June 10, 2025

As economic uncertainty looms over the U.S., American shoppers have already mapped out how to approach holiday shopping this year. Most prioritize value, trust, and a seamless omnichannel experience, with 75% saying they intend to shop online, according to the Bazaarvoice Holiday Consumer Report 2025.

Understanding their shopping behavior is more important than ever, as Americans spent $282 billion during the 2024 holiday season, which is nearly a quarter of global spending. Smart brands are already taking action by leaning into early-bird deals, value-driven messaging, and simplified fulfillment. They’re also focusing on shoppable content and influencer holiday gift guides that are steering purchase decisions.

The brands that will come out ahead are those that meet shoppers where they scroll, search, and shop.

Let’s take a look at what’s shaping the next season of shopping and how you can stay ahead.

Holiday shopping tips say “Quality > Quantity”

The holiday shopping rush isn’t what it used to be. Shoppers have moved from frantic, last-minute buying to more intentional, strategic behavior. Whether to beat the rising prices or the crowds, today’s shoppers are planning smarter and holding higher expectations.

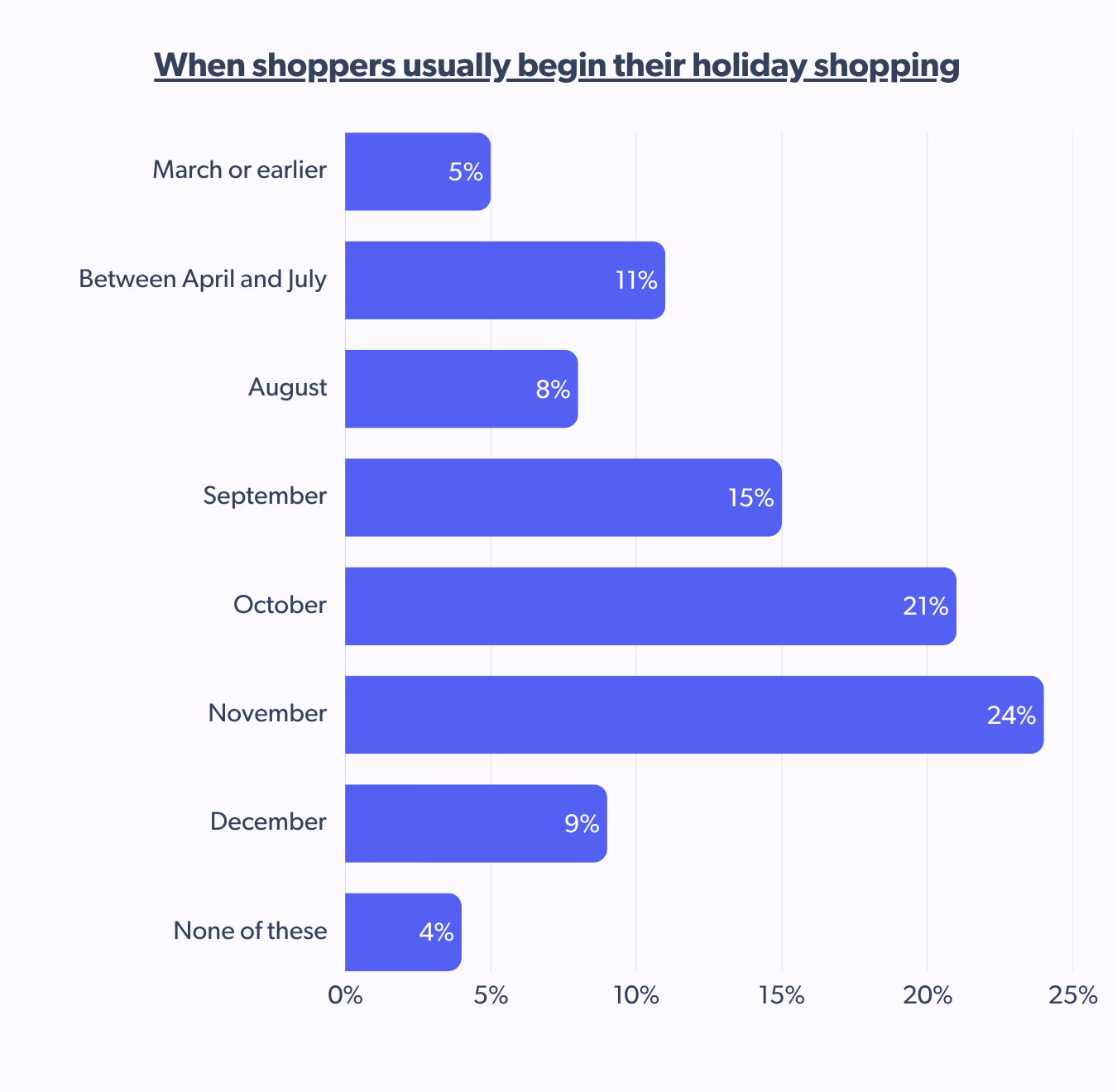

60% kick off holiday shopping in October or earlier

Shoppers have begun applying the ‘early bird gets the worm’ proverb quite literally to holiday spending. The late-November “official kickoff” no longer applies, and brands that wait for Black Friday to launch campaigns may already be too late.

Almost half (45%) of U.S. shoppers do their holiday shopping in October and November, which drastically dips to 9% in December.

Marketers should front-load their messaging and ensure holiday campaigns are live and shoppable well before Halloween.

How are consumers planning their holiday shopping this year?

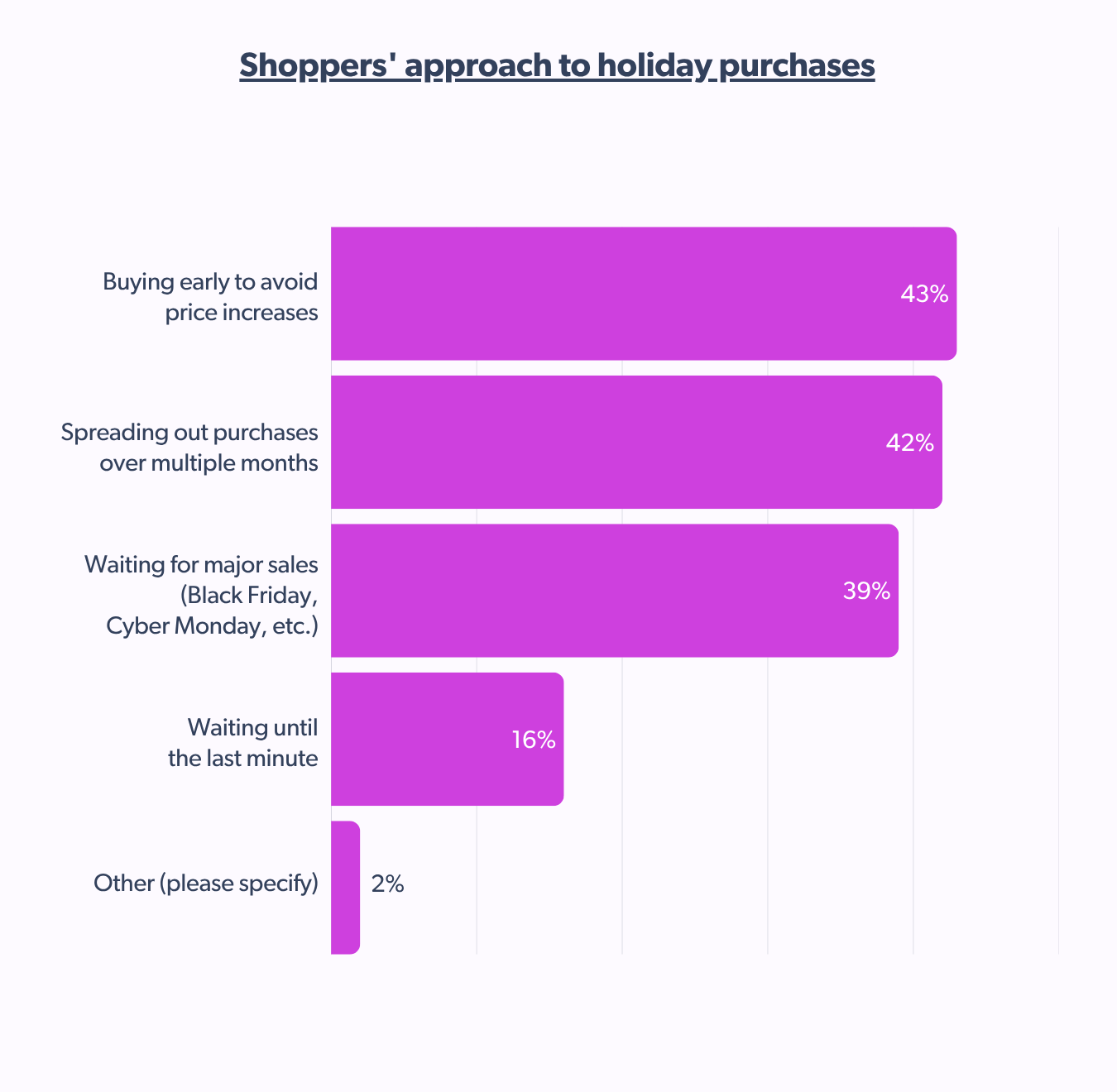

Shoppers are planning and strategizing to tackle rising prices with three clear strategies emerging:

- Buying early to avoid price hikes

- Spreading purchases across months to manage budgets more effectively

- Hold out for big sale events like Black Friday and Cyber Monday

Brands need to strike a balance to cater to each of these mindsets. This can mean launching early-bird campaigns, focusing on value-led messaging, and still building excitement for the big sales.

But that might not be everyone’s cup of tea.

16% of Americans admit they wait until the very last minute, highlighting a strong need for urgency-led messaging. Limited-time offers and fast shipping then become the priority, especially in the last leg of the season.

And this isn’t just an American story. Global markets show a growing preference for these shopping factors. It’s the perfect moment for seasonal reminders and holiday shopping tips focused on managing budgets.

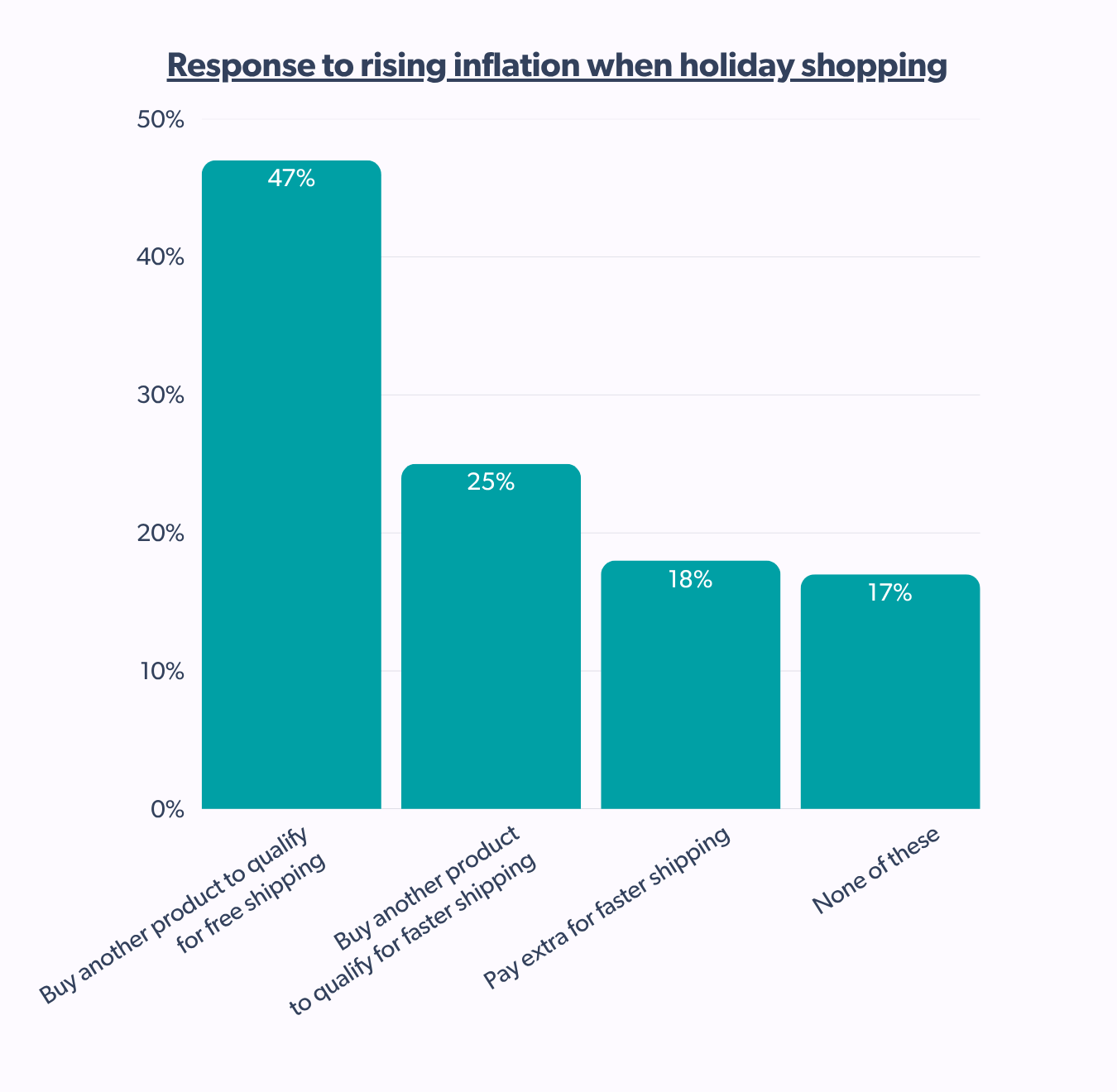

‘Free over fast,’ a key holiday shopping strategy

When it comes to holiday shopping decisions, cost-saving consistently wins over convenience and speed for Americans.

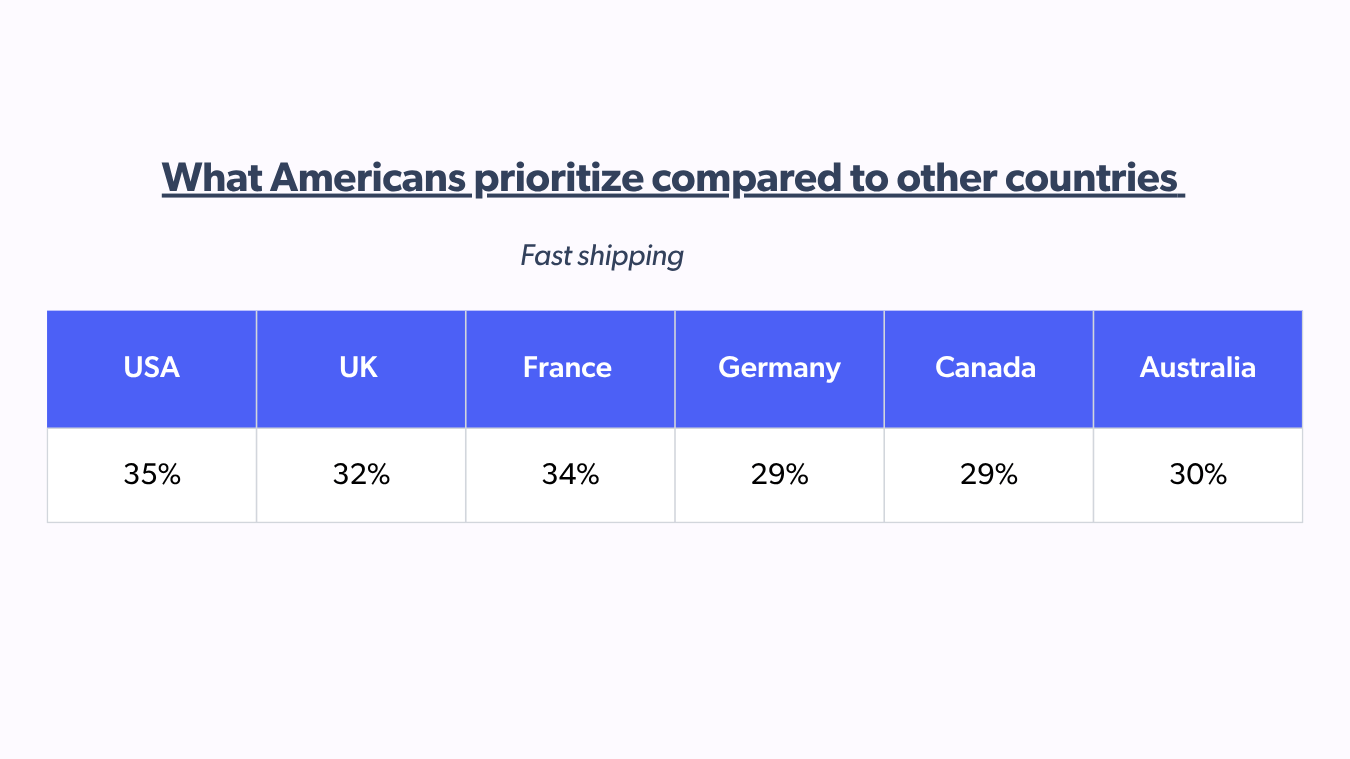

Especially when reaching out to retailers, U.S. shoppers care most about free shipping (57%), discounts (51%), and easy returns (42%), with fast shipping (35%) and in-store experience (33%) also playing key roles. Only 14% prioritize personalized recommendations.

For most Americans, cost trumps convenience. Nearly half of shoppers are willing to add more to their cart just to qualify for free shipping, and only 18% would pay extra for speed.

Compared to other countries, U.S. shoppers place a higher premium on free shipping, but fast shipping remains a close secondary priority, leading across global markets. While personalized recommendations are typically lower on the scale, Americans still prefer them more than shoppers from other countries.

American shoppers show a slightly higher preference for personalized recommendations, with 14% listing it as a priority, just above the global average of 13%.

Brands should highlight value-led messages, free shipping thresholds, and holiday shopping deals in campaigns that drop earlier than November. These strategies can help attract and retain customers in the US market. Easy returns and a positive in-store experience also contribute to their overall satisfaction.

Store brands top holiday shopping lists in 2025

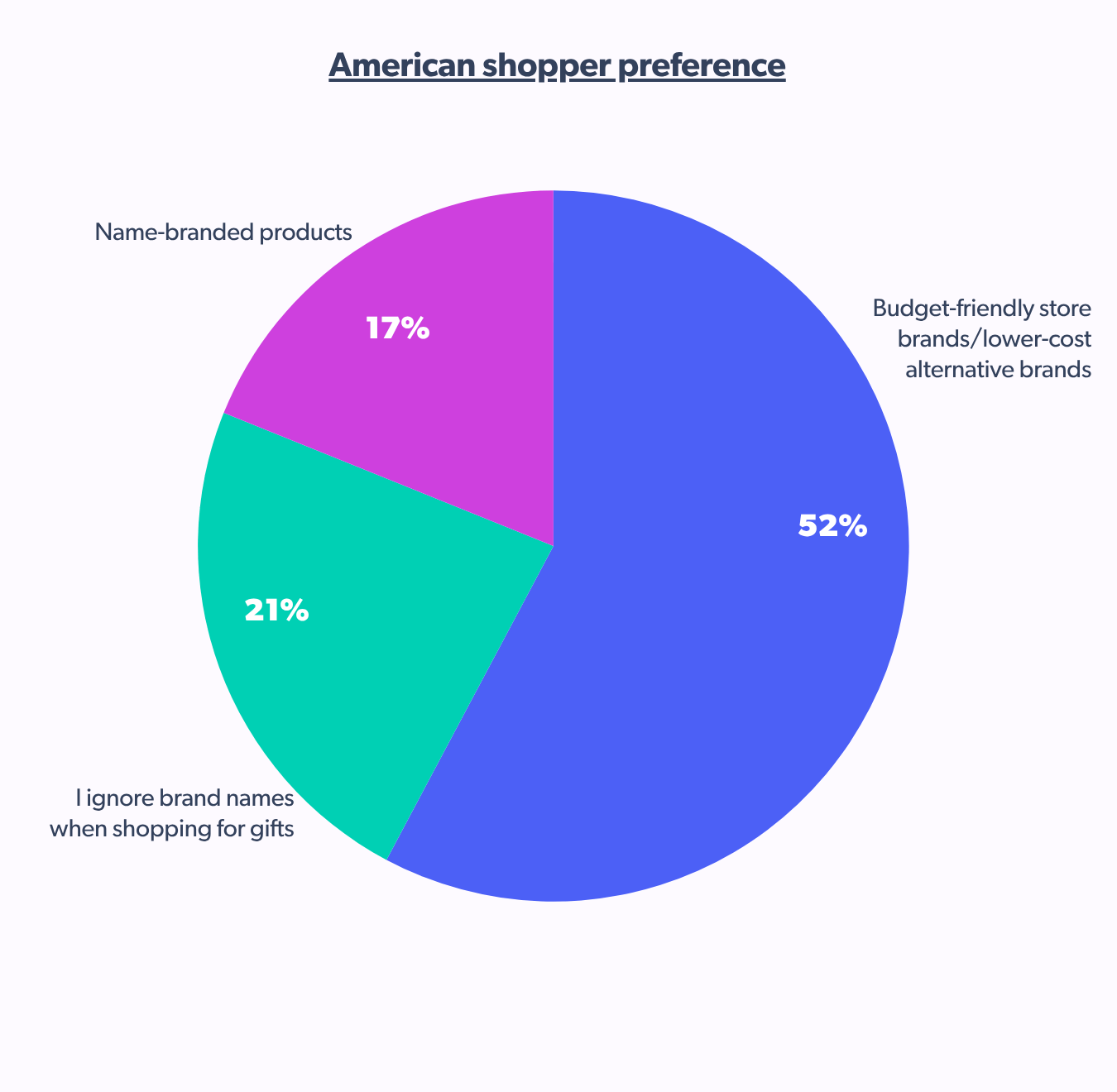

A minority say they’re leaning toward name brands this holiday season; most are shopping smart. One in five don’t even factor brand names into their decision.

This is a significant opportunity for retailers with strong private label lines or value-focused assortments. This year, the emphasis isn’t on status but on savings.

Buy-now-pay-later gaining ground

As consumers face economic pressure, flexible payments are becoming an attractive and expected option.

While 44% of shoppers prefer paying upfront, 17% say they use BNPL (Buy Now, Pay Later) more than last year. Another 17% are considering trying it for the first time this holiday shopping season.

Retailers who offer BNPL options can meet customers where they are, especially for higher-ticket items or early-bird shoppers looking to lock in holiday shopping deals in 2025 without straining their pockets. This can help reduce cart abandonment and make it easier for shoppers to commit.

Omnichannel shopping is the standard, not the exception

The digital-physical divide no longer exists. Even if it does, it is now irrelevant to American consumers. Shoppers demand a seamless omnichannel experience that lets them shop when, where, and how they want.

Online + in-store plays a role for 60% of shoppers

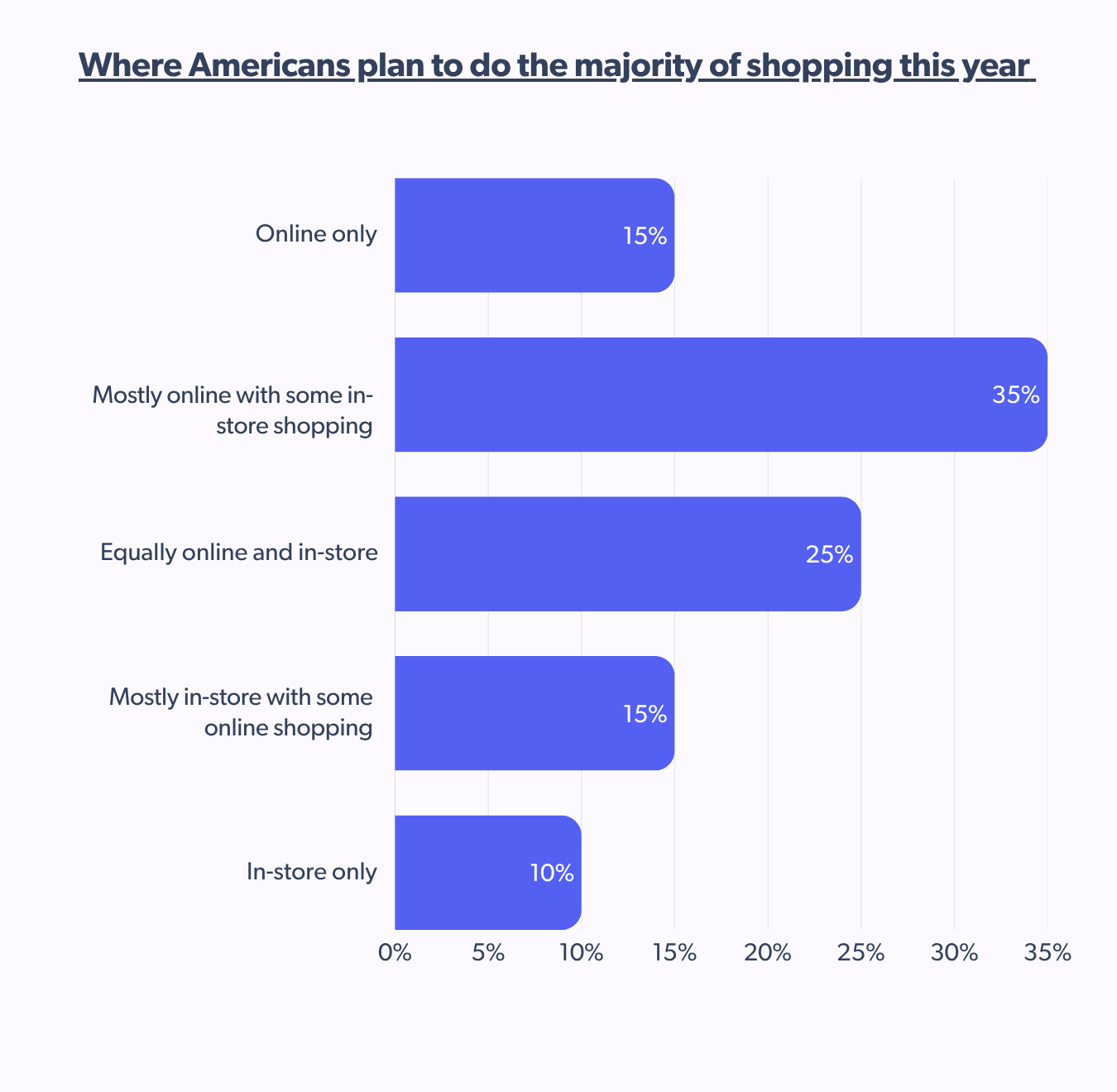

The modern American holiday shopper expects flexibility and convenience, moving fluidly between digital and physical environments. While 75% plan to shop online in some capacity, 60% say they want a hybrid experience, combining both online and in-store experiences.

Brands are expected to be present across all touchpoints, offering a seamless omnichannel experience to all shoppers.

Three out of four U.S. shoppers are prioritizing online in some form, whether that’s primarily, equally, or partially.

51% of shoppers research online before buying in-store

Many brands and retailers fail to realize that their digital presence drives in-store decisions. For 51% of American shoppers, even when the purchase happens in-store, the digital journey starts long before that.

Shoppers are researching before visiting stores, with one in two knowing what they want. Websites, product pages, reviews, and inventory visibility are now critical sales enablers. Retailers risk missing half the funnel if online experiences don’t influence offline behavior.

But how do shoppers want to discover holiday gifts in the first place?

Americans prefer a hybrid approach

Product and gift discovery is multi-surface led, with physical and digital shelves running neck and neck. 61% of shoppers prefer to discover gifts in-store, closely followed by 59% who prefer online channels (excluding social media). 12% look to social media for holiday gift inspiration.

Retailers should make discovery easy everywhere. Invest in store layouts that drive exploration and online UX that mimics the delight of in-person discovery.

Deal alerts win scrolls, relevance drives clicks

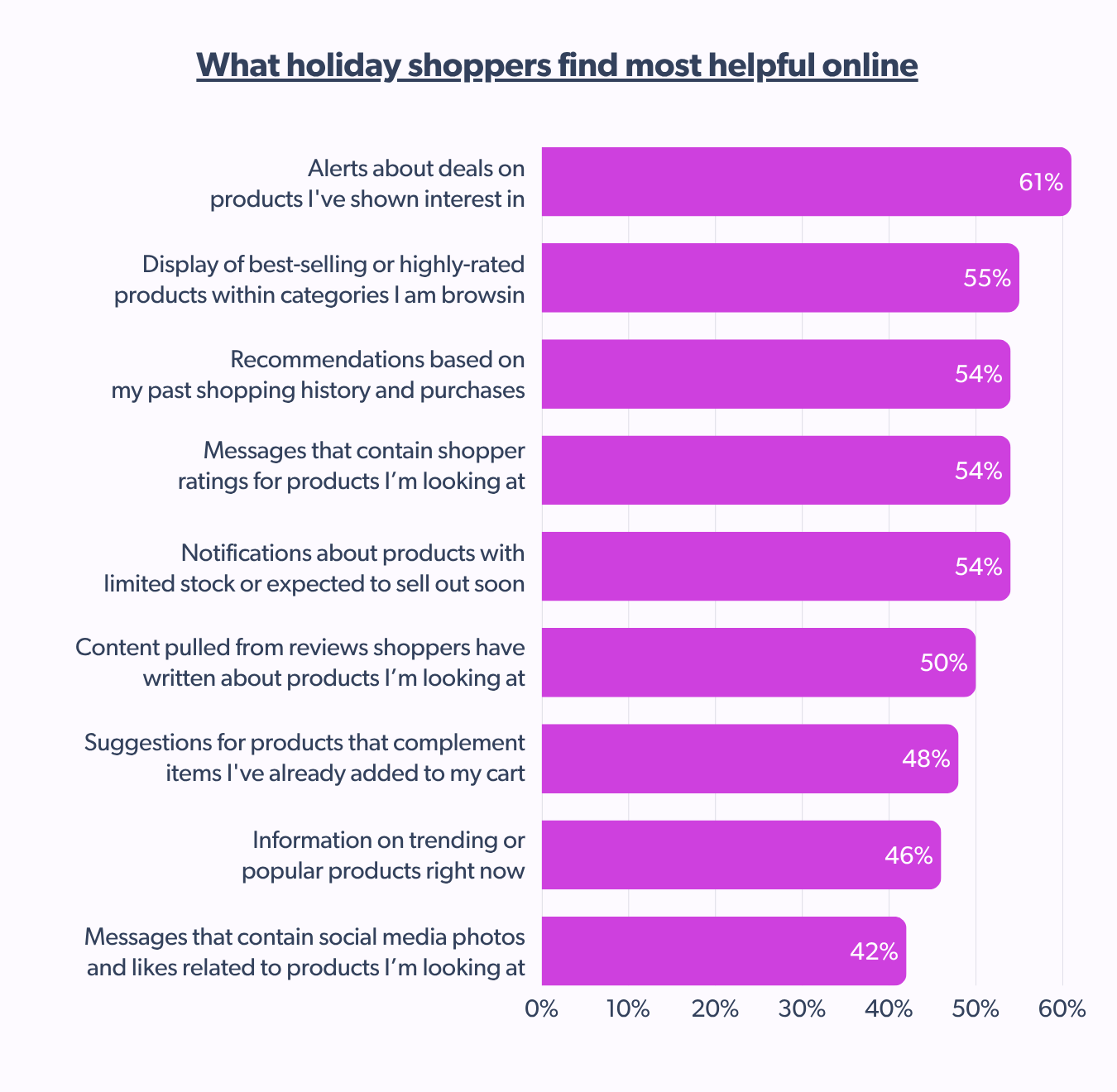

Shoppers browsing online are on the lookout for the best gift at the perfect time and at the right price. They want more than help. They want intelligent assistance.

Deal alerts are only impactful as long as they’re related to their browsing history. Especially when time, trust, and budgets are tight, relevance is strongly preferred over aesthetics.

If you are planning to build anticipation, excitement, and urgency among your potential consumers, Bazaarvoice CoCo (Contextual Commerce) can help you stay ahead by powering real-time, relevant messaging across shopper journeys.

CoCo makes it easy to trigger timely, relevant notifications like low-stock alerts, trending items, and contextualized reviews, especially when there’s high demand and tight inventory.

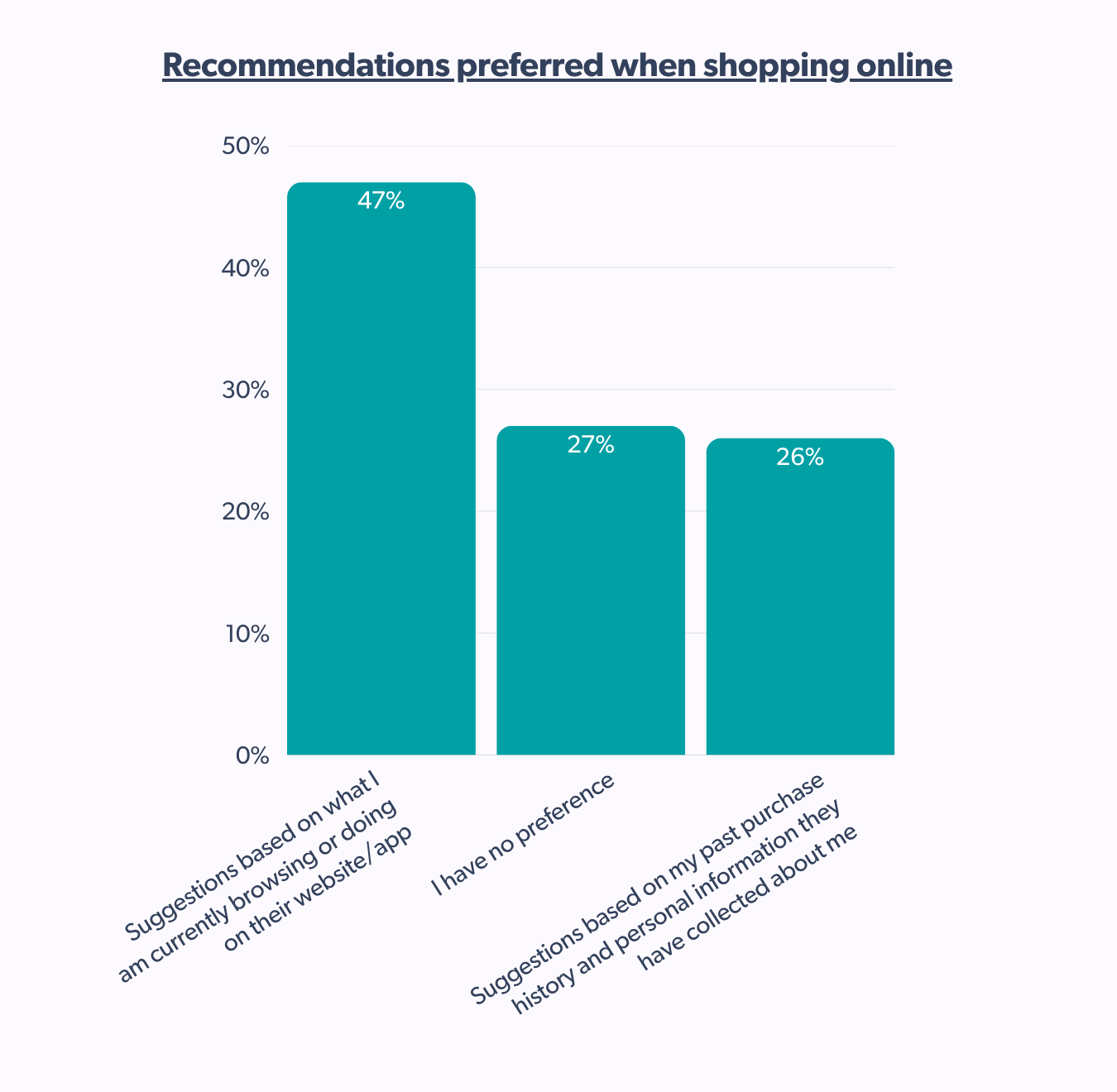

47% want contextual recommendations

For most American shoppers, personalization is about the now. Nearly half of shoppers prefer real-time recommendations tailored to their activities.

Brands can leverage this to bridge the gap between online and in-store, leveraging the right content strategy to push relevant products at every touchpoint. This will help drive more meaningful and real-time engagement.

Creator content locks the deal with reels, reviews, results

Social media powers every step of the modern holiday shopping journey. From idea discovery to social commerce, American shoppers are increasingly looking to social platforms for holiday spending.

While 6 in 10 find inspiration on their scrolls, the remaining 4 click ‘buy now’ directly in-app. It is the era where shippable content, AI-generated content, and influencer-led posts are taking the lead in holiday shopping this year.

6 in 10 use social media for discovery

Social platforms are now the go-to destination for holiday gift discovery, with 61% of US shoppers saying they’ve found gift ideas through socials, second only to the UK.

This makes social media strategy non-negotiable for brands aiming to own the awareness phase of holiday shopping.

Brands can pair influencer partnerships with curated shoppable content to drive discovery and conversion in one scroll. More than a third of American shoppers (37%) have already made purchases directly through social platforms, signaling that social commerce may not be fully mainstream yet, but it’s far from niche.

This opens the door to optimized shoppable content and AI-generated content that guides users toward confident, seamless transactions.

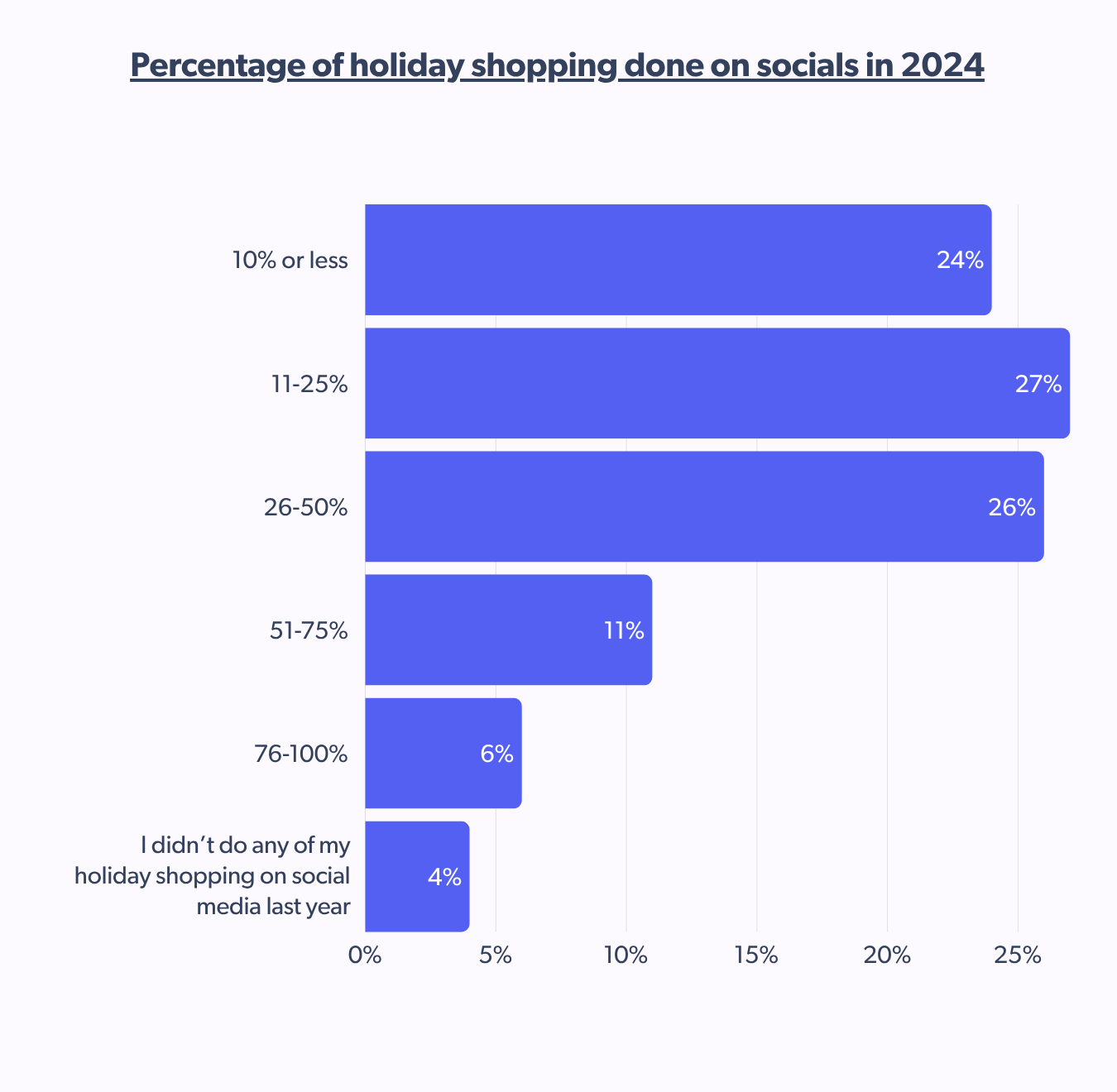

77% of Americans do up to half their shopping via social media

More than half the shoppers (53%) attributed 11% to 50% of their holiday haul to social platforms. Meanwhile, 17% went all in, doing over half their shopping on socials, and 24% kept it low-key with less than 10%. This shift shows shoppers’ comfort level with discovering products on social and how secure e-commerce sites have become for seamless checkout.

Brands can easily scale and tailor their strategies with AI-generated content, automated processes, and tools like VIbe in the mix.

Socials prove best for discovery

Social media’s strength of visual inspiration makes them natural starting points for holiday shoppers seeking fresh ideas. 43% of U.S. shoppers use it primarily for discovering products, while nearly half now rely on it for both discovery and purchase.

This proves that these shoppers are directly transitioning from awareness to conversion, as shoppable content and AI-generated content are shifting social from top-funnel inspiration to full-funnel action.

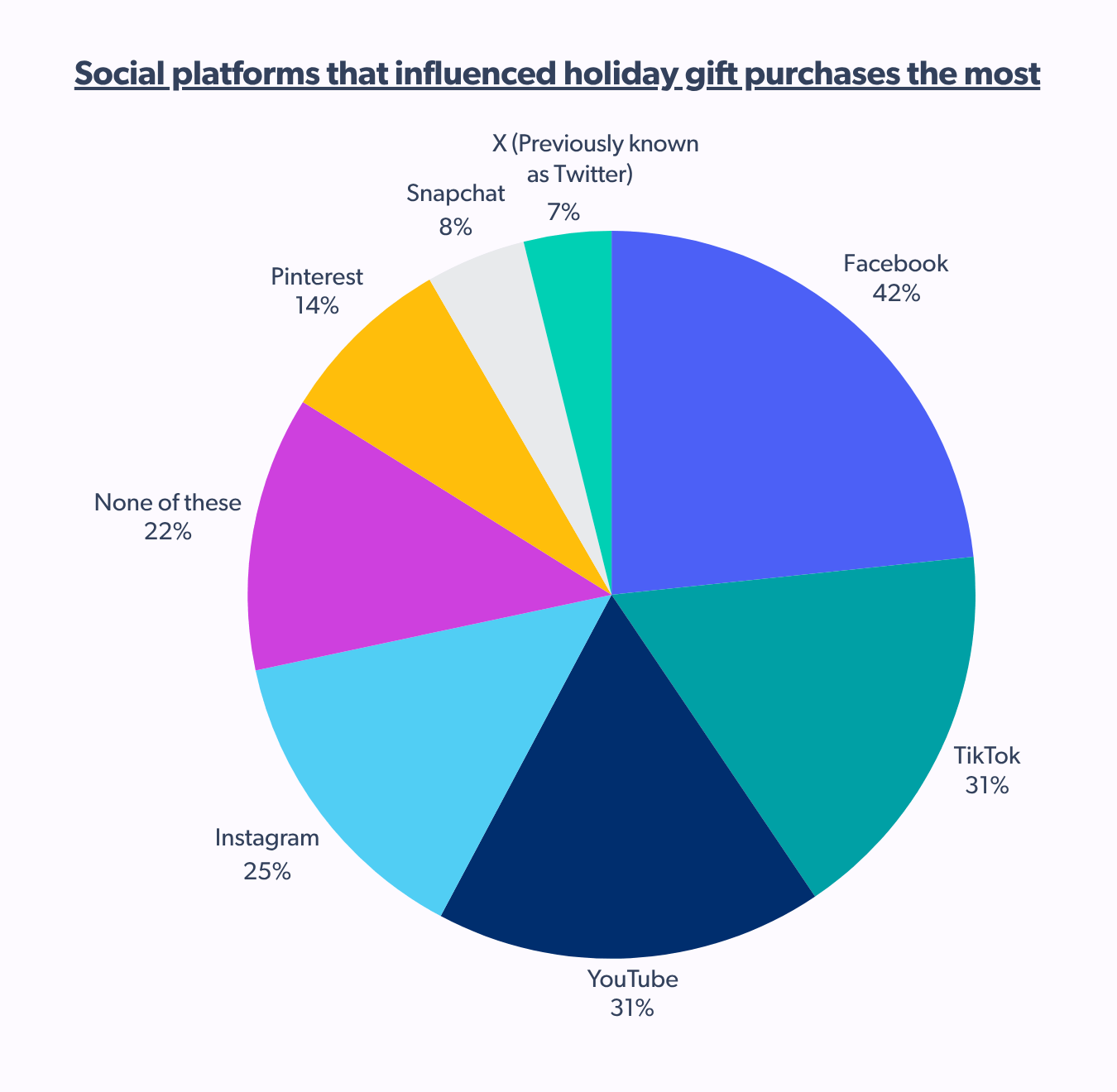

Facebook leads in shoppable content influence

Facebook‘s influence remains unmatched, likely due to its broad user base and how well-acquainted users are with the platform. But TikTok and YouTube are surging, especially with influencer holiday gift guides, authentic reviews, and unboxing-style content that inspire trust and drive action.

Now’s the time to double down on platform-specific strategies and make holiday shopping deals irresistible in 2025. Let’s chat about how we can make this happen.

U.S. shoppers prioritize intent and relevance over creator reach

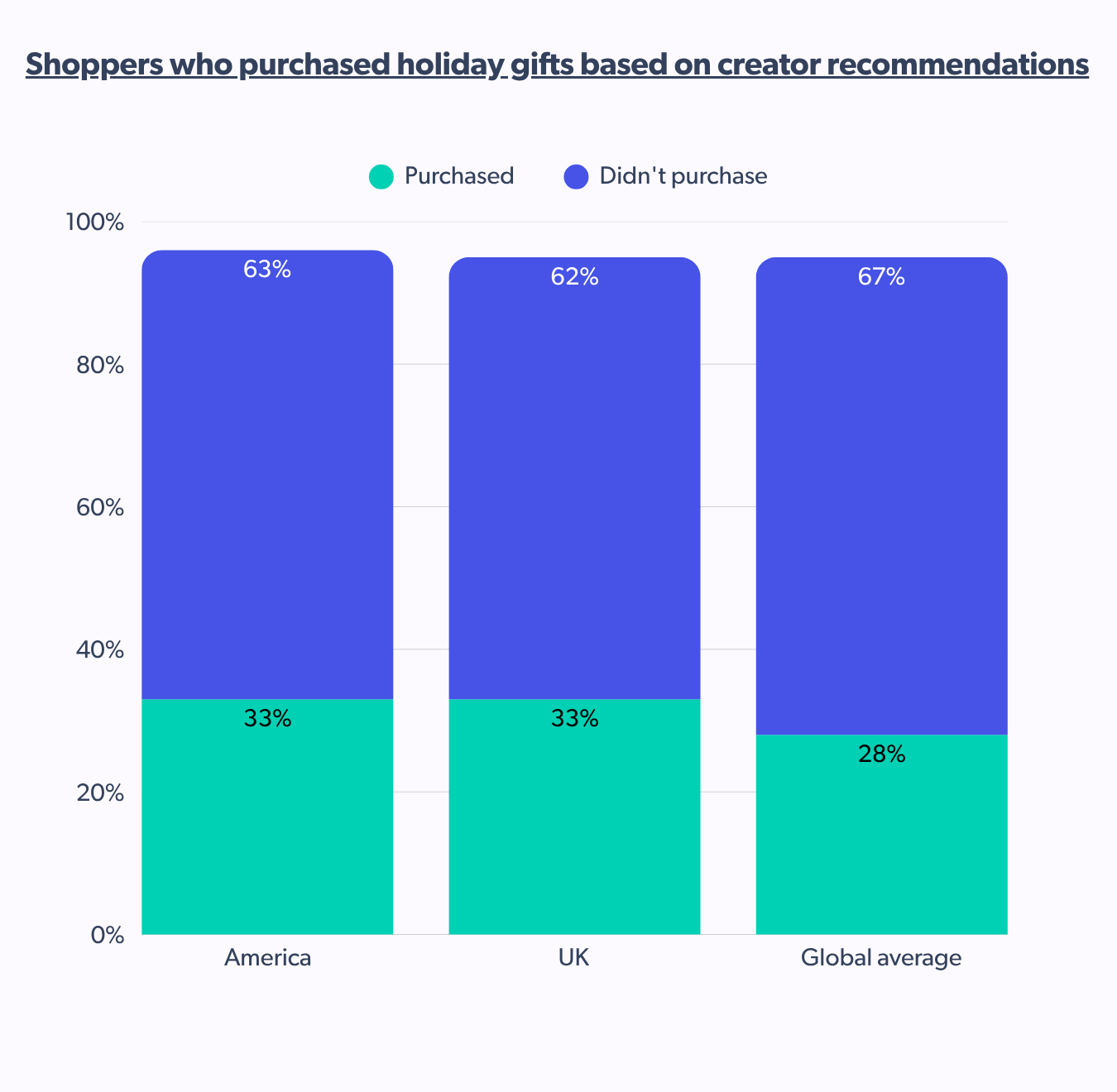

1 in 3 U.S. shoppers buy gifts because of creator influence

Holiday shopping isn’t just about deals anymore. It’s about who’s making the recommendations.

1 in 3 American shoppers purchased a gift based on an influencer or content creator’s recommendation. That’s a 5-point jump above the global average.

However, with almost two-thirds still prioritizing their research or traditional channels, brands must adopt a full-funnel perspective. Utilize influencers to build awareness, but ensure product pages, reviews, and overall brand presence across all touchpoints are equally compelling to capture the broader market.

For the American shoppers, trust in holiday creator recommendations isn’t a blanket “yes.” It is conditional. While 73% believe in creator recommendations, some say it depends on the creator, while others think product type makes a difference.

Brands should work with influencers who align with their ethos and ensure clear disclosures like #ad or “sponsored by” tags are visible and honest.

Authentic reviews + Real voices = Higher holiday conversions

For a majority of American shoppers, seeing is believing.

Unboxings and product reviews lead the way at 38%. This dominance highlights the shoppers’ need for tangible proof and relatable experiences. This is followed by gift guides (28%), tutorial videos (17%), and personal recommendations (16%). They want to go beyond the pitch and actually see the product in action. The same sentiment carries over to shopper trust levels.

Personal networks still hold more sway

One-third (31%) of US shoppers turn to friends and family when seeking holiday gift ideas. If they do consider creators, the smaller, more focused voices tend to resonate louder than the bigger ones. Even in this age of content, personal connections truly make a difference.

Real content = Real results

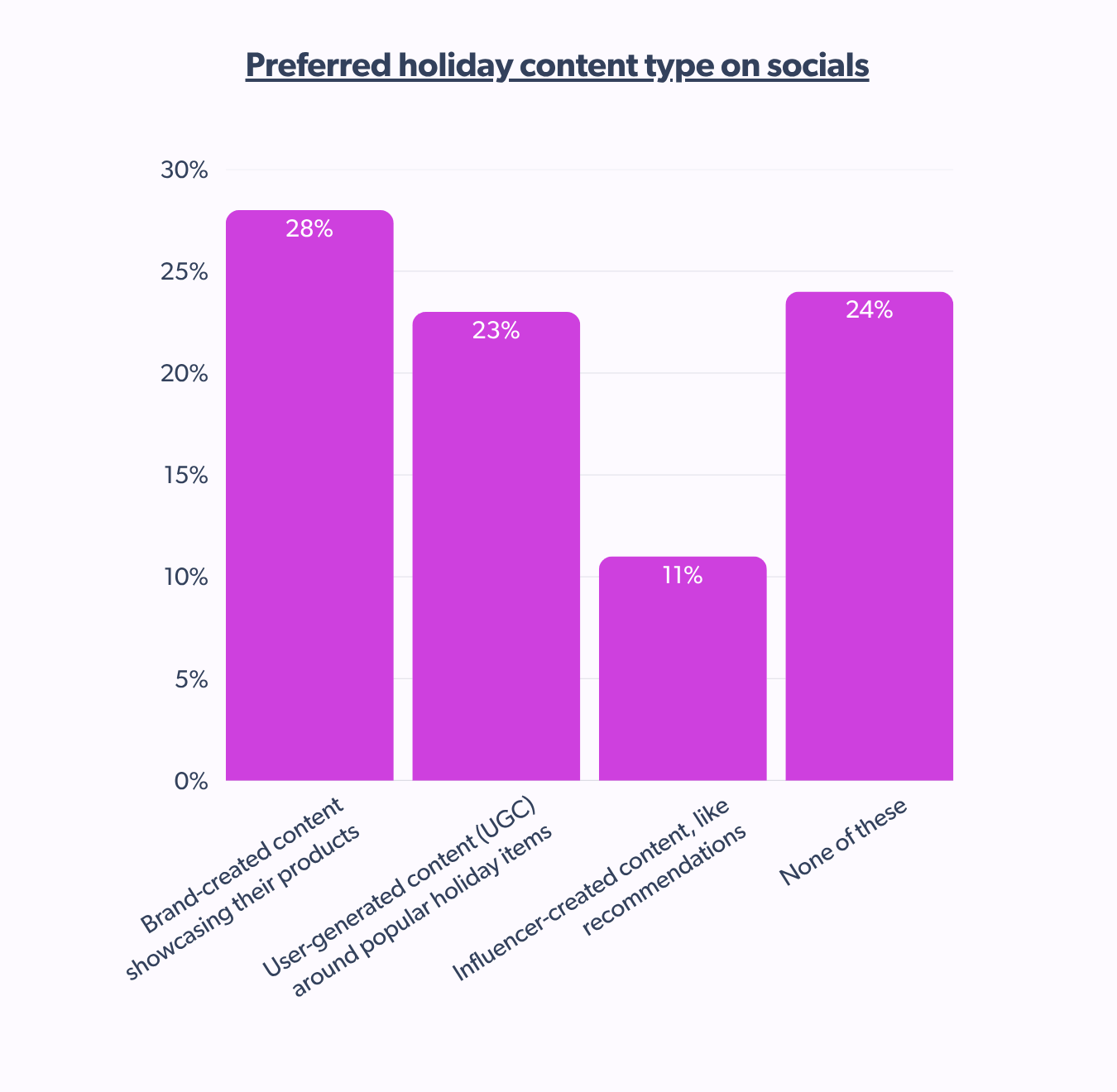

Smart holiday marketing campaigns blend UGC & branded assets

What kind of content cuts through the noise and draws shoppers’ attention during the holiday season?

Both official brand messages and real experiences from users are influential. This is probably because shoppers want clear information about products, discounts, and holiday offers straight from the source.

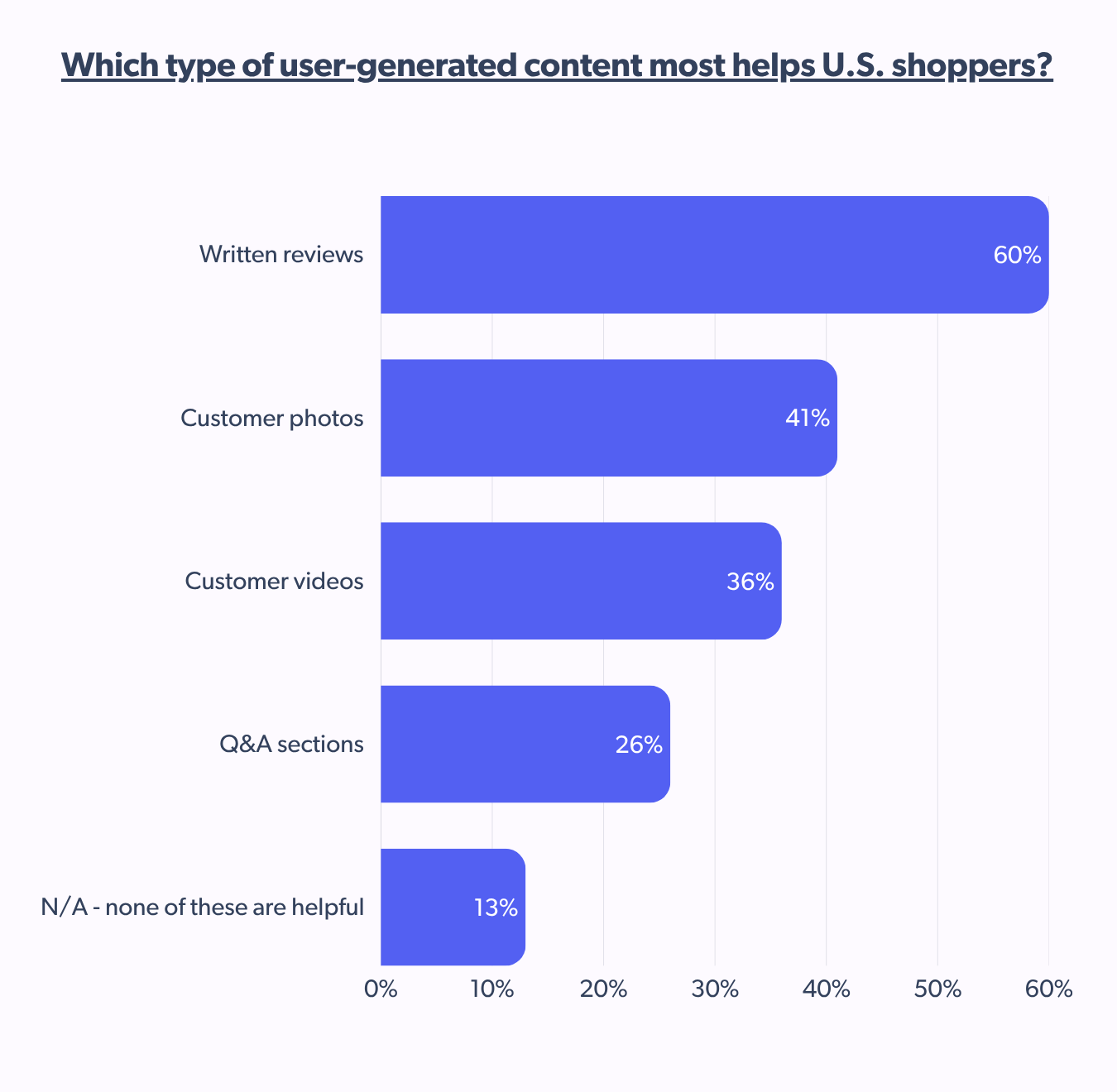

60% say written reviews are still the MVP

Written reviews hold down the fort when it comes to gift selection for American shoppers. But rich media (photos and videos) also hold sway. They help humanize the product, build fair expectations, and instill confidence.

The charm of a one-size-fits-all gift guide is fading. 46% say they find gift guides helpful only sometimes, while 28% say they find them useful. However, 12% say they are not helpful. Dynamic guides presented contextually can enhance the shopping experience.

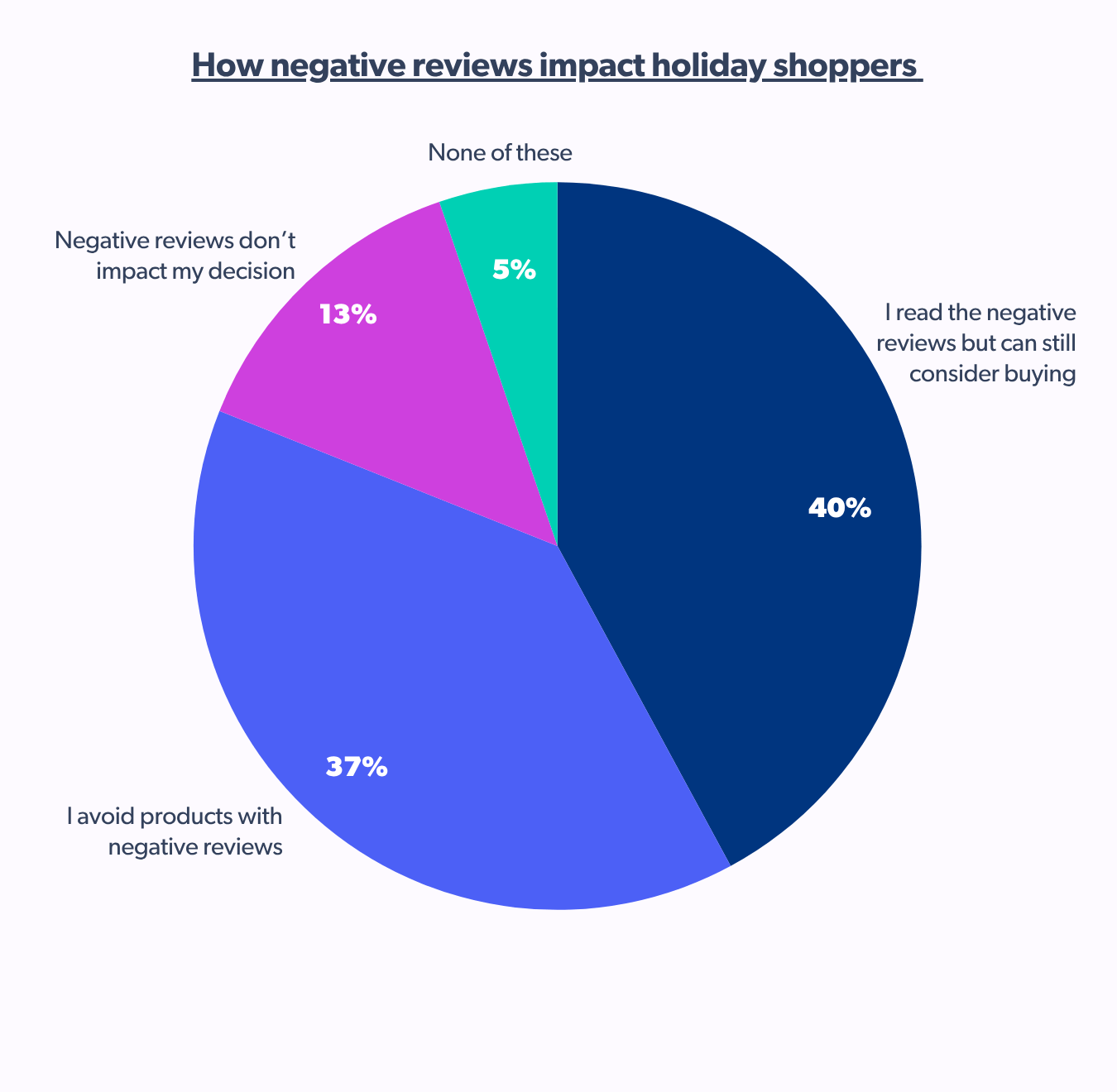

Negative reviews not dealbreakers

For most shoppers, negative reviews aren’t a hard no. They’re part of the decision process.

While 40% still consider buying despite critical feedback, a nearly equal 37% choose to avoid such products entirely. That means brands can influence perception by transparently addressing all comments.

By quickly responding to criticism, brands can demonstrate how they resolve issues without shying away from less-than-great feedback.

The era of earned trust now begins

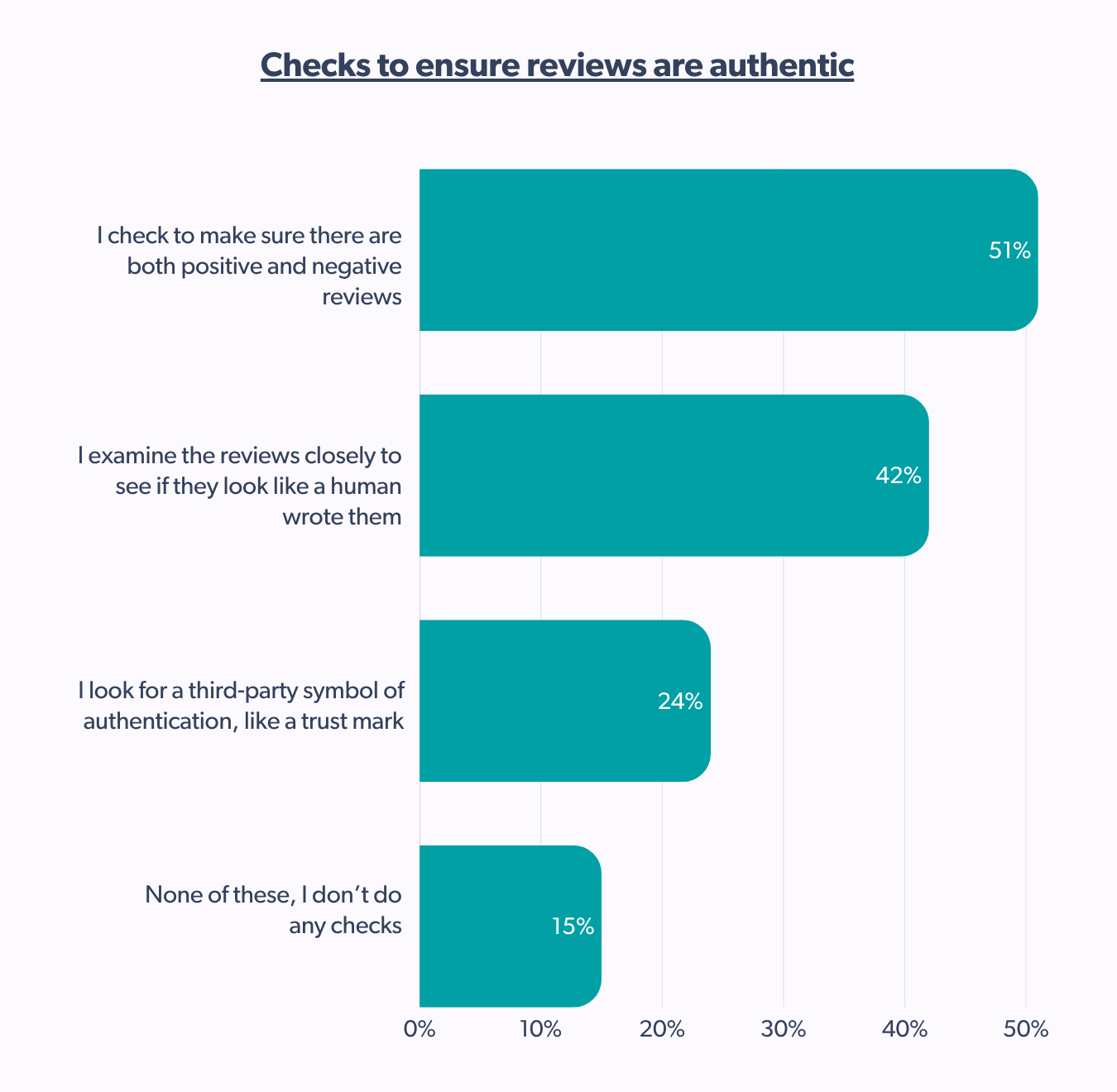

If there’s one priority for US shoppers, it’s authenticity. As holiday shopping ramps up, consumers seek authentic, verified content that signals a brand is the real deal.

Authenticity is a non-negotiable

Shoppers want real opinions from real people before they buy. More than half the shoppers say they “Always” or “Often” read product reviews before purchasing a holiday gift.

Product reviews are a non-negotiable part of the online shopping journey. But it doesn’t stop at reading them. Consumers scan for signs that a review is legit, not spammy or AI-generated.

For brands, this means doubling down on transparency: making verified reviews visible, encouraging review submissions, and avoiding manipulating or filtering feedback. Trust is earned, not automated.

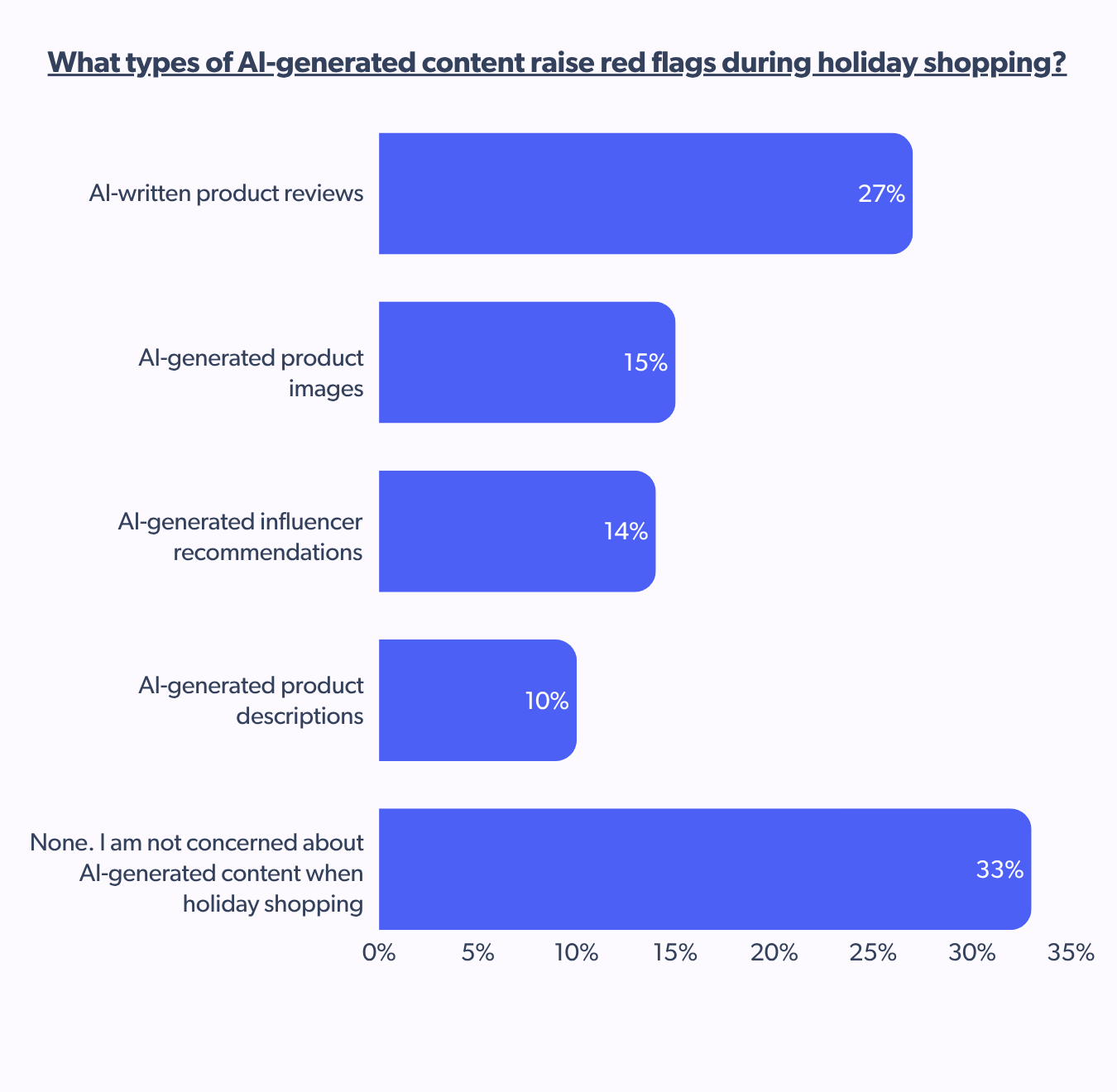

1 in 3 American shoppers not worried about AI

AI tools can boost efficiency, but shoppers want transparency and a human touch regarding content that shapes purchase decisions.

Brands cannot afford to compromise on credibility. Even though 33% say they’re unfazed by AI, product reviews written by AI are the biggest trust breaker.

AI-generated content works on socials if authentic

Consumers aren’t necessarily against AI but can immediately spot something that feels artificial or doesn’t resonate.

Would consumers care if a brand’s social media post is 100% AI-generated? 34% said it would depend on the post, while 27% said yes, they would care, and 23% said no. Meanwhile, 16% revealed they’d never holiday shop on social media.

When asked if knowing a brand used AI-only content would impact their purchase decisions, only a quarter of consumers said it would make them more likely to buy. Nearly 30% said it would make them less likely to hit “add to cart.”

AI has its place. But trust must always come first. Consumers are open to brands using AI to scale content as long as there’s disclosure, a human layer, and no deception.

The real secret to winning over U.S. holiday shoppers? Show, don’t sell.

American shoppers are crystal clear about what earns their clicks and cash. They want content that feels human, helpful, and honest. From unboxing videos to written reviews, the demand for real-world validation is louder than ever.

American consumers want content that reflects genuine experiences. They’re cutting through the noise, demanding genuine insights over hype.