June 10, 2025

In 2025, more Australians will embrace the omnichannel experience for holiday shopping, with 58% starting their product discovery online.

This aligns with a strategic, value-focused approach. Many shop early and seek incentives, and economic factors influence their approach to spending.

Besides, authenticity and peer recommendations matter more than influencer content, with Australians showing a slight preference for user-generated content (UGC) over brand content, according to the Bazaarvoice Holiday Consumer Shopping Report 2025.

Let’s have a detailed look at the unfolding of Australian holiday shopping behavior.

Australians prefer smart holiday shopping

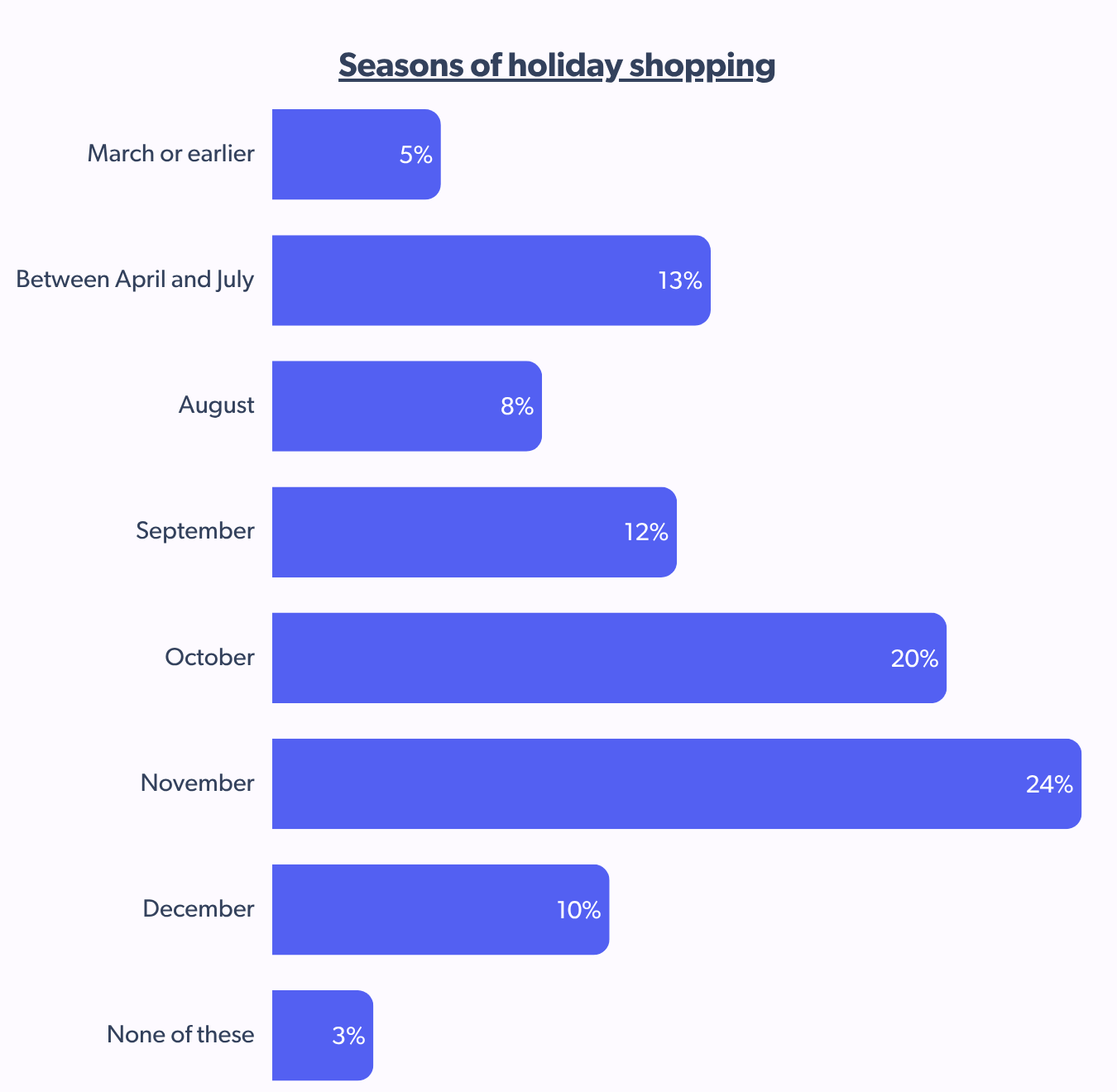

As the festive season approaches, the world prepares for a surge in holiday shopping. The report reveals that a significant 64% of shoppers kick off their gift buying from September through November, with a notable 24% favoring November.

As the purchase is spread across months, it is crucial for brands to begin their campaigns early.

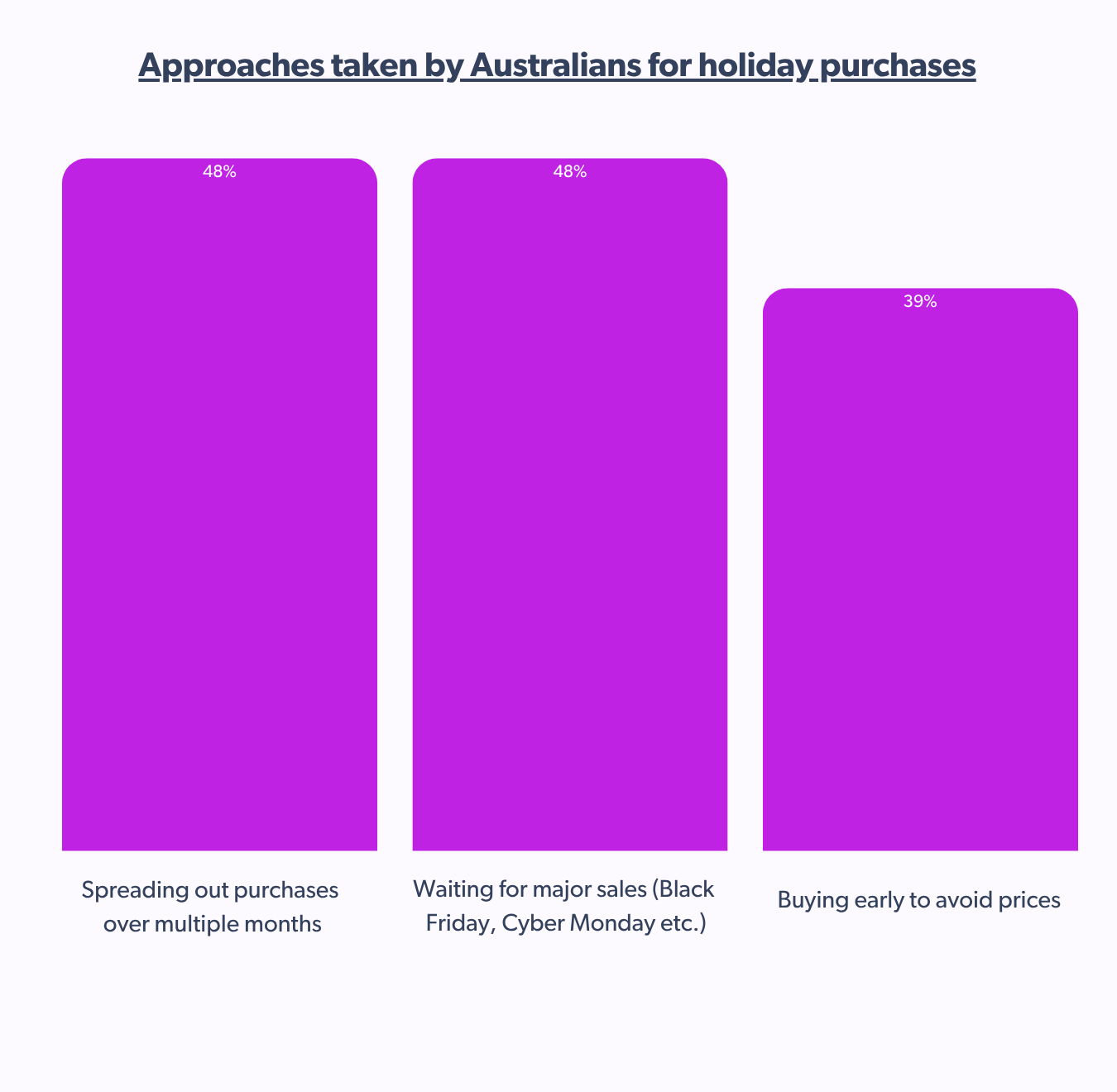

Facing economic pressures, Australian holiday shoppers are employing three main strategies:

- Early Purchases (39%): Buying in September-October to avoid inflation-driven price increases.

- Budget Spreading (48%): Distributing purchases over several months for better financial management.

- Deal Hunting (48%): Waiting for major sales events like Black Friday and Cyber Monday to maximize savings.

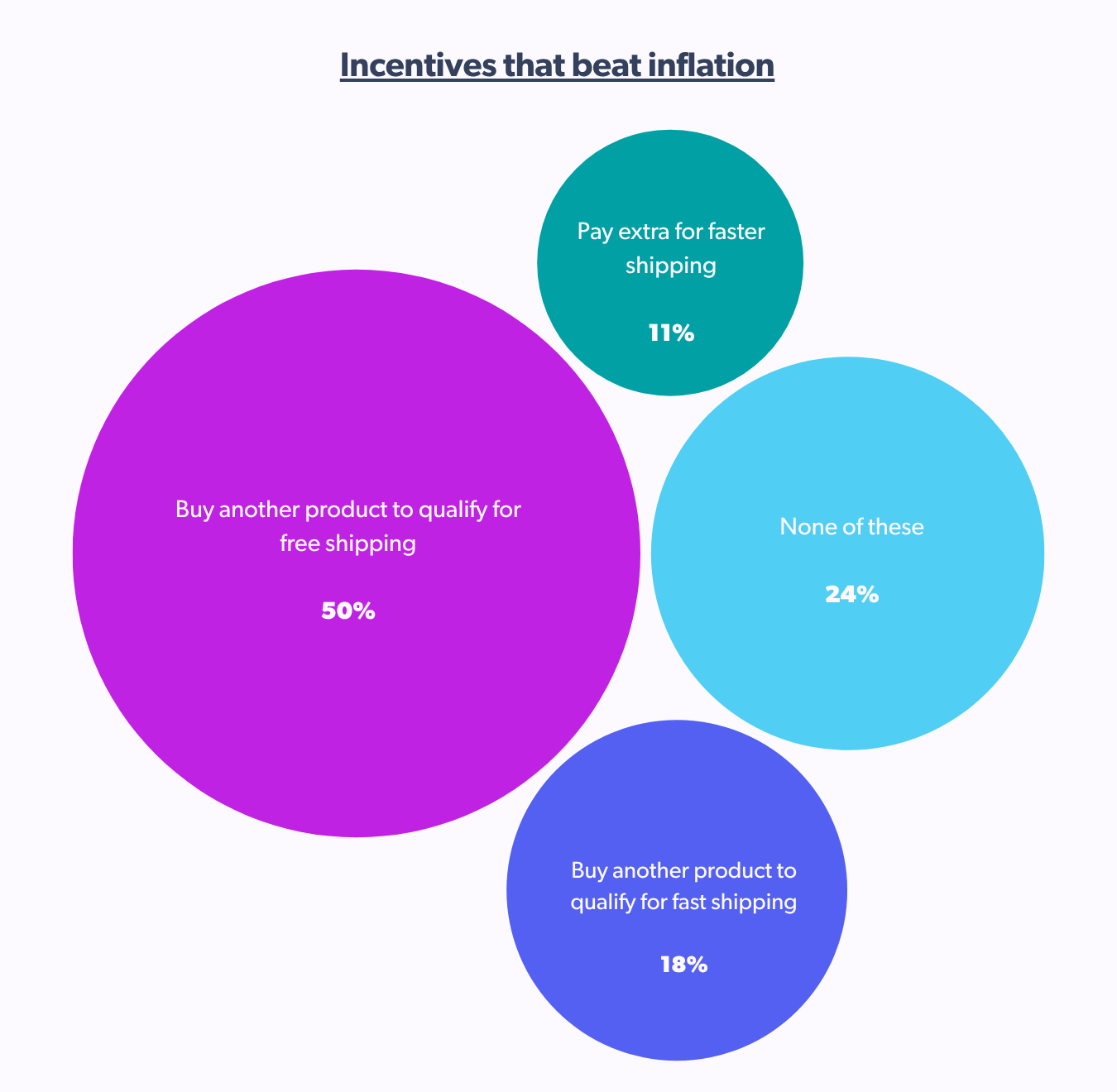

Because of high inflation, the global economy is struggling, impacting every industry. 50% of Australian shoppers buy another product to qualify for free shipping, which is greater than the global average of 48%. And with only 18%, faster shipping is not much of a priority for the Australian shoppers.

When it comes to retailers, discounts and promotions (63%) have proven to be the most important factor for Australian shoppers, closely followed by free shipping (58%), along with easy returns and exchanges (42%).

This is a great opportunity for brands and retailers to run their campaigns during the early months of shopping, focusing exclusively on free shipping and doubling down on discounts and promotions as incentives.

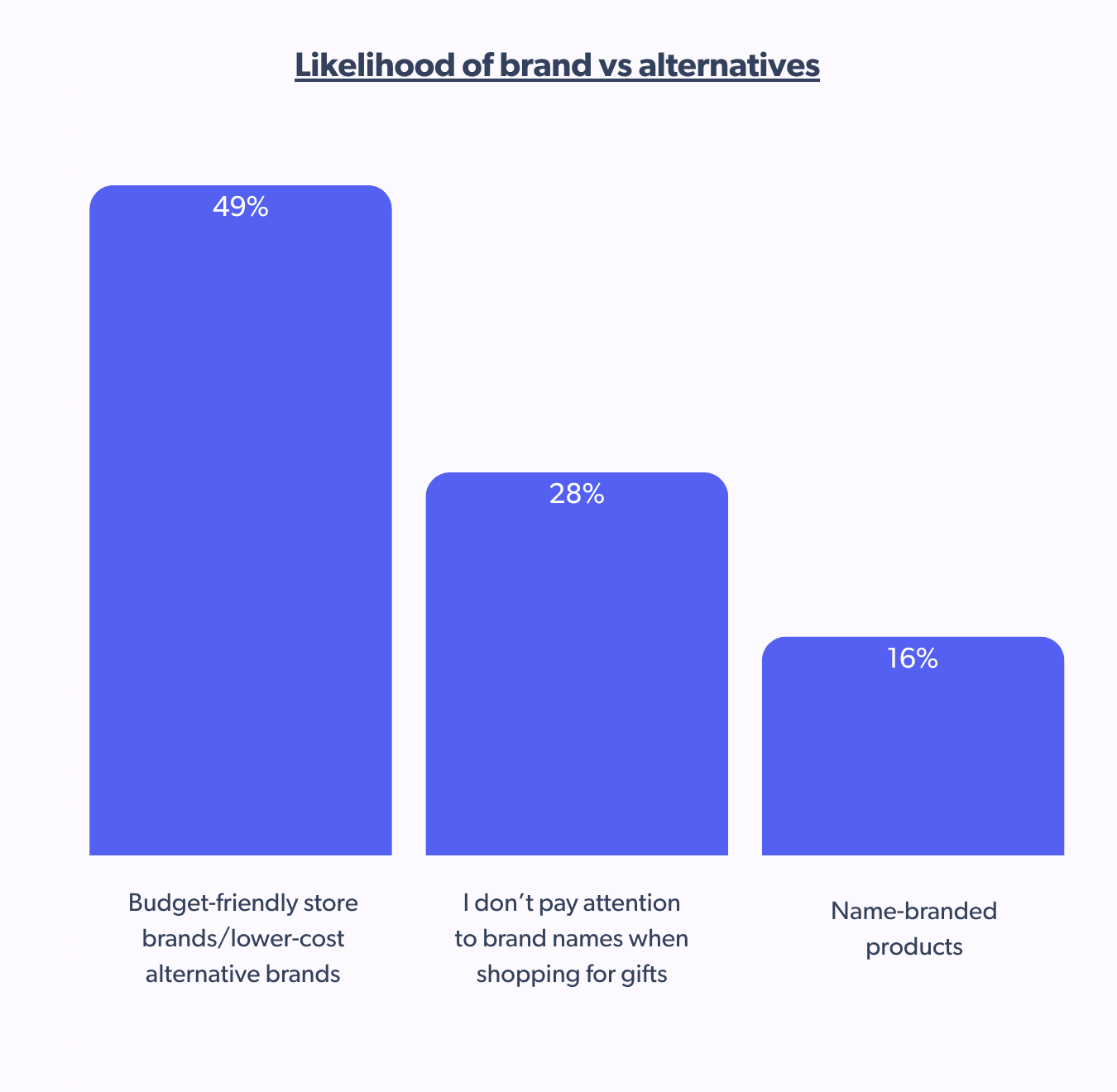

If we address holiday shopping, it is impossible to get by without mentioning the rise of store brands. And these statistics prove that almost half of Australian shoppers (49%) prefer budget-friendly store brands/lower-cost alternatives.

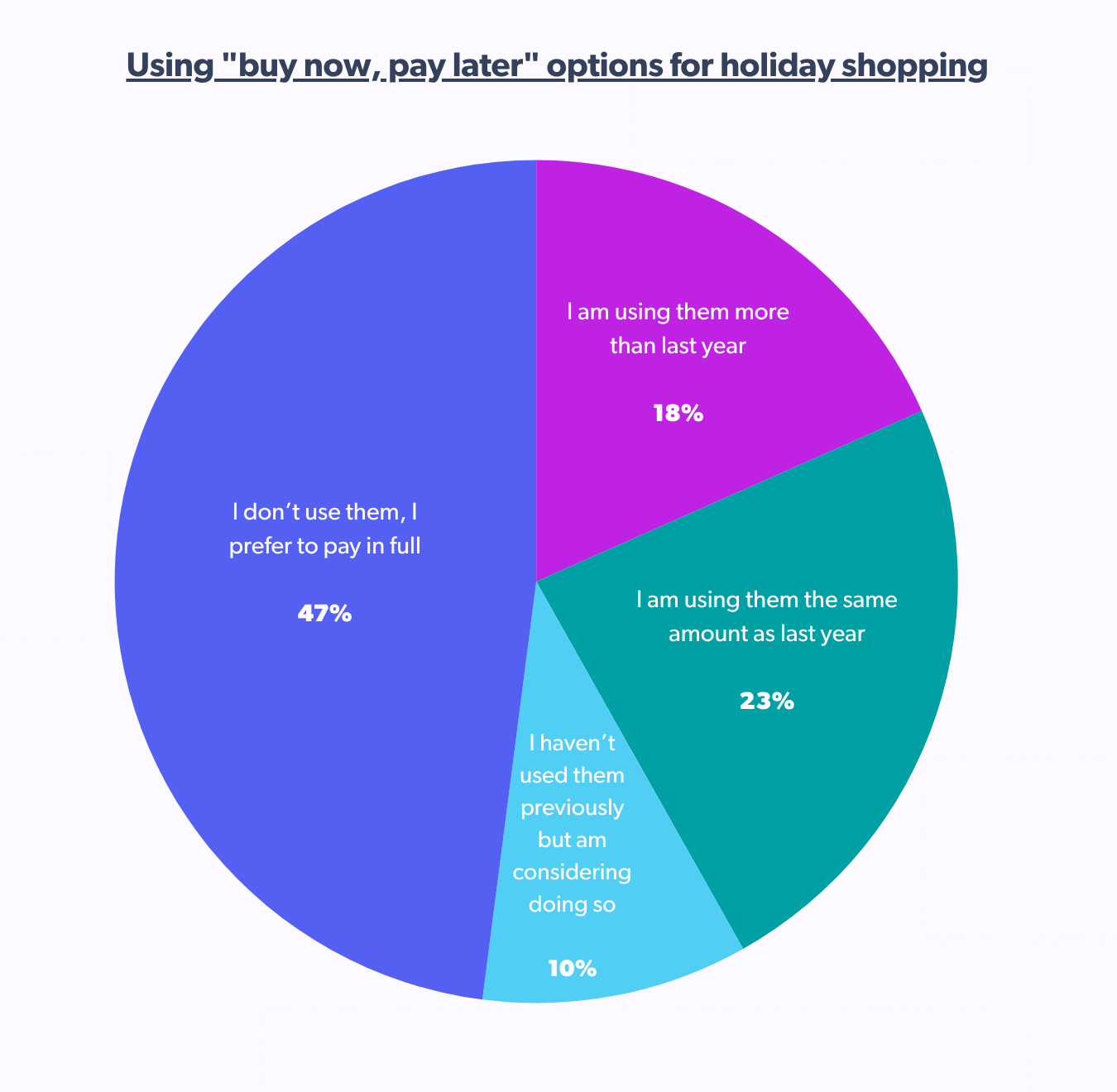

Australians are leading the way in adopting the “buy now, pay later” (BNPL) policy for holiday shopping. Compared globally, 18% of Australian shoppers use BNPL more than last year, and another 23% use it at the same high rate.

This popularity reflects BNPL’s flexibility for budgeting, avoidance of credit card interest, and convenience, particularly for holiday purchases.

Omnichannel shopping experience is the new normal

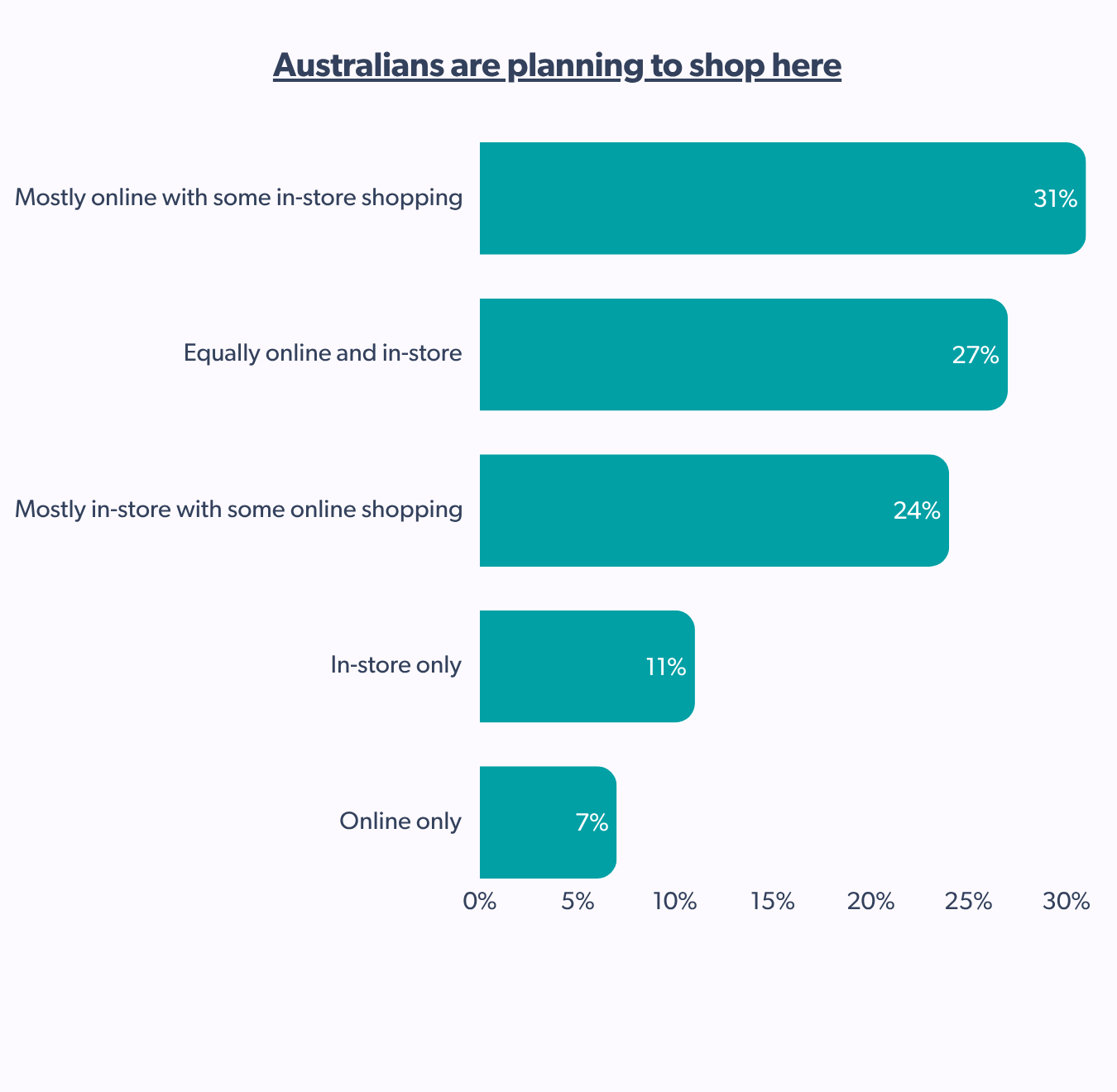

Overall, online shopping is emerging as a major consideration for holiday shopping but Australian shoppers are still huge advocates for an omnichannel experience, with 31% going mostly online with some in-store shopping. 27% of Australians distribute it equally between online and in-store, and 24% of them still choose in-store with some online shopping.

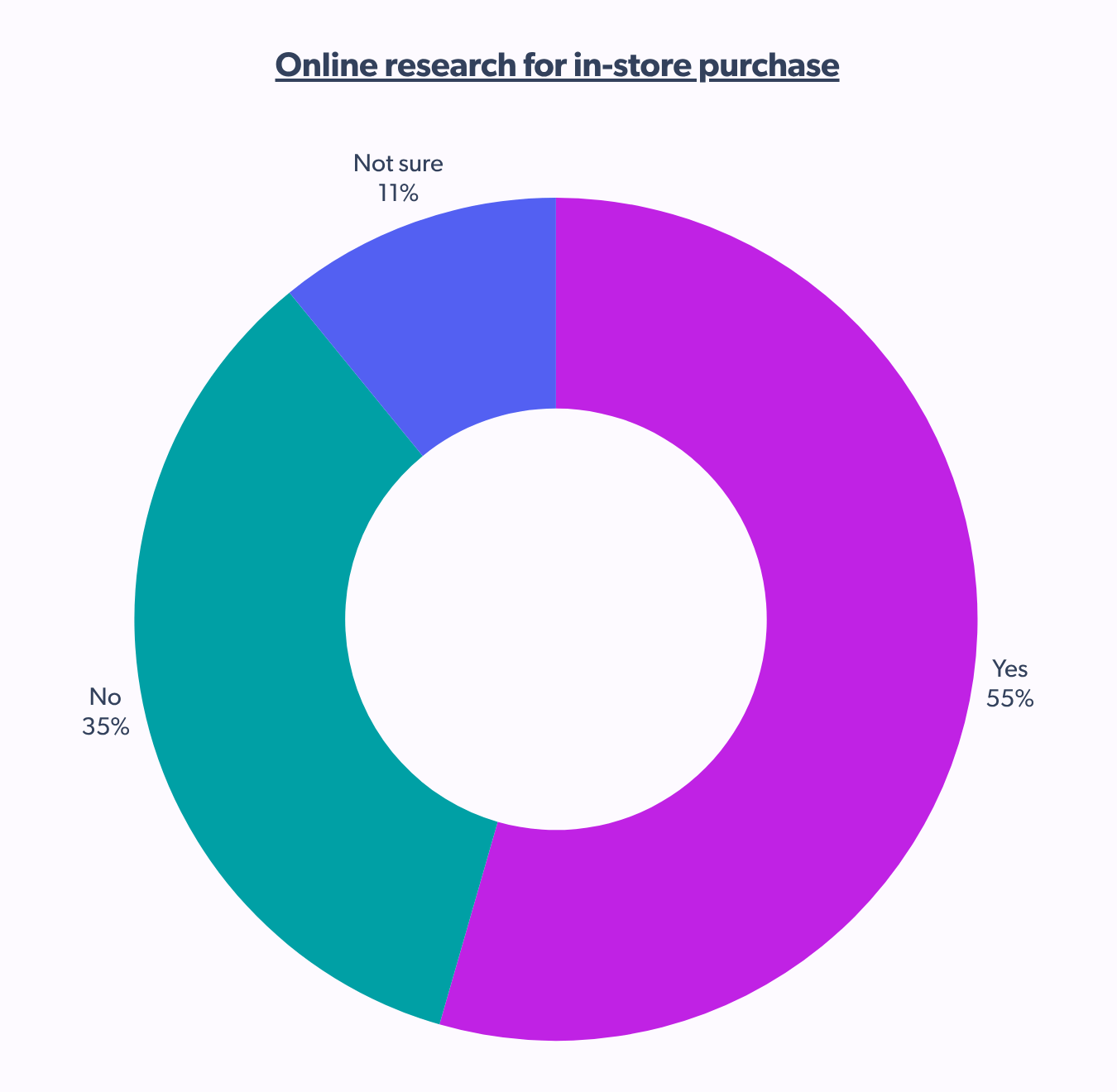

This ties in well with how Australians shop during the holiday season because it gives us insight into their purchasing habits from last year. More than half (55%) of Australian shoppers have done online research before making the purchase in-store.

It is a great opportunity for retailers to blend digital and physical strategies to capture diverse shopper segments and capitalize on omnichannel shopping trends. This requires content alignment. How do you achieve that?

Most holiday content is disconnected, whereas holiday shoppers’ experiences are omnichannel. Bazaarvoice Vibe links creator, social, sampling, reviews, and PDP.

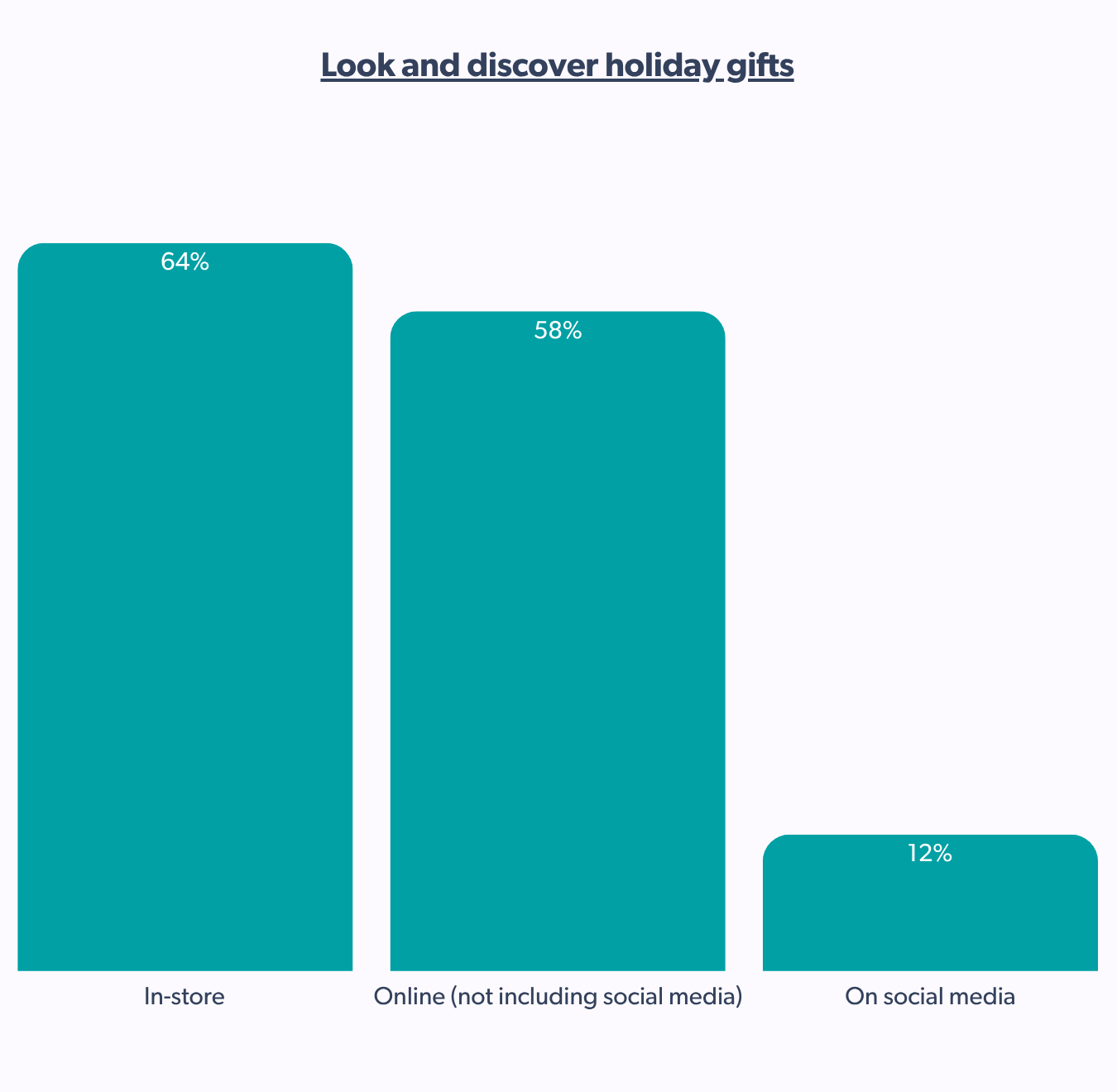

As we have seen in the previous data, Australian shoppers are slightly more inclined to purchase in-store. To further prove this, more than three-fourths (64%) of Australians prefer to look for or discover holiday gifts in-store, and online (58%).

Despite an overall inclination towards in-store purchasing, online is also a major component, as Australian shoppers use it for discovery purposes.

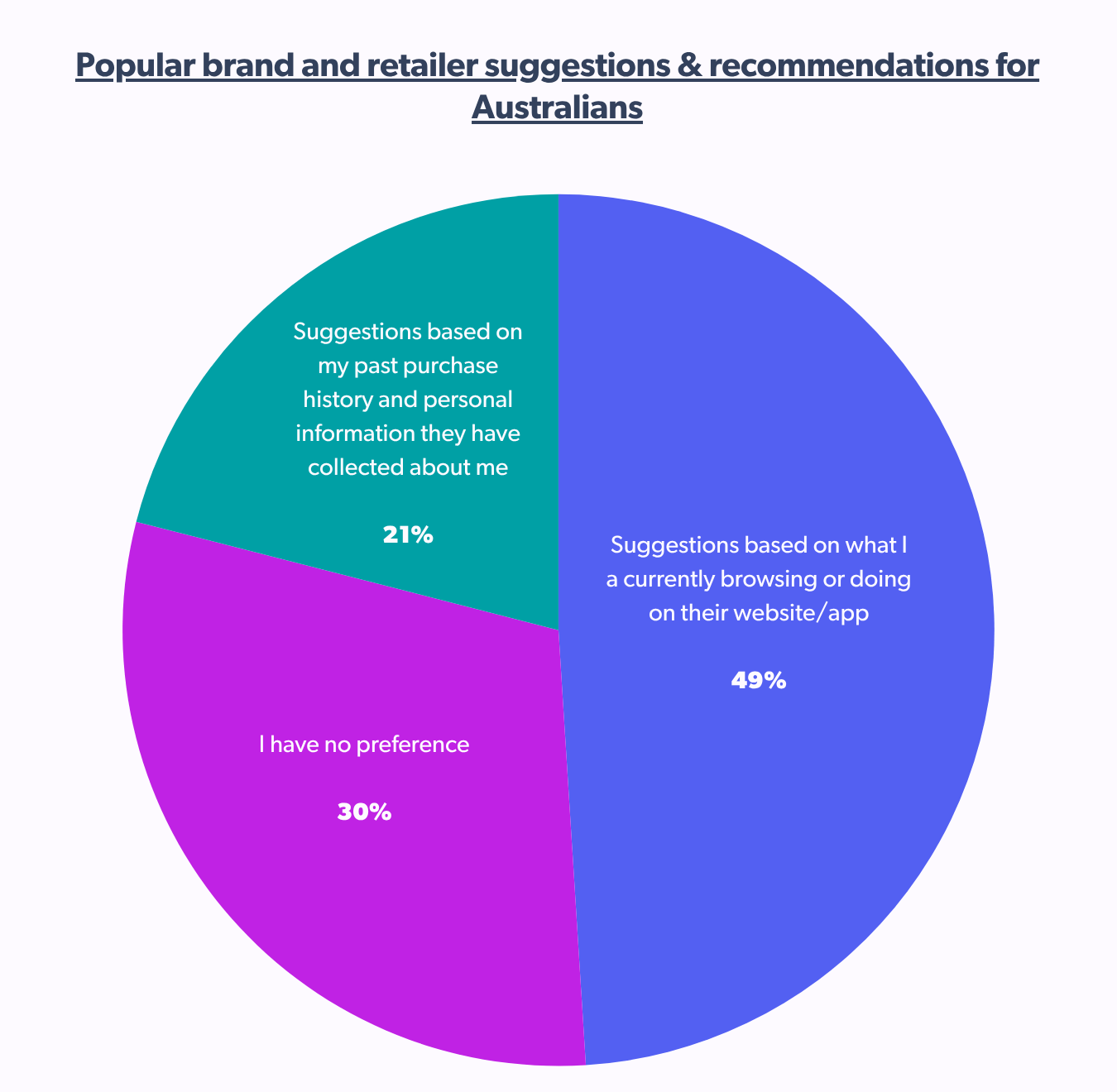

Almost half of Australian shoppers (49%) prefer recommendations based on what they are currently browsing or doing on their website or app, which is higher than the global average of 43%. This is followed up with no preference at 30%, and suggestions based on past purchase history and personal information they have collected about the shopper.

Shoppable content as a multi-channel strategy

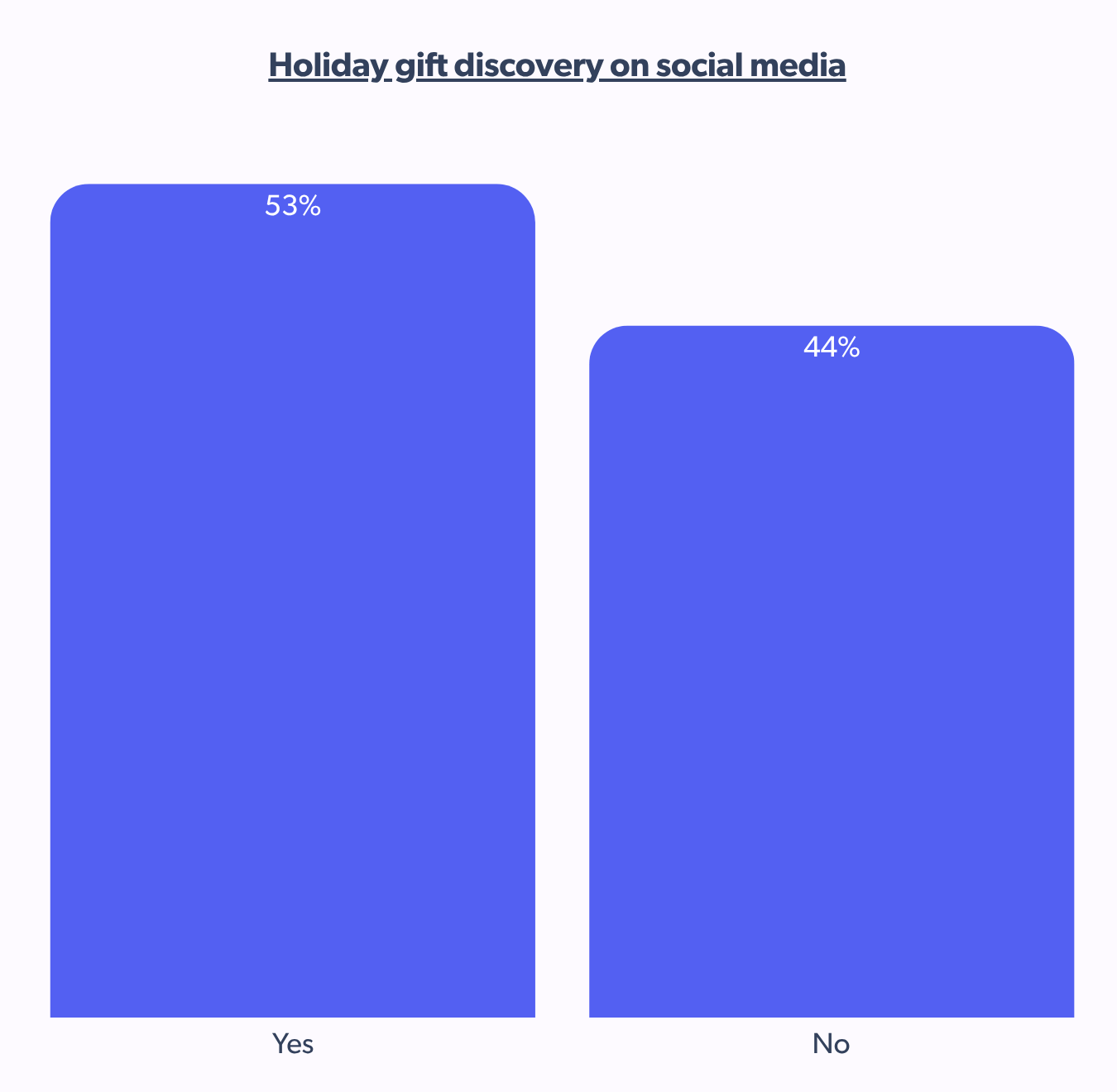

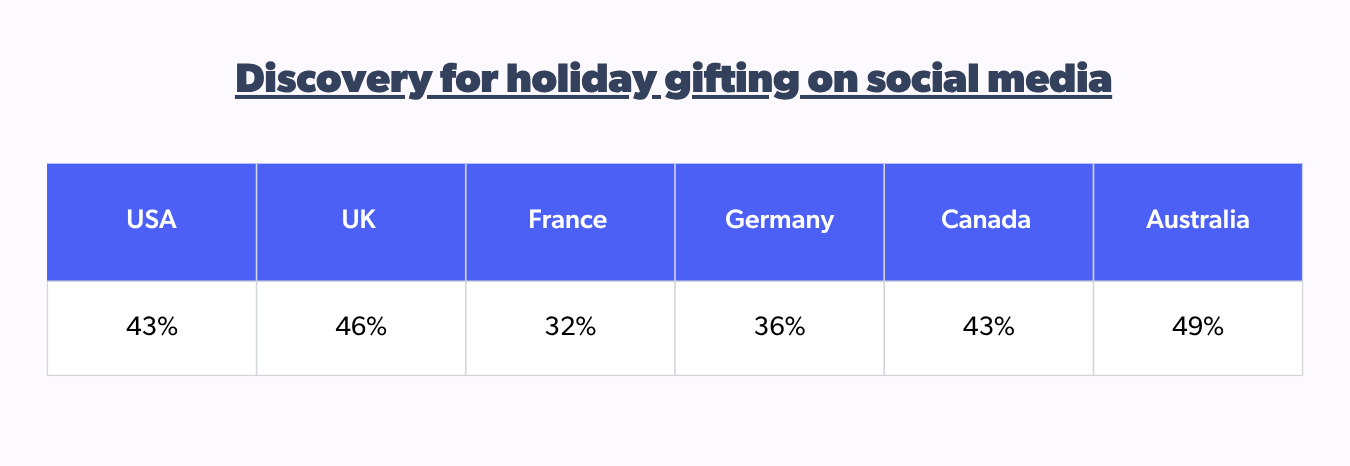

For brands and retailers, having a social media presence is a considerable advantage for a multi-channel strategy to reach potential customers at every turn. This is especially true when discovering holiday gifts. 53% of Australian shoppers discover holiday gifts through shoppable content, slightly higher than the global average of 52%.

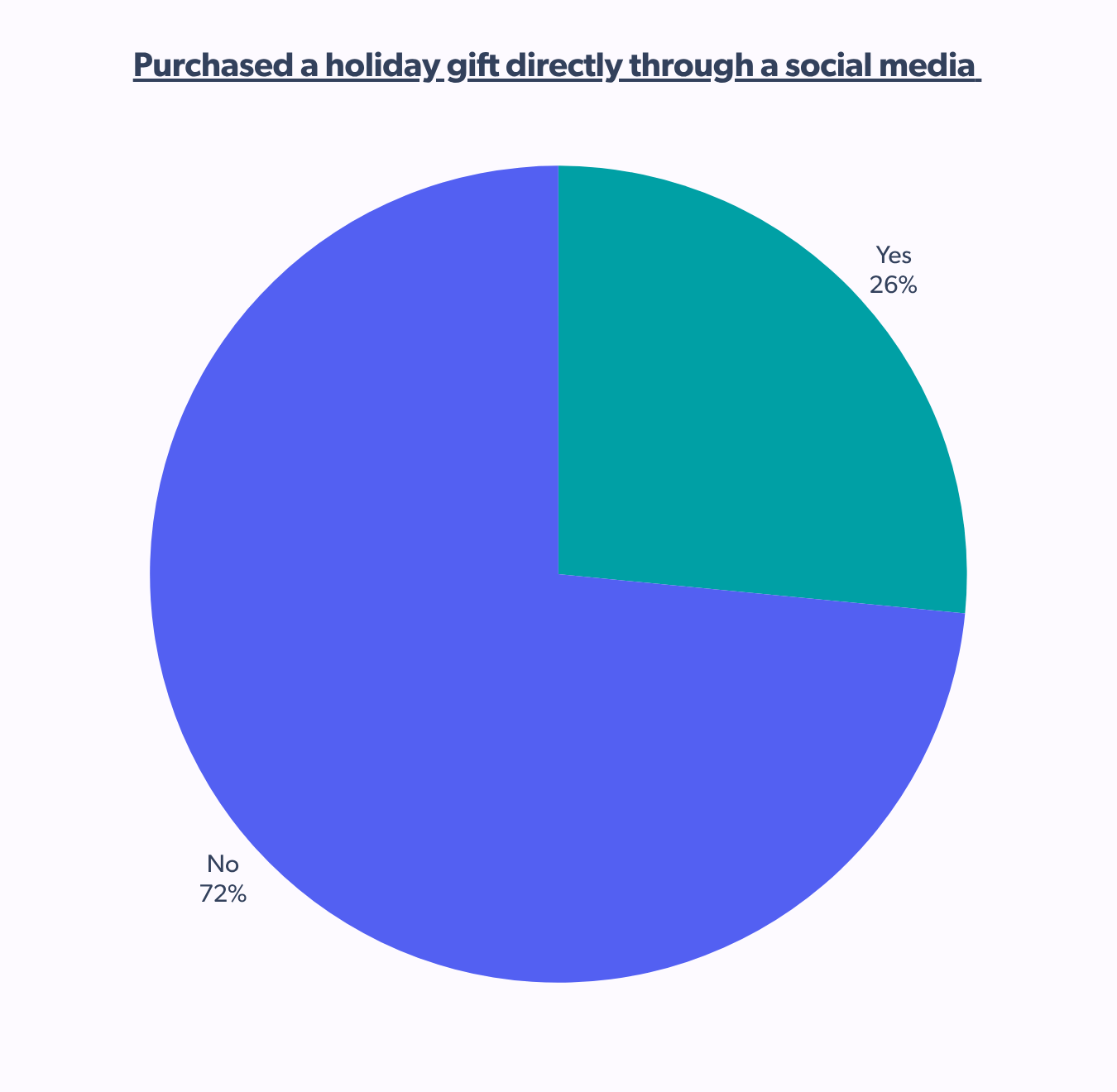

It has been observed that when it comes to purchasing holiday gifts on social media, Australian shoppers are still hesitant and prefer traditional methods, with only 26% saying yes and 72% saying no.

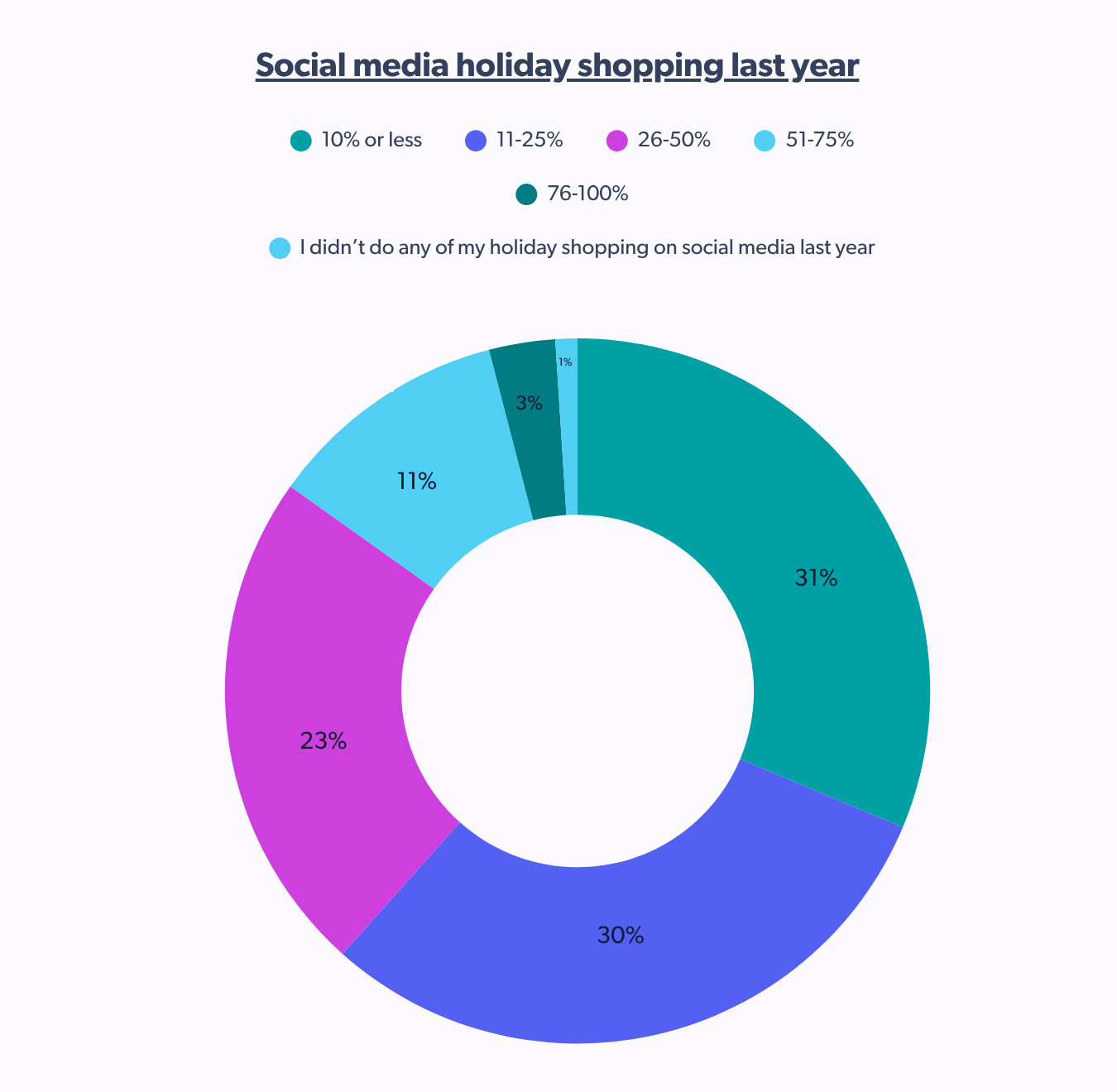

Regarding holiday shopping on social media, 84% of Australian shoppers shop 50% or less than 10%, and only 14% do more than half of their shopping on social media.

It is clear that for Australian shoppers, using social media platforms to purchase holiday gifts is not the primary option. Almost half of Australians (49%) primarily use social media to discover products compared to the rest of the economies.

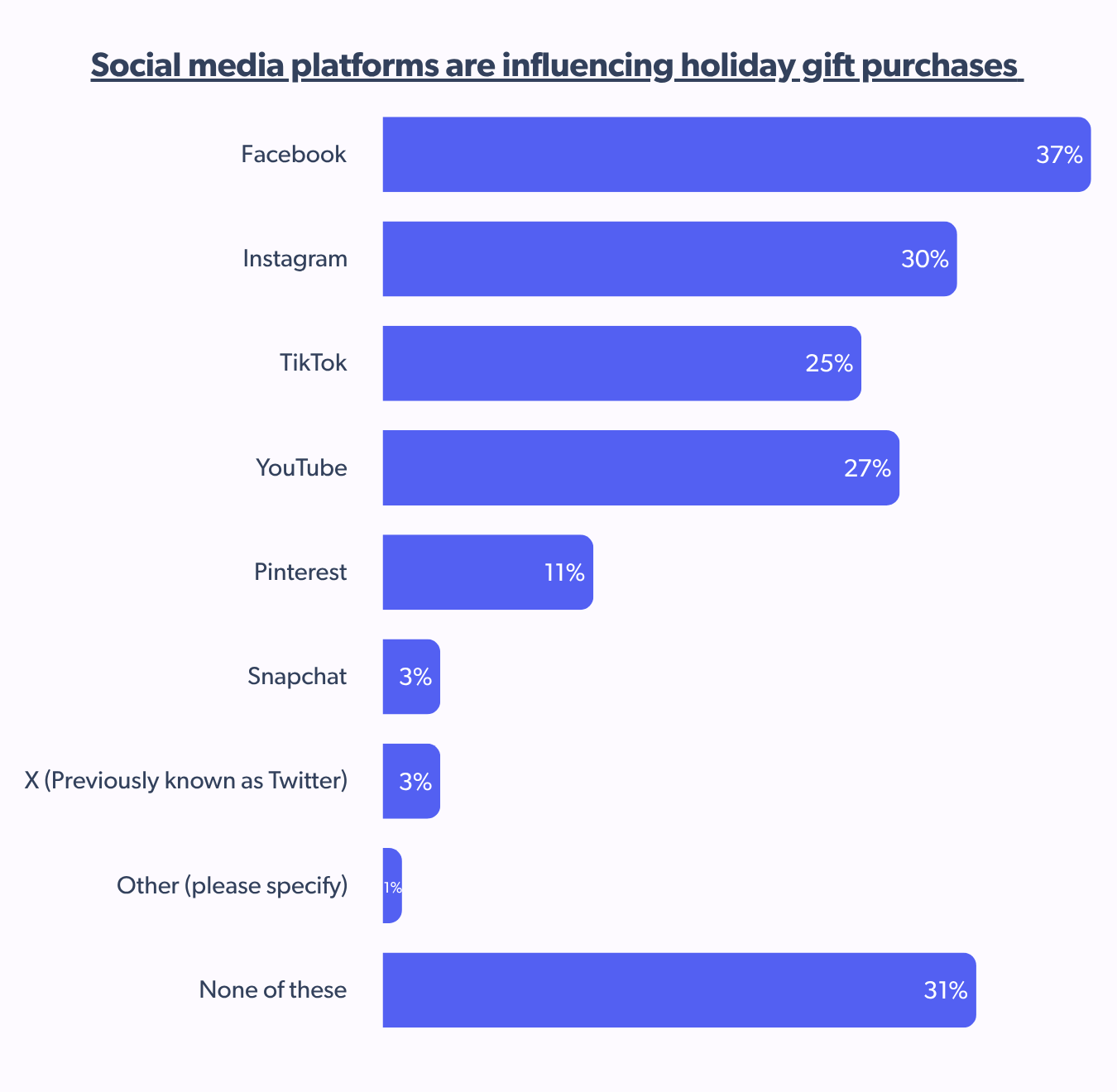

For Australians, even though social media purchasing for holiday shopping is a nice-to-have rather than a must-have, they still have their favorites.

The most popular one, with 37%, is Facebook, followed by Instagram at 30%. Different TikTok gift ideas in Australia and YouTube are notable mentions, comfortably positioned at 25% and 27%, respectively.

Creator influence thrives on context to convert

Diversifying market channels to achieve a wider reach is crucial, considering that content creators do not sway a significant 70% of shoppers.

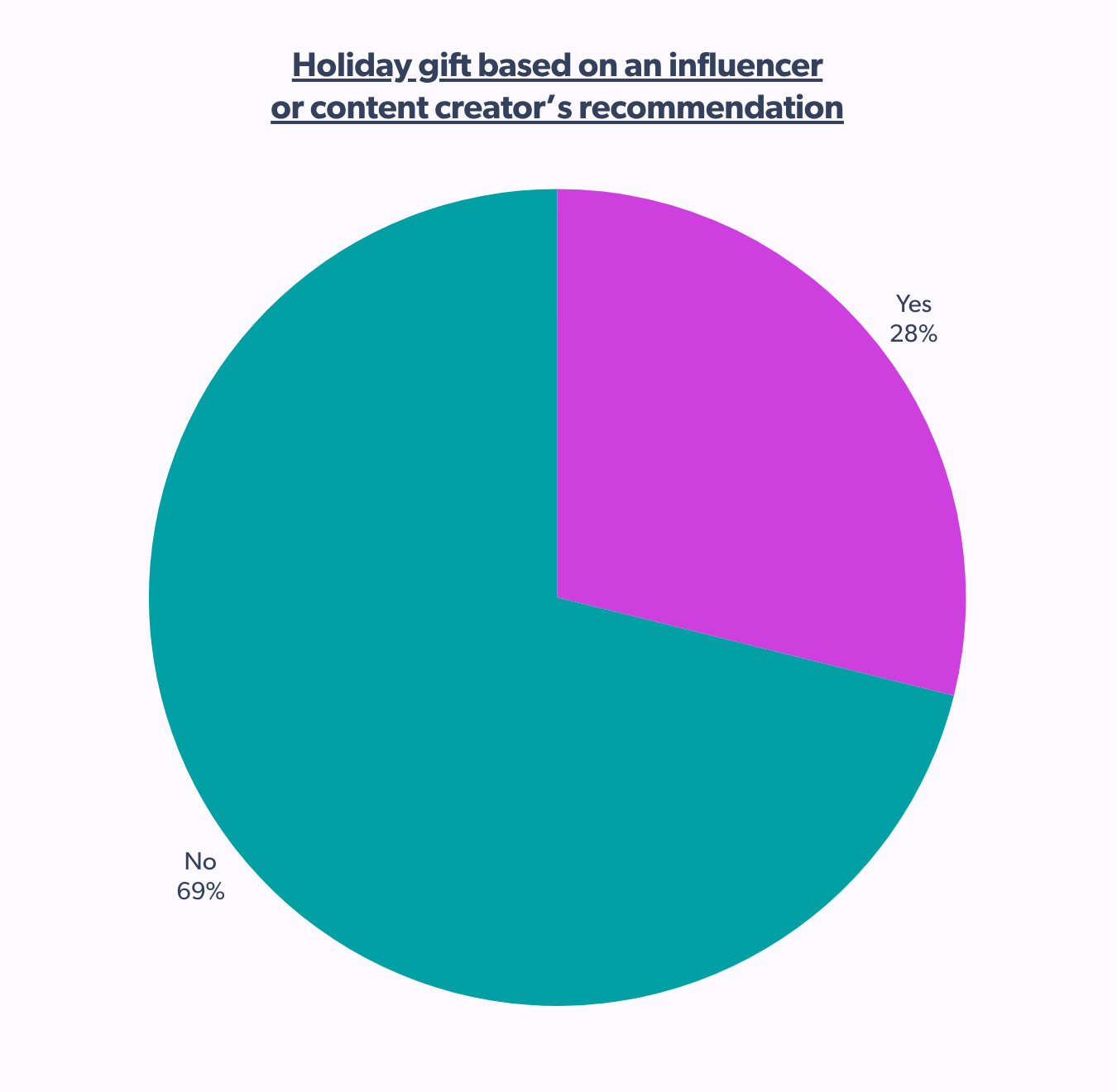

Specifically, in Australia, content creator recommendations do not influence the holiday gift purchases of 69% of shoppers, in contrast to the 28% who have made a purchase based on such recommendations.

This stark difference underscores the need for a multifaceted marketing strategy that extends beyond influencer collaborations to engage most Australian holiday shoppers effectively.

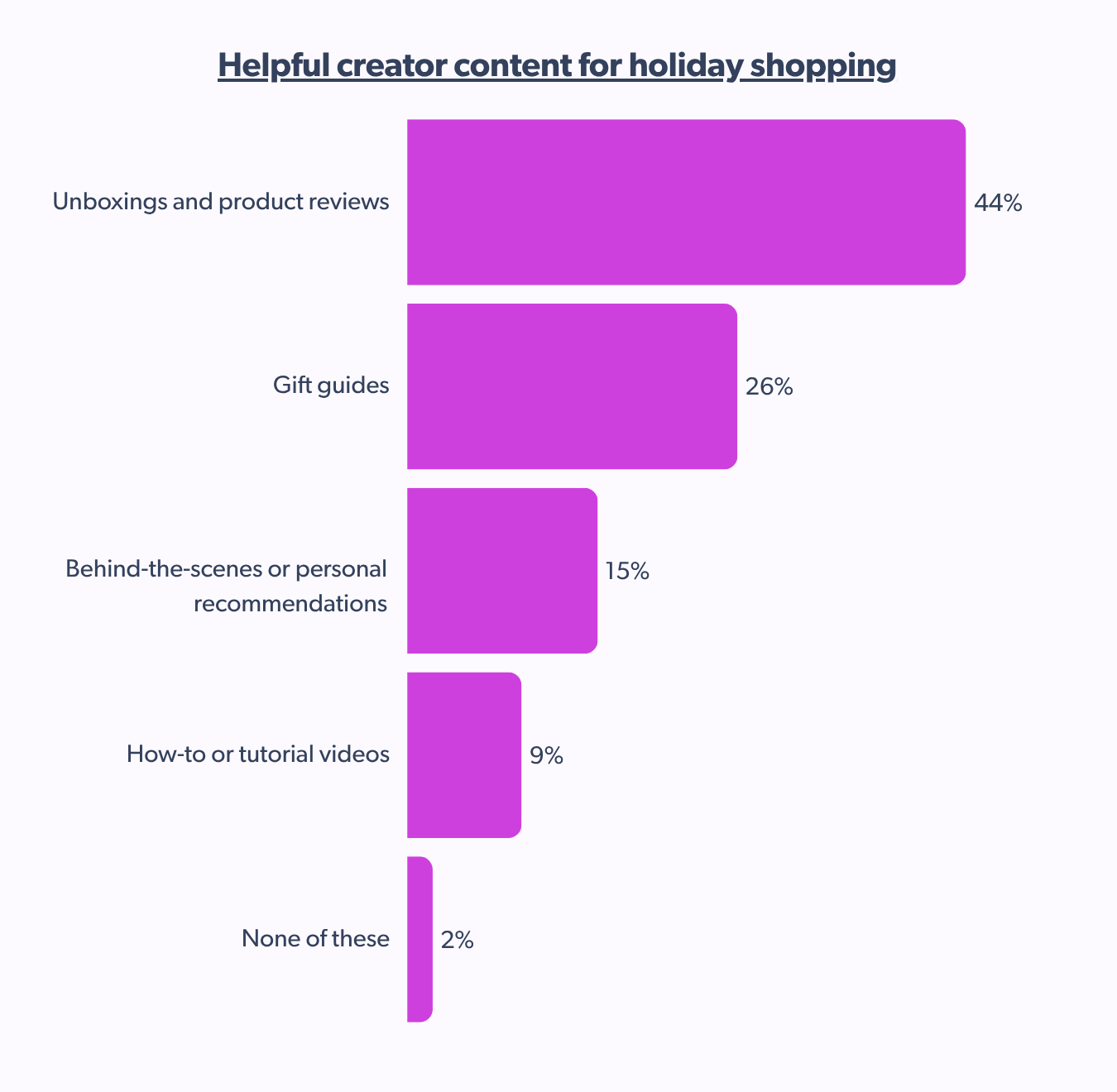

Among the Australian holiday shoppers who do make purchases based on content creator recommendations, unboxings and product reviews stand out as the most helpful content (44%), followed by gift guides (26%), which provide valuable inspiration.

This indicates that when content creators impact purchasing decisions for Australian holiday shoppers, practical and informative content formats are the most effective.

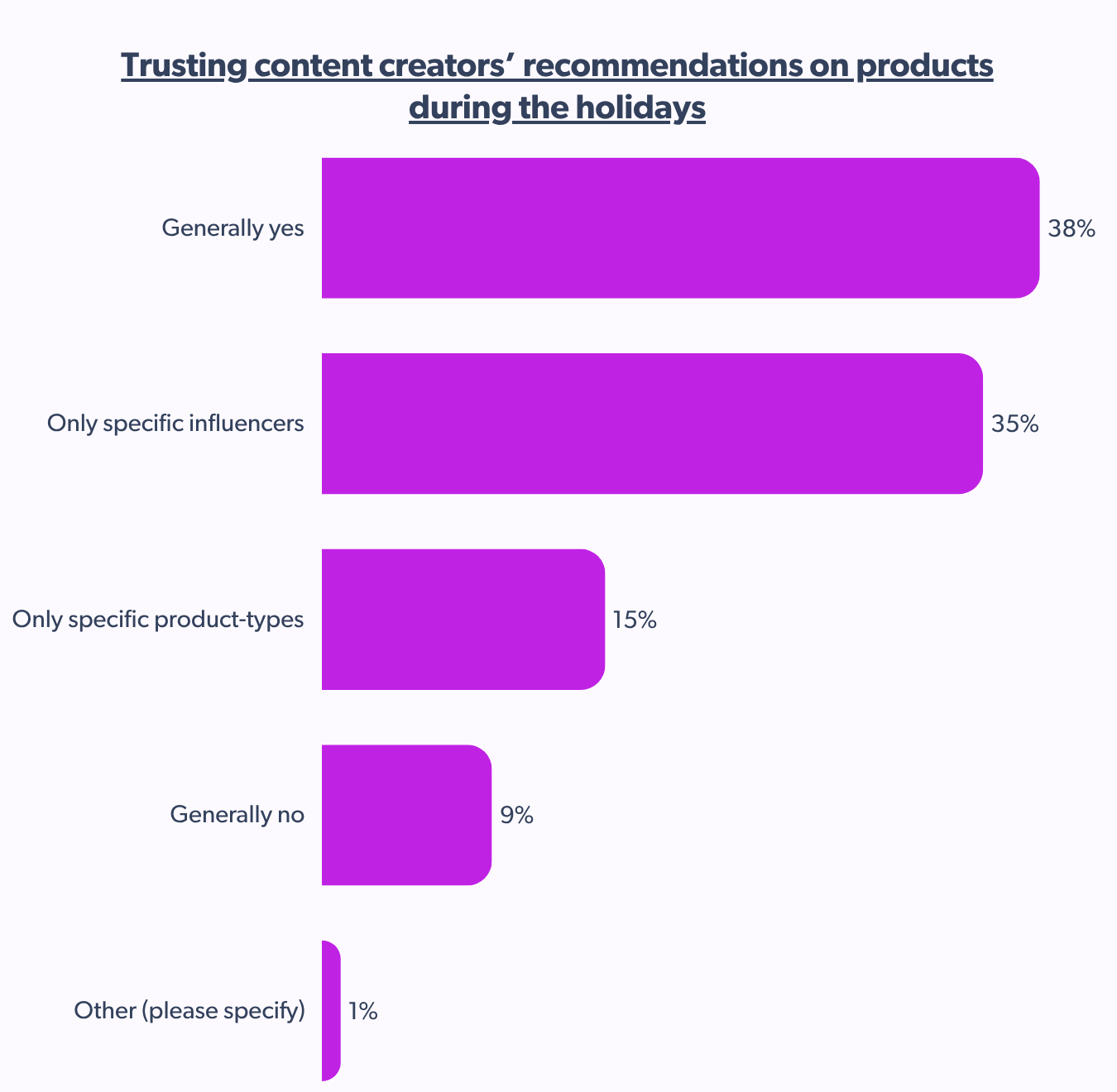

Many Australian shoppers express trust in holiday product recommendations from content creators. Notably, over a third (35%) trust recommendations only from influencers they deem credible, while a slightly larger group (38%) generally trusts these endorsements.

This highlights a nuanced approach where Australian shoppers are receptive to influencer marketing during the holiday season but often prioritize the source of the recommendation.

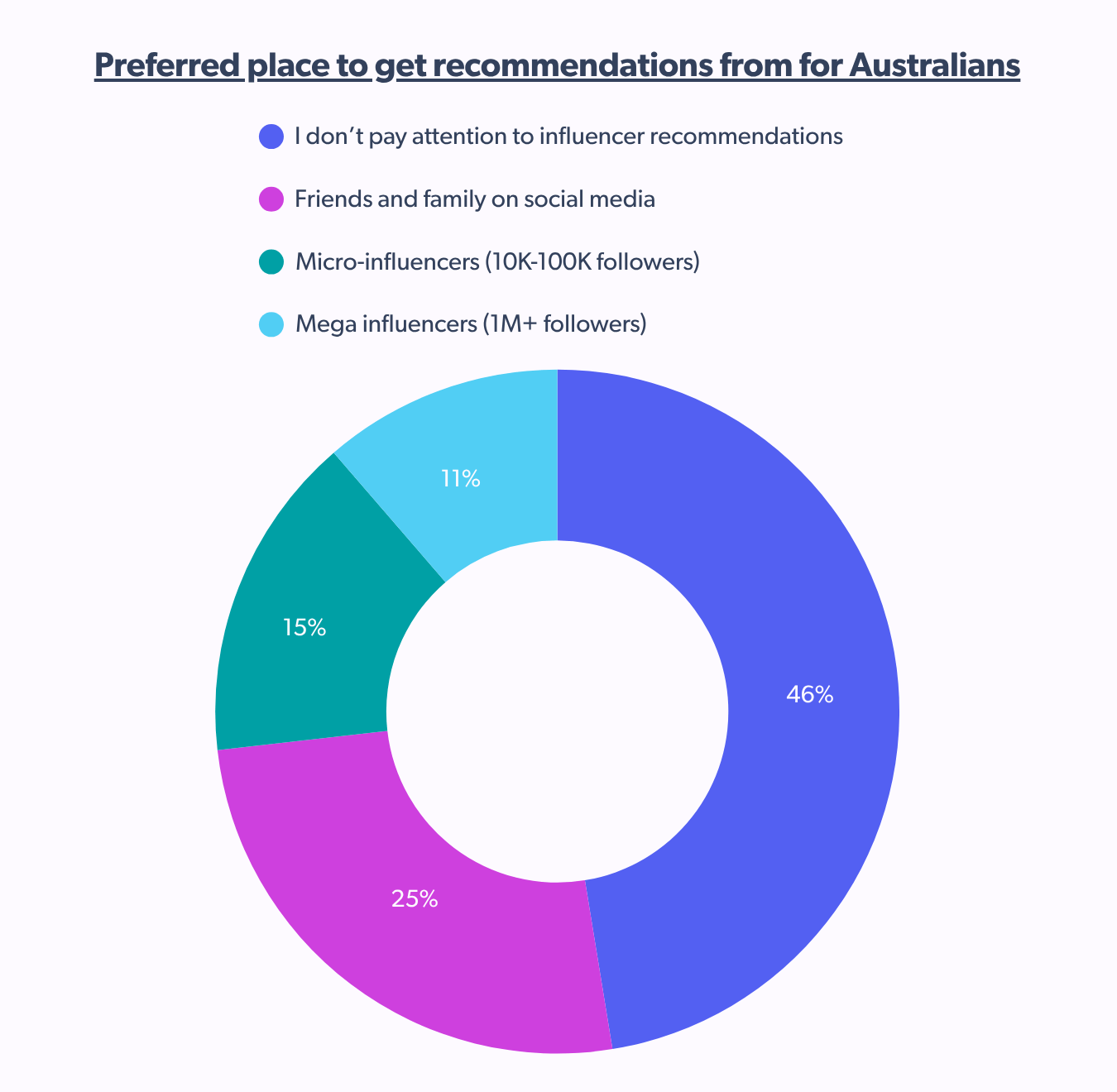

While a significant 46% of Australian shoppers disregard influencer recommendations, a notable one-fourth (25%) prefer advice from friends and family on social media. This highlights a valuable opportunity for brands and retailers to foster UGC and leverage the power of personal networks to broaden their appeal during the holiday shopping season.

Branded content and UGC equally engage holiday shoppers

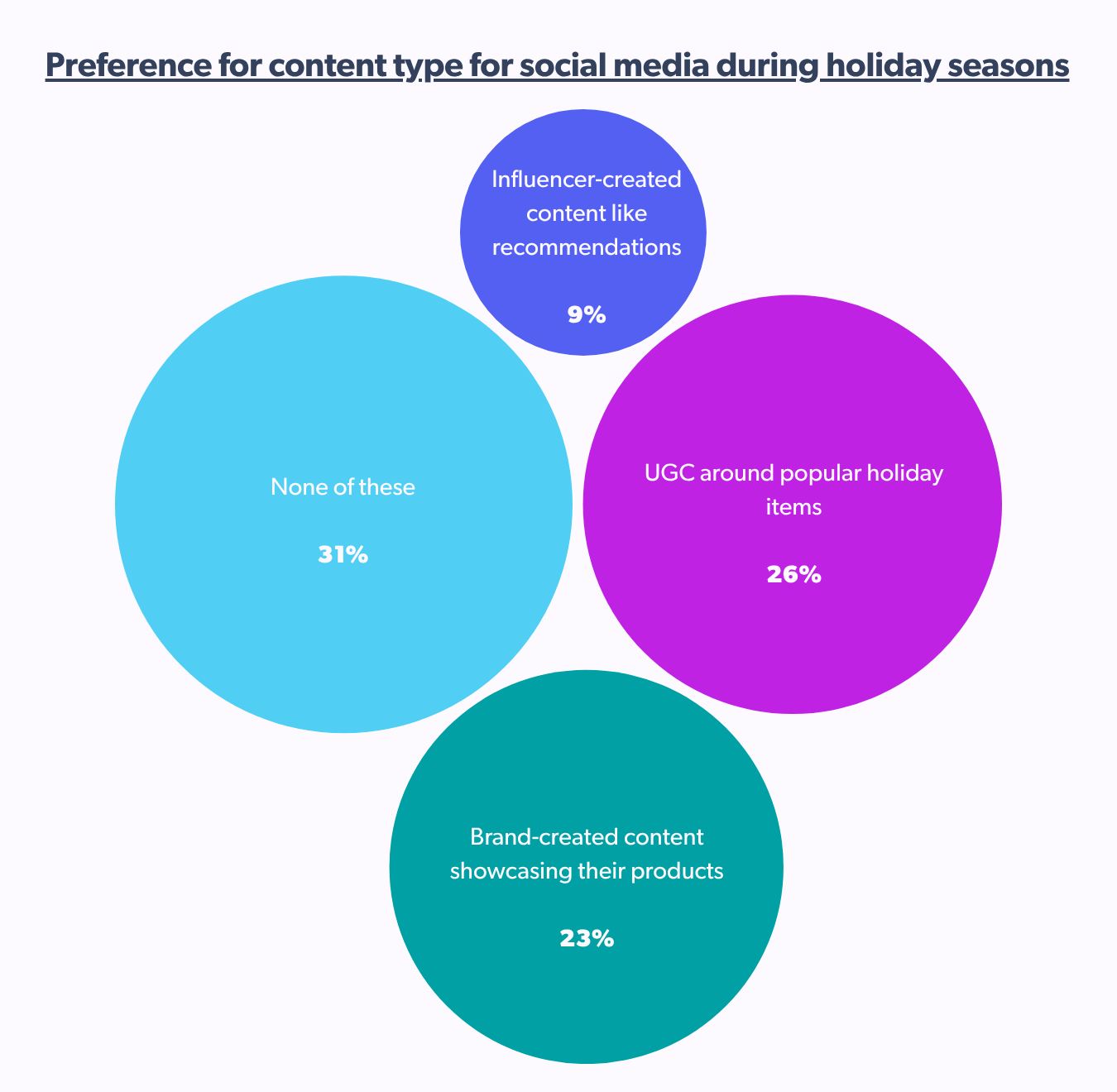

According to the Bazaarvoice Holiday Consumer Shopping Report 2025, both brand content and UGC are favored by Australian holiday shoppers. With UGC holding a slight edge over content directly produced by brands.

Specifically, 26% of Australian shoppers prefer to see UGC showcasing products, while 23% prefer brand-created content. Here’s a holiday shopping tip for brands and retailers trying to crack the Australian market: focus on peer-to-peer and authentic endorsements.

Many brands view ratings and reviews as a basic checkbox — not as a dynamic performance engine. As a result, they either settle for entry-level solutions or fail to connect UGC to broader growth strategies.

Competing vendors offer surface-level features, creating confusion about what matters most. The brands that succeed don’t just capture reviews — they create a foundation for trust that powers long-term growth.

As trust has become scarce in recent times due to AI-generated content, UGC is evolving as the savior in different formats such as ratings, reviews, product photos, and videos.

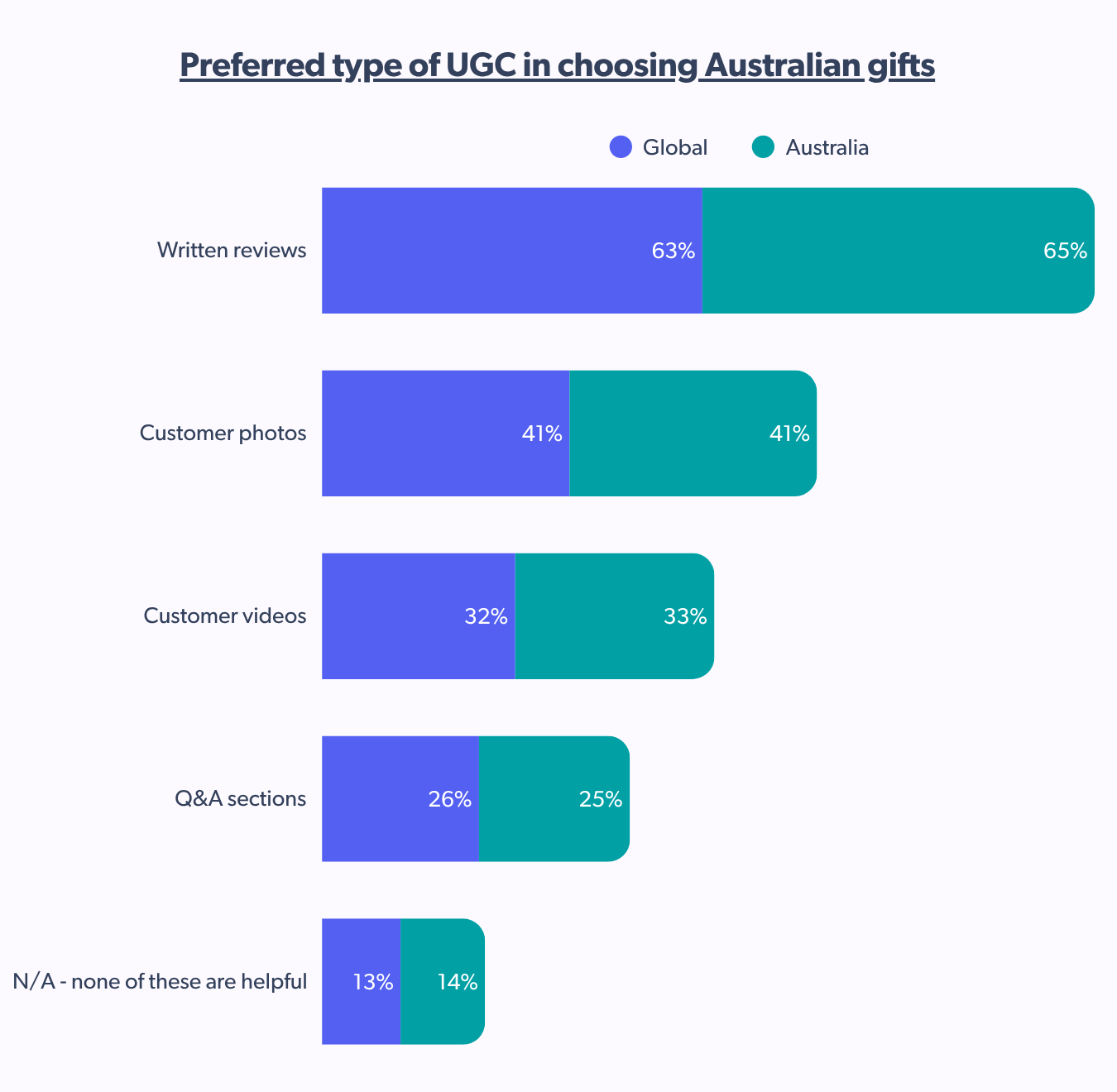

This stands true when it comes to Australian shoppers finding written reviews, with 65% being the most useful when choosing a holiday gift. This is followed by customer photos with 41% and customer videos with 33%.

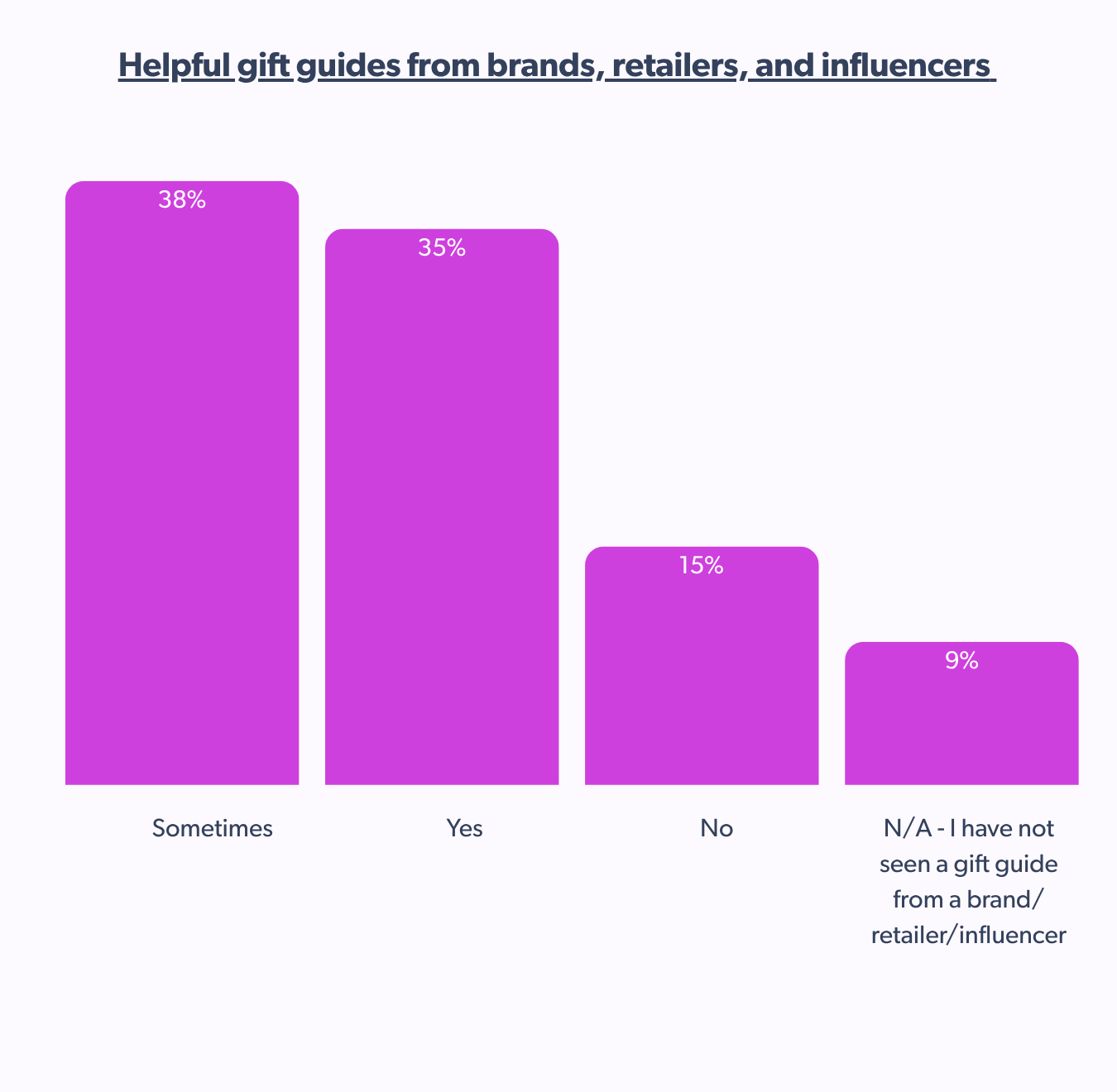

More than half of Australian shoppers (51%) sometimes find gift guides from brands, retailers, or influencers helpful, but only 22% say a definite yes. Focusing on targeted marketing for gift guides is an effective holiday shopping tip for brands and retailers.

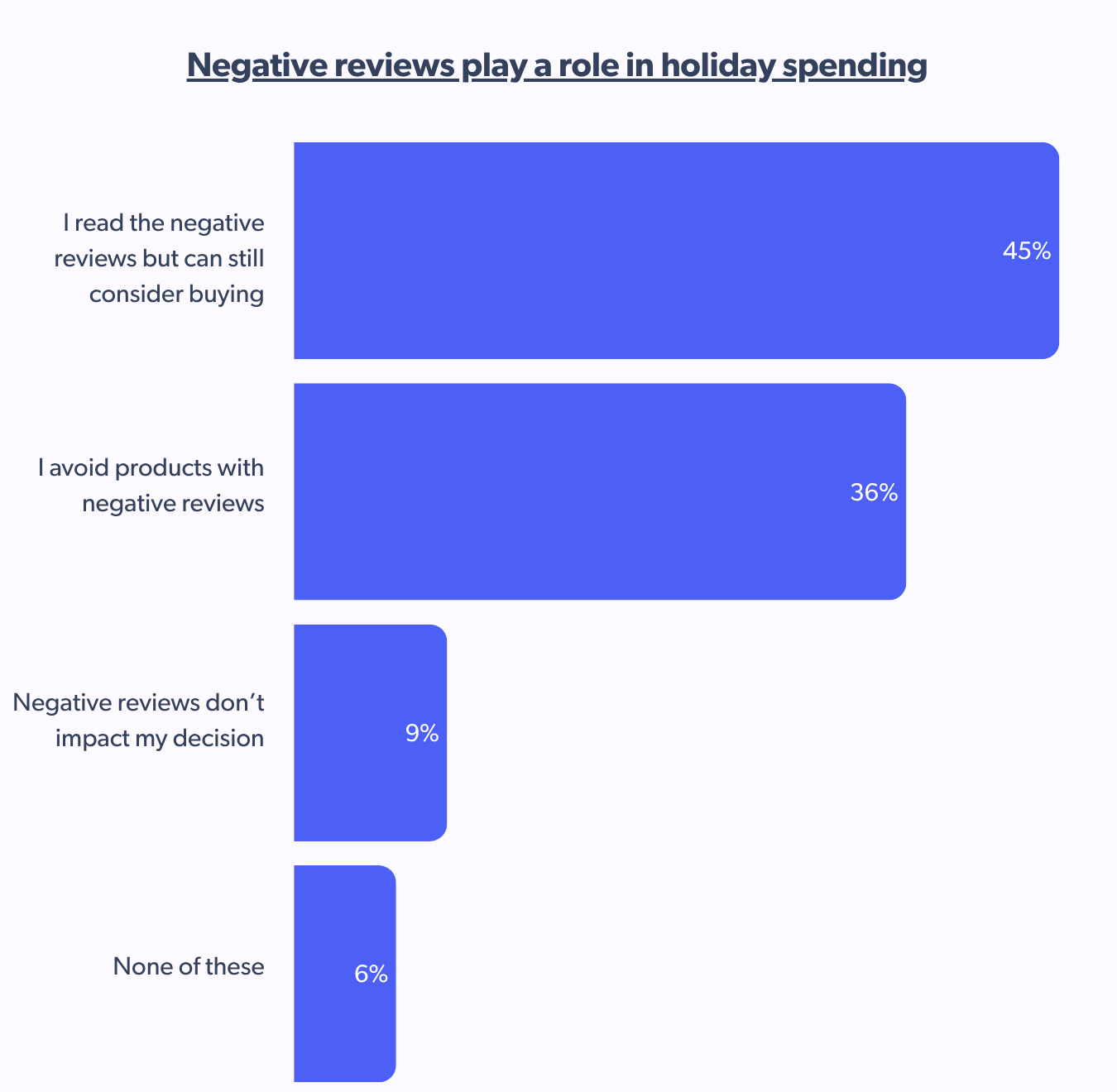

Two-fifths of Australians (45%) prefer authenticity over branded content when it comes to holiday shopping; therefore, even when encountering a negative review, they still consider buying. And 36% avoid products with negative reviews, and a small yet mighty 9% of Australian holiday shoppers don’t let negative reviews impact their decision to purchase.

Authenticity is the new currency due to AI-generated content

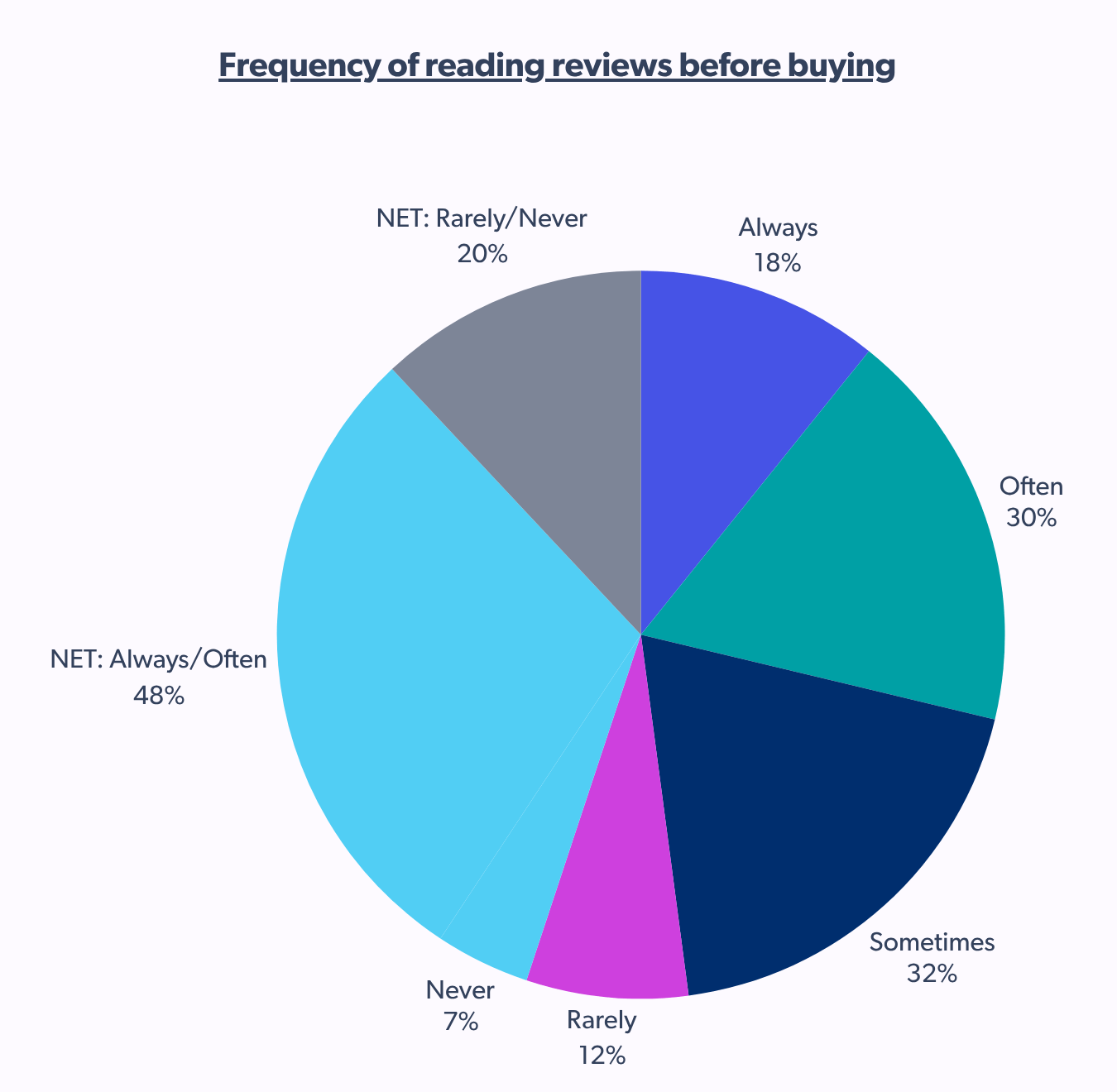

At least 48% of NET Australian shoppers always/often read reviews before buying, compared to NET 20% of those who rarely or never read reviews. This shows that they seek information to help them make a purchasing decision in the buyers’ journey.

In this era of online shopping, authenticity can’t be bought. But there are sure-shot ways to determine it, such as authentic product reviews for Australian gifts.

About 50% of Australians check for both positive and negative reviews. 42% examine the reviews closely to see if they look like they were written by a human. Another vital sign is that 25% of them look for a third-party symbol of authentication, like a trustmark.

➡️ Check out our newly evolved Intelligent Trust mark launched during the Summit 2025.

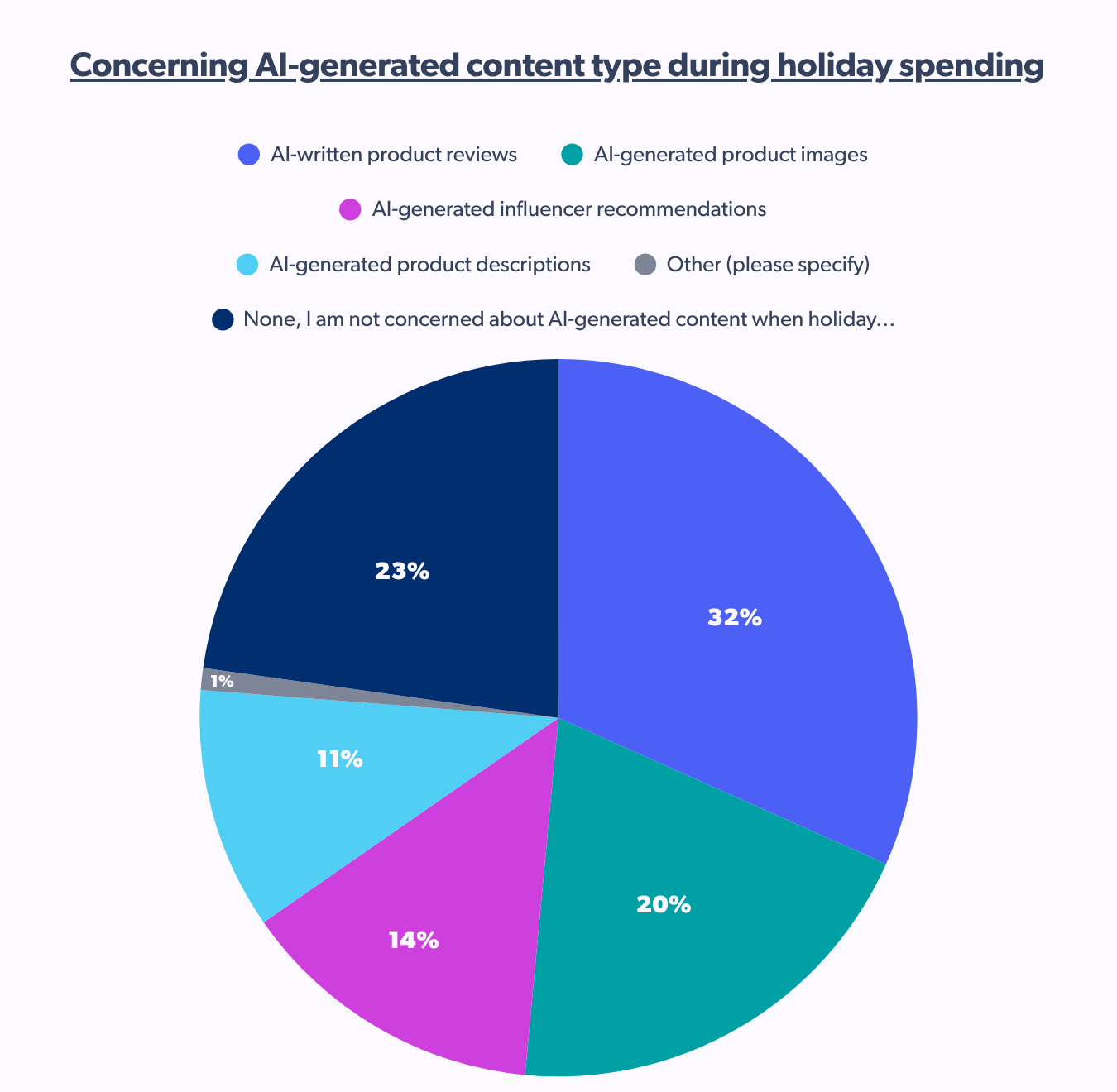

The topmost concern regarding AI-generated content for Australian holiday shoppers is the AI-generated product reviews, with 32%, closely followed by 20% for AI-written product reviews, which are significantly higher than the global averages of 29% and 17%, respectively.

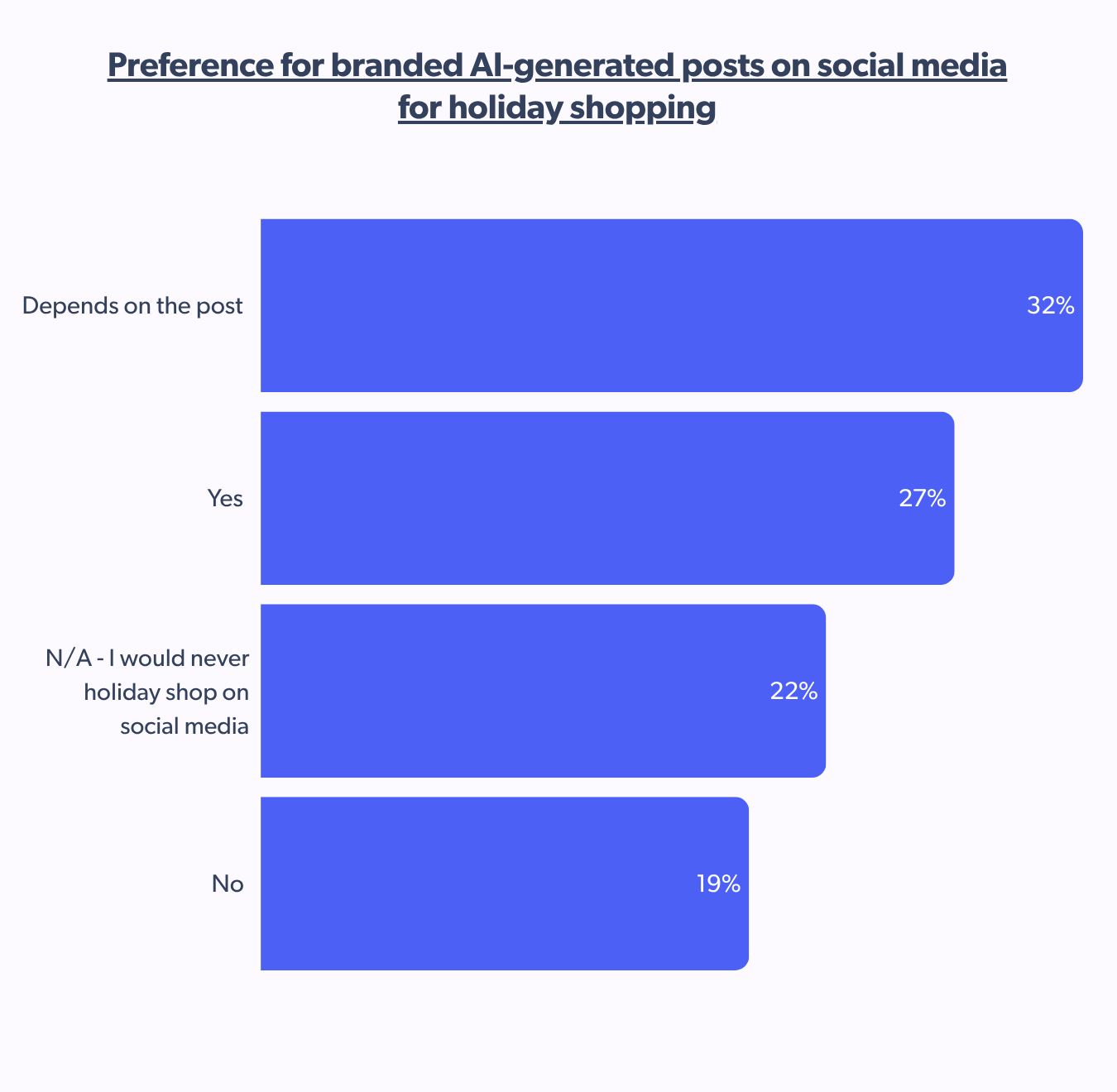

For Australian holiday shoppers, the content itself dictates whether they engage with AI-generated branded posts on social media, with 32% indicating their interest depends entirely on the post’s specifics.

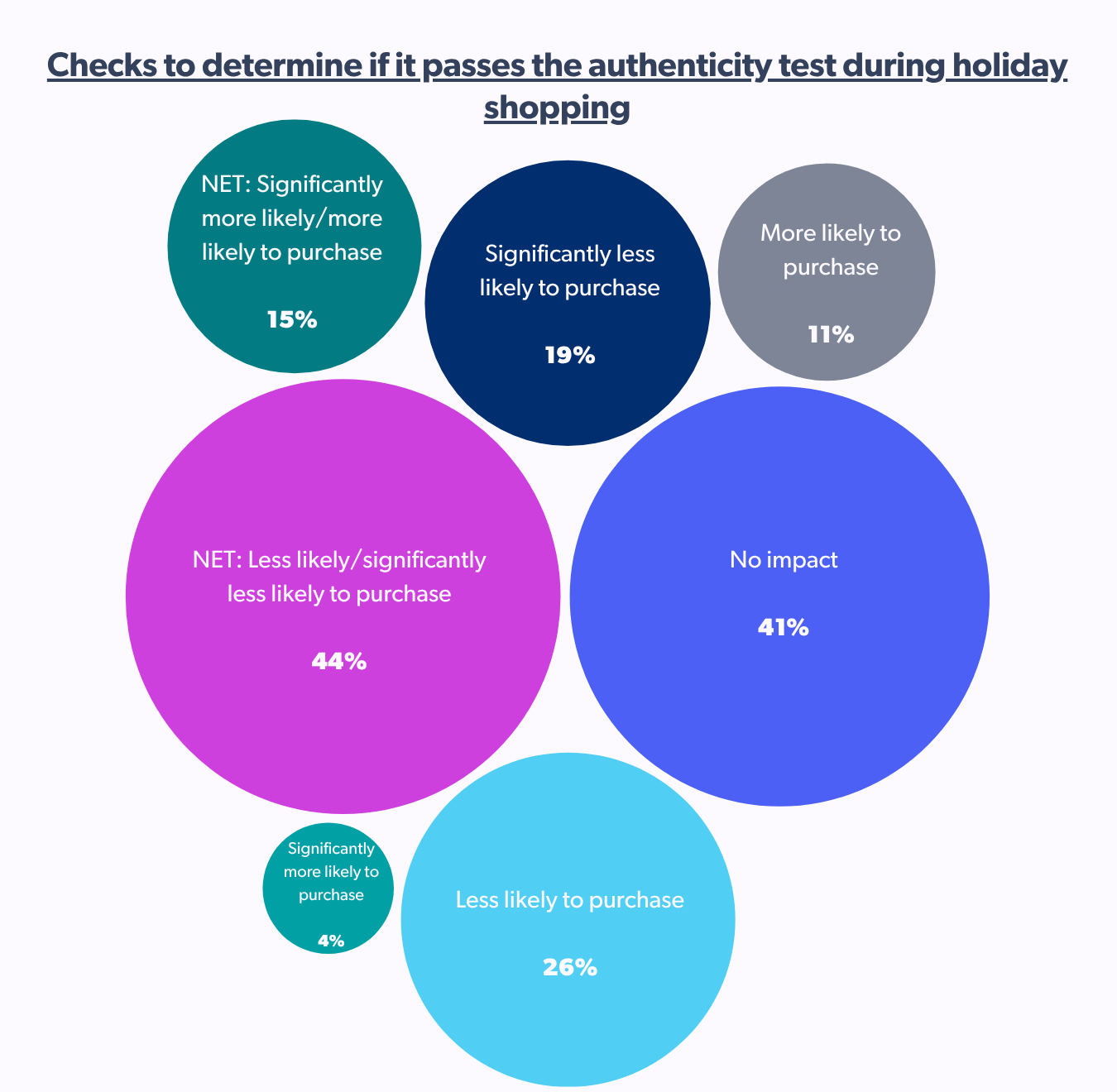

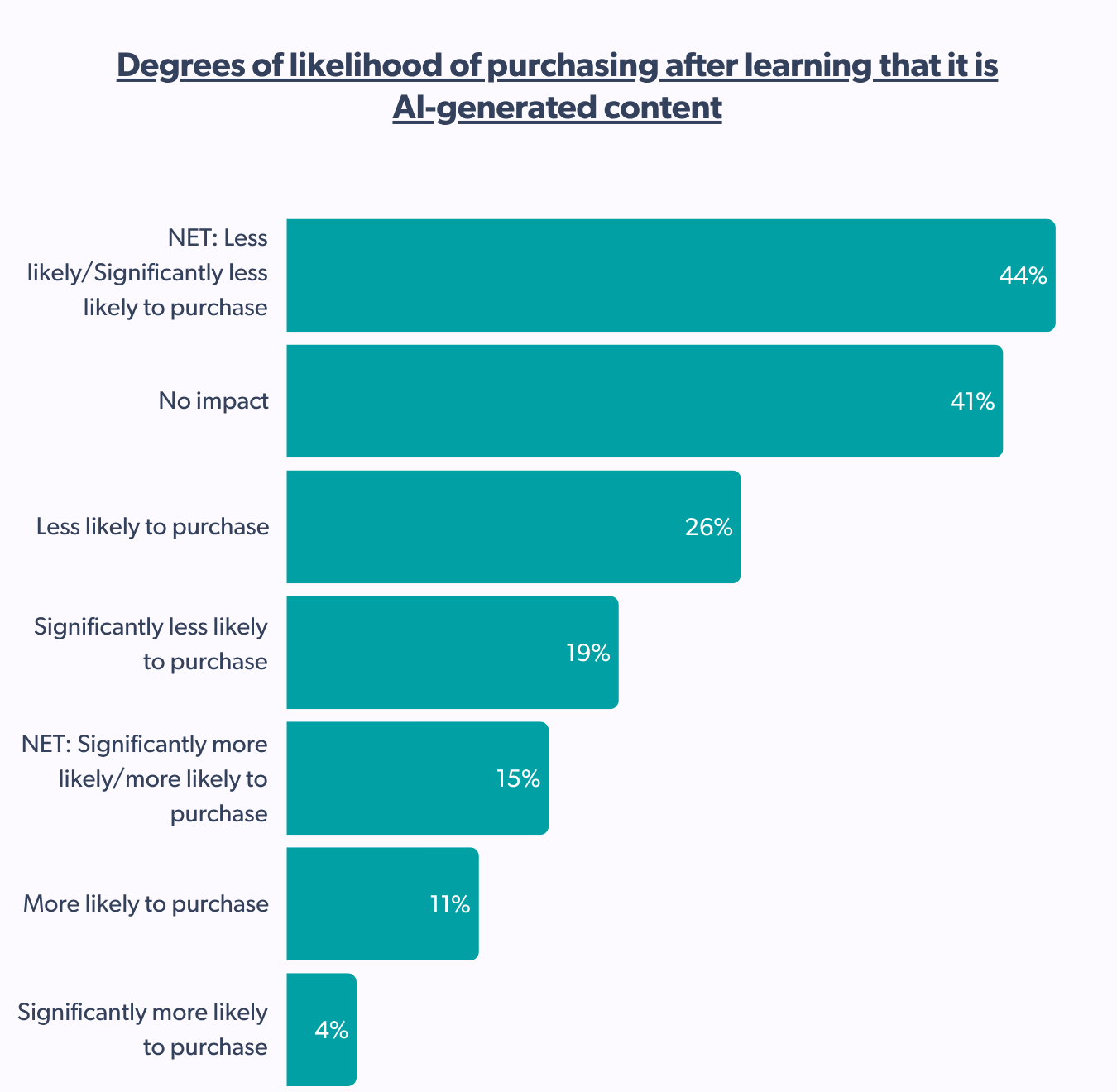

At least 41% of Australian holiday shoppers’ purchase decisions remain unaffected when they learn a brand’s social media post is completely AI-generated.

The report observed a general negative sentiment towards AI-generated content. Hence, a holiday shopping tip for brands and retailers would be to disclose that it is, in fact, AI-generated content that provides clarity and intent for building authenticity.

Conclusion

In a nutshell, Australian holiday shoppers seek valuable information through discovery first, then mostly purchase in-store.

Hence, if you are looking for success during this holiday season, here are a few early holiday shopping tips for Australian brands and retailers: start your targeted marketing campaigns early because shoppers tend to spread it across months, and always have an omnichannel shopping journey prepared.

To learn more about how shoppers worldwide shop for holiday gifting, check out the main report.