August 7, 2025

A notable transformation in purchasing habits is taking hold, with value and trust emerging as paramount drivers amid the economic shifts and the evolving consumer behavior. This shift is prominently seen in the ascendance of private label brands, for they offer compelling price and quality.

Retailers like Aldi and Lidl have successfully built loyalty through high-quality private labels. While Target’s owned brands, such as Good & Gather and All in Motion, demonstrate how these can become powerful brand identities, fostering significant consumer trust.

Parallel to the rise of private labels, there is influence of User-Generated Content (UGC). Consumers increasingly rely on the authentic voices of their peers through ratings, reviews, social media posts, and video testimonials as a primary source of information. After which they make the purchasing decisions for private label brands or any e-Commerce brand.

Against this backdrop, Bazaarvoice has accumulated data from its multiple reports to understand global retail consumer behavior, which includes their purchasing motivations, the impact of UGC and trusted platforms etc., in this global retail consumer behavior report.

I. Strategic imperatives for private label brands

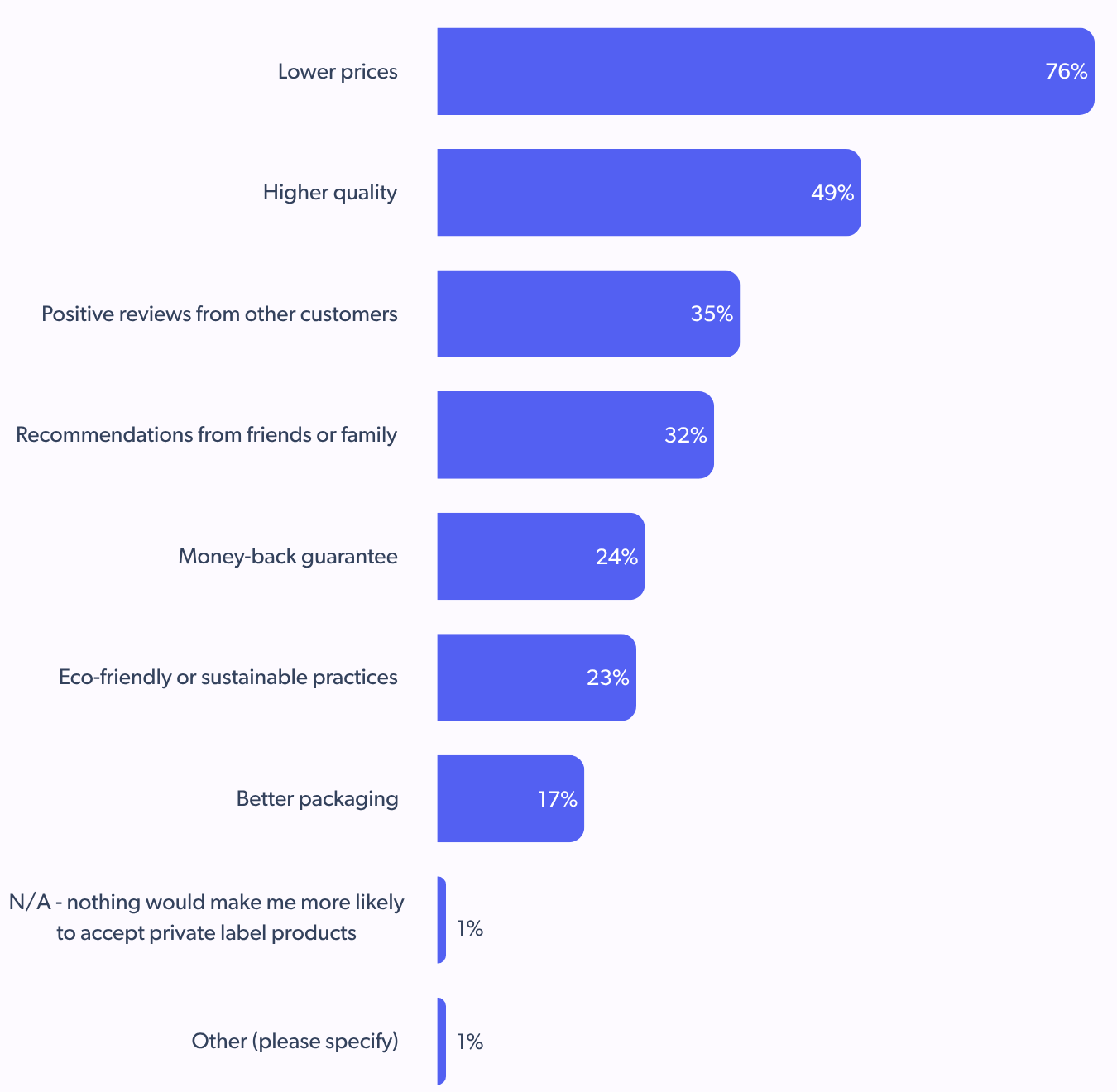

1. Lower prices (76%) drive private label adoption

The data clearly indicates that price remains the primary driver for consumers opting for private label products. A staggering 76% of respondents cite lower prices as the key factor.

This underscores the power of value in influencing purchasing decisions, especially in economically sensitive times. Retailers must continue to emphasize competitive pricing for their private label offerings to attract and retain cost-conscious consumers.

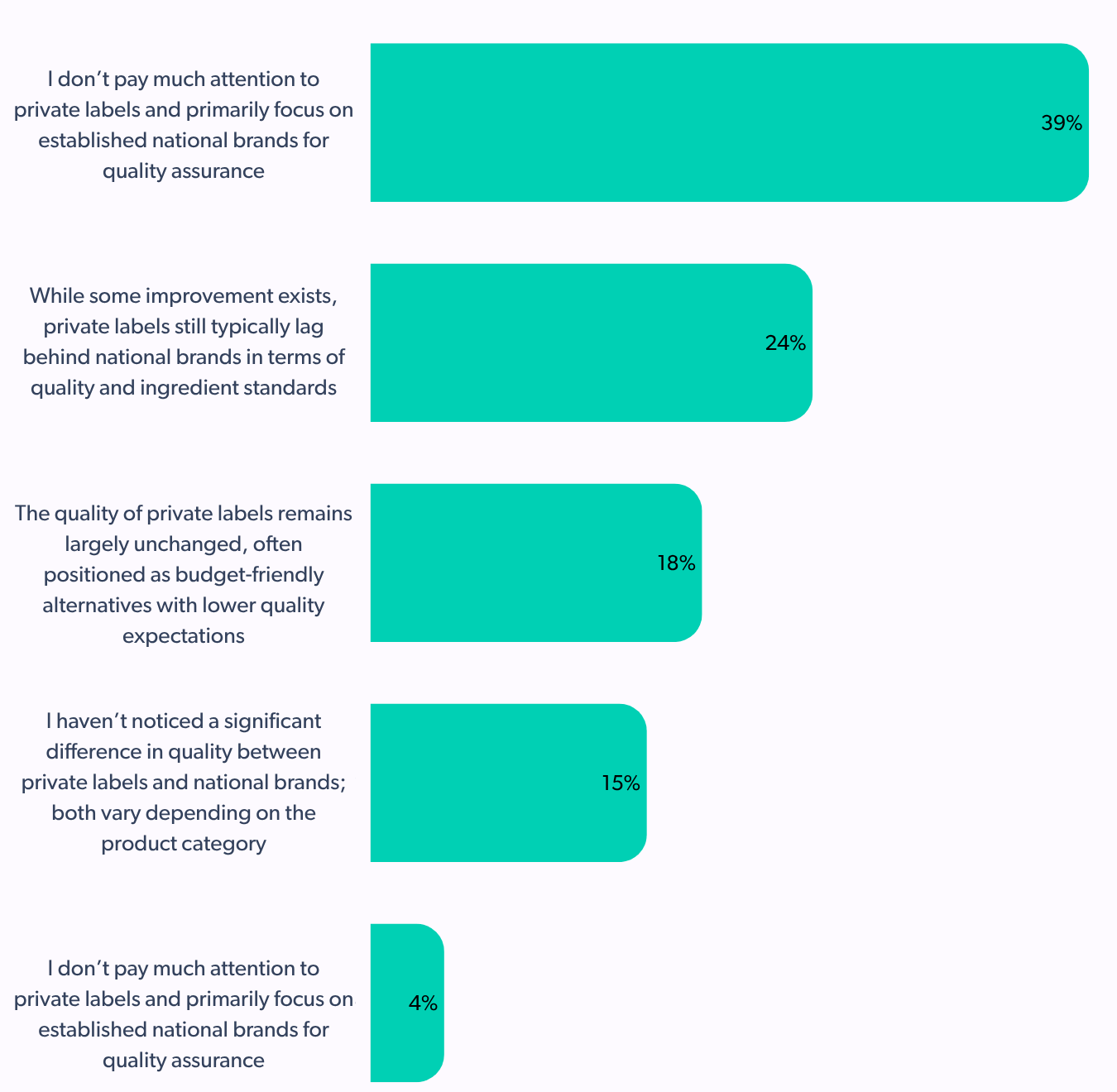

- Improved quality perceptions (39%) contribute to private label acceptance, even when not significantly cheaper

While price is paramount, quality is rapidly gaining ground. A significant 39% of consumers believe that private label quality has significantly improved, offering comparable or even better quality than national brands in many categories. This shift in perception is crucial. It suggests that consumers are increasingly willing to choose private labels. And not just for cost savings, but also for perceived quality, even if the price difference isn’t substantial.

This highlights the importance for retailers to invest in the quality and perception of their private label products.

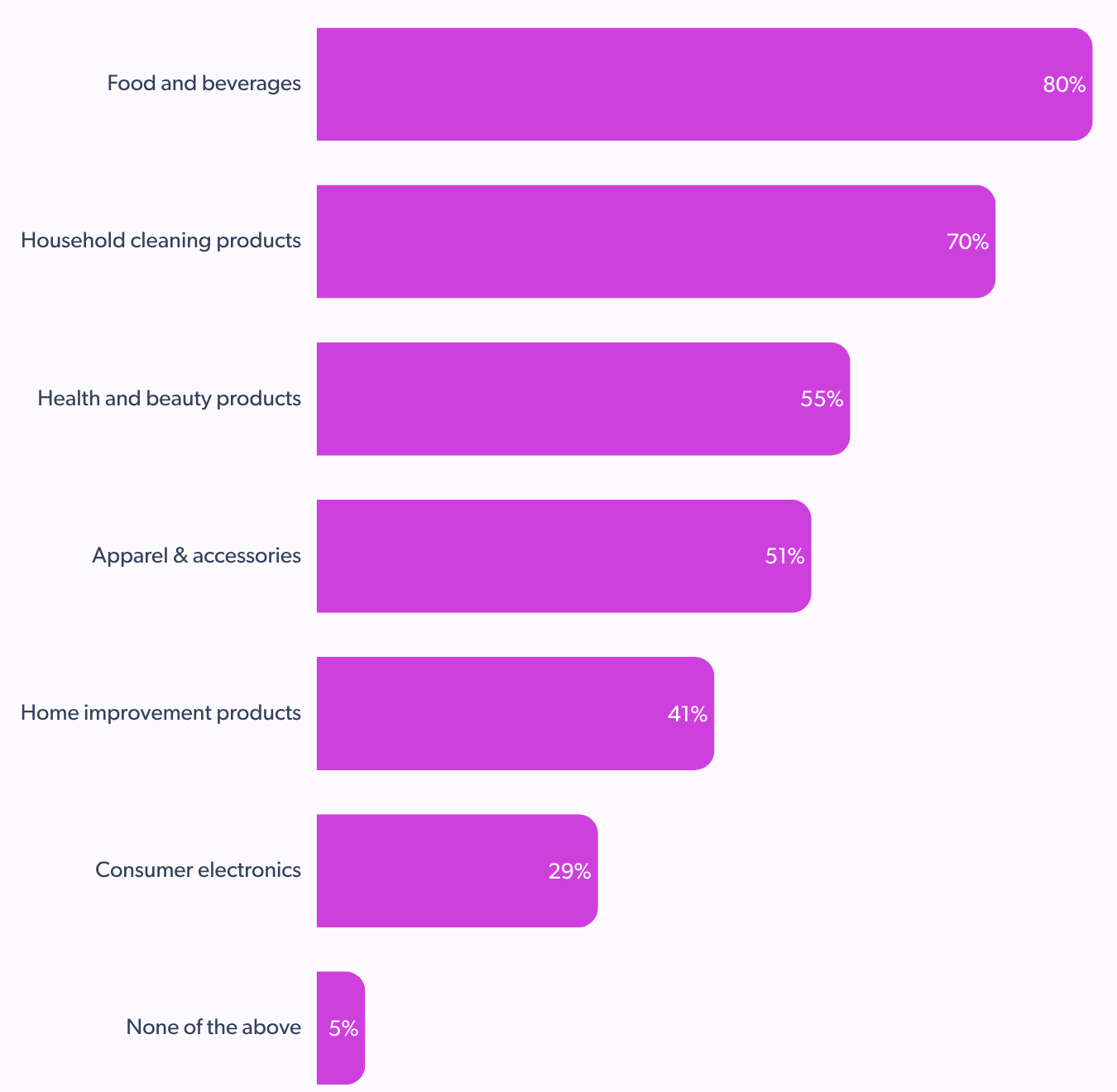

- Food and beverages (80%) are prime categories for private label success

Food and beverages stand out as the top category where consumers are likely to consider buying private label products, with an overwhelming 80% indicating this preference. A strategic entry point for private label expansion as well.

Other strong categories include household cleaning products (70%), health and beauty products (55%), and apparel and accessories (51%). Retailers should prioritize these categories for private label development, tailoring their offerings to meet specific consumer needs and preferences within each.

2. Cultivating loyalty and brand switching

Private labels are proving to be effective tools for fostering customer loyalty and encouraging brand switching, leading to long-term shifts in consumer behavior.

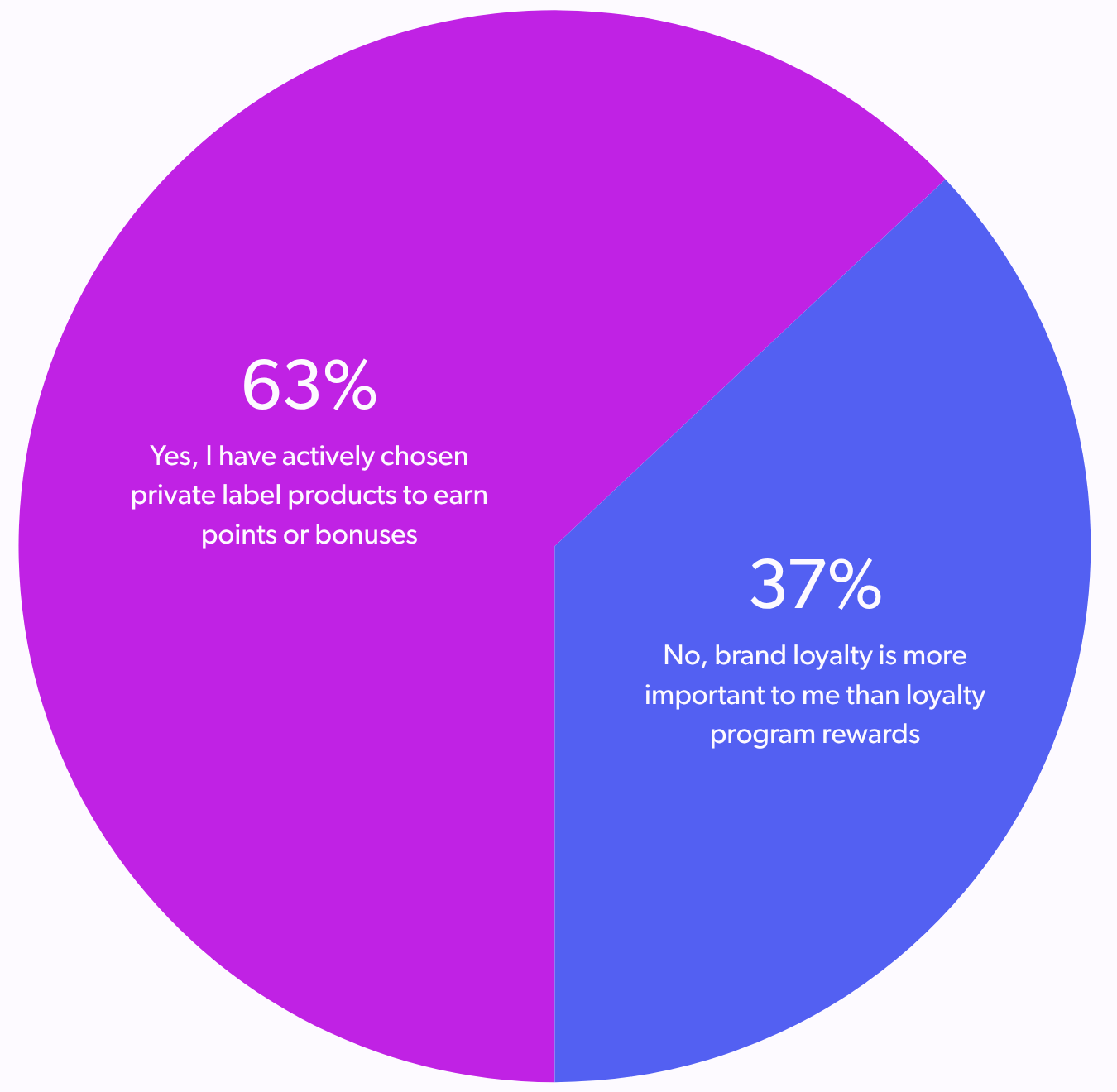

- Loyalty programs (63%) encourage switching to private labels

Loyalty programs are a powerful incentive for private label adoption, with 63% of consumers actively choosing private label products to earn points or bonuses. Integrating private labels into existing loyalty schemes can boost appeal and drive repeat purchases. Retailers should optimize their loyalty programs to highlight the benefits of choosing private label items.

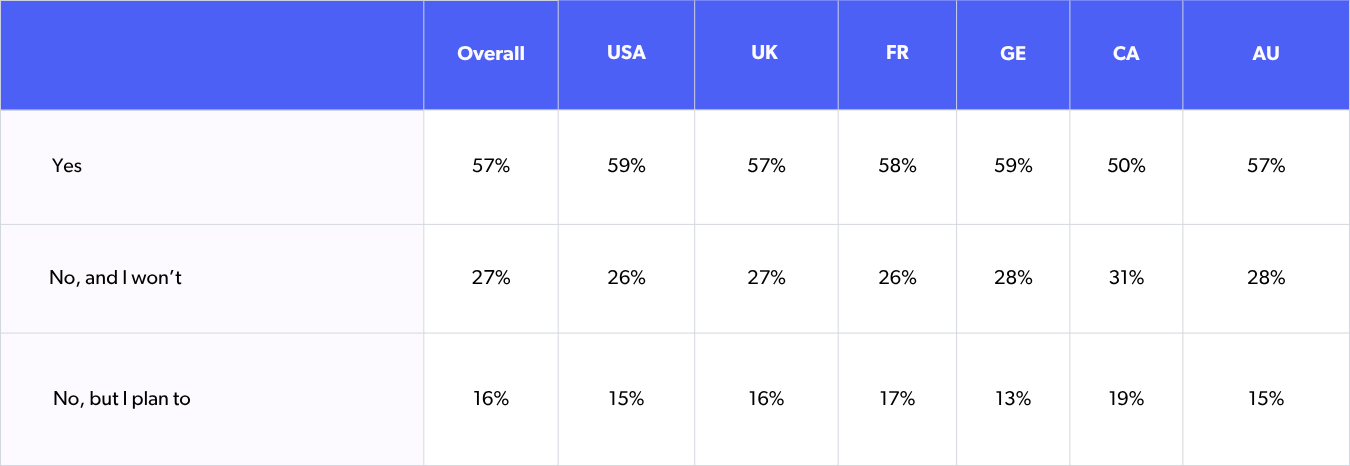

- 57% of consumers have permanently switched to store brands

A remarkable 57% of consumers across various countries (including 59% in the US and Germany, and 57% in the UK and Australia) have permanently switched some of their regular products to store brands.

This isn’t just a temporary trend; it represents a fundamental change in how consumers view and integrate private labels into their everyday lives.

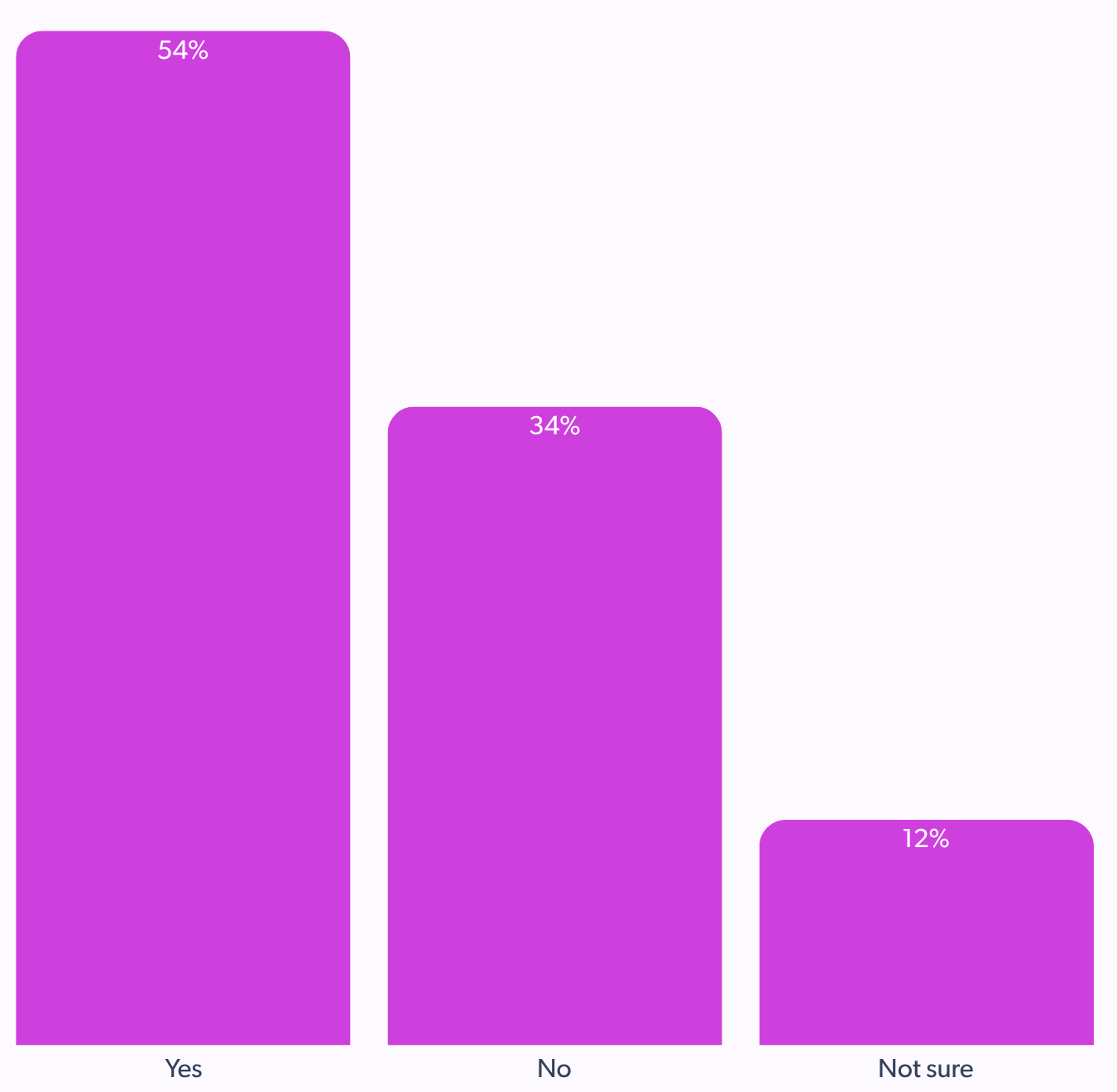

- 54% made a private label purchase in the past year, indicating ongoing momentum

The momentum for private labels continues, with 54% of consumers having made a private label purchase in the past year.

Reinforcing the ongoing relevance and increasing acceptance of private label products in the market, it suggests that retailers who invest in their private label strategy are likely to see continued growth.

3. Enhancing retailer reputation

A strong private label offering can significantly bolster a retailer’s overall brand image and reputation.

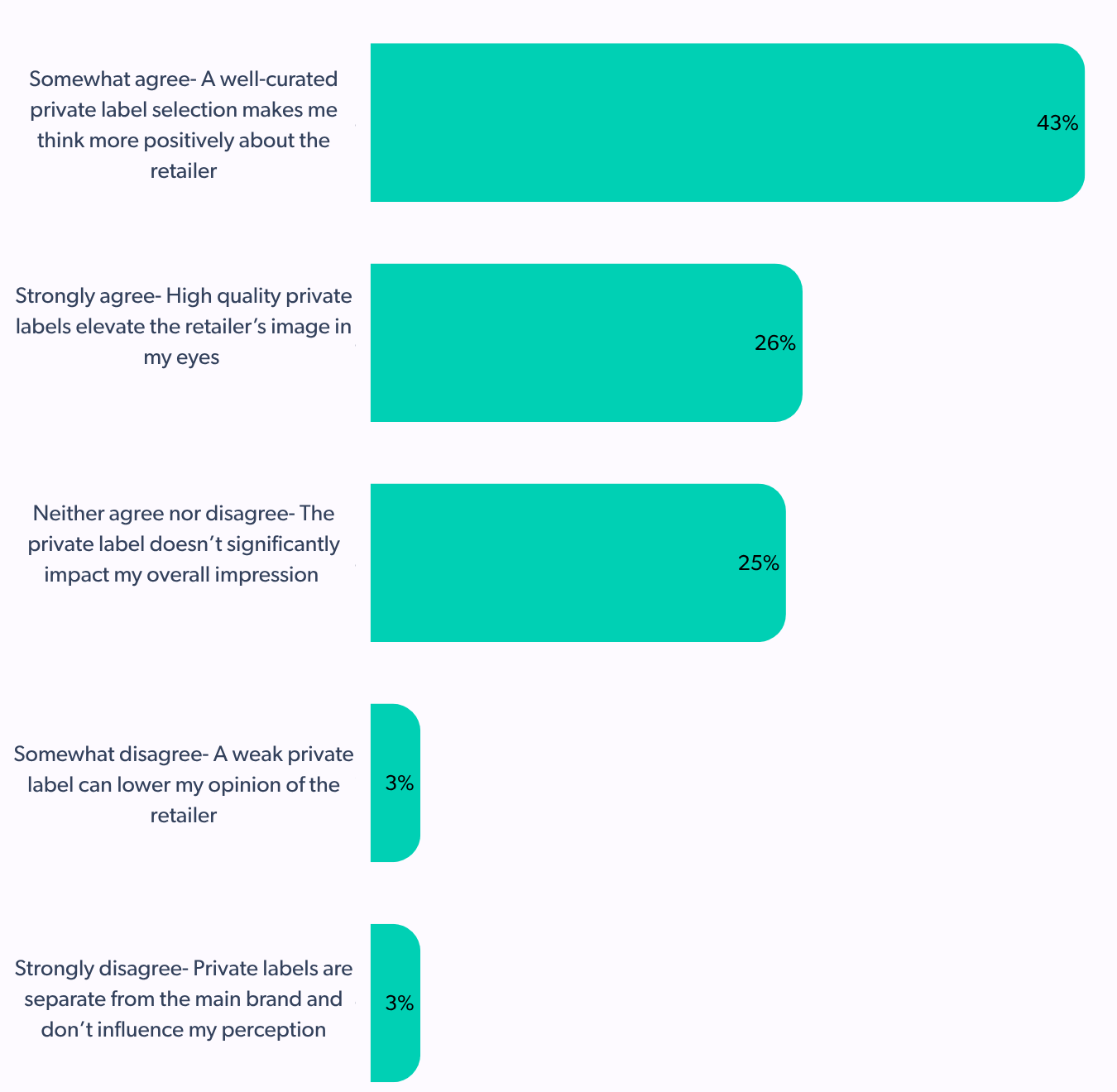

Direct correlation between private label quality/range and overall retailer brand perception (43%).

A substantial 43% of consumers agree that a well-curated private label selection makes them think more positively about the retailer. Furthermore, 26% strongly agree that high-quality private labels elevate the retailers’ image.

This highlights a direct link between the quality and breadth of private label products and the overall perception of the retailer’s brand.

A strong private label offering can bolster a retailer’s reputation for quality and value. The data suggests that private labels are becoming a key differentiator for retailers. By consistently delivering quality and value through their private label lines, retailers can cultivate a reputation for reliability and customer-centricity, ultimately leading to increased consumer trust and loyalty.

II. Leveraging UGC for growth

UGC, encompassing ratings, reviews, photos, and videos from other shoppers, plays an increasingly vital role in influencing consumer behavior and driving online conversions.

UGC as a core influence on consumer behavior

Consumers widely recognize the importance and usefulness of UGC in their purchasing journey.

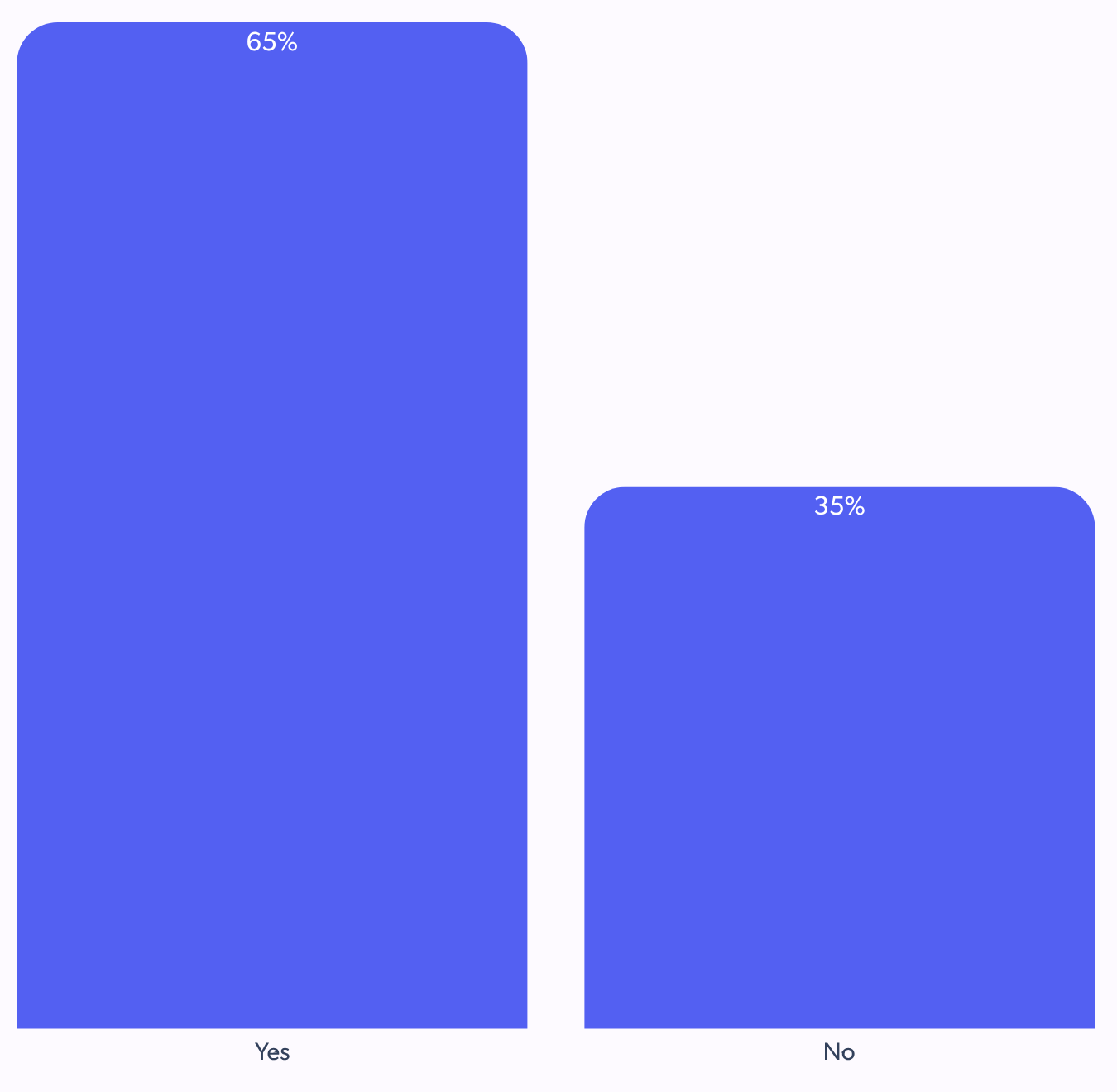

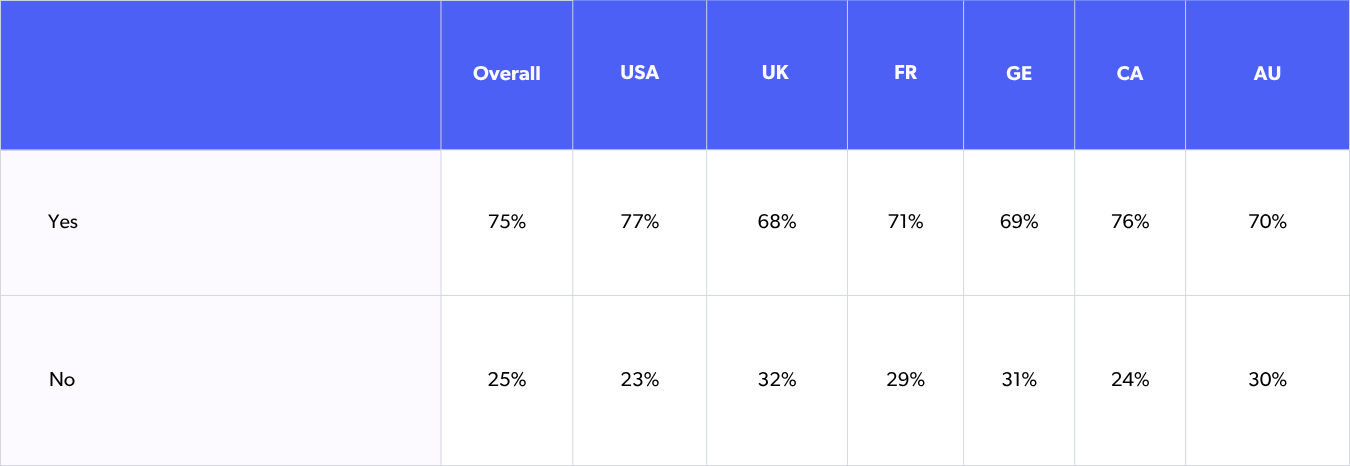

- High perceived importance (65%) and usefulness (75%) of UGC

A significant 65% of consumers find UGC important. 75% find it useful when making purchase decisions.

Highlighting the critical role UGC plays in providing authentic insights and building confidence among shoppers, retailers must actively encourage and integrate UGC into their online platforms.

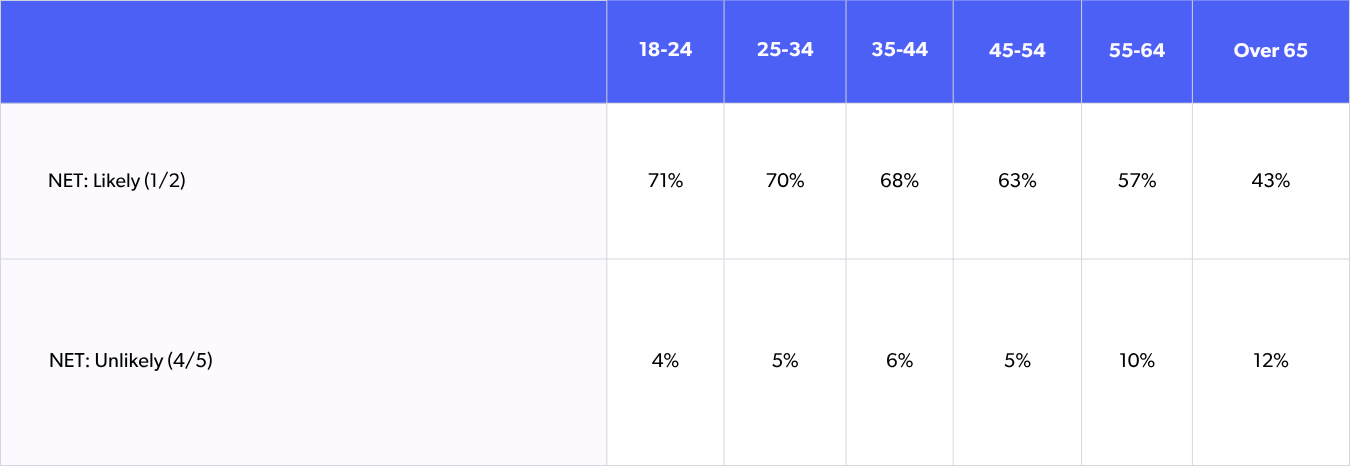

- UGC significantly influences purchase likelihood, especially for younger demographics

UGC has a direct impact on purchase likelihood, with 71% of 18-24 year olds and 70% of 25-34 year olds indicating they are likely to make a purchase based on UGC.

While this likelihood decreases with age, it remains a powerful influencing factor across all demographics. This highlights the importance of tailoring UGC strategies to resonate with different age groups.

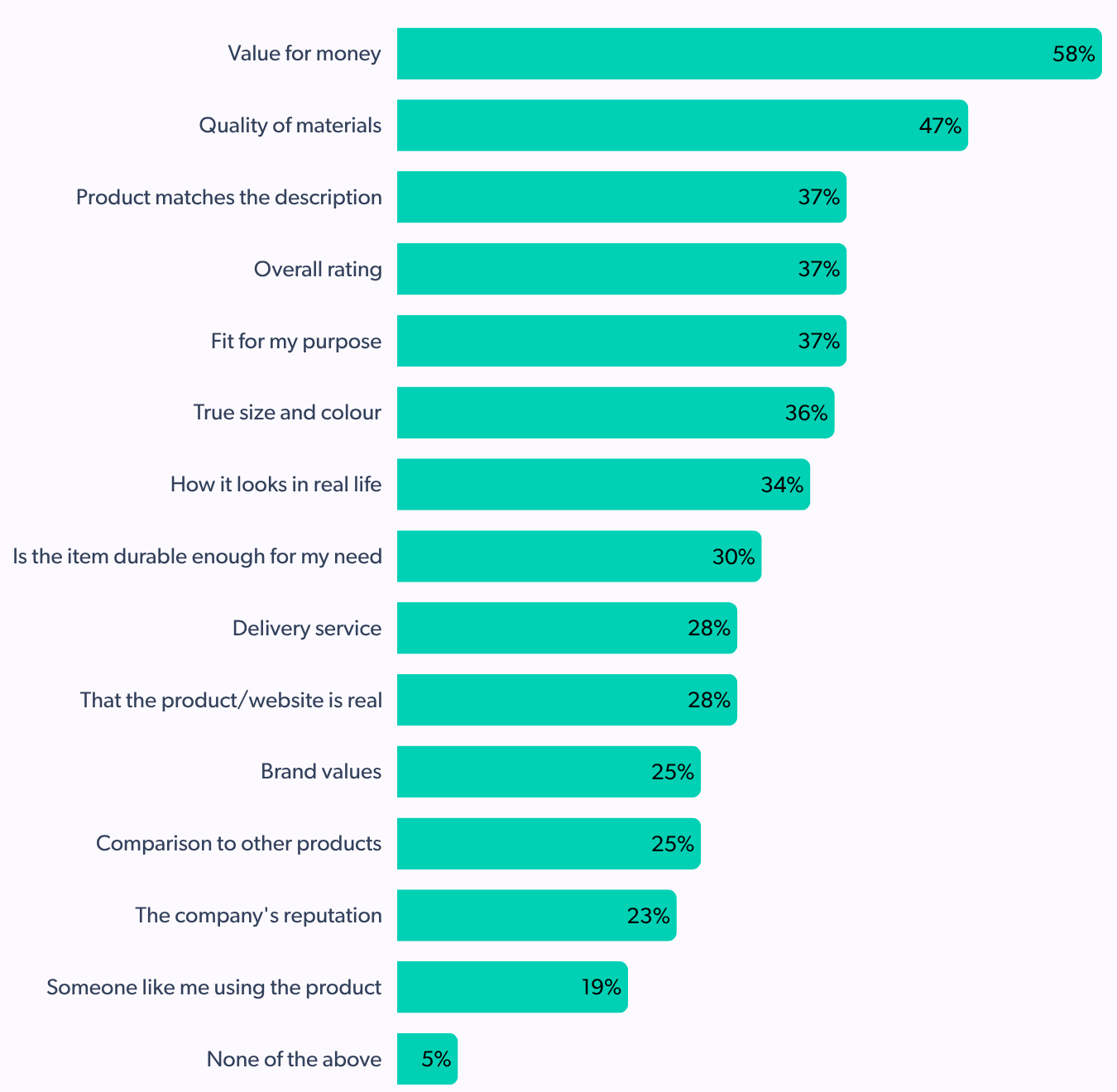

- Value for money (58%) is the top information consumers seek from shopper content.

When engaging with shopper content, 58% consumers are primarily seeking information about “value for money”. Followed by “quality of materials” (47%), and whether the “product matches the description” (37%).

This provides clear guidance for businesses on what aspects of their products and services to highlight in UGC requests and displays.

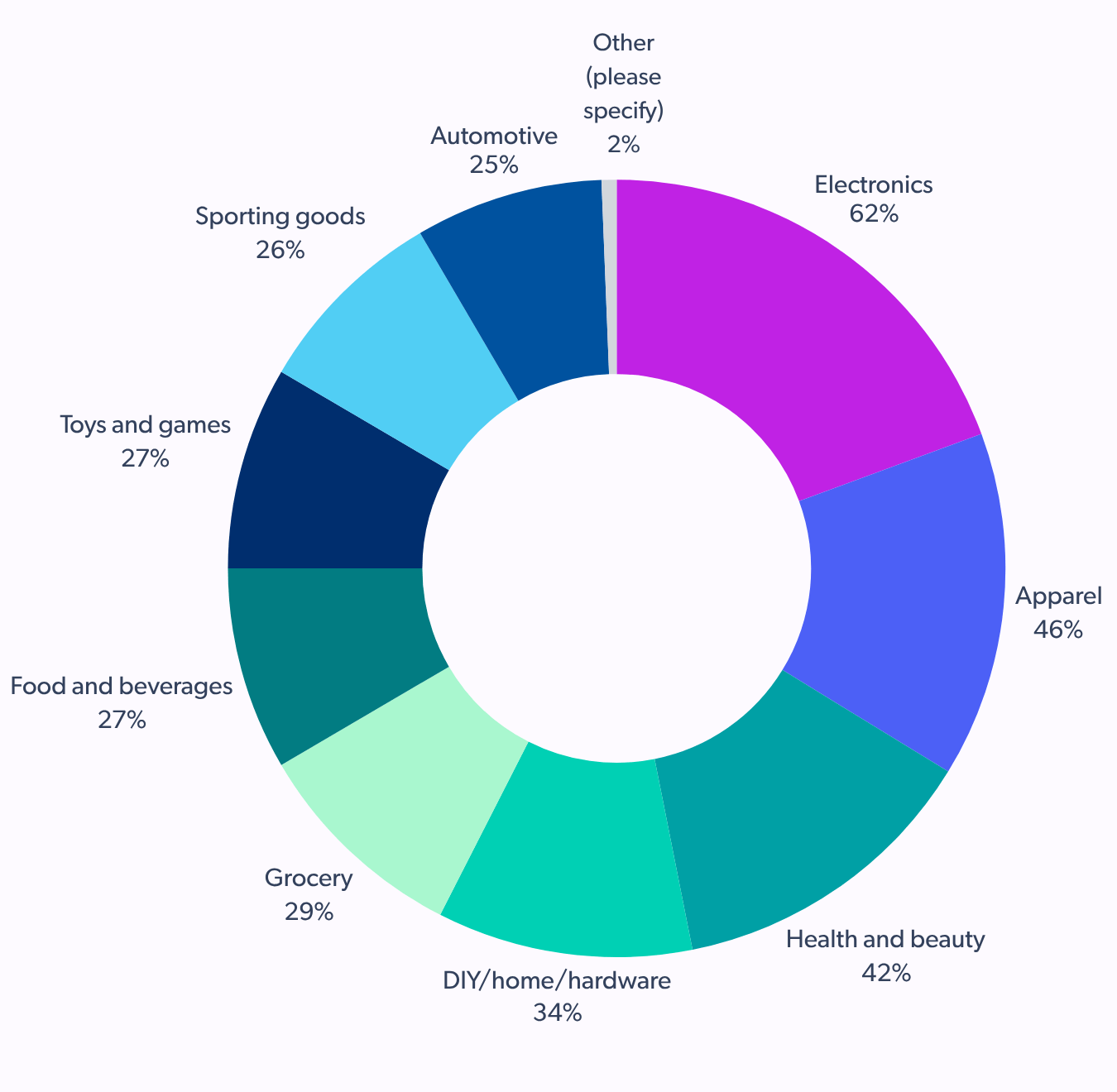

- Prevalence of UGC review for electronics (62%).

Electronics lead the way in product categories where consumers actively read reviews and look at UGC, with 62% doing so. Apparel (46%) and health and beauty (42%) also show strong engagement.

III. Optimizing UGC for online conversion

To maximize the impact of UGC, retailers need to focus on key elements that directly influence online purchase decisions.

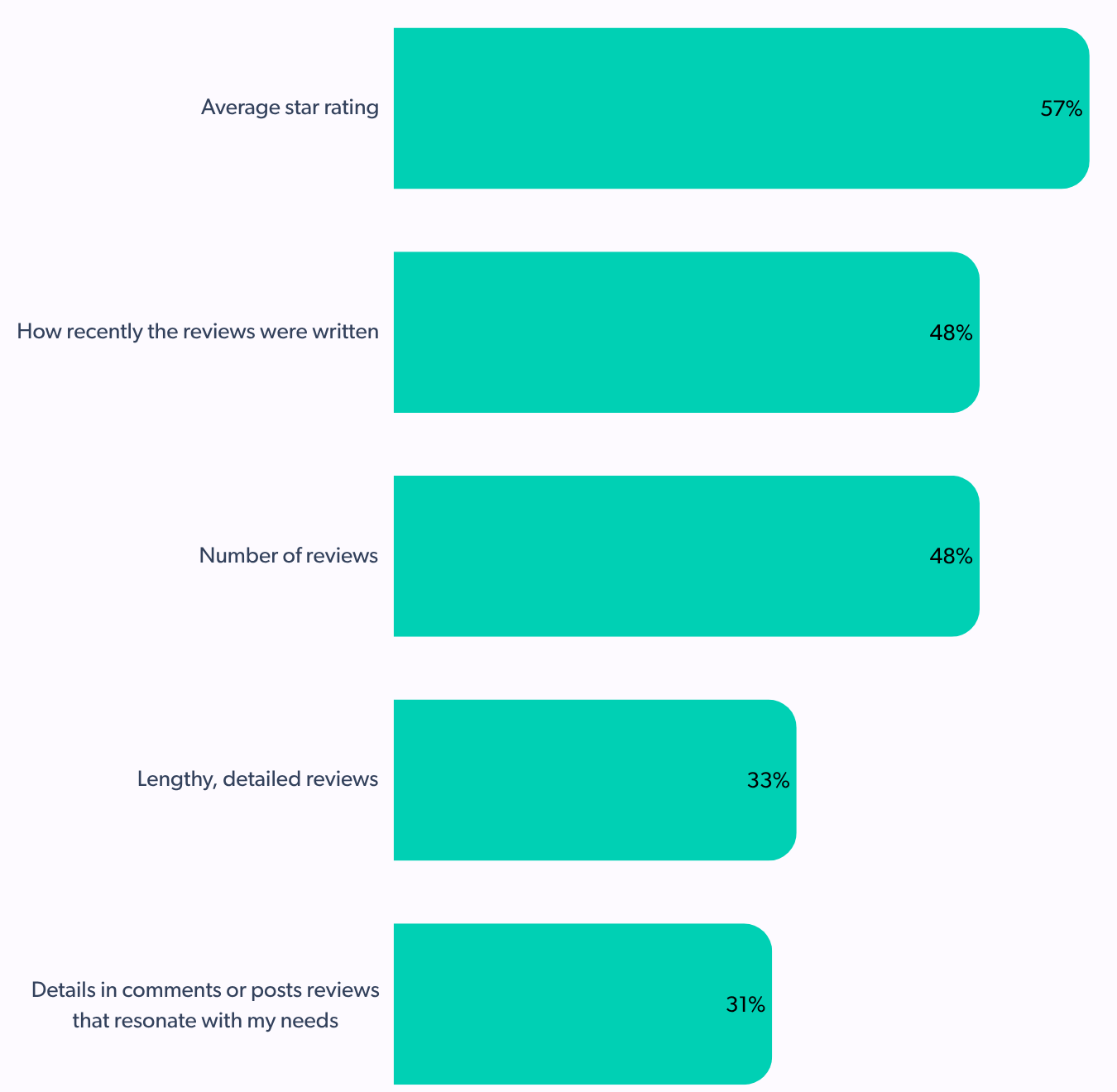

- Dominance of average star ratings (57%) and review recency (48%) in online purchase decisions.

When shopping online, the “average star rating” (57%) and “how recently the reviews were written” (48%) are the most influential UGC elements.

This emphasizes the need for retailers to not only accumulate a high volume of positive reviews but also to ensure a continuous stream of fresh content.

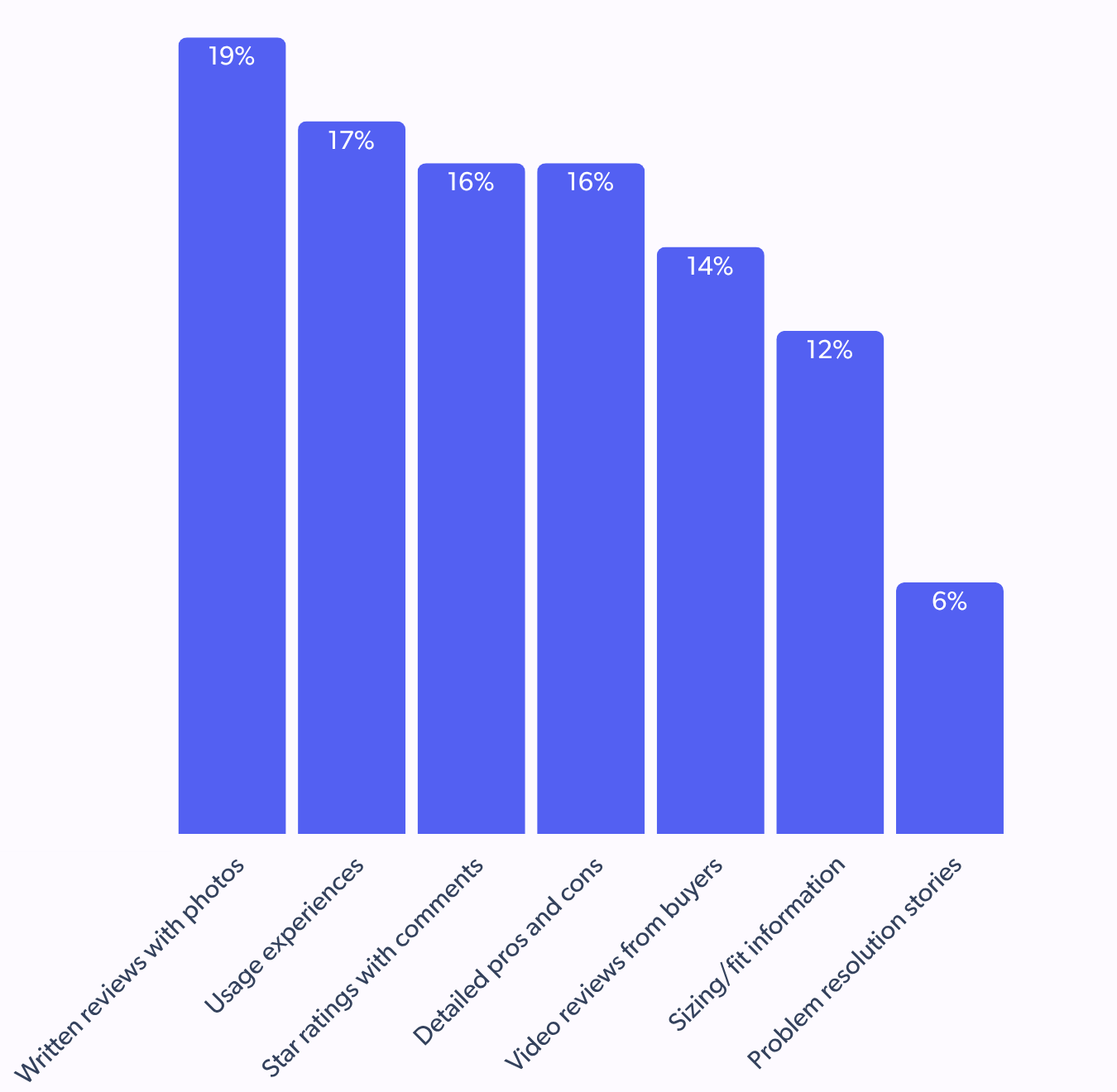

- Content formats that convert – written reviews with photos (19%) and usage experiences (17%)

While star ratings are crucial, detailed content also plays a significant role. Written reviews with photos (19%) and reviews detailing “usage experiences” (17%) are found to be most helpful.

Retailers must encourage users to submit reviews with visual aids and practical insights can significantly enhance their impact.

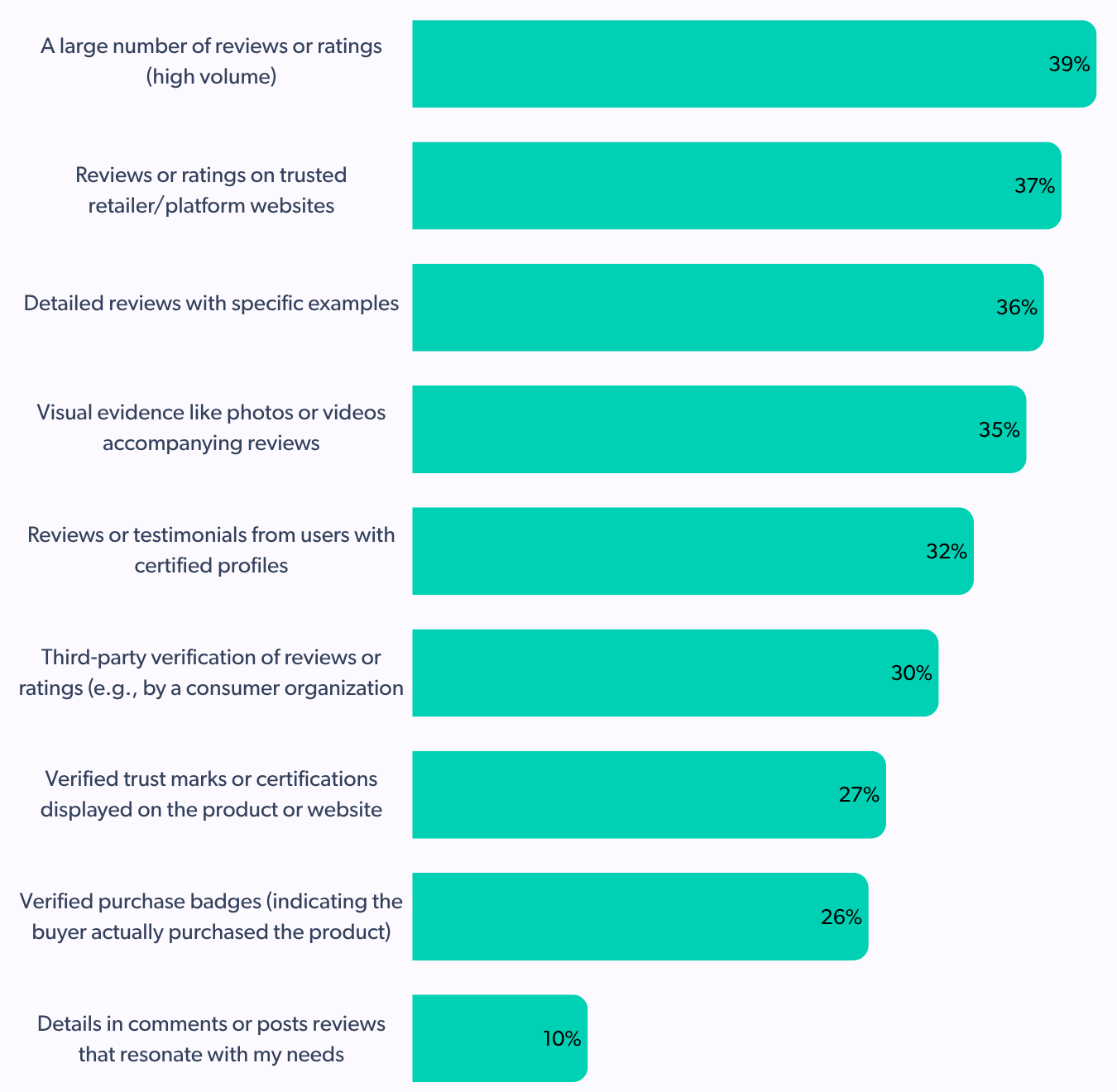

- Strategies to leverage large volumes of ratings/reviews (39%) and trusted platform reviews (37%) for consumer confidence

Consumers are influenced by a “large number of reviews or ratings” (39%) and “reviews or ratings on trusted retailer/platform websites” (37%), highlighting the importance of both quantity and credibility in UGC.

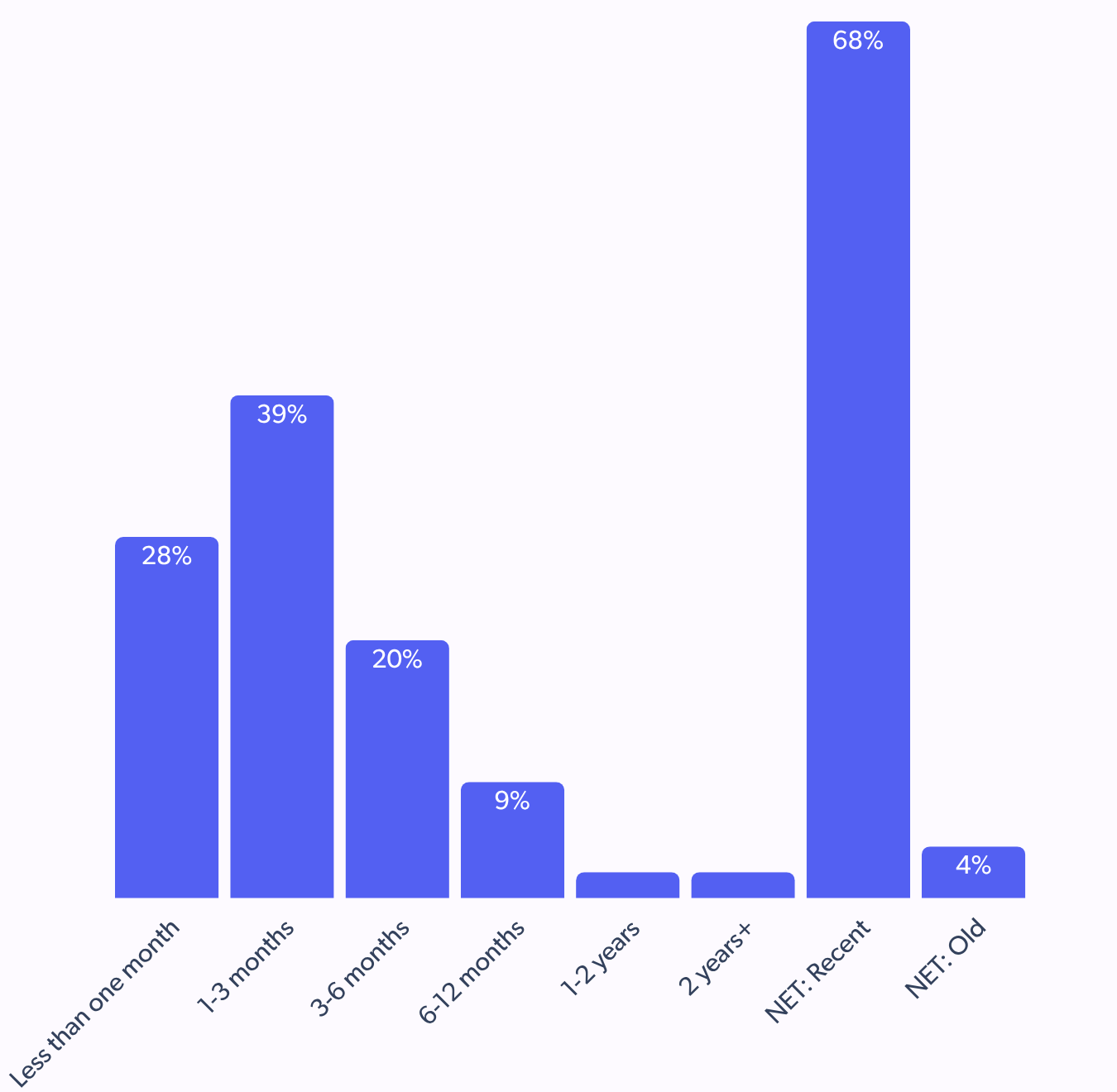

- Meeting consumer expectations for review recency (68% 1-12 months) and volume (40% 11-50 reviews)

Consumers expect reviews to be recent, with 68% considering reviews from the past 1-12 months as accurate. In terms of volume, 40% feel confident with 11-50 reviews. This provides clear benchmarks for retailers to aim for in terms of review generation and display.

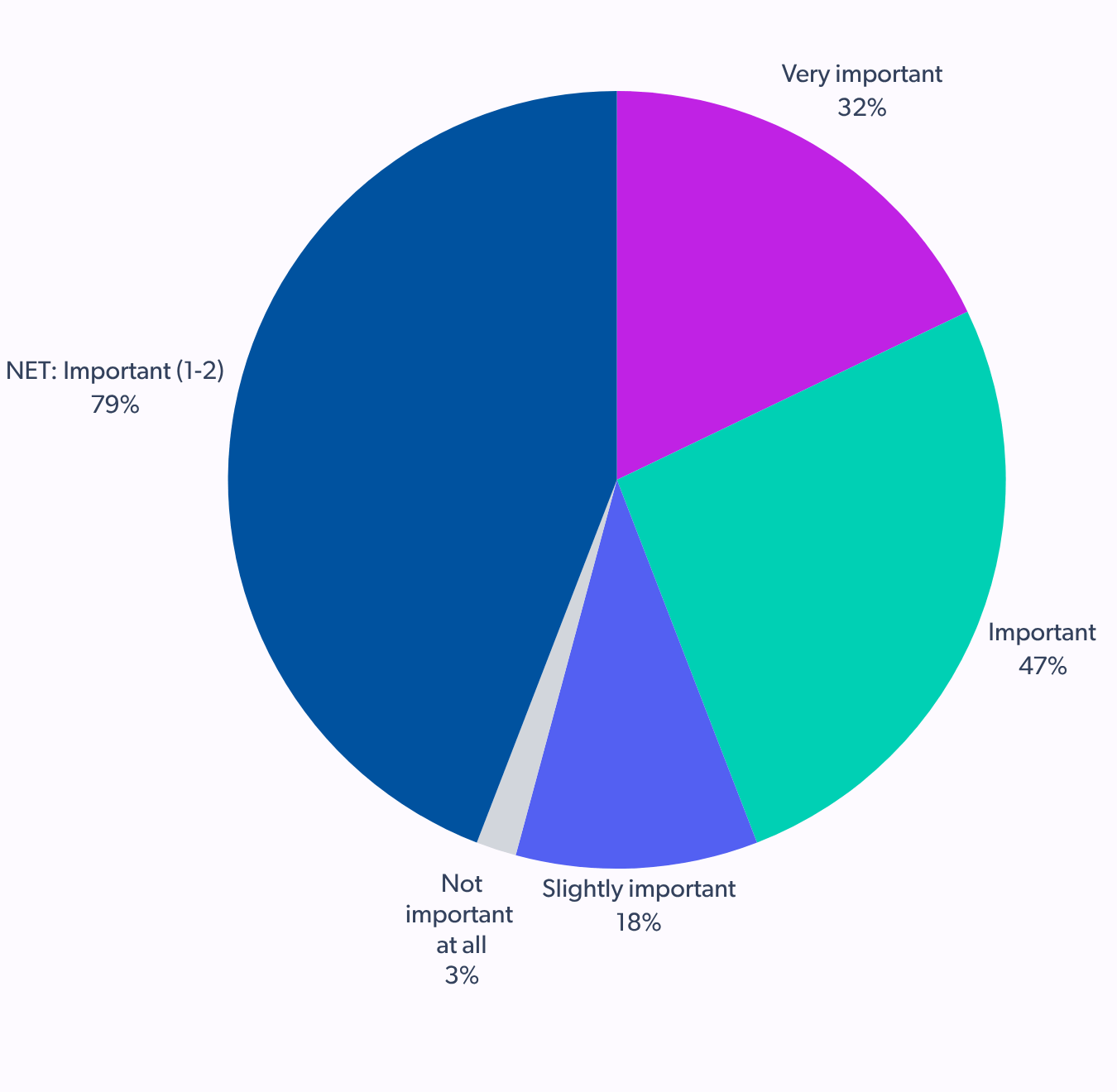

- Significant role of a higher total number of reviews (79%) in product choice

A higher total number of reviews is very important (32%) or important (47%) for 79% of consumers when choosing one product over another. Clearly, a robust volume of reviews signals popularity and reliability. This significantly impacts the purchasing decisions.

III. Harnessing UGC on social media for e-commerce success

Social media has emerged as a powerful channel for UGC, directly influencing purchasing behavior.

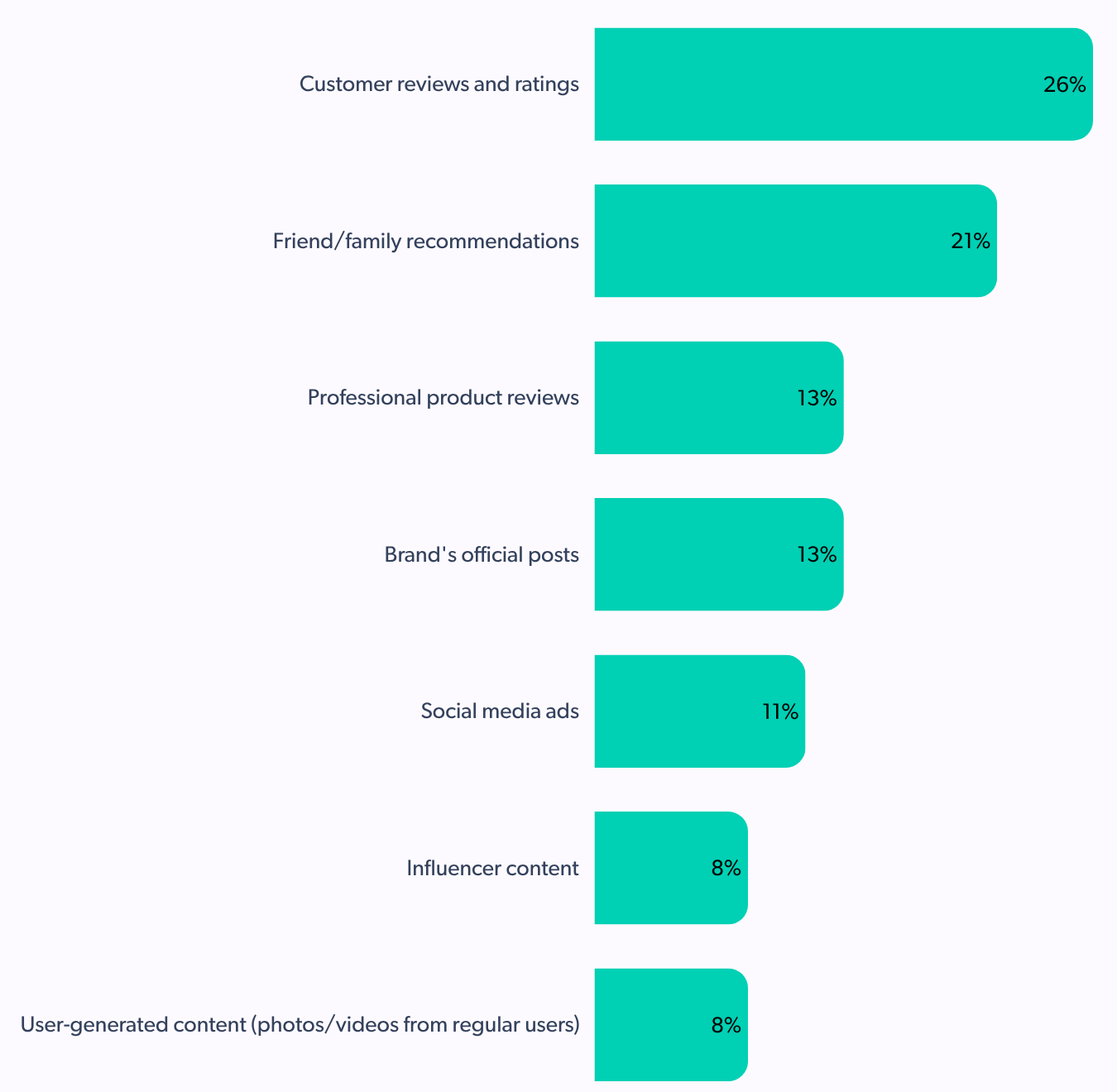

- Customer reviews and ratings (26%) on social media outweigh brand posts and friend recommendations.

Highlighting the authentic and influential nature of peer-generated content on social platforms, the data shows that on social media, customer reviews and ratings (26%) are the most trusted information source for shopping, surpassing even friend/family recommendations (21%) and brand’s official posts (13%).

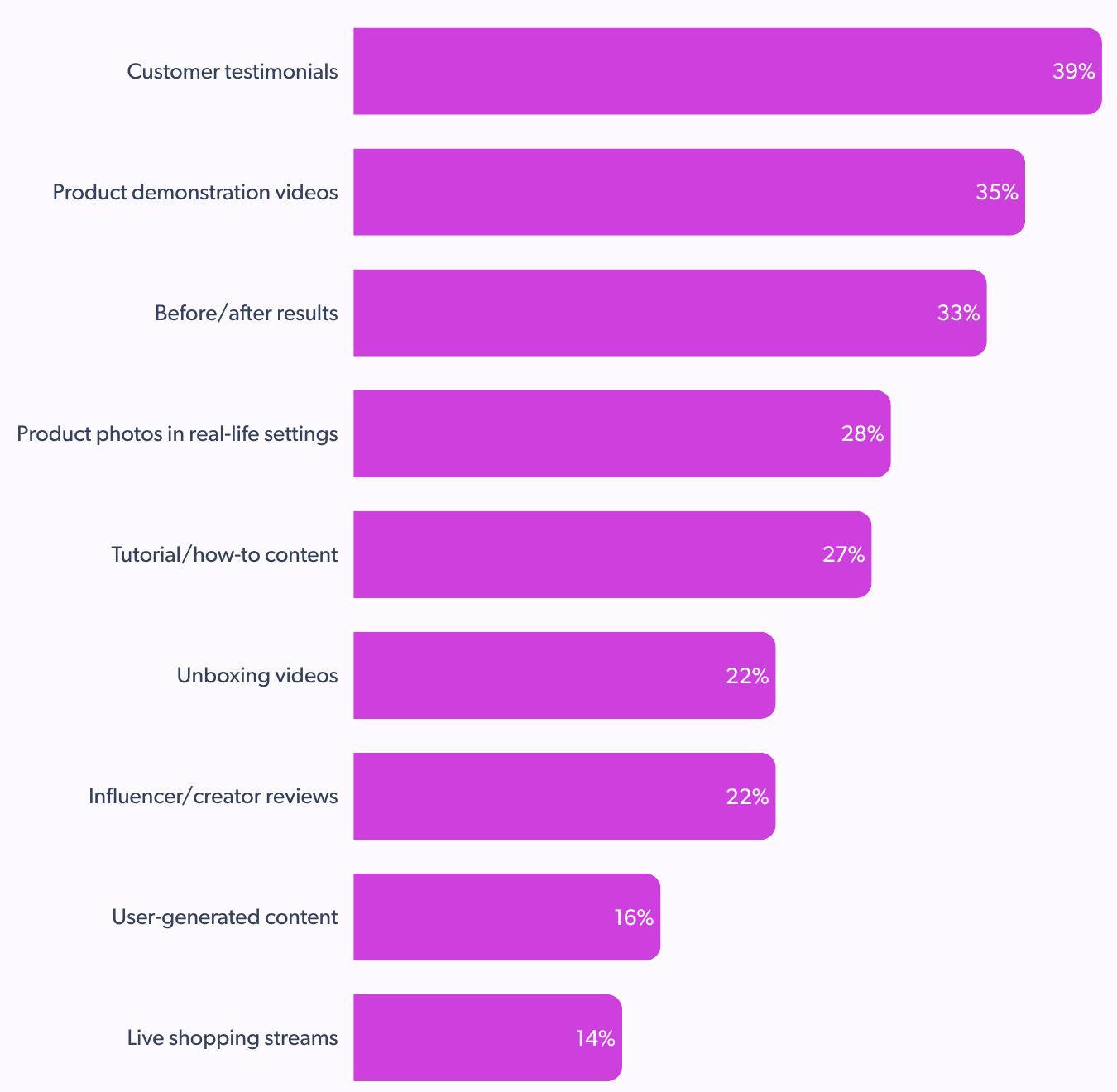

- Power of customer testimonials (39%) in driving purchase consideration on social media

Video content is highly impactful, with customer testimonials (39%) being the most likely to drive purchase consideration on social media. Product demonstration videos (35%) and before/after results (33%) also perform strongly.

Retailers should encourage and facilitate the creation of video testimonials and demonstrations by their customers.

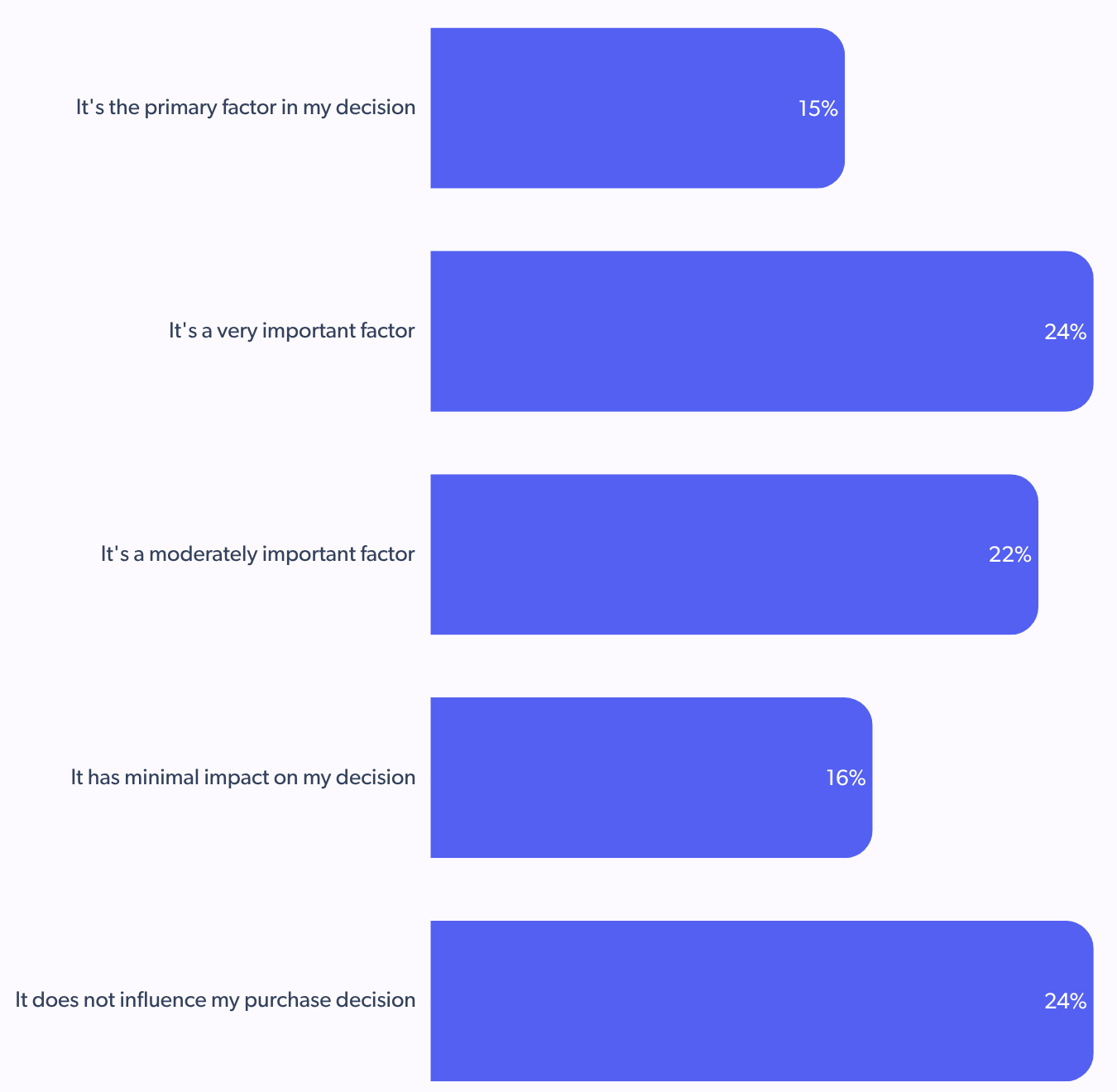

- Social media UGC influences adding to cart and completing purchases (61%).

Social media UGC plays a significant role in the purchase journey, with 15% considering it the primary factor, 24% a very important factor, and 22% a moderately important factor in adding to cart and completing purchases.

This cumulative 61% demonstrates the direct influence of social media UGC on conversion.

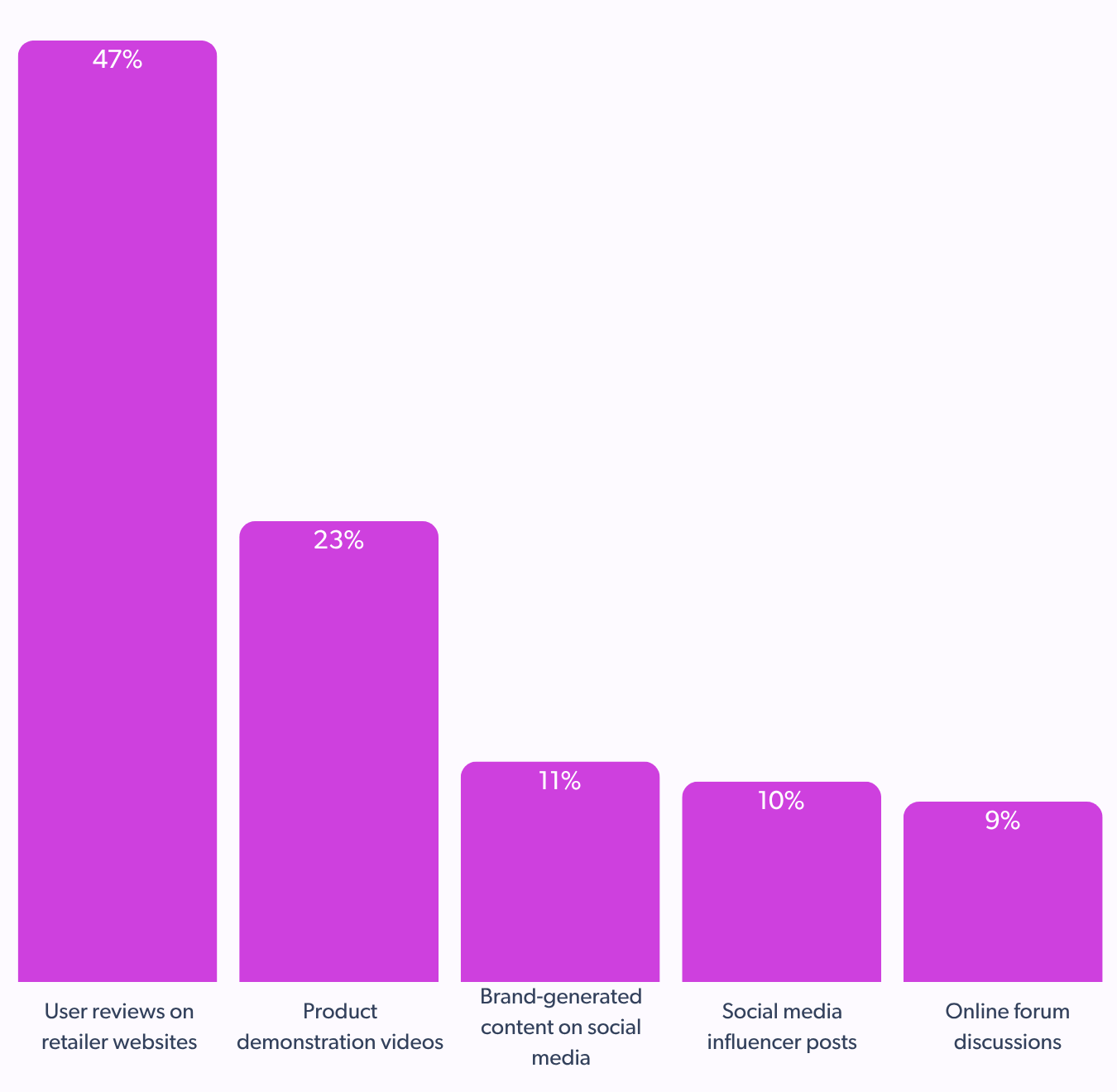

- User reviews on retailer websites (47%), most influential content for online product research

While social media is powerful, user reviews on retailer websites remain the most influential content for online product research (47%). This indicates that consumers often start their research on retailer sites, even if they discover products on social media. A seamless integration of UGC across all platforms is therefore essential.

IV. Maintaining UGC authenticity and trust

The effectiveness of UGC hinges on its authenticity, and consumers are increasingly discerning about genuine content.

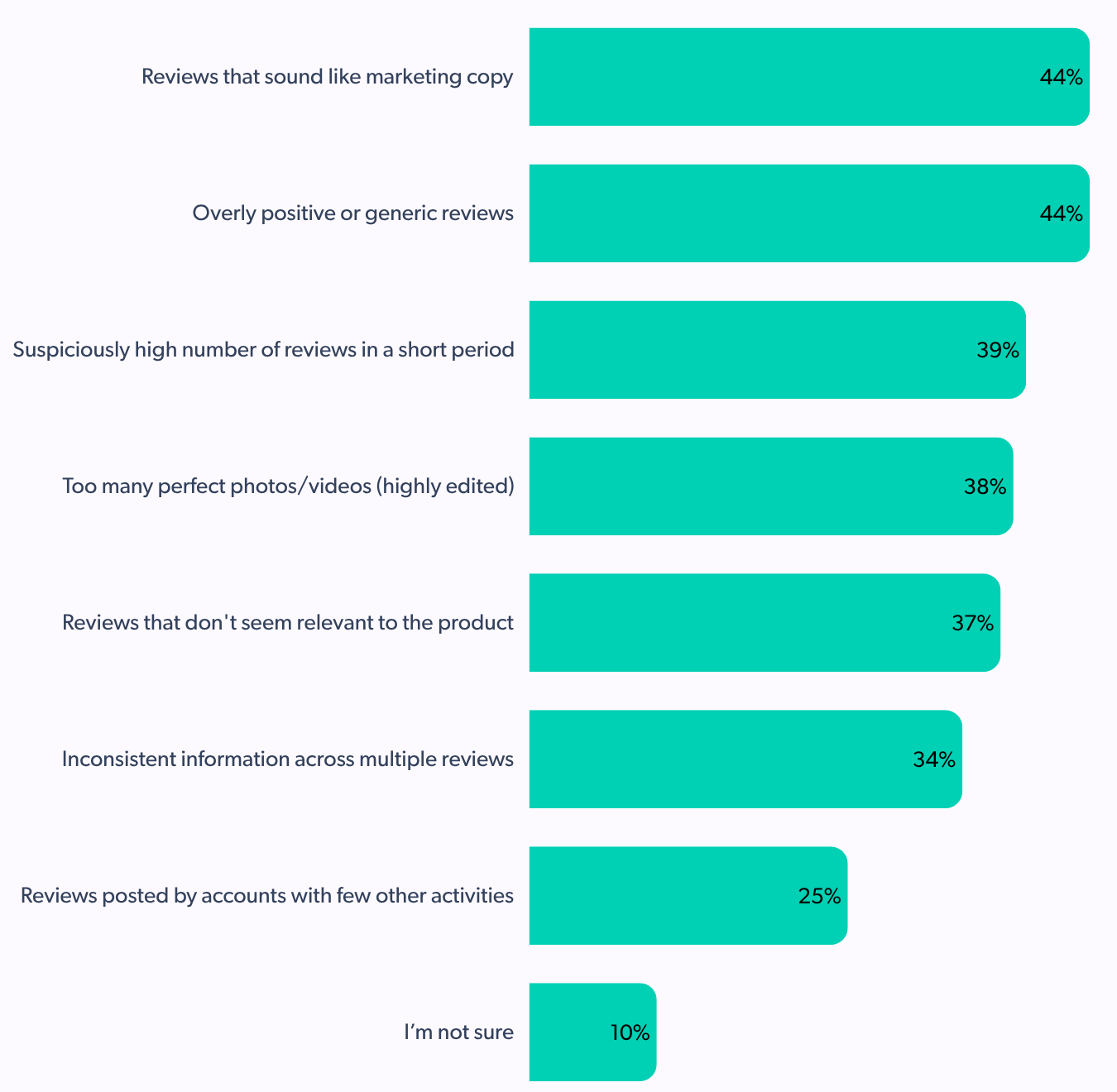

- Consumer concerns about reviews sounding like marketing copy (44%) or being overly positive/generic (44%).

Consumers are wary of UGC that appears inauthentic. Reviews that “sound like marketing copy” (44%) or are “overly positive or generic” (44%) are key indicators of non-genuine content. Other red flags include a “suspiciously high number of reviews in a short period” (39%) and “too many perfect photos/videos” (38%).

To combat skepticism, retailers must prioritize strategies that foster genuine UGC. This includes transparent review policies, verified purchase badges, and encouraging diverse and detailed feedback. Building trust in UGC is paramount for its continued effectiveness as a growth driver.