December 16, 2025

Holiday marketing usually sells a dream. The 2025 consumer is living in a very different reality.

There is a massive gap between the consumer in your holiday ad and the consumer in the checkout line. One is celebrating. The other is just trying to get through the month. When you look at the actual data on holiday spending, the festive narrative falls apart.

The Q4 shopper isn’t just shopping; they are managing anxiety. They are oscillating between two distinct psychological modes: survival and coping. This changes everything about how you should position your products.

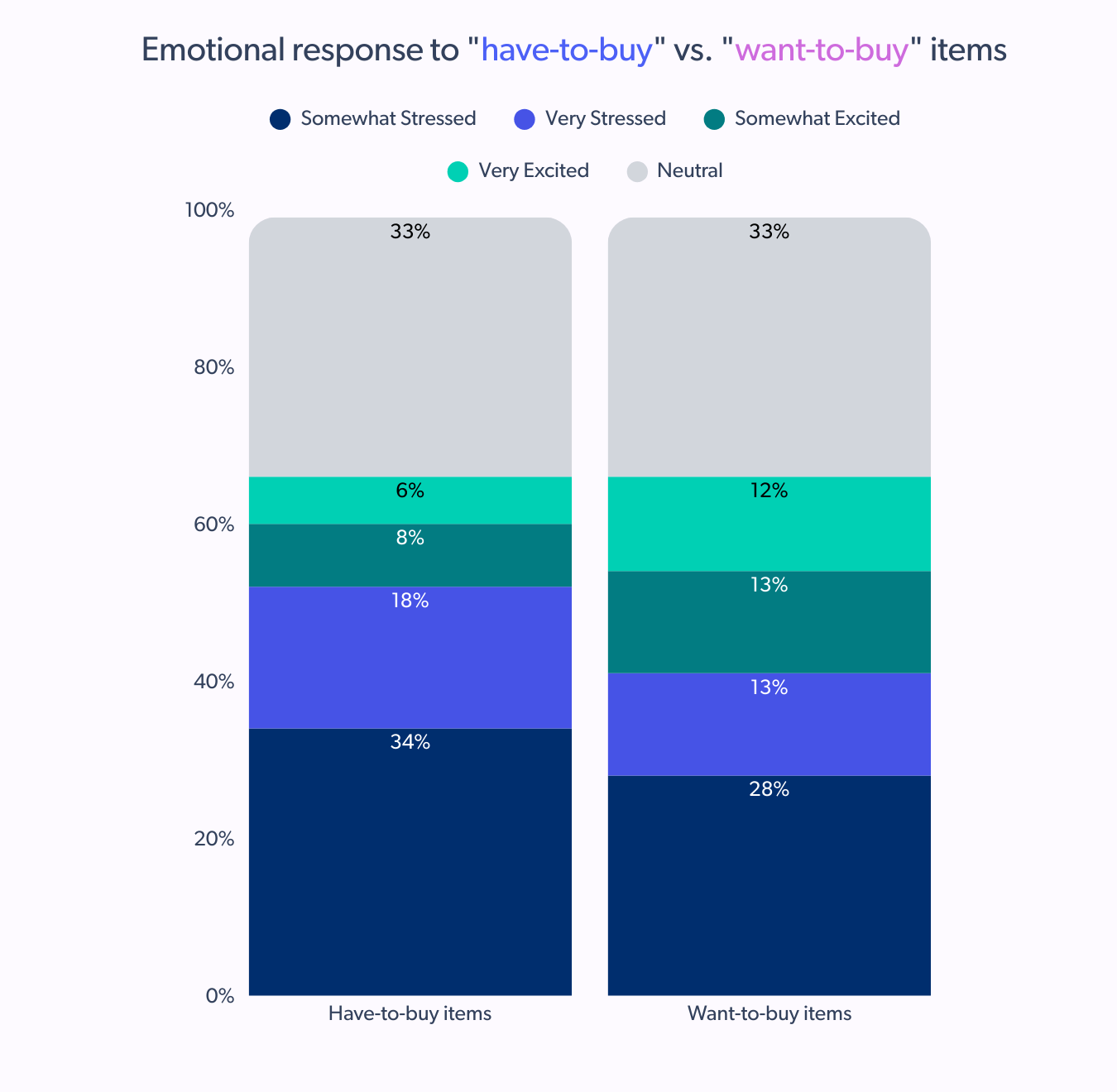

The “one-size-fits-all” holiday marketing strategy is dead. Our latest research on consumer holiday spending & psychology confirms this shift. We mapped the emotional difference between buying needs and buying wants, and the data paints a stark picture of the modern buyer.

| About the data: This report is based on a Bazaarvoice survey of 2,440 shoppers aged 18+ across the US, APAC, and EMEA, conducted in December 2025. We analyzed distinct emotional triggers across essential and impulse purchase categories. |

And here is the reality: 52% of shoppers feel stressed about buying essentials, and 41% feel stressed about buying treats.

The anxiety is universal, but the cause is different. For essentials, the stress is logistical (will it arrive?). For treats, the stress is financial (should I really buy this?).

If you treat every product in your catalog like a gift, you fail both mindsets. You cannot market paper towels with the same energy as a new gaming console. To win this season, you need to categorize your products into two buckets: “the chore” and “the splurge”, and optimize your content to solve the specific anxiety of each.

The “little treat” economy

Before we break down the buckets, we need to understand the economic engine driving holiday spending in 2025: the “little treat”.

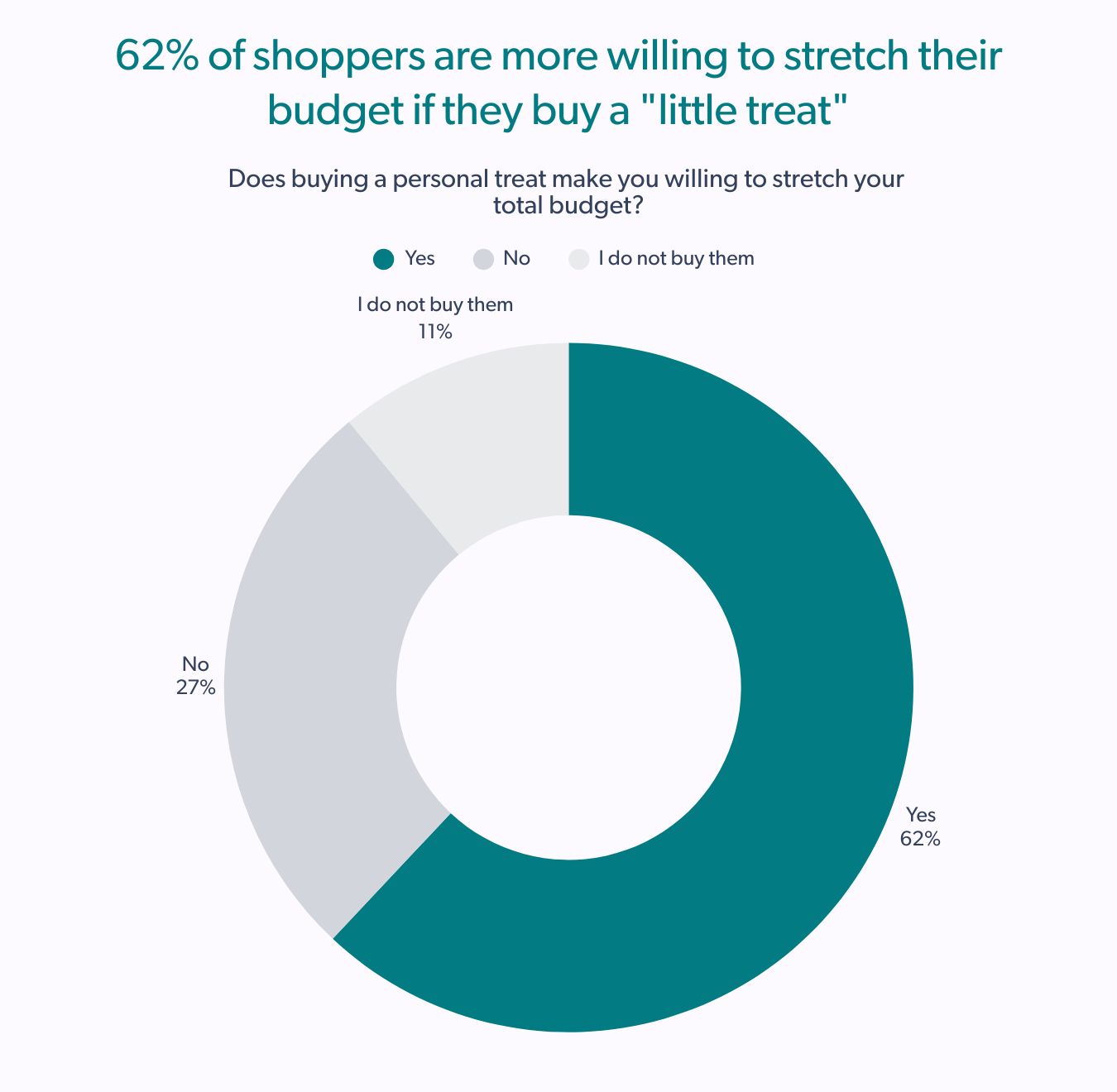

Our data shows that 62% of shoppers are willing to stretch their overall holiday budget if they purchase a small indulgence for themselves.

This is the “lipstick effect” in action. Shoppers are anxious about the macro-economy, so they are cutting back on big-ticket items. But they are still spending. They are doom scrolling (78% agree it leads to impulse buys) and looking for affordable dopamine.

This is your leverage point. If you win the treat, you unlock the wallet. But you can’t win the treat if you don’t understand the psychology behind it.

Bucket 1: The chore (essentials & utilities)

The products: Batteries, ingredients, paper goods, basic apparel. The psychology: Survival mode.

When a shopper buys “have-to-buy” items, they aren’t looking for inspiration. They are looking for assurance. Our survey found that 52% of consumers feel stressed when shopping for these items. They are bored, anxious, and want the task to be over.

The strategy: Sell efficiency

Your job here is friction removal. You control the input (content), and the desired output is speed.

- Don’t try to delight them with emotional storytelling.

- Do prove reliability.

Leverage authentic product reviews that speak to utility. A shopper buying a blender for holiday hosting doesn’t care about the lifestyle. They care that it crushes ice and is available for pickup today. Even if they are hunting for holiday shopping deals, availability often trumps price when stress is high. Ensure your PDP highlights specific attributes: stock availability, shipping speed, and durability.

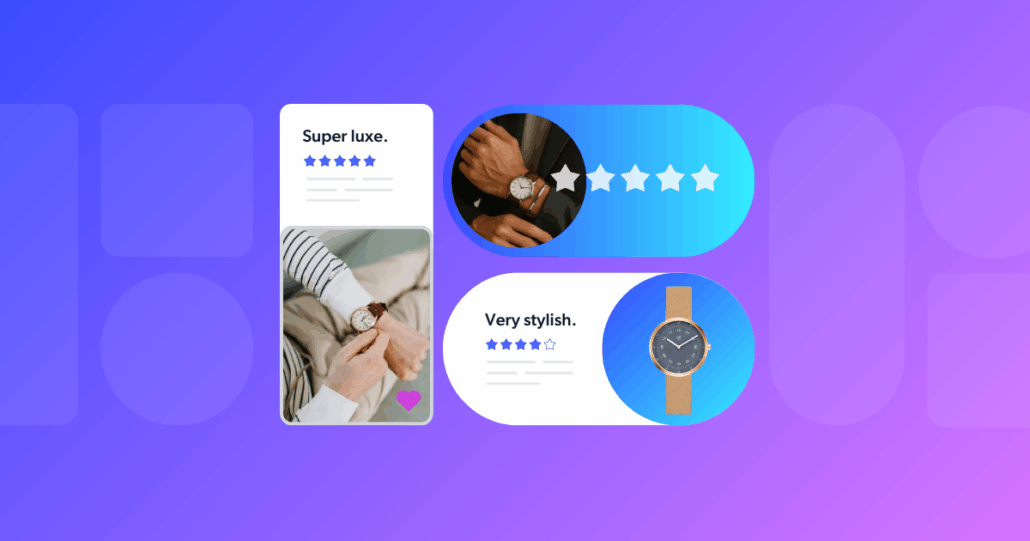

The proof is in the volume. Take Beko Europe as a blueprint. Selling home appliances places them squarely in the “chore” bucket. To prove reliability at scale, Beko focused on syndicating reviews across their retail network. The result was an 845% increase in displayable reviews across Europe.

This wasn’t just a vanity metric; it was a trust signal. When a product has to work, high review volume is the fastest way to prove reliability and silence doubt.

If you are selling a “chore”, your content should signal : “This works. It will arrive on time. You can cross this off your list.”

Bucket 2: The splurge (gifts & treats)

The products: Beauty, tech, fashion, toys. The psychology: Retail therapy.

Here is where the data contradicts conventional wisdom. Most brands assume “want-to-buy” items are pure joy. But 41% of shoppers admit these purchases make them feel stressed.

Why? Because they feel guilty.

The shopper wants the dopamine hit of the “little treat”, but they are financially anxious. They are looking for permission to spend the money.

The strategy: Sell validation

Your job here is not just to generate hype; it is to mitigate the risk of regret.

This is where shoppable content and visual UGC become critical. Hype creates the initial interest, but social proof closes the sale.

- 79% of shoppers bought a gift directly while scrolling social apps.

- 92% say positive reviews significantly reduce the likelihood of regret.

In an era where AI agents and summaries are making decisions for shoppers, authenticity is the only currency that matters. You don’t only need content that converts humans; you also need verified data that teaches AI what is true.

When a shopper sees a real person enjoying the product on TikTok or Instagram, it serves a dual purpose: it offers social proof to the human, and engagement signals to the algorithm. It tells the shopper, “Everyone else is doing this. It’s okay for you to do it too.”

The proof is in the engagement. For a perfect example of validation at scale, look at Iconic London. Selling beauty products is selling a want, not a need. To convert browsers who were hesitant to splurge, they transformed their site into a social experience using shoppable galleries.

They didn’t just entertain shoppers; they gave them permission to buy. The impact? A 126% lift in conversion rates and a massive 361% increase in time on site. When customers see real people looking good in the product, the financial guilt fades, and the “add to cart” instinct takes over.

If you are selling a “splurge”, your content should whisper: “You deserve this. It’s worth the money. You won’t regret it.”

How to balance the mix

We know what you are thinking: “My brand sells both.” Or even harder: “My product is both.”

This is a common challenge for legacy brands. You have a high-end laptop that needs to look fun but perform seriously. Or you are a retailer selling paper towels in aisle 4 and video games in aisle 10.

In the store, this is simple. These items are physically separated. You walk down a different aisle, see different signage, and feel a different vibe. You know exactly when you are shopping for a “chore” versus a “splurge”.

Online, it’s harder. Your website likely uses the same template for every product page. This is a trap. If you force a paper towel and a video game into the exact same layout, you end up with a generic experience that doesn’t work for either.

The solution is to get specific

For the hybrid portfolio: If you sell different categories, you don’t need two brand voices; you just need to change the volume on your content types.

- For the “chore” products: Dial up the facts. A paper towel page should look like a data sheet. Focus on stock, specs, and star ratings.

- For the “splurge” products: Dial up the feeling. A console page should look like a social feed. Focus on unboxing videos, influencer photos, and lifestyle content.

For the hybrid product: Take a high-end laptop. The shopper needs to know it works but wants to feel good about buying it. The fix? Layer the experience. Use the top of the page to prove reliability (specs, speed, shipping). Use the bottom of the page to validate the purchase (social proof, rich visuals, unboxing videos). Logic opens the wallet, emotion closes the sale.

Dyson is the gold standard here. They masterfully balance “chore” content (suction specs, warranty info) with “splurge” content (TikTok styling tutorials) on the very same page. They solve the burden and justify the reward simultaneously.

Is it easy to pull off? No. It requires a flexible content supply chain and a deep understanding of your catalog. But recognizing that your customer is complex is the first step to capturing them.

The regret mitigation gap

The “input vs. output” framework is clear here. You provide the content (input), and the consumer manages the regret (output).

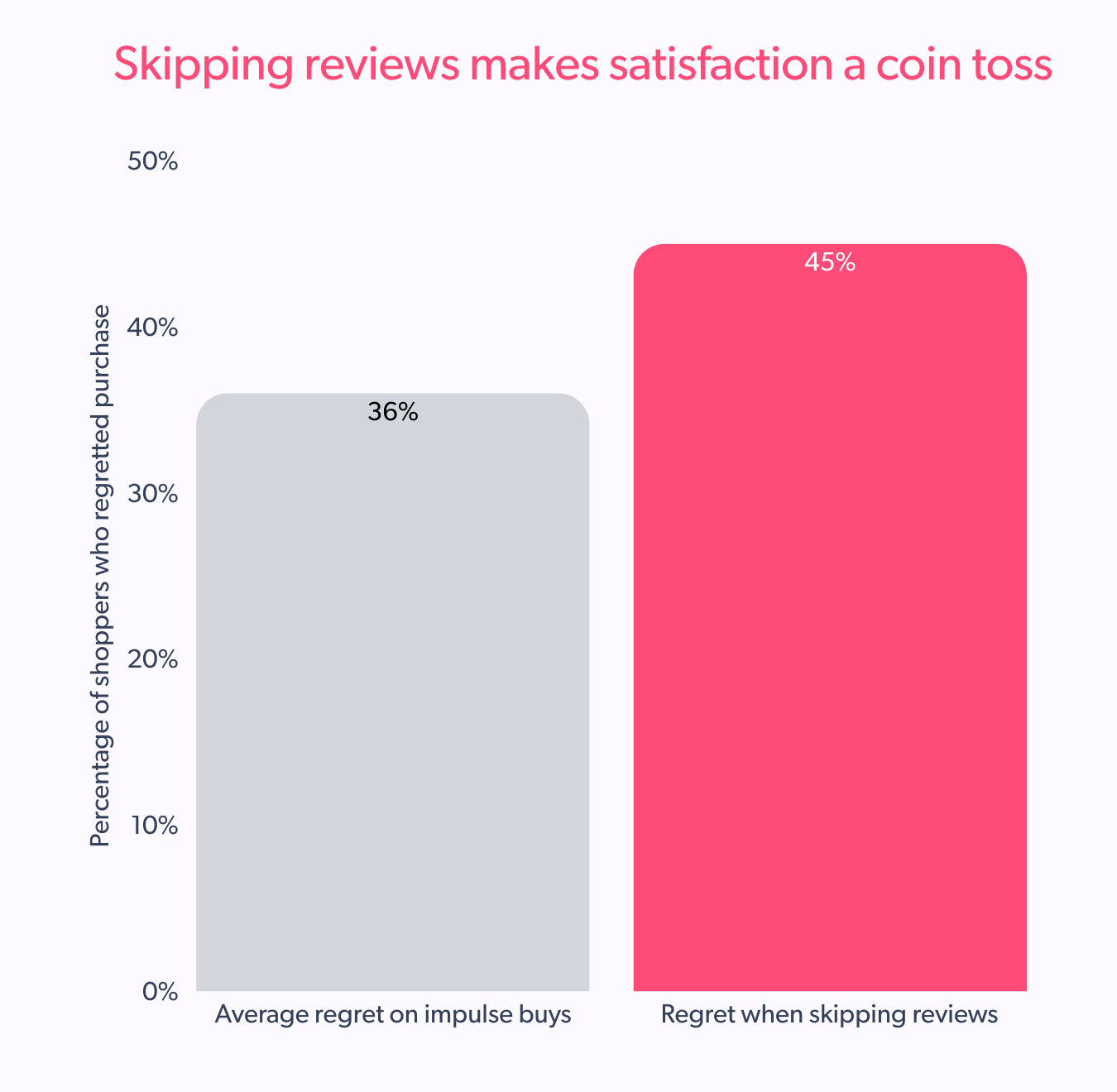

Our data shows that 36% of shoppers regretted an impulse buy in the holiday season. But among those who checked reviews, regret dropped significantly.

Reviews and UGC act as an insurance policy for the shopper’s ego. They allow the consumer to chase the dopamine of the “little treat” without the hangover of buyer’s remorse.

Stop marketing to the generic holiday shopper

Audit your catalog today. Identify which emotional lane your product sits in.

- Is it a chore? Optimize for speed, specs, and star ratings. Solve their logistical stress.

- Is it a splurge? Optimize for visual proof and social validation. Relieve their financial guilt.

The brands that win won’t just be the ones with the most stock. They will be the ones that align their content to these emotional lanes, removing friction for the “chore” and validating the “splurge”. This is how you move beyond just being seen to being discovered, trusted, and chosen.

Ready to capture the 62% of shoppers who are looking for a reason to spend more?