September 30, 2025

Forget everything you know about the top of the funnel. For decades, digital commerce relied on an equation of search engine optimization (SEO), paid media, and keyword supremacy. Today, that equation is obsolete. Consumers are now bypassing the traditional digital shelf, opting instead for a new, conversational, and hyper-efficient search experience driven by artificial intelligence (AI). The question for every brand and retailer is no longer, “Will AI impact commerce?” but: “Are your products ready for the AI recommendation engine?” The shift is not future-tense. According to the Bazaarvoice Shopper Experience Index (SEI) 2025, which surveyed over 8,000 global consumers, the change is already here:

- Among the crucial 18-34 age demographic, a striking 41% now use a Generative AI tool to search for a product instead of a traditional search engine.

- Overall, the shift is significant, with 24% of all consumers using GenAI for product search, and a growing number trusting the results: 75% of the 18-34 age group trust GenAI for at least some recommendations.

This represents a fundamental re-architecture of the shopper journey. AI is not merely indexing pages; it is analyzing authentic, real-world data, specifically customer reviews, to understand product performance and make informed recommendations. A Columbia/Yale study found that products with both high ratings and review volumes get the strongest preference boost from AI agents. Brands and retailers must urgently prioritize their AI search strategies to influence how their products are surfaced. Here are the three key insights from the SEI 2025 that are essential for shaping your commerce strategy this year.

1. Private label dominance reshapes the value conversation

Economic headwinds have been a major factor, with a large majority of consumers (83%) reporting that the economy has affected their online shopping behaviour. This has accelerated the acceptance and dominance of private labels.

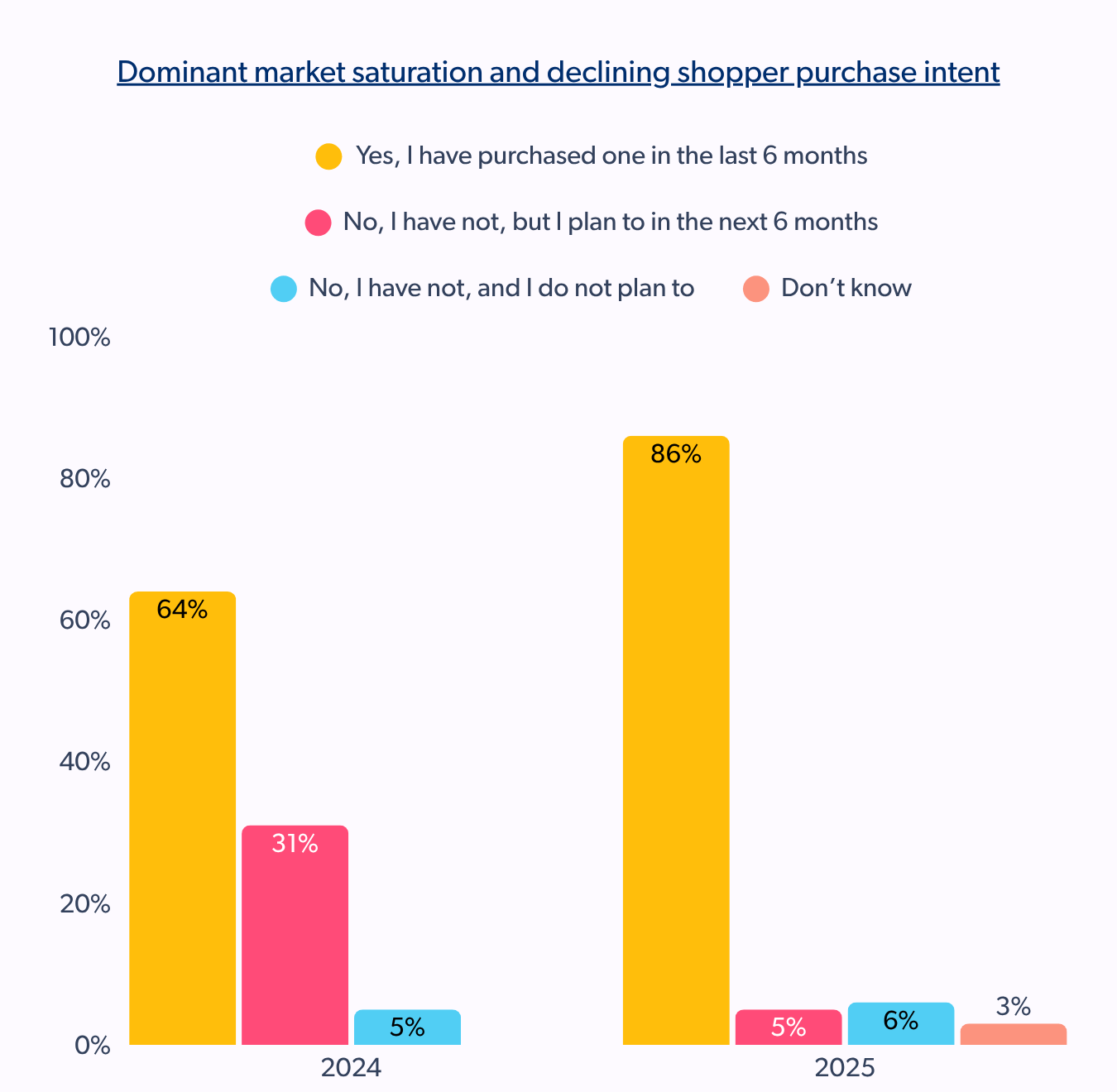

- A staple purchase: The adoption of private labels is now a “dominant force” across all surveyed countries and age groups. The percentage of consumers who purchased a private label in the last six months jumped higher from 2024 to 2025.

- The permanent switch: More strikingly, 73% of consumers have permanently switched some of their staple products to private label, up from 46% in 2024. This transition has been so aggressive that those who plan to purchase a private label in the next six months (but haven’t yet) plunged from a higher percentage in 2024 to just a significantly lower percentage in 2025.

- Economic vulnerability: The 35−54 age group is noted as being most prone to delaying major purchases due to economic shifts. Moreover, Canada and Australia showed the highest impact in terms of consumers buying less overall and delaying major purchases.

Callout: Private labels are no longer just budget-friendly alternatives; they are now staples that put increasing pressure on national or established brands. Retailers must strategically develop and promote their private-label lines while ensuring the quality and consistency that justifies the permanent switch.

2. The physical store is staging a 4X comeback

Despite the growth of digital channels, physical stores are experiencing a substantial rebound, indicating a clear recalibration of the retail landscape.

- Foot traffic surge: The percentage of consumers who exclusively shop in-store surged from 7% in 2024 to 29% in 2025. Conversely, the shoppers who “only shop online” dropped sharply from 13% to just 5%.

- The hybrid shopper shift: While the “mix of in-store and online” remains the most common shopping method, its share significantly decreased from 80% to 66%. This reinforces that shoppers are increasingly choosing a single channel more often, signalling a shift away from constant platform hopping.

- Research fatigue: There’s a noticeable shift away from extensive online product research before in-store purchases in 2025. Those who “Always” research online before buying in-store decreased from 18% to 13%. Furthermore, Showrooming (visiting stores to view products before purchasing online) has also declined across all frequencies in 2025 compared to 2024.

Callout: Shoppers are consolidating their activity into more traditional channels. This requires brands to deliver a consistent, seamless omnichannel experience across all touchpoints: website, in-store, app, and email, to keep up with consumer expectations.

3. Skepticism triumphs: Declining trust in creator Content and reviews

Shoppers are increasingly skeptical, which is why trust and transparency have become the most valuable currencies in commerce.

- The trust crisis: The single most frequently cited frustration in the shopping journey is “Knowing if reviews are real or trustworthy” at 46%. This problem is widespread:

37% of consumers are equally concerned by “All types of fake reviews”. - The source of confidence: While reviews are highly scrutinized, seeing “recent reviews from real customers” remains one of the top three factors that make consumers feel confident in a purchase, alongside lower price and free shipping. In fact, “Looking for reviews or ratings” is the most common step consumers take (43%) after discovering a product or intending to purchase it.

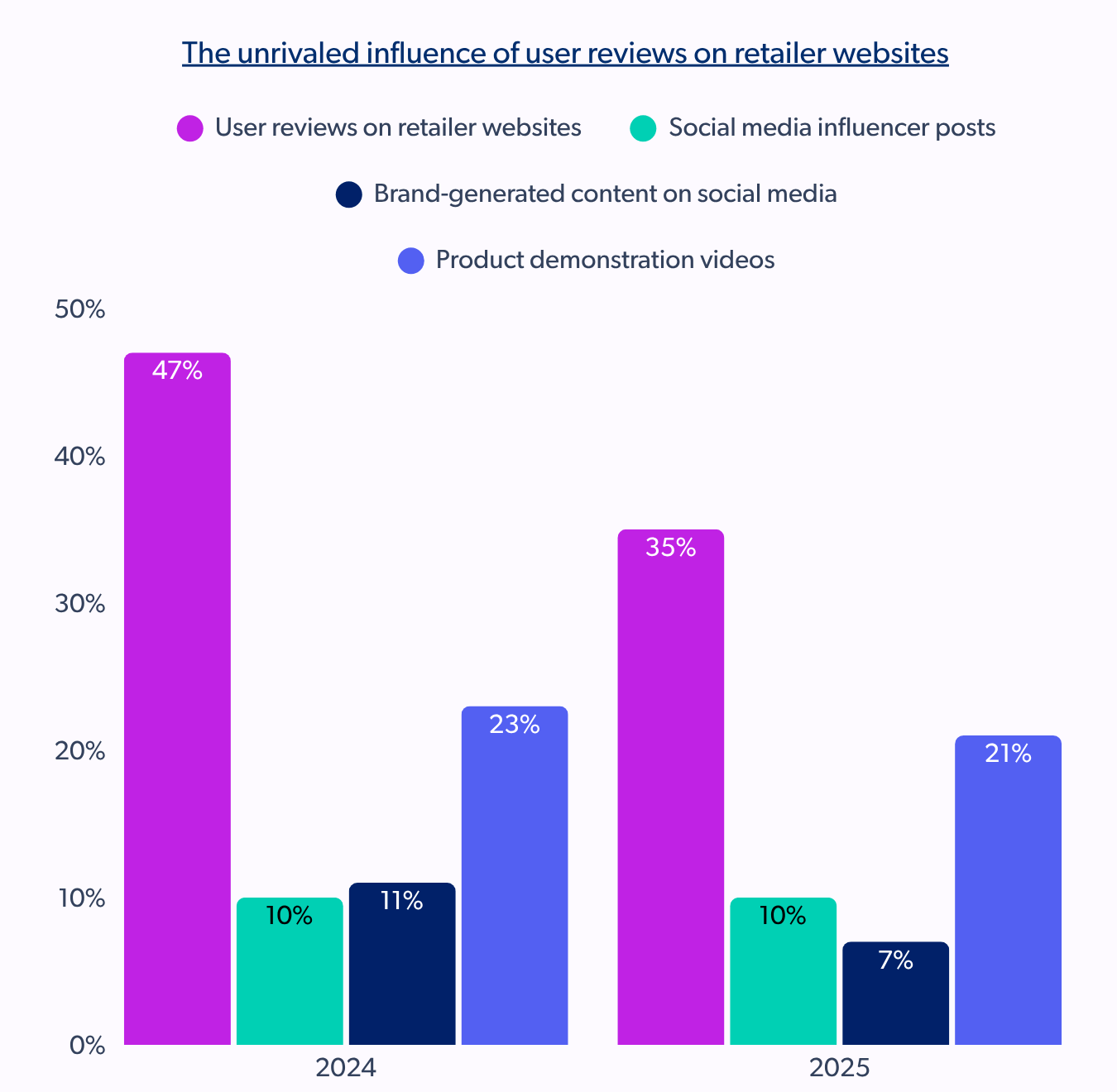

- Declining influence of retailer reviews: The influence of “user reviews on retailer websites” as a top factor for purchase confidence dropped significantly in 2024 and 2025, as displayed below:

- Trust signals plummet: The distrust extends to third-party verification, as the percentage of consumers who would “Trust a lot” a “trust signal” from an independent 3rd party plummeted from 26% in 2024 to just 12% in 2025. This is paired with an increase in consumers who feel “Neutral” or simply “Not trust” the signal, which collectively rose from 27% in 2024 to 44% in 2025.

Callout: Promotional content is losing its effectiveness. Brands need to focus on content that provides genuine value, educational utility, and transparency to rebuild consumer confidence. Critically, consumers largely believe that brands themselves (54% in 2025) should be solving issues of fraudulent content online.

The mandate for brands: authenticity, utility, and integrated data

The findings from the SEI 2025 report paint a clear picture: shoppers are smarter, more skeptical, and more in control. They are directing their own journey, whether that’s by using AI to search, returning to physical aisles, or prioritizing value through private labels.

For brands, the opportunity lies in authenticity, utility, and integrated digital data. By prioritizing the collection and display of genuine user-generated content (UGC), optimizing content for GenAI search, and creating seamless omnichannel experiences, you can meet the modern shopper exactly where and how they choose to buy.