July 13, 2025

No demographic is shaping the holiday shopping season quite like the 18–34-year-old bracket a.k.a Gen Z holiday shoppers. Though they are the most satisfied shoppers this season, largely due to their comfort with digital tools and flexibility, the generation balances convenience, value, and intentionality.

The latest Bazaarvoice Holiday Consumer Shopping Survey 2025, unpacks how Gen Z holiday shoppers are planning their holiday purchases. Whether it’s jumping on early deals, balancing brand loyalty with bargain-hunting, or navigating AI-driven experiences with caution, Gen Z and young millennials are not impulsive buyers but strategic, savvy, and in control.

Let’s dive into the data behind how they’re filling their sleighs this season.

1. Smart spending by intentional shoppers

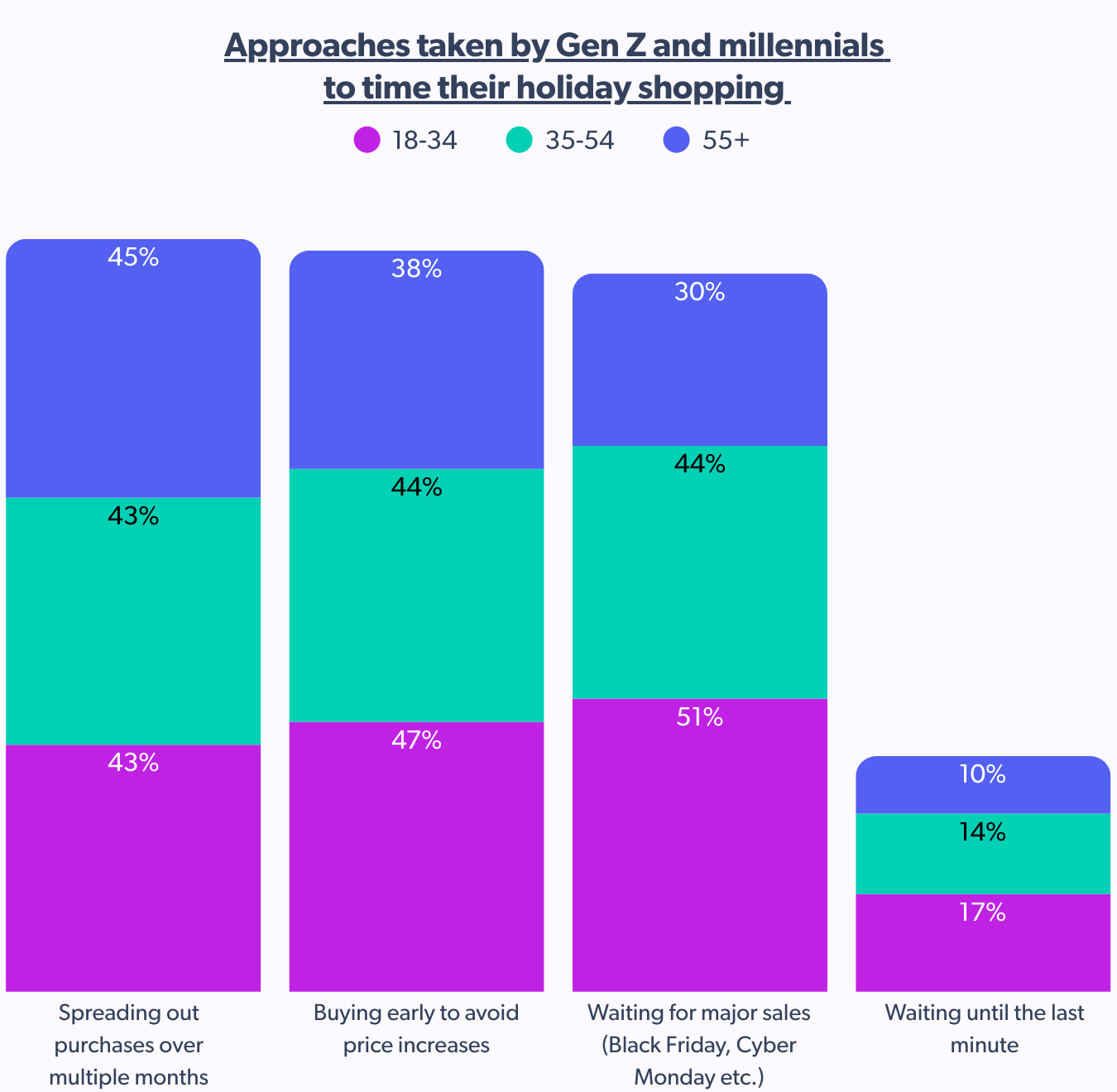

While the overall trend is shifting to intentional buying rather than being impulse driven, young shoppers are not left untouched. From focusing on major sales day to stretching their holiday spending over months and opting for budget-friendly options while leaning for name brands. Here are some trends young shoppers are highlighting.

- Defying the inflationary odds

While 3 in 5 consumers are tightening budgets, 18-34-year-olds are increasing holiday spending by 19%, more than double the 55+ group (7%). - The brand-conscious bargain hunter

There’s a noticeable paradox among younger shoppers: 26% prefer name-brand products and 50–51% seek budget-friendly options. Younger consumers are looking for value within the brand, combining quality assurance with price sensitivity. They’re not just hunting for deals; they’re curating smart, cost-effective choices. - The early bird catches the deal: Sales-driven shopping

Young shoppers are mostly sales-driven (51% vs. 30% older shoppers). 47% buy early to avoid price increases vs. 38% older shoppers.

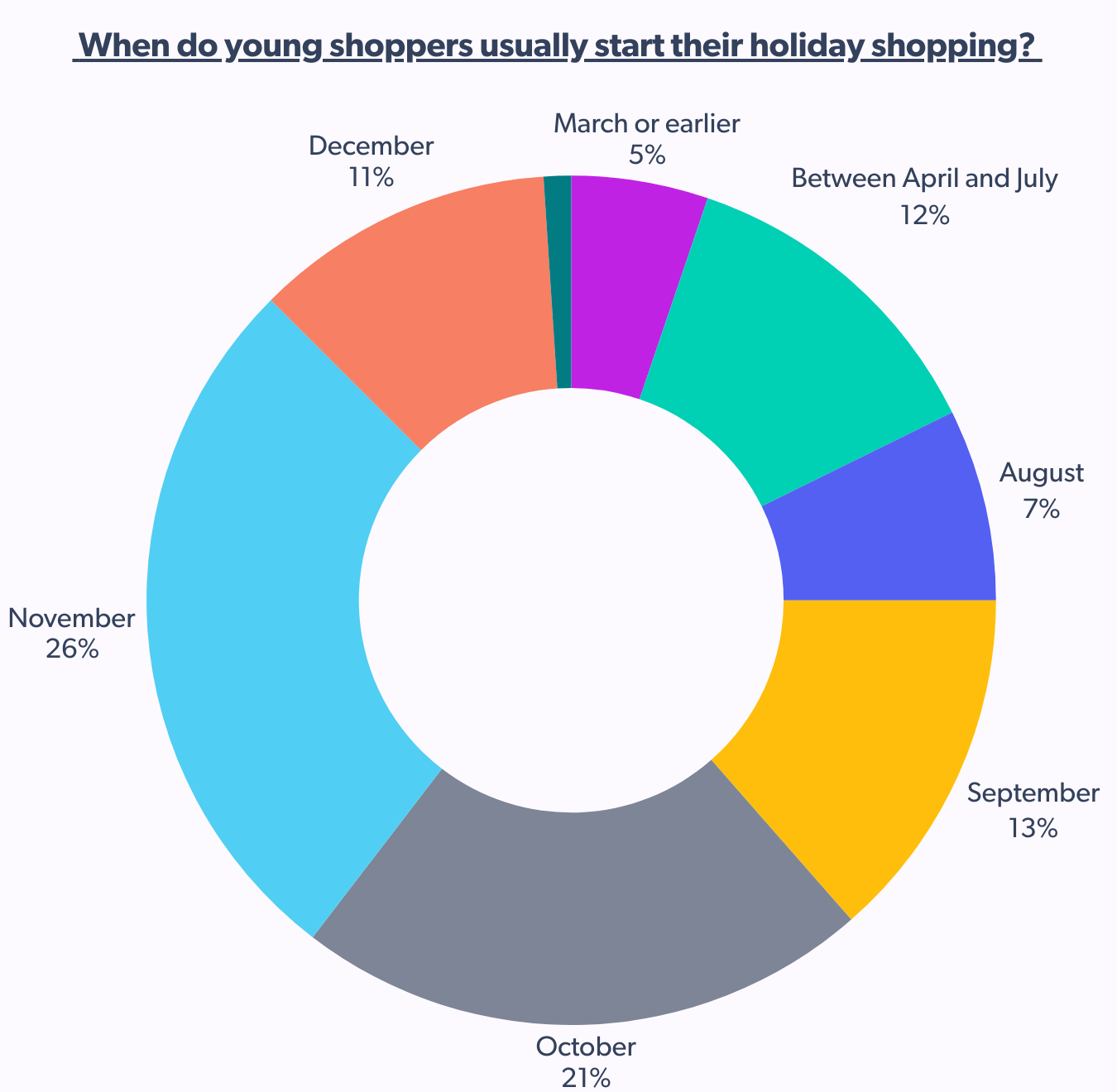

Here’s a look at how Gen Z and millennials are spreading their holiday purchases across months.

Callout: Young shoppers are intentional, not impulsive. Gen Z holiday shoppers are increasingly spending but on their terms, with early planning, brand-meets-budget choices, and a tactical approach to holiday sales. Brands that deliver value, flexibility, and early-bird promotions will win their wallets.

2. Payment flexibility: BNPL and speed sensitivity

Young shoppers are financially flexible but convenience-driven, a defining paradox in young shopper behavior. On one hand, they use tools like Buy Now, Pay Later (BNPL) to ease immediate financial burden, while on the other, they’re willing to pay a premium for speed and convenience, especially during time-sensitive occasions like the holidays.

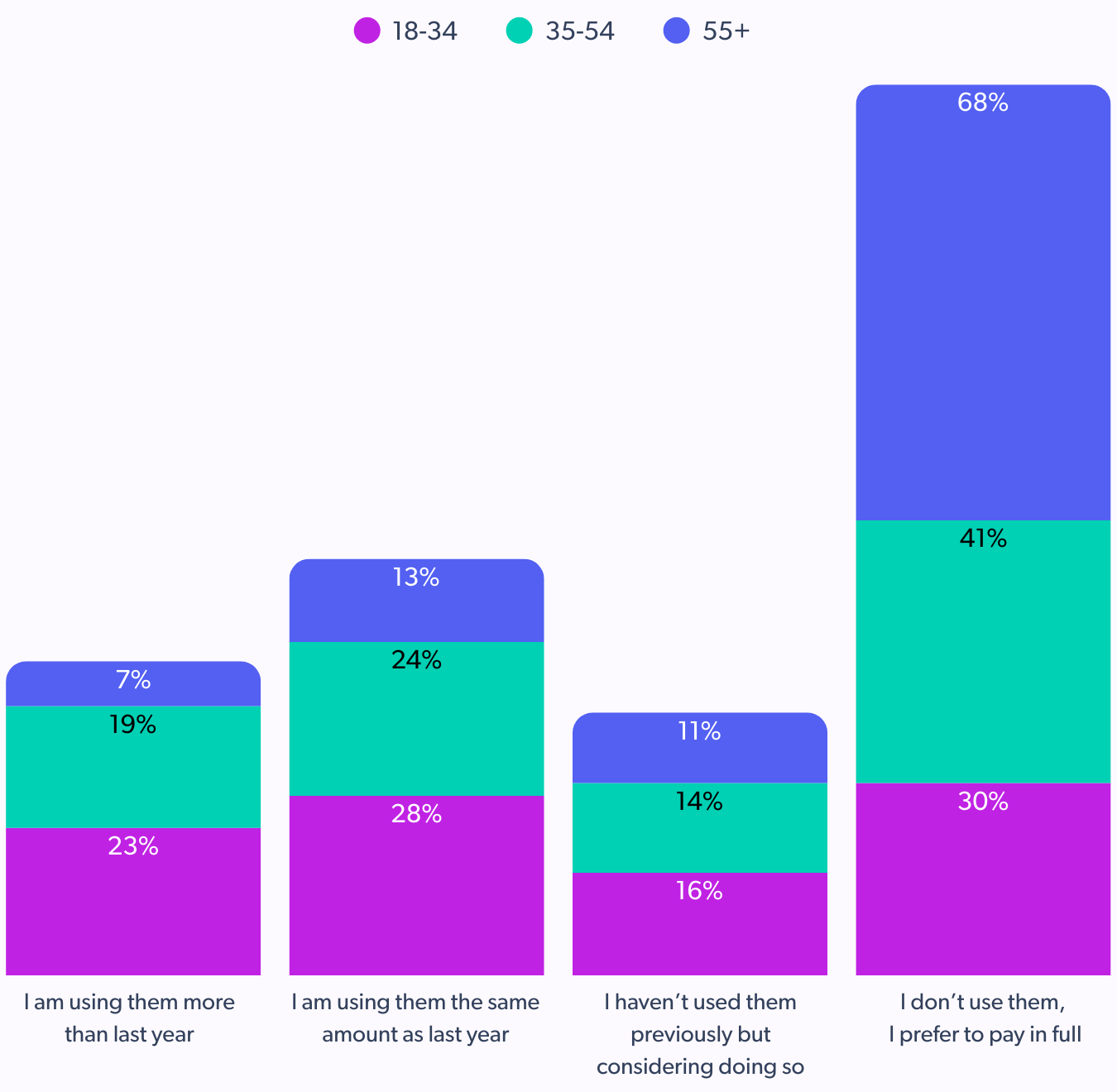

Several reports affirm that Gen Z and millennials are more open to BNPL. Clearly, they budget smartly (e.g., using BNPL), but splurge selectively (e.g., on express shipping).

- BNPL Usage is strongest among 18–34-year-olds

The data shows that among all the age groups, Gen Z are the highest users of BNPL. At least 51% of 18-34 year olds embrace BNPL.

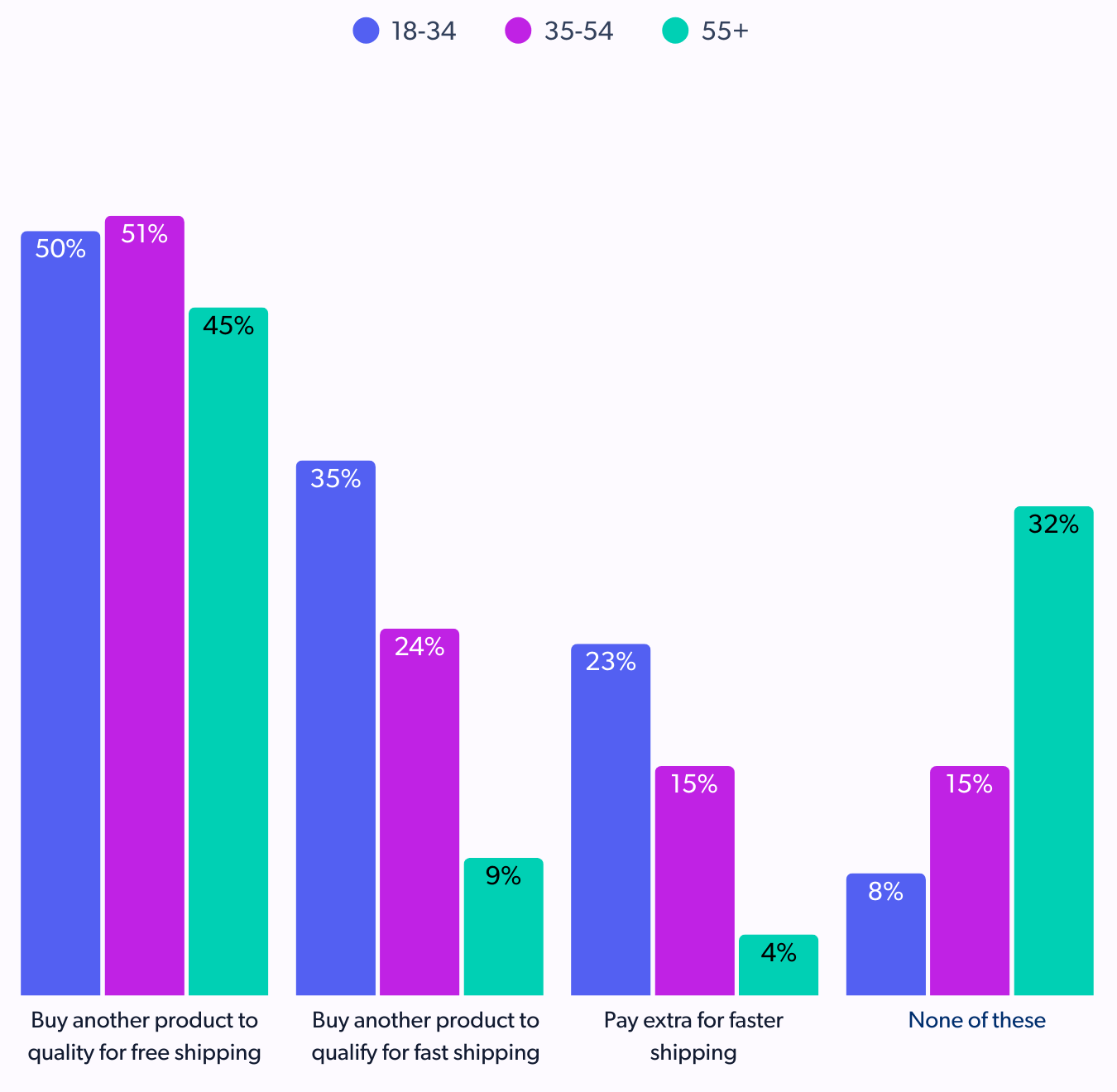

- Speed trumps cost when time is tight

Speed matters. They’re more likely to pay extra for faster delivery if it means gifts arrive on time. 35% will add items for faster shipping, and 23% are willing to pay extra for speed.

Callout: Brands that offer flexible payments and shipping speed options will win with this generation. Young shoppers want financial control and delivery on demand. They’re not reckless spenders — they’re strategic ones, balancing BNPL for budgeting with paid perks like fast shipping for convenience.

3. High social commerce influence

This holiday season, capitalize on young consumers’ social media shopping habits. Social media is four times more effective at reaching younger consumers compared to older ones. This makes it a critical channel for holiday gift marketing.

While social commerce is still gaining traction among the broader population and hasn’t yet become mainstream, Gen Z and Millennials are its most active users. Interestingly, their frequent interaction with social media is driving them to spend more on these platforms both in terms of a greater willingness to shop via social channels and a steady increase in social media spending over the years.

- Social media’s influence on Gen Zs is undeniable

Social media marketing for holiday gifts should be heavily weighted toward Gen Z holiday shoppers, as 78% of 18–34-year-olds say they are heavily influenced by social media during the holiday season.

However, when asked whether they’ve actually purchased a holiday gift directly through a platform’s shopping features, the response is more nuanced: 48% say they have, while 50% have not.

This demonstrates that while social media is a powerful discovery and influence tool, its role as a direct purchase channel is still evolving. The gap presents a key opportunity for brands to improve the path to purchase by optimizing shoppable content, building trust, and reducing friction at checkout. - Young shoppers are spending more on social

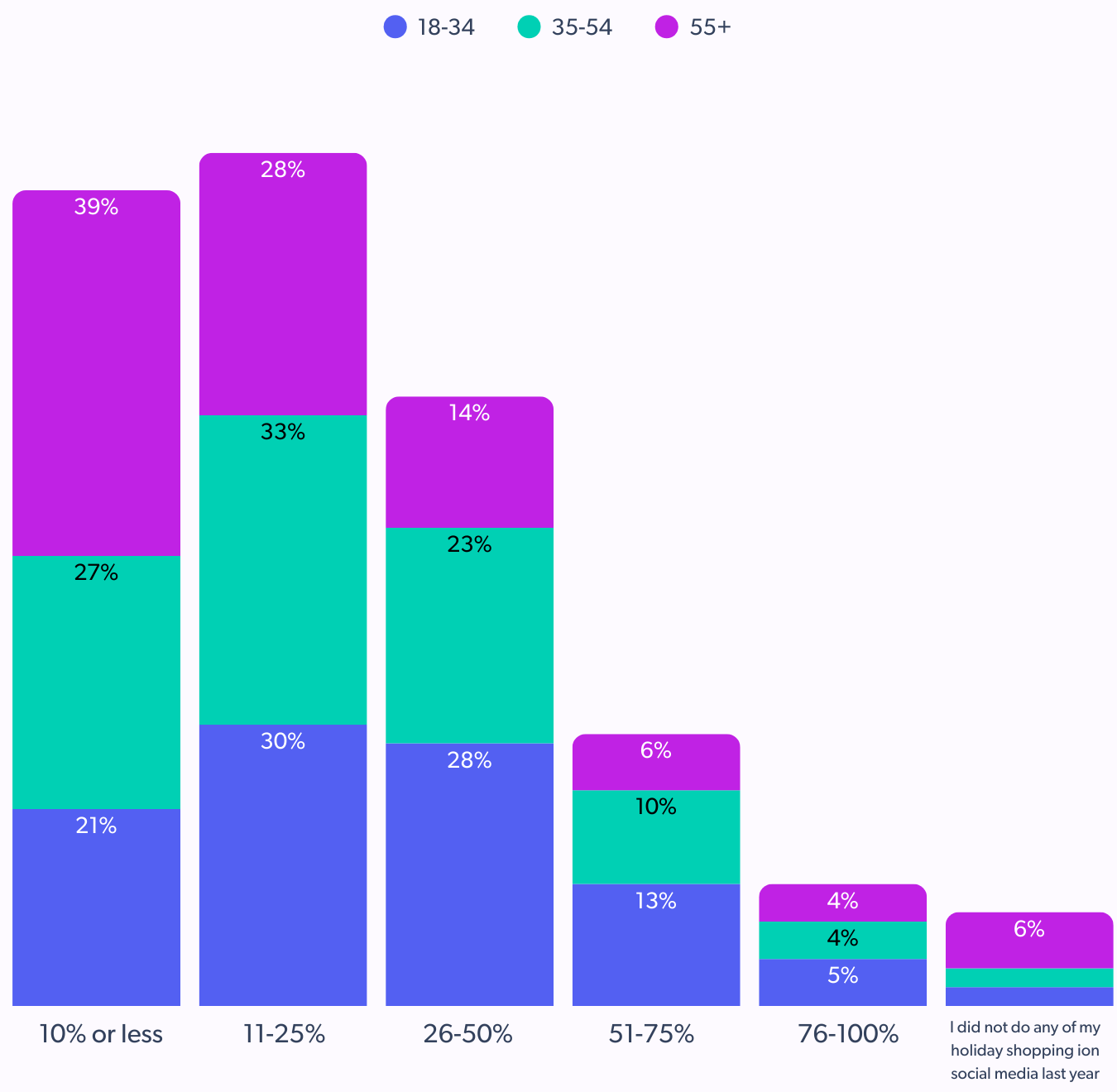

When asked how much of their holiday shopping they did through social media last year, 46% of 18–34s said they completed at least a quarter of their purchases on these platforms, underscoring social media’s growing role in the holiday purchase journey.

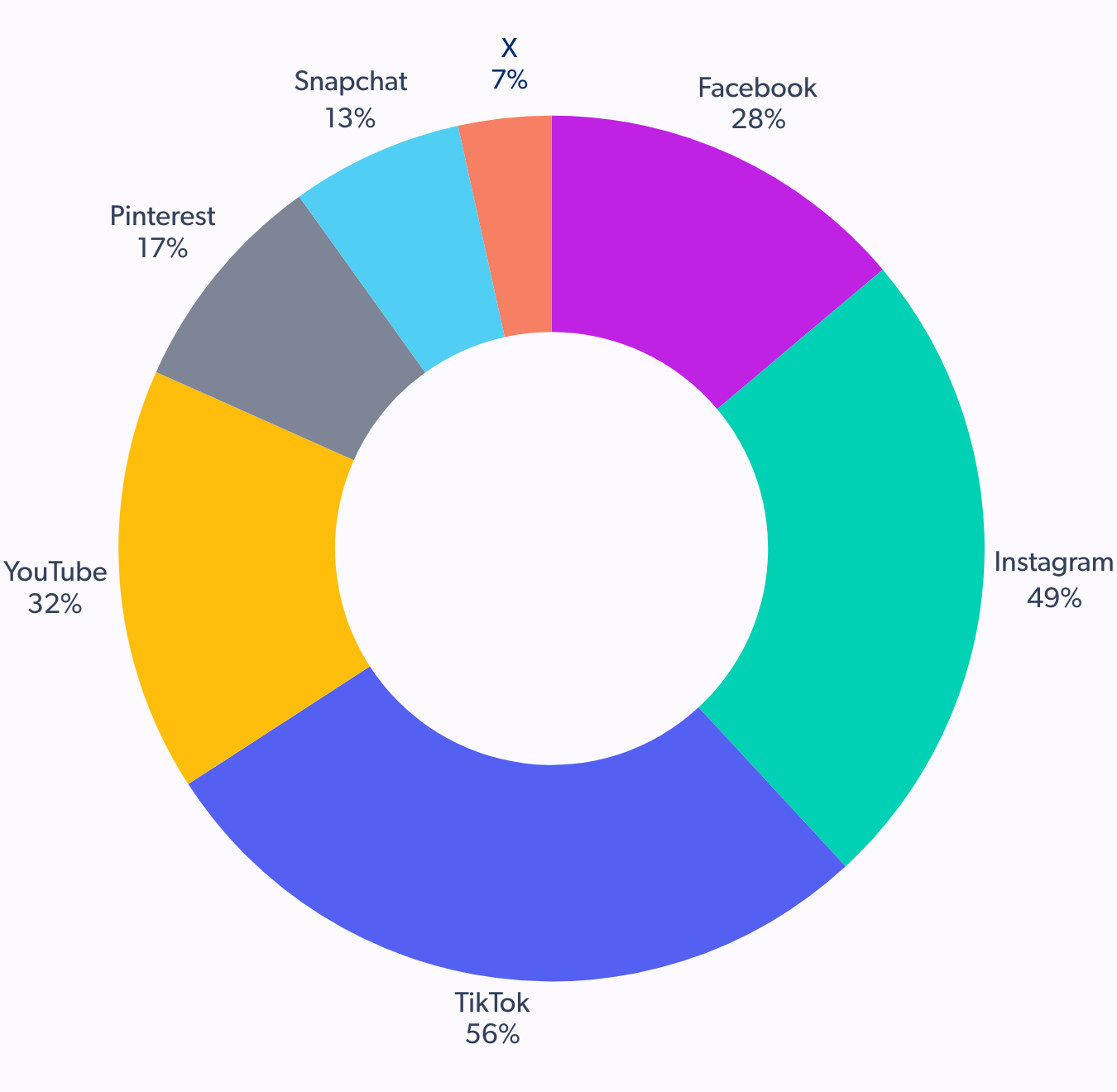

- Platform preferences: TikTok leads the pack

The social commerce landscape varies by generation. Among 18–34-year-olds, TikTok clearly dominates, making it a prime platform for targeted holiday campaigns and social commerce experiments.

- Discovery vs. conversion: Bridging the gap

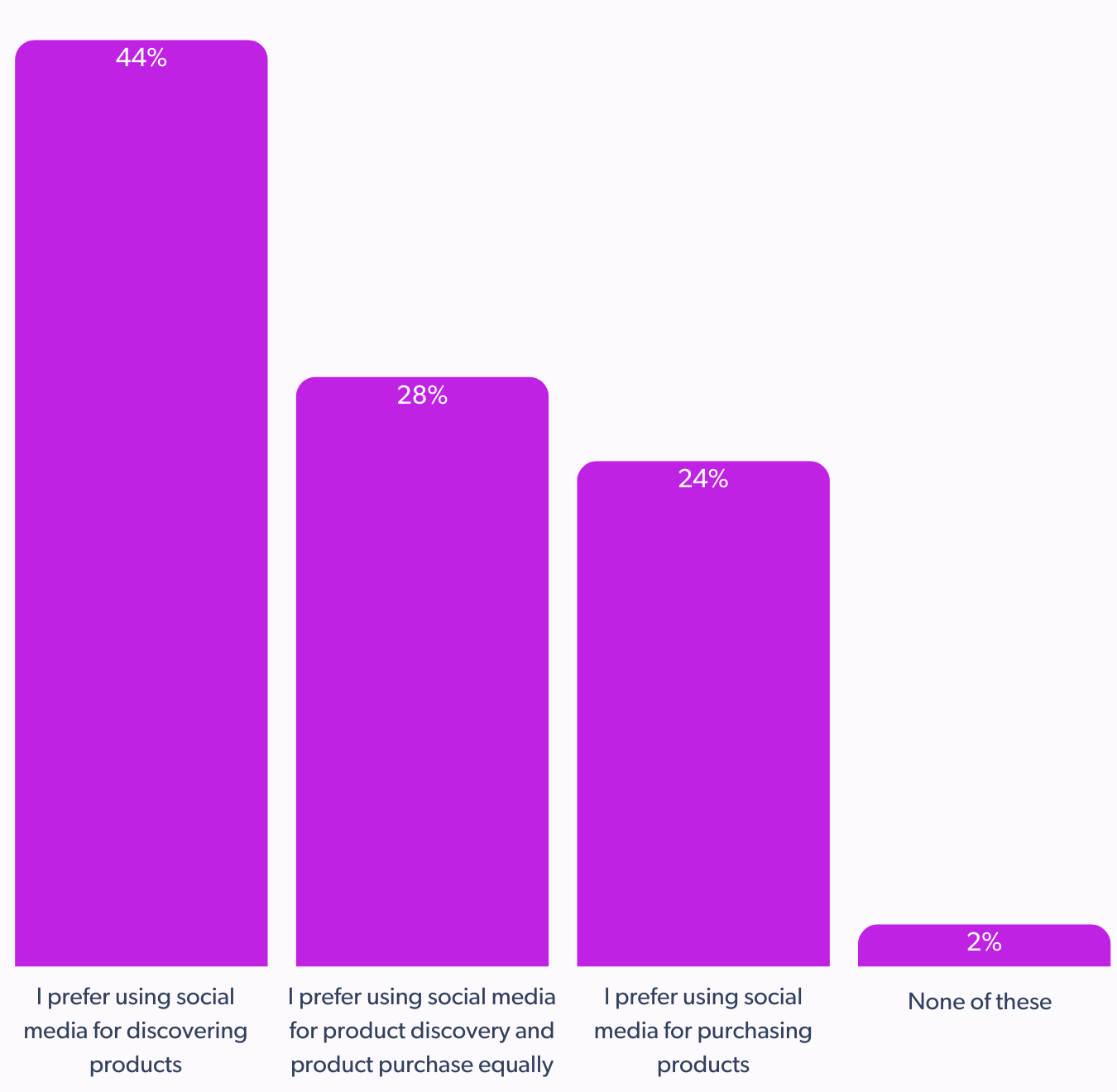

Are young shoppers more focused on discovering new products or completing purchases directly through social media?

Gen Z and millennials are more comfortable completing transactions on social platforms (24%). But twice as many young users prefer discovery to purchasing (44% vs 24%), indicating a need for a better conversion strategy to optimize social-to-purchase pathways.

Callout: While Gen Z and Millennials are highly influenced by social content and increasingly open to social commerce, there’s still a gap between discovery and conversion. To close it, brands must deliver seamless, trust-driven experiences, from compelling, platform-native content to frictionless checkout. The future of holiday shopping is in how well brands turn scrolls into sales.

Bazaarvoice Social Commerce solution turns Instagram, TikTok, or Pinterest content into shoppable experiences. It creates visual UGC galleries by embedding customer photos and videos into PDPs to increase conversion. And curate and tag high-performing social UGC with clear product links and trust signals.

4. Trust builds creator connection

Creator-driven holiday purchases are now mainstream among Gen Z and Millennials, with nearly half of 18–34-year-olds saying they’re influenced by creators during the holiday season.

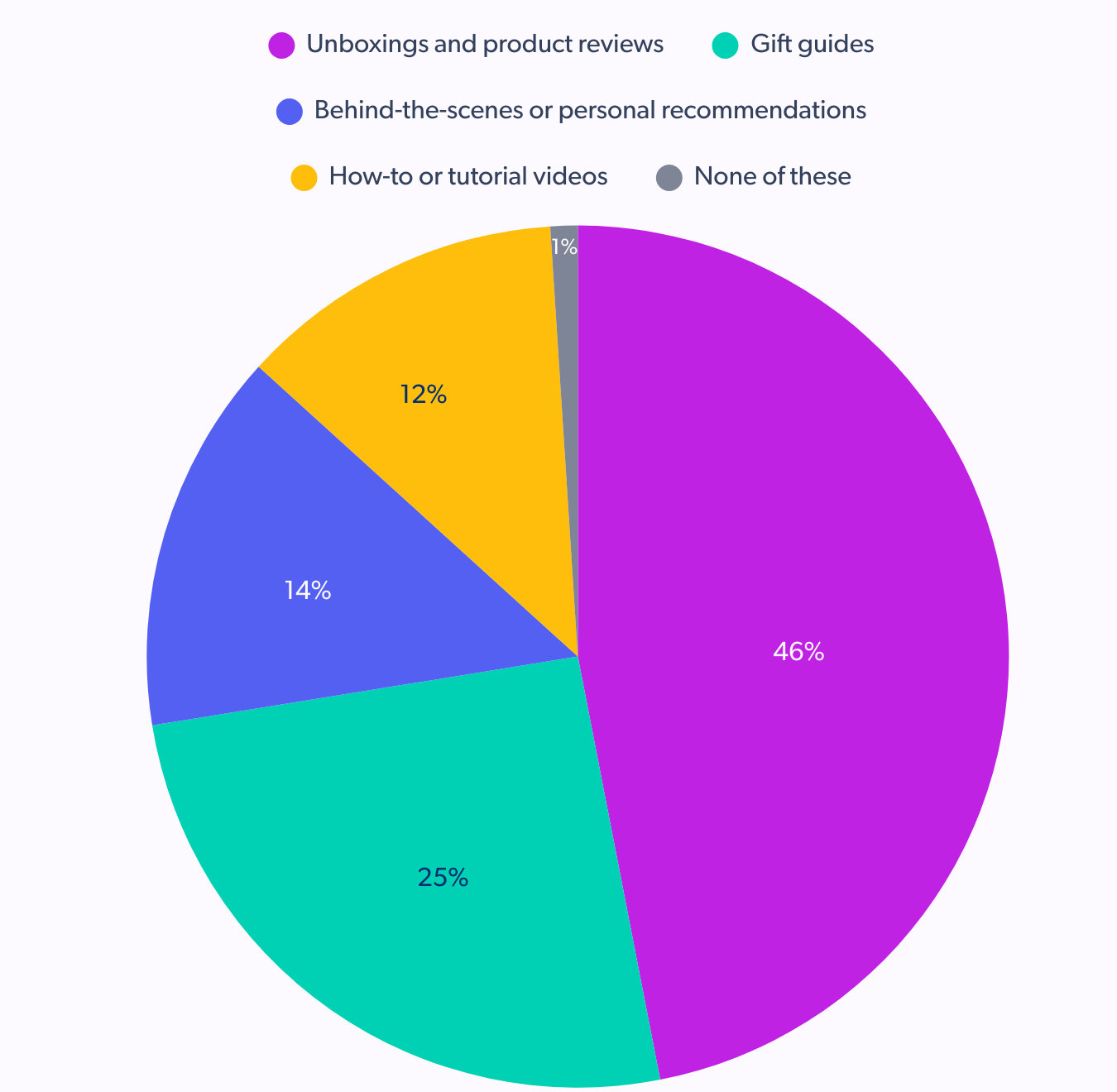

If you’re wondering what type of content drives engagement? The answer is clear: product-focused content like unboxing videos and reviews resonates most. This kind of content offers tangible insights into product quality and functionality, helping shoppers make informed decisions.

And when it comes to creators, Gen Z and Millennials tend to follow specific influencers they trust, rather than being swayed by broad trends or celebrity endorsements.

- Creators do influence but without guaranteed conversions

Nearly half of 18–34-year-olds say they’re influenced by creators, yet only 27% have actually made holiday purchases based on creator content, a clear signal of lingering skepticism. This gap highlights the need for brands to prioritize authenticity, relevance, and tangible value in creator partnerships to truly convert influence into action. - Unboxings and reviews lead in the creator content that converts

Unboxing videos and product reviews top the list at 46% among Gen Z and millennials but trust is increasingly selective. While this content format remains the most preferred across all age groups, its appeal declines with age, suggesting that younger shoppers seek both information and authenticity in creator content.

- Specificity over hype when trusting creators

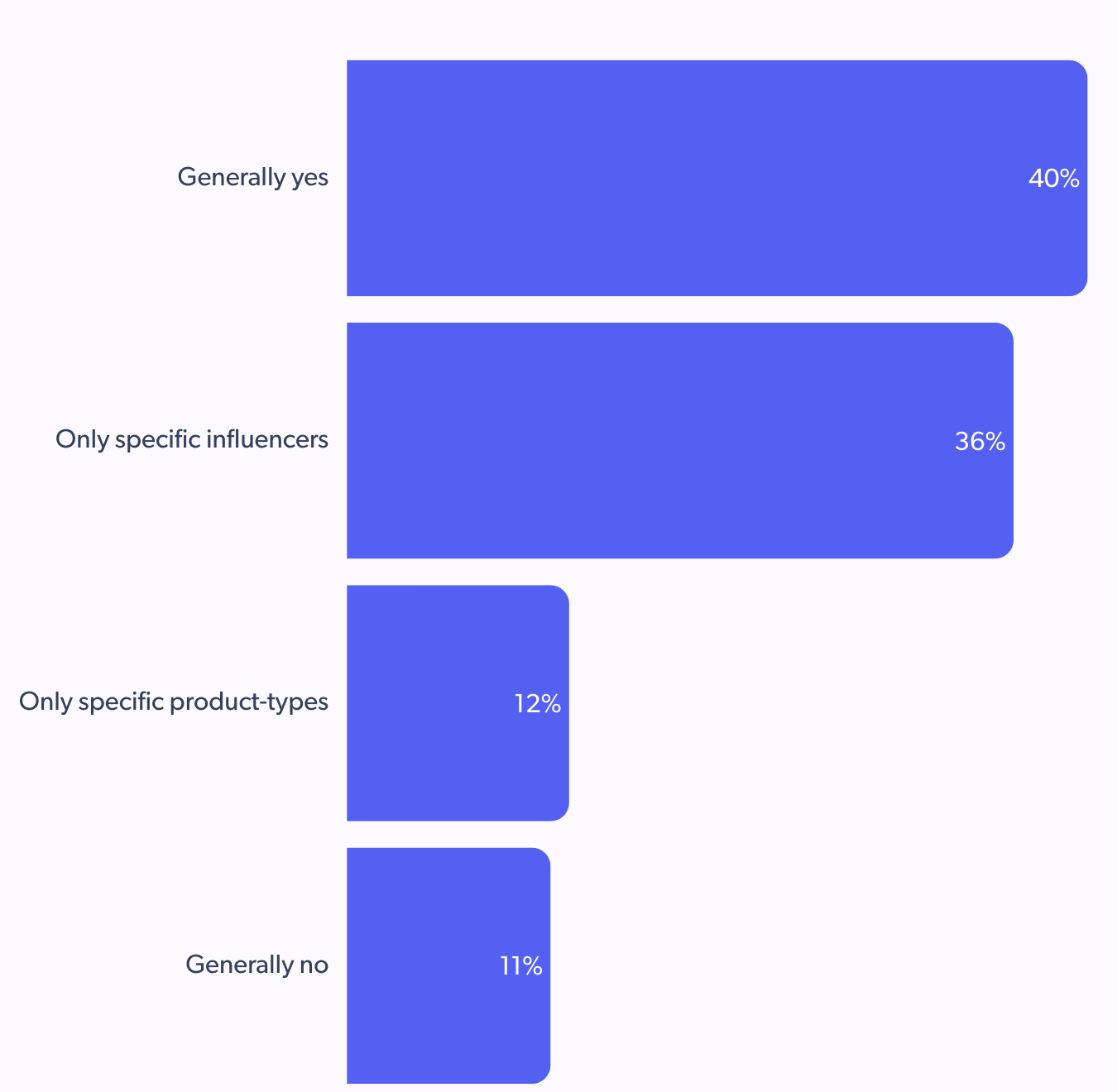

Do younger shoppers trust micro or mega influencers more—and how does this compare to other age groups?

Among 18–34-year-olds, 52% trust micro and mega influencers more than personal networks, showing a significant shift in influence dynamics. This group shows a balanced trust profile, with 40% expressing general trust in creators, and 36% placing trust in specific influencers they follow, highlighting the importance of familiarity and selective engagement in building credibility.

Callout: For Gen Z and Millennials, creator content works—but only when it’s real, relatable, and rooted in value. Brands that partner with trusted influencers, focus on product-driven storytelling, and deliver content that educates and inspires will be the ones that turn influence into impact.

5. Building trust through UGC and visual content

In a content-saturated world, peer reviews and visual proof still win with young shoppers.

While creator content drives influence, user-generated content (UGC) and brand-created visuals continue to play a vital role in shaping purchase decisions, especially for Gen Z and Millennials. It’s not a new trend, but one that’s evolving in its impact: authentic, visually rich UGC amplifies trust and reach.

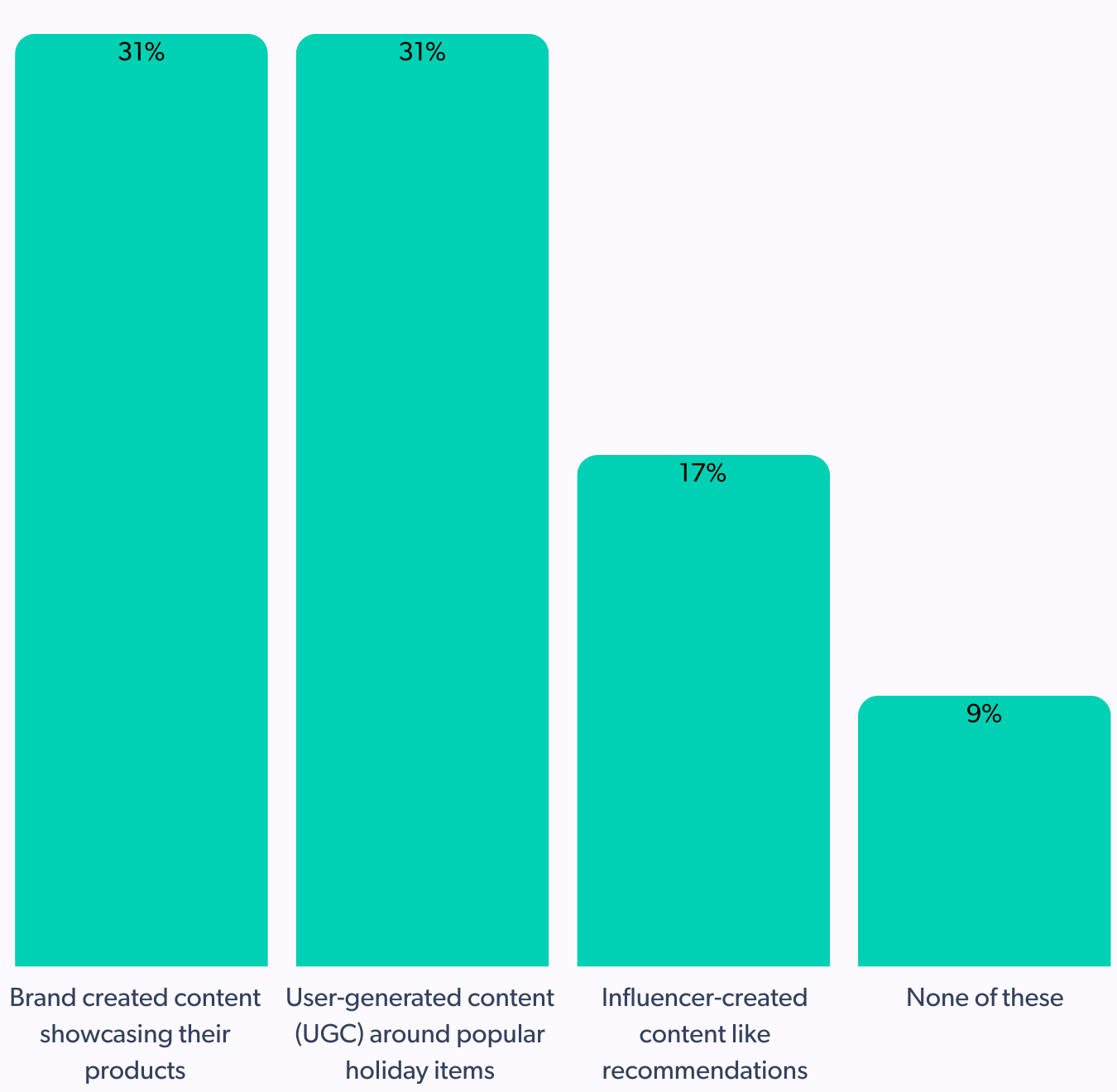

- UGC and brand content are neck and neck

Gen Z and Millennials are more open to a range of content types and show equal preference for brand-created content and UGC—with 31% choosing each. What sets them apart is their higher interest in influencer content (17%)compared to older age groups.

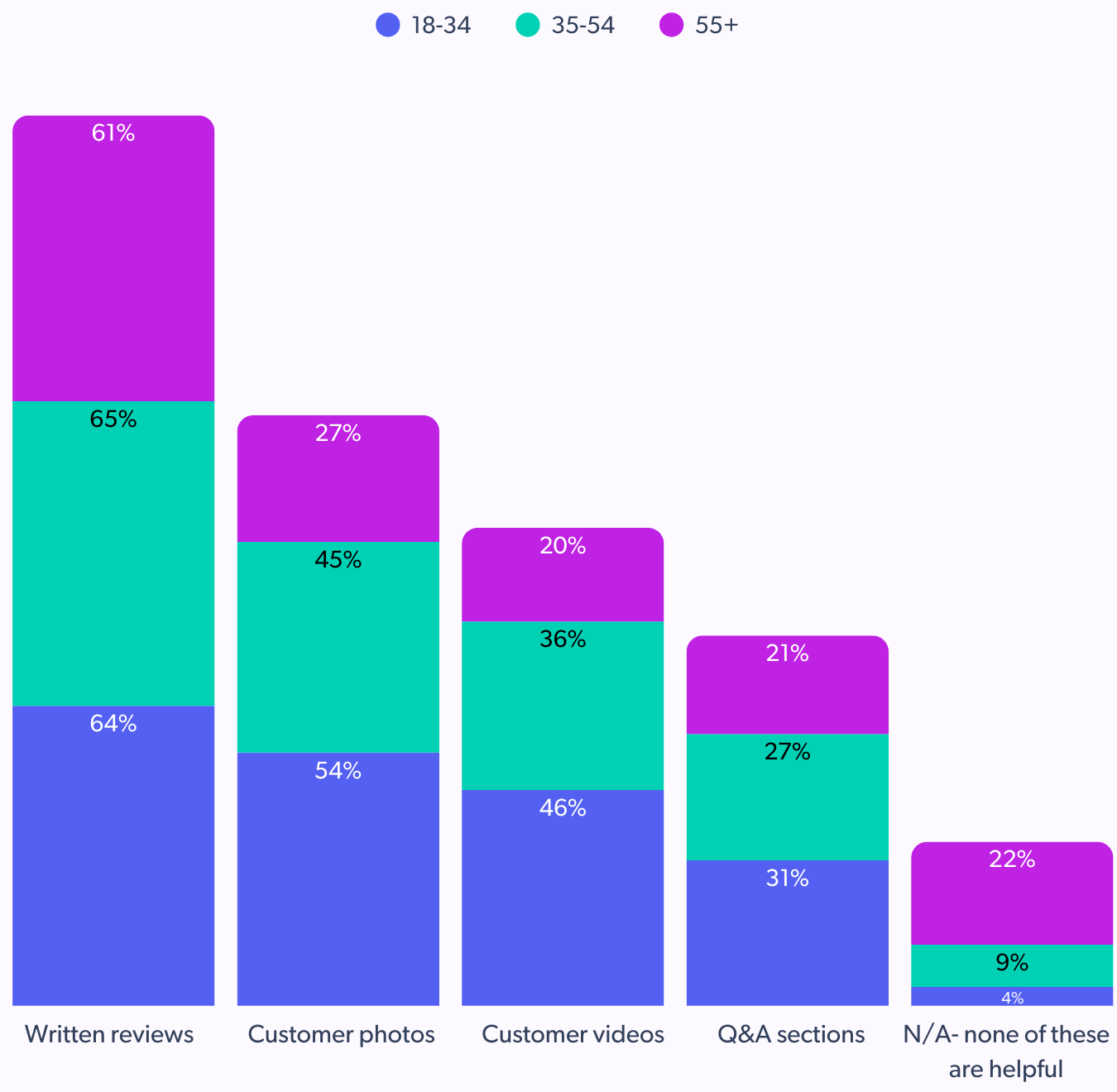

- Seeing is believing for Gen Z and millennials

Young shoppers value written reviews (64%), but they show a clear preference for visual UGC – 54% trust customer photos and 46% value customer videos. That’s significantly higher than older demographics, showing a need for brands to amplify visual review content across product pages and social platforms.

- Don’t overlook guides and how-tos

36% of 18–34-year-olds say product guides are consistently helpful, compared to just 22% across all age groups. For brands, this is a strong content opportunity, especially when paired with visuals and real user insights.

Callout: Younger consumers crave proof and they want to see it. UGC that’s visual, authentic, and easy to find builds trust and drives action. Whether it’s a helpful guide, a photo from a peer, or a branded product demo, the brands that combine storytelling with social proof will win younger shoppers this holiday season.

6. Blurring the lines between online and in-store

Younger shoppers don’t see a divide; they expect seamless experiences across online and in-store.

For Gen Z and Millennials, holiday shopping isn’t bound by a single channel. Whether they’re researching online before heading to a store or switching between apps and aisles, their behavior signals one thing: omnichannel expectations are the new norm.

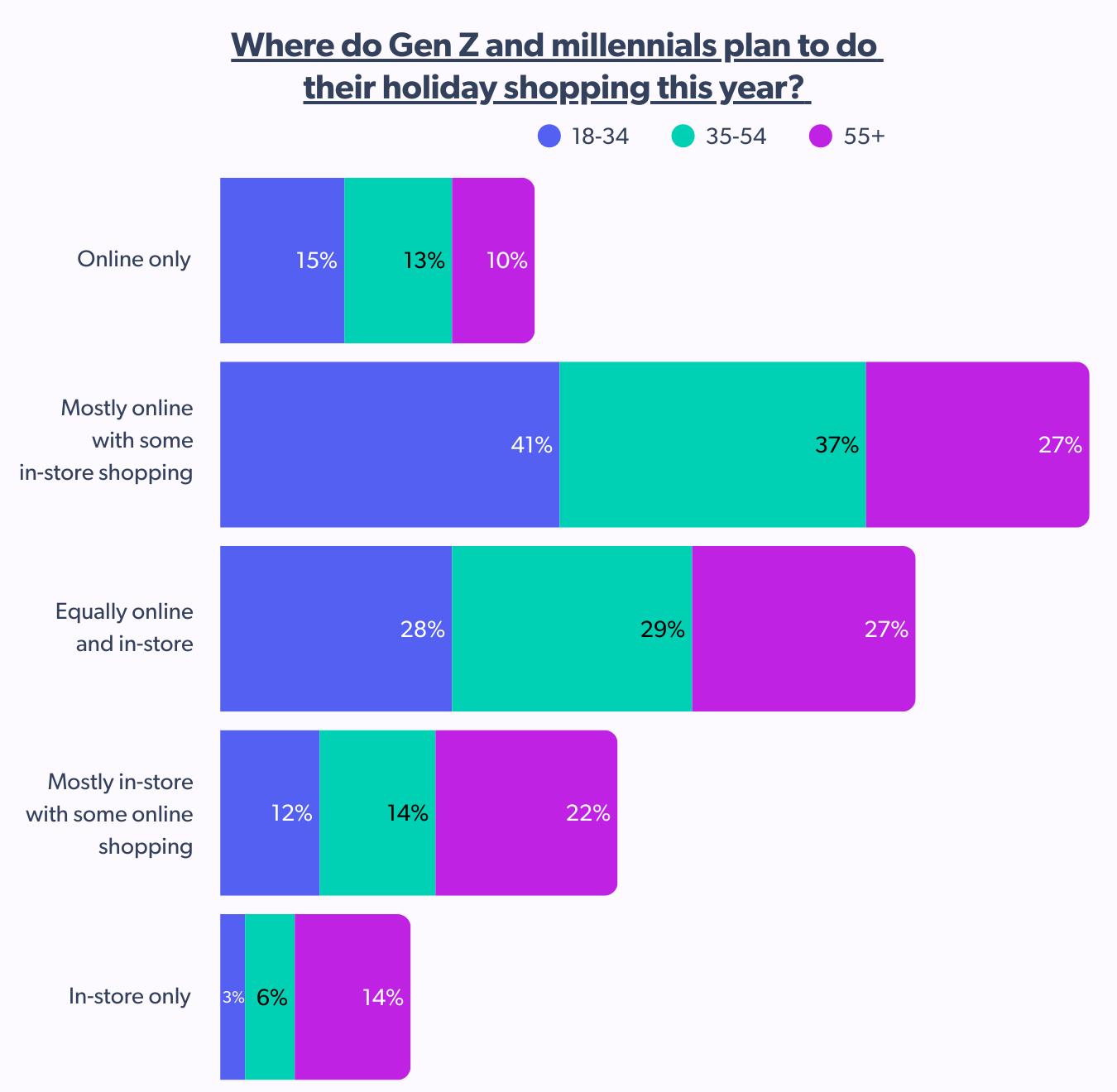

- Online leads, but in-store still matters

Among 18–34-year-olds, 56% plan to shop mostly or entirely online this holiday season, compared to just 15% who plan to shop exclusively online. Meanwhile, 28% prefer a fully blended experience, shopping equally online and in-store.

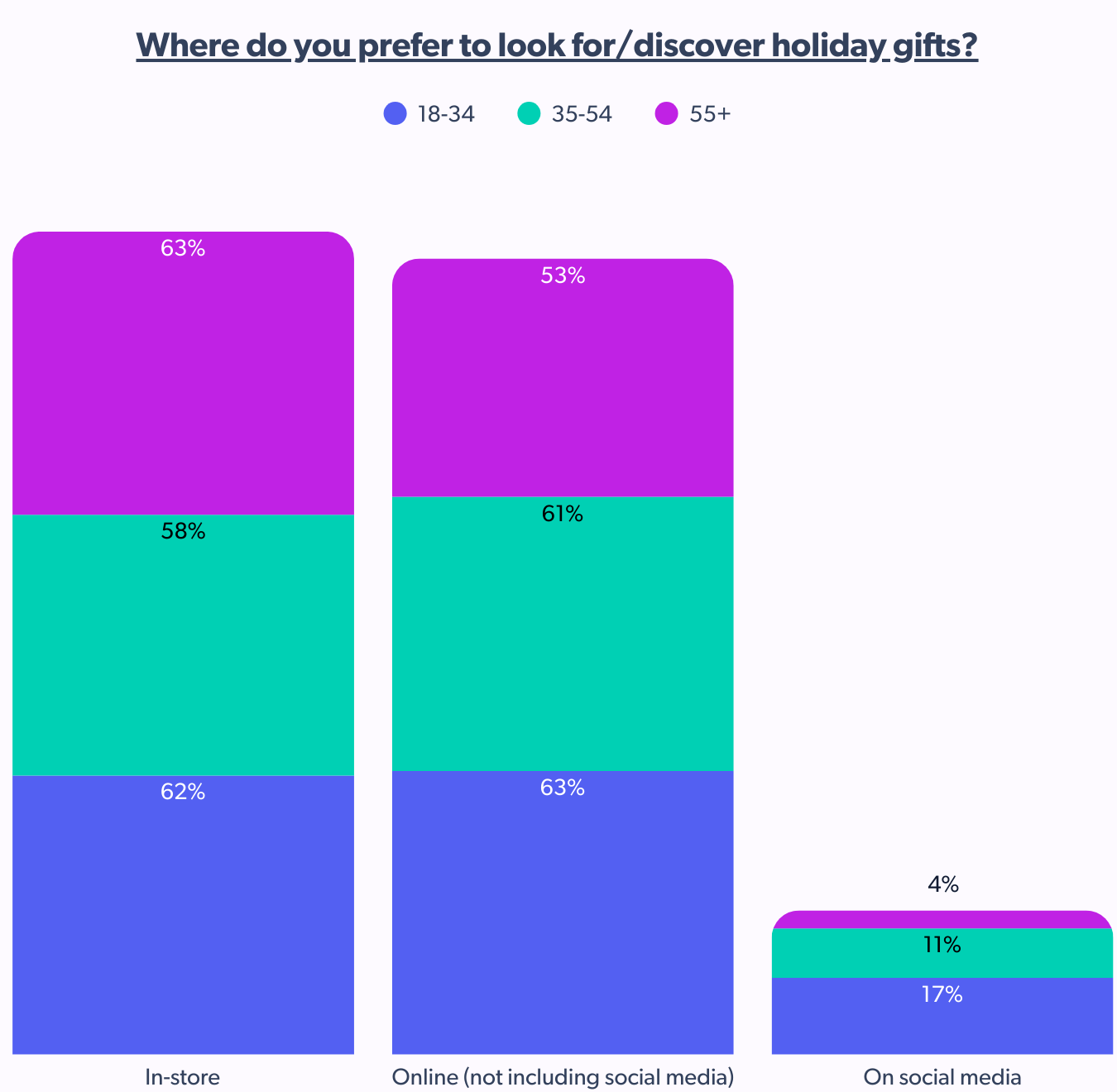

- Discovery starts online

When asked where they prefer to discover holiday gifts, younger shoppers showed the strongest preference for online research (63%), followed closely by in-store browsing (62%). Notably, 17% of 18–34s also rely on social media for gift discovery—more than four times the rate of older generations.

- In-store research influence

90% of shoppers research online before making in-store purchases, making a strong digital presence essential to influence offline sales. For brands, this means optimizing SEO, visual UGC, and customer reviews across websites and social platforms, especially for holiday-related keywords and gift searches.

Among younger shoppers, the digital dependency is even higher: 63% of 18–34-year-olds prefer to discover holiday gifts online, and 17% turn to social media for product discovery—the highest across all age groups. - Mobile and loyalty lead the way

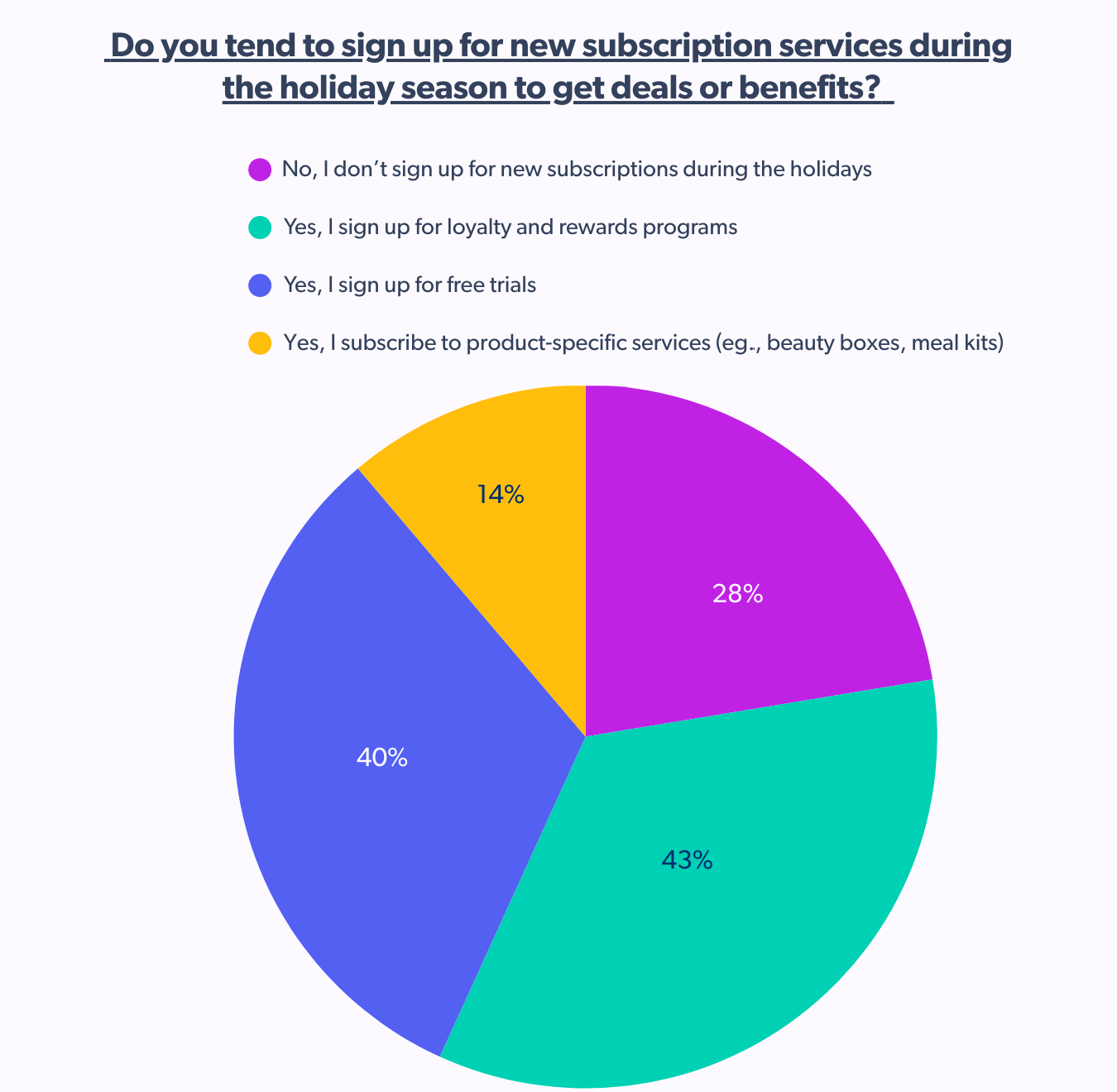

Gen Z and Millennials are hyper-receptive to digital offers, with 88% saying they engage with mobile apps or loyalty programs during the holidays. In fact, 43% actively sign up for rewards programs, making them prime targets for personalized, FOMO-driven promotions.

- What influences young shoppers most?

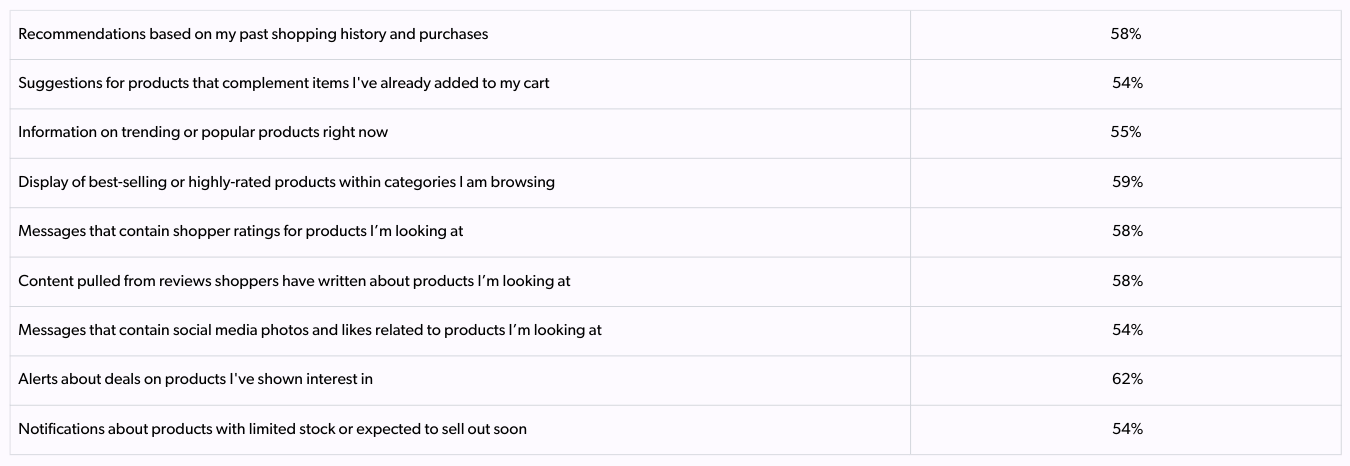

For 18–34-year-olds, deal alerts, peer reviews, and tailored product suggestions are the biggest nudges. This group wants contextual content that feels helpful, not intrusive.

Callout: Younger shoppers expect a connected, personalized experience—whether they’re shopping online, in-store, or both. To win holiday conversions, brands must optimize their digital footprint (reviews, SEO, UGC), strengthen mobile and loyalty offerings, and create intuitive omnichannel journeys that blend discovery and purchase across platforms.

7. Trust & AI: Personalization meets skepticism

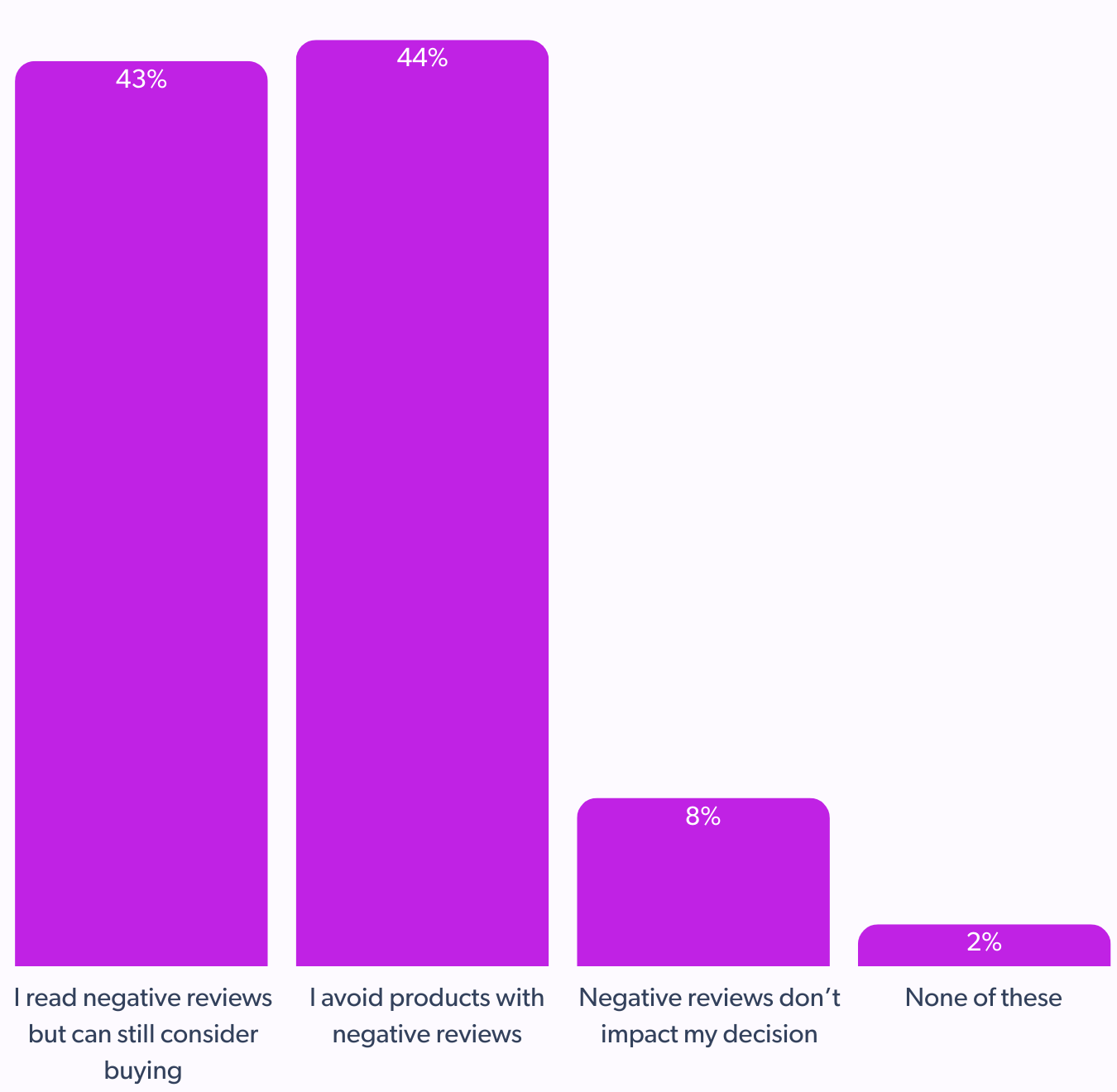

In the buying journey, several factors help shoppers build trust in your brand. For Gen Z and millennials, one negative review isn’t a deal-breaker. They prefer reading both positive and negative reviews, especially when it’s clear they’re written by real people or AI.

If you’re considering using AI-generated content, be mindful: young shoppers are becoming increasingly wary of AI-generated reviews and images.

- Reviews matter more than reputation

Shoppers aged 18–34 are the most review-dependent—44% avoid products with negative reviews. They’re also less influenced by brand reputation, with 38% saying they wouldn’t buy a holiday gift if it had no reviews. While they rely heavily on reviews, they’re also more open to taking risks compared to older age groups.

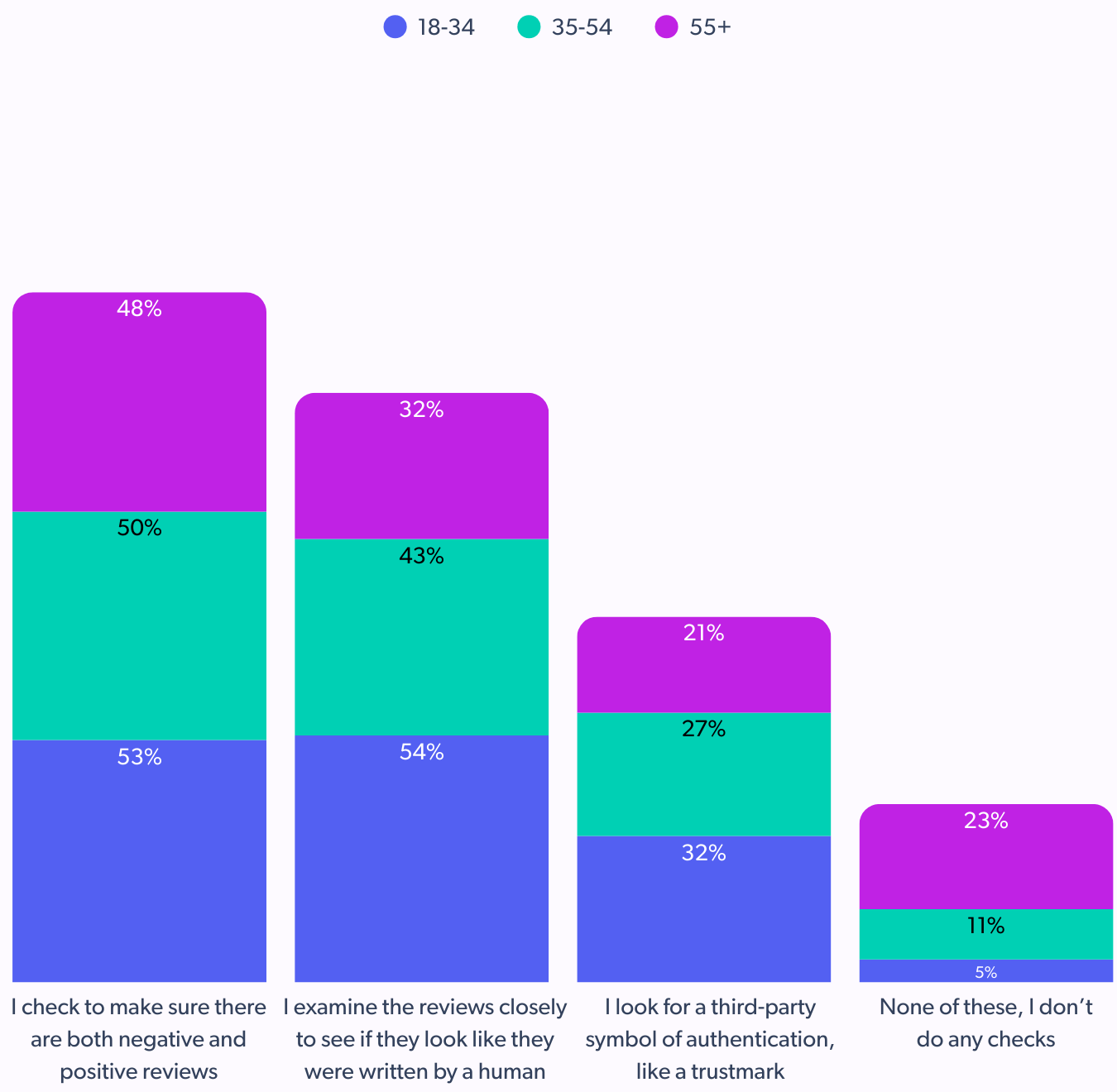

- Authenticity checks are the norm

What signals matter most to this group? Is it review authenticity, human verification, or something else? Among 18–34-year-olds, 53% check for a mix of positive and negative reviews on a website, while 54% closely examine reviews to assess if they appear to be written by a human. This age group has the highest rate of human-verification behavior.

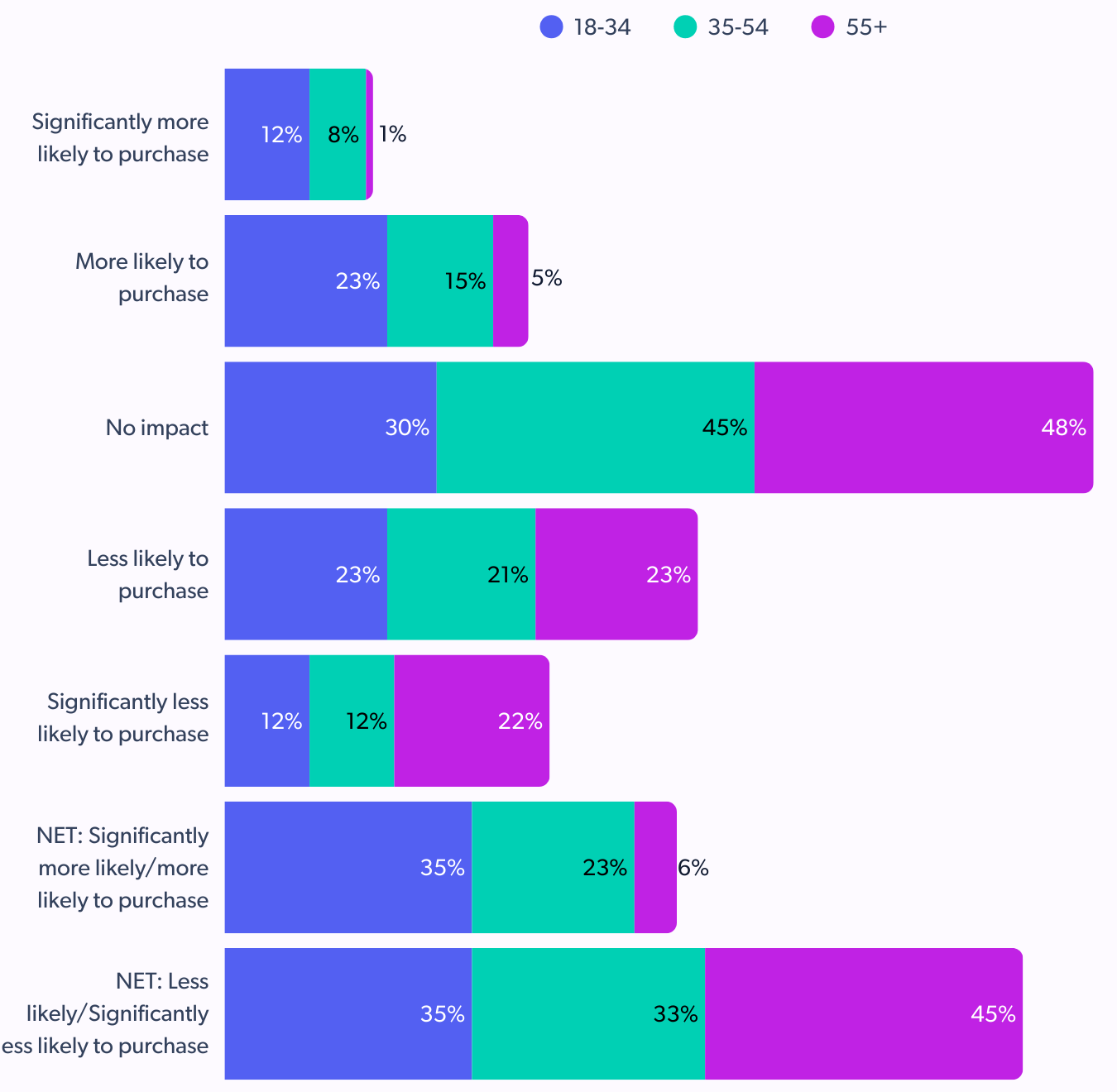

- Gen Z leads in AI-powered purchasing

Shoppers aged 18–34 are the most receptive to AI-generated content. 38% expressing openness to it and 23% more likely to purchase based on AI recommendations, both the highest figures across age groups.

Notably, 12% say they are significantly more likely to buy, which is 12 times higher than older shoppers, reinforcing their strong positive sentiment toward AI-assisted buying.

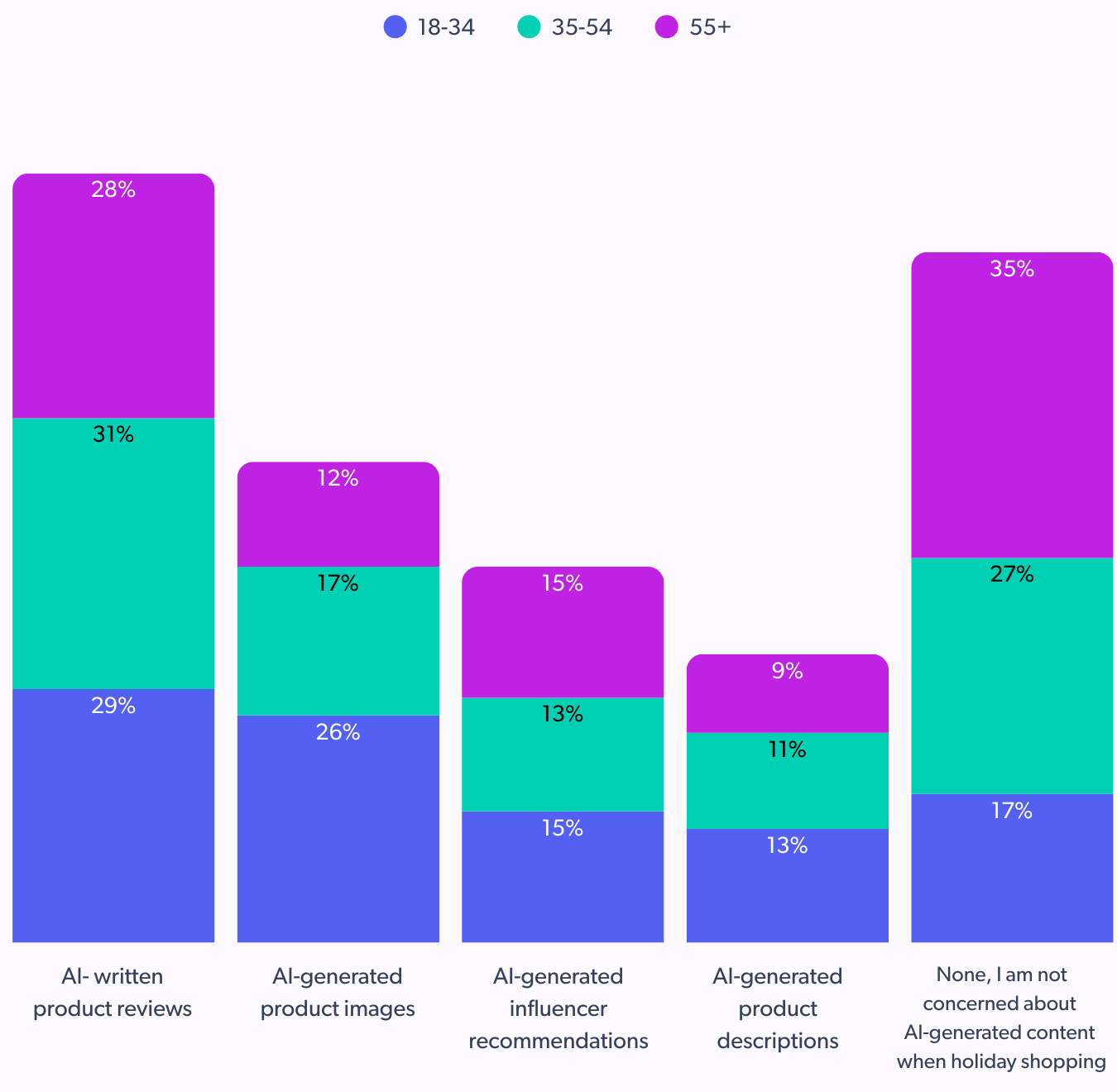

- AI- reviews and images are red flags

What worries Gen Z and young millennials most? AI-generated reviews and images top the list.

Call out: AI can personalize, but it can’t replace authenticity. Gen Z and millennials crave tailored, tech-enhanced experiences but not at the cost of trust. They read reviews critically, verify authenticity, and are quick to spot anything that feels artificial. Pair automation with transparency, real voices, and credible visuals to earn and keep their trust.

Summing up

For brands, the opportunity is clear and so is the challenge. Winning this audience requires more than discounts or flashy ads. It calls for real customer voices, smarter content delivery, flexible buying options, and trustworthy experiences across every touchpoint.

That’s where Bazaarvoice Vibe comes in. By powering authentic reviews, scaling UGC, and bridging discovery and conversion across channels, it helps brands meet young shoppers where they scroll, shop, and share, turning trust into transactions this holiday season and beyond.

Learn more about the global report here!