June 6, 2025

Planning your holiday shopping marketing strategy? You’ll need to meet Canadian shoppers with more than just deals — they’re heading into the 2025 season with sharper intentions and higher expectations.

Our latest Holiday Headquarters, based on insights from 1,053 Canadian consumers (part of a global study of 8,456 respondents), reveals what really drives purchase decisions this year.

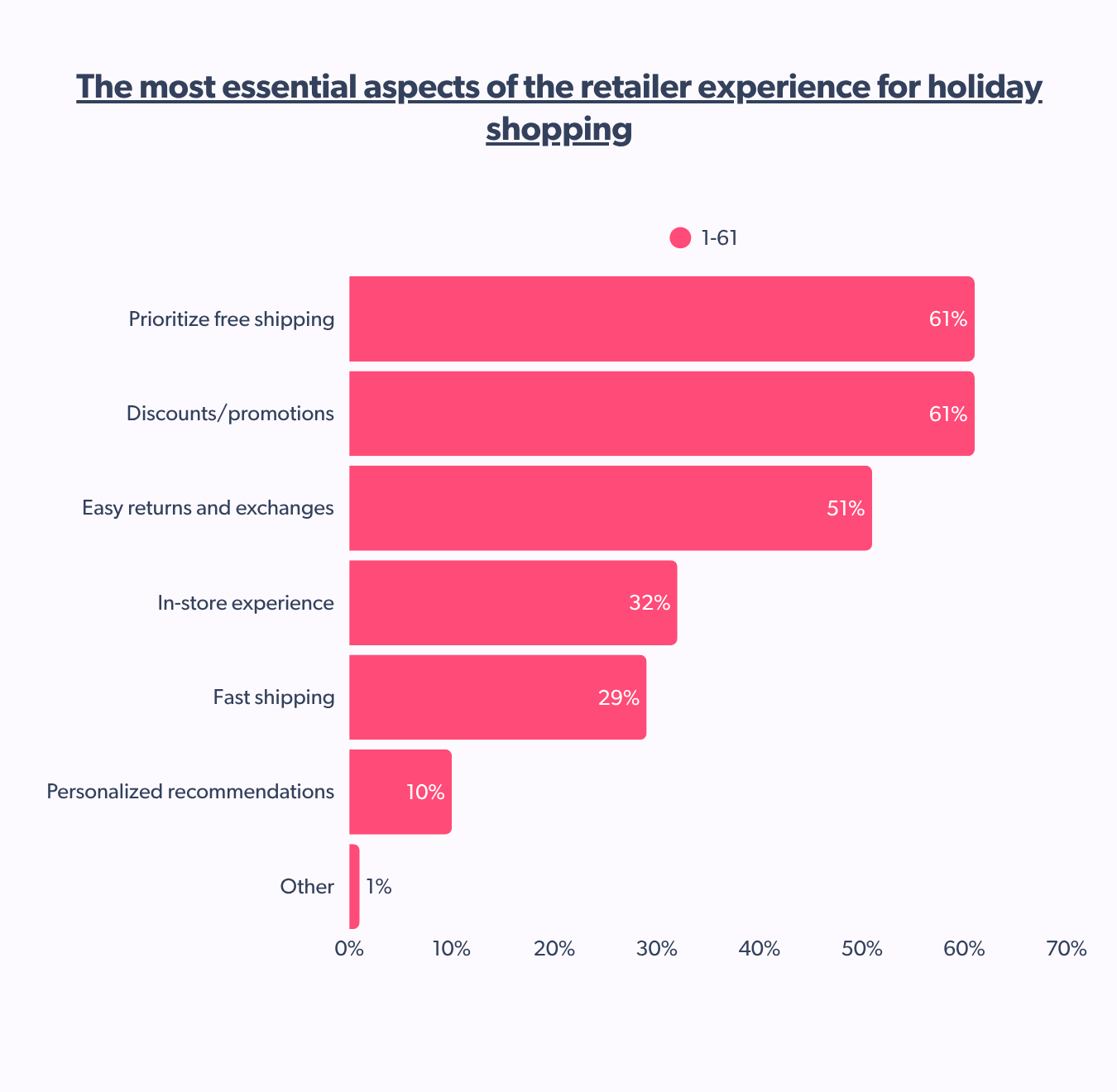

For 55%, free shipping seals the deal. Another 32% are ready to join loyalty programs for exclusive perks. And with 61% saying this is their biggest spending season, brands can’t afford to miss the moment.

Read on to uncover what Canadian shoppers truly want and how to meet them with smarter strategies, content, and experiences this holiday season.

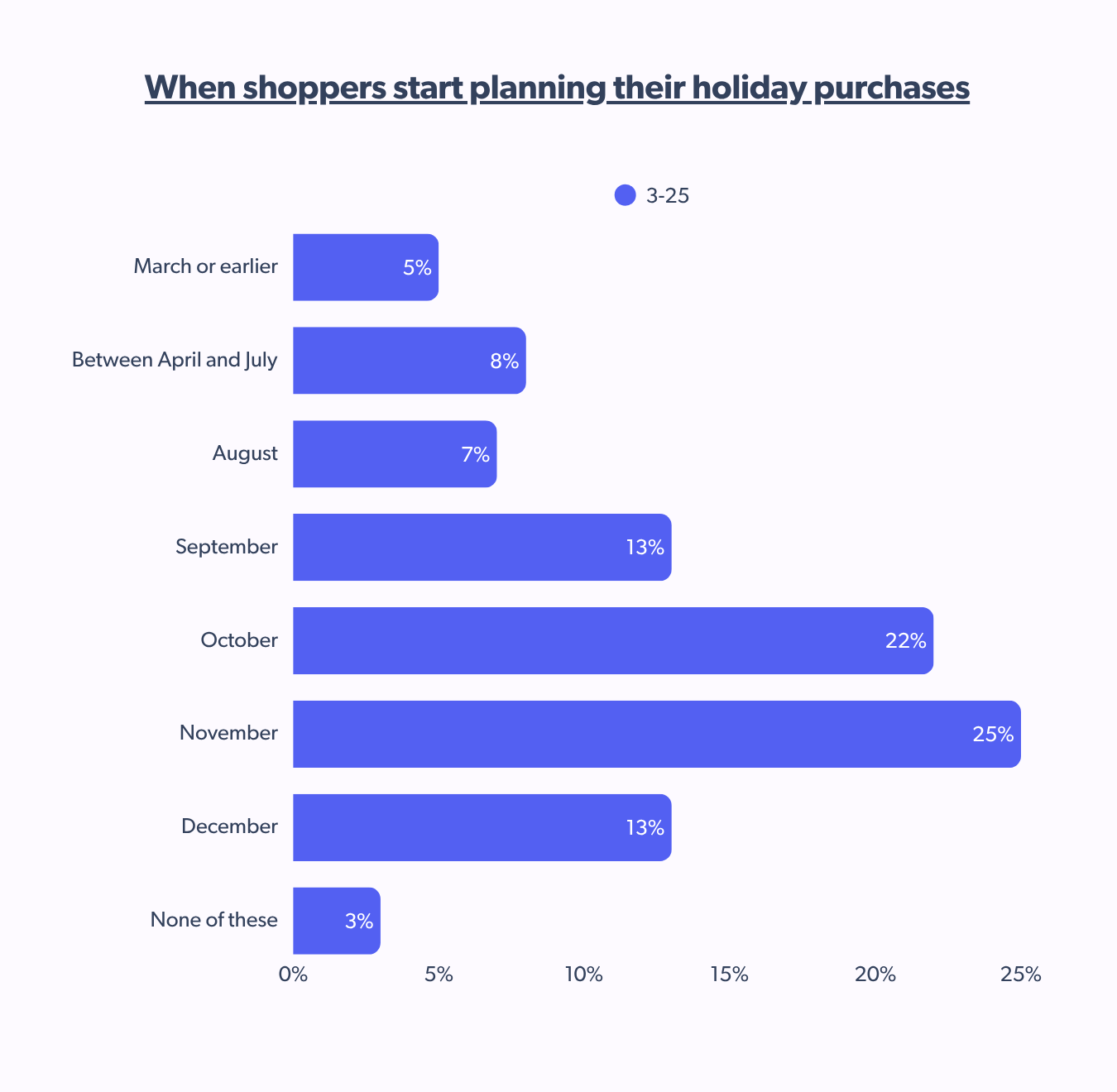

More than two in five Canadians are starting holiday shopping early

In 2025, Canadian shoppers are showing a clear shift in behavior: They’re planning their holiday purchases well in advance, and they expect brands to be ready. While 44% say they’ll spread their spending out across multiple months, 40% plan to shop early to avoid price hikes, and 46% hold out for key sales moments like Black Friday or Cyber Monday.

For brands, this means the traditional December push won’t cut it. The holiday window is expanding, and your marketing, messaging, and promotions must reflect that. You may already be too late if you’re not engaging shoppers in September, October, and even earlier.

Brands or budgets? Canadian shoppers are clear

Since Canadian shoppers actively seek ways to spend less, they will likely switch to store brands without feeling compelled to stick to big-name or national products this holiday season. While comparing globally in our Holiday survey, with USA (52%), UK (44%), France (32%), Germany (39%), and Australia (49%); Canada ranks higher at 53% when it comes to shoppers opting for budget-friendly store brands or affordable alternatives. Just 16% still go for big-name products, and 23% don’t even check the label.

The same cautious mindset shows up in payment habits. The majority, 56%, prefer to pay in full rather than splitting costs with buy now, pay later (BNPL) tools. That said, 14% are considering using BNPL for the first time, so it’s still on the radar. But what does all this mean for brands? Simply put: value, convenience, and trust are non-negotiables.

In Canada, omnichannel isn’t a strategy; it’s just shopping

Remember when online and in-store were seen as two separate worlds? That line’s completely blurred now. Even as omnichannel is a must-have, most shoppers are inclined toward in-store shopping, especially during the holiday season. 41% lean toward online. But a higher portion (59%) value is in-store purchases.

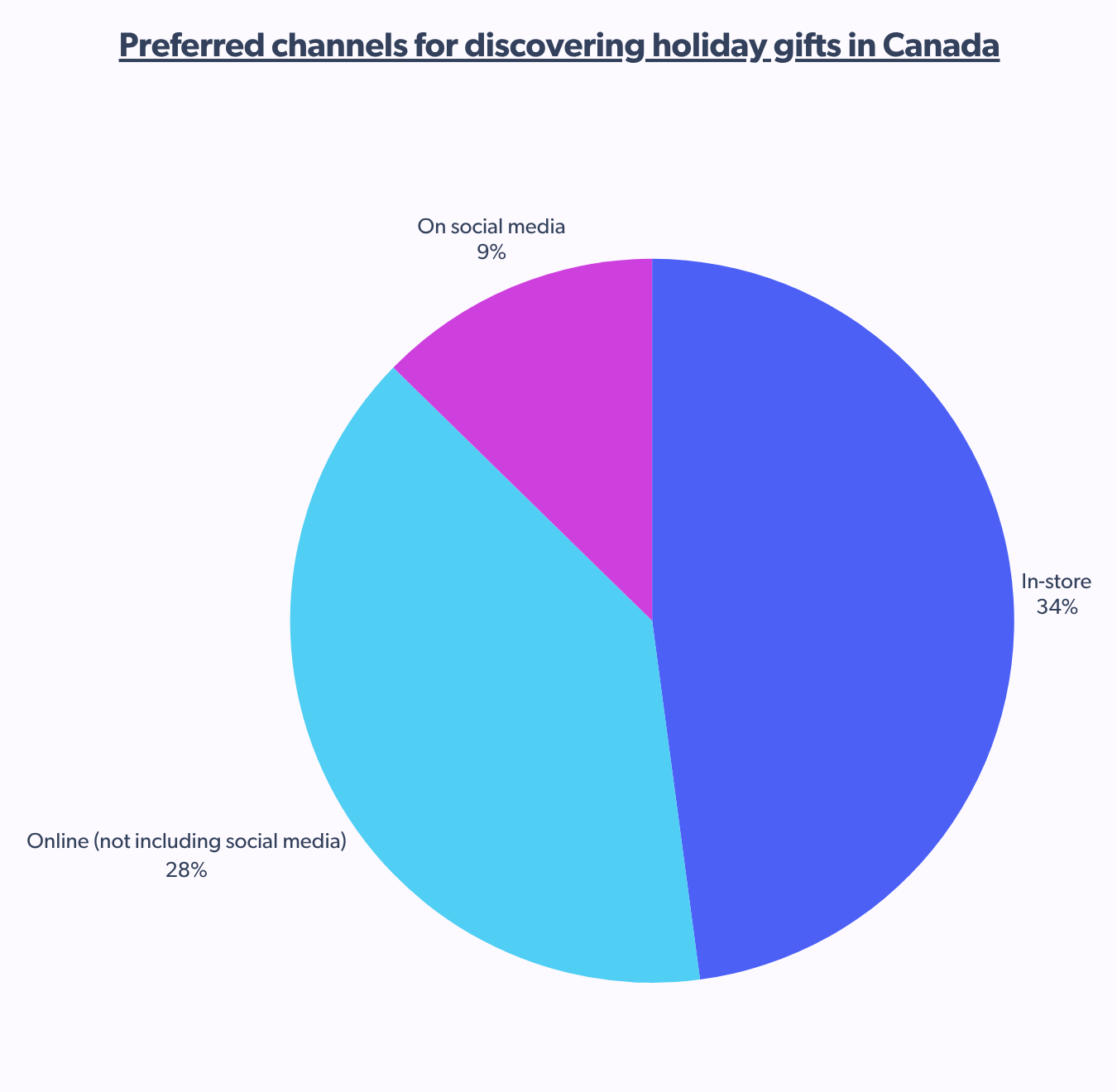

Let’s break it down. 28% of shoppers are splitting purchases equally between online and in-store. Some skew more digital (32%) while others prefer brick-and-mortar with a dash of online (20%). Only a small chunk sticks to one channel — 11% are in-store, and 9% are online. It’s a hybrid hustle, and it’s happening naturally.And before anyone heads to a store, they’re doing their homework. Over half (54%) of Canadians research online before entering a physical store. This is a clear sign that digital tools are no longer just part of the experience — they guide it. And while research starts online, the desire to shop in person is still strong: 64% prefer to look for or discover holiday gifts in store.

Real-time personalization: what shoppers actually want

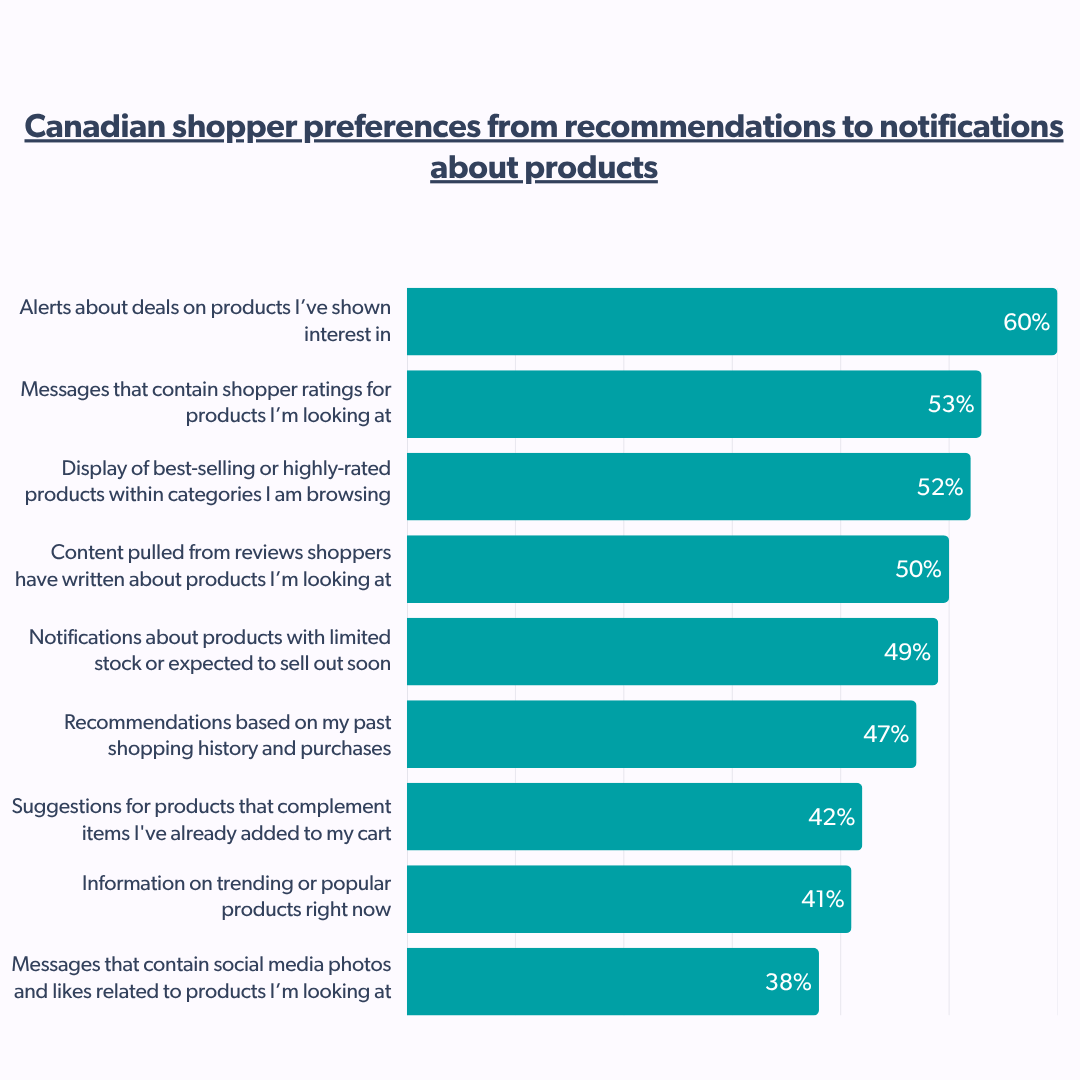

Before diving into personalization, let’s take a look at the kind of recommendations Canadian shoppers actually want from brands. The table below highlights preferences gathered from our Canada-specific data set:

These numbers tell a clear story: shoppers want timely, relevant information, not generic suggestions. But what’s the top preference? Getting alerted about deals on products they’re already interested in.

That brings us to real-time personalization. It isn’t just a buzzword anymore — it’s an expectation. Canadian shoppers are saying: “Show me what matters right now.”

- 49% want product suggestions based on what they’re currently browsing

- Only 22% care about recommendations from past purchases

- 29% are fine with either

What does that tell us? The future is real-time relevance. If a shopper is browsing winter boots, don’t show them last summer’s sunglasses. They want help in the moment, not a history lesson.

This is where Bazaarvoice’s Contextual Commerce (CoCo) comes in. It powers notifications that matter, like alerts for limited stock or deals on products a shopper has already viewed. By connecting real-time signals — browsing behavior, reviews, shopper-submitted photos — to the moment of decision, CoCo turns inspiration into action. Whether online, on their phone, or in a store aisle, shoppers get relevant content when it counts most.

Discovery happens everywhere, especially in social

Now here’s where it gets even more interesting. The old-school idea that people discover gifts only in-store or through catalogs? It’s gone.

That might not sound huge yet, but it’s growing — and it’s changing the role of social media. It’s no longer just a place to scroll and dream. It’s becoming a full-on shopping engine, helping Canadians move from “I like this” to “I’m buying this” in just a few taps.

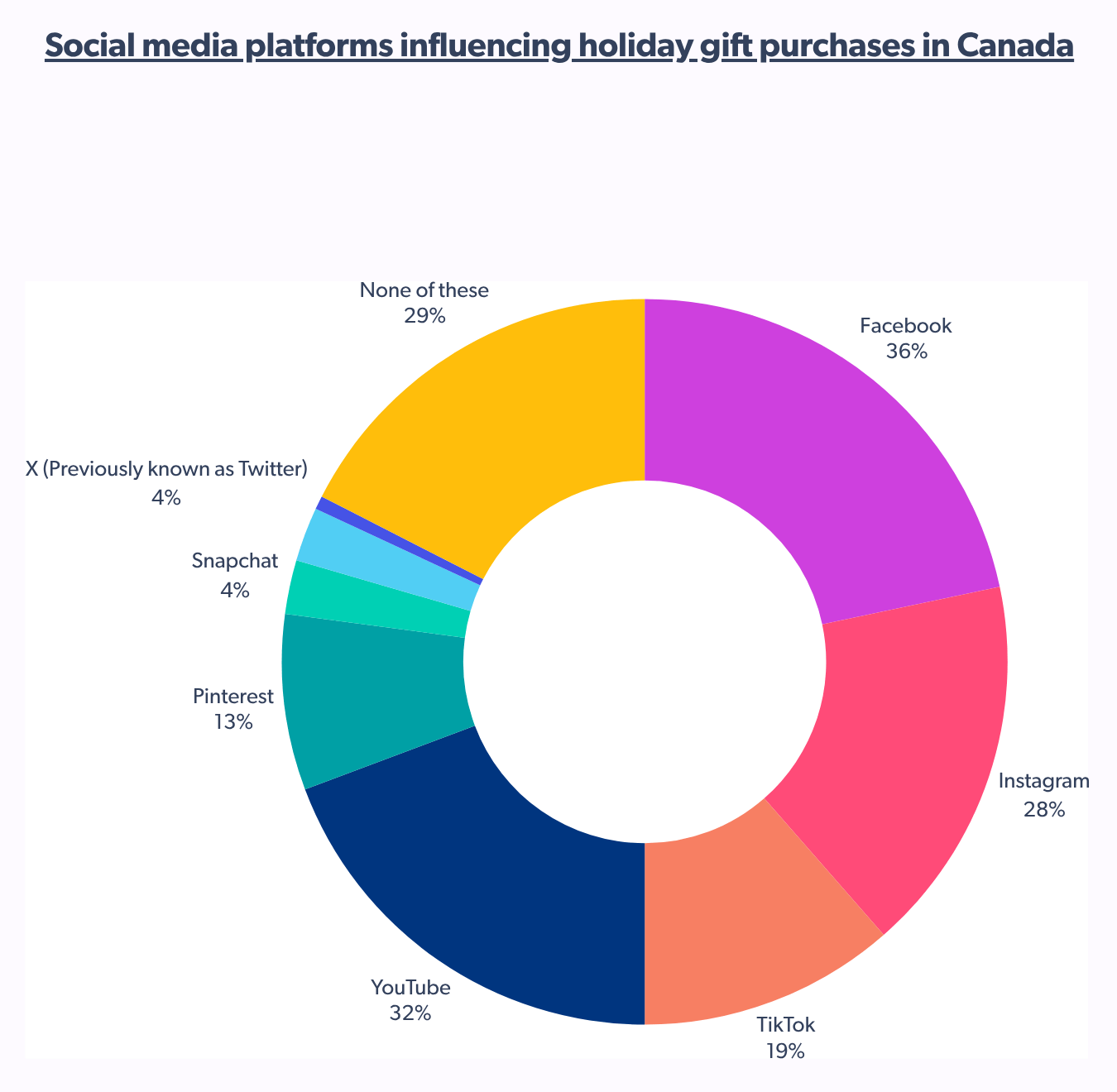

From scroll to sale: Canadians are using social to shop smarter

Social media isn’t just where Canadians go to escape the holiday madness — it’s where the gift-giving magic starts. 56% of Canadian shoppers say they get gift ideas straight from their feeds. Think of it as the new window shopping — just digital, faster, and more personalized.

Now, while discovery is booming, purchasing is still catching up. Only 27% of shoppers have actually bought a product through the social media platform’s shopping feature. That means platforms are crushing it on inspiration, but still warming up on the transaction front.

And how much do people shop via social media? It’s not a one-size-fits-all story.

- 28% did just 10% or less of their shopping there

- 48% were in the 11–50% range

- Only 16% did more than half of their shopping on social media.

What they’re doing tells us a lot about why they’re there: 43% use social media for discovery, 30% use it equally for discovery and purchases, and 18% prefer it mainly for buying. The message is clear: social media has officially gone full-funnel. From “Ooh, that’s cute” to “Add to cart,” the journey is happening on our screens — creators are playing a huge part in driving that momentum.

Creators, trust, and the content that converts

Let’s talk about trust. During the holidays, it’s everything. Canadian shoppers aren’t just listening to anyone.

- 26% say they’ve bought something based on an influencer recommendation

- But 44% skip influencers altogether, leaning more on friends and family (30%), micro-influencers (12%), or even mega-influencers (10%)

So, who are they trusting? The answer lies in context and authenticity. 75% trust creator recommendations when promoting products during the holidays, including 36% who only trust specific influencers, 15% trust only when it comes to specific product types, and just 8% say they don’t trust influencers.

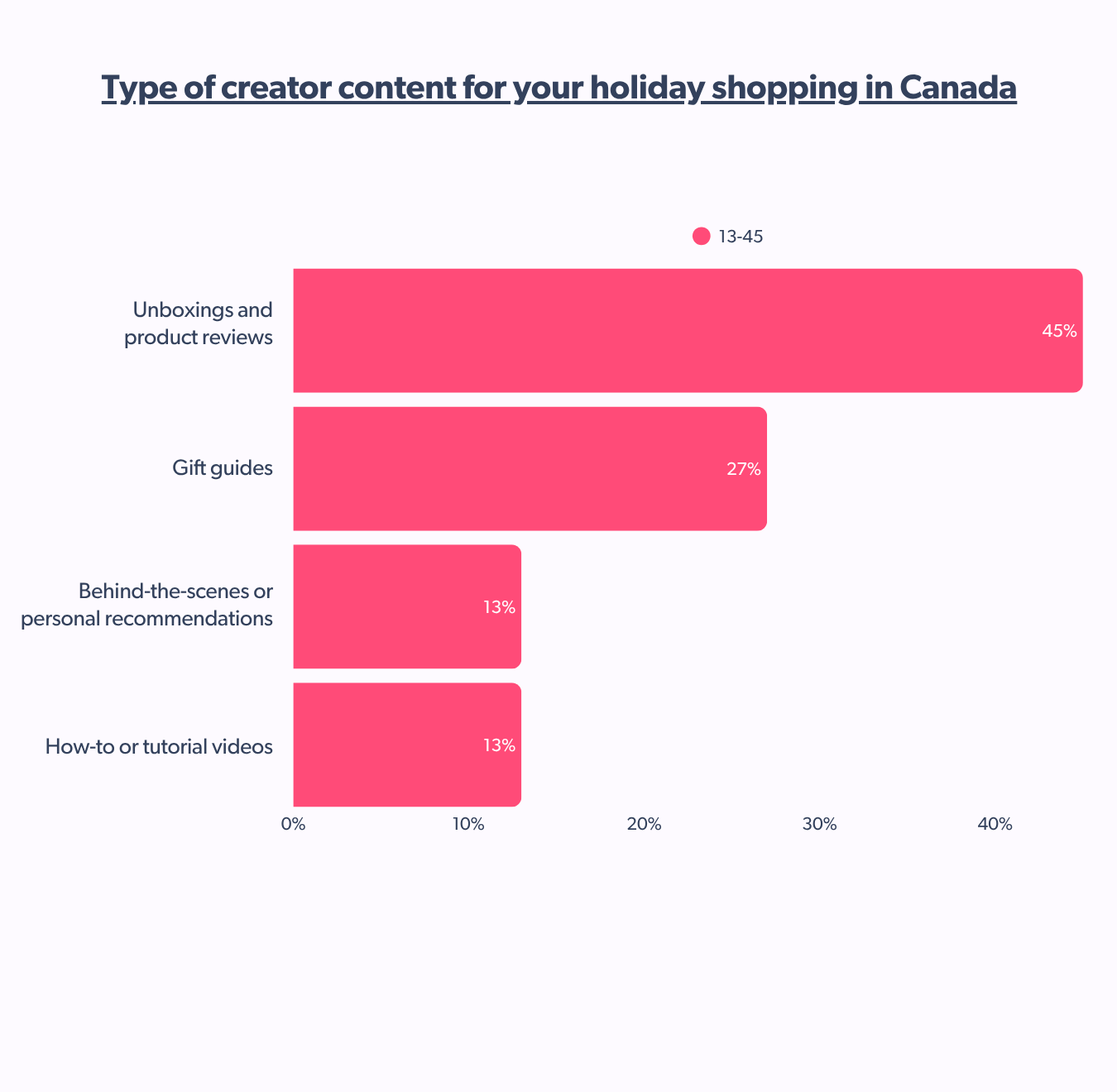

However, with content types, Canadians are pretty clear about what helps most during holiday shopping: When compared to other countries globally, Canadian shoppers rank higher at 45% who want unboxings and product reviews, 27% turn to gift guides, 13% enjoy behind-the-scenes or personal takes and another 13% find value in how-to videos.

This shows a clear desire for content that feels real and useful, not overly staged. And that’s where content creators shine. The best ones act less like marketers and more like fellow shoppers, making their recommendations feel relatable, not rehearsed.

UGC vs. brand content? Canadians say both

Here’s something you might not expect — Canadian shoppers aren’t choosing sides when it comes to content.

- 24% prefer brand-created content that showcases products

- 25% lean toward UGC — real people sharing their real holiday hauls

- 24% prefer brand-created content that showcases products

- But 29% say “neither,” highlighting a gap and a big opportunity to better connect with audiences

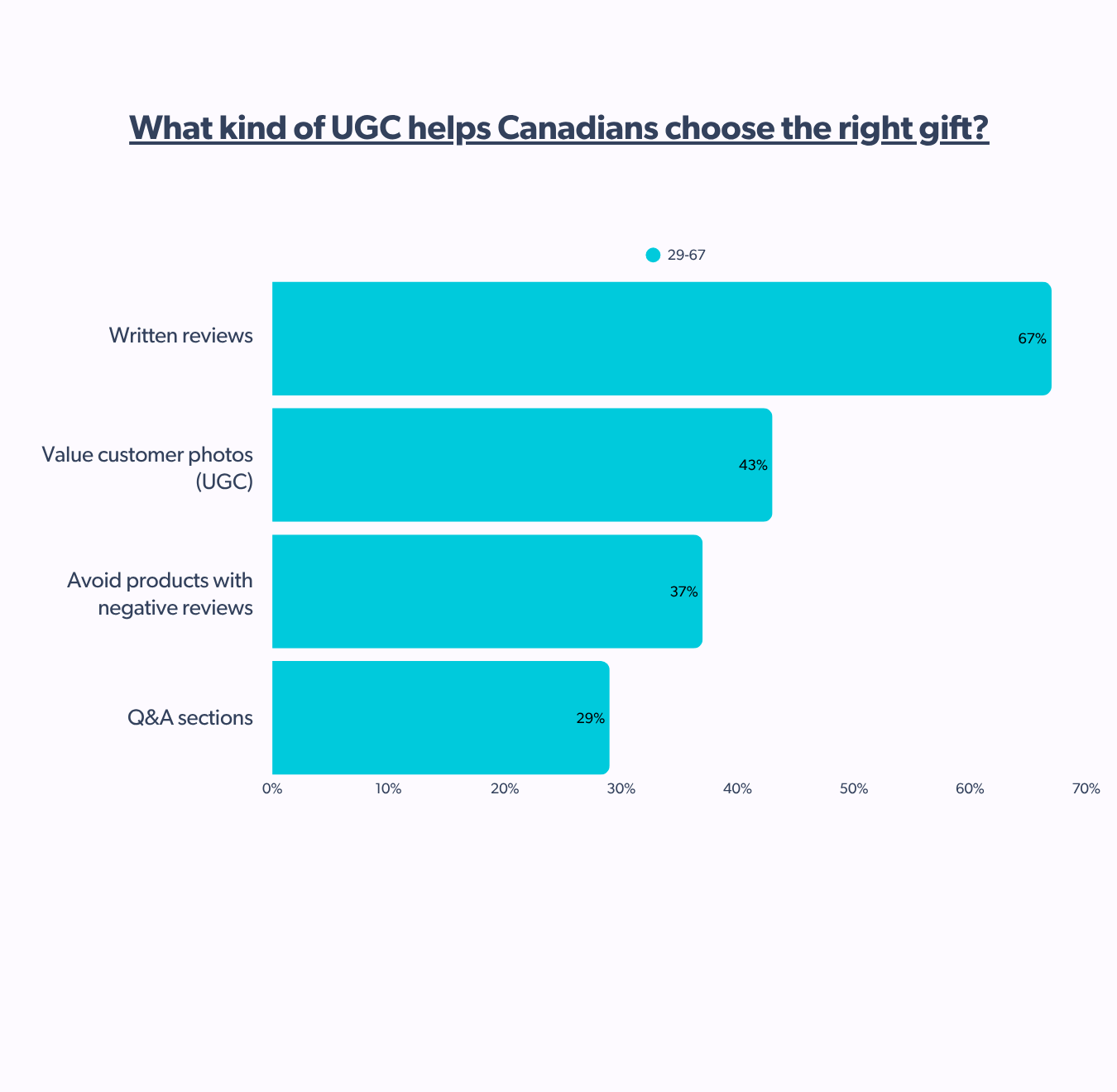

So, what kind of content actually drives decisions? Let’s take a closer look below:

Only 11% say UGC isn’t helpful — a clear sign that authentic feedback from real shoppers plays a crucial role. And when it comes to negative reviews? 45% say they’d still consider the product, proving that transparency builds trust, not doubt. Gift guides also play a role, 53% say they’re sometimes helpful. But 14% haven’t seen one from a brand, retailer, or influencer. That’s a missed opportunity to deliver curated, confidence-boosting content.

Here’s the bigger problem: too many brands treat Ratings & Reviews as a checkbox, settling for surface-level solutions or one-size-fits-all platforms. That’s where Bazaarvoice Ratings & Reviews makes a difference. It enables brands to unlock scalable, verified review content that not only informs but also converts and builds lasting credibility.

Globally, the appetite for UGC is growing. Whether it’s written reviews, customer photos, or product Q&As, shoppers crave real experiences, not over-polished perfection. As AI-generated content becomes more common, authentic voices will stand out even more. At the end of the day, authenticity isn’t just preferred—it’s what wins a shopper’s trust!

Trust is everything, and Canadians are paying attention

If there’s one thing Canadian shoppers are clear about, it’s this: trust is the currency that converts. This holiday season, that trust starts with authentic product reviews.

- 53% say they always or often read reviews before making a gift purchase

- Another 30% do so sometimes

- Only 5% say they never read them

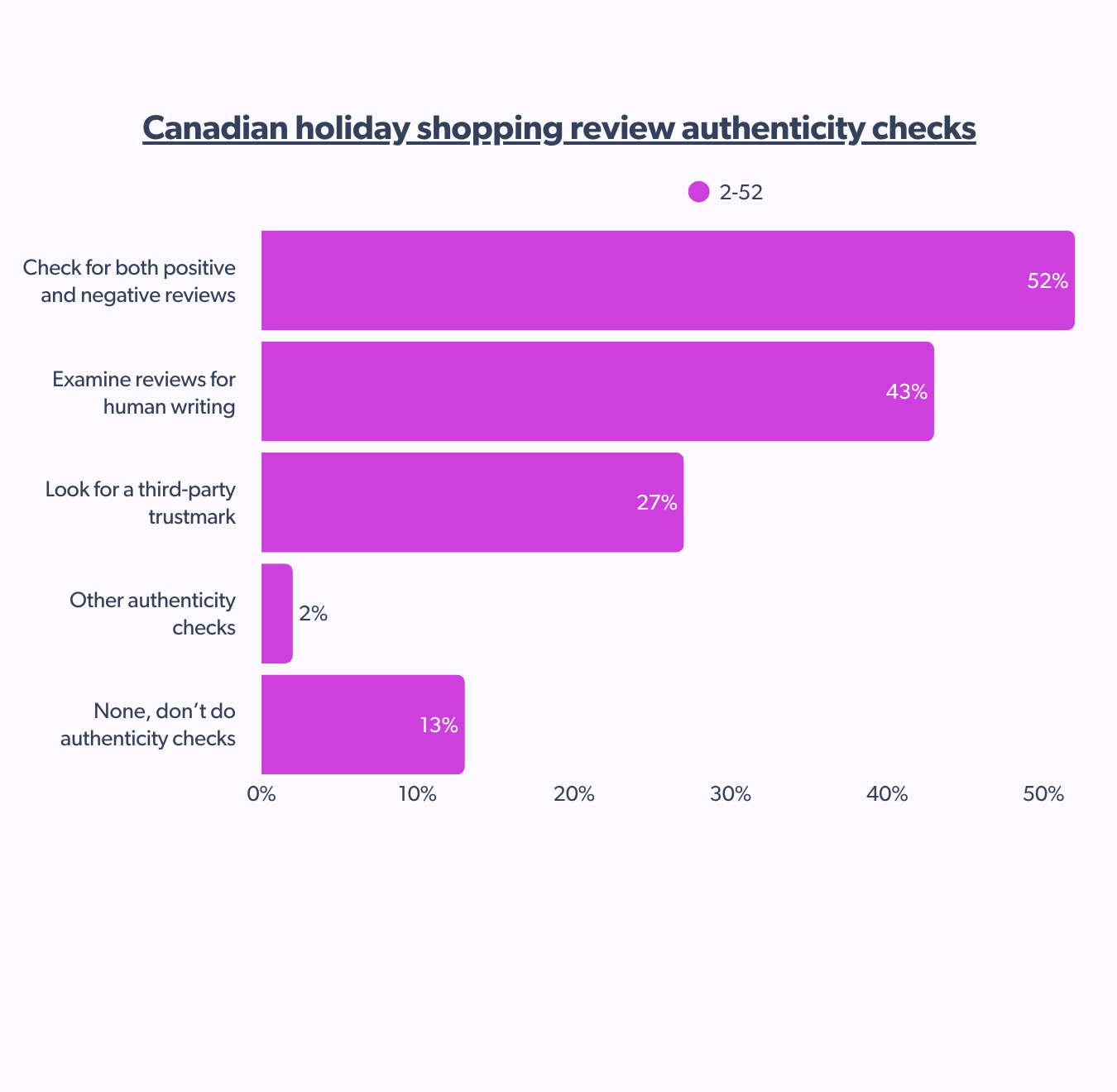

But Canadian shoppers don’t just read reviews; they scrutinize them. Globally, they’re among the most meticulous when it comes to evaluating authenticity. Over half of shoppers check for a mix of positive and negative reviews, while less than half analyze whether the review feels human-written. Others look for third-party trust marks to validate credibility. Only 13% say they skip authenticity checks altogether.

That level of diligence extends to AI-generated content, which is emerging as a growing concern among Canadian shoppers. 32% are most wary of AI-written product reviews, 16% express concern over AI-generated images, and 13% are cautious about influencer content created by AI. That said, not everyone is alarmed — 28% say they’re not concerned at all.

So, how does AI influence behavior? It’s nuanced.

- 39% are less likely to buy from brands using fully AI-generated posts

- 42% say it doesn’t affect their decision

- 19% are more likely to buy from such brands

Thus, Canadian shoppers are getting smarter, and their radar for authenticity is sharper than ever. They’re not just reading reviews. They’re evaluating tone, source, and intent.

Smarter shopping starts with smarter content

Holiday shopping in Canada is evolving. It’s not just about snagging the best deals or ensuring fast delivery anymore — it’s about confidence in the product, the brand, and the content that informs every click and purchase.

And with shoppers bouncing between channels, scrolling social, scanning reviews, hopping between digital carts and physical aisles, content alignment has never been more critical. To truly meet them where they are, brands must deliver on three things:

- Unbeatable value

- Seamless omnichannel experiences

- Trustworthy, content-driven engagement

That’s where Bazaarvoice Vibe comes in. It’s built to help brands tap into the content that truly converts — from written reviews and customer photos to creator partnerships and shoppable social experiences. Authentic voices, honest opinions, and real influence turn browsers into buyers.

So if you’re planning your holiday content strategy, the takeaway is simple: lean into what’s real. Authenticity isn’t just a nice-to-have — it’s your competitive edge. To get more insights into it, read our Holiday Headquarters to uncover Canadian shopper behaviour and how you can act on it to drive holiday performance that delivers.