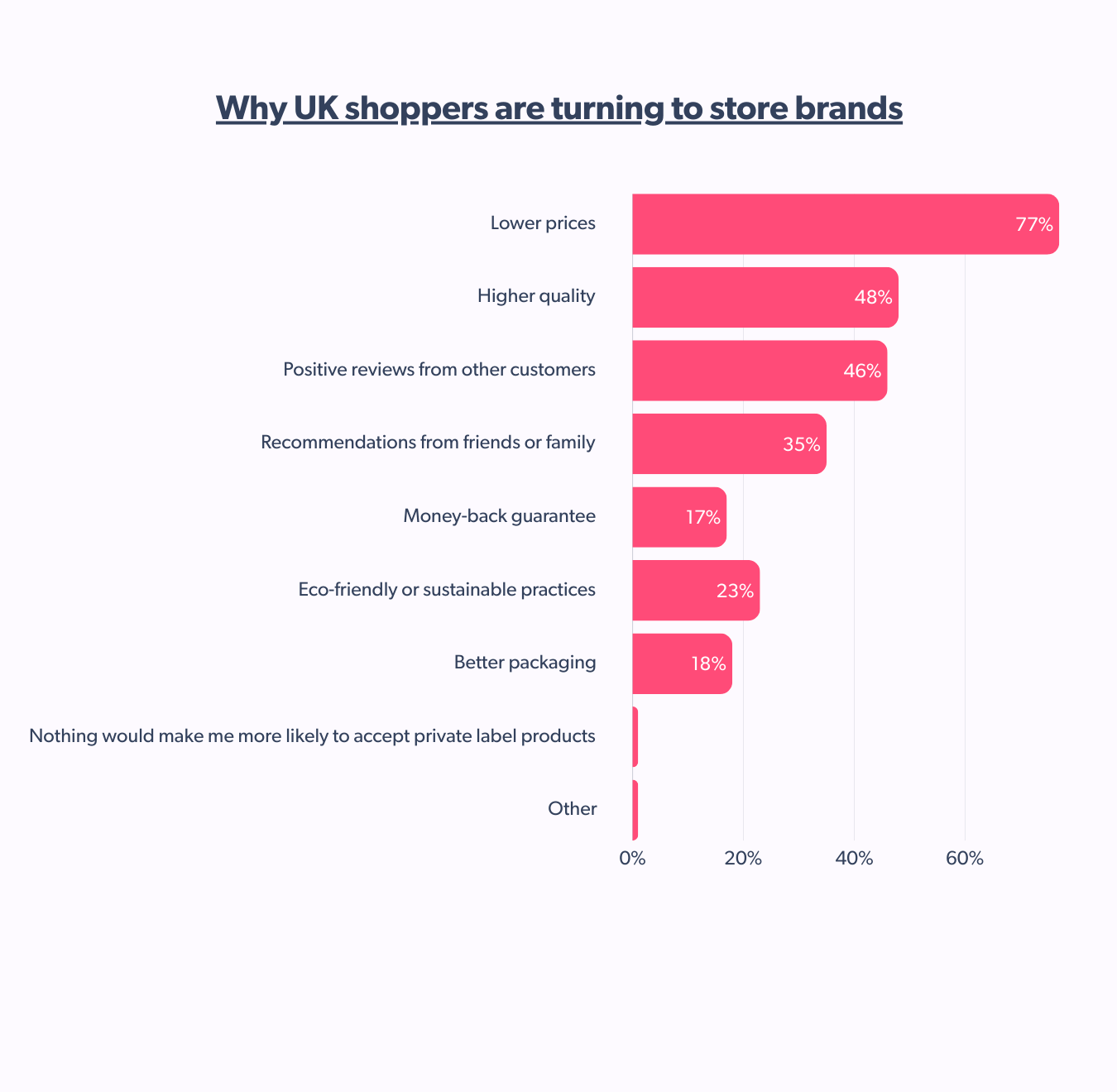

A quest to prioritize affordability among UK shoppers has translated into an uptick in the popularity of affordable store brands. Consumers prefer affordable private-label products, with 77% attributing lower prices as their motivation.

This trend mirrors the growing dominance of supermarkets like Tesco and Aldi, whose well-crafted own-brand ranges offer affordability without compromising quality. Players that leverage private-label strategies through pricing strategy and by understanding what influences consumer trust can win the loyalty of UK consumers in a big way in 2025.

Building trust with the cautious UK shopper

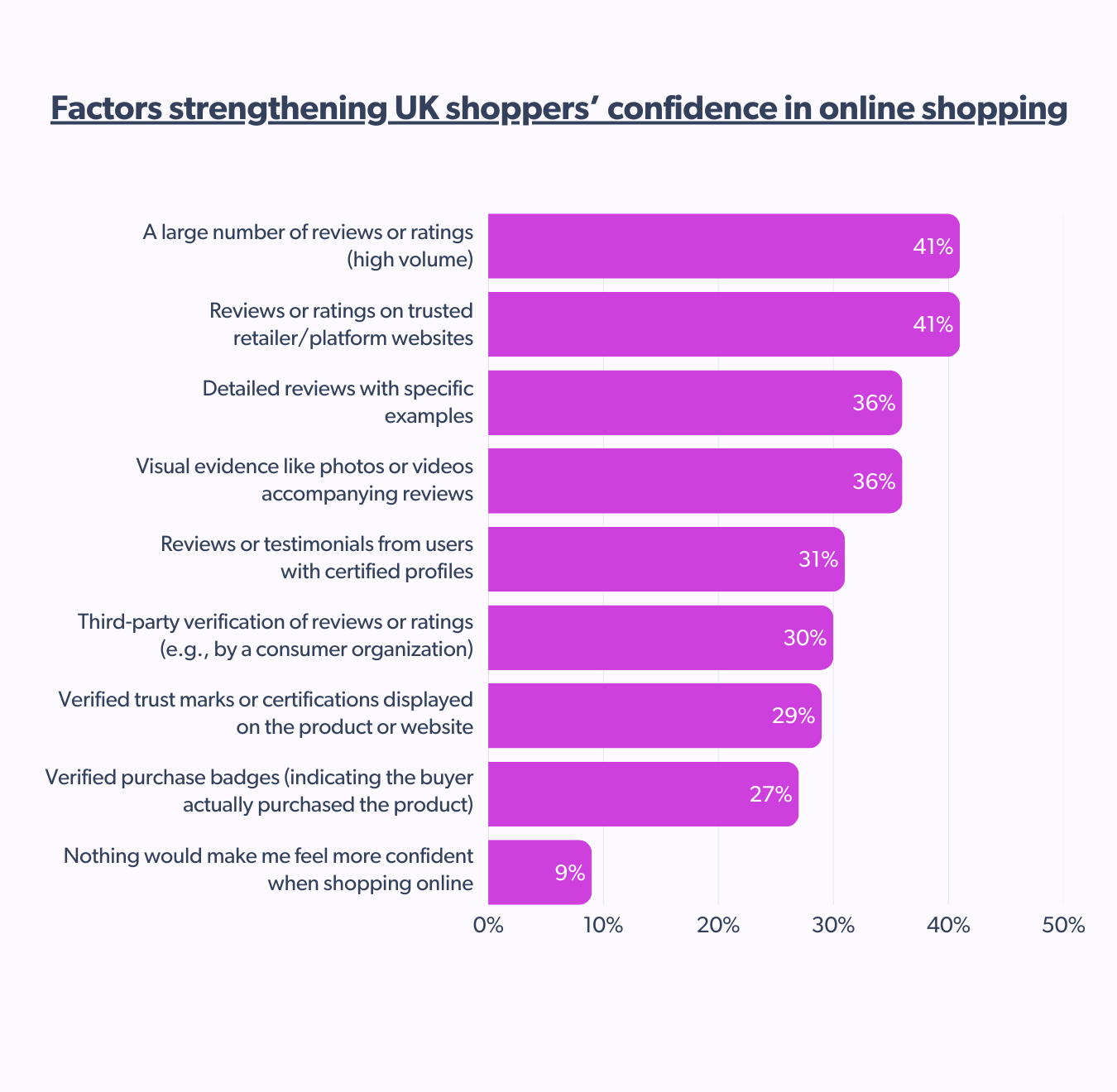

Building trust with UK shoppers requires a strategic mix of authentic storytelling and content formats that resonate with their preferences. With 41% of UK shoppers relying on ratings and reviews from trusted retailer platforms, confidence in online shopping hinges on transparency and authenticity.

To deepen trust, brands must also embrace short-form videos with customer testimonials. Nearly half of UK shoppers vouch for these formats, which create an engaging, authentic narrative. Written reviews with photos and before-after results also sway UK shoppers’ purchase decisions.

These could collectively strengthen shoppers’ trust, especially because 48% of them continue to research products even after encountering negative content until they are confident about their purchase.

Nearly one-third of UK consumers are influenced by content creators

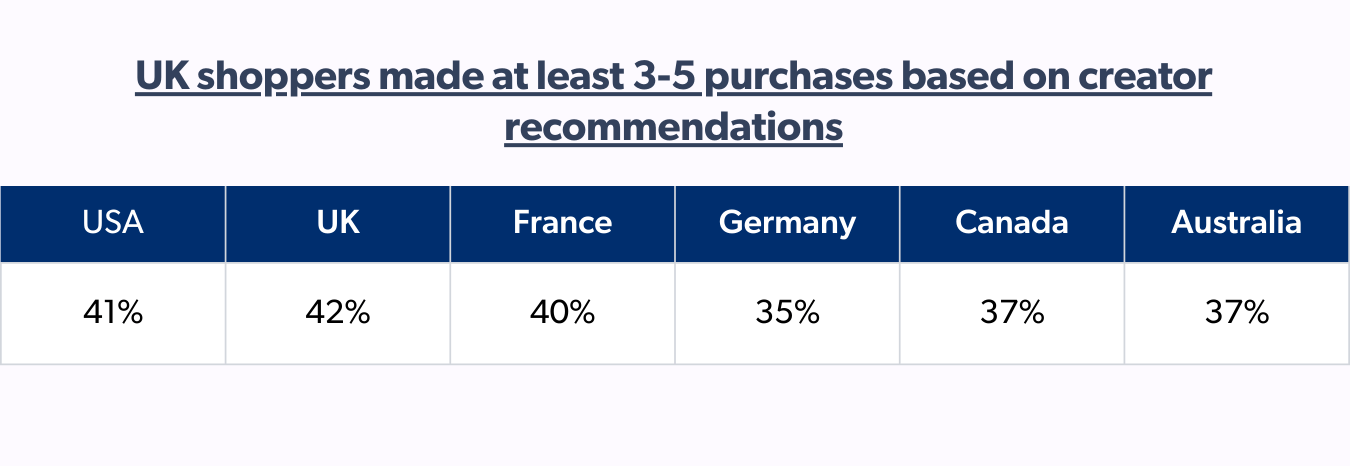

Engagement with creator content is shaping consumer behavior in the UK. According to the report, 30% of UK shoppers have purchased a product based on a creator’s recommendation.

In the past six months alone, 45% made one to two purchases influenced by creators, while 42% made between three and five. Health and beauty emerged as the leading category, where shoppers were most likely to follow through on creator-driven inspiration.

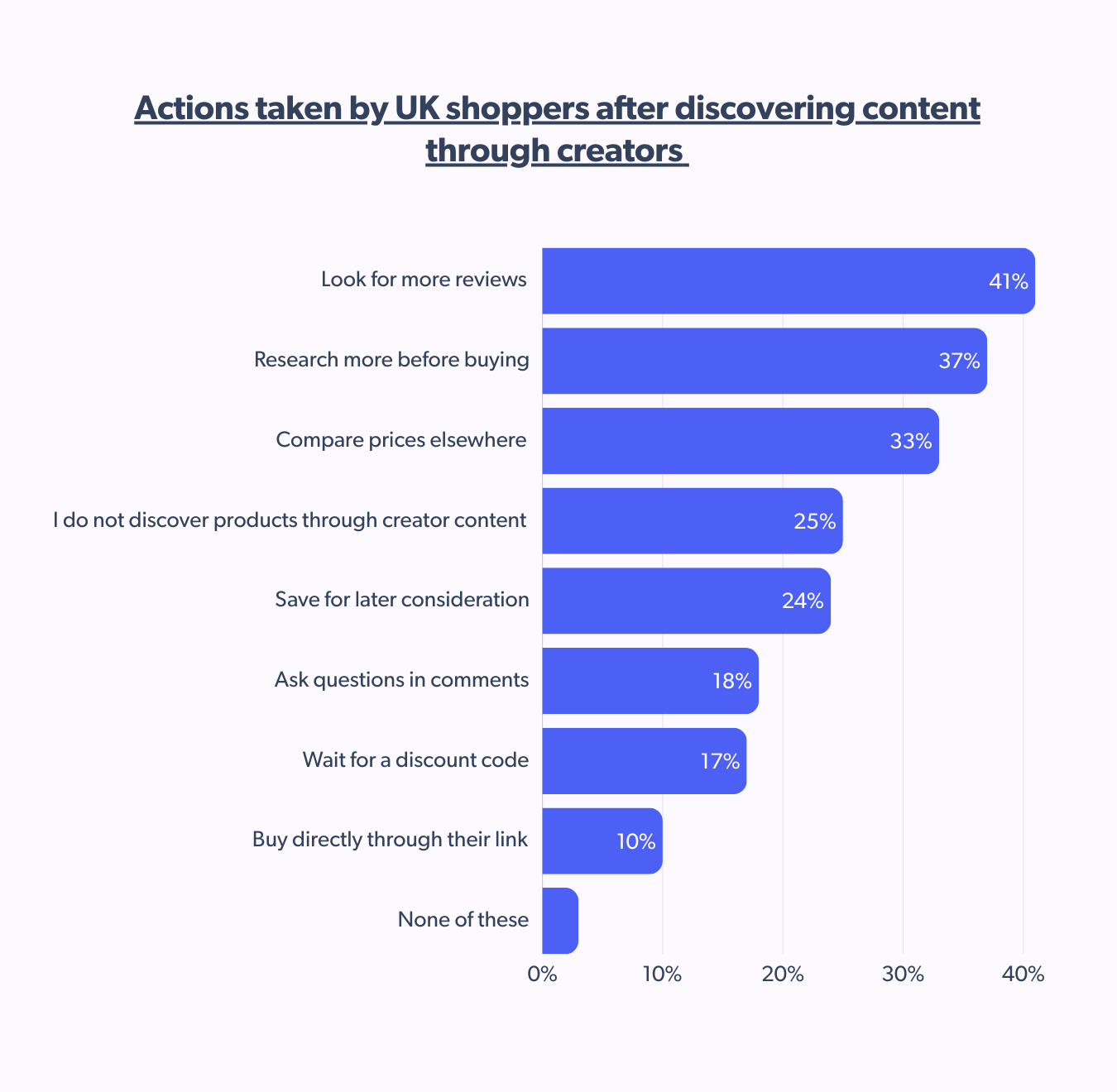

However, UK consumers don’t just buy the product based on creator recommendations in one go. At least 41% look for more reviews, 37% research more before buying, and 33% compare prices elsewhere. This aligns with the overall behavior of shoppers who keep on researching until they feel confident.

In line with global trends, UK consumers prioritize transparency when shopping based on creator recommendations. Clear disclosure of brand partnerships is essential, but trust goes deeper.

For 39% of UK shoppers, a creator’s long-term relationship with a brand significantly boosts credibility, while 38% value professional credentials. These trust signals point at the importance of authenticity and expertise in creator-led content.

Driven by affordability and led by TikTok, shopping on social media climbs

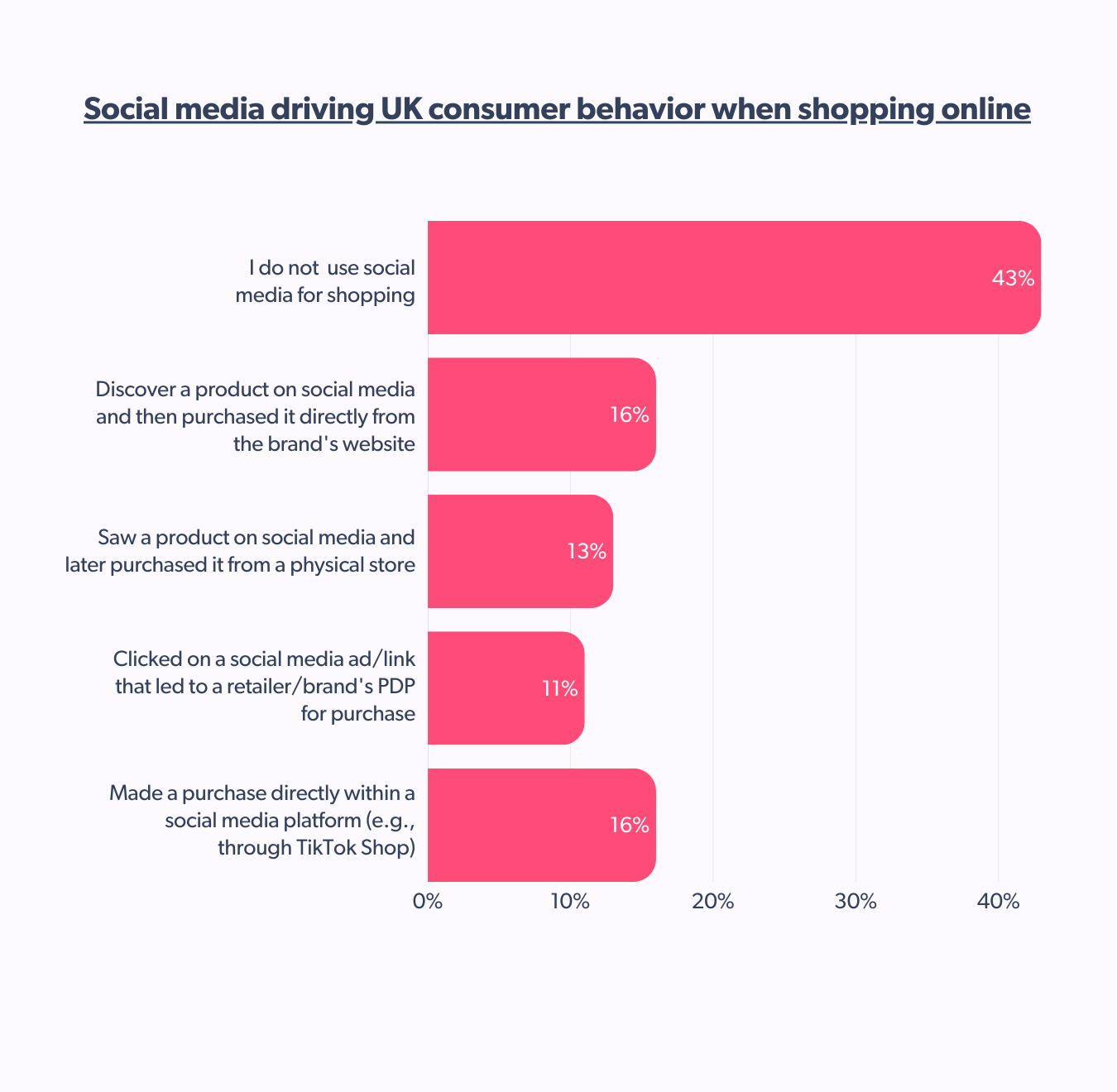

For at least 56% of UK shoppers, social media has a key role in the shopping journey. It leads to a multi-path purchase journey, where UK consumer behavior shows signs of easing into shoppable social.

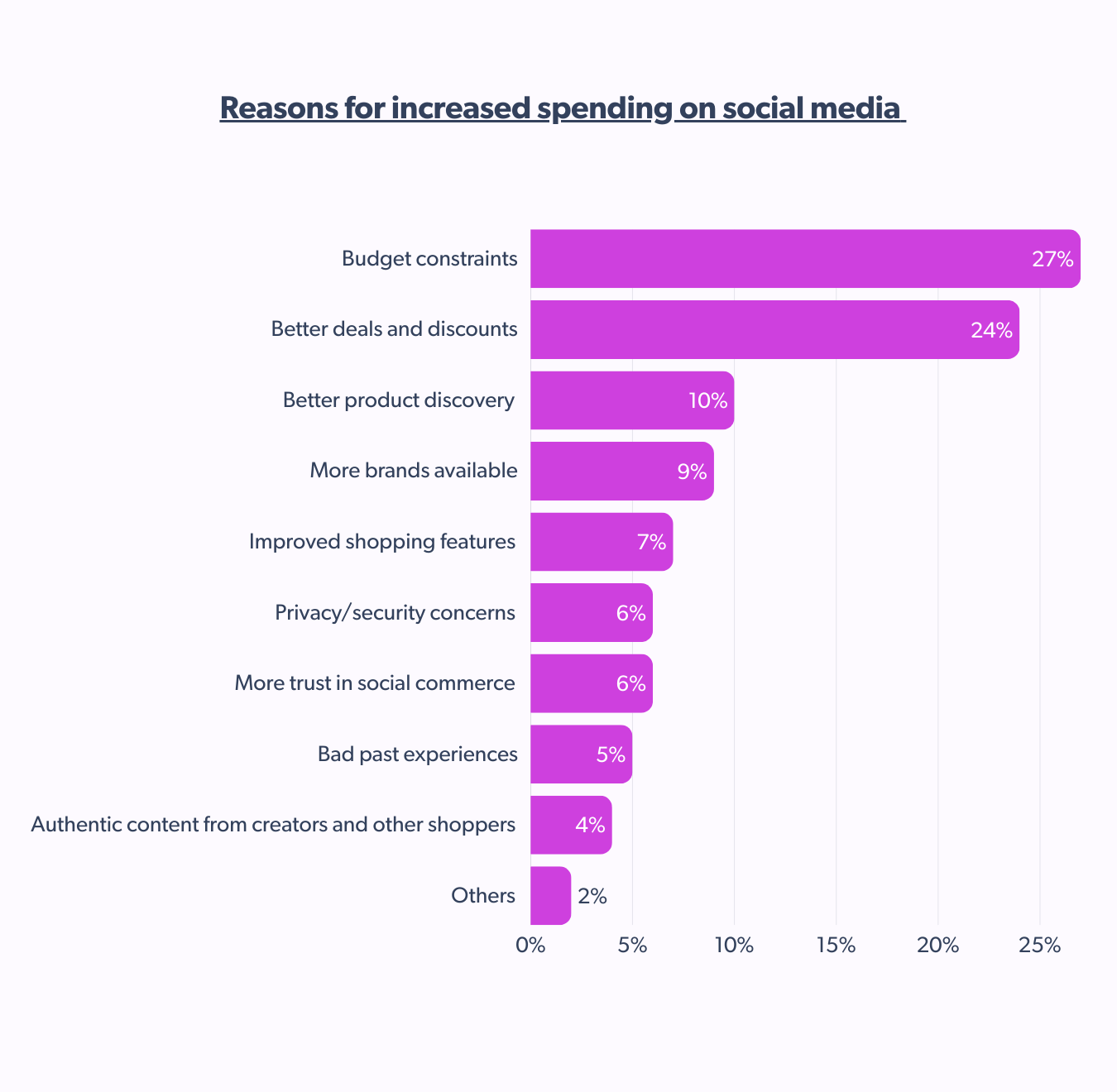

Like in most other facets, affordability even plays a role in deepening the UK consumer’s relationship with social media shopping.

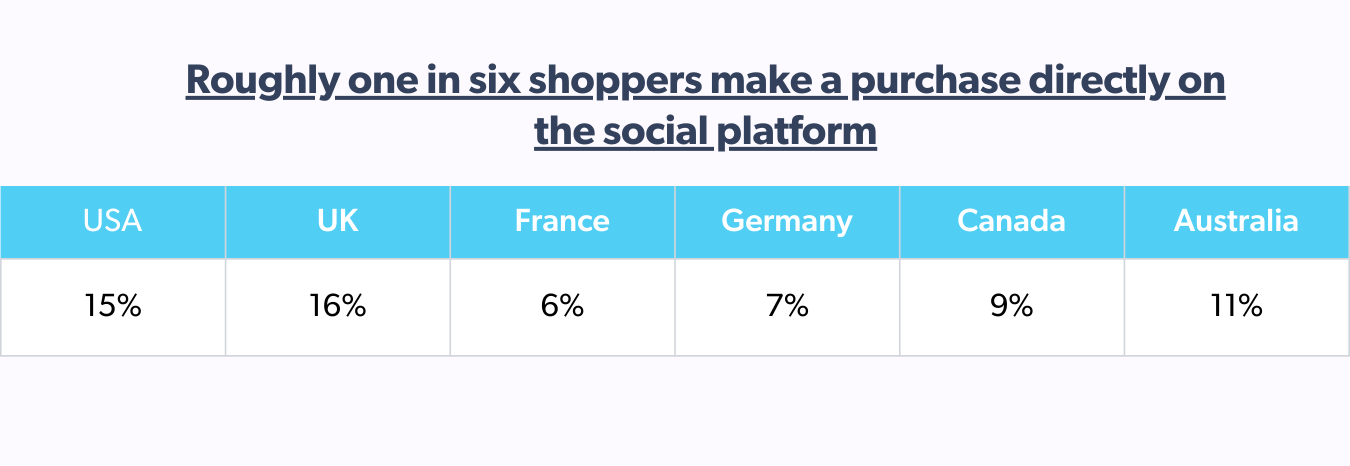

For 24% of UK consumers, shopping on social media has increased by 20% or more over the past year due to budget constraints, better deals, and discounts, among other factors. Health and beauty are the categories where the maximum purchases are made through social media.

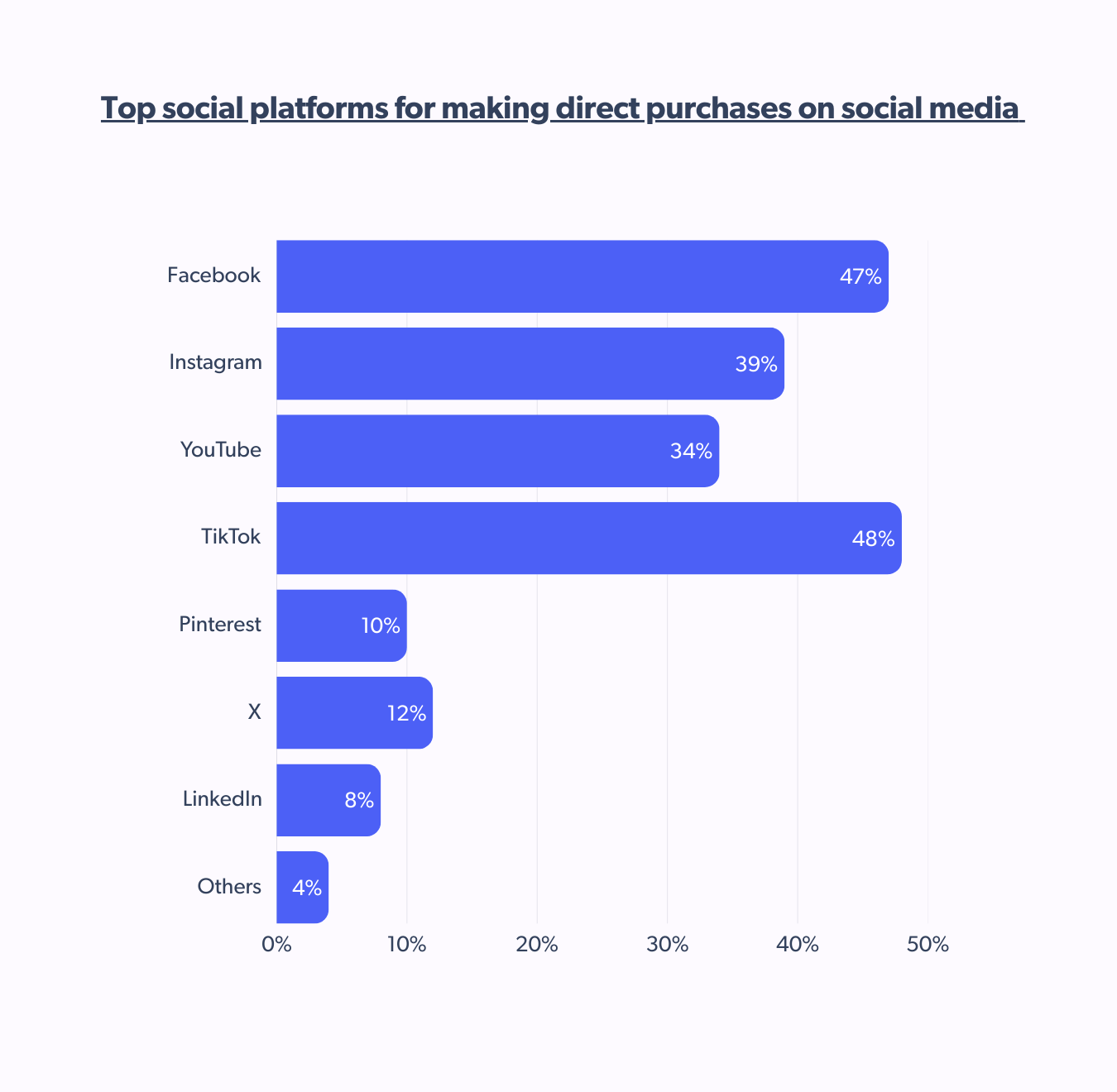

TikTok, followed closely by Facebook, is driving this influence, motivating direct purchases among UK shoppers and averaging well above global standards.

Eco-conscious spending as a growing priority

Sustainability is no longer a niche concern. It’s influencing mainstream purchase decisions, with 23% of UK shoppers preferring eco-friendly store brands. This aligns with broader UK consumer trends, where nearly 66% of Brits actively seek out environmentally friendly products (Statista, 2024).

Retailers and brands that fail to meet sustainability expectations risk alienating a growing segment of shoppers. Transparency around sourcing, eco-friendly packaging, and ethical production processes are no longer optional, they’re key consumer expectations for your brand.

Closing the digital-and-physical gap with experiential

Despite the digital boom, while in-store shopping hasn’t disappeared from UK consumer behavior, there is an expectation from physical stores to offer customers more than the traditional experience.

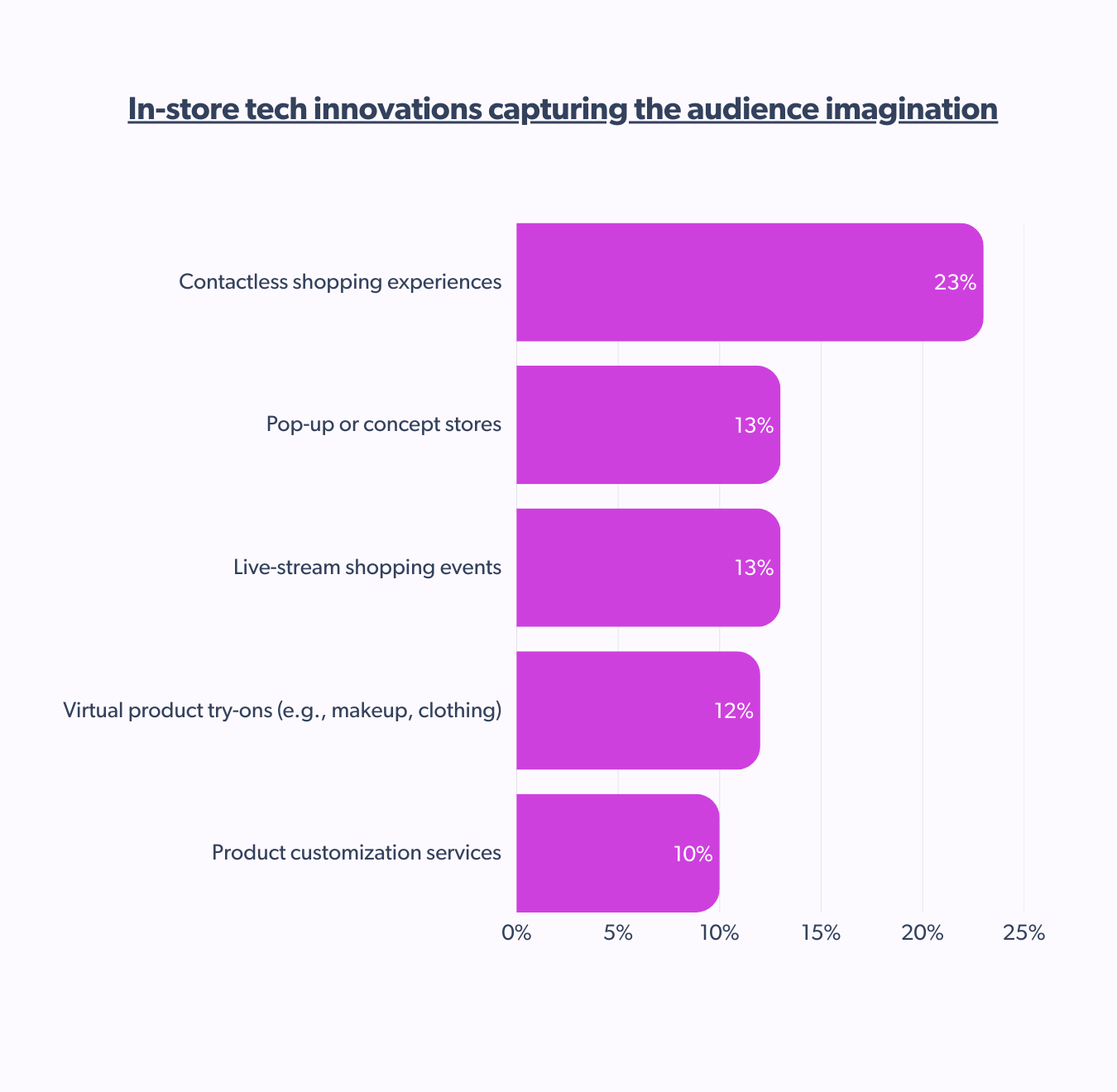

Digital innovations are enhancing the shopping experience in ways that blend both worlds, and 22% of UK shoppers are here for it and curious about aspects of AR and VR. Smart fitting rooms, for example, is an in-store technology that 26% of UK shoppers are excited about.

Additionally, with 23% of UK shoppers already having participated in contactless shopping experiences in the past year, it’s only a matter of time until other niche tech trends like virtual try-ons and live-stream shopping events garner interest and gain momentum.

For the UK, futuristic tech-driven shopping remains a curiosity rather than a necessity for most. But brands should keep an eye on evolving digital habits, especially as younger consumers continue to come up as the dominant spending force.

Key takeaways for brands and retailers

- Price matters more than ever: UK shoppers are trading big-name brands for private labels. Competitive pricing combined with quality is key to staying relevant.

- Trust is the ultimate currency: Consumers scrutinize reviews and prefer word-of-mouth recommendations strengthened with visual aids

- Social commerce is growing, but cautiously: Facebook remains dominant, but TikTok is shaping the habits of younger generations.

- Sustainability sells: More UK shoppers are actively choosing eco-friendly brands, making green credentials a competitive advantage.

- Authenticity moves: Polished brand ads are losing impact, while balanced storytelling and unfiltered, informative content hold greater sway.

- In-store is evolving with experiential experience is evolving: While digital commerce continues to rise, brick-and-mortar stores will have to up their appeal with immersive, experiential shopping journeys to remain relevant within UK consumer behavior.

The UK region specific information in this blog has been sourced from our Shopper Preference Survey conducted in January 2025.

For global information and data on shopper preferences in 2025, download our full Shopper Preference Report and discover what has been shaping UK consumer behavior.