June 3, 2025

French consumers are heading into the 2025 holiday season armed with frugality, scroll-savviness, and a growing list of expectations.

They’re dodging inflation like pros, craving convenience like it’s second nature, and placing their bets on brands they can actually trust. In other words, the bar is high, and patience is low.

And while many brands think they’re hitting the mark, the data says not quite. Only 14% of French shoppers feel that brands completely “get” their holiday needs.

There’s a shift underfoot, too, with 51% of shoppers saying sustainability and ethical sourcing have somewhat influenced their gifting choices. It’s not their top priority (yet), but it’s definitely on the list.

So, how do you win over these intentional, high-expectation shoppers? Based on Bazaarvoice’s consumer research on holiday shopping, we’re unpacking the holiday shopping tips, trends, and behavioral shifts that’ll help your brand go from being scrolled past to being saved, shared, and shopped this holiday season.

The French are strategic about their shopping

Today’s French holiday shoppers are more spreadsheets than spontaneity, planning purchases with the caution of a consumer who’s seen one too many inflation headlines.

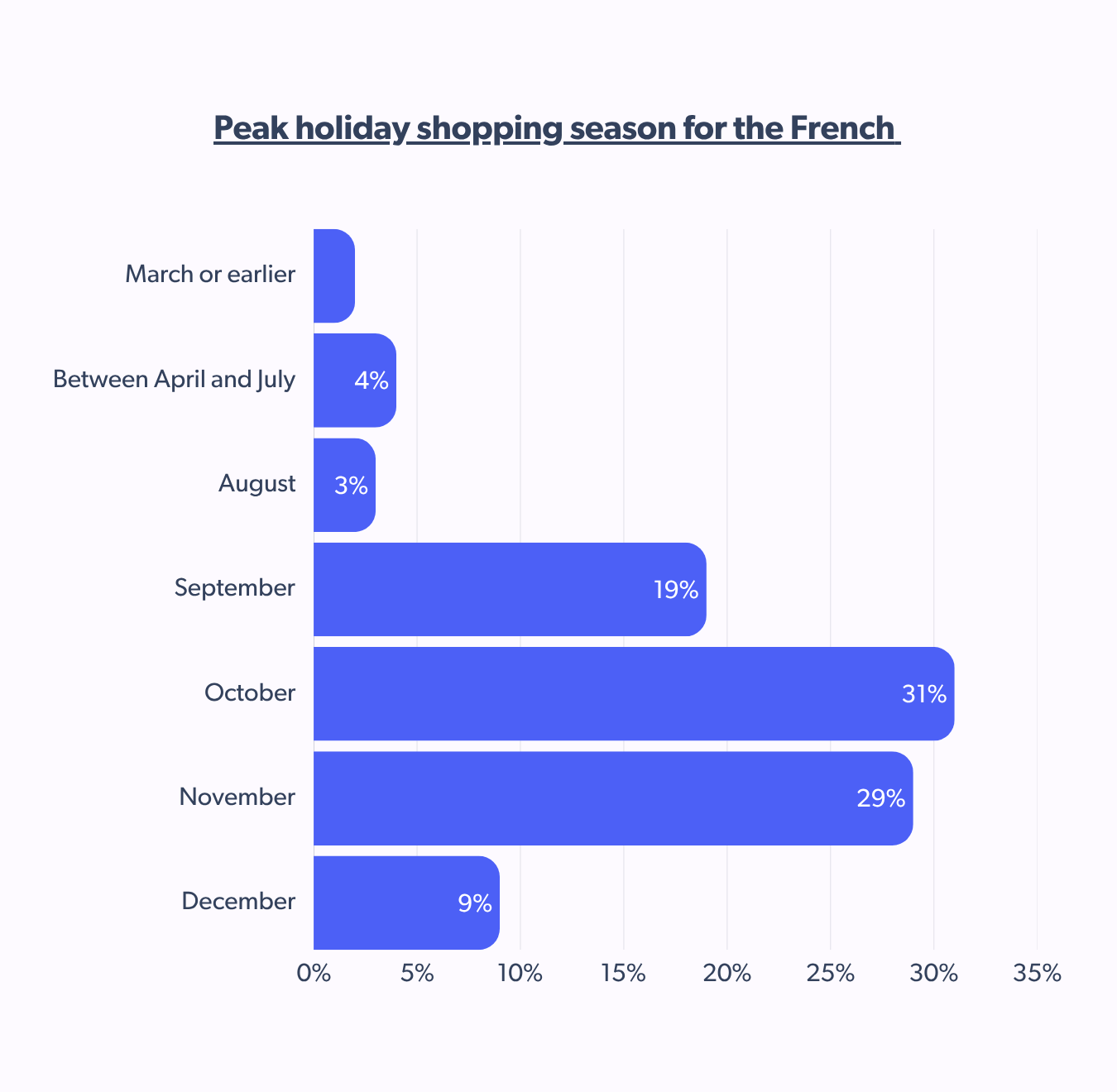

If you’re a brand hoping to woo the French this holiday season, here’s your golden window: October and November are your peak opportunity zones, as 60% start their holiday shopping at this time. Drop the ball here, and it won’t just be lost sales, it’ll be missed moments on their well-timed shopping timeline.

With 47% buying early to avoid price surges, 46% waiting for major sales to begin and 45% of French consumers spreading out their holiday spending across the months, it looks like the French are staging a perfectly timed and priced retail heist.

This makes for a steady hum of shopping activity from September through November rather than one big December blowout.

Brands must front-load campaigns, launching gift guides, email pushes, and influencer content as early as late August to align with these behavior shifts.

Budget-conscious holiday spending on the rise

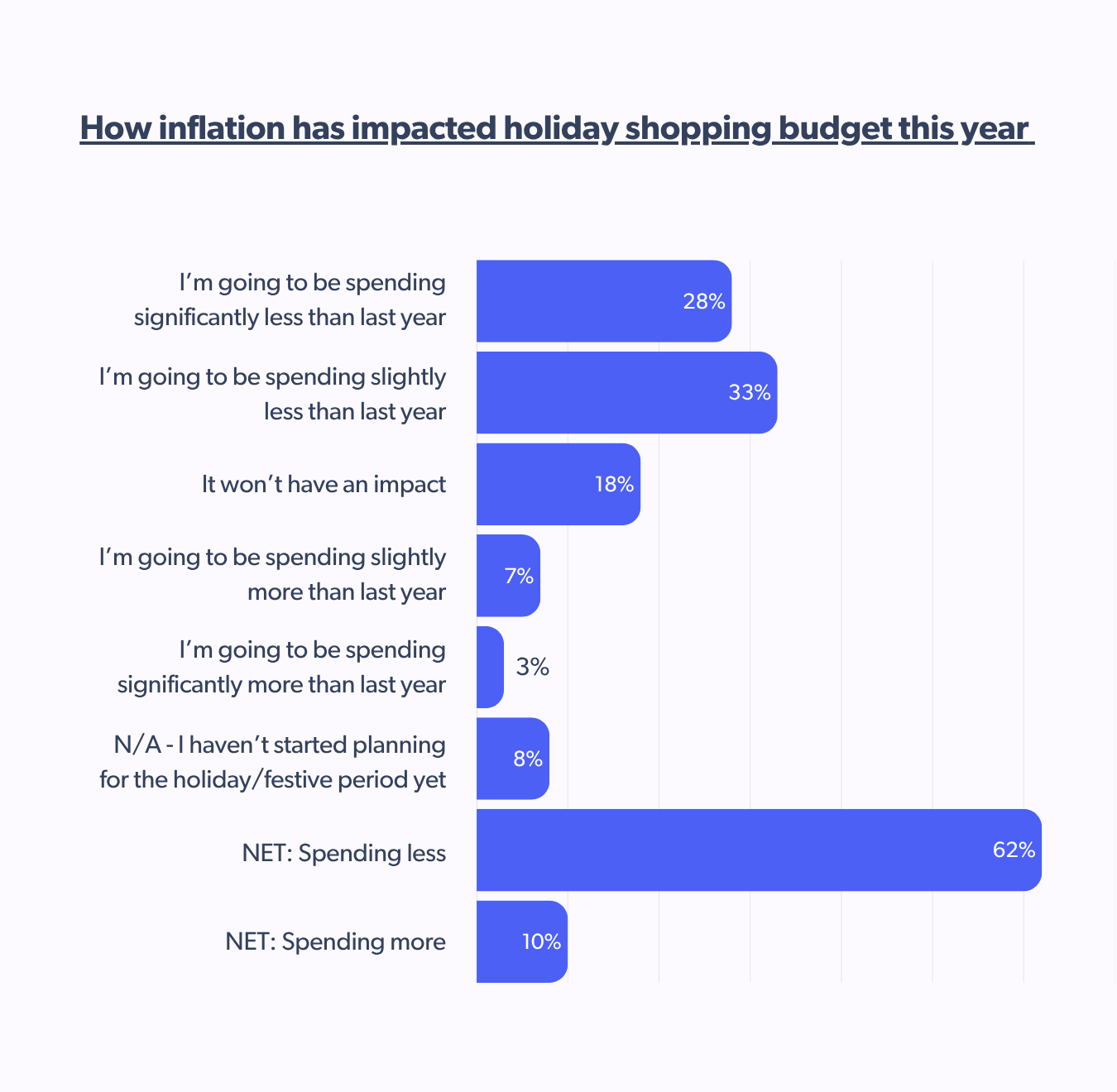

French shoppers are editing their holiday lists with a proverbial red marker. In an economy where prices keep hitting the roof, 62% of French consumers are tightening the reins on holiday spending. That’s the third highest rate among all countries in our research.

Inflation is reshaping gift-giving among the French with fewer splurges, more savvy swaps, and a whole lot of “do I really need to buy something for my cousin’s dog this year?

If it wasn’t clear that the French shopper has their bargain-hunting hat firmly on this holiday season, these numbers should spell it out like a neon discount sign.

Among the shoppers, 35% are indifferent to brand names when shopping for gifts this year and 31% are swapping premium brands for economically practical alternatives.

Nearly half are racing the calendar at 47% buying early to dodge the dreaded holiday price surge. Simply put, value is king and timing the empress!

Let’s be clear: French shoppers aren’t maxing out their holiday cheer on credit. At least 53% still prefer to pay in full, keeping things interest-free.

That said, economic realities are gently nudging some toward flexibility, with 11% of French shoppers saying they are using Buy Now Pay Later more than last year. It’s proof that even the most fiscally disciplined can be tempted by the lure of a split payment plan.

If you’re targeting the TikTok generation, flaunt those BNPL options proudly and early in the funnel. But if you’re courting the over-40 crowd, stick to value and the comforting promise of transparency.

French shoppers have felt inflation’s sting and they’re fighting back with smarter, savvier checkout strategies.

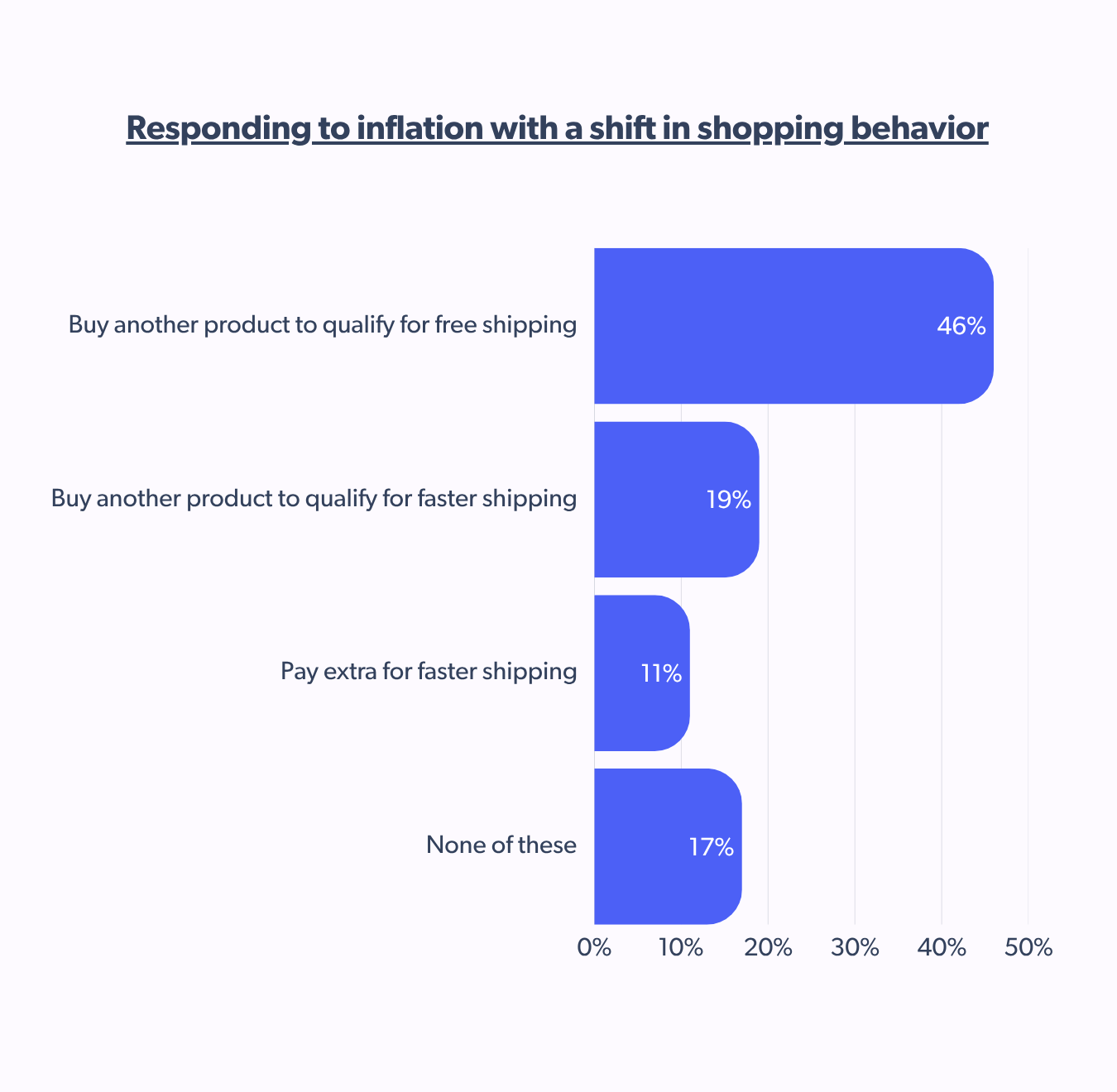

Beyond tightening their wallets, they’re padding their carts: Many are now adding extra items just to unlock free shipping, a behavior that’s becoming just as common within holiday shopping in France as it is globally.

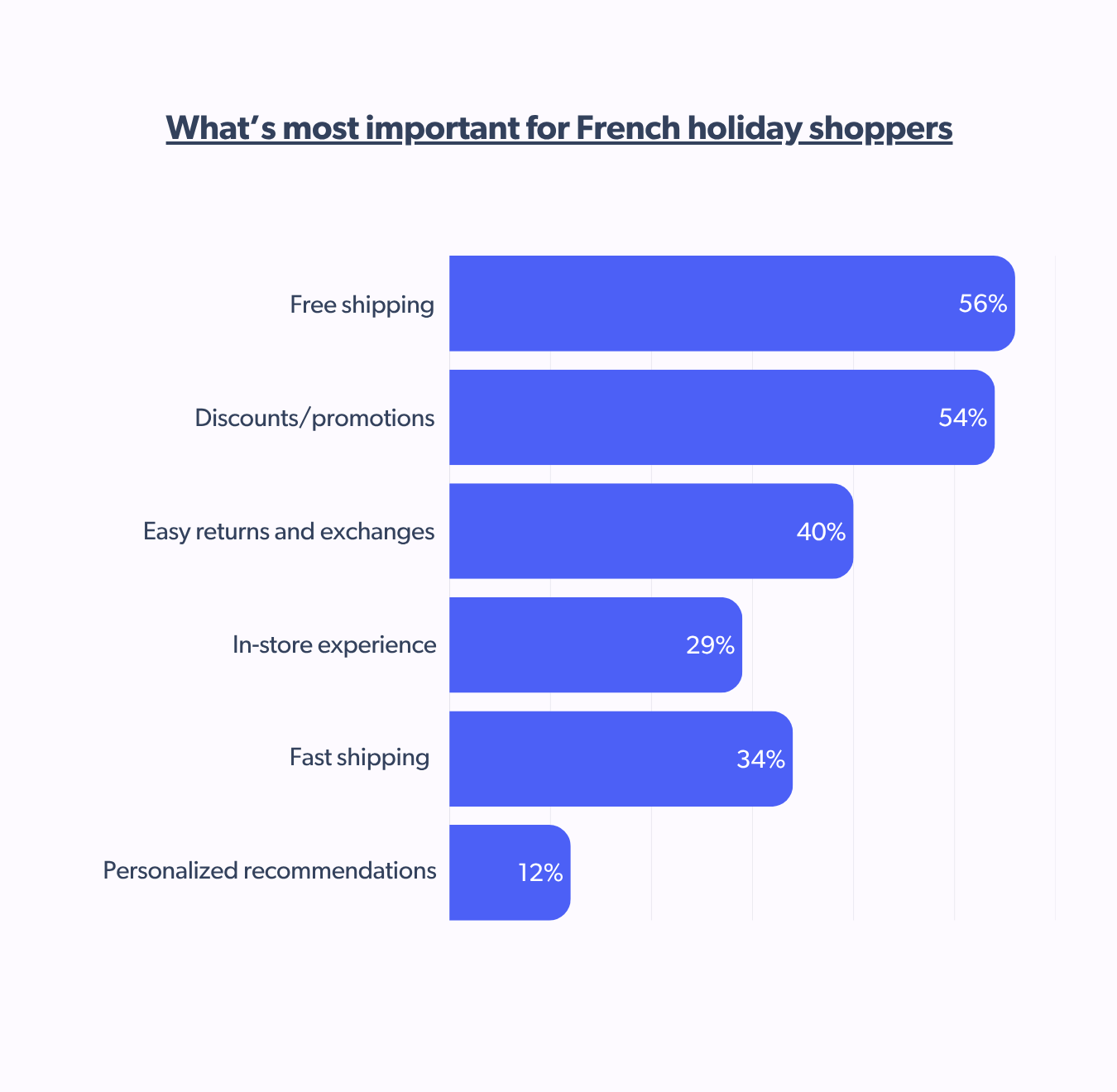

Regarding what drives that final click, free shipping and juicy discounts are emerging as the real rockstars of the checkout experience.

For brands and retailers, this is your cue: Highlight those shipping thresholds and savings loud and clear. In a landscape where every penny counts, communicating ‘price-offs’ could be the difference between cart abandonment and conversion gold.

The cost-control mindset doesn’t stop there, with 22% of French shoppers even signing up for subscription services to score better deals during the holidays.

The French still love to go shopping, even as more of them embrace online

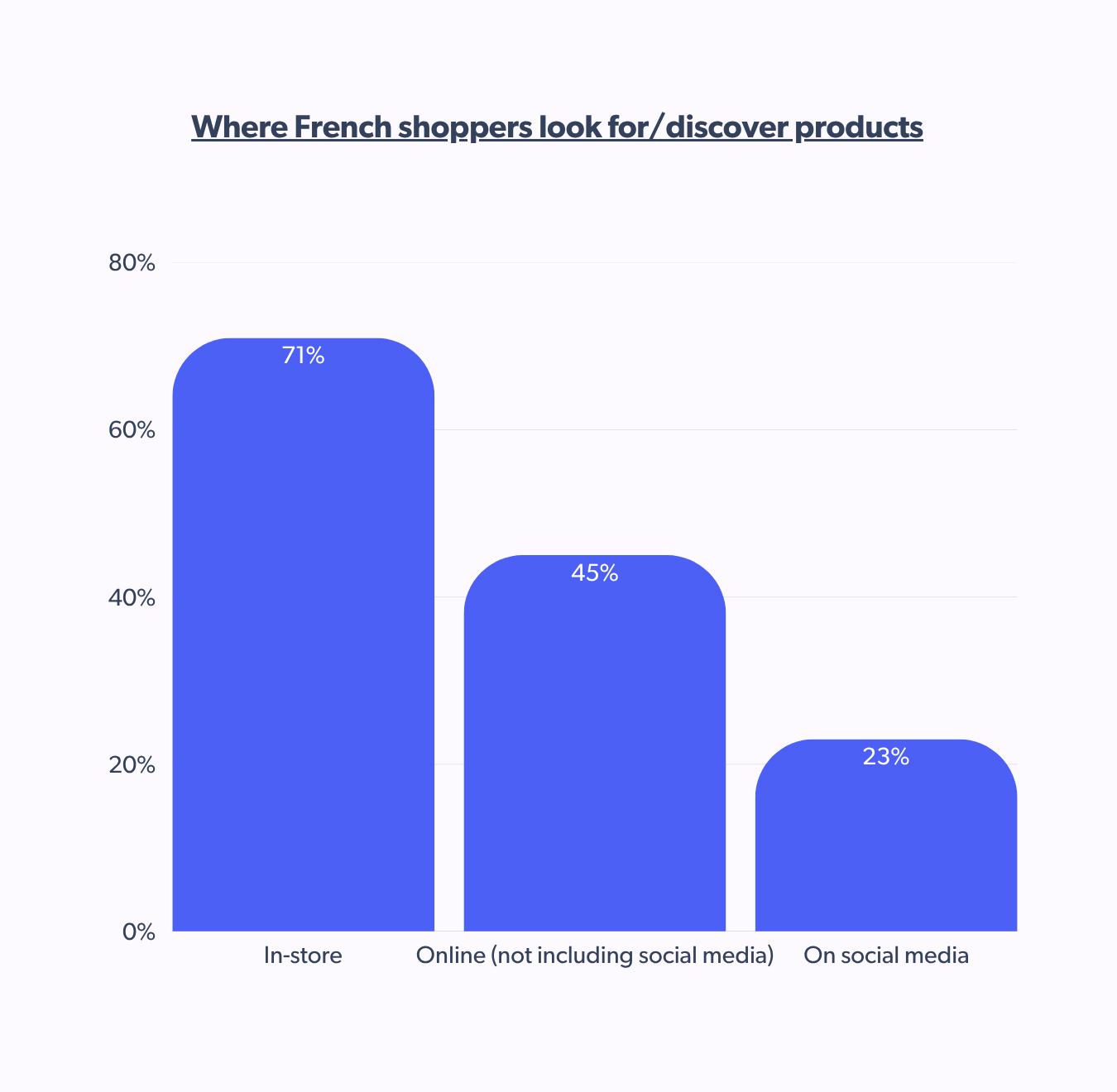

We have said this before the French lead the way in holding on to the tangible shopping experiences and it’s no different during the holiday season.

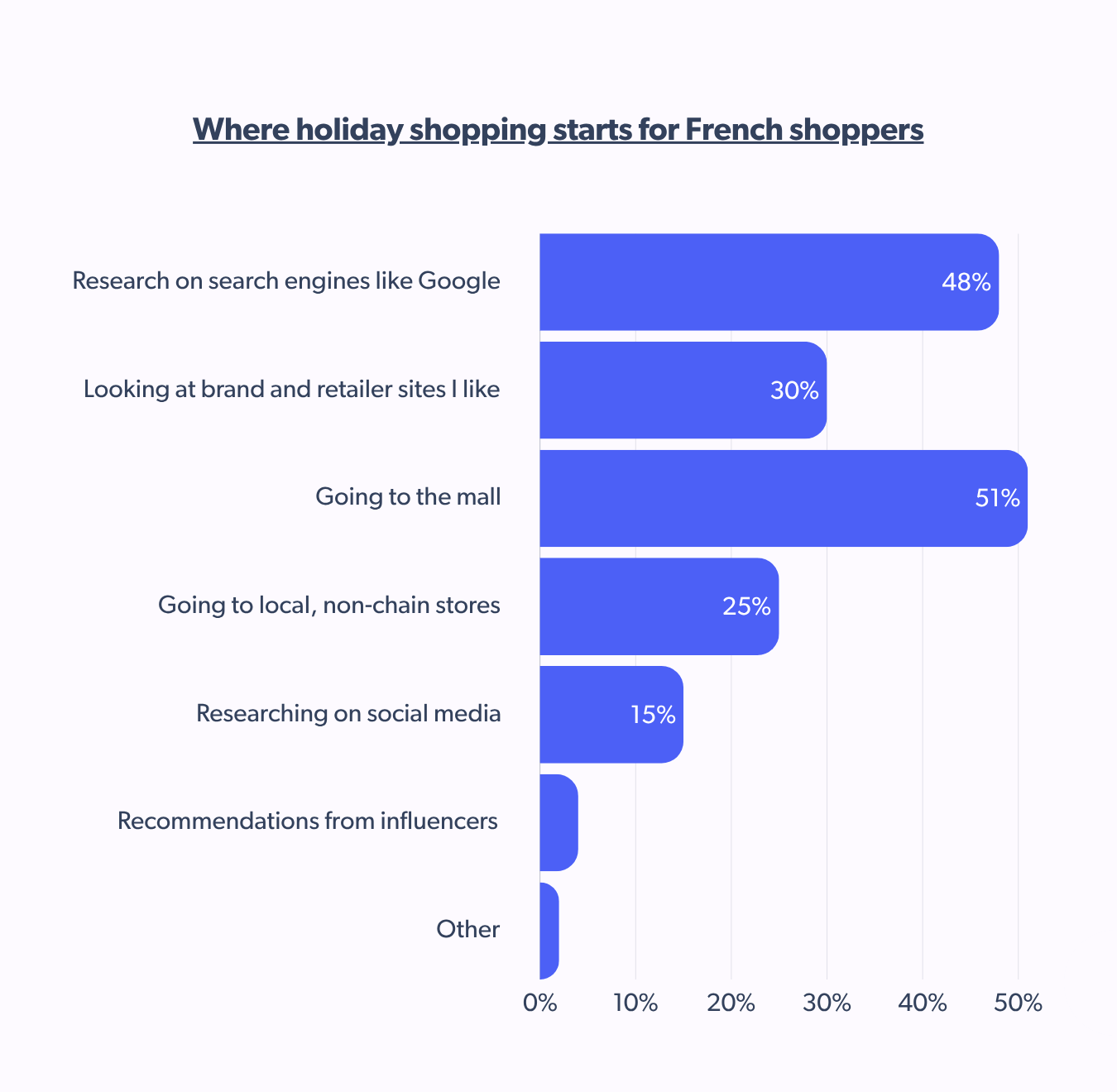

But it’s a blended path to beginning the process, with 51% going to the mall to start their holiday shopping and 48% relying on search engines like Google.

Omnichannel shopping is taking centre stage in French holiday shopping as well. When asked to look back at the time when they were last buying a holiday gift, the majority remember researching it online before buying it at the store. At 34%, the majority of French shoppers also say yes to doing most of their holiday shopping online this year.

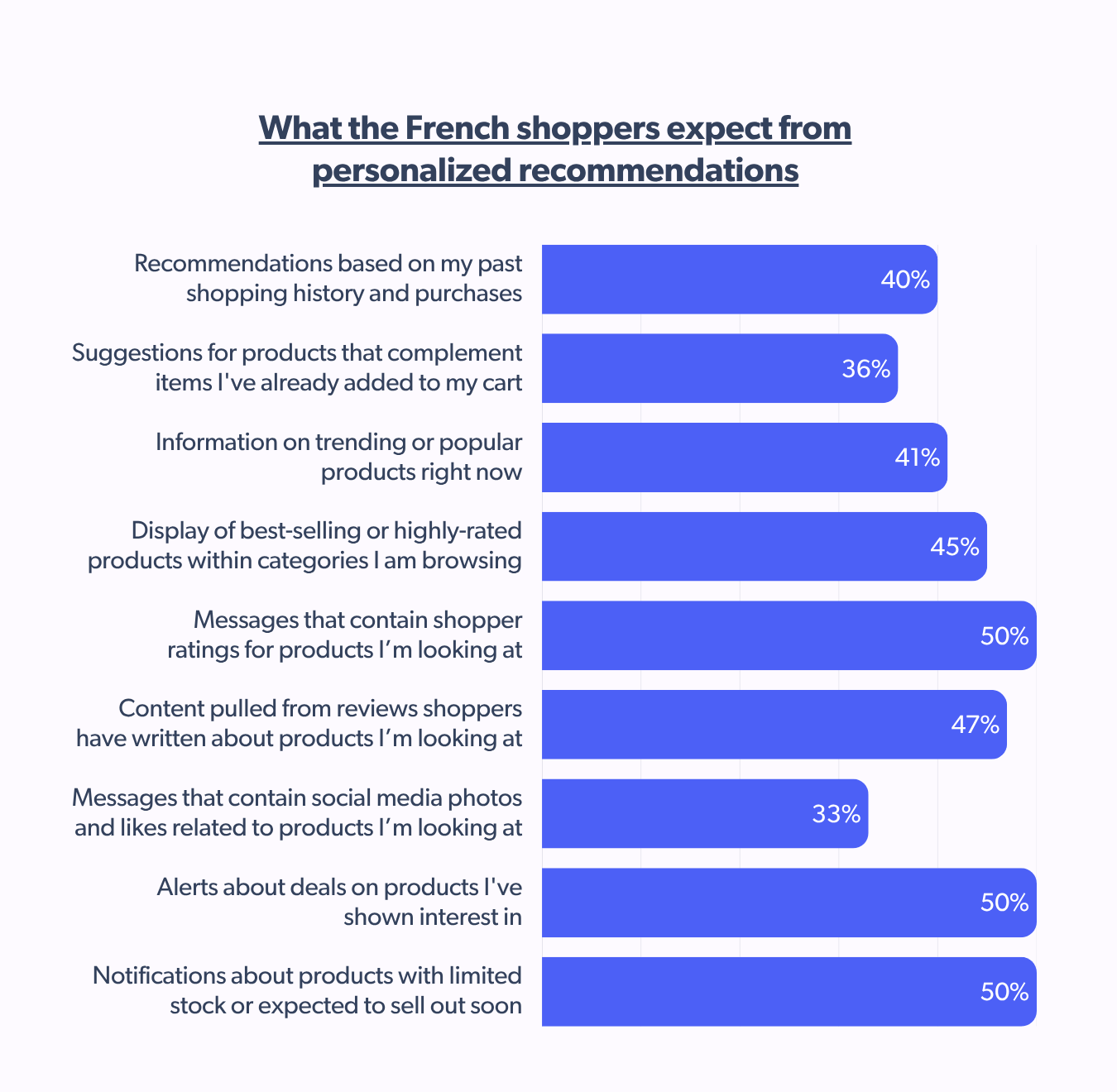

French shoppers today are like retail ninjas, gracefully leaping between online and actual stores. To prevent them from getting lost in this glorious shopping maze, personalized recommendations swoop in like the companion who just gets their style.

So, what do these discerning French shoppers actually want whispered in their ears (or displayed on their screens)?

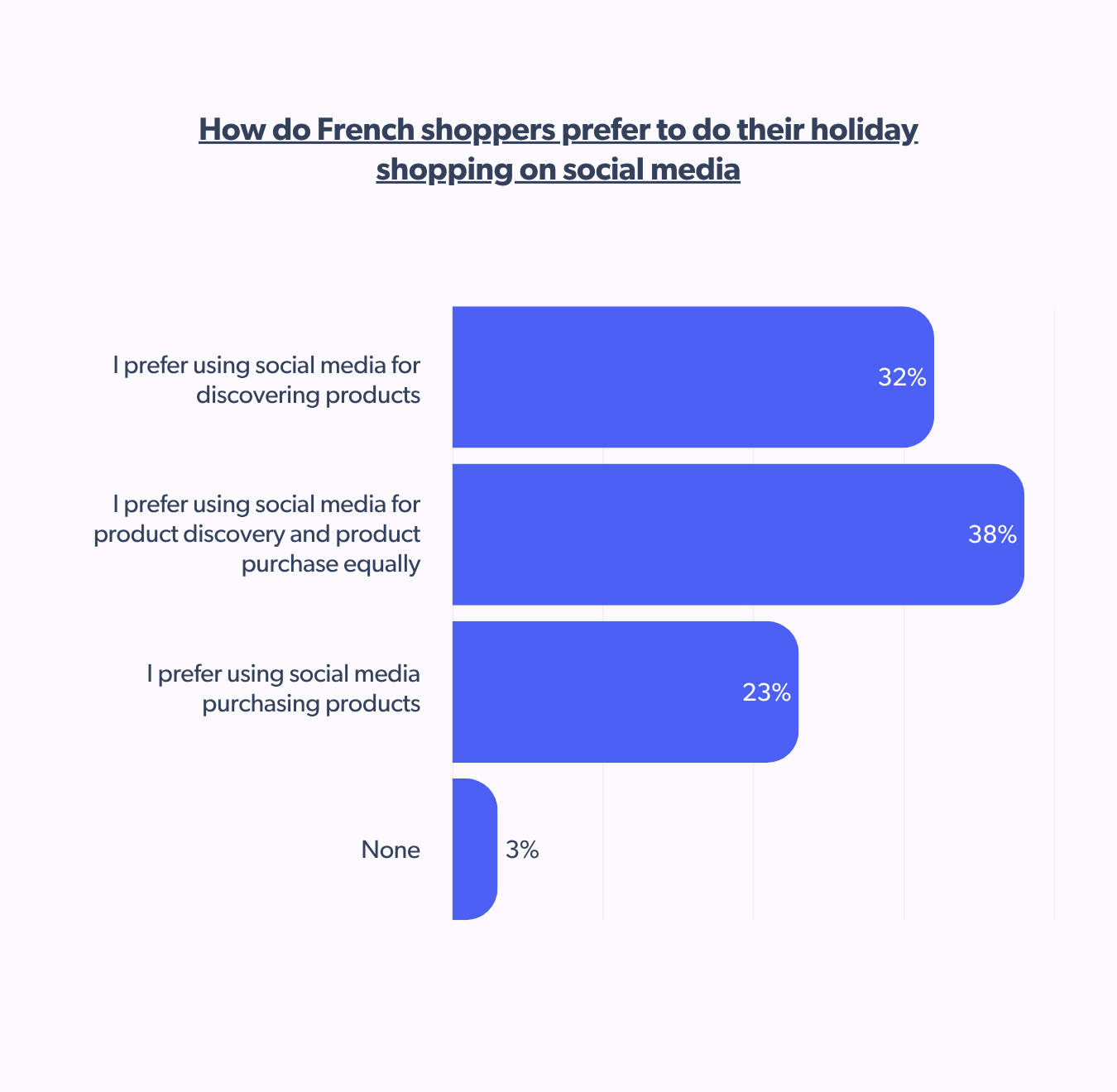

Growing acceptance of shoppable social

It’s interesting to note that 41% of French shoppers are discovering holiday gift ideas on social media. Yet they are among the last of the shoppers in global comparison that would directly buy gifts from social media platform’s shopping feature at 22% for reasons that could include anything from lack of awareness around those features, general skepticism to data privacy concerns.

Last year, 12% did more than half of their shopping on social media, 58% did between 11-50%, and 25% did less than 10% of their shopping on social media. Interestingly, 38% of them found themselves on social media for product discovery and purchase equally.

At 31%, Facebook influences French shoppers’ holiday gift purchases the most.

French shoppers don’t mind a little holiday inspiration from creators, but let’s not get ahead of ourselves.

When 31% say they generally trust creator recommendations during the festive season, it’s promising until you realize 77% admit they’ve never actually bought anything because of one, and 51% don’t even pay attention to influencer promos in the first place.

Still, creators shouldn’t pack up their ring lights just yet. The influence isn’t absent, it just needs a glow-up.

Brands should prioritize visually rich, shoppable content on these platforms and build trust by partnering with relatable creators.

French shoppers discern authenticity in UGC

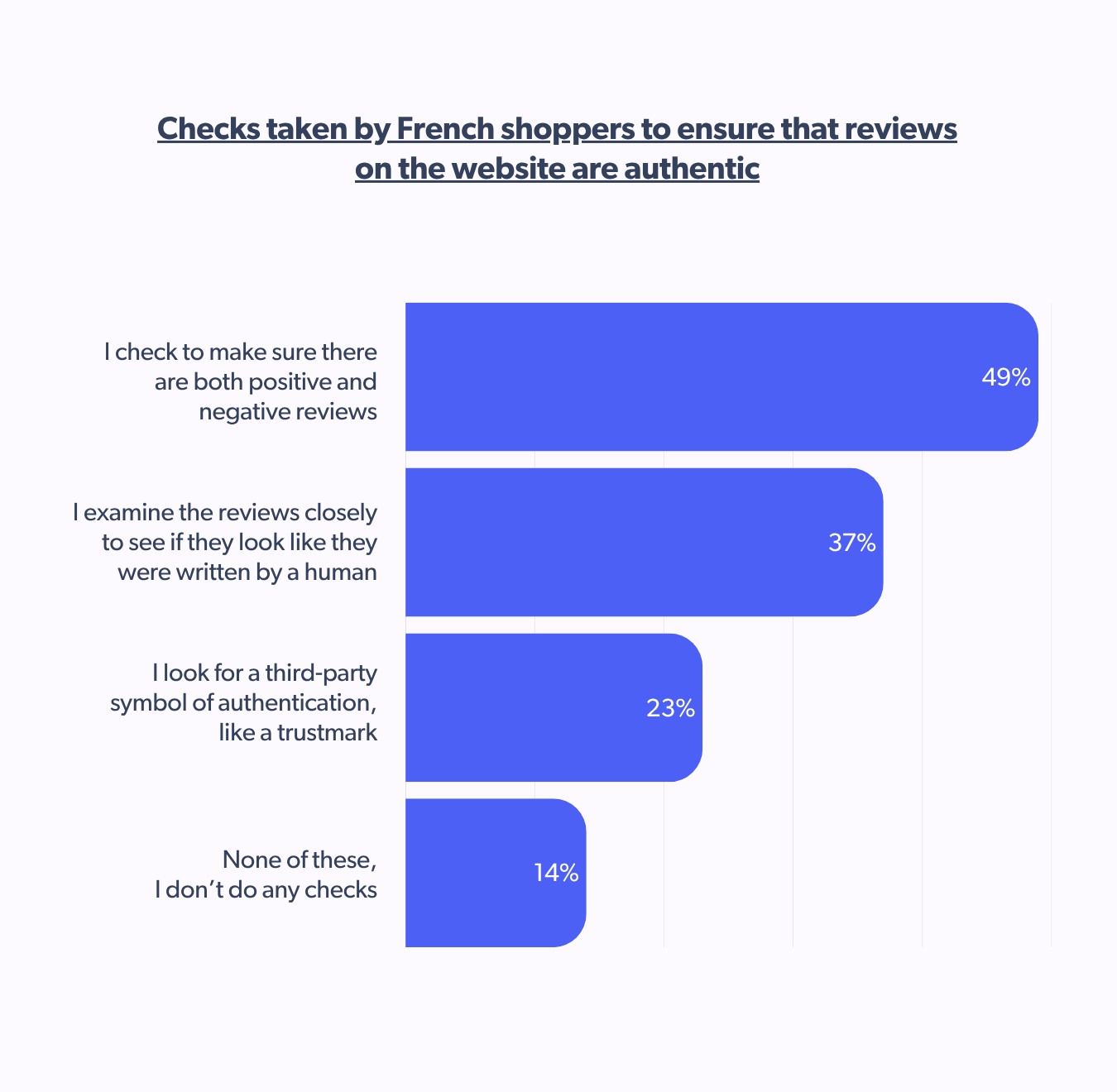

The French shopper is individualistic to the extent of sometimes bordering on difficult to predict. Yes, half of them determine authenticity on brand websites based on whether the review collection contains both negative and positive reviews.

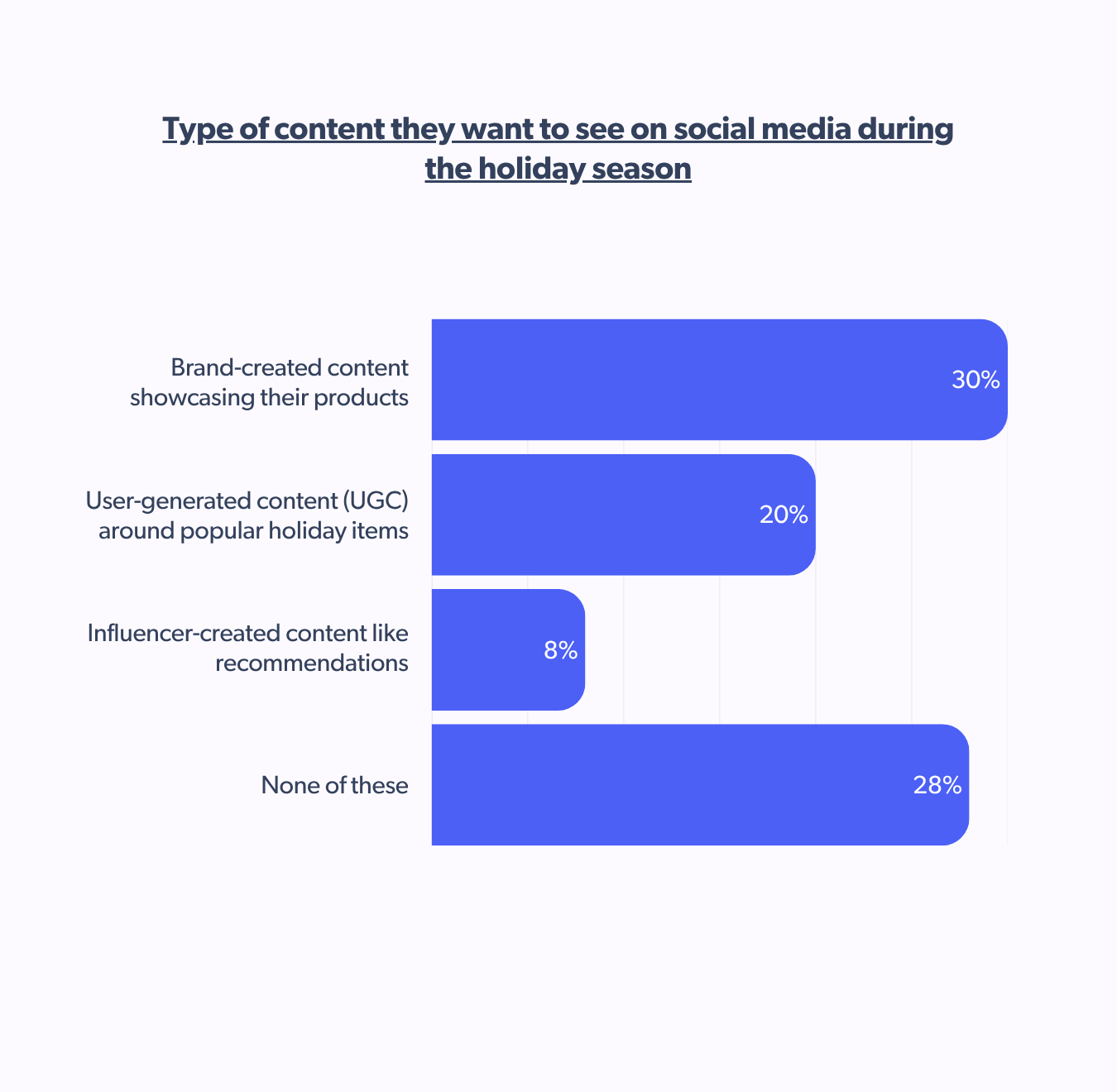

When it comes to the content they prefer to see on social media, at 30%, branded content detailing the product comes out on top, ahead of UGC or creator recommendations.

That doesn’t stop authentic reviews for holiday shopping in France from being relevant, with 30% of French shoppers often reading product reviews while making purchase decisions.

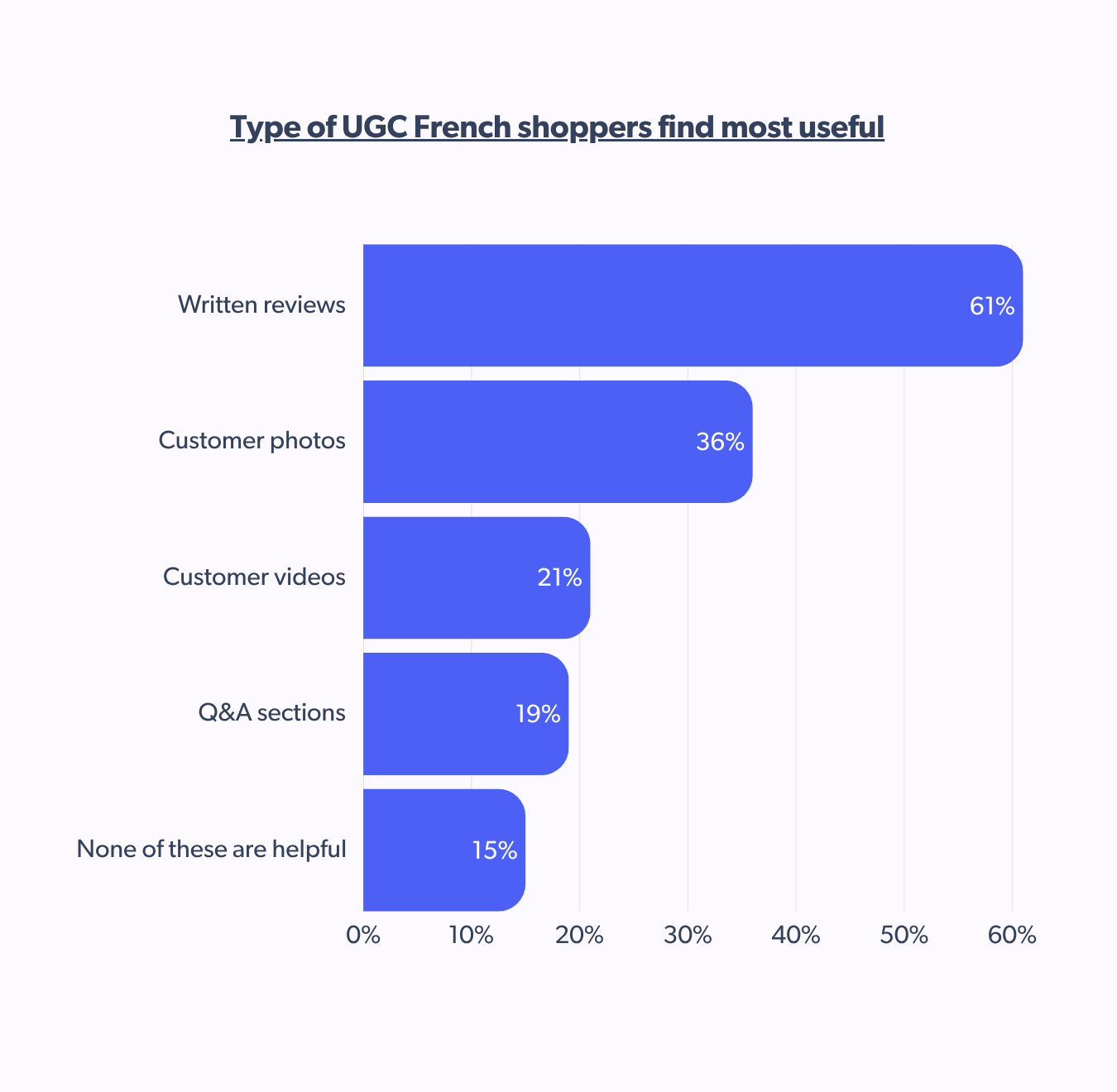

They also believe that written reviews are the most helpful aid among all forms of UGC when choosing a gift for the holiday season.

But is a negative review enough for them to stop considering purchasing the product? For 38% of French shoppers, it’s a dealbreaker, but 37% would still consider buying it. Surprisingly, 35% of French shoppers would even end up buying a product if it had no reviews.

If you want the French to click ‘add to cart’, skip the dreamy lifestyle montages and focus on what really sells: good old-fashioned unboxings and product reviews, which 43% of French shoppers find the most compelling type of creator content.

Less curated perfection, more what’s actually in the box.

French shoppers and AI: A relationship in progress

France’s relationship with AI? Let’s just say it’s complicated.

Ask a French shopper if AI generated content can truly channel the holiday spirit or sprinkle that warm, fuzzy, genuine touch into the shopping experience, and 37% and 42%, respectively, will give you a hard non. Yet, in classic French fashion, a nearly equal 39% and 42% will raise an eyebrow, shrug, and say, “It might.”

When it comes to AI-generated brand posts, things get more personal with 32% saying they’d care if a brand’s post was completely AI-created, and 25% say it would actually make them less likely to buy the product. But 41% take a more laissez-faire approach, AI or not, it doesn’t move the needle for them.

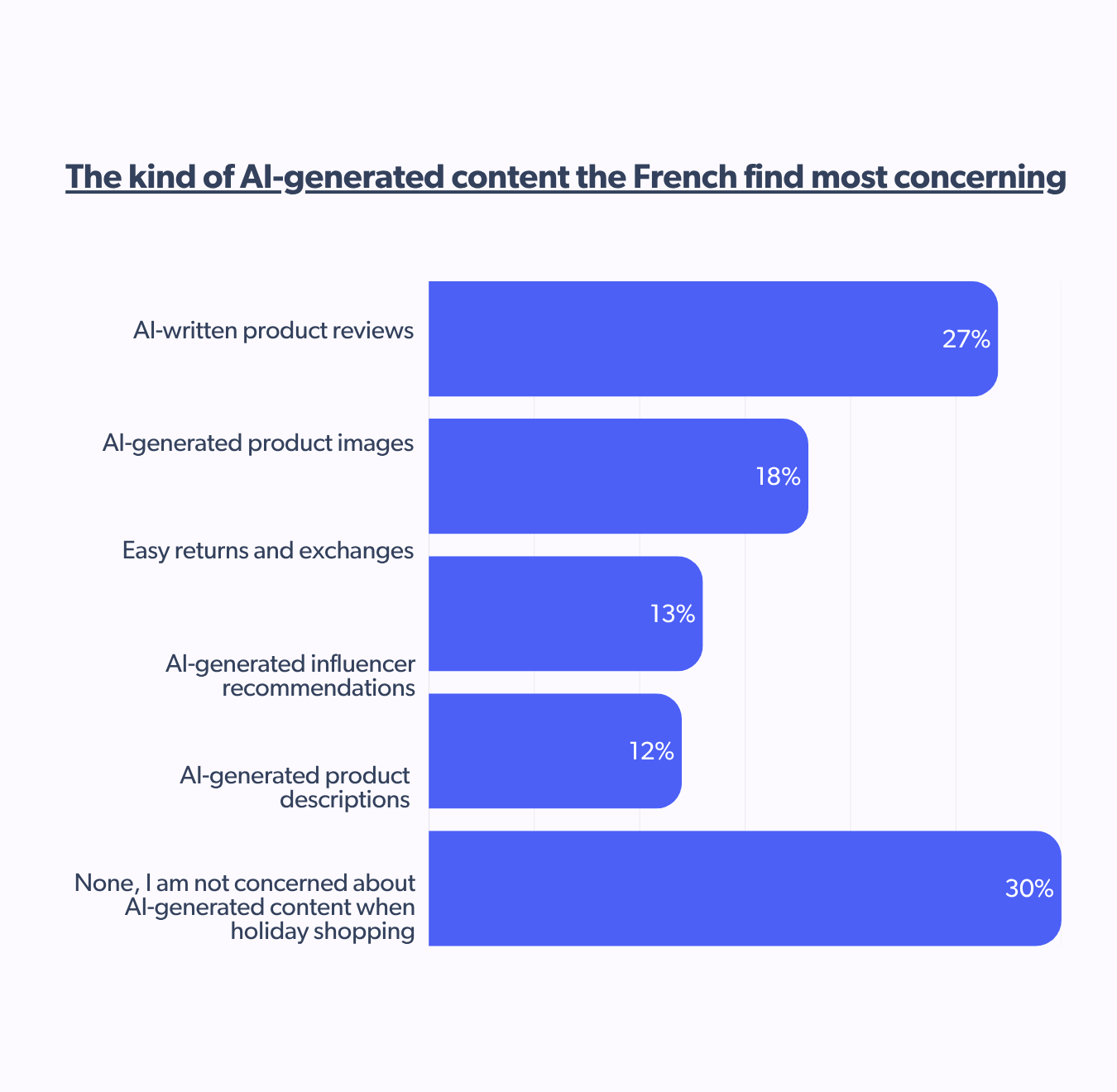

Still, the biggest red flag? Not the images. Not the captions. It’s the reviews.

With 27% of French shoppers saying AI-written product reviews make them uncomfortable, one of the most useful holiday shopping tips for brands would be to leave out the robots in pretending to be picky humans with opinions about a coffee machine.

The power of contextual personalization on French shoppers

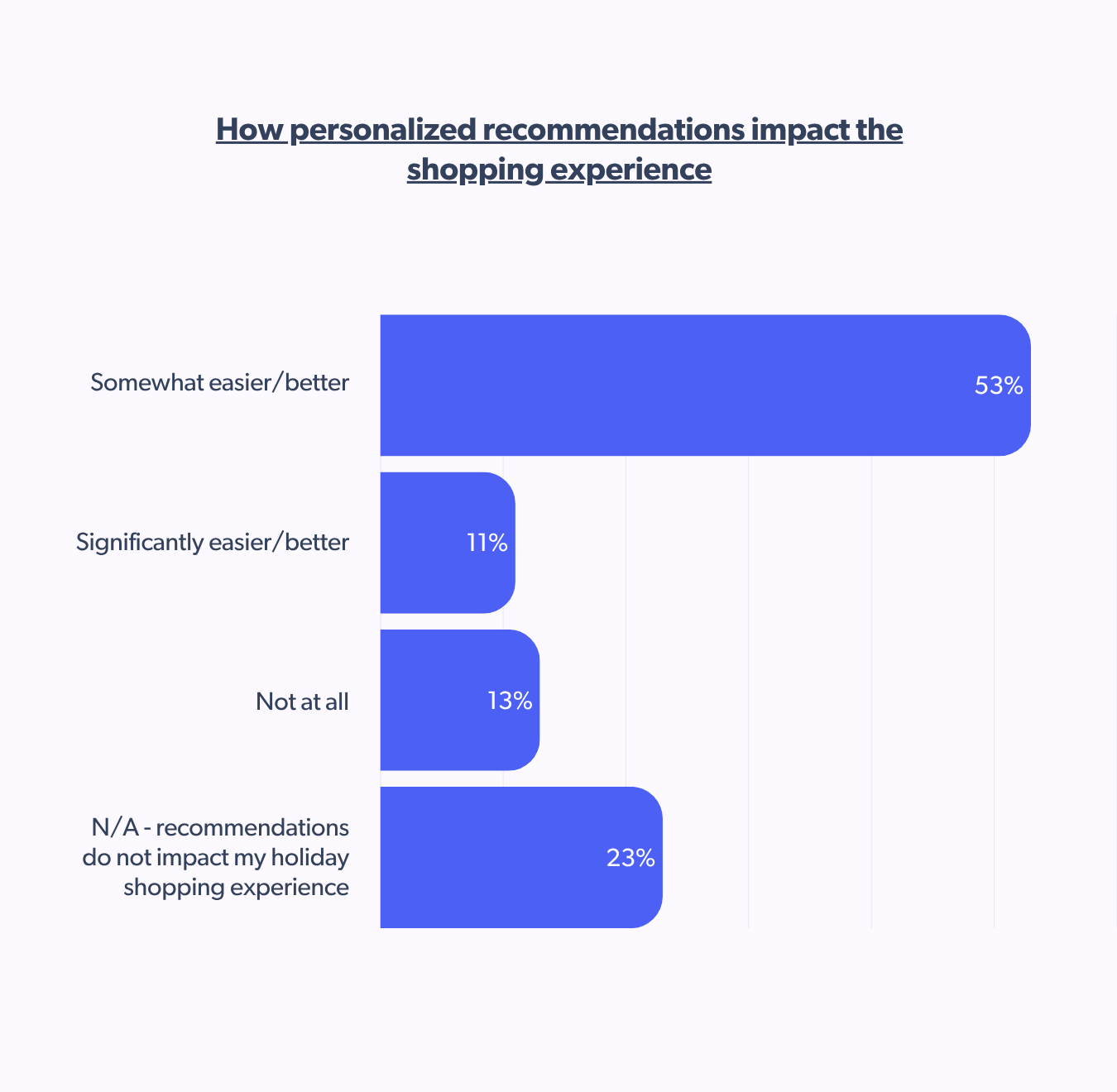

French shoppers are increasingly looking for real-time, relevant content, rather than generic personalization. They are looking for tailored and relevant shopping recommendations with more than half of them claiming it makes their journey easier.

It goes up to 30% wanting brands to base suggestions on what they’re doing right now on the brand website. So, your data from their 2021 faux leather boot phase stands expired.

Get it right, though, and you’ll win them over. Nearly half say their opinion of a brand becomes more positive when those recommendations hit the sweet spot.

Brands take note: It’s time to invest in smarter content systems that adjust by moment, mood, and clicks.

Making the French holiday shopper love your brand in 2025

Want to win the hearts (and carts) of French holiday shoppers in 2025? Here’s your cheat sheet for getting it right:

- Start early, or get left behind. Think of September as your soft launch, October as your runway moment, and November as your conversion crescendo.

- Lead with value, not volume. French shoppers are drawn to brands that offer real savings, real trust, and real people saying, “Oui, this is worth it.”

- Be everywhere they are, but strategically. From TikTok to the nearest mall, from search engines to PDPs, every channel is fair game. But don’t just exist, engage with purpose.

- Free shipping + discounts = amour. If your promotion feels like a gift itself, you’re doing it right. Otherwise, you might just be another unopened tab.

- More reviews, please but make them feel human. Authentic voices sell better with the French. Think less Cannes Film Festival, more real talk from people who’ve actually used the product.

- Mix up the content formats. Gift guides, influencer picks, reviews, branded social. It’s not one or the other. French shoppers appreciate variety as long as it’s aligned with their vibe and age group.

Want the full global download on holiday shopping ahead of the season?