June 10, 2025

In 2025, buying holiday gifts online is expected to be the top choice for many in the UK due to its convenience and wide selection. This strong preference for online shopping means that having a user-friendly and efficient online presence will be crucial for UK retailers aiming to succeed during the holiday season.

According to the Holiday Consumer Report 2025, UK shoppers are also predicted to be smart about their online purchases, likely starting their gift searches early to find the best deals and discounts available on the internet.

Understanding this online-first approach and the factors influencing their digital purchasing decisions will be key for UK businesses wanting to connect with holiday shoppers in 2025.

Let’s explore how UK consumers navigate online to fulfill their holiday gifting needs.

Beat the crisis with smarter ways of holiday shopping

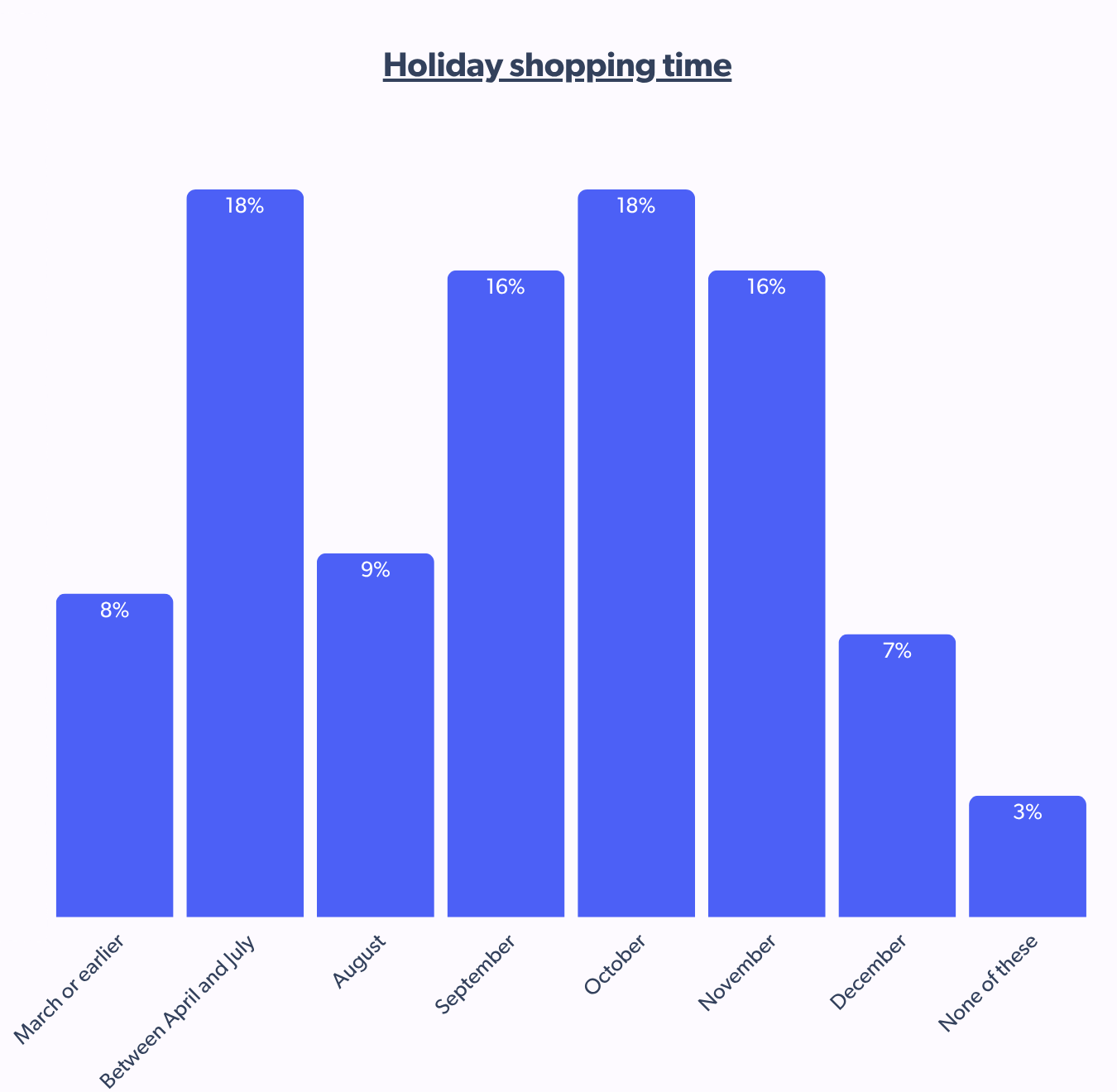

Holiday shopping among UK shoppers typically begins between April and July, dips in August, and then picks up again from September through November. This means there are specific holiday spending patterns for particular holidays spread across the months.

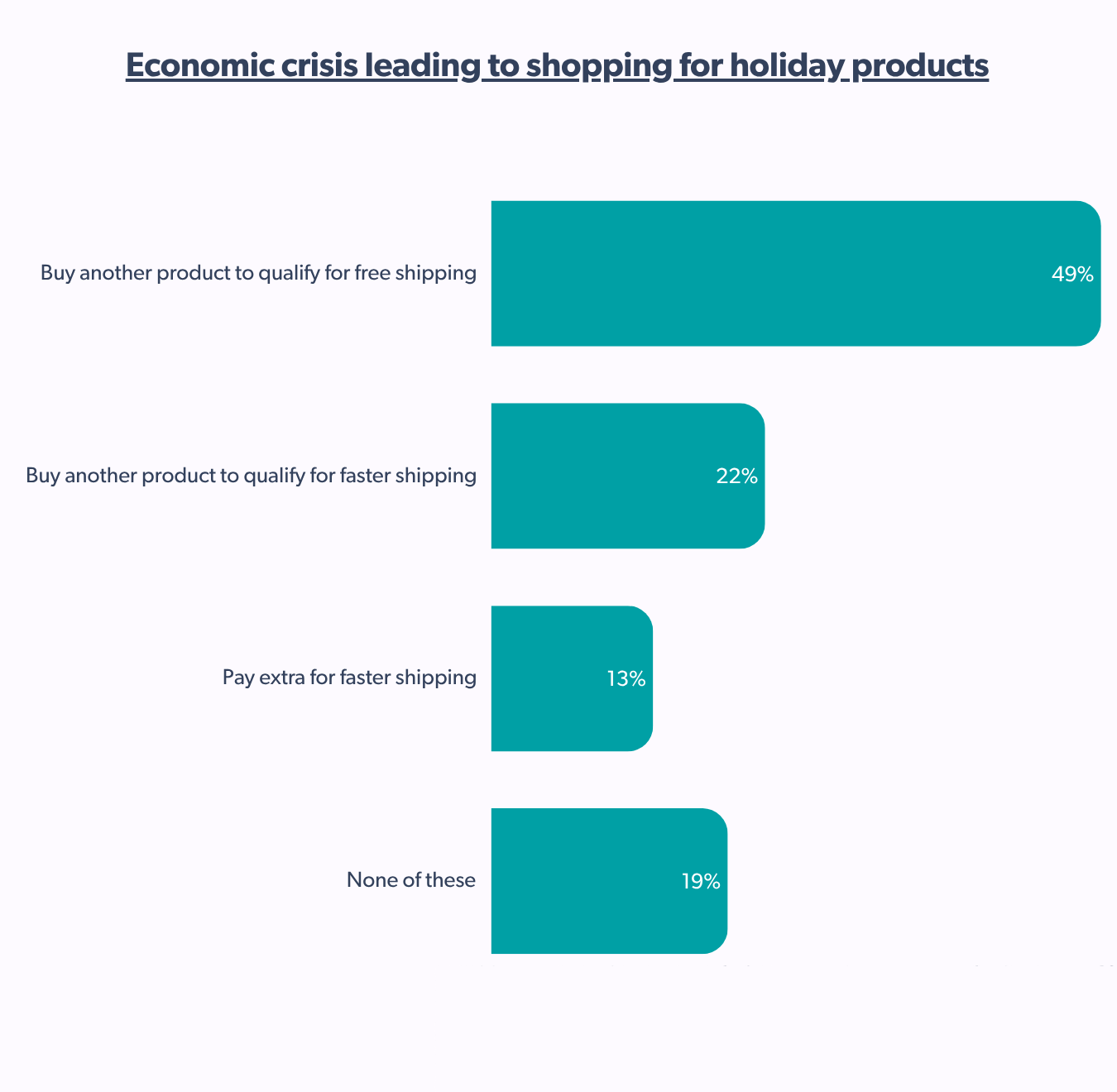

Now, as we see the world unfold to a significant economic crisis, it’s hard not to consider high inflation while doing holiday shopping. Hence, 49% of UK shoppers are looking to buy holiday products that qualify primarily for free shipping, higher than the global average of 48%, and 22% for faster shipping.

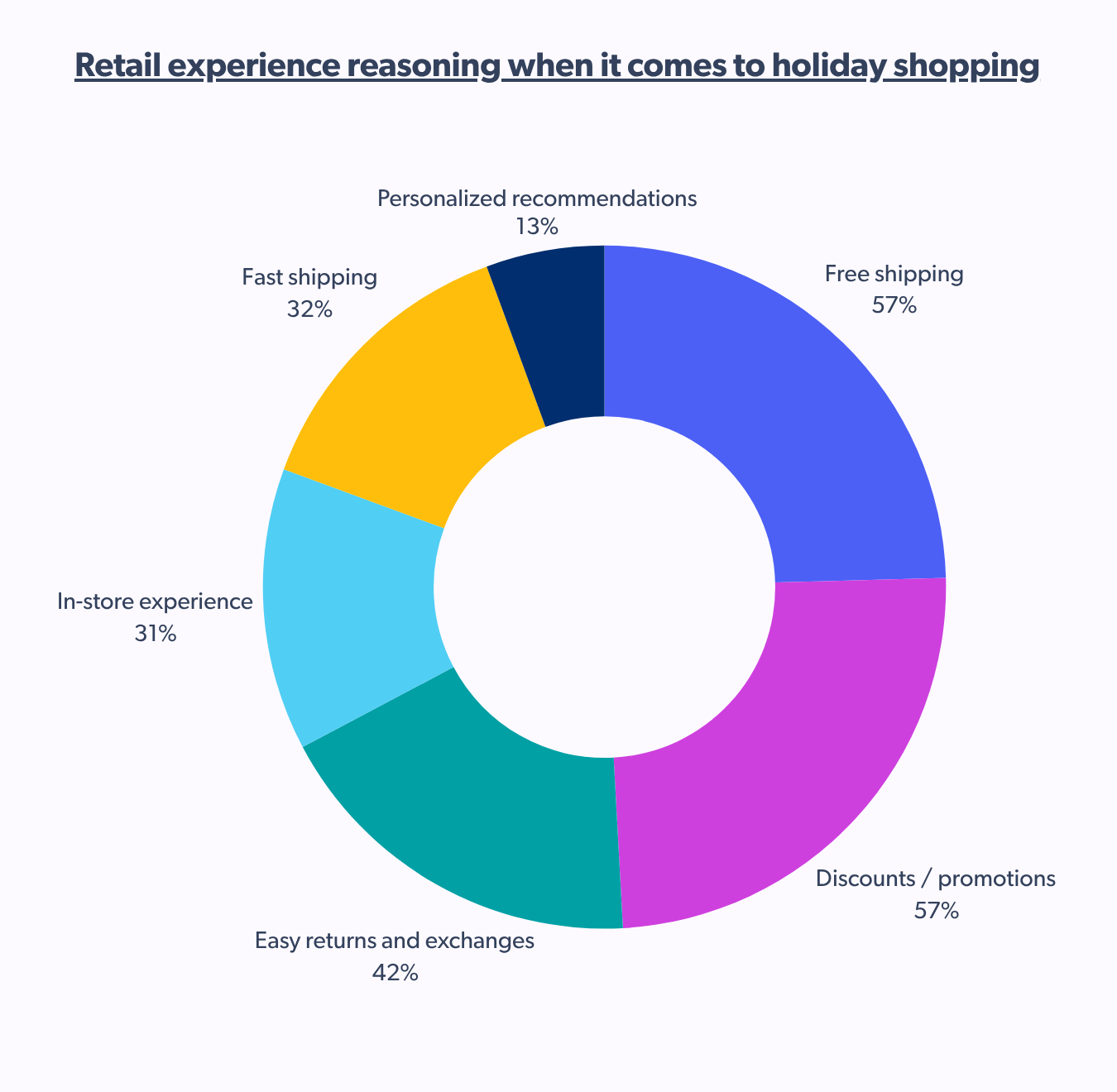

When it comes to buying through retailers, even distribution with free shipping and discounts/promotions of 57% means these two aspects are the top priorities for UK holiday shoppers. With easy returns and exchanges at 42%, UK shoppers are also looking for convenience over speed, as fast shipping preference is at 32%.

This contributes to the fact that UK holiday shoppers emphasize free shipping as their top incentive, along with discounts and promotions on holiday gifts.

A holiday shopping tip for retailers would be to spread across your marketing campaigns focused on providing free shipping during the holiday season, and keep your services available around the clock.

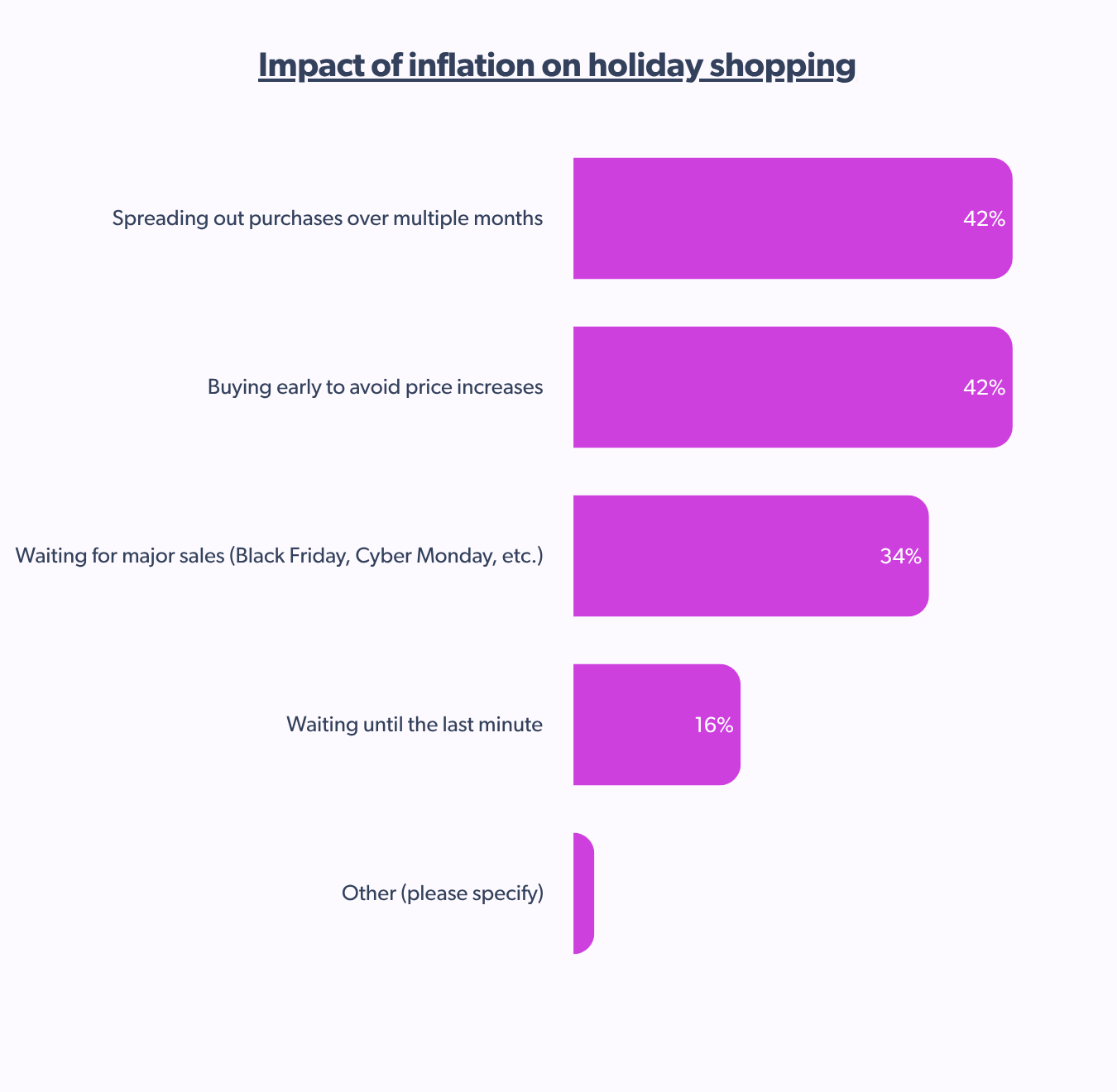

UK shoppers prefer these top 3 shopping strategies amid economic pressures:

- During holiday spending, 42% of UK shoppers are primarily choosing to spread out purchases over multiple months

- At 42%, UK shoppers are buying early to avoid price increases as a way of beating inflation

- And last but not least we have 34% of UK holiday shoppers waiting for major sales such as Black Friday, Cyber Monday, etc.

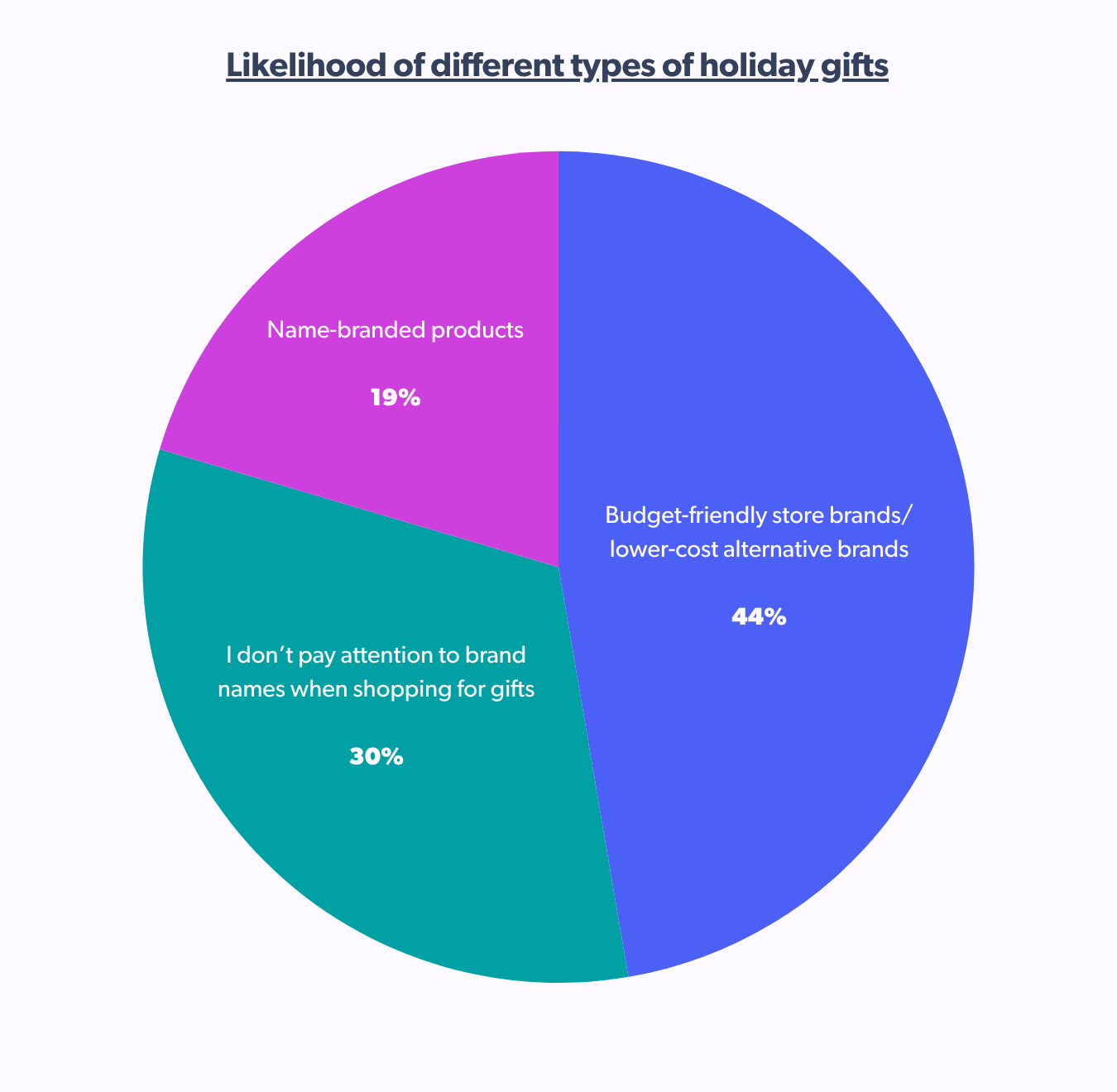

Another shopping behavior decoded in UK holiday shoppers is the likelihood of purchasing budget-friendly store brands or lower-cost alternative brands. To say so, we’ll have to compare 44% of these to name-branded products at 19%. A small yet significant proportion of 30% don’t pay attention to the brand when shopping for holiday gifts.

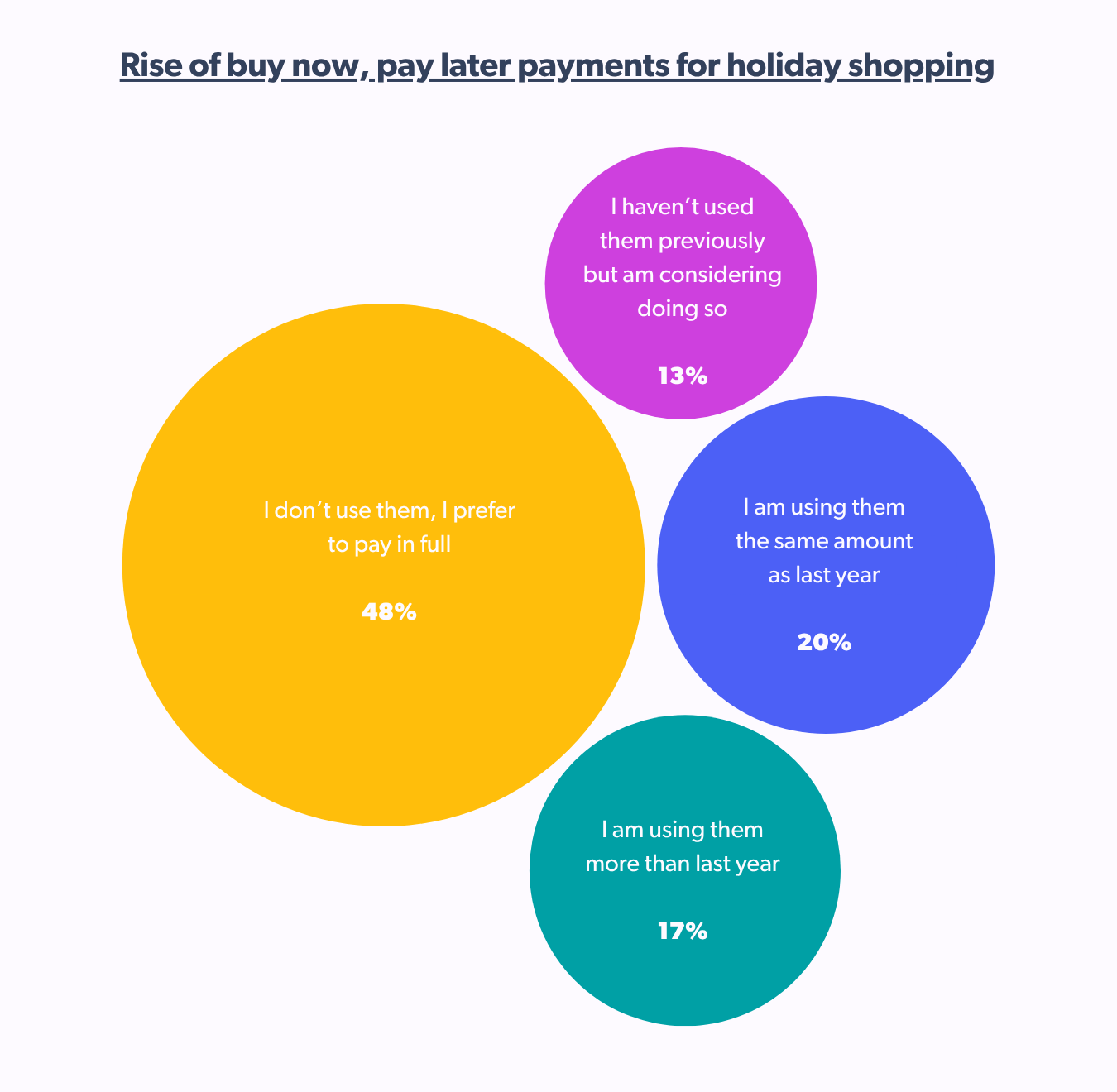

Moving on to the next shopping behavior, which is the rise of the buy now, pay later (BNPL) payment option. UK shoppers have largely adopted BNPL, with 17% using them more than last year, higher than the global average of 15%.

This is followed by 20% of UK holiday shoppers using them the same amount as last year. A significant portion of 13% states that they haven’t used them previously but are considering doing so.

With half of UK holiday shoppers accepting them, 48% who don’t use them and prefer to pay in full. A holiday shopping tip for brands and retailers is to explore BNPL as a different payment method due to its rise in adoption.

Omnichannel shopping primarily favors online

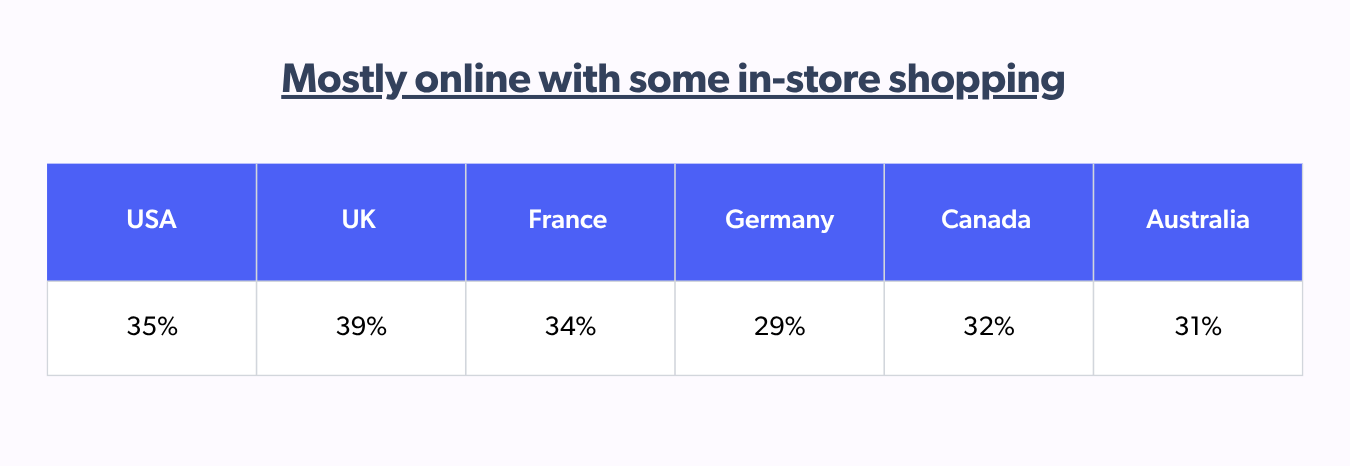

Most UK shoppers will be shopping online this year, with some in-store shopping at 39%. At the same time, 27% of shoppers will be equally distributed between online and in-store shopping.

With 14% planning to shop mostly in-store, with some online shopping, and only a mere 5% going for in-store only. We can see that UK holiday shoppers are more inclined towards online shopping during the holiday season than in-store shopping.

There is a range of retailers and brands that can implement the omnichannel shopping experience for UK holiday shoppers.

Let’s dive deeper into how omnichannel shopping works if you target UK holiday shoppers. More than half of UK shoppers (52%) research online before purchasing a holiday gift in-store compared to last year.

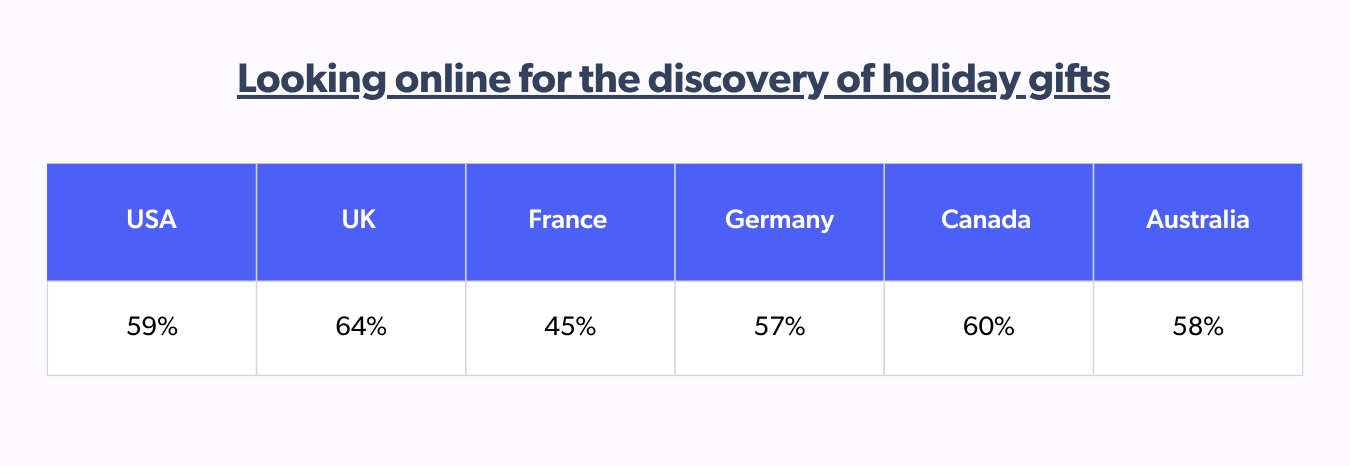

More than three-fourths of UK holiday shoppers (64%) mostly prefer an online way to discover or look for holiday gifts. Closely followed by 53% for in-store and 11% for social media.

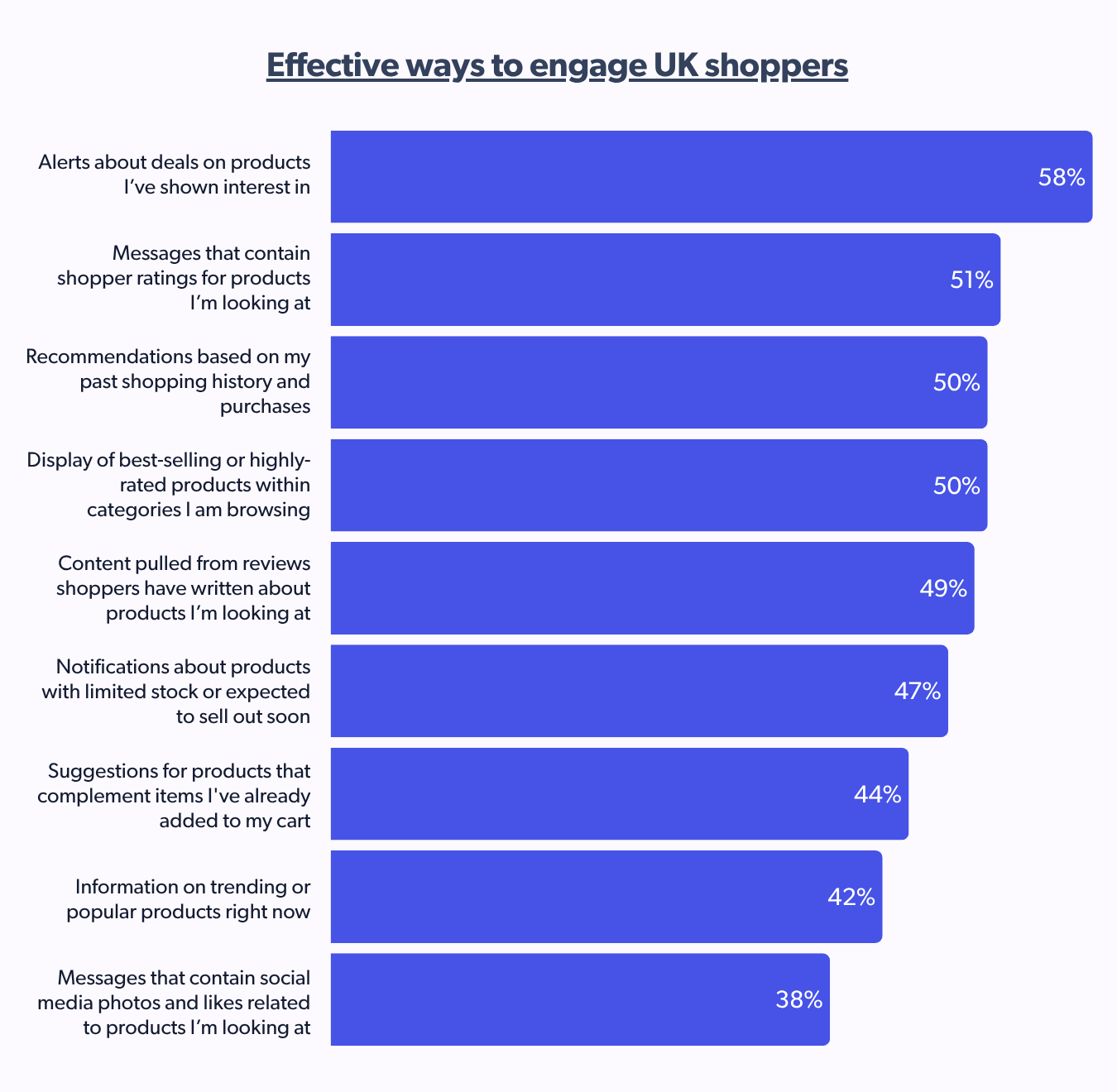

And when UK holiday shoppers look online, they find alerts about deals on products shown interest in (58%) and messages containing shopper ratings for products (51%) to be the most useful.

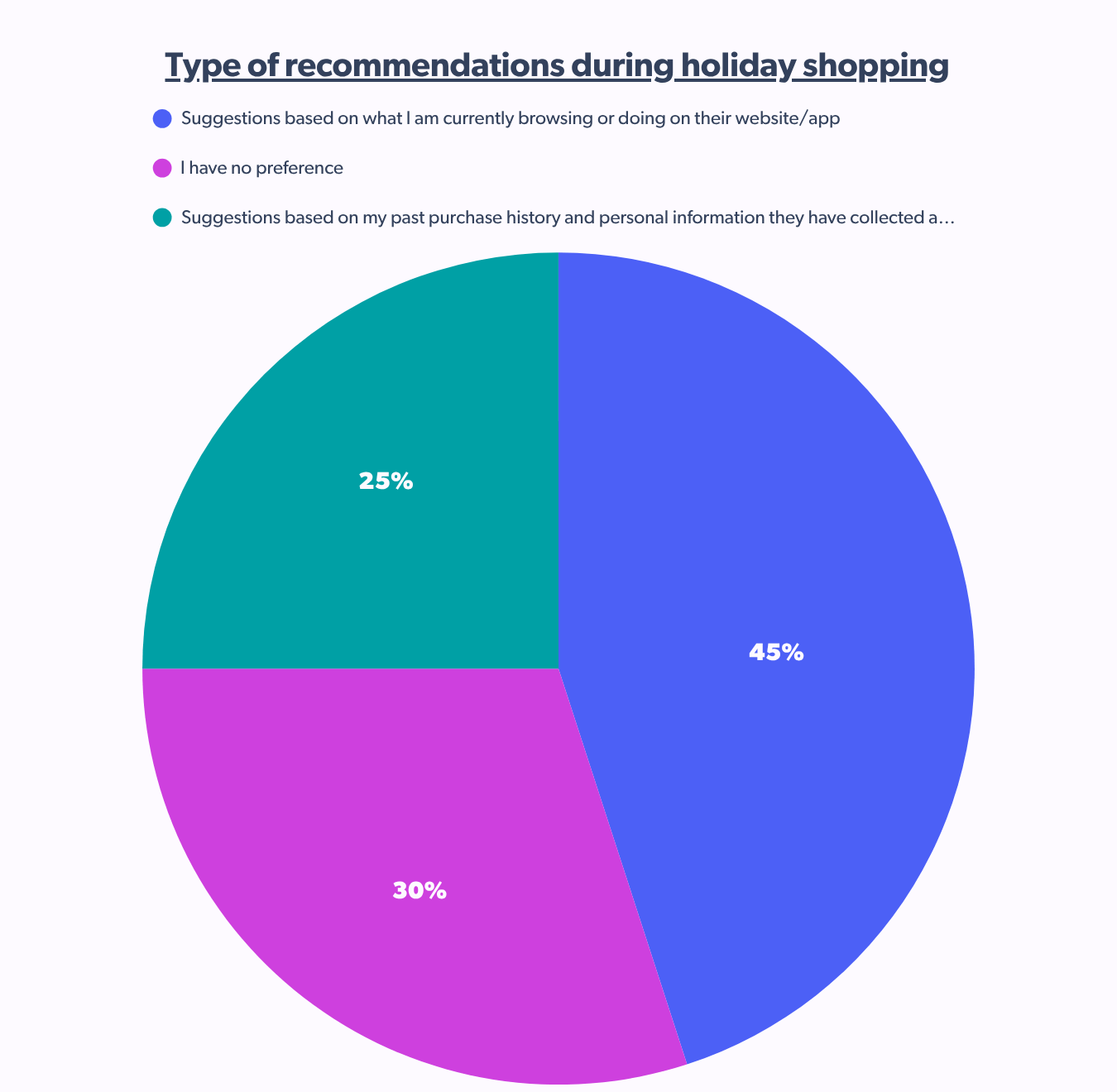

As a brand or retailer, this is how you should approach your online customers, specifically when it comes to offering suggestions and recommendations. Go with suggestions based on what they are currently browsing or doing on their website or app, as 45% of UK holiday shoppers already prefer this type of recommendation.

Due to privacy concerns, only 25% of shoppers prefer suggestions based on their past purchase history and personal information collected about them. And 30% of them have no preference when it comes to recommendations.

Shoppable socials are a discovery weapon

Shoppable content is slowly but surely changing the landscape of shopping. Starting with the discovery of holiday gift ideas, more than half of UK holiday shoppers (51%) say yes to doing so. And 46% said no to doing discovery via social media.

According to UK holiday shoppers, 32% have purchased directly through a social media platform’s shopping feature. To understand these low numbers, we have to realise the skepticism or lack of awareness of social media purchase features.

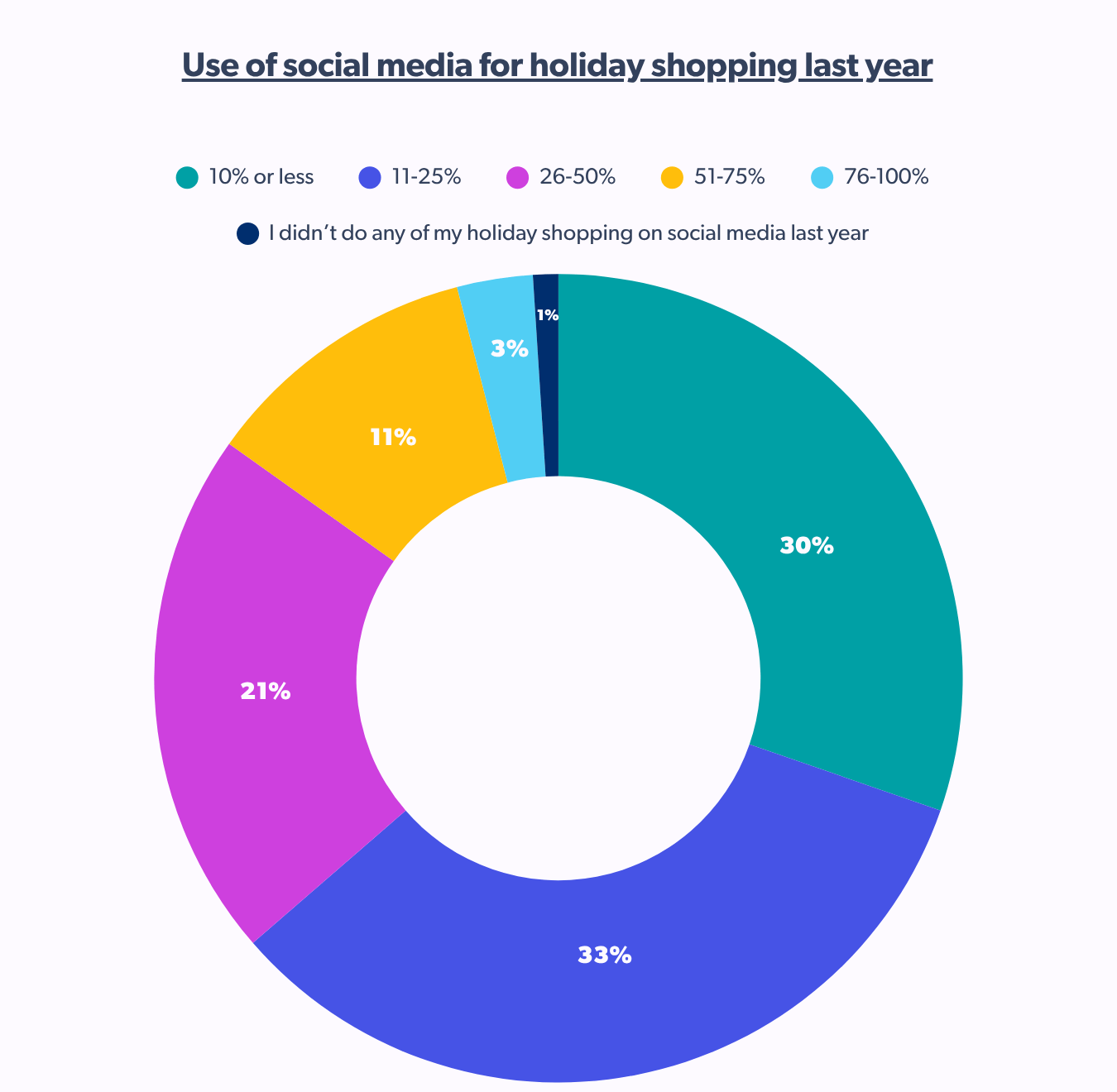

A significant 16% of shoppers conducted over half of their shopping on social media, while a larger segment, 54%, completed between 11% and 50% of their purchases through these platforms.

This data underscores that for the majority of UK holiday shoppers, social media serves as a minor influence, with traditional retail and other online avenues likely remaining the primary destinations for their gift-buying needs.

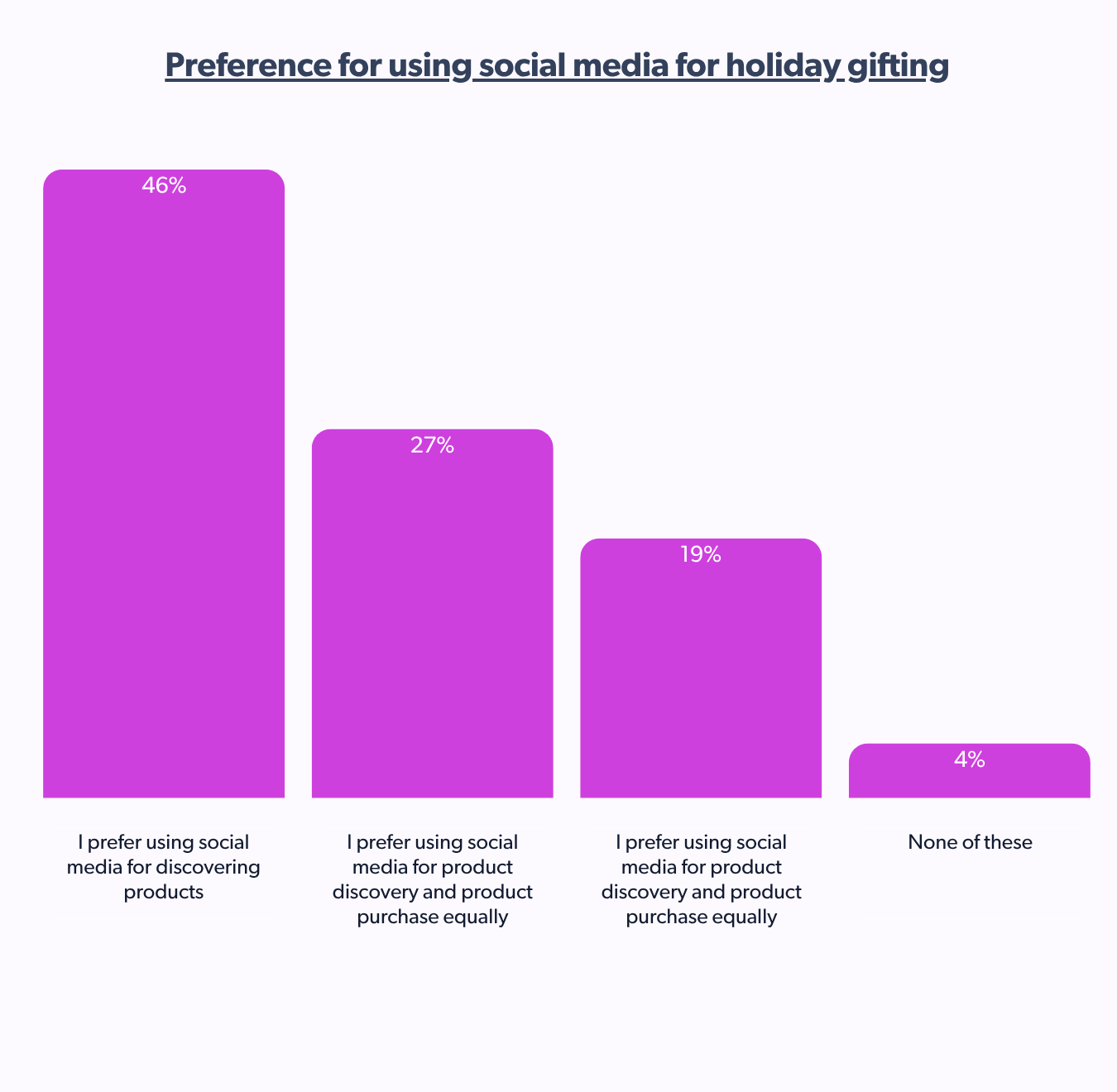

While direct purchases via shoppable social media content may not be the primary method for UK holiday shoppers, social platforms are a significant avenue for product discovery, favored by a substantial 46%.

Interestingly, over a quarter of these shoppers (27%) value social media equally for both discovering and purchasing holiday gifts. This highlights social media’s crucial role in the initial stages of the shopping journey, even if it doesn’t always culminate in an immediate on-platform transaction for the majority.

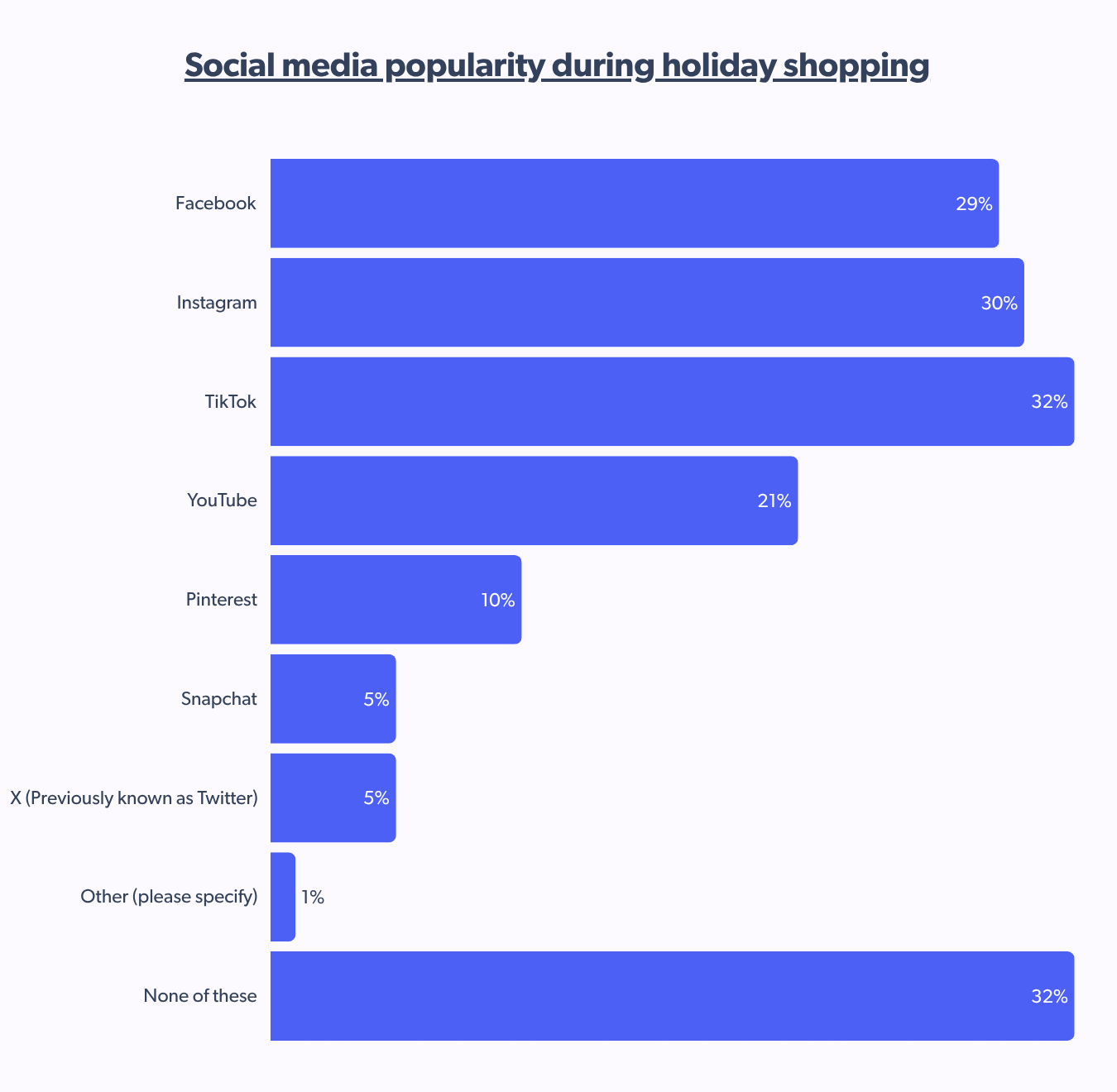

Now that we know the top reason behind social media usage for holiday spending, let’s look at which platform influences UK holiday shoppers most. 32% of shoppers look for gift ideas on TikTok, which is closely followed by Instagram gift inspiration among UK holiday shoppers at 30% and Facebook at 29%.

A striking observation for brands and retailers is that even though UK holiday shoppers do not directly purchase from social media, they are heavily influenced by it; therefore, they should run ads and campaigns that satisfy shoppers’ needs during the season.

Social media is no longer just a place for holiday browsing; it’s a vital point of purchase. By leveraging the underpriced social attention available in early fall, brands can effectively capture consumer interest ahead of their competitors.

➡️ Check out Bazaarvoice VIBE on how to use social media for your business better.

Creator recommendations influence consideration

Moving on to the next section, which deals with creator content and recommendations. In this, 29% of UK holiday shoppers have purchased a holiday gift based on an influencer or content creator’s recommendation. While the remaining 68% did not.

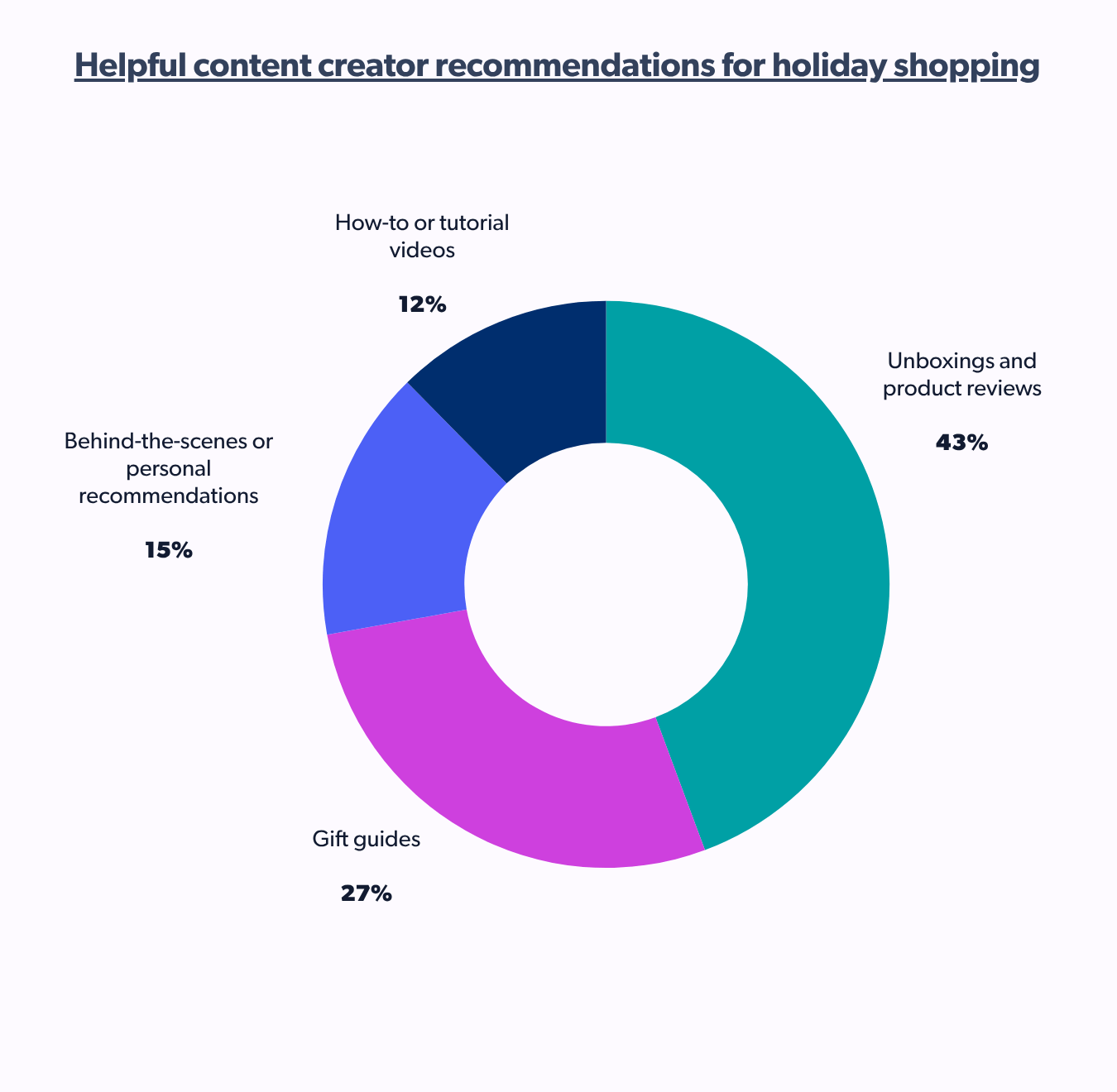

Two-fourths (43%) of UK holiday shoppers find looking at unboxing and product reviews helpful for their holiday shopping. UK creators’ holiday gift guides are the second most popular type of content sought by 27% of shoppers. Meanwhile, behind-the-scenes or personal recommendations stand at 15%, and how-to or tutorial videos at 12%.

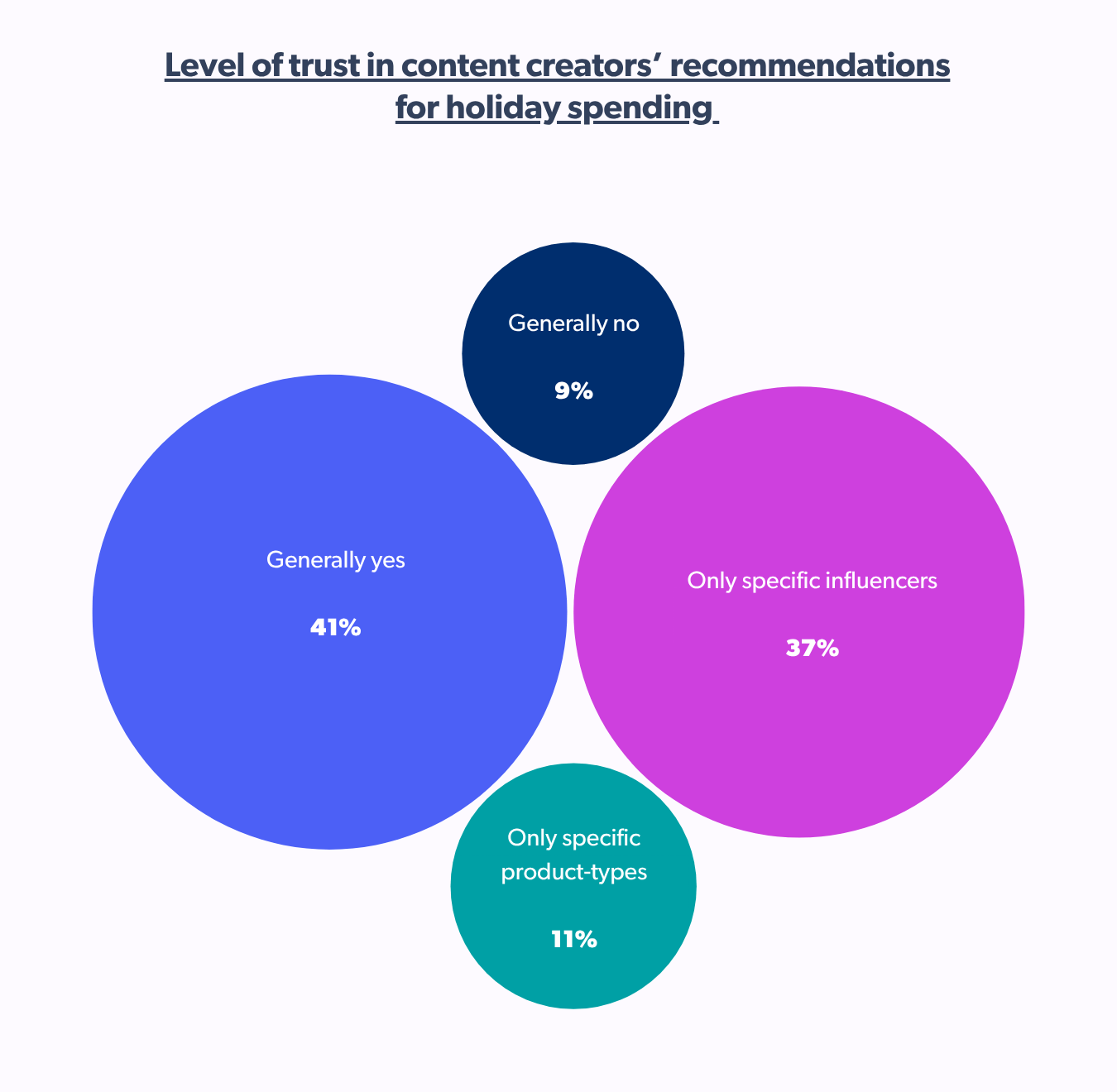

78% of UK shoppers generally trust content creator recommendations during holidays. Let’s look at the breakdown of the level of trust for holiday shopping.

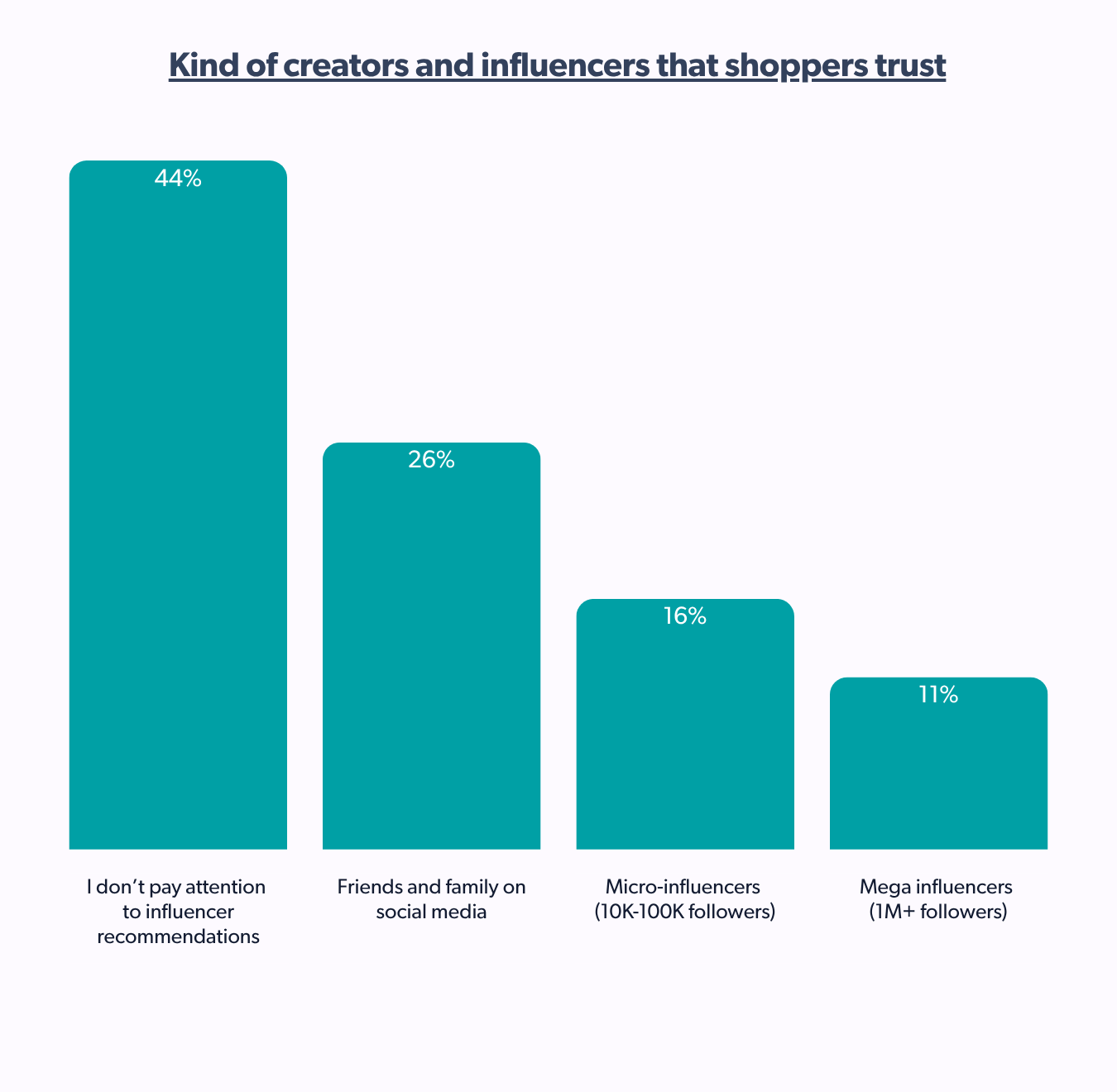

Let’s take a step closer and observe the preferences in recommendations from. 44% of UK holiday shoppers pay no attention to influencer recommendations whatsoever. A significant chunk of 26% of the population prefers these recommendations from friends and family on social media.

Brand and community-led content are anchors of holiday shopping

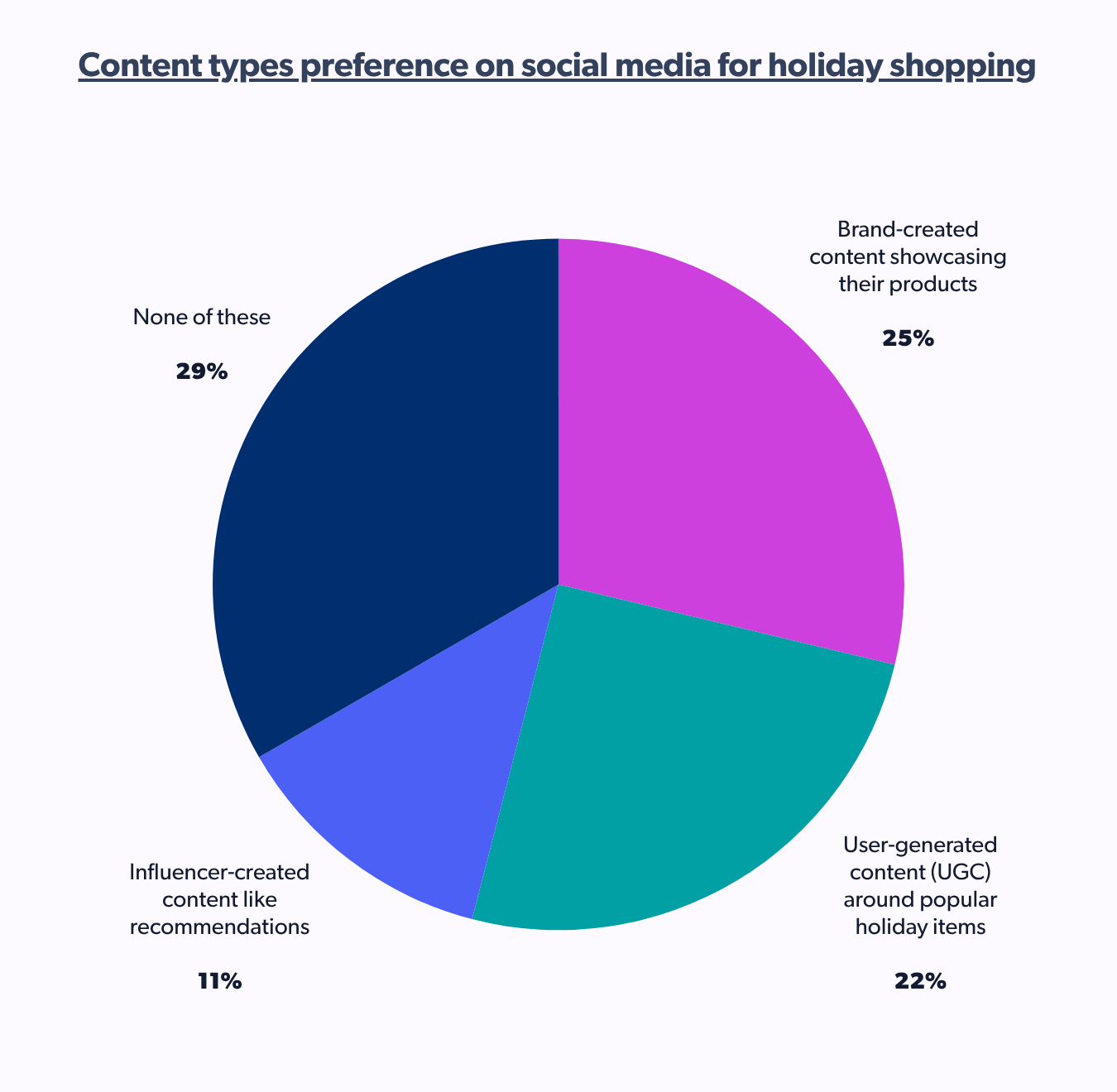

One-fourth of UK holiday shoppers (25%) prefer brand-created content showcasing their products on social media during the holiday season. And 22% prefer user-generated content (UGC) around popular holiday items.

It’s a very close call. A holiday shopping tip for brands and retailers, keep the strategies divided between UGC and brand-owned for maximum reach.

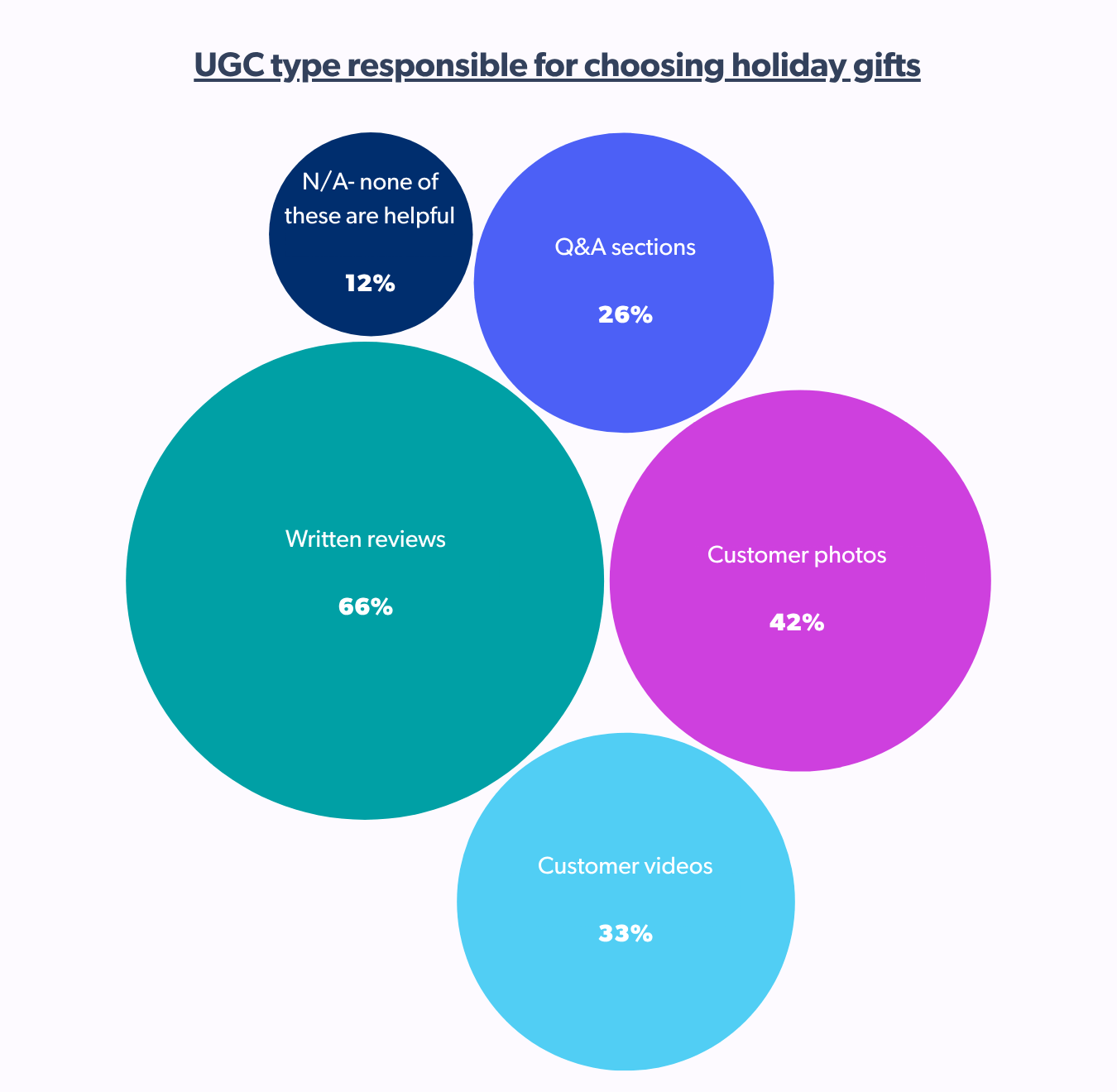

Trustworthy written reviews for UK holiday shopping are the most helpful UGC when choosing a holiday gift for 66% of shoppers. Coming in next with 42% are the customer photos, and at 33%, it is customer videos.

Another topic we need to discuss is the usefulness of gift guides offered by brands, retailers, or influencers. More than half of UK holiday shoppers (51%) say sometimes, which is higher than the global average of 47%.

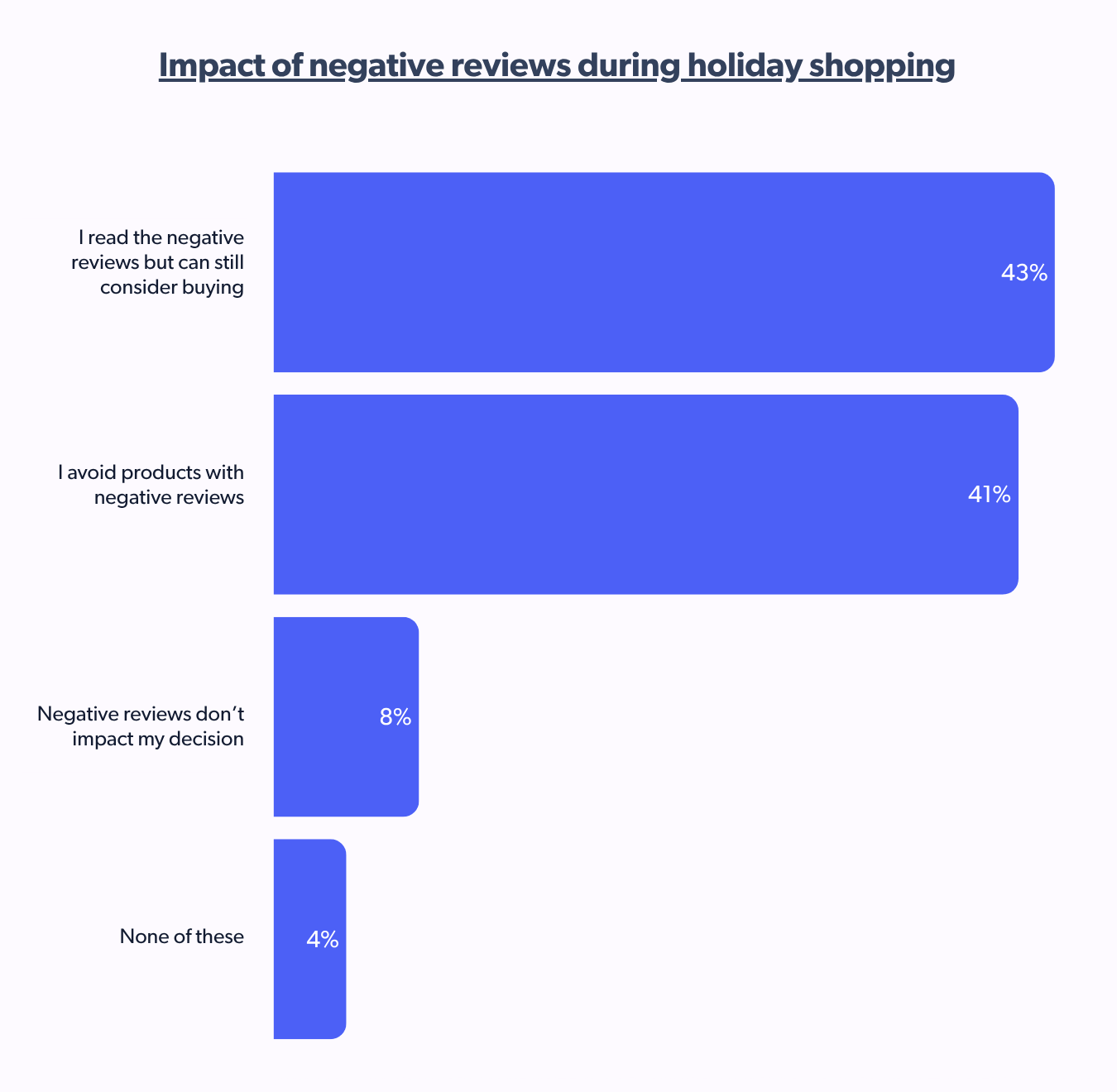

Negative reviews can heavily impact purchasing during holiday shopping. More than two-fourths of UK holiday shoppers (43%) consider buying even after encountering negative reviews. While the other substantial majority of 41% say they avoid products with negative reviews.

Since the impact is almost equally diversified. It is best for brands and retailers to show both positive and negative reviews. This will help them build trust and sustain credibility.

Authenticity wins by building trust in the AI era

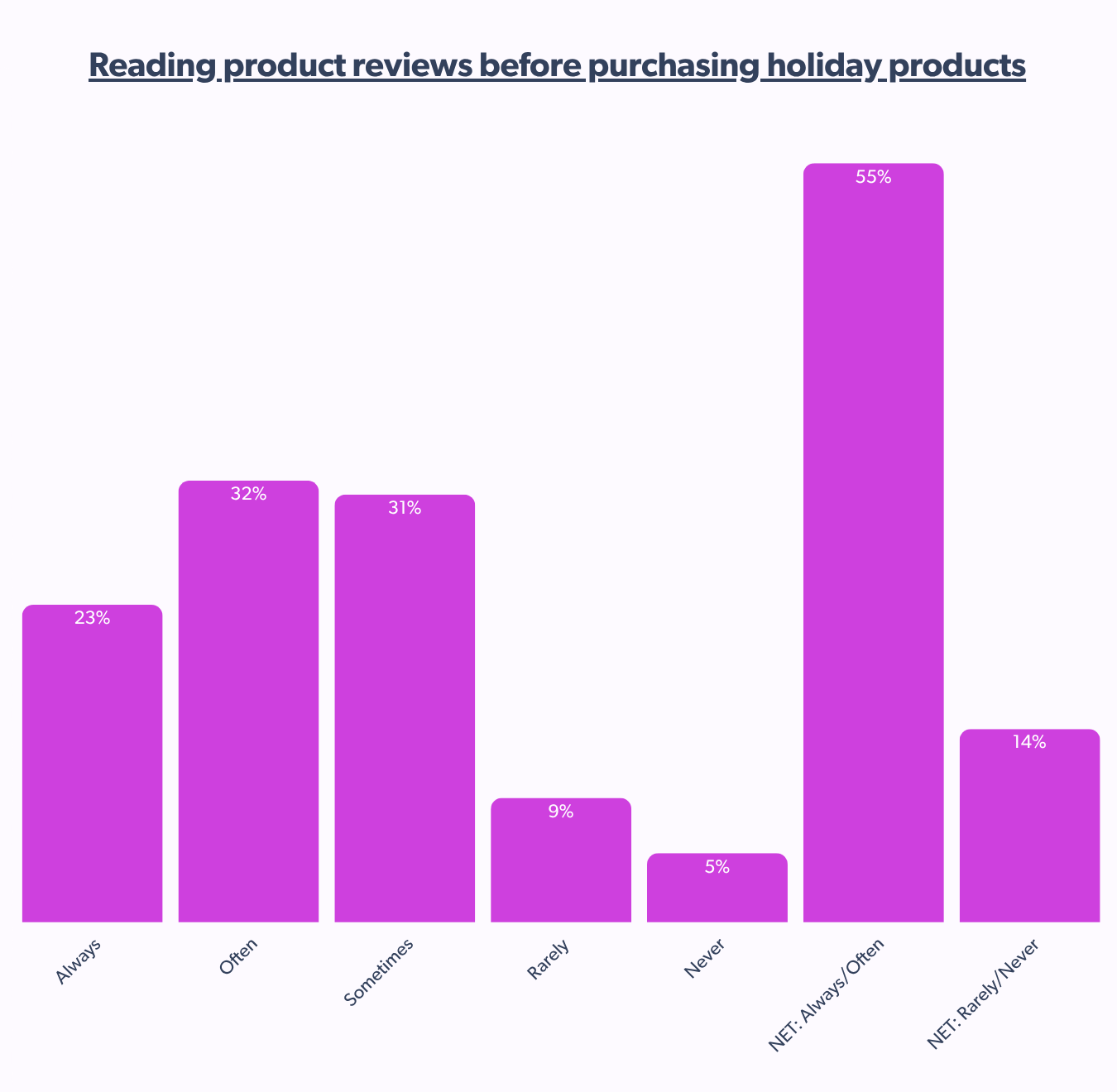

The provided data indicates that product reviews are a significant factor for UK holiday shoppers. A substantial 55% (23% always, 32% often) actively seek out and read these reviews before making gift purchases, suggesting that peer opinions heavily influence buying decisions.

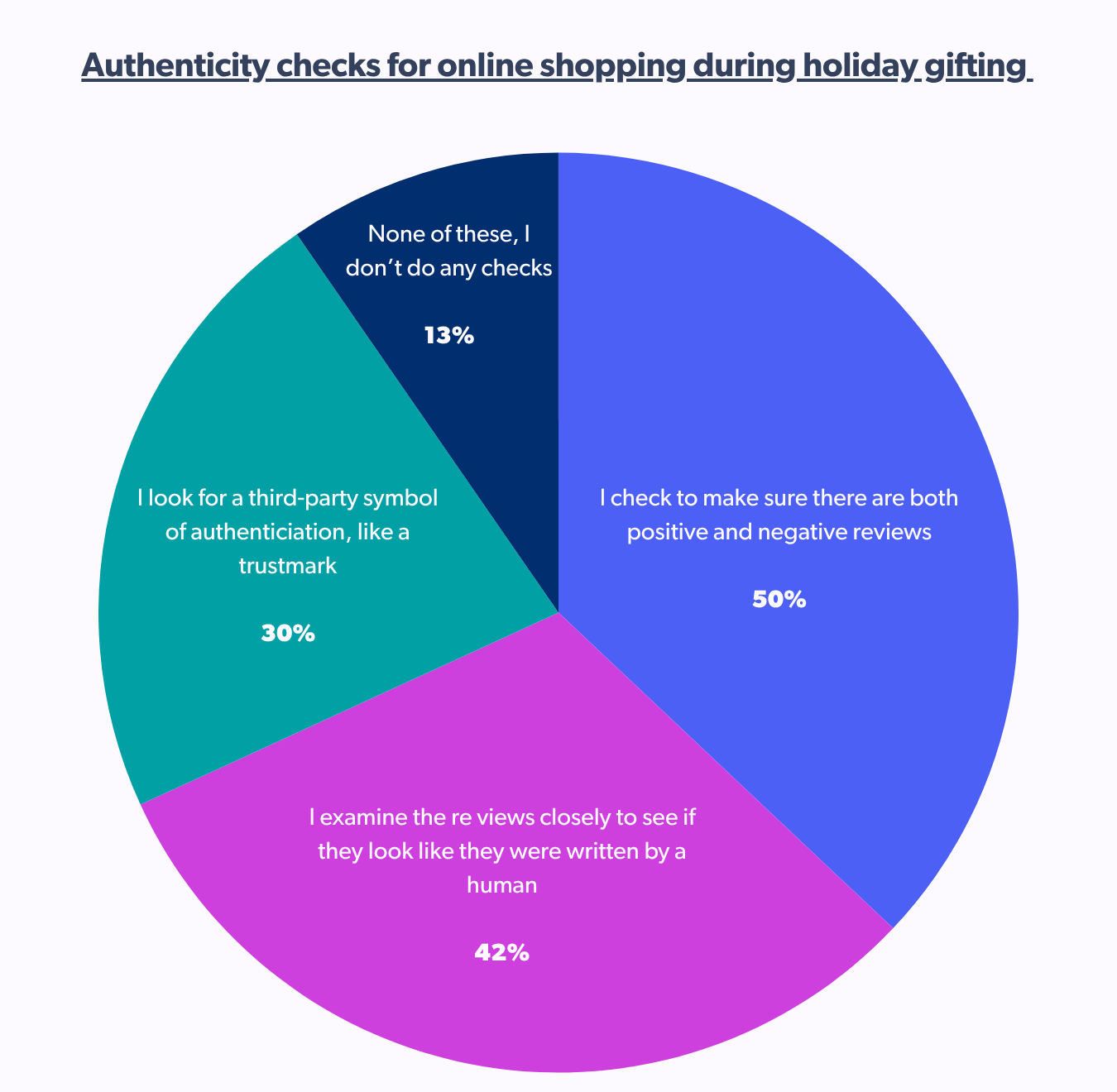

With the rise of AI-generated content, authenticity has become crucial. There are certain checks that UK holiday shoppers follow when shopping online during the holidays.

Half of them (50%) check to make sure there are both positive and negative reviews. Next, shoppers examine the reviews closely to see if they look like a human wrote them, at 42%. This is closely followed by looking for a third-party authentication symbol, like a Trustmark, at 30%.

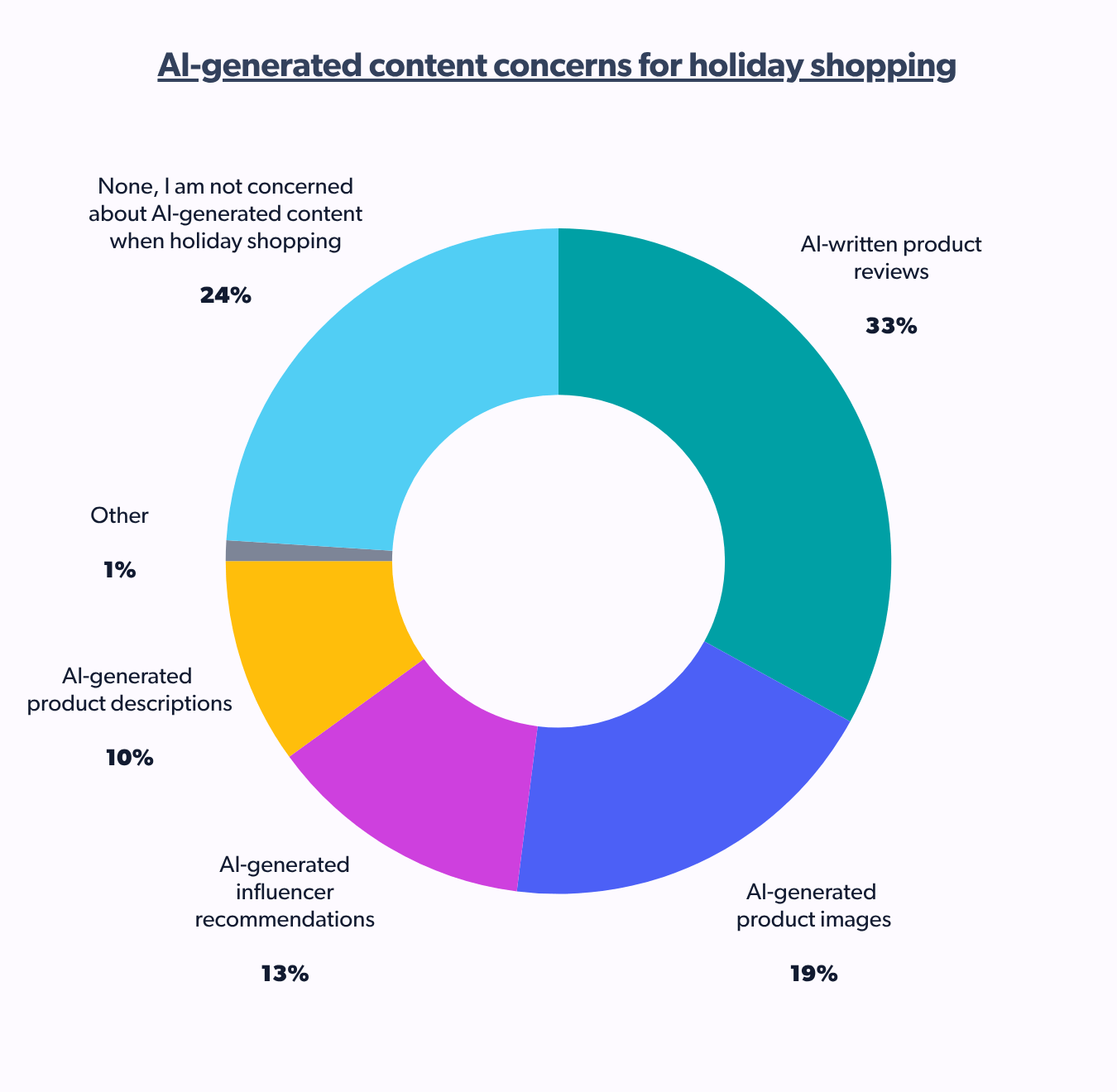

AI-written product reviews are the single biggest AI-generated content concern for 33% of UK holiday shoppers. Followed by 19% for AI-generated product images and AI-generated influencer recommendations at 13%.

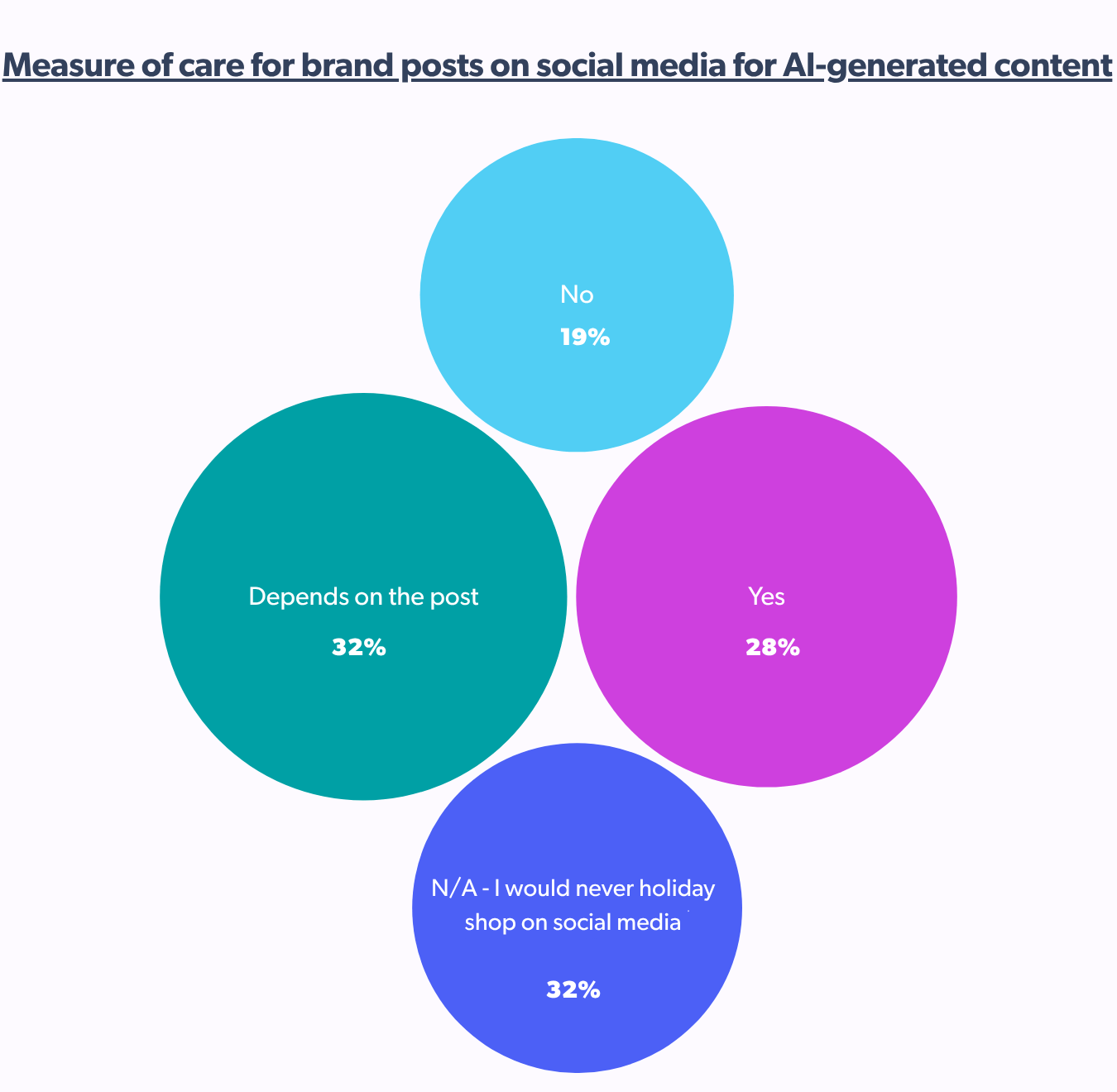

At least 32% of UK holiday shoppers say that it depends on the context of the post whether or not they’d care if a brand posted something completely AI-generated. On the other hand, 28% strongly say yes and 19% say no.

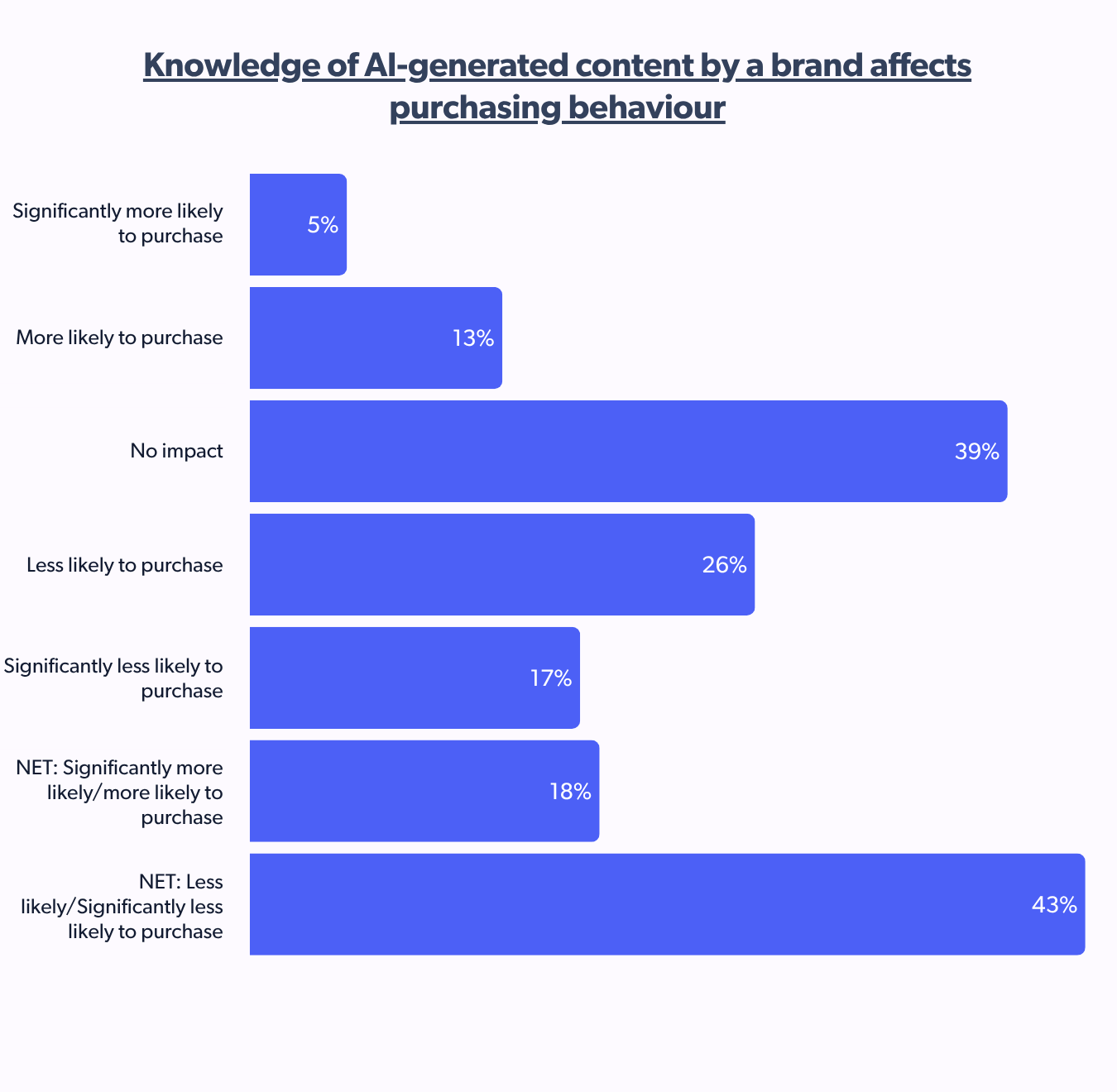

Knowing the fact that a brand’s social media is completely AI-generated does not create much impact. As 39% of UK holiday shoppers say that it has no impact on their purchasing decision from that brand.

Conclusion

UK holiday shoppers often begin their product discovery on social media. However, they heavily rely on readily available online product reviews to make informed purchasing decisions.

Consequently, for UK brands and retailers seeking online holiday success, prominently featuring authentic and positive product reviews on their e-commerce platforms is paramount.

Moreover, considering the significant role of social media in initial exploration, a seamless omnichannel experience that bridges online discovery. This readily makes review information accessible for converting online interest into actual sales during the holiday season.

Check out our 2025 Holiday Shopping Report, featuring worldwide consumer behavior and effective retail strategies for global holiday shopping insights.