May 23, 2025

The land of maple trees is leaning toward sweeter deals, not just in taste but also in spending. Amid the ongoing tariff war and economic downturn, Canadian shoppers are opting for affordable alternatives without compromising on value.

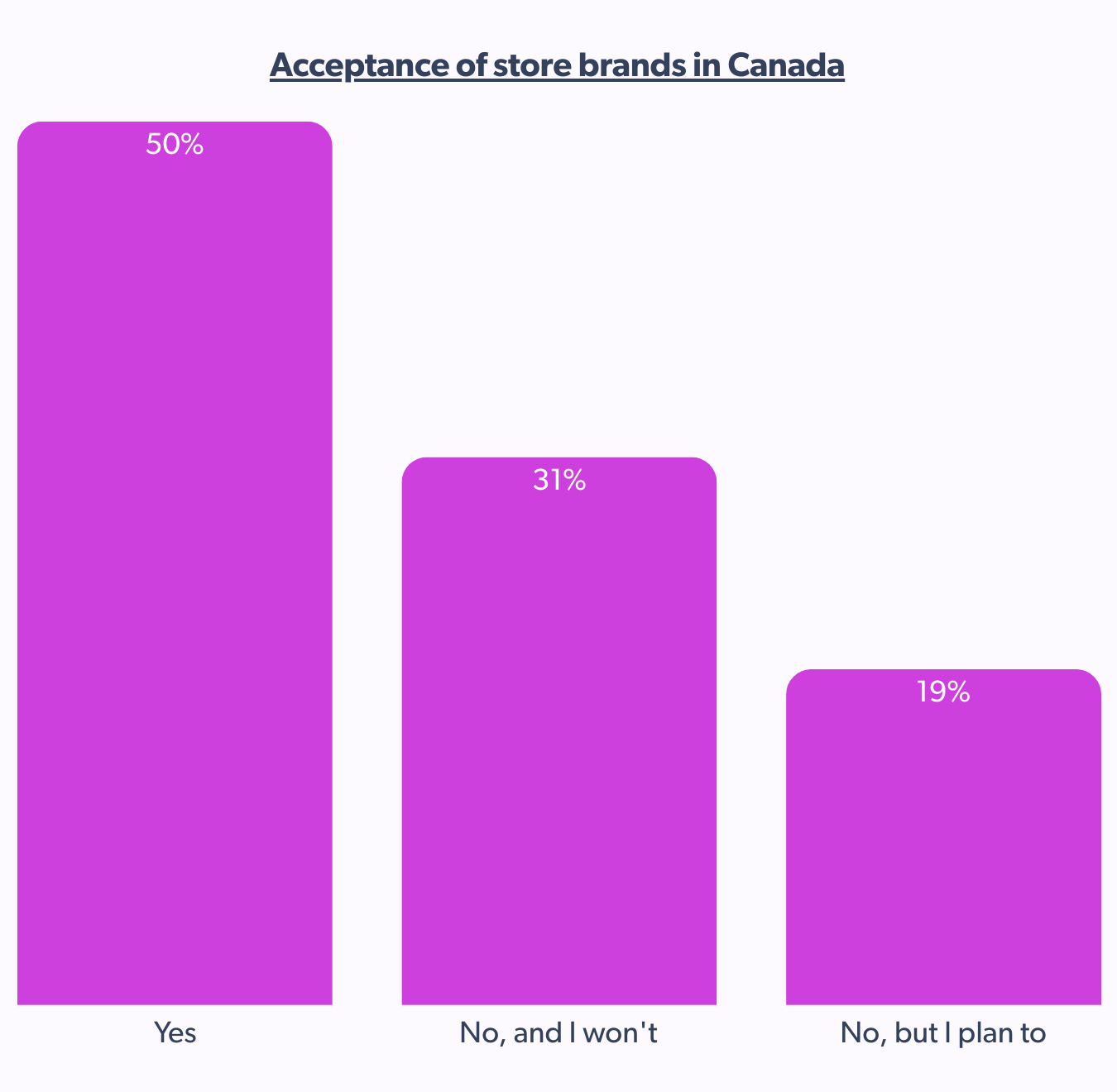

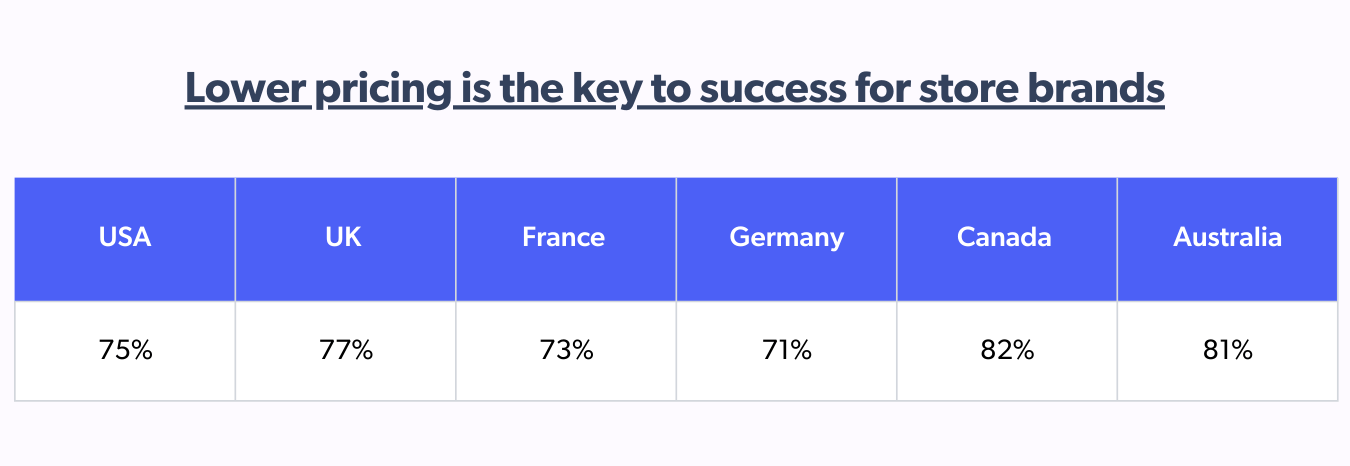

According to the Bazaarvoice Shopper Preference Report 2025, at least 82% of Canadian shoppers are more likely to accept store-brand products over national brands due to lower prices.

As price sensitivity grows, deal hunting and offers are taking center stage, spanning all major touchpoints, whether online, on social media, or in a physical store.

Stick around to see how the Canadian consumer trend for value-driven shopping habits reshapes the purchase path.

Canadian consumer trends show value for store-brands

Half of Canadian shoppers have already switched to store brands, and roughly one-fifth are planning to do so. This shift reflects a growing acceptance of store brands. Brands and retailers, here’s your whitespace opportunity.

Compared to the rest of the world, Canadian shoppers rank at the top for wanting lower pricing when choosing store brands. Quality and social proof are closely followed, with 52% valuing higher product quality and 34% influenced by positive reviews.

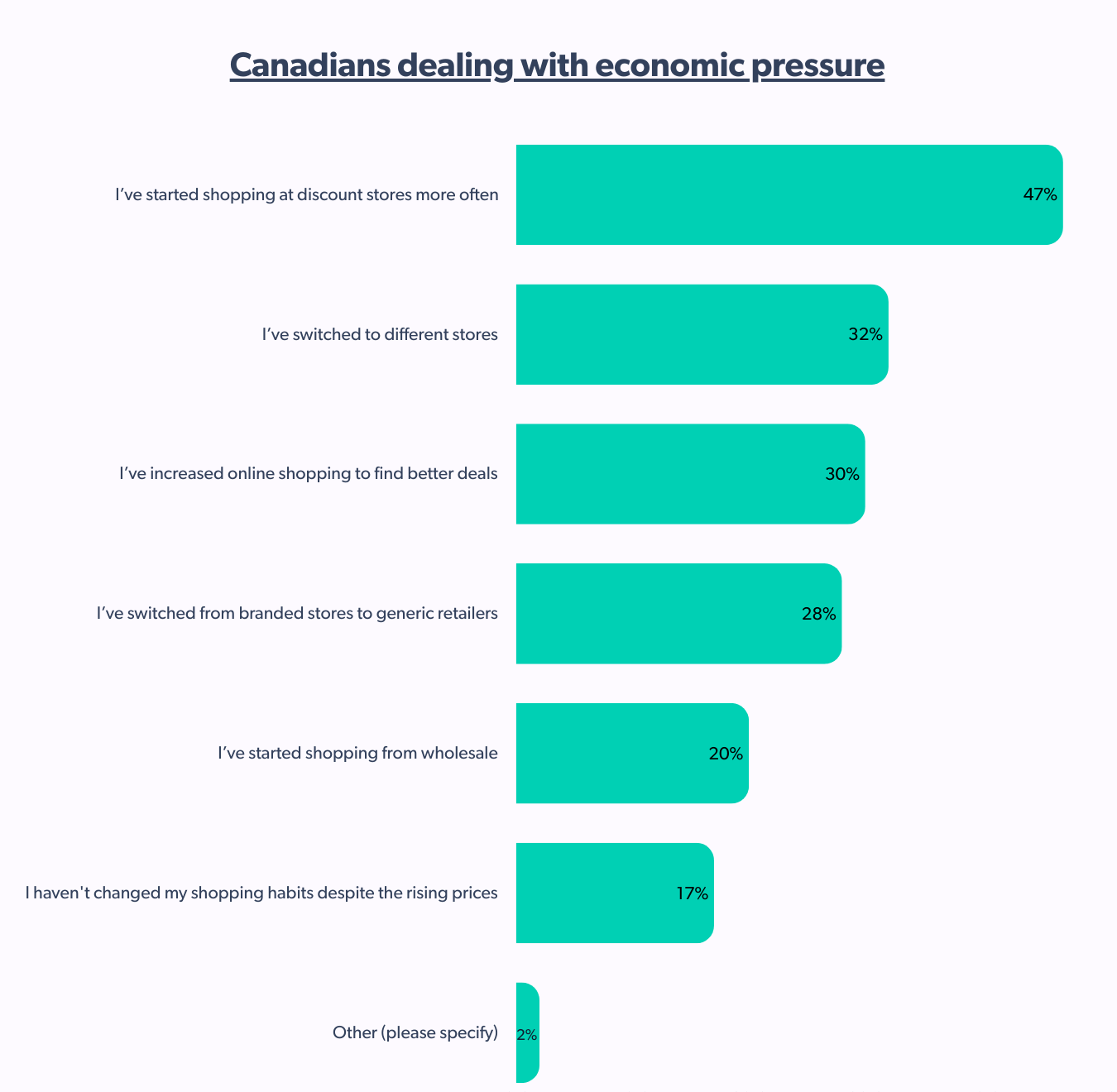

The economic pressure has led Canadian shoppers to deal with rising prices by shopping at discount stores more often and switching to different stores altogether.

This value-driven search does not end with Canadian consumers switching from trusted branded stores to generic retailers but also includes an increase in online shopping to find better deals.

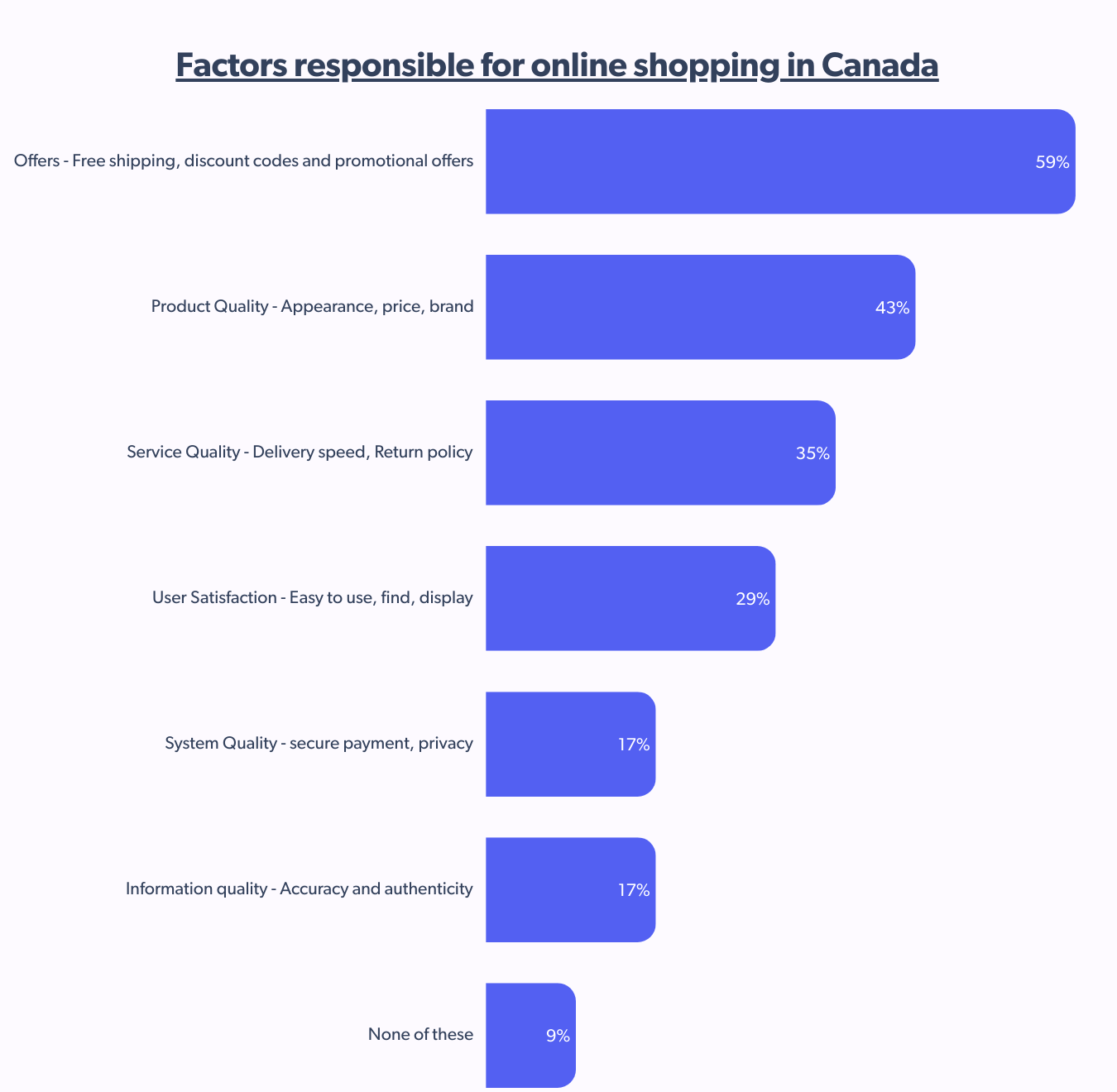

The demand for better deals is not limited to stores but extends to online shopping and social media. Over the past year, the leading factor for Canadian shoppers to make online purchases has been offers like free shipping, discount codes, and promotional offers. So, double down on those incentives and keep the ball rolling.

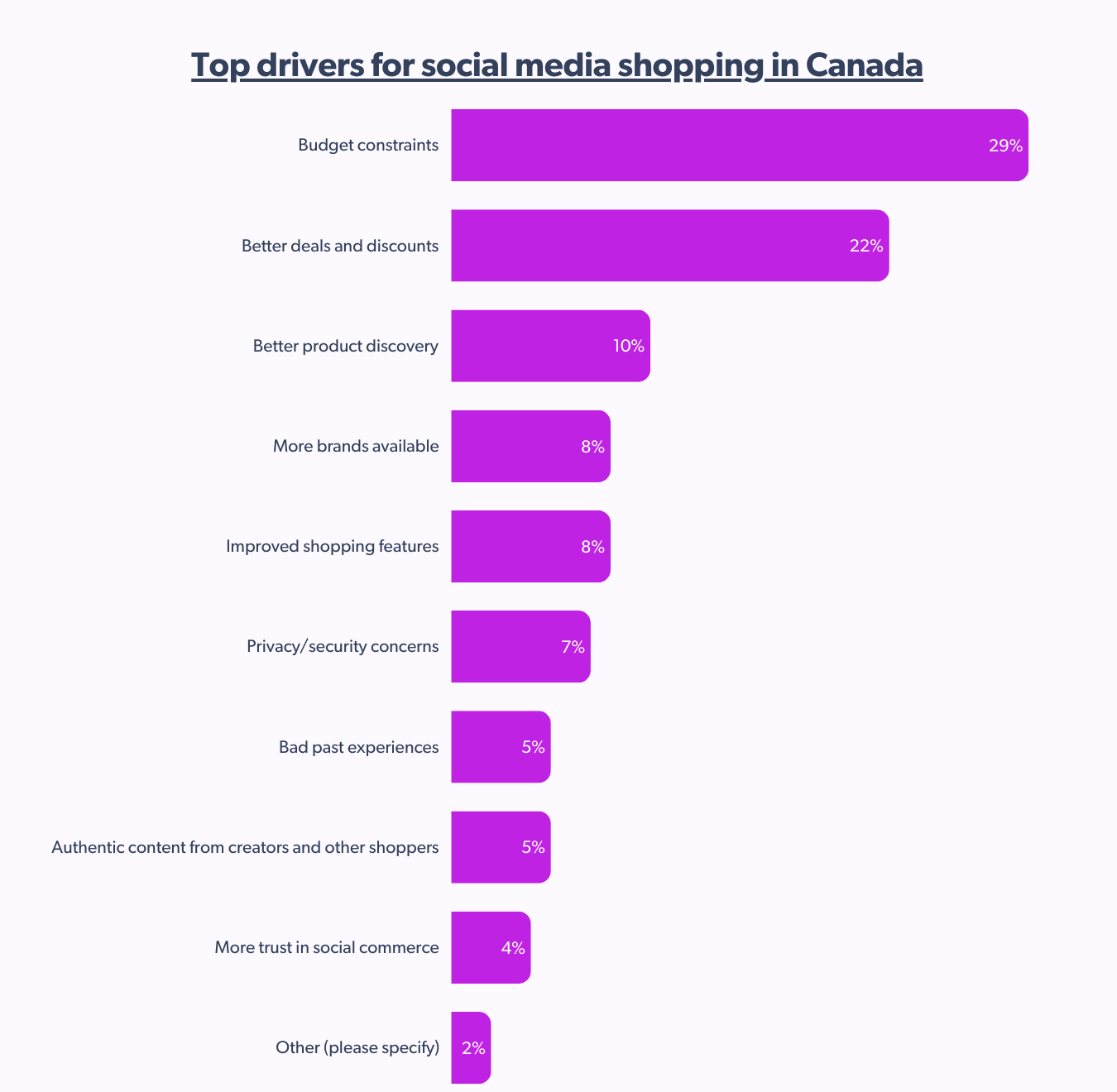

When it comes to value-driven shopping, Canadian shoppers leave no stone unturned. Social media spending falls on par with consumers, citing budget constraints and better deals and discounts as the driving forces. Other reasons, like better product discovery and more brands available, are indicators of discoverability and more choices.

Trust drives online consumer trends in Canada

Besides being price-conscious, Canadian shoppers also look for the trust factor at every step of the multipoint buying journey. Therefore, social proofs like testimonials, ratings, and reviews across brand websites and social media play significant roles in shaping the purchase decision.

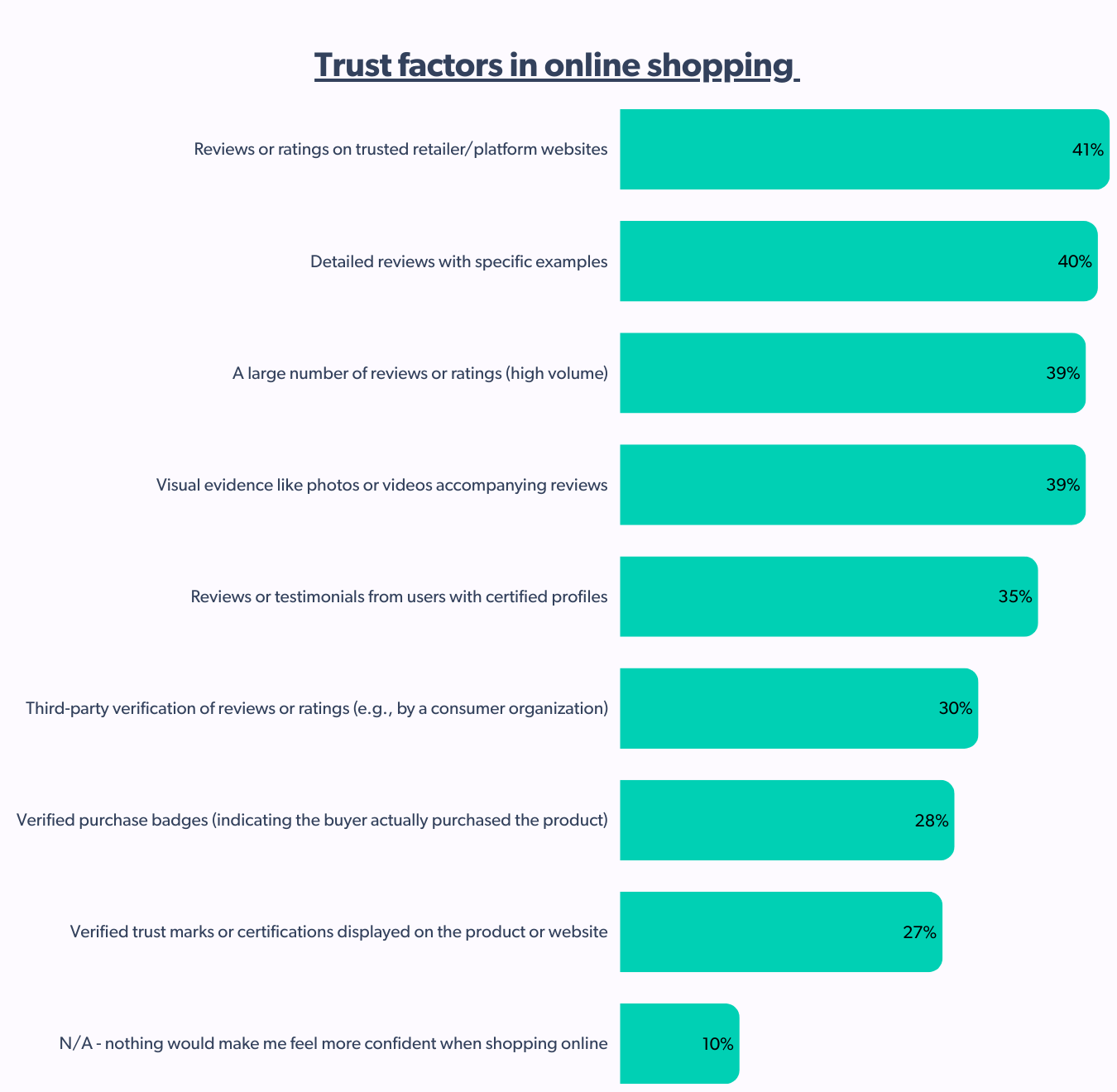

Canadian shoppers feel more confident when they can find reviews or ratings on trusted retailers or platform websites and detailed reviews with specific examples when shopping online. It is an excellent takeaway for brands and retailers looking to optimize their product detail page (PDP).

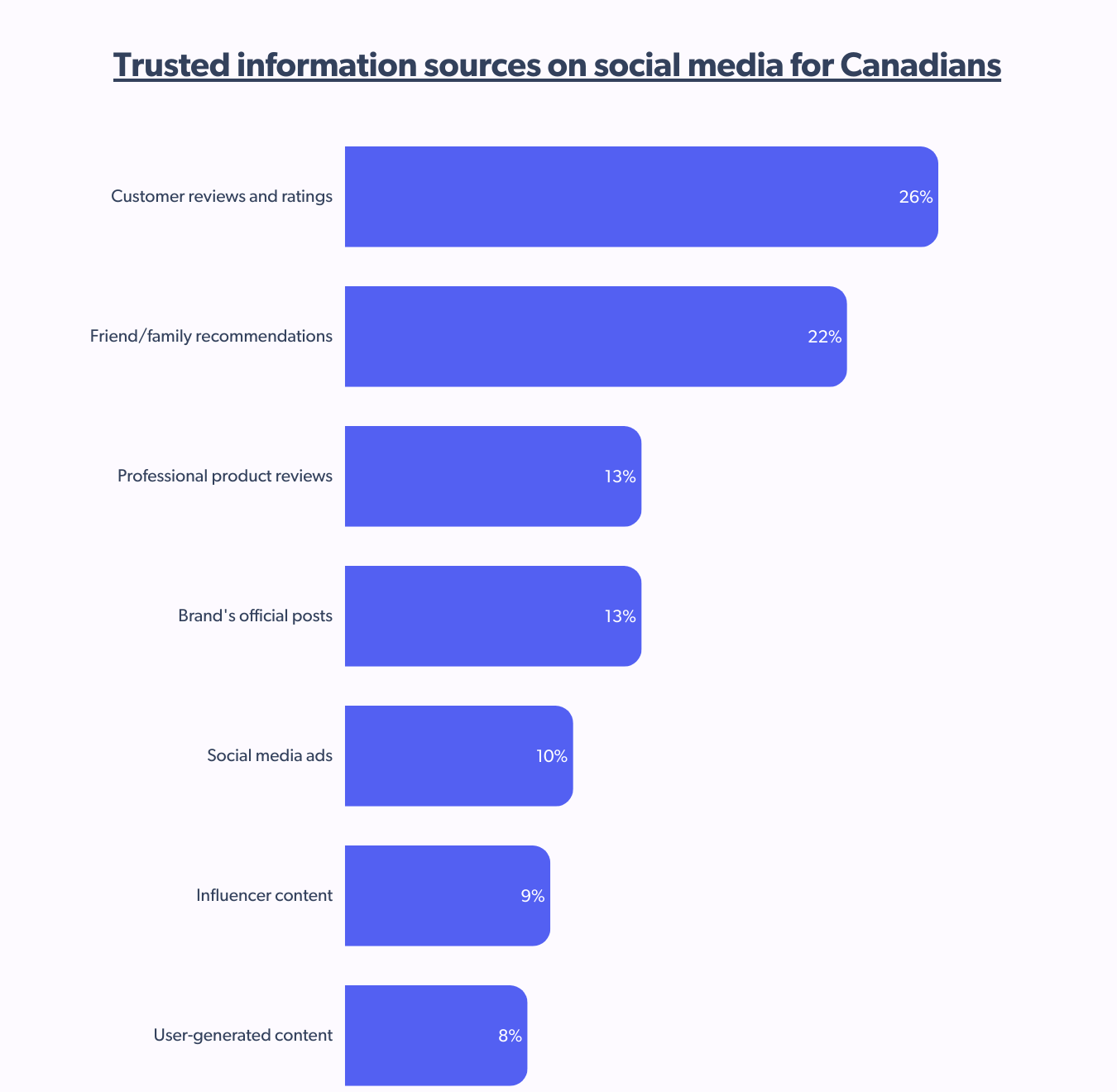

Regarding social media shopping, Canadian shoppers’ most trusted information sources are customer reviews and ratings, and recommendations from friends and family.

To attest to the above, Canadian consumer trends show shoppers prefer customer reviews or testimonials as the most influential content format over the past year at 47%, very closely followed by short-form videos (46%), still images (32%), and long-form videos (29%).

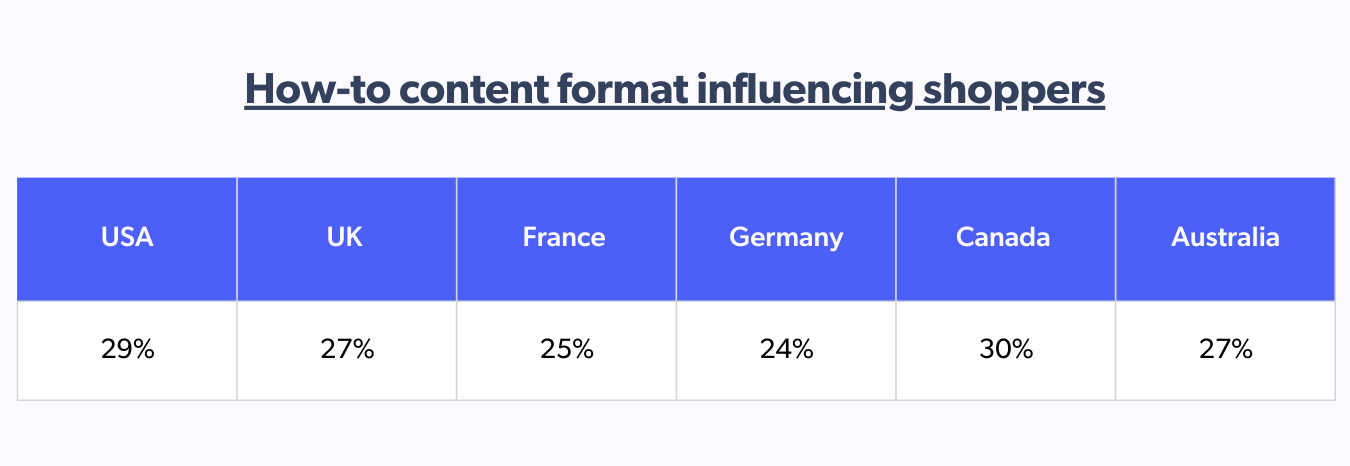

Of all the video content formats, Canada is at the top for tutorials or how-to content compared to the rest of the world.

Now that we know customer reviews and ratings are the top information sources, the next step is to understand the types of reviews that lead to purchasing decisions.

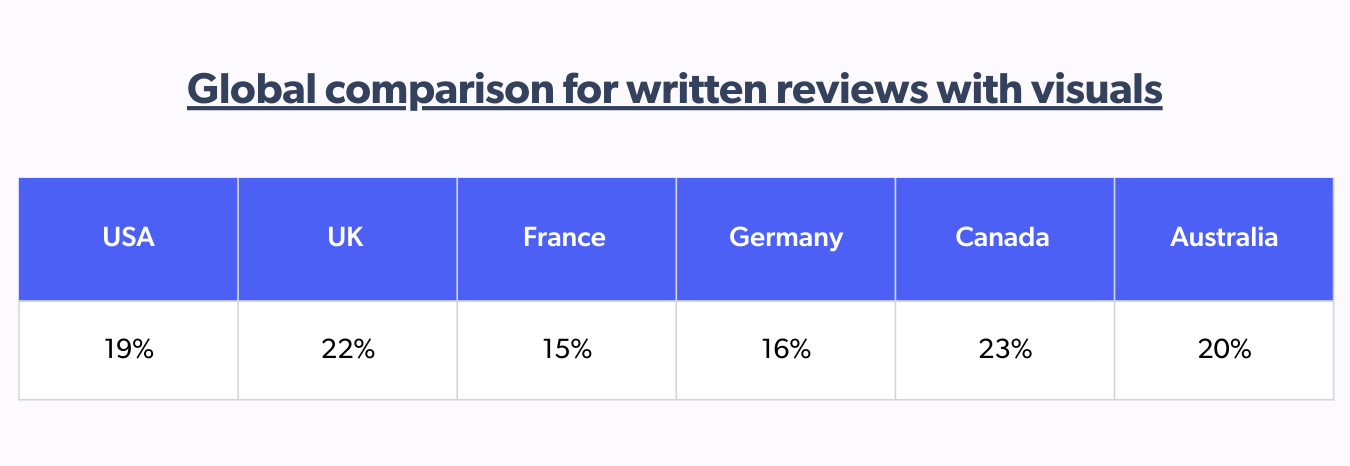

Globally, written reviews with photos are most important for Canadian shoppers when shopping on social media because they provide details and in-depth insights. Usage experiences (17%) and star ratings with comments (14%) closely follow each other.

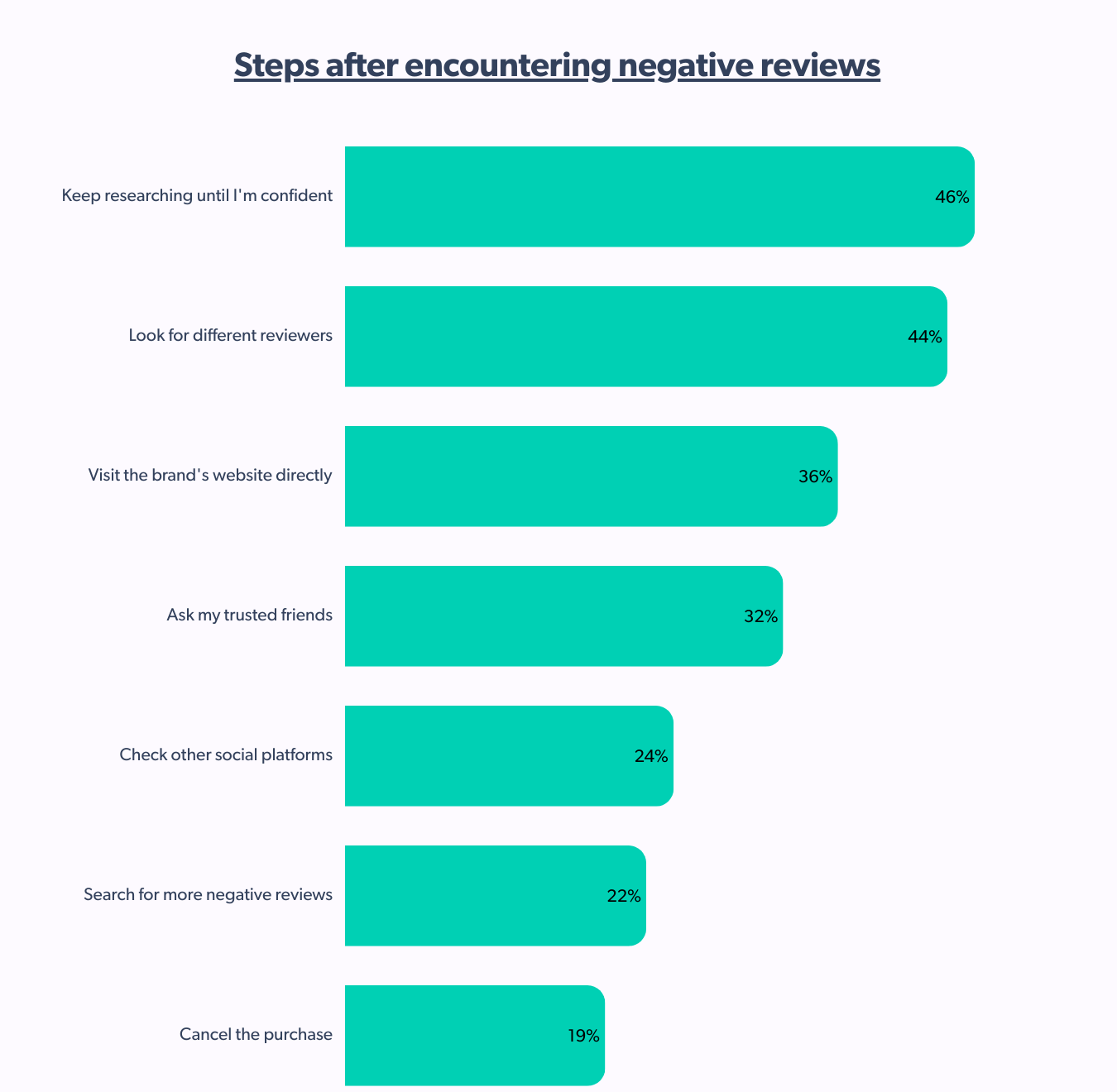

Let’s face it: trust has both negative and positive sides. Canadian consumer trends highlight shoppers do not stop at one bad review because they keep researching until they are confident and continue to look for different reviewers — a typical response during the consideration phase after encountering negative content.

Role of content creators for Canadian shoppers

Canadian consumer trends show shoppers are not strongly inclined toward purchasing a product a creator recommends. Now, here’s the catch: even though more than half of the population says no, there’s that 31% that is on board with it.

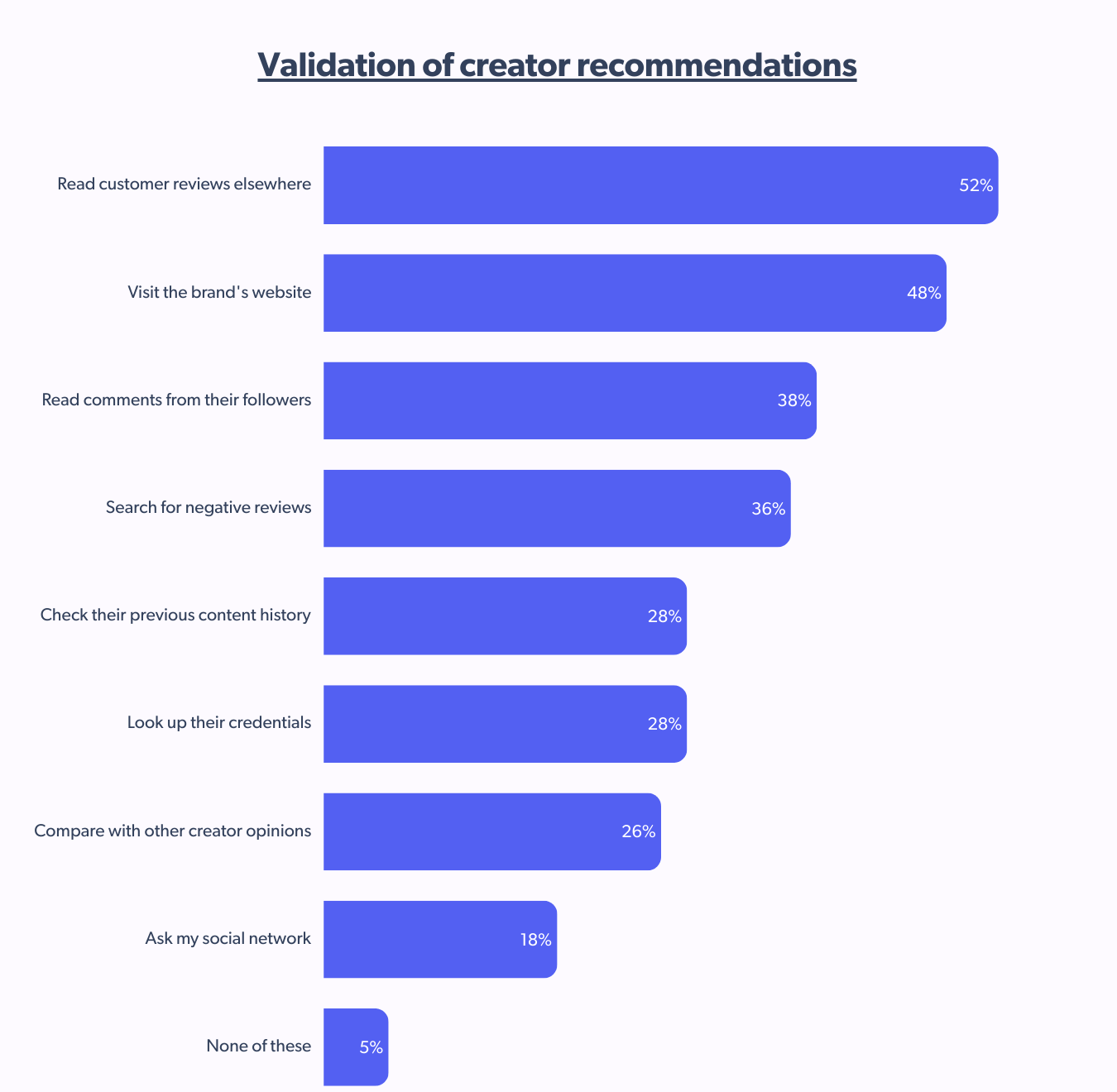

Most Canadian shoppers read customer reviews elsewhere to validate and trust creator recommendations, and some visit the brand’s website. This vigilance helps the shoppers build trust and credibility through more information seeking.

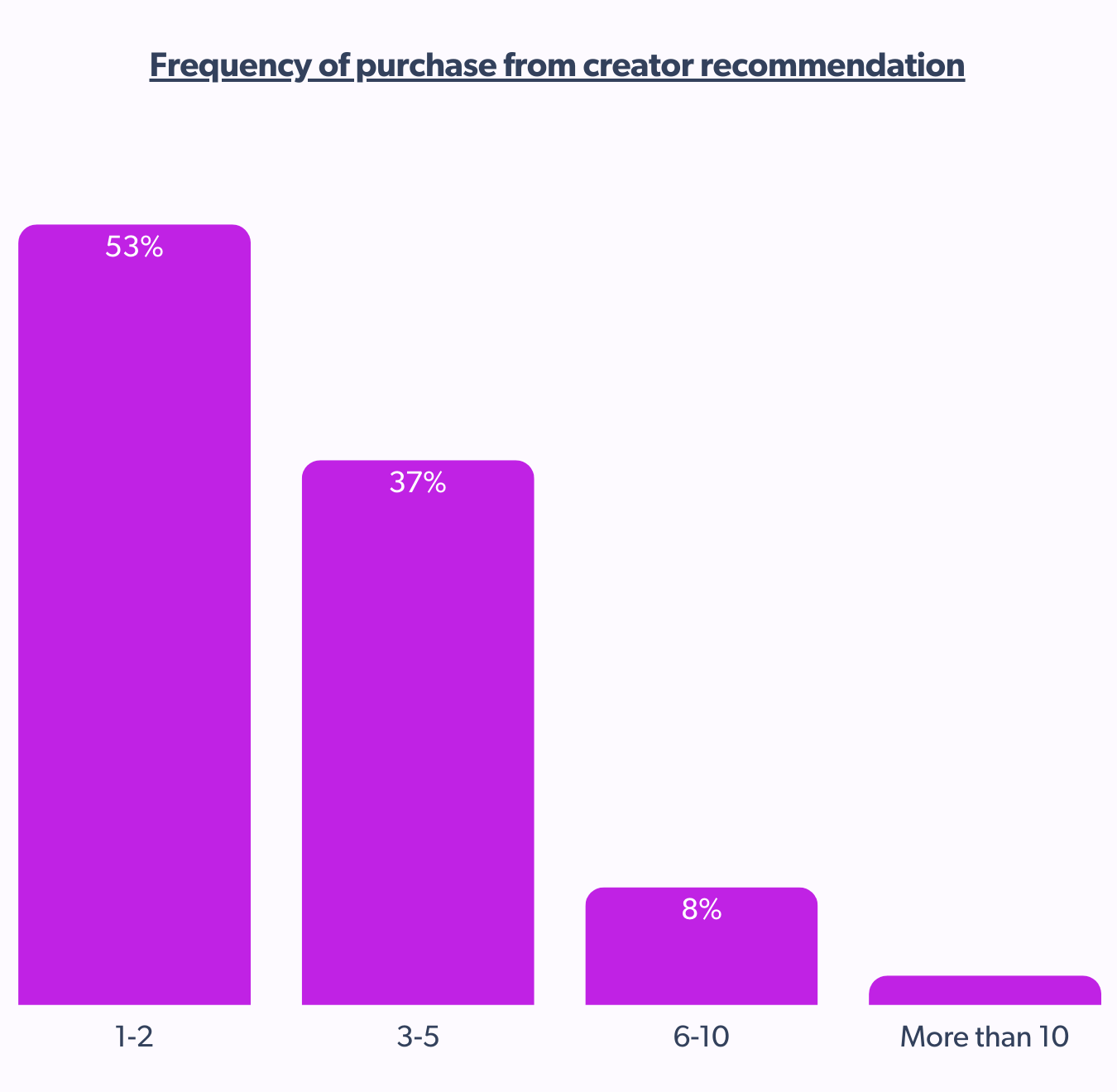

Nearly half of Canadian shoppers have purchased at least once or twice based on creator recommendations in the last six months. Roughly four in 10 shoppers have purchased 3-5 times trusting creator content.

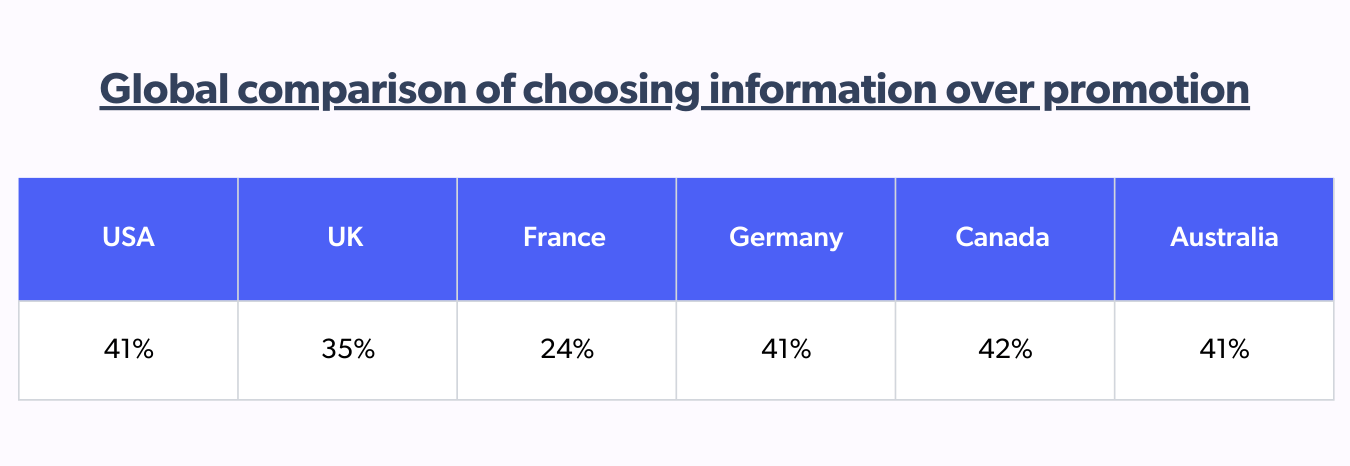

As we progress in this creator-led buying journey, Canadian shoppers find value in creators who focus on providing valuable information rather than just promoting products that do not align well with the demand for in-depth and detailed insights.

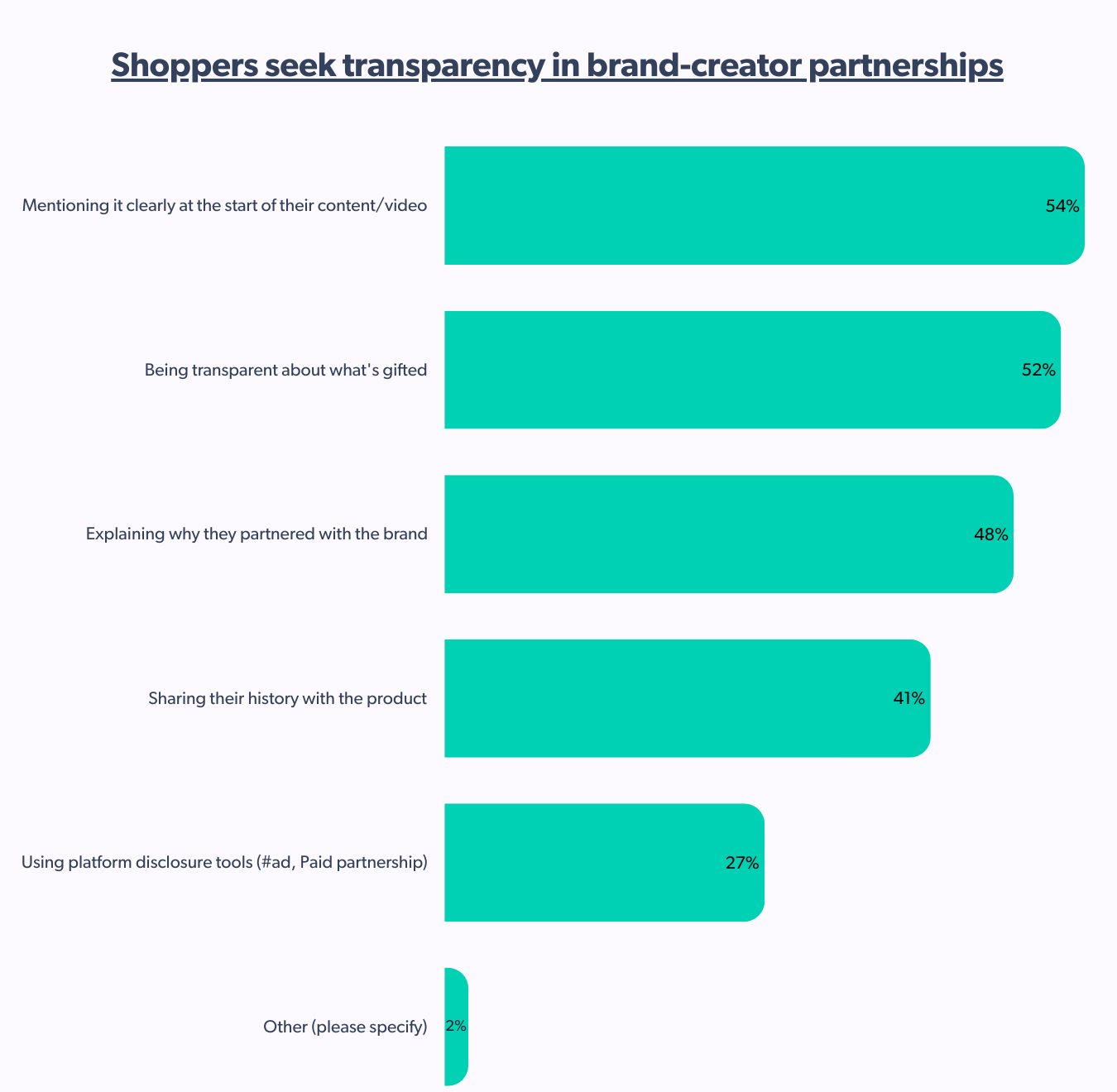

Partnership transparency is a huge indicator that creators must maintain their authenticity. Canadian shoppers prefer creators to disclose any partnership clearly at the start of their content/video, be transparent about what’s gifted, and clearly explain the purpose.

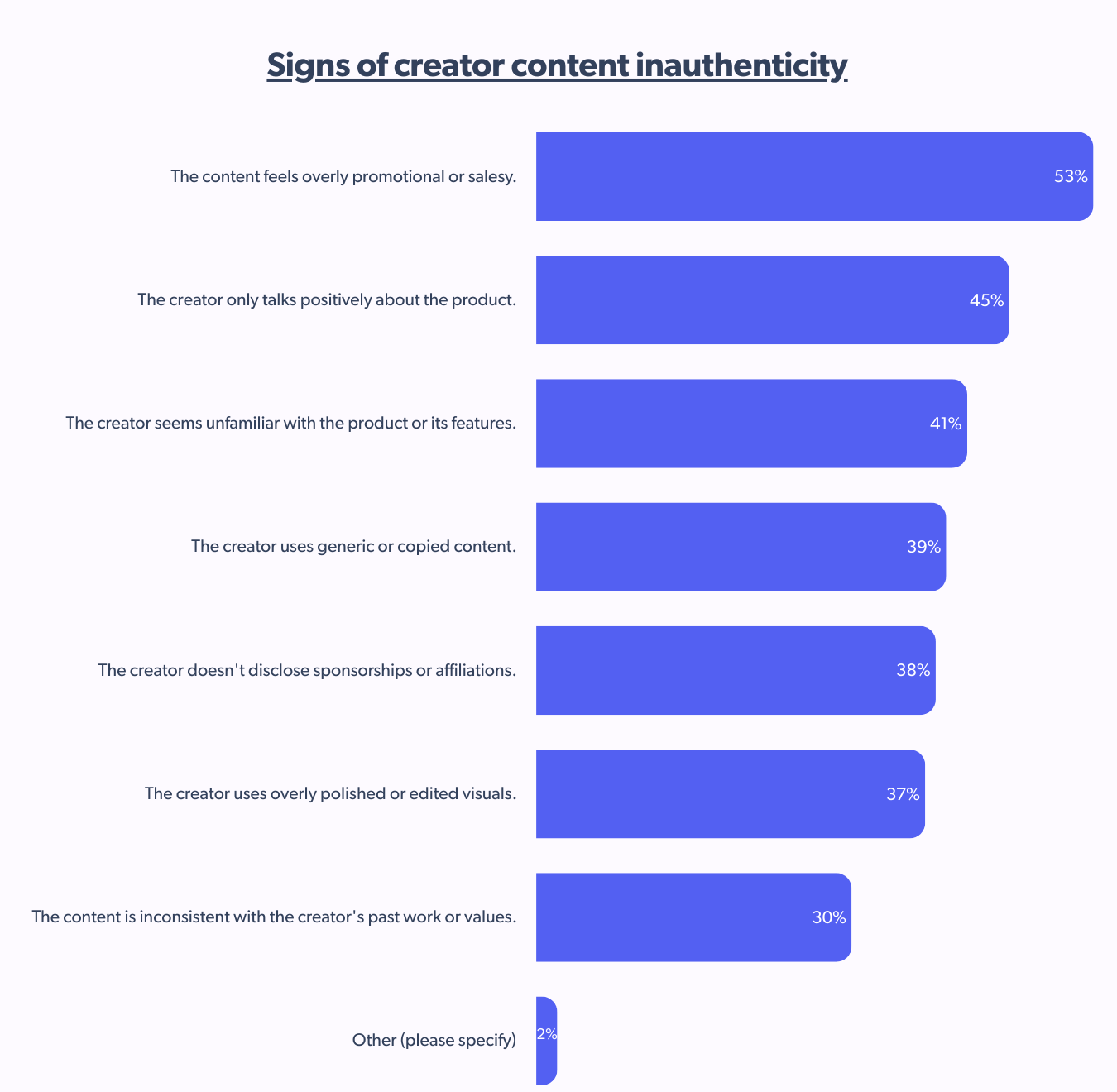

Consumers are, by default, value-driven, so it is extremely important for them to identify if the information is not doctored and absolutely raw.

Consumers don’t like it when the content feels too promotional or salesy, only talks positively about the product, and are unaware of its features. These are clear proofs of inauthenticity that the shoppers are fed up with and seek honest content.

Search for better deals drives social commerce

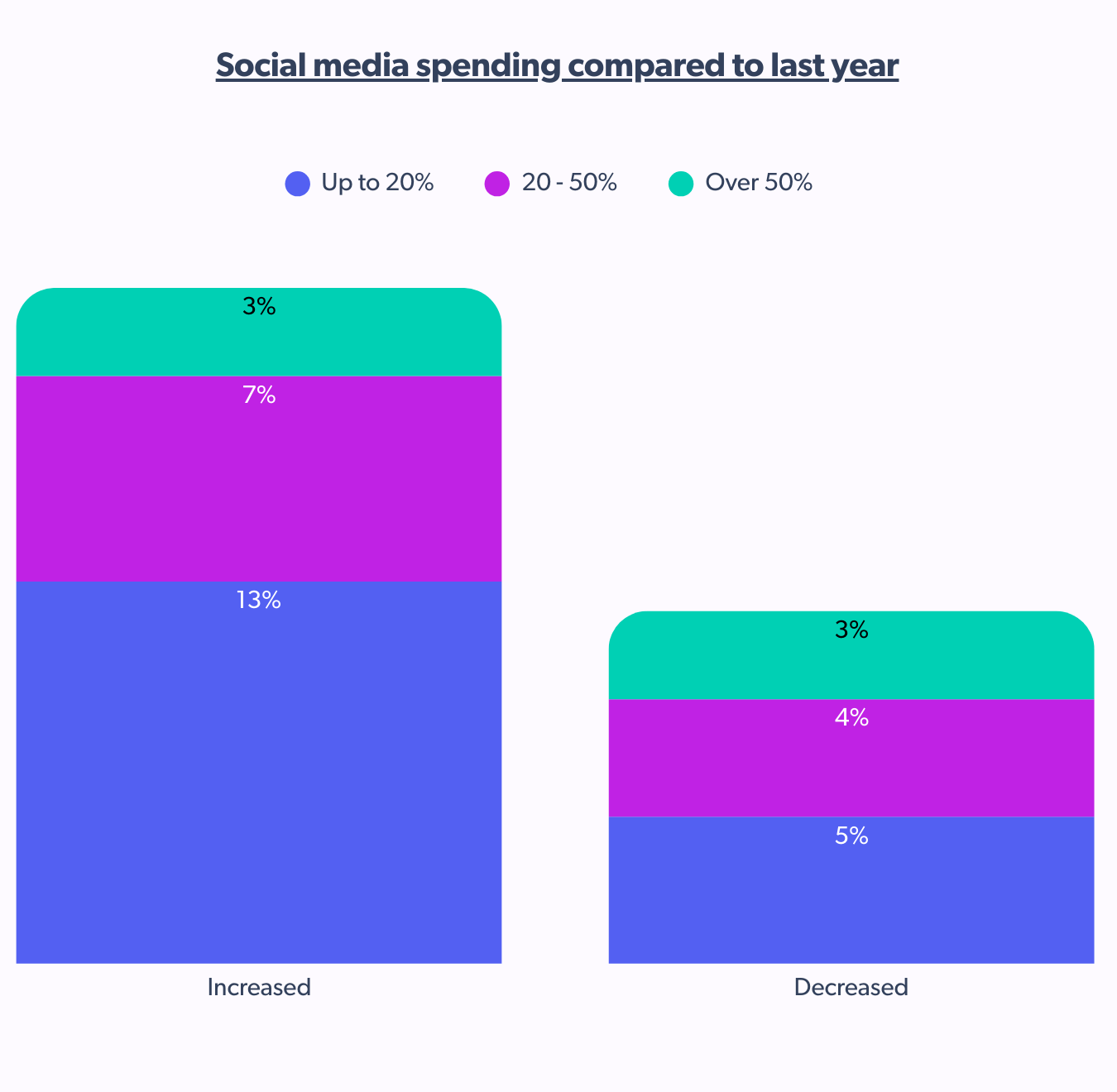

In only a year, social commerce has experienced a positive rise within the shopper realm. Canadian consumer trends show at least 23% of shoppers have increased their spending on social media by 20% or more.

Over the past year, Canada has ranked at the top for interacting with brands on social media solely to get discounts and promotions. Learning more about products/services (41%) and participating in contests/giveaways (35%) remain close second and third.

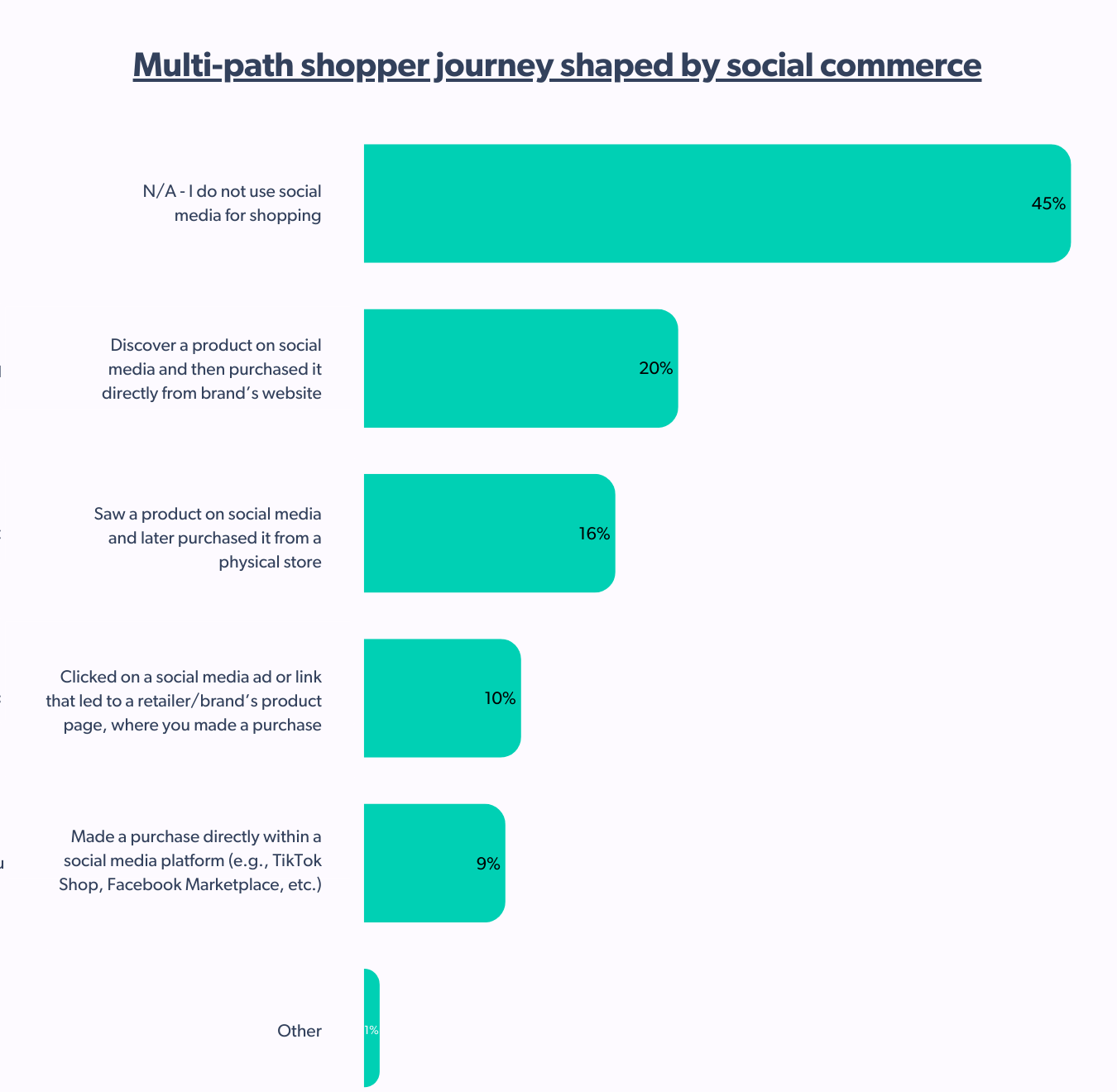

Shoppers worldwide use social media primarily to discover a product and purchase it directly from the brand’s website. Compared to the rest of the world, Canadian shoppers are more likely to see a product on social media and later purchase it from a physical store. This is where the concept of mapping engagement in social commerce comes in, where discoverability and online trust coincide.

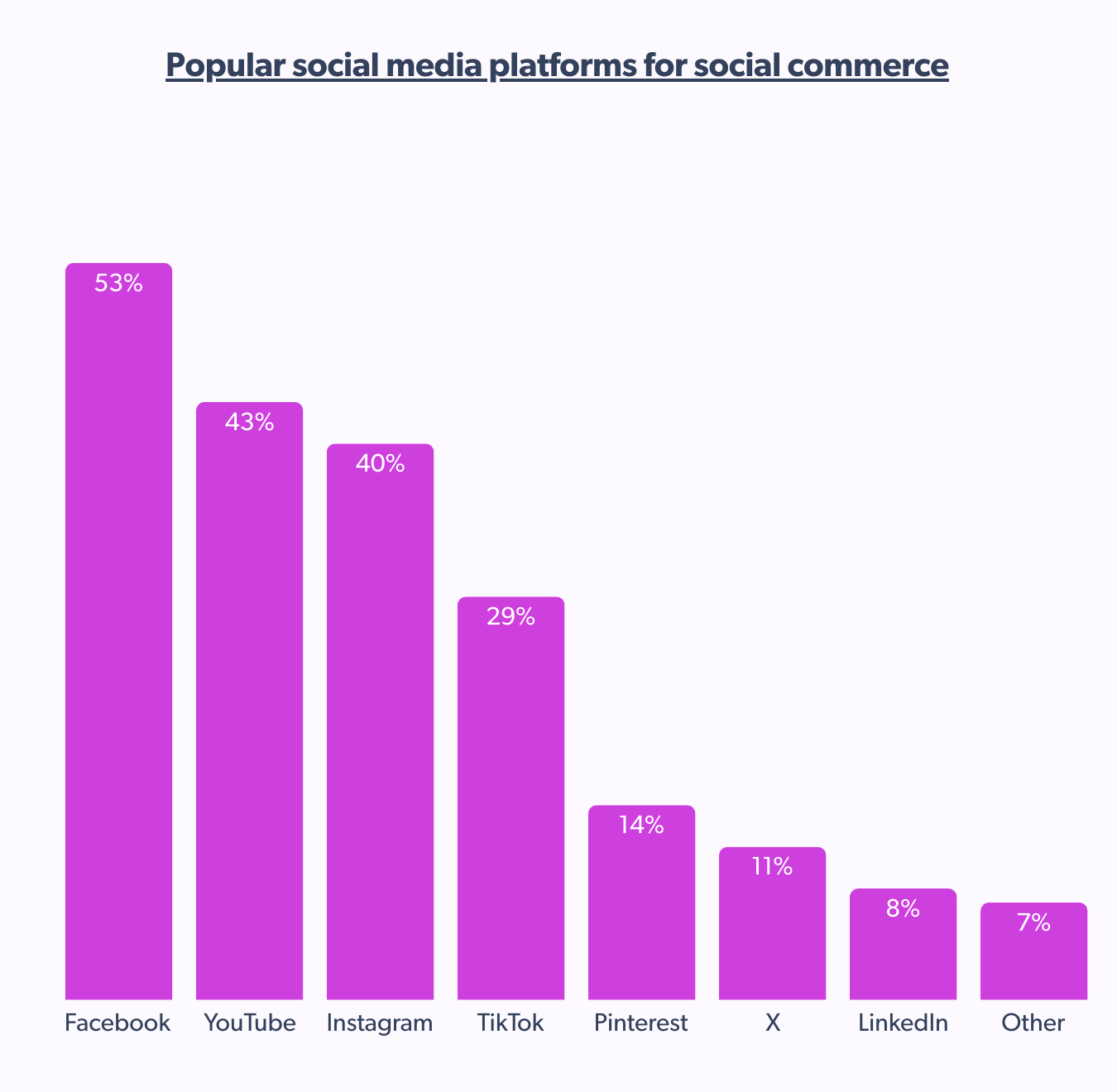

Globally, Facebook has been the top choice for making direct purchases. So is the case for Canadian shoppers, with 53%, higher than the global average of 52%. YouTube made it second place, and Instagram a close third, depicting the Canadian consumer trend of how-to video content influencing the shoppers.

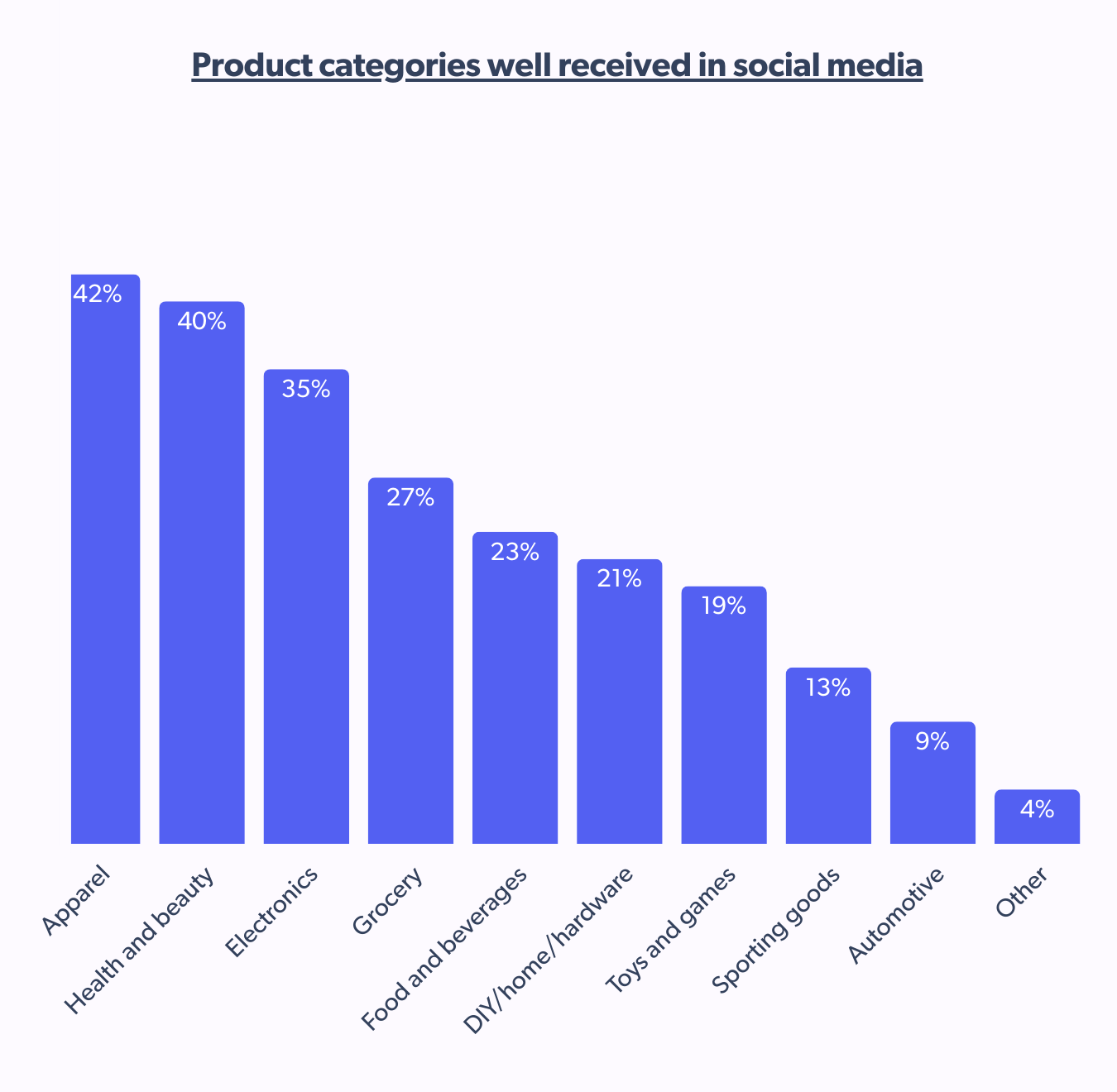

Canadian shoppers favor apparel, and health and beauty purchases on social media, with electronics and groceries also showing strong engagement at 35% and 27%, respectively.

While Facebook maintains a community focus and YouTube provides long-form content, Instagram and TikTok’s shoppable features and short-form video formats drive apparel and health and beauty sales.

Conclusion

From the acceptance of store brands to the multi-point buying journey and rise of social commerce to the trust in creator content, everything has a story tied to the value-driven mindset of Canadian shoppers.

Learn more about Canadian consumer trends and gain insights for your retail business or brand from Shopper Preference Report 2025.