June 17, 2025

This year, when you’re untangling fairy lights and Mariah Carey is echoing through every store speaker, many shoppers will already finish their holiday shopping.

Our latest Holiday Headquarters surveyed 8,456 shoppers globally and found that 38% plan to spread their purchases between March and September, while 43% concentrated their spending in the prime months of October and November.

The data shows that holiday shopping has become more strategic than ever, even before the festive season begins. Retailers like Target, Trader Joe’s, Costco, and Harry & David, among others, responded last year by offering deep discounts, free shipping, and flexible options like Buy Now and Pay Later as early as possible to retain customers.

In 2025, shoppers are expecting even more. So how are consumers managing their holiday shopping this year without compromising their gifting goals? Let’s unwrap five clever ways they’re planning, pivoting, and saving big and what that means for your brand’s holiday playbook.

1. Shoppers are starting early to beat the price hike

If you thought October was early to start holiday shopping, think again. Holiday shopping is no longer a December event. It’s stretching across seasons.

Globally, 5% of shoppers start as early as March, which surges to 15% by September. Like, in the UK, 8% start in March or earlier, and 16% begin by September. Whereas in the US, 11% shop between April and July.

Why the rush?

Inflation is the main driver. At least 43% of US shoppers say they buy early to avoid price hikes, and 42% spread spending out to reduce the impact of one big expense. These early shoppers aren’t just planning ahead, they’re actively purchasing, long before most brands launch holiday campaigns. If you’re looking for specific regional insights?

Looking for more regional insights? Check out our UK or Germany blogs for deeper geo-specific analysis.

Example: Trader Joe’s jumps the calendar, stocking holiday favorites ahead of fall

Trader Joe’s, the American grocery store chain, introduces seasonal snacks, treats, and decorations well before the holiday season. While they don’t announce sales or discounts in advance, they consistently launch unique food products at some of the lowest prices.

In 2024, they rolled out “Pumpkin Palooza,” featuring over 70 pumpkin-themed products. To keep shoppers in the loop, Trader Joe’s ran a podcast to give customers the inside scoop on what’s new and what’s returning, helping to fill the season with flavor and festivity.

2. Plan, pace, and pounce on deals for holiday spending

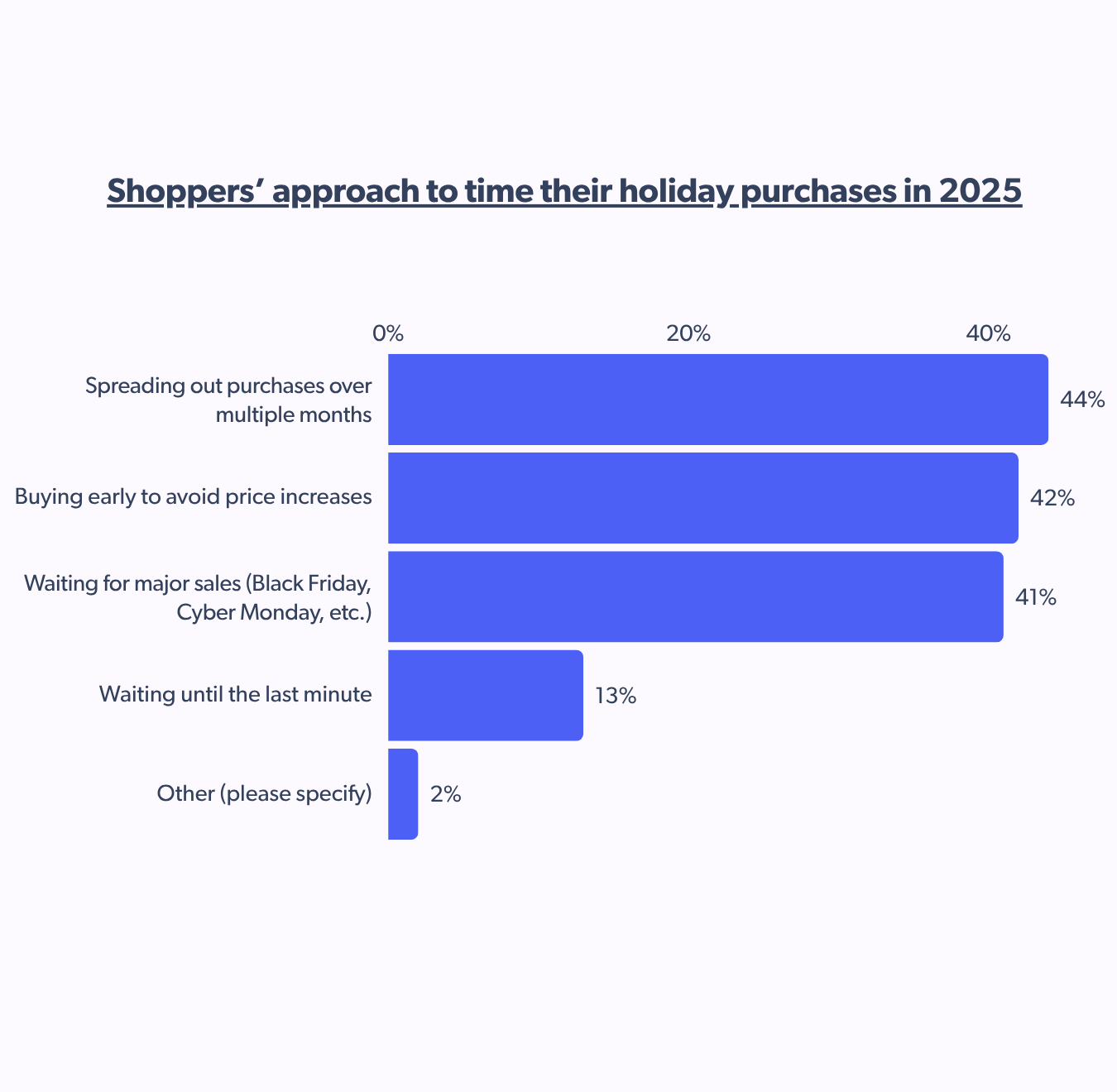

As shoppers plan months in advance for holiday shopping, they’re turning to three key strategies to time their purchases.

Globally, 44% of consumers are expanding their shopping to manage their budgeting and financial planning better. Meanwhile, 42% are buying early to avoid price increases driven by inflation, and 41% are holding out for major sales events like Black Friday and Cyber Monday as part of their deal-hunting approach.

These strategies vary across regions. For example, 48% of Australian shoppers focus on budgeting and prefer to space out their purchases, while 47% of French shoppers buy early to avoid price hikes.

Example: Target sets the stone with their “Deal of the day” campaign

Target tapped into shoppers’ holiday shopping mindset with its Target Circle Week campaign in October 2024, launching holiday deals nearly two months ahead of Christmas. The campaign included discounts across categories like toys, home, tech, and fashion, plus a “Deal of the Day” program that refreshed daily offers through November.

This consistent drumbeat of savings kept shoppers engaged and created an incentive to return frequently, which was especially appealing to budget-conscious consumers who were keeping tabs on prices.

To sweeten the deal, Target expanded its holiday assortment by 50%, focusing on value-forward items, many under $5 and $10, making it easier for families to check off wishlists without breaking the bank. Instead of waiting for Cyber Week, Target got ahead of shopper expectations and positioned itself as the go-to early destination.

3. Free shipping wins over speed for holiday shoppers

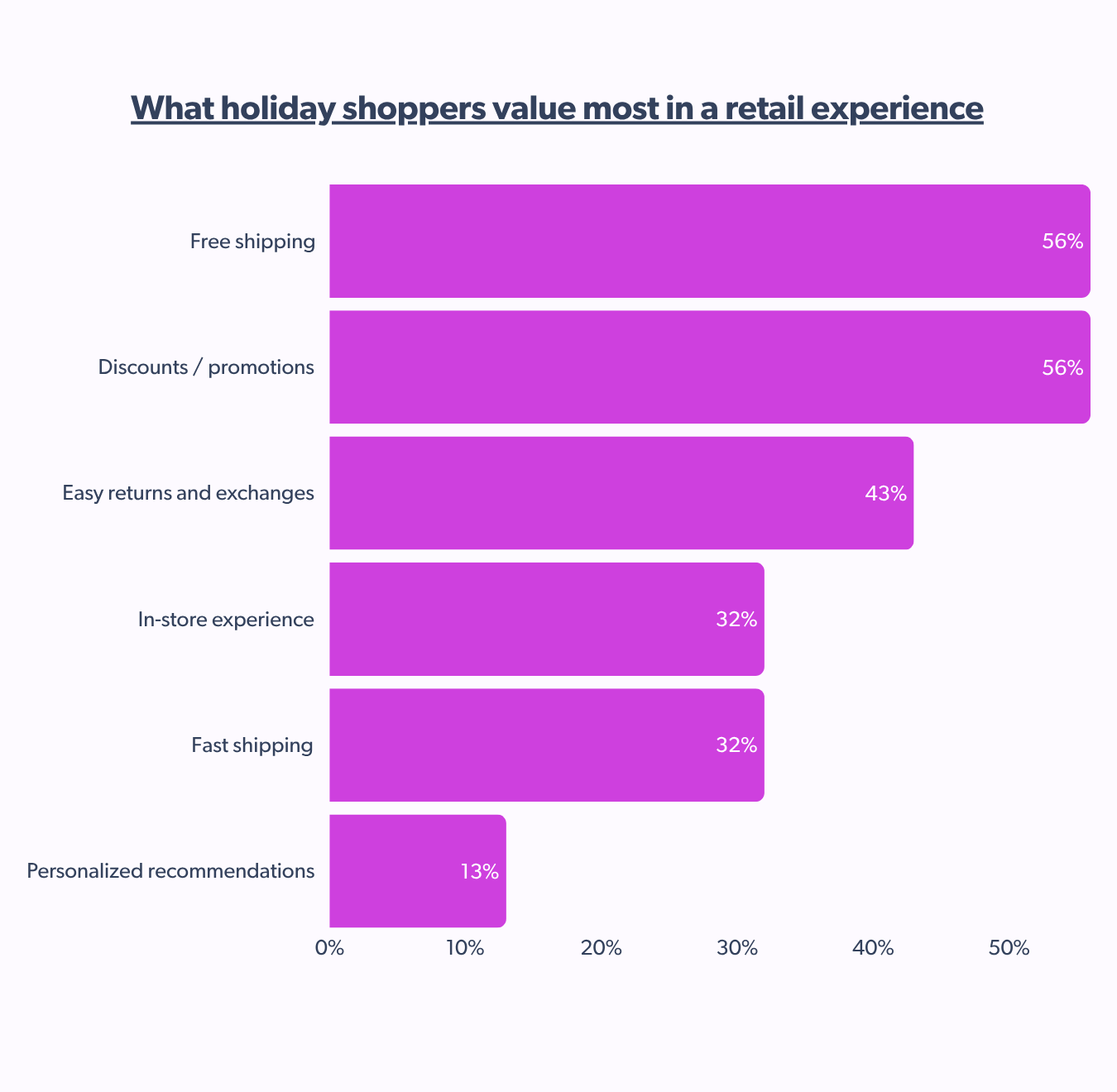

Holiday shoppers are laser-focused on perks like free shipping and standout deals. Globally, 56% of consumers rank free shipping as the top retailer experience, with 57% in the US and 61% in Canada echoing this sentiment. Discounts and promotions are closely followed and are sought by 51% of US shoppers and 63% in Australia. Notably, 60% of shoppers aged 55+ actively seek these savings opportunities.

Example: Harry & David launched 2024 holiday collection with free shipping offers and discount codes

Harry & David is an American premium food and gift company, renowned for its gourmet gift baskets. For the 2024 holiday season, Harry & David offered curated gift collections with coupon codes that include free shipping on select items. In August 2024, they launched a festive holiday cookie collection to kick‑start the season early.

Their assortment is thoughtfully packaged to suit specific recipients, whether you’re shopping for family, coworkers, or a spouse. Returning Christmas bestsellers from last year are available, and gifts are conveniently categorized by price ranges: under $50, $75, $100, and top-tier “Best Gifts Only.”

4. Private labels take the reins this holiday season

With holiday shopping starting early, one big question looms: are shoppers sticking with their favorite brands or chasing the best deals when price tags shout louder than labels?

Globally, 45% of shoppers are switching to private labels or lower-cost alternatives in 2025. It’s even higher in Canada at 53%, followed by Australia at 49%.

When it comes to brand influence, many shoppers just aren’t buying it. Roughly 21% of US, 30% of UK, and 36% of German shoppers say they don’t care about the brand but just quality at a fair price.

Example: Costco’s $140 gold heart earrings ruled social media as holiday gifts last year

In 2024, content creators recommended Costco’s 14K solid gold earrings, priced under a hundred dollars as a budget-friendly Christmas gift. A piece like that would typically cost much more from a luxury brand like Van Cleef & Arpels.

With shoppers more financially stretched than ever, private label brands, also known as store brands, are gaining significant traction among consumers, making them more relevant than ever. Like Costco, many retailers are expanding their store-brand offerings across various categories.

Interestingly, private label brands are also growing in popularity through user-generated content, such as ratings and reviews, as well as creator-led content that helps spotlight these value-driven products, especially during the holiday season. TikTok and YouTube are full of shopper reviews and seasonal hauls that fuel FOMO and foot traffic. Brands looking to replicate this strategy can tap into tools like Bazaarvoice Vibe, which helps source and amplify high-performing social content across the buyer’s journey — from inspiration to checkout.

5. Buy now and pay later flexibility

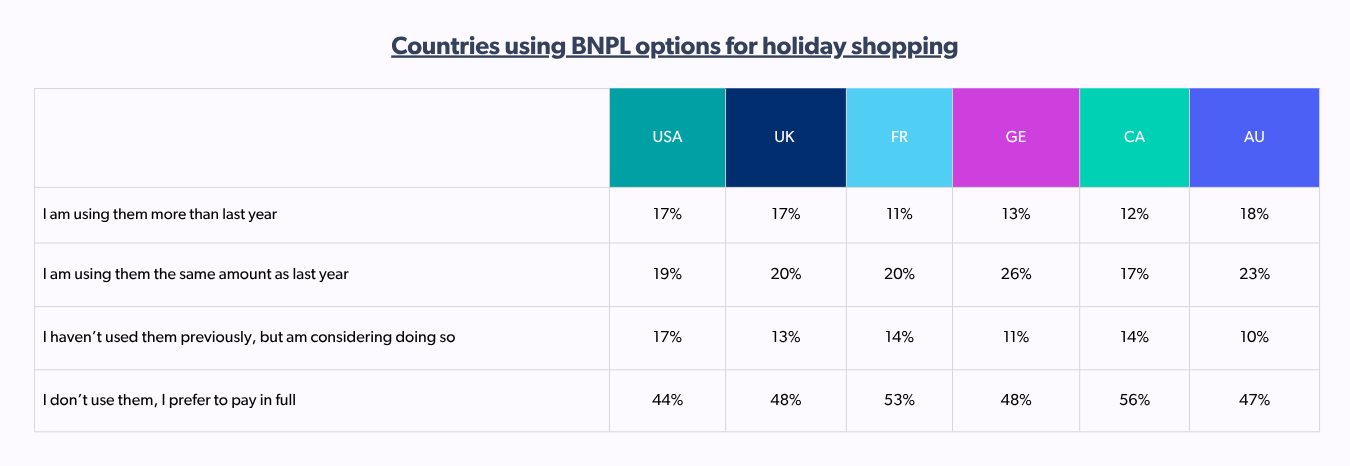

As holiday expenses mount, flexible payment options become essential. Recognizing this, several retailers allow members to finance online purchases ranging from $500 to $17,500 over 3 to 36 months, especially for big-ticket items like electronics and furniture. Generally, the BNPL option provides transparent terms without hidden fees, making it easier for shoppers to plan and budget their holiday spending.

The report shows that more consumers seek flexible payment solutions amid economic uncertainties. By integrating BNPL options, retailers meet customer demand and position themselves to capture a larger share of holiday spending. selves to capture a larger share of holiday spending.

To learn more, explore our Holiday Headquarters and gain insights on how consumers navigate the holidays this year and how your brand can rise to the top.

Let this be the season your brand shows up, not just at the right time but in the right way!