July 11, 2025

This holiday season, the 35-54 year old (millennials) demographic is bringing intentionality, practicality, and a healthy dose of discernment to their shopping habits.

They’re not cutting joy out of their celebrations but just spending smarter. This is the group that blends old-school confidence with modern digital habits, toggling between online research and in-store experiences, gift guides and Google.

If brands and retailers want to win their loyalty, they’ll need to meet these shoppers where they are. Bazaarvoice Holiday Consumer Report 2025 will help you gather all the insights needed to reach out to these consumers.

1. How are 35-54 year olds rewriting the holiday spending playbook?

Forget mindless splurging. Millennial holiday shoppers shop with purpose, balancing joy with smart planning, value hunting, and financial discipline. They’re cutting back, but not cutting corners as 62% of 35-54s plan to spend less this year, showing restraint and control amid economic uncertainty.

- They know value when they see it

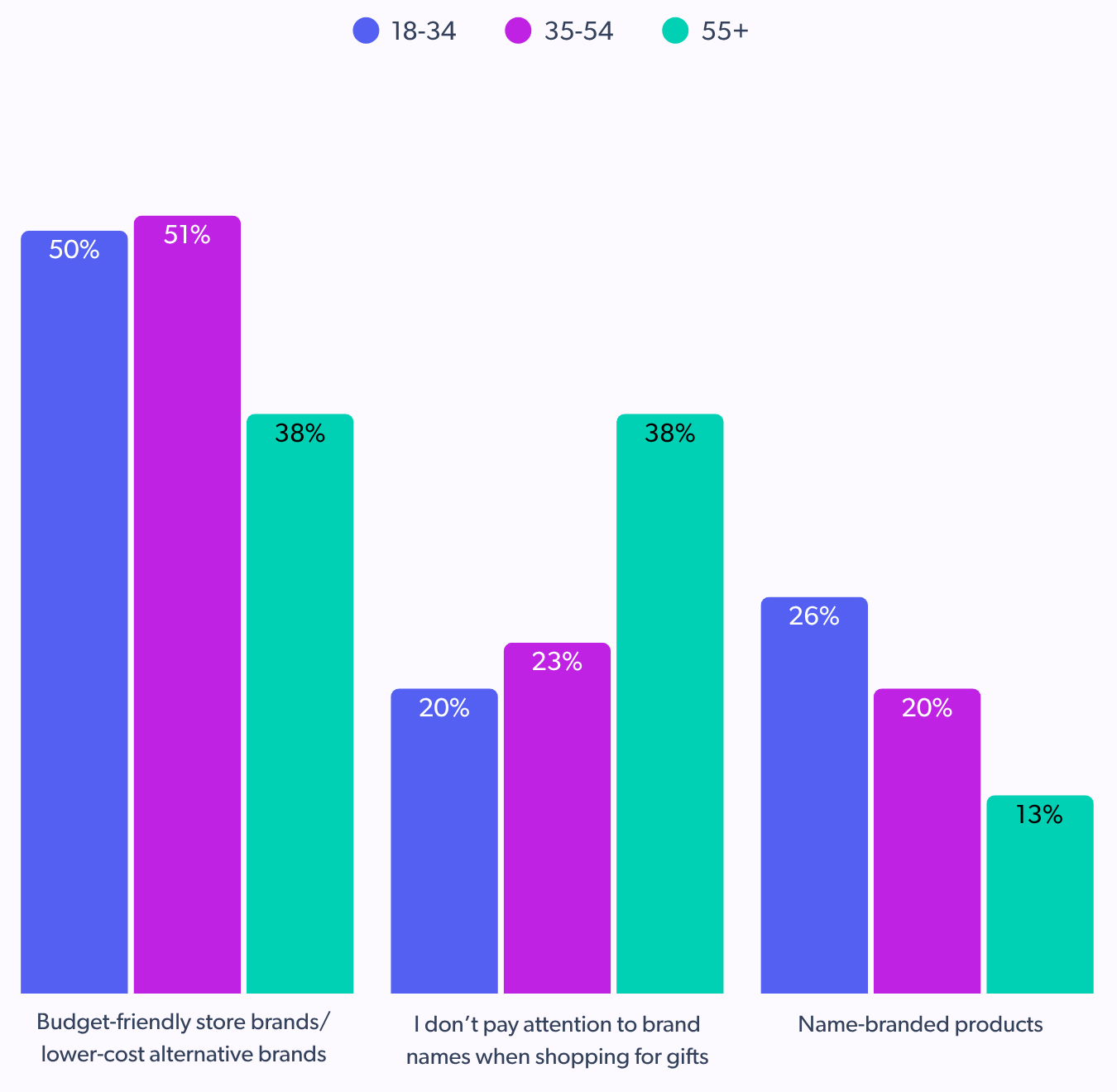

51% are prioritizing budget-friendly buys. They want deals, not duds.

- Three spending styles, one smart shopper

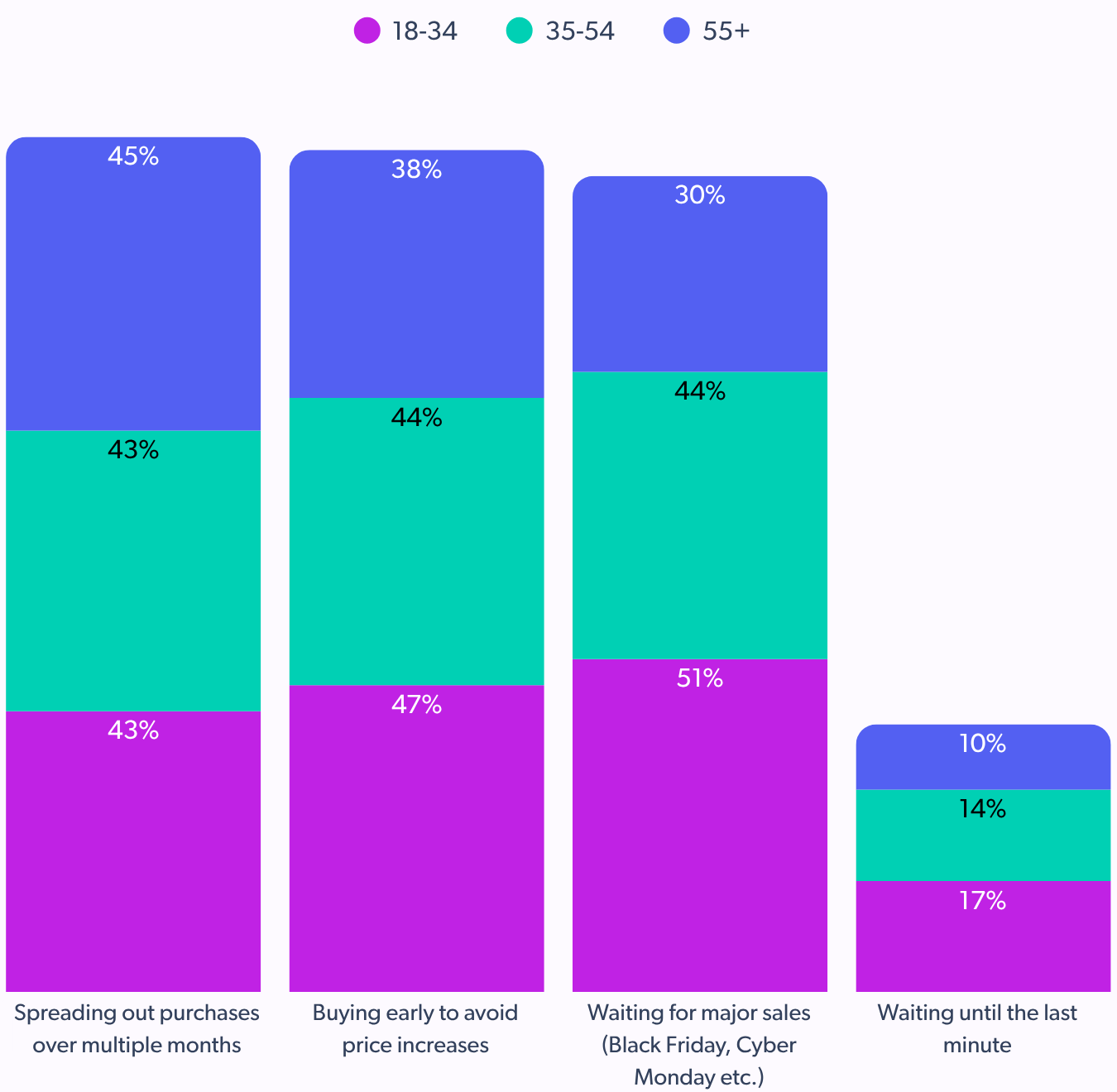

This group is split across strategies. At least 44% are buying early to beat price hikes, while 44% are waiting for big sales, and 43% are spreading purchases across months.

- They’re not waiting for December to get festive

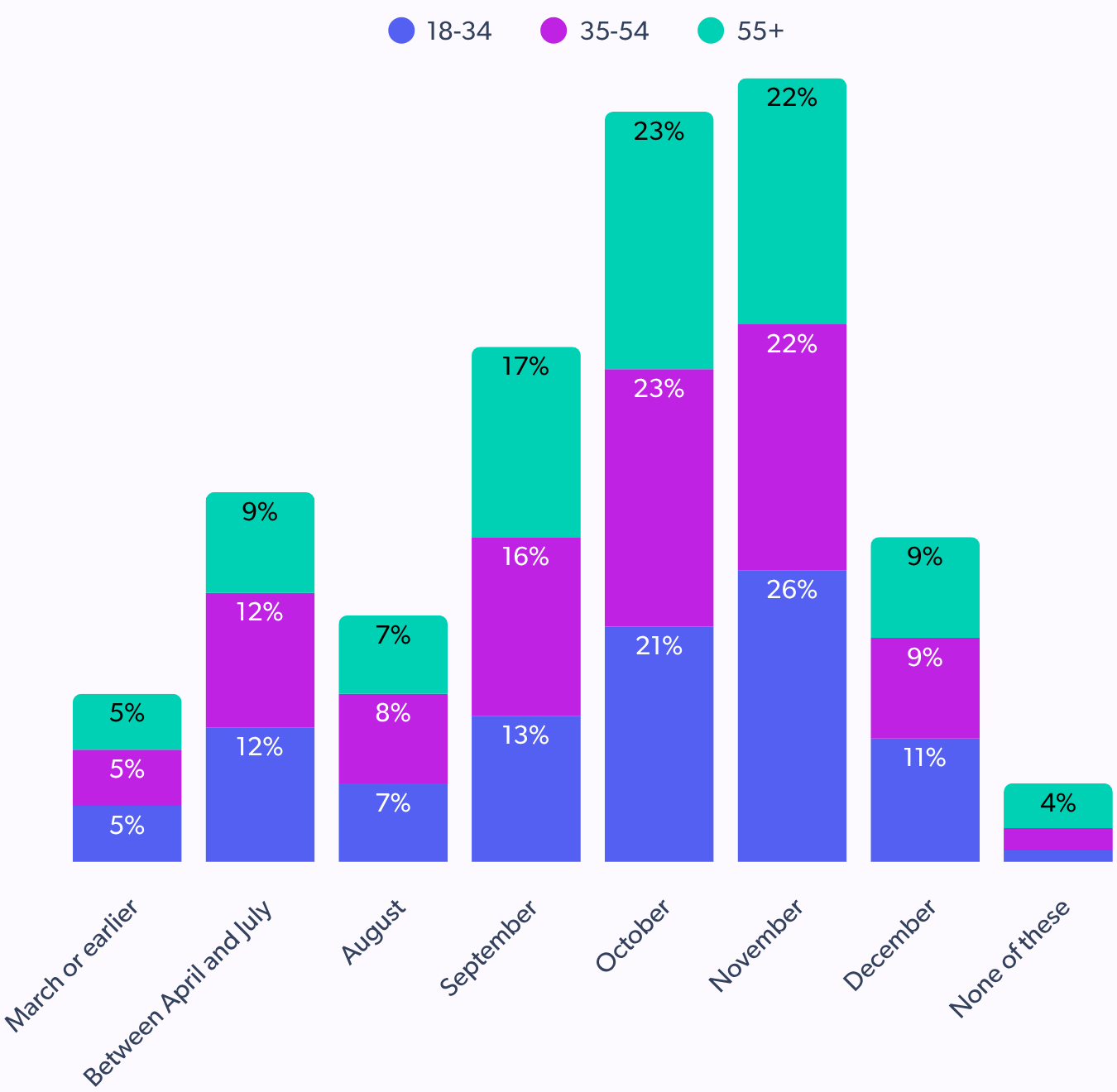

Shopping starts early, with 16% starting in September and peaks in October (23%) and November (22%).

Callout: To capture the attention of 35-54 year old shoppers, brands should plan promotions in waves, extending beyond just Black Friday or Cyber Monday. Consider segmenting offers to appeal to different shopping styles – early birds, deal-hunters, and long-haul planners.

2. Is flexibility their favorite perk this season?

Only if it’s practical. Millennial holiday shopping is about a good deal but not at the cost of convenience or control.

- BNPL? Only if it fits the budget

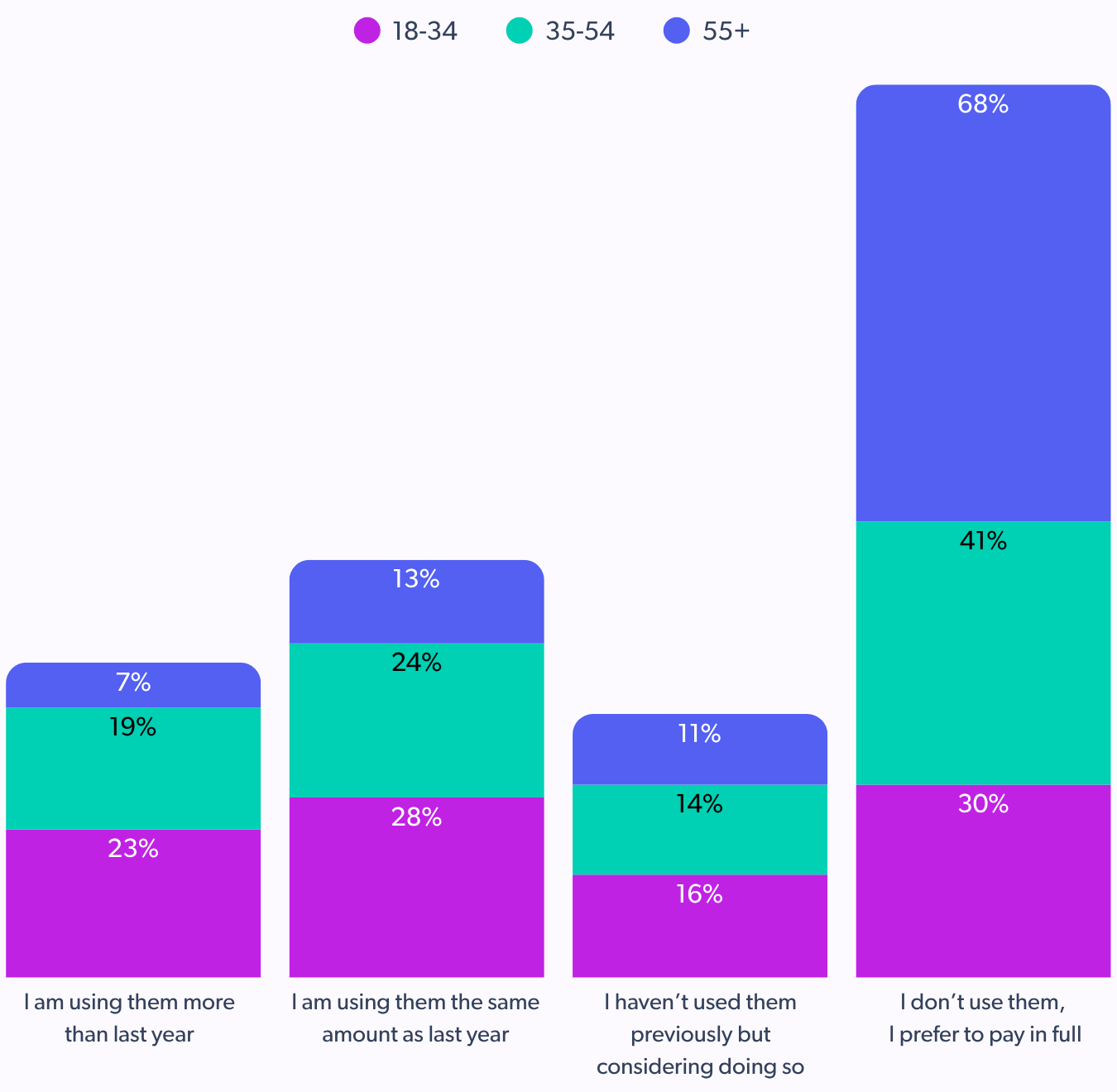

41% say they don’t use Buy Now, Pay Later, but 43% are open to it, suggesting cautious experimentation.

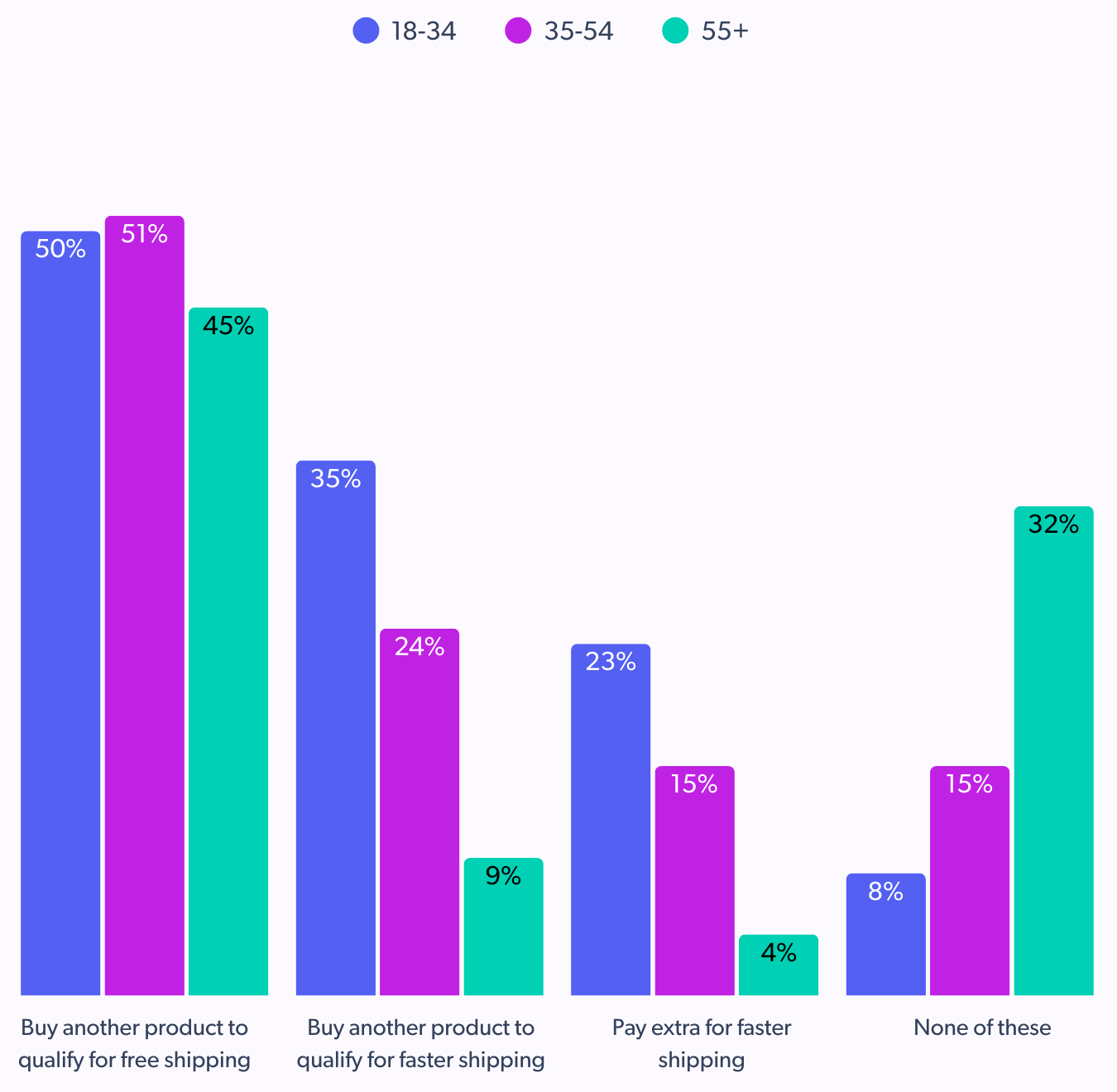

- Free shipping is the real flex

51% would add items to qualify for free shipping. Only 15% are willing to pay extra for faster delivery.

Callout: To cater to the practicality of these shoppers, brands should prominently highlight free shipping thresholds over express delivery options. Implement bundle promotions that make it easy and obvious for shoppers to qualify for free shipping, such as “Spend $X more to get free shipping” or “Buy these two items together and get free delivery.

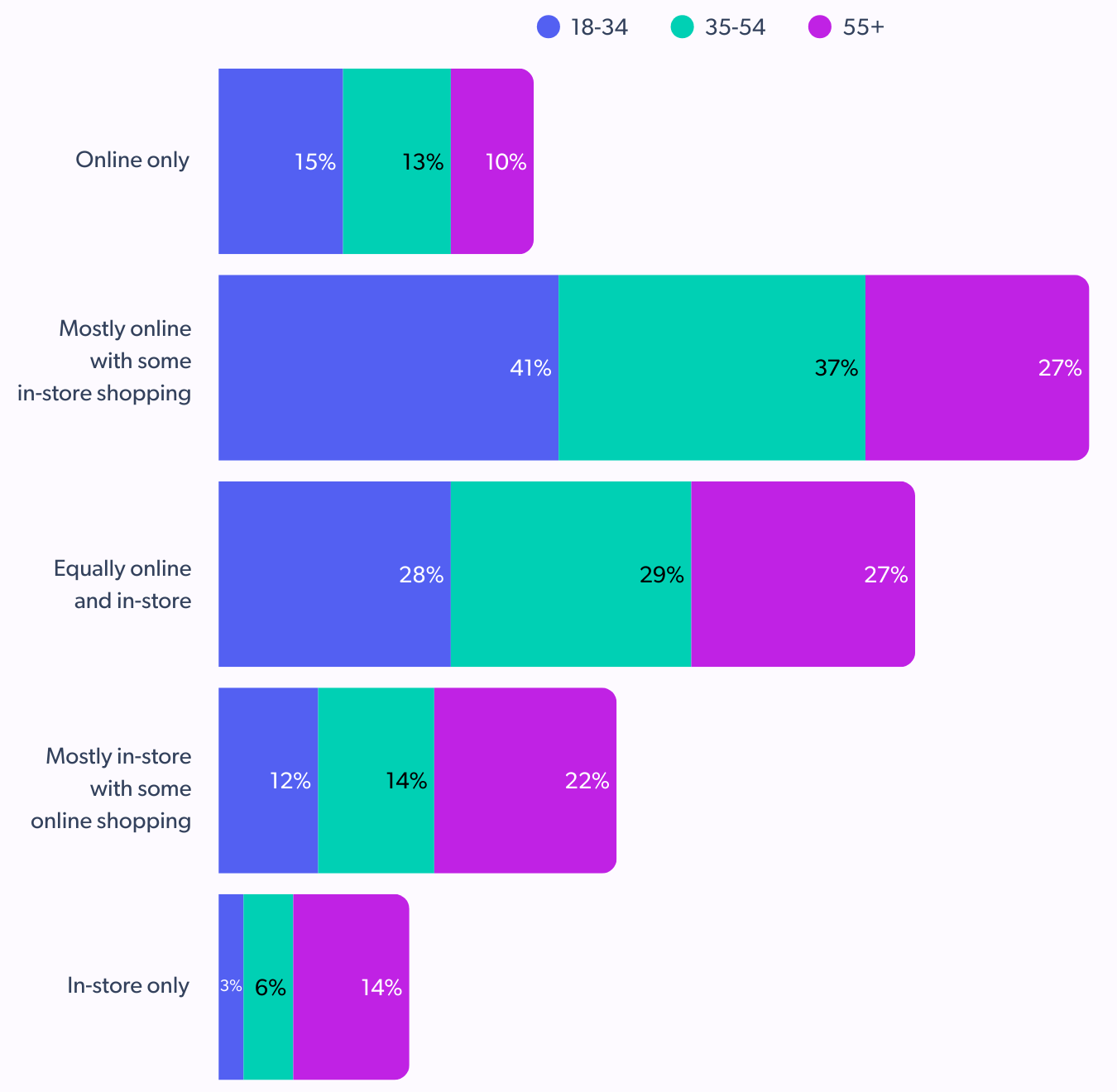

3. Are they loyal to online shopping or still roaming the aisles?

Both. Meet the hybrid holiday hero, shoppers are scrolling, searching, and strolling their way to the perfect gift.

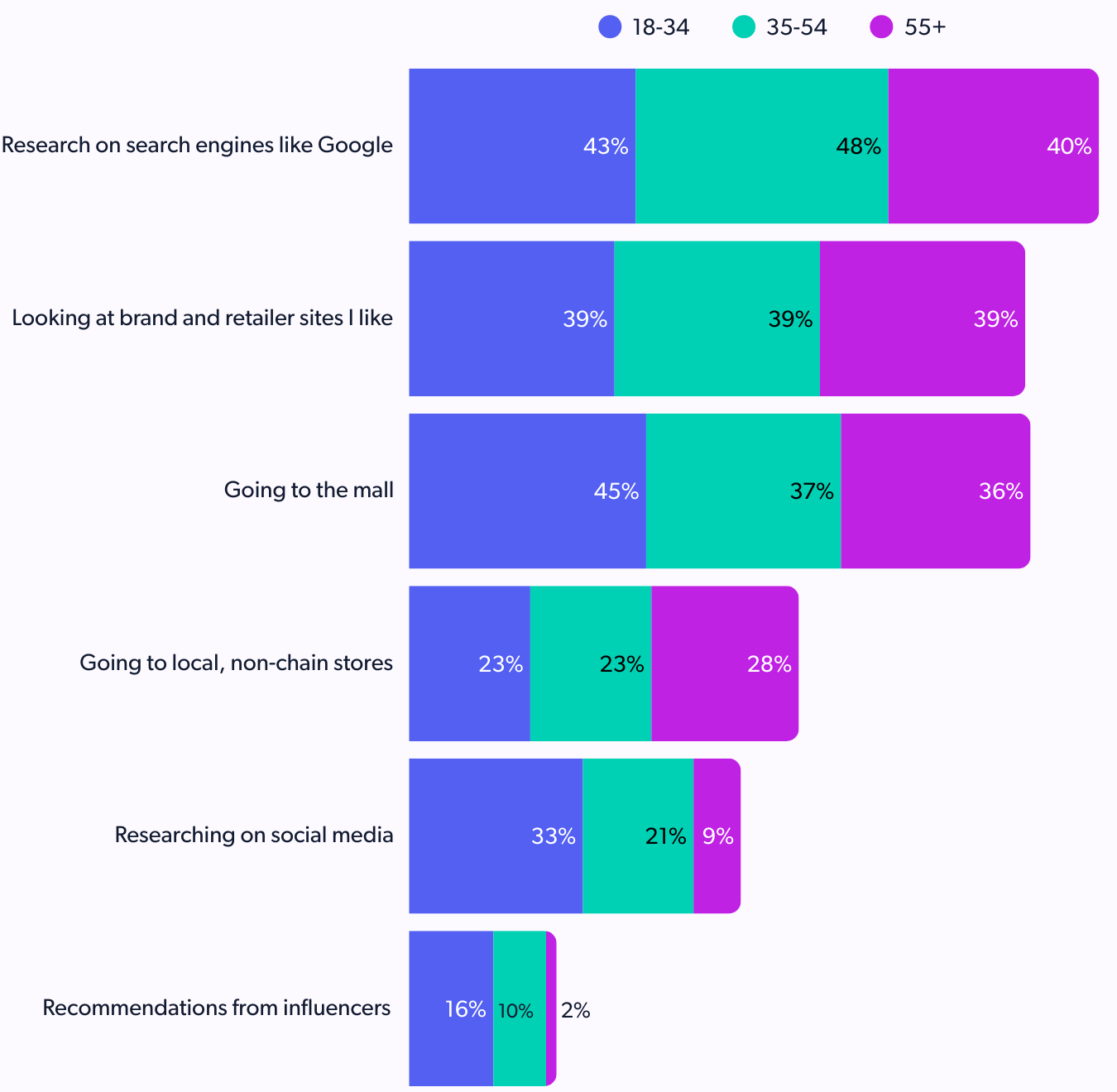

- Search is their starting point

48% begin their shopping with Google. SEO and product discoverability are key. 37% begin their gift hunt in-store, lower than Gen Z but still meaningful.

- Digital meets physical in a near-even split

50% lean digital, while 49% still rely on in-store experiences. Even holiday gift discovery is digital.

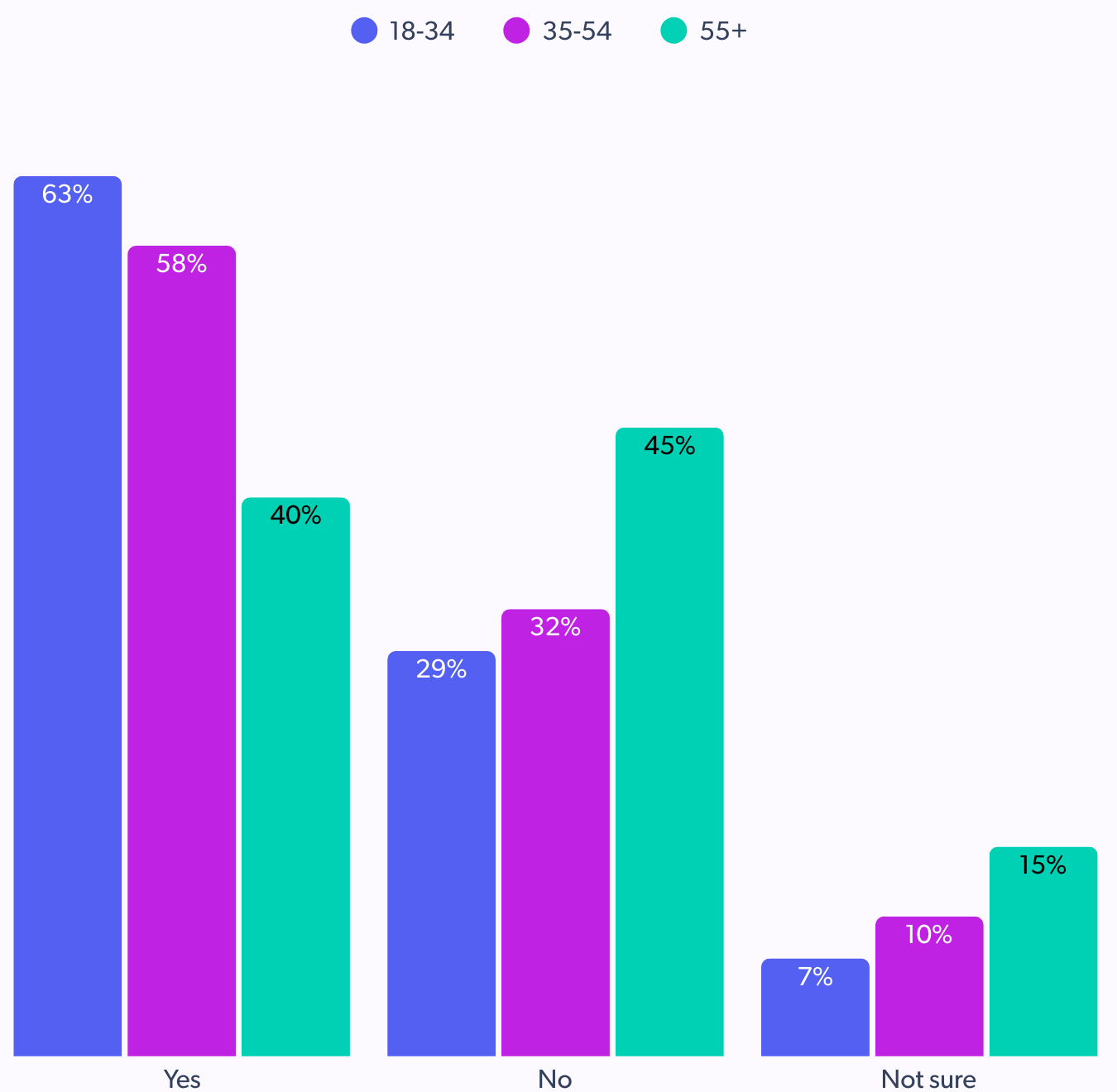

- They research before they swipe

58% research online before buying in-store last year. A product page could make or break a sale.

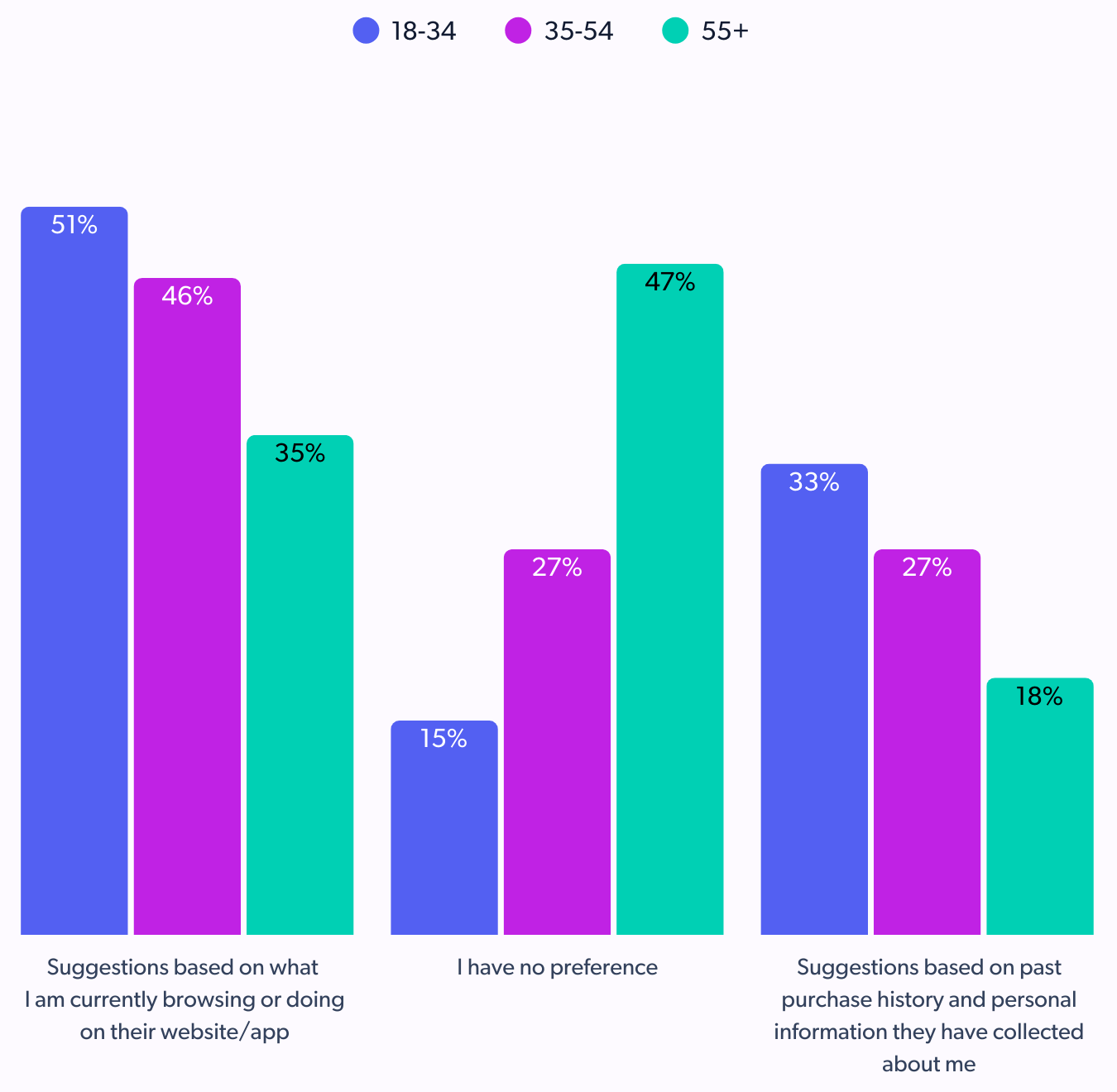

- They expect smart suggestions

46% want real-time recommendations based on current browsing, while at lest 27% want suggestions tied to past purchases.

Callout: Brands must seamlessly align their digital and physical touchpoints to cater to these hybrid shoppers. Implement behavior-based recommendations on websites and in apps to keep them engaged throughout their journey.

This includes showing “Customers who viewed this also bought…” or “Based on your Browse history, you might like…” suggestions, both online and potentially through in-store digital displays. Ensure product information is consistent and comprehensive across all channels, as shoppers are researching online before buying in-store.

4. Is social media shaping what they buy or just what they see?

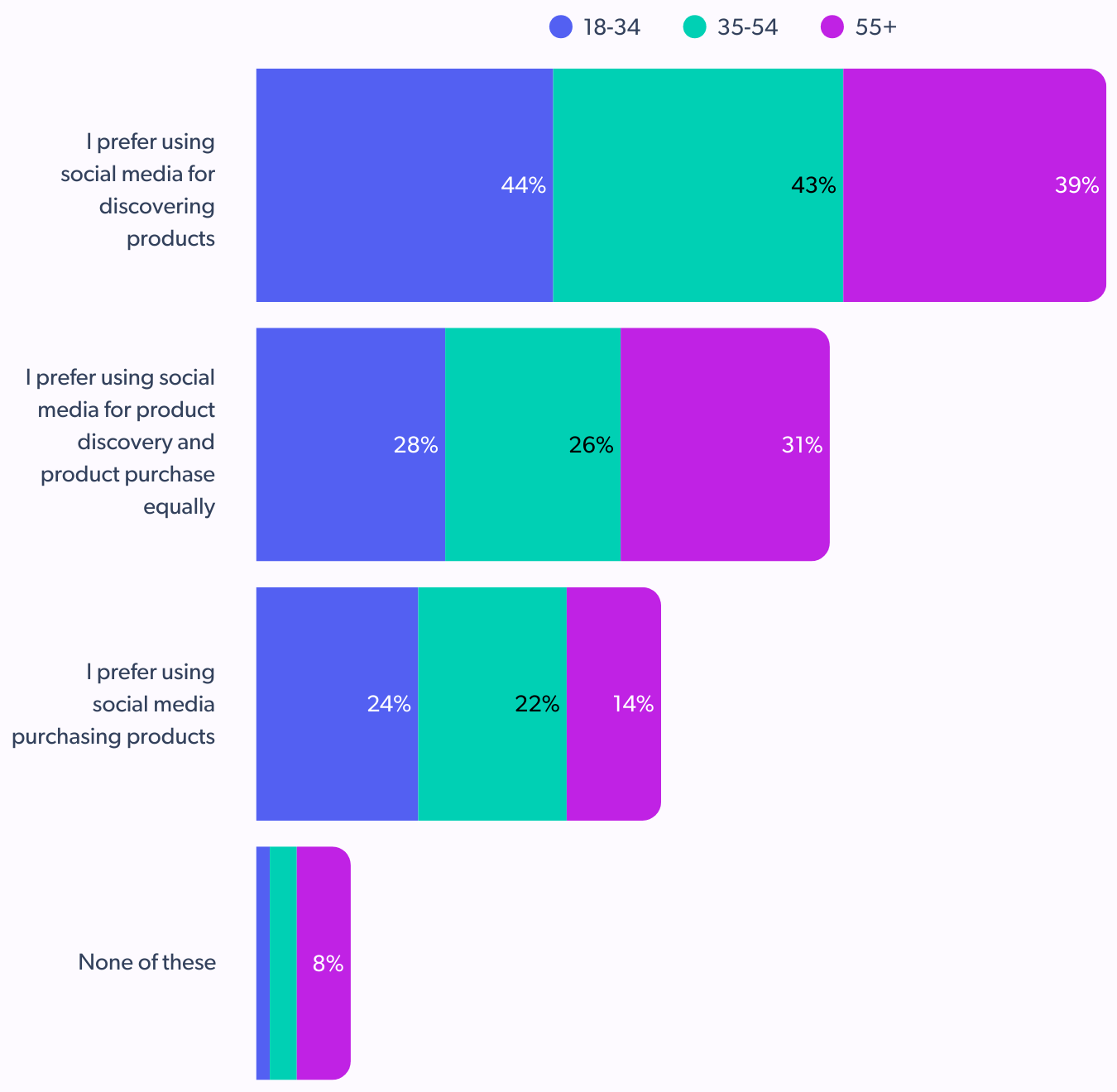

It’s mostly a discovery engine. Social media sets the stage, but the transaction often happens elsewhere. 57% have discovered gift ideas via social media but 66% have never bought directly through it.

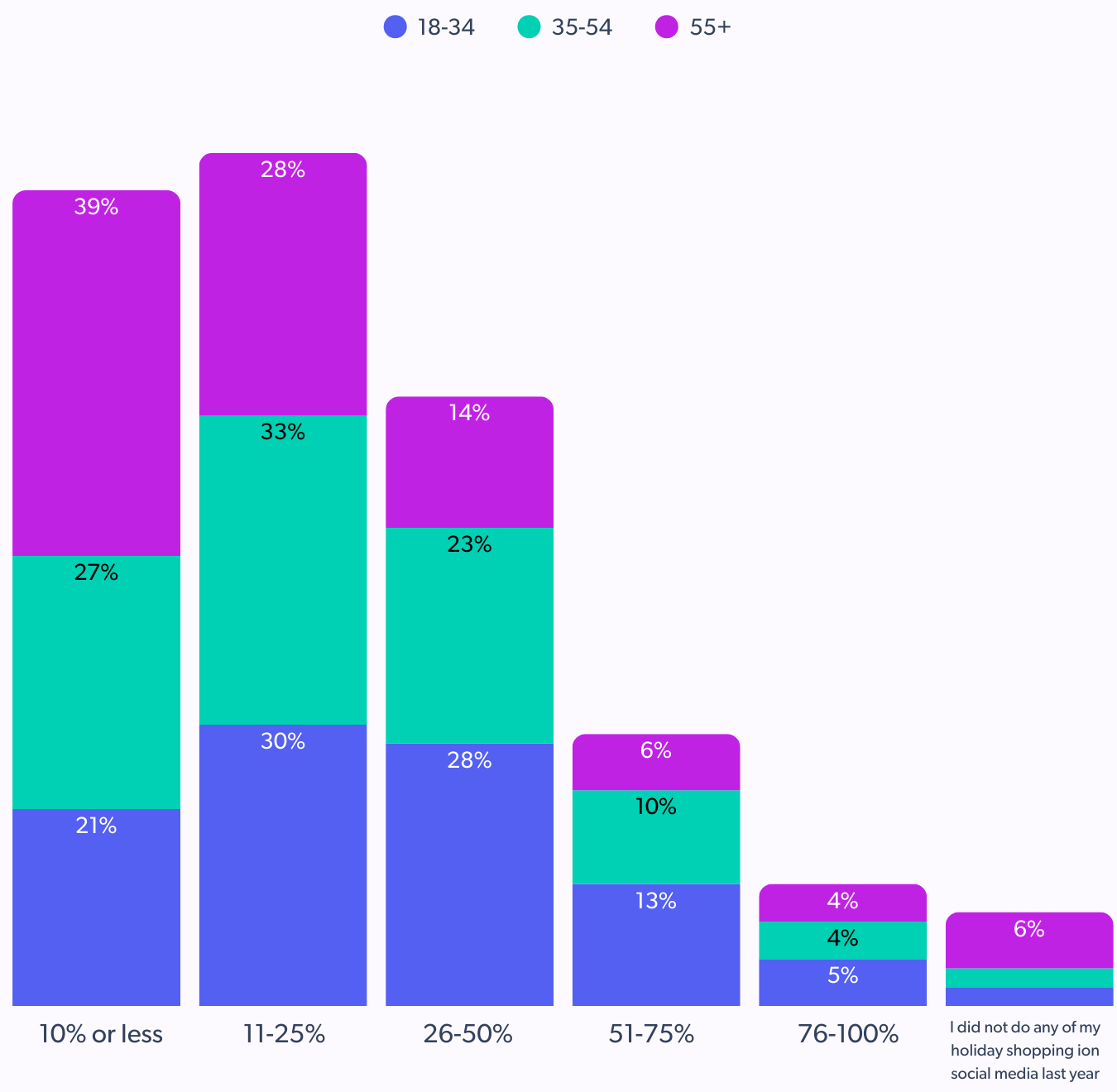

- Casual shoppers on social

33% do 11–25% of their shopping on social media, but only 14% do more than half.

- Discovery dominates the funnel

43% use social for discovery, while at least 26% complete the purchase journey there. In 2025, only 27% plan to shop via social media in 2025, highlighting interest is low but interest is steady.

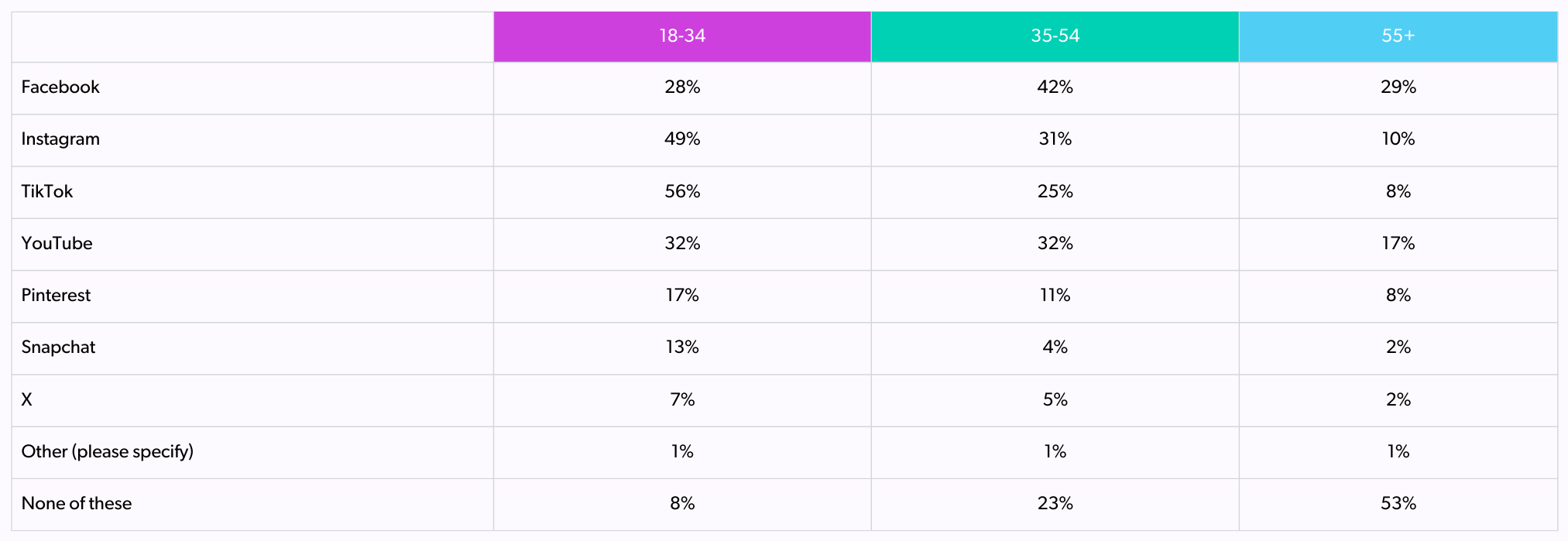

- Facebook is their favorite festive platform

A complex social commerce landscape exists where different generations interact with different platforms. 42% of mature millennials use Facebook most for holiday shopping, followed by YouTube (32%) and Instagram (31%).

Callout: Create engaging content that highlights gift ideas, product features, and brand stories, encouraging users to then visit the brand’s website or physical store to complete their purchase. Tailor content to platforms, recognizing Facebook’s strong preference among this demographic.

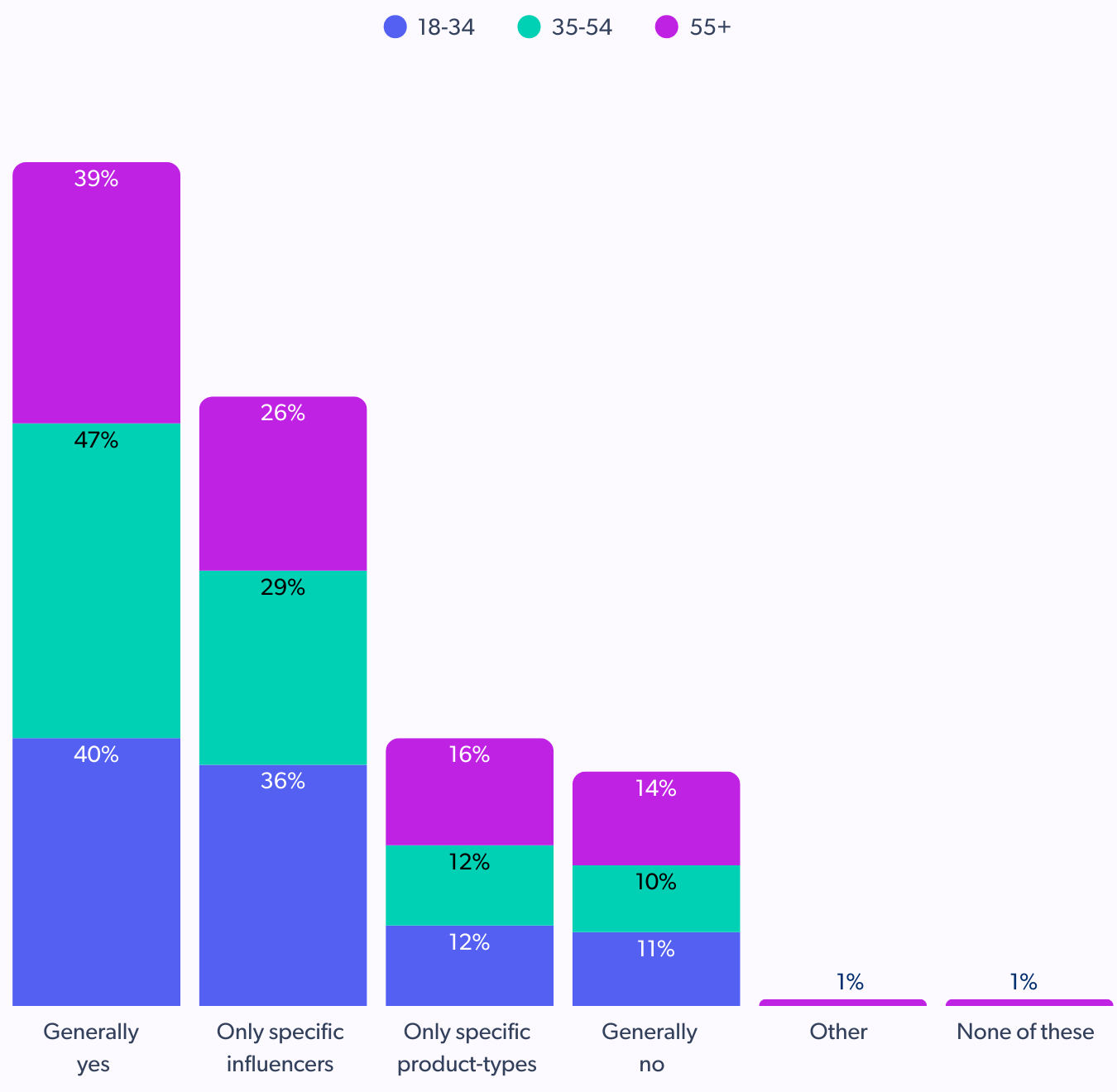

5. Do they trust creators with their holiday lists?

They’re not easily swayed, but when trust is earned, creators can influence real decisions. The generation trusts content creators but cautiously as 29% have bought products based on creator recommendations.

- Surprisingly high trust during holidays

47% trust creators during the holidays, the highest of any age group.

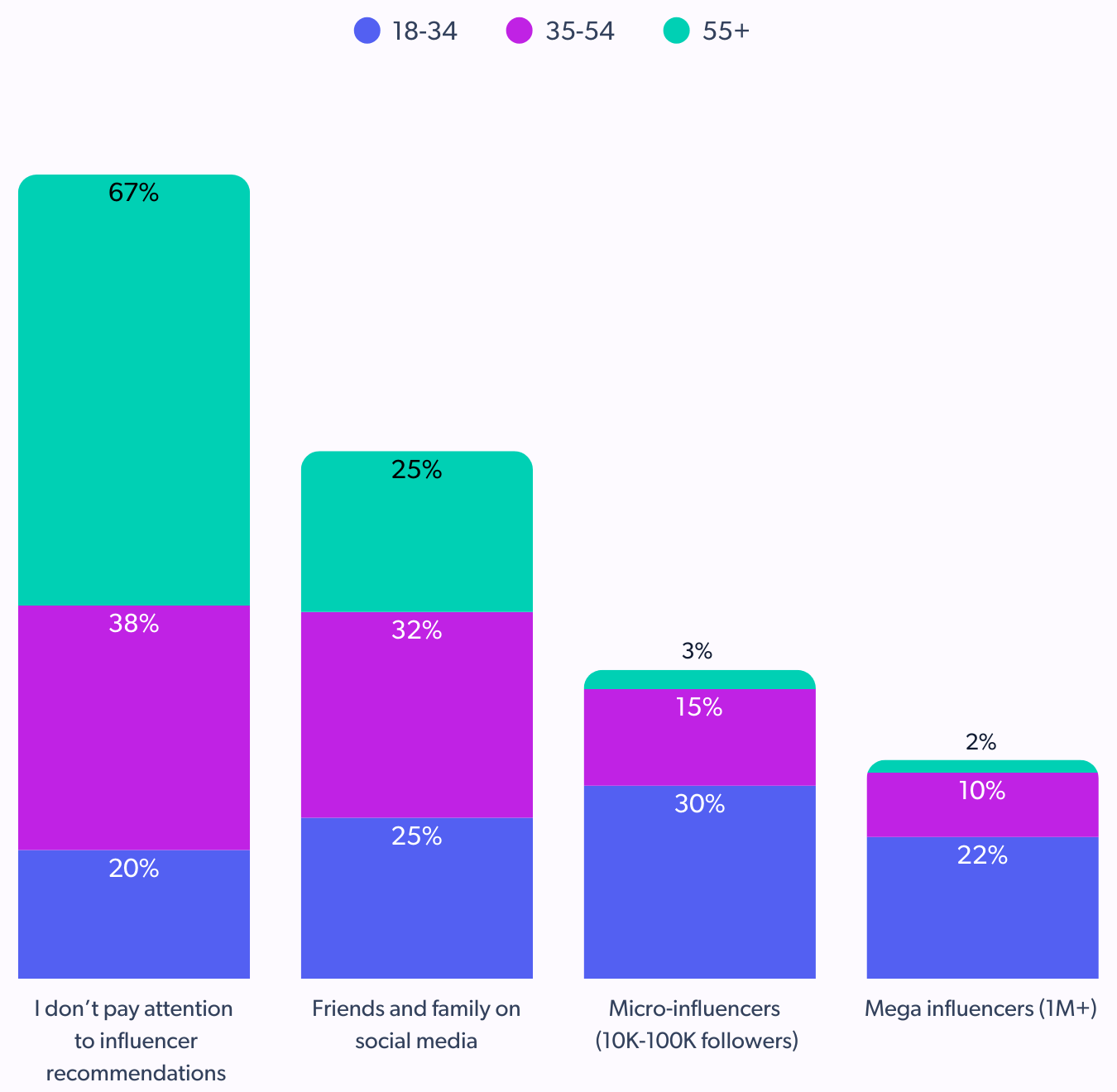

- They turn to people they know

32% trust friends and family on social media more than influencers. But many scroll right past as 38% don’t engage with influencer recommendations at all.

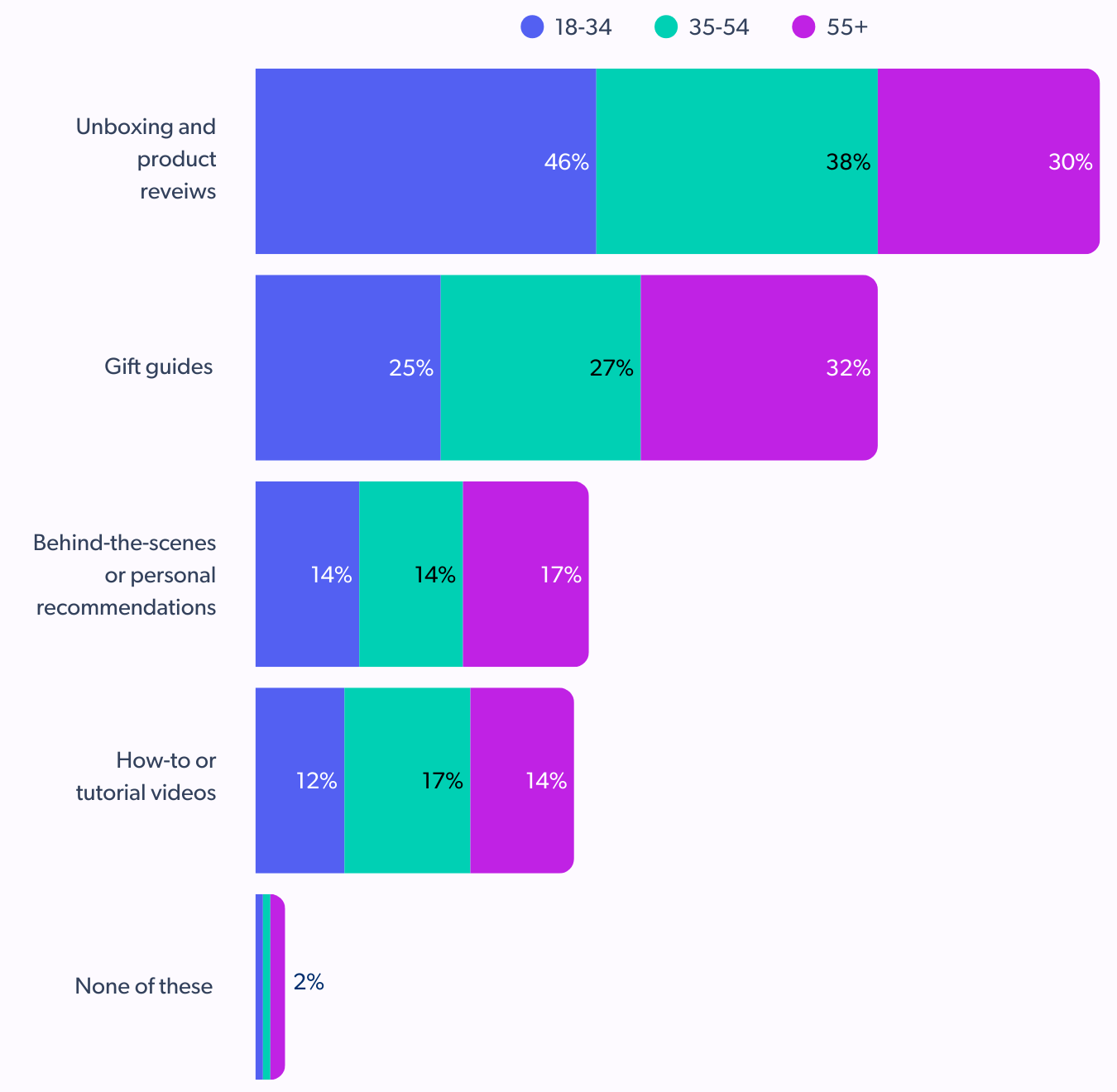

- They want demos, not drama

38% find unboxings and reviews most helpful; 27% prefer curated gift guides.

Callout: To effectively influence 35-54-year-old shoppers, collaborate with creators who prioritize usefulness and authenticity over flashy presentations.

Lean into educational content like how-to videos, product demonstrations and practical applications of products. Foster peer-like trust by featuring creators who genuinely align with your brand values and can offer relatable insights, akin to recommendations from friends and family.

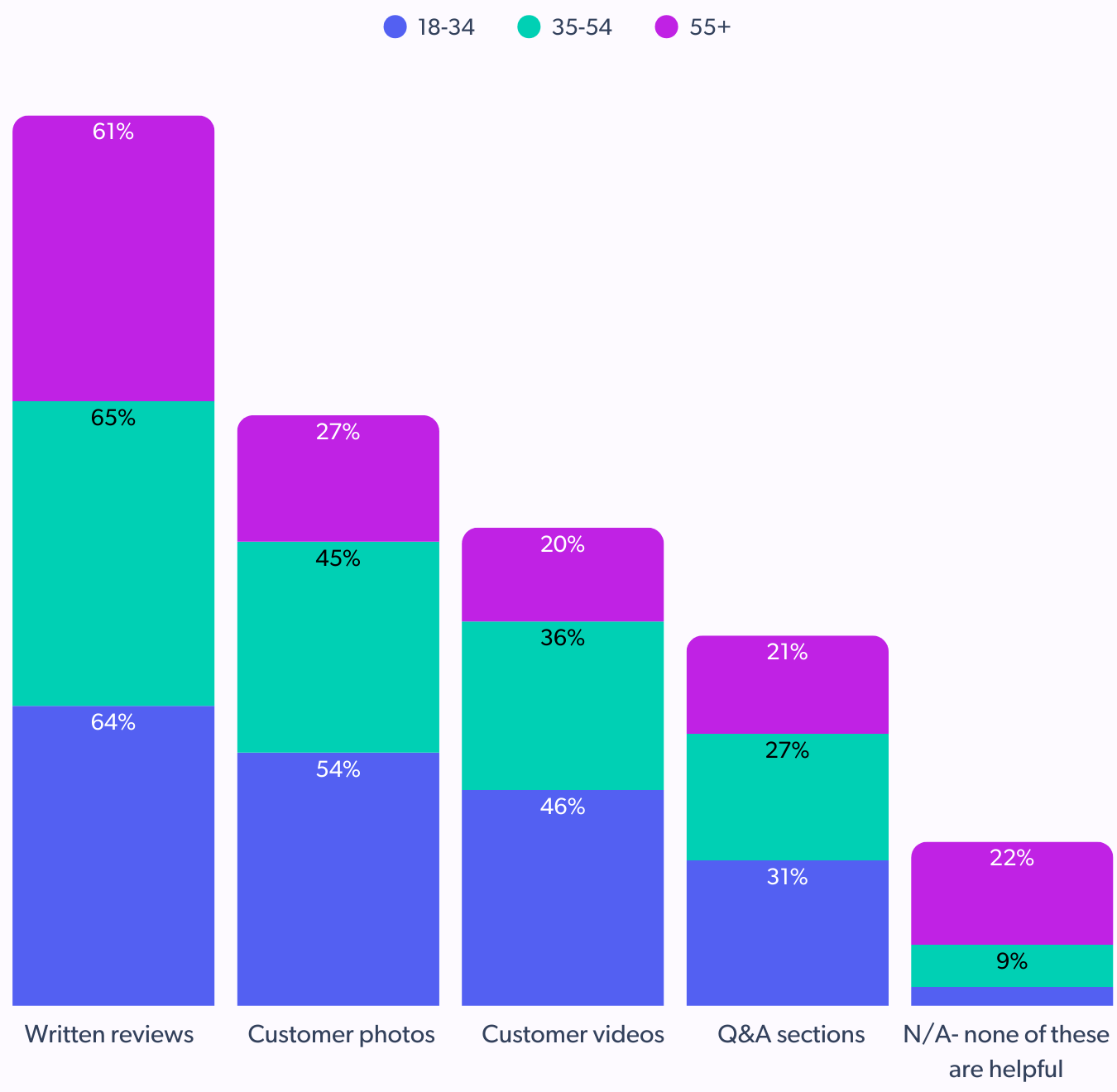

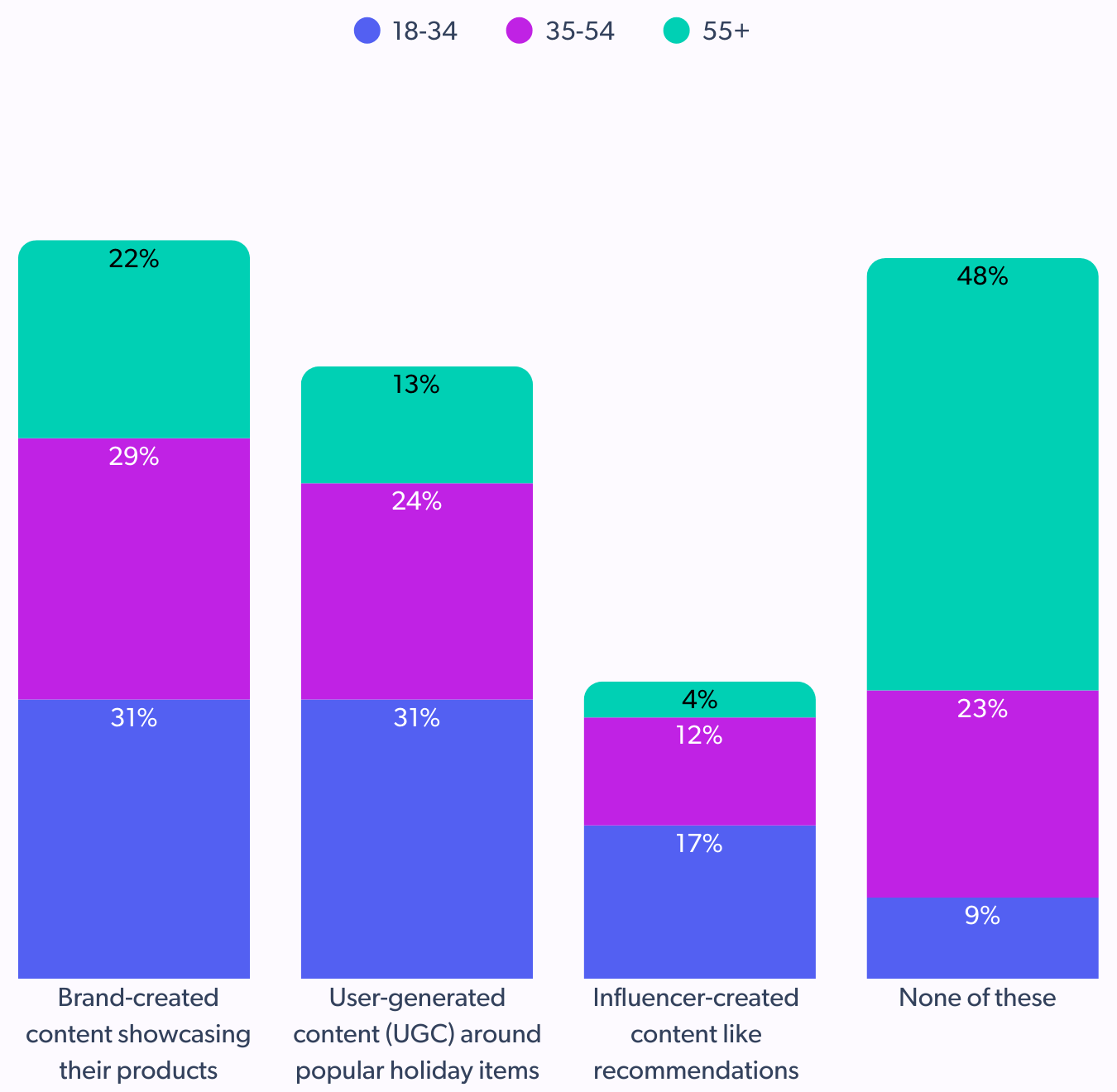

6. What kind of content helps them choose gifts?

Real, relatable, and review-rich. They trust human experiences more than flashy campaigns.

- They read before they buy

65% find written reviews helpful when choosing gifts.

- They like it official, but not overdone

29% prefer brand-generated content, while 24% engage with UGC around trending items.

Callout: Brands should prioritize collecting and prominently displaying thoughtful customer reviews. Actively encourage customers to leave detailed written reviews, and where possible, include customer photos and videos. Leverage these real customer voices to validate your product story and build credibility, as authentic feedback resonates strongly with this demographic.

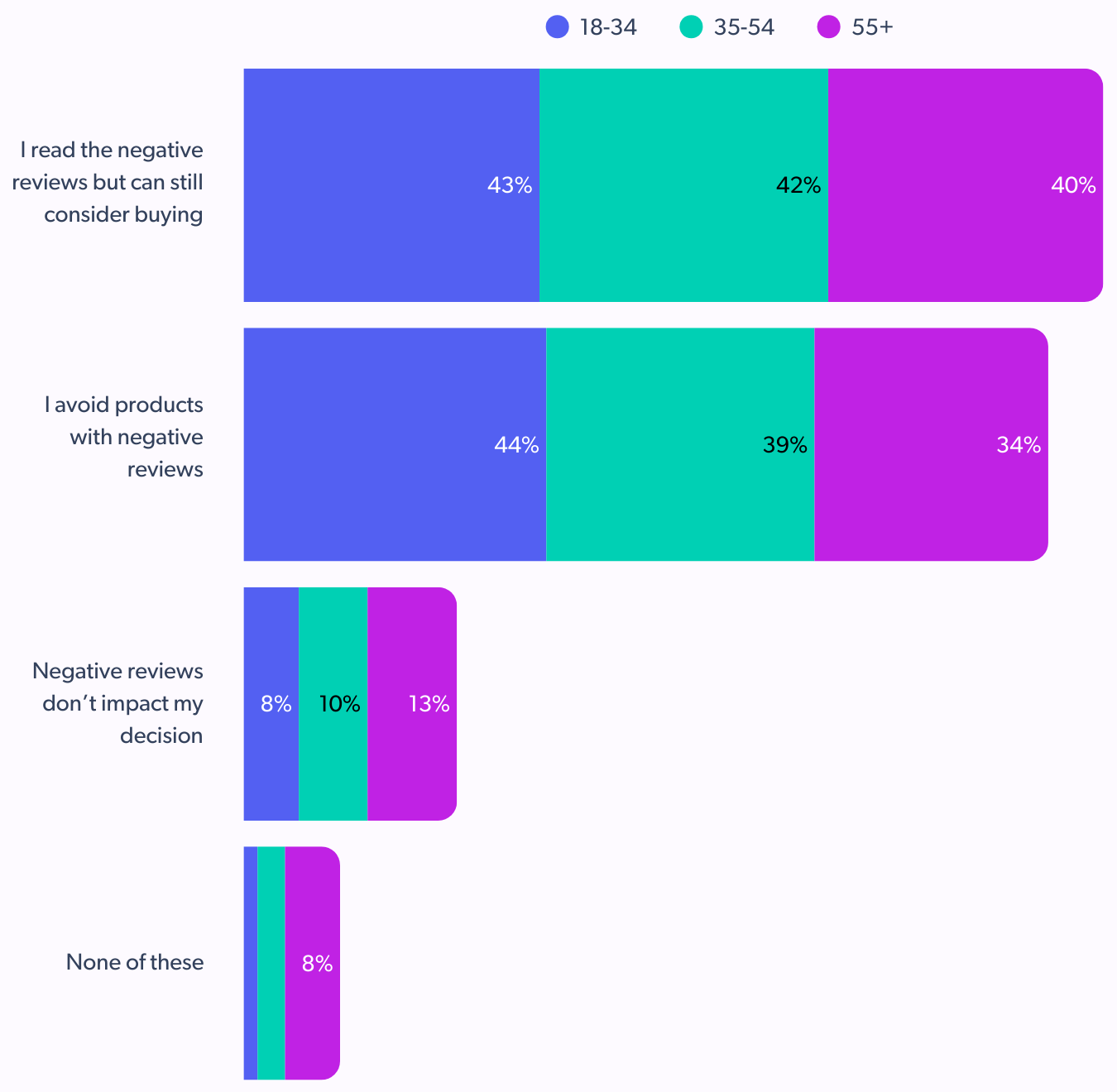

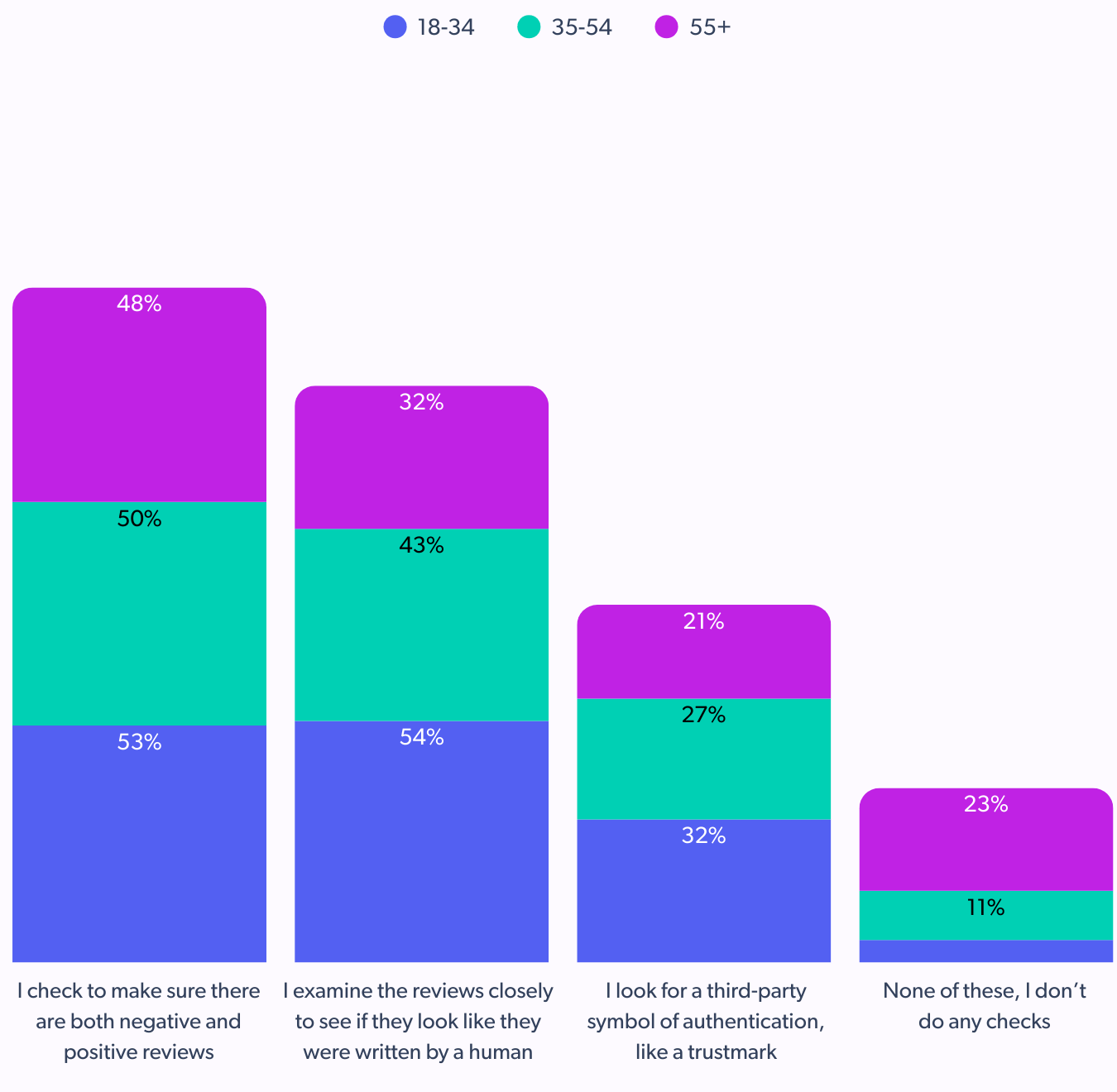

7. What makes them trust a brand during the holidays?

Authenticity, transparency, and a balance of polished content and people-powered proof.

- No reviews? No chance.

Only 25% would consider buying a gift with zero reviews.

- Negative reviews aren’t always dealbreakers

42% may still buy despite them, though 39% would walk away.

- They want the whole story

50% look for both positive and negative reviews; 43% examine them for human authenticity.

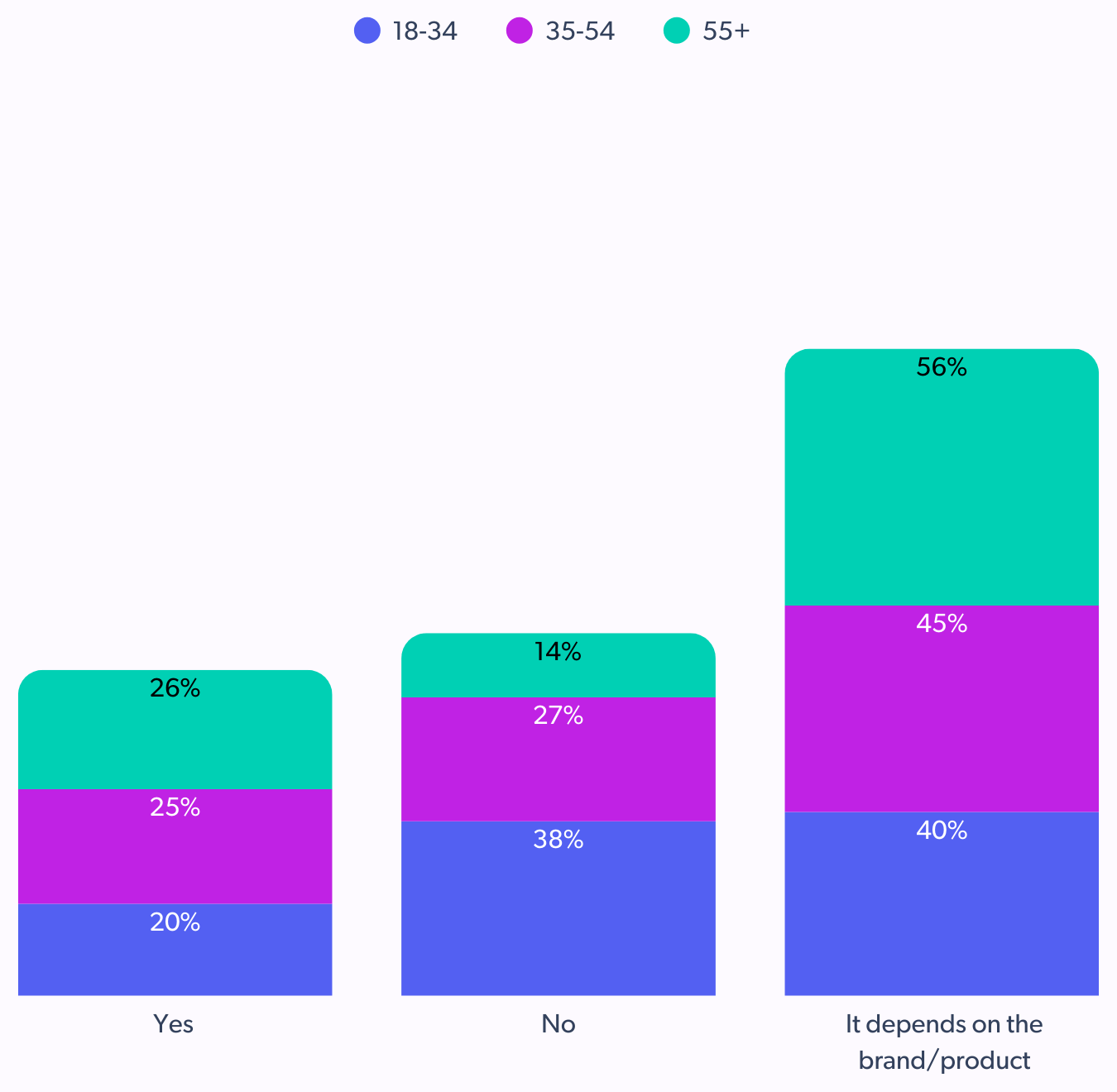

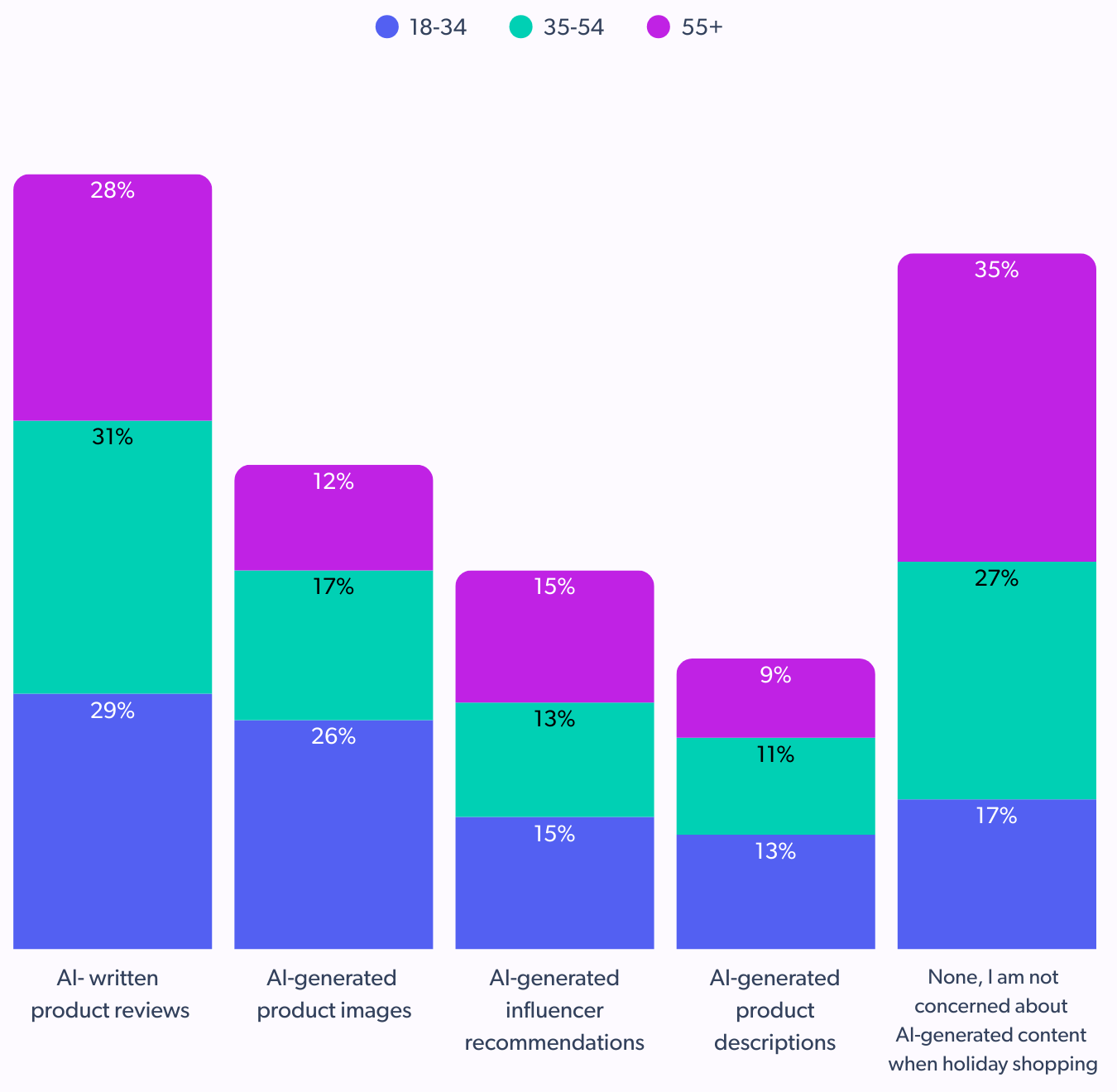

- AI content is under scrutiny

35% say “it depends” on whether they trust AI-generated posts, and 31% are concerned about AI-written product reviews.

Callout: Display a mix of positive and negative reviews, along with clear responses to negative feedback, can enhance credibility. Your best asset is real customer voices. Prioritize authentic, human-written reviews and be cautious with AI-generated content, especially for product reviews, to maintain trust.

Final thought

The 35–54 shopper is savvy, self-aware, and split across digital and physical worlds. They crave convenience but demand credibility. To win them over this season, brands must go beyond offers and algorithms and focus on trust, timing, and truth.

Learn more about the holiday shopping behavior here!