May 19, 2025

French consumers are rewriting the rules of modern shopping. While 75% prefer store brands, they’re not just embracing them for the price — they’re doing that without sacrificing quality.

According to the Bazaarvoice Shopper Preference Report 2025, French consumer behavior strikes a unique balance: they trust private labels, yet they’re also eager to explore, discovering new products through social media, creator content, and emerging and innovative shopping experiences.

Authenticity still reigns. Peer reviews carry weight. And for brands hoping to win hearts — and carts — quality, credibility, and that elusive je ne sais quoi are non-negotiables.

Store brands win shelf space but must earn trust

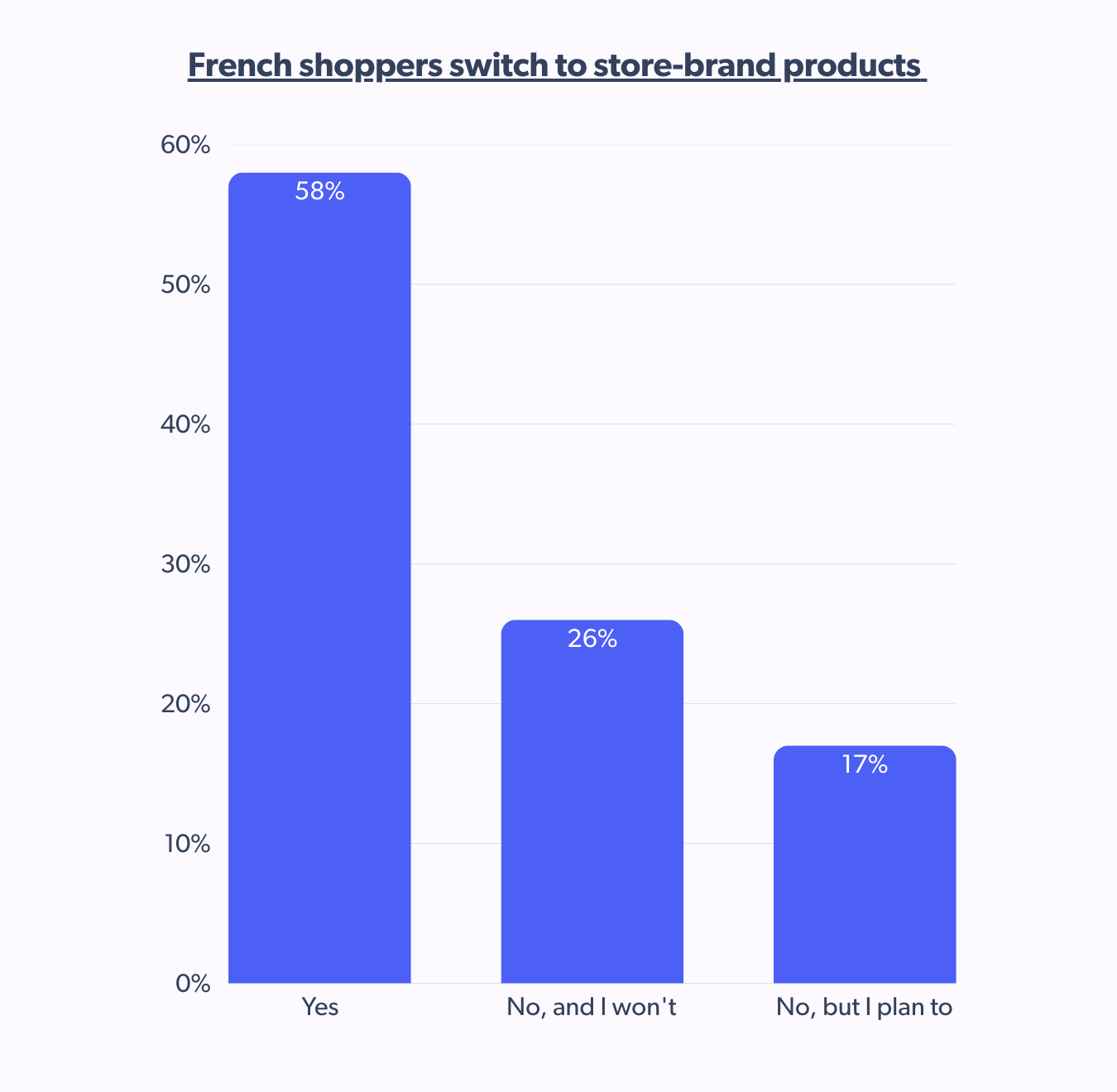

Inflation is driving French consumer behavior to cheaper options and creating smarter shoppers. At least 75% of French shoppers have either switched to store-brand products or plan to, which edges out most global markets.

This isn’t bargain-bin behavior.

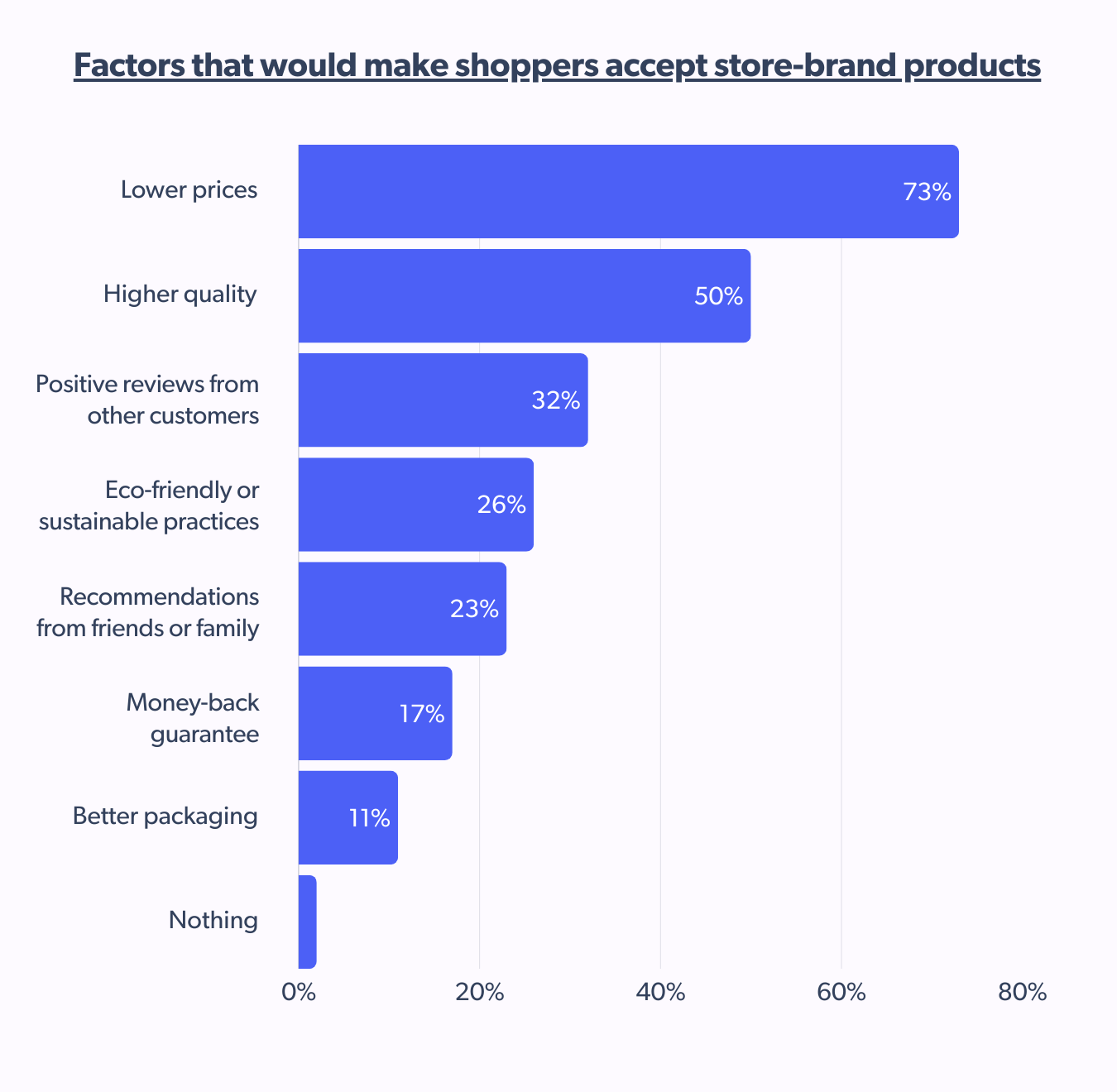

This shift is about strategic value. French shoppers want store brands to earn their place through quality, verified reviews, and justifiable pricing. Their approach combines frugality with discernment.

In France, 50% of shoppers say higher quality would make them choose private labels, slightly above the global average. While German consumers rank highest in prioritizing quality, France is not far behind, reinforcing the idea that premium store-brand products can win big in this market.

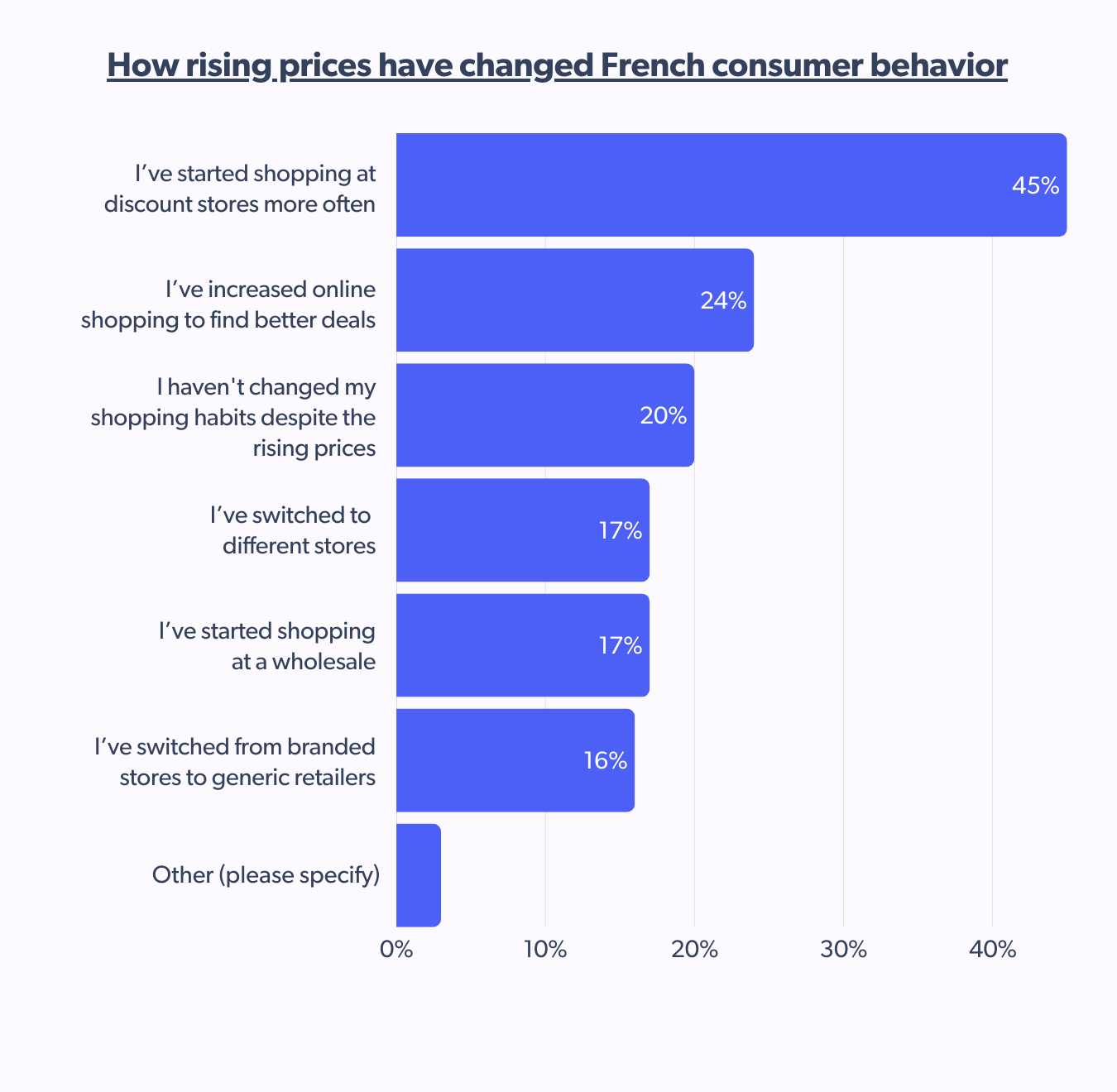

Economic uncertainty is not only reshaping what French consumers buy but also where they choose to spend.

Nearly half of shoppers now frequent discount stores, while many turn to online channels for better deals. Yet, one in five haven’t changed their habits, highlighting the resilience of French consumer behavior in certain segments.

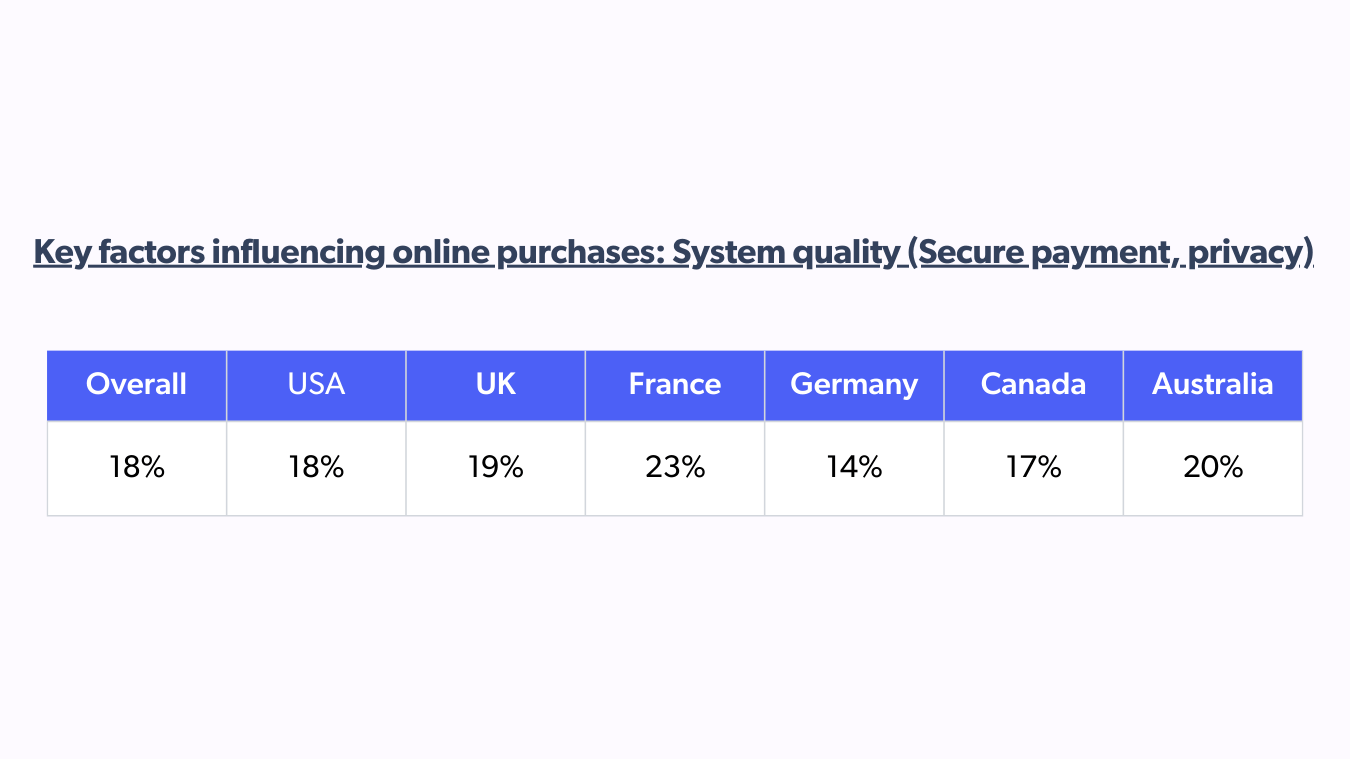

As more French consumers expand their online shopping behavior, price and platform integrity drive their confidence. Compared to other markets, French consumer behavior shows the highest value on secure payment systems and data privacy.

To attract and convert these cautious yet curious buyers, brands must lead with messaging that reinforces robust e-commerce protections and frictionless, secure transactions.

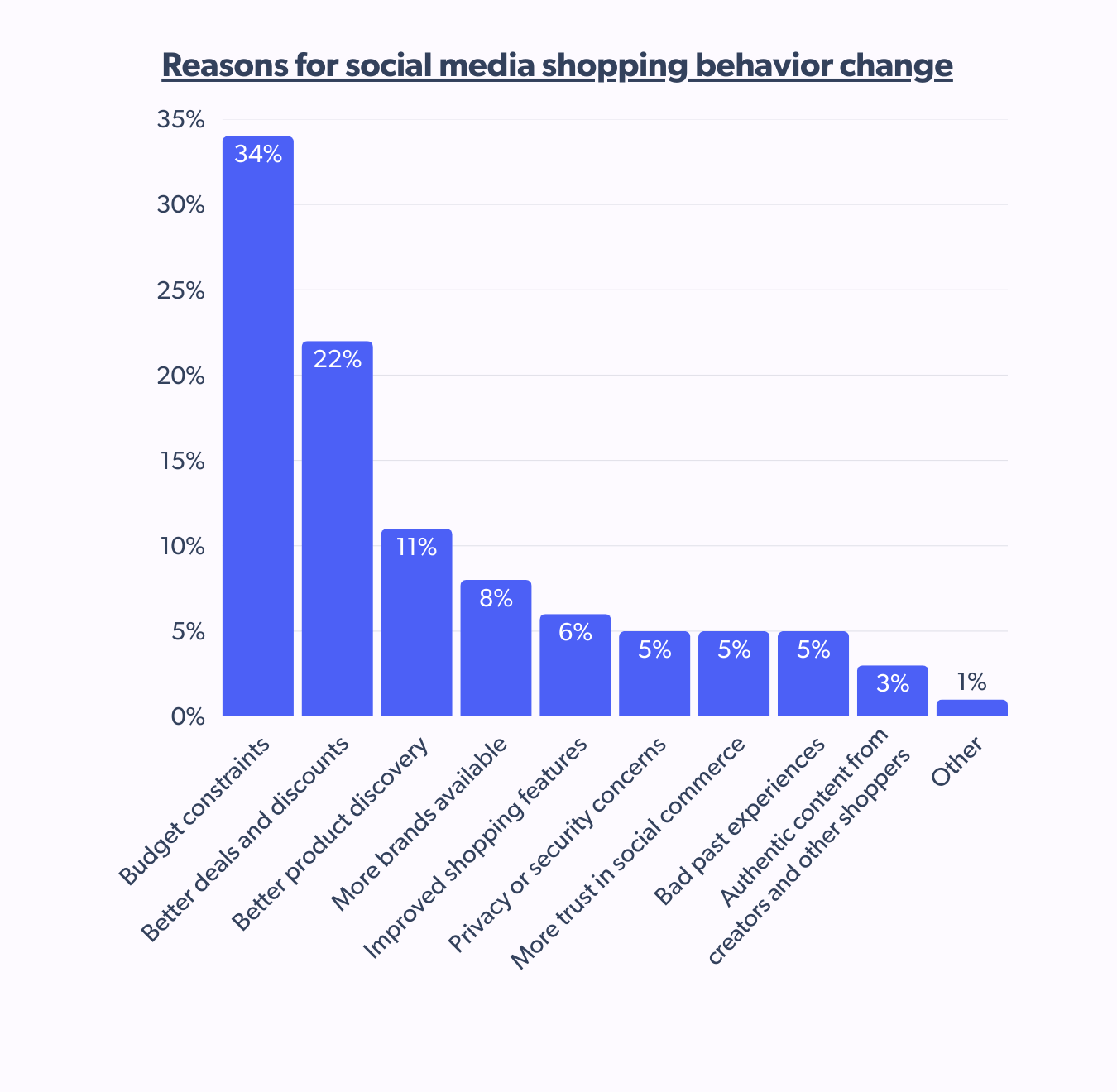

While global trends show social media’s growing influence on purchasing, it’s still a secondary channel in France. Some have increased spending on these platforms due to their shopping budget and high chances of getting better deals and discounts.

Why peer reviews far outshine traditional ads for the French

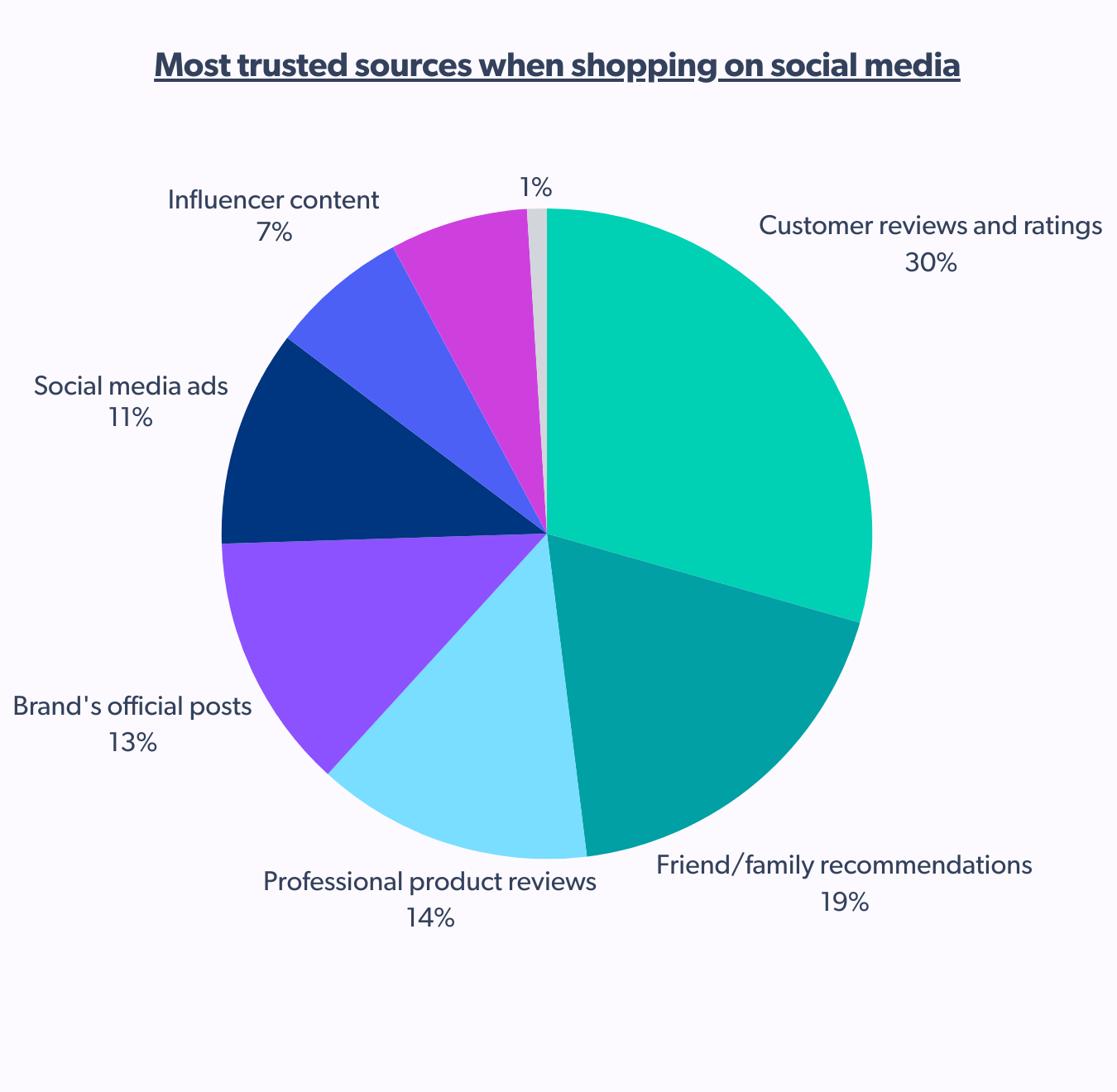

French consumer behavior reflects the strongest trust in customer reviews and ratings. While traditional word-of-mouth, such as recommendations from friends and family, remains relevant, professional product reviews and influencer marketing content hold less weight.

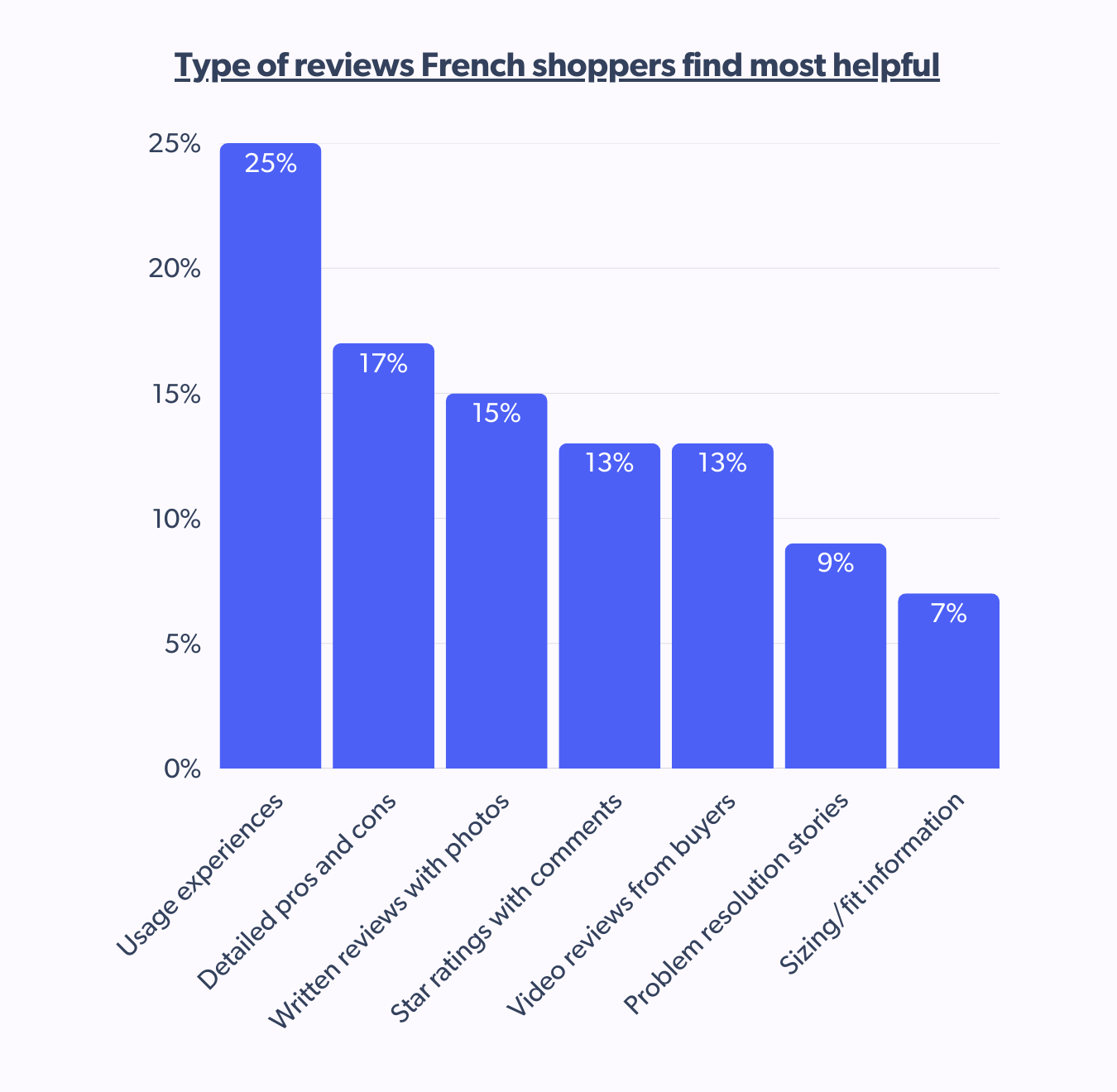

But what kinds of peer reviews are the most appealing to the French?

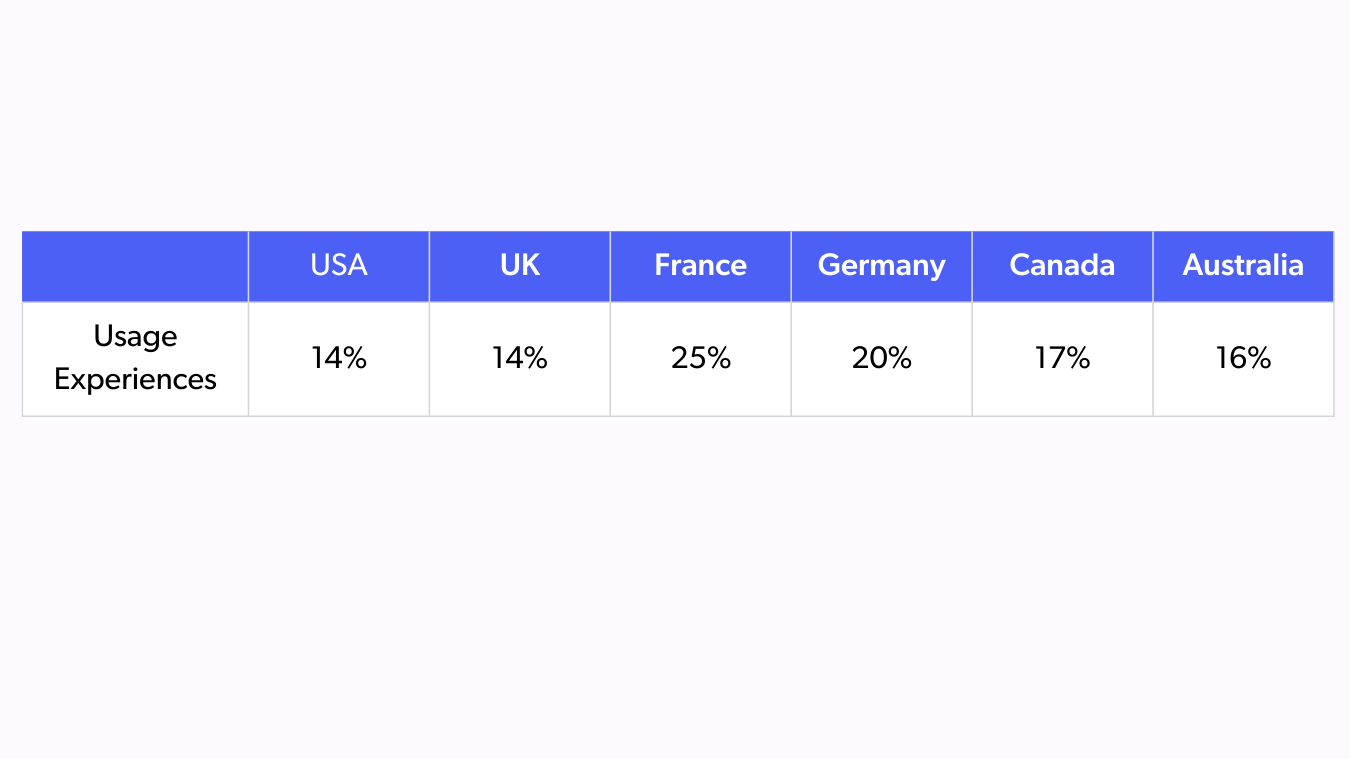

Interestingly, among all surveyed markets, France had the highest percentage of shoppers who found ‘usage experiences’ the most useful when shopping on social media.

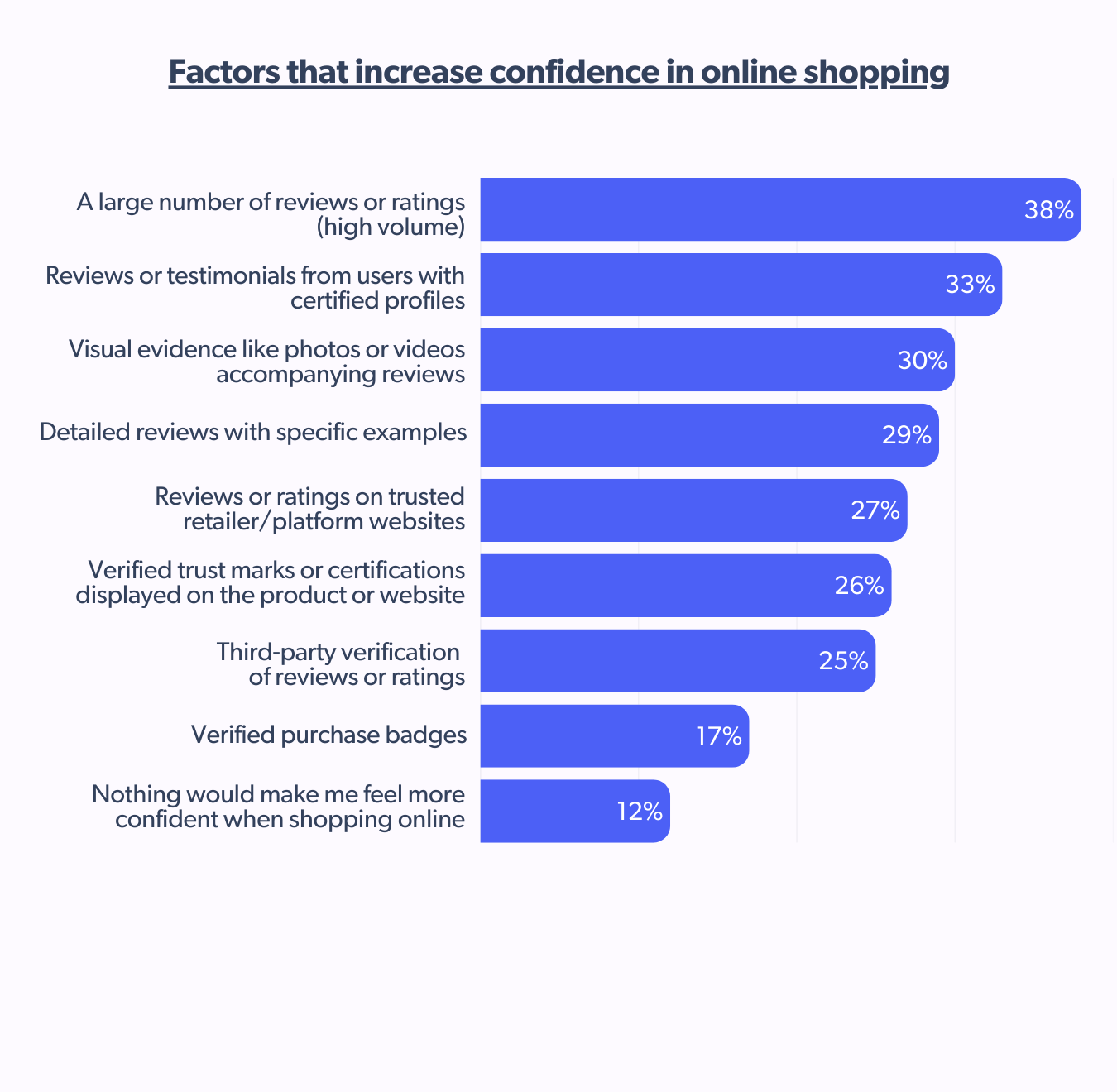

French shoppers value both review volume and verified trust marks, including third-party verification, highlighting how much they value social proof in their shopping behavior.

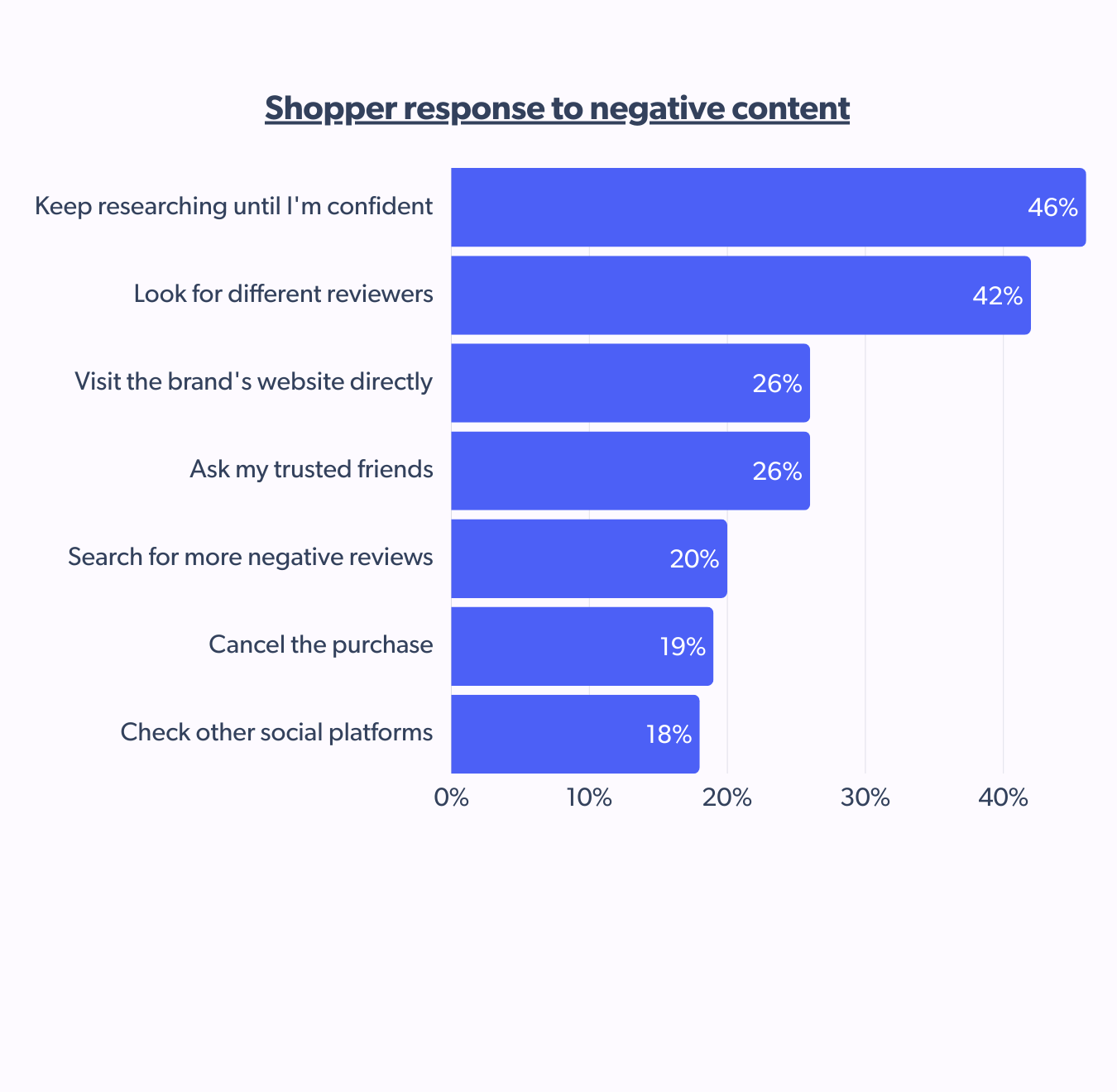

But trust is not easily won or lost. When faced with a negative review, nearly half will continue researching until fully confident, while many will cross-check multiple sources to form a balanced opinion.

Au revoir, Emily, say the French

Much like the skepticism towards the oft-idealized influencer world portrayed in the Netflix series Emily in Paris, actual French shoppers also approach creator recommendations with a critical eye.

Despite the saturation of influencer-driven content, most French shoppers remain selective when purchasing based on creator marketing. While 46% have made only 1-2 purchases in the last six months due to creator influence, about 10% have made 6-10 purchases, the highest across all markets surveyed.

True to form, 28% of French consumers prefer to cross-check creator recommendations with other creators, proving just how cautious and calculated they are before adding to a cart.

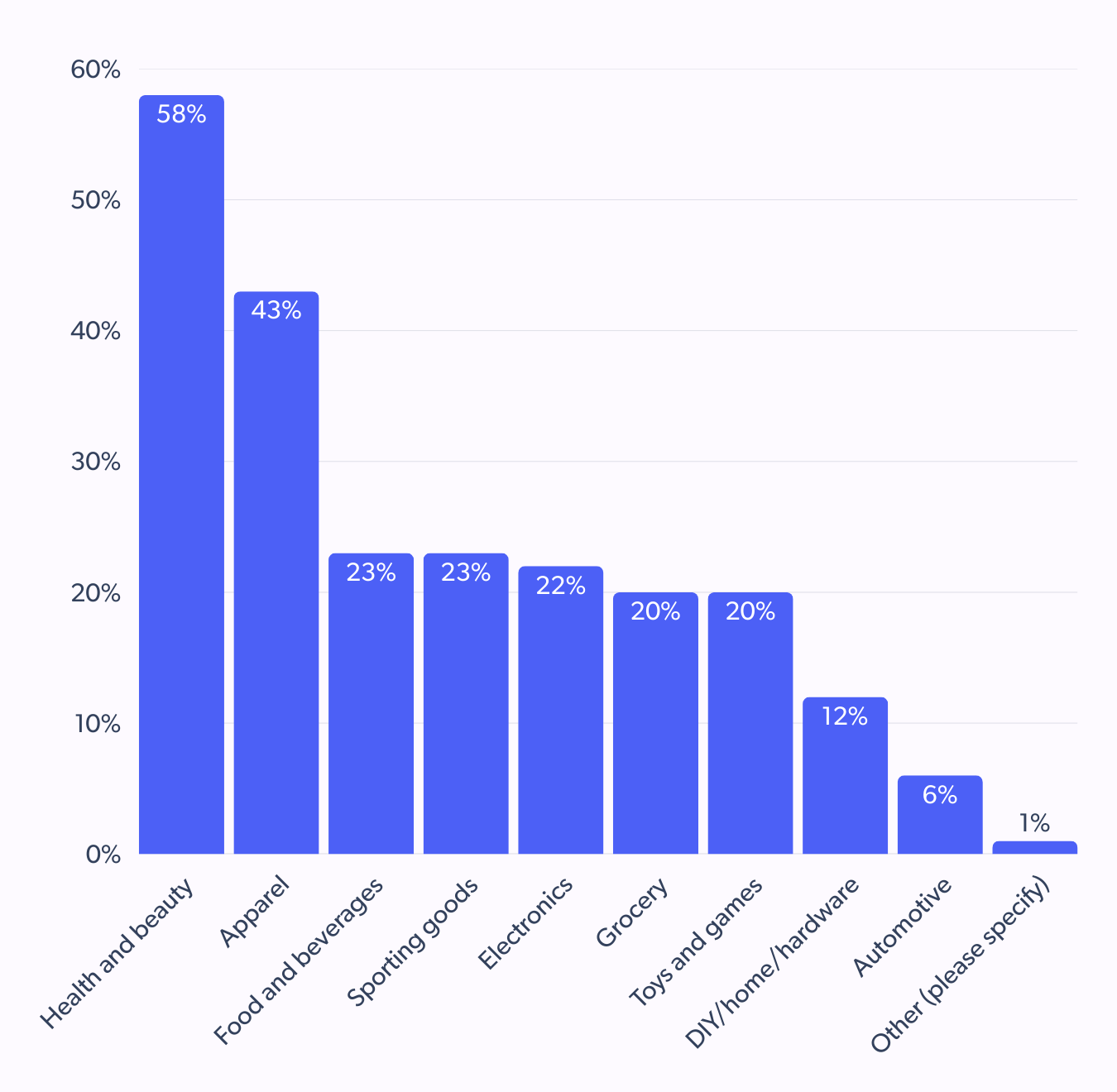

Beauty and fashion dominate among French creator content

The top two sectors influenced by creator content are health and beauty (58%) and apparel (43%), reinforcing the power of influencer marketing in industries where aesthetics, personal experience, and trust play a major role.

38% prefer unscripted and balanced content

For the French, authenticity is less about formal disclosures and more about a creator’s tone, approach, and storytelling style.

When assessing whether creator content feels real, 38% say they value content that feels natural and unscripted, while 35% appreciate when a creator acknowledges the pros and cons of a product.

In contrast, factors like transparency about sponsorships (23%) and a focus on valuable information over promotion (24%) rank lower than in other markets.

49% want clear disclosure of gifted items

French shoppers want upfront transparency about product gifting to content creators, a higher preference than in the US (45%) and Germany (40%).

Clear partnerships mentioned at the start of content and explanations of why a creator collaborated with a brand are equally valued.

Interestingly, platform disclosure tools like #ad and “Paid Partnership” labels are among the least preferred methods of disclosure (19%), indicating that French shoppers rely more on direct, verbal transparency from creators rather than platform-enforced markers.

French shoppers value authenticity

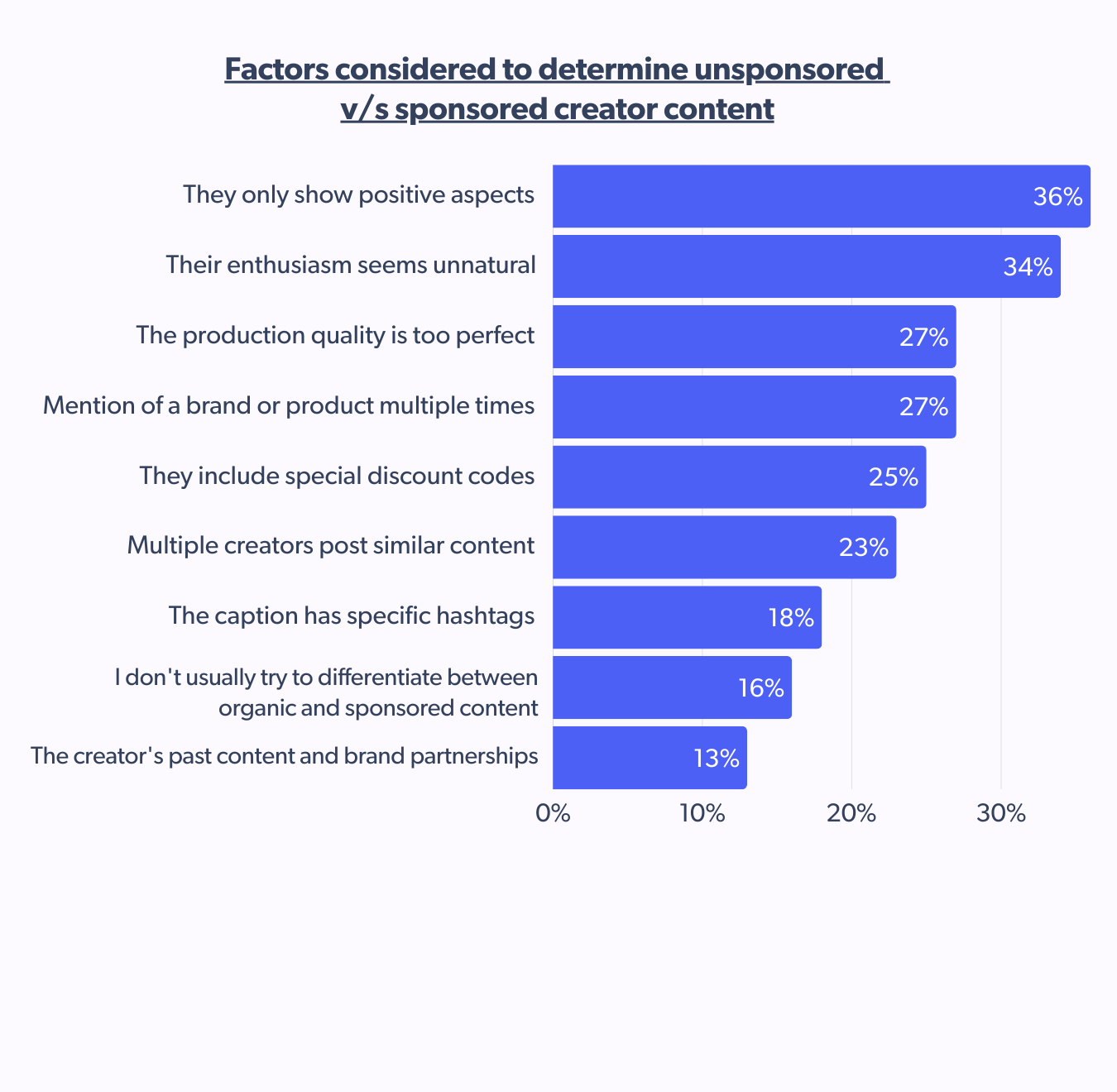

French shoppers say they become skeptical when a creator only highlights the positives of a product, and some cite unnatural enthusiasm as a red flag. Other factors, such as overly polished production or excessive brand mentions, contribute to skepticism but are secondary to emotional and tonal cues.

Trust breakers for France

When content feels overly promotional or sales-driven (52%), shoppers disengage. Similarly, when creators highlight only the positives (42%), it reflects French consumer behavior marked by skepticism and a demand for authenticity.

Inconsistent content (25%) is also a concern, signaling that creators who suddenly shift their tone or brand alignment risk losing trust.

The answer is clear for brands looking to make an impact in France: authenticity wins. Creators who balance honesty with storytelling and transparency with engagement will build the most credibility. And, in turn, drive the most conversions.

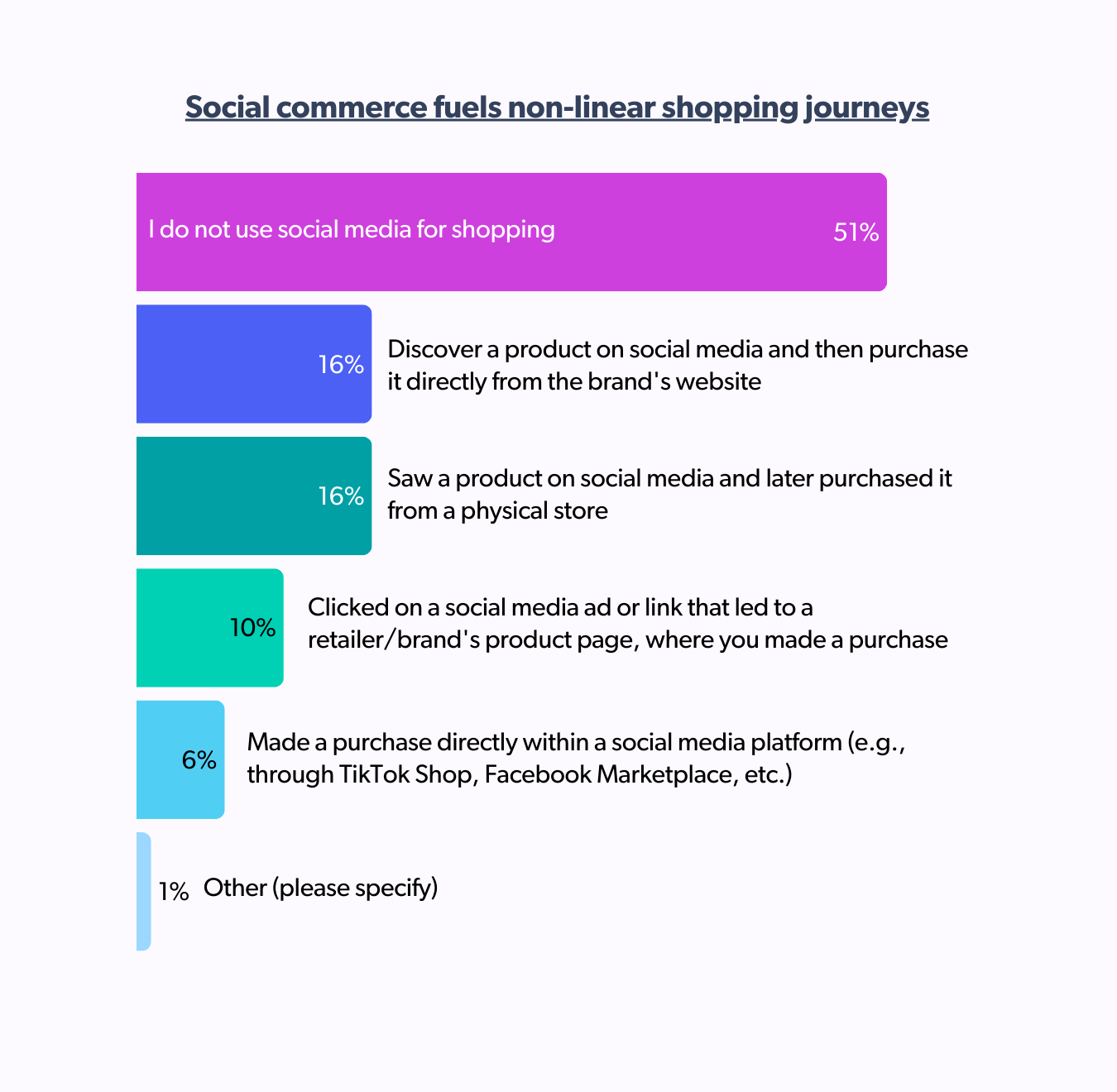

Social commerce sees a slow but steady lift in French consumer behavior

French shoppers are still warming up to social commerce. At least 51% say they don’t use social media for shopping. However, for the remaining 49%, social platforms play a key role in their path to purchase, often guiding them to brand websites, retailer sites, and even physical stores.

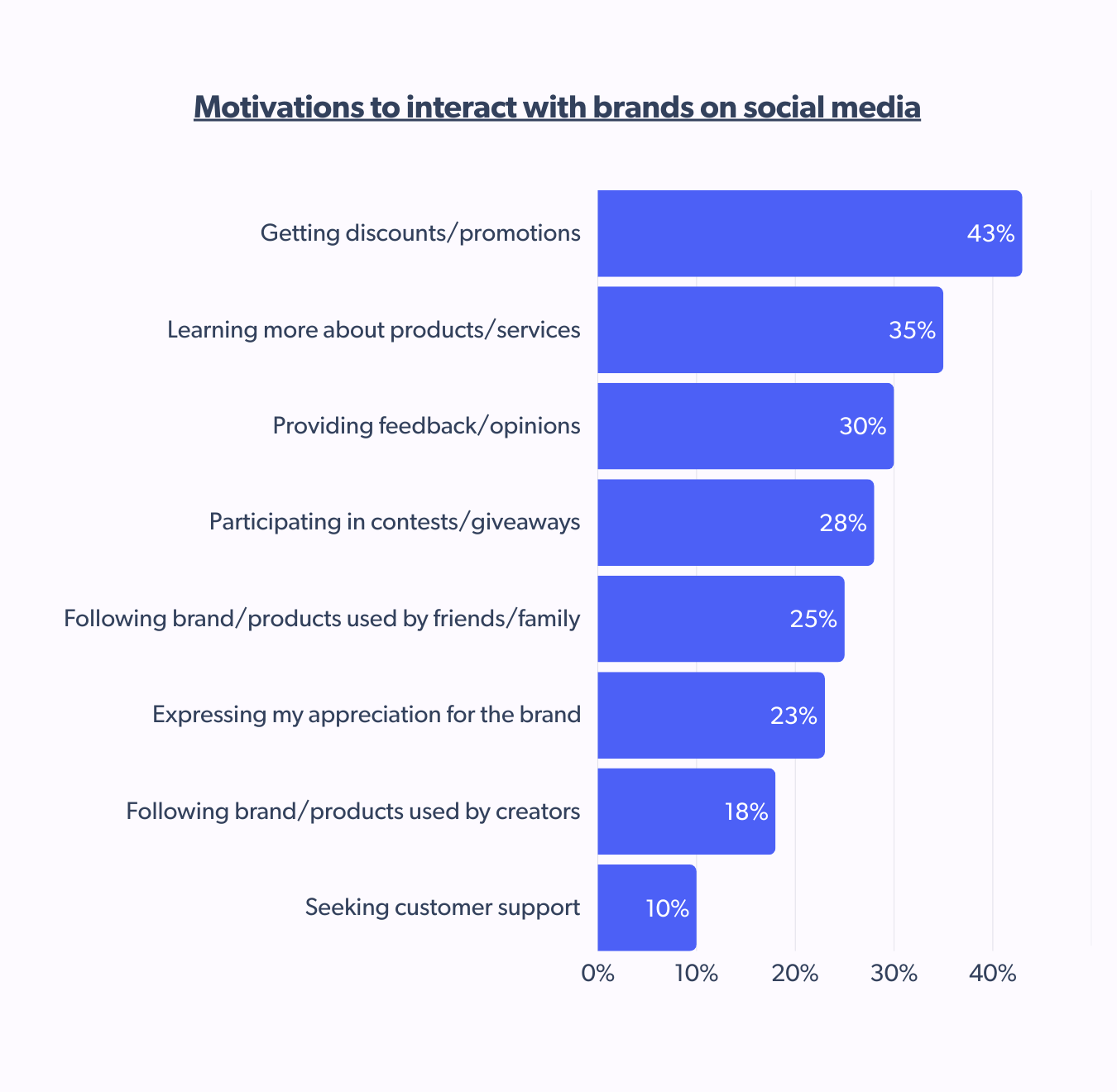

Discounts and promotions are the leading reasons for engagement with brands on social media, followed by wanting to learn more about products and services.

Where the French browse and buy:

Even among engaged shoppers, platform preferences and product categories vary, reflecting how different content formats shape French consumer behavior:

- TikTok dominates health and beauty (28%), far surpassing its other categories — proof that short-form video drives discovery and purchase in this space.

- Instagram thrives on visuals, making it a top choice for health and beauty (21%) and apparel (15%), where aesthetics play a key role.

- Facebook remains a steady performer across categories, with apparel (23%) and DIY/home/hardware (11%) leading — showcasing its broad appeal for varied shopping needs.

- YouTube excels for electronics (11%), as shoppers rely on in-depth reviews and product demos before buying.

Video formats that hold sway

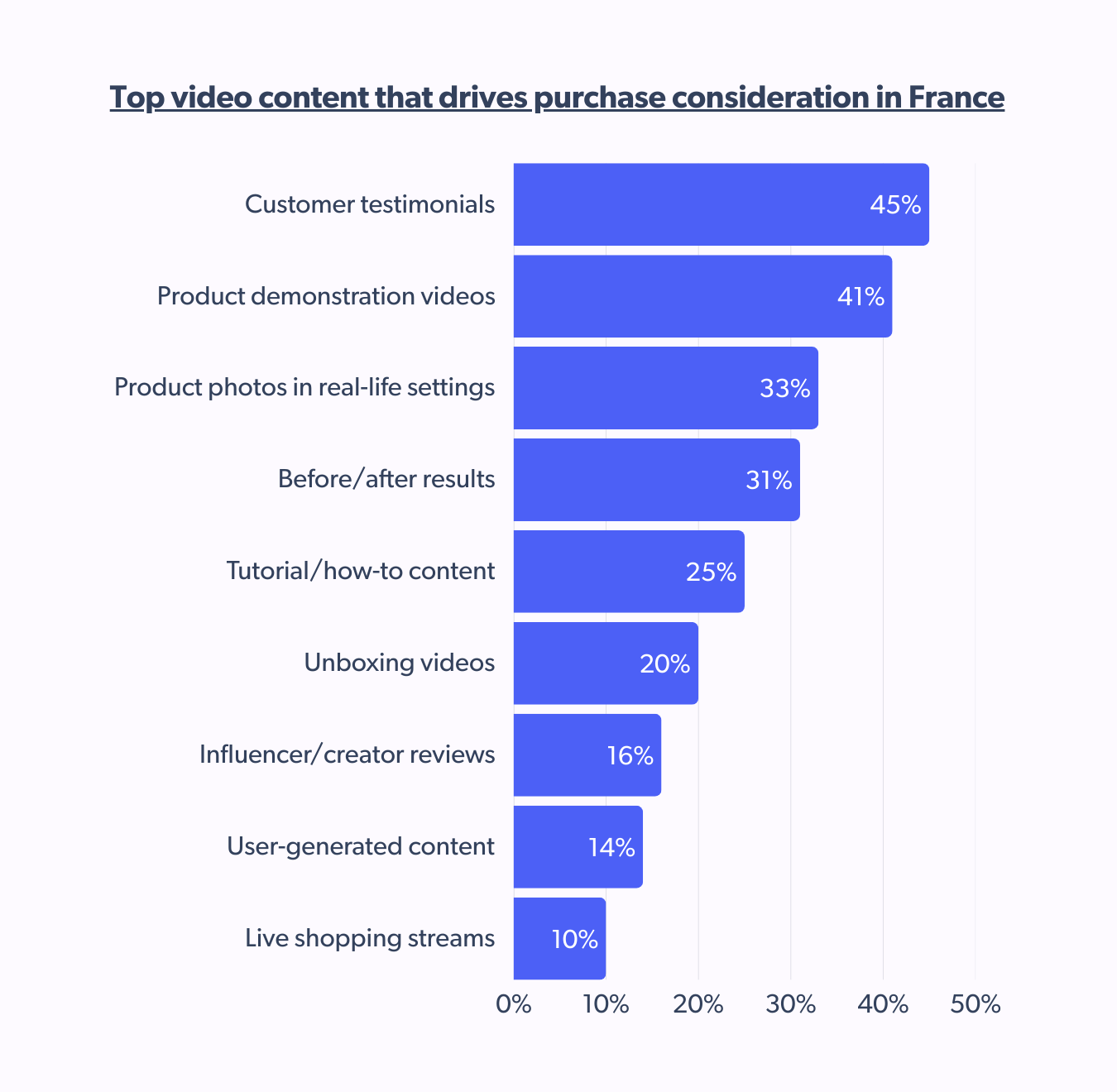

At 45%, videos with customer testimonials are the top influencers in purchasing decisions, higher than the global average (39%). Unlike other markets where influencer reviews or live shopping streams hold more sway, French consumer behavior remains focused on authenticity and tangible evidence when engaging with video content.

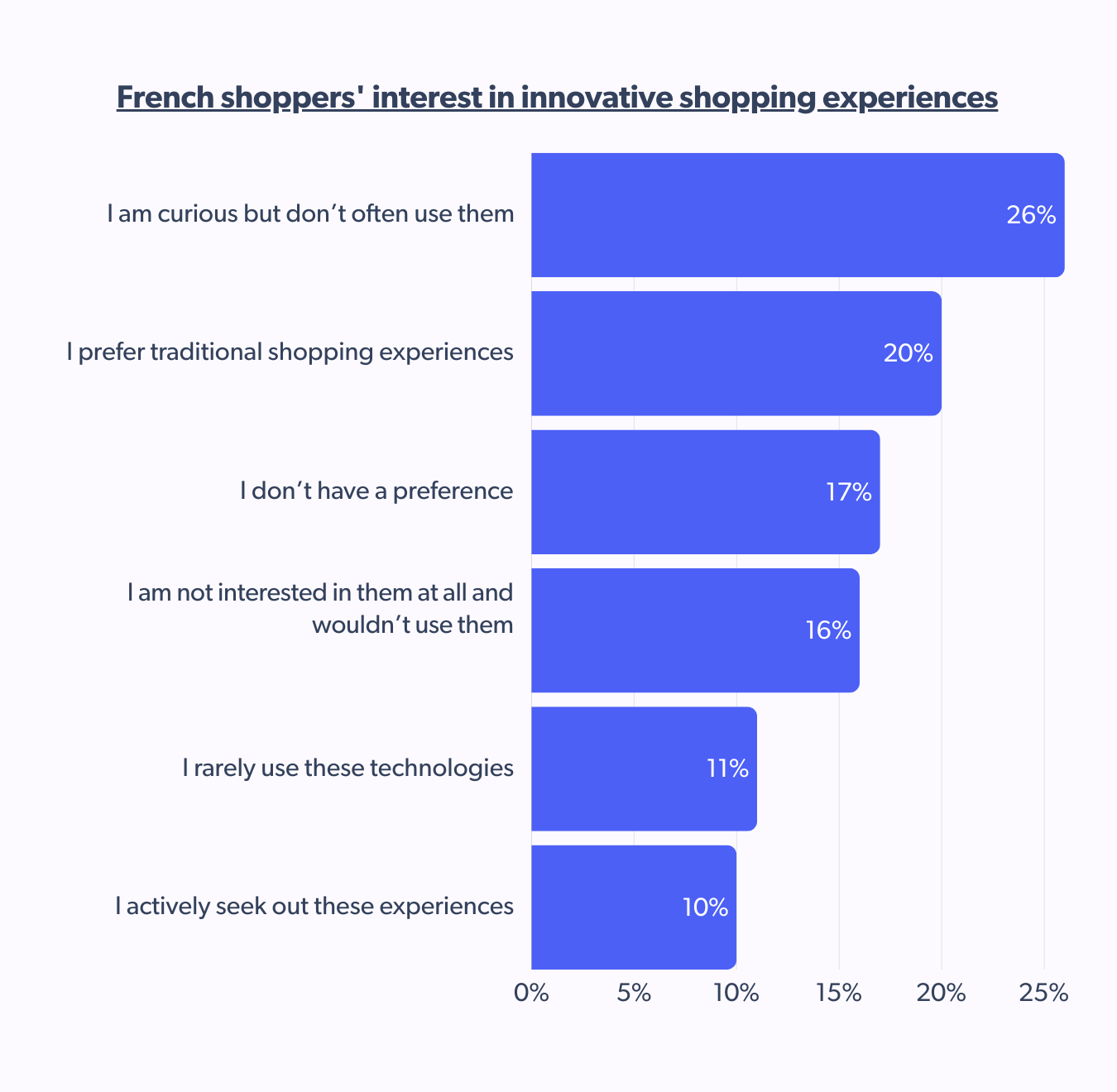

At 26%, France tops for curiosity in retail innovation

While emerging shopping technologies like augmented and virtual reality (AR/VR) present exciting opportunities, French consumer behavior remains cautious in their adoption. Interest is evident, but regular engagement remains low.

Most French shoppers (52%) have not participated in any of the listed innovative shopping experiences in the past 12 months, signaling a slower adoption rate.

Some forms of innovation, such as contactless shopping and experiential retail pop-ups, have seen moderate engagement. About 34% of French shoppers have explored augmented reality product visualization, and many have participated in pop-up or concept stores.

Still, digital-first formats like virtual try-ons and live shopping remain niche in this market, suggesting that while there’s curiosity about innovation, the preference for traditional or proven retail methods still dominates in the French market.

Build trust and loyalty to win the French shoppers over

French consumer behavior demands authenticity, relies on real customer experiences, and seeks value beyond price. Brands that can balance quality and value and prioritize social proof in their strategy will drive the market.

Dive deeper into consumer trends and strategies for success in the USA, UK, Germany, and other key markets.

Explore the full Bazaarvoice Shopper Preference Report 2025 and unlock the strategies for connecting, converting, and building lasting loyalty.